Market Overview

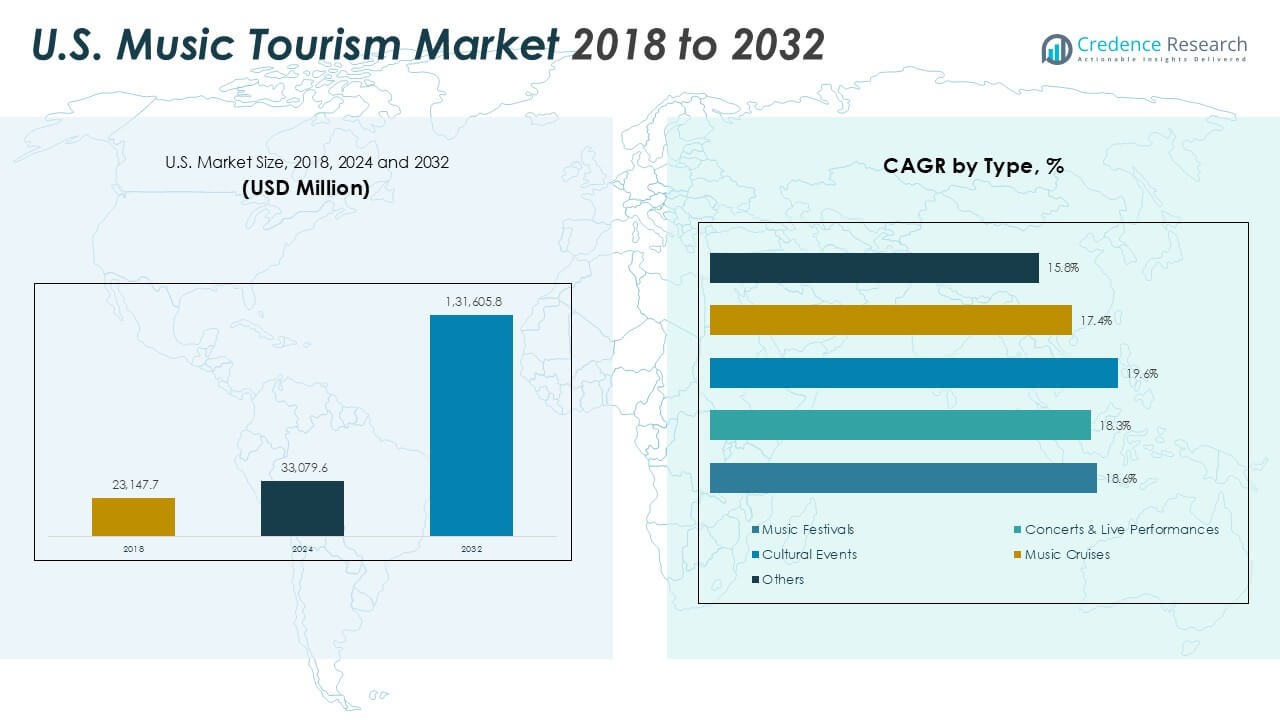

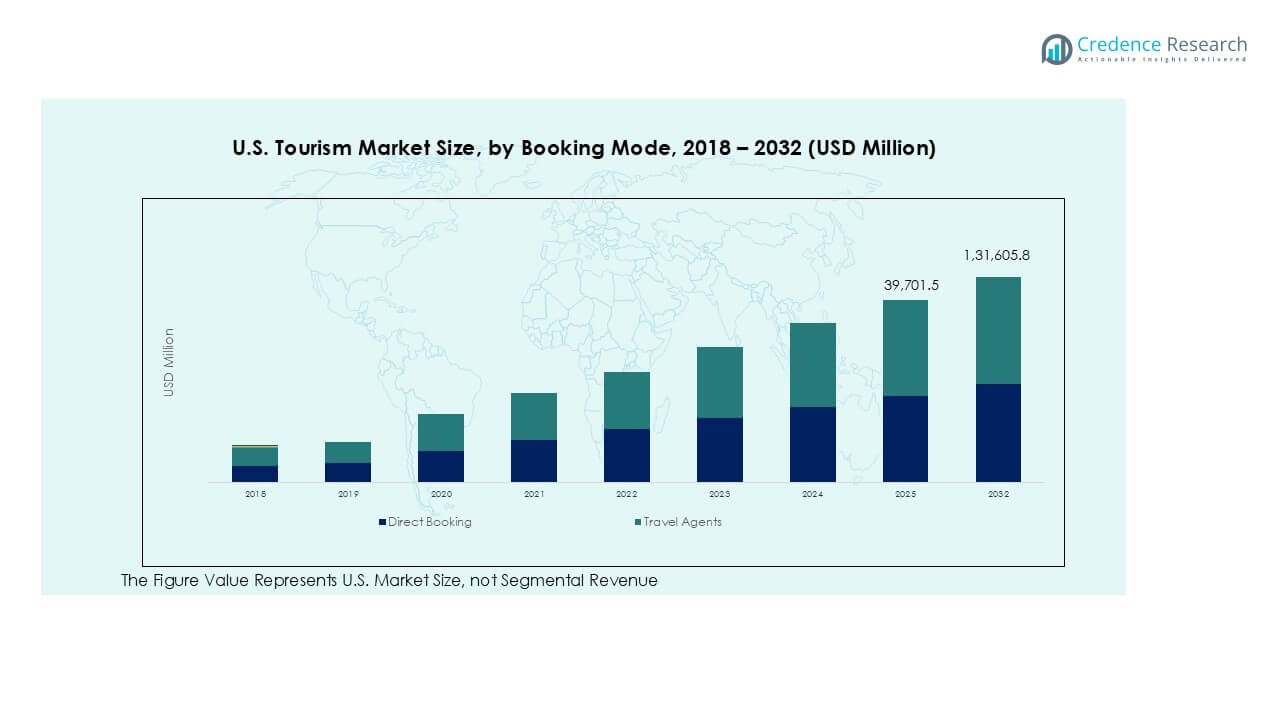

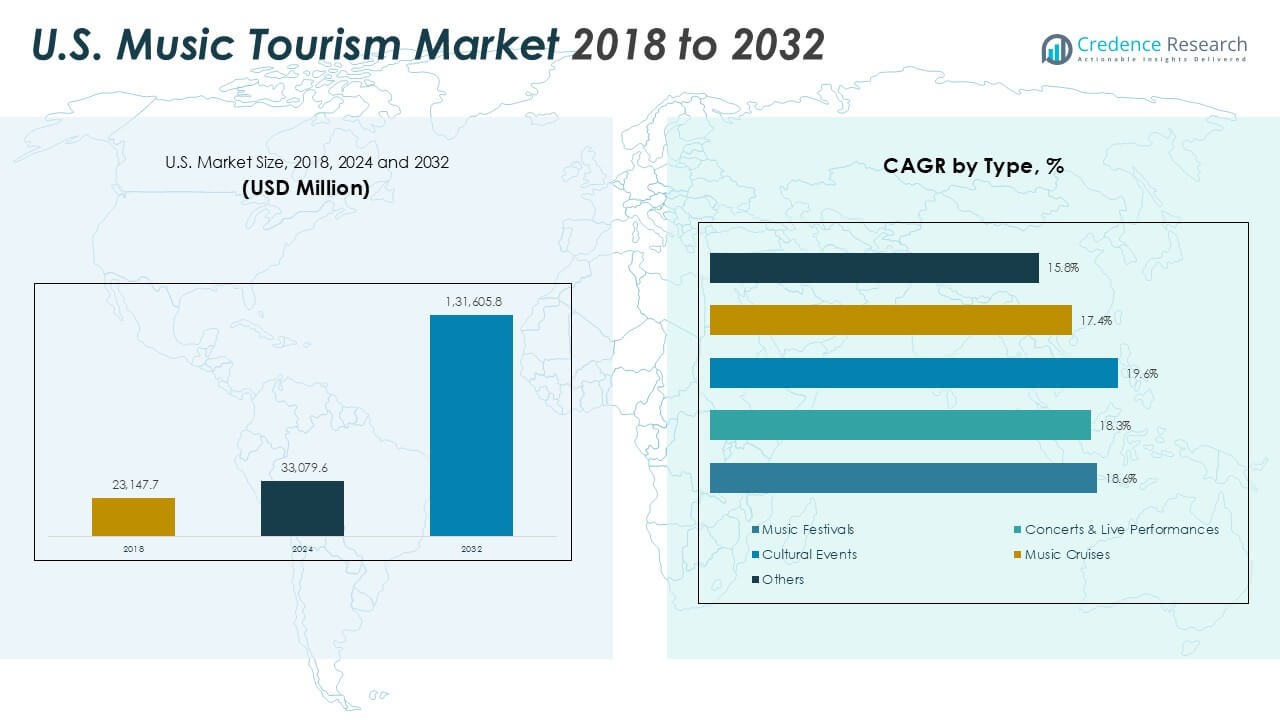

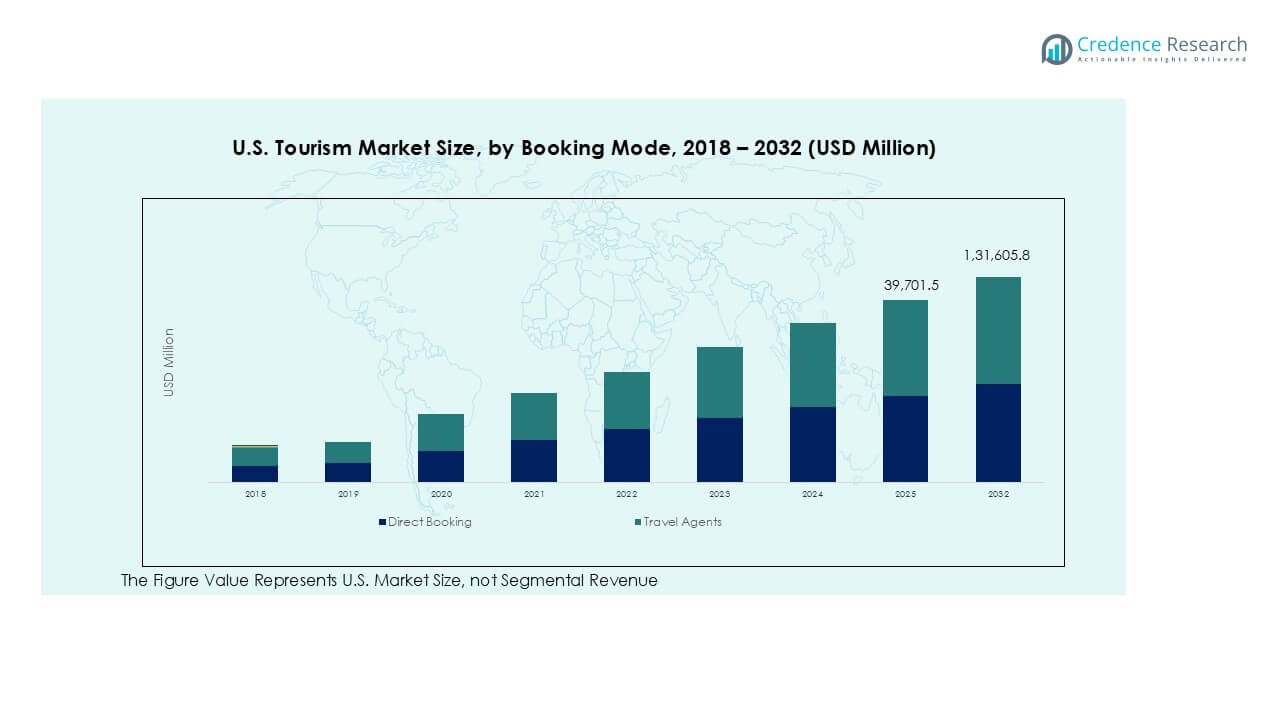

U.S. Music Tourism market size was valued at USD 23,147.7 million in 2018, increasing to USD 33,079.6 million in 2024, and is anticipated to reach USD 131,605.8 million by 2032, growing at a CAGR of 18.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Music Tourism market Size 2024 |

USD 33,079.6 Million |

| U.S. Music Tourism market, CAGR |

18.67% |

| U.S. Music Tourism market Size 2032 |

USD 131,605.8 Million |

The U.S. music tourism market is led by prominent players such as Live Nation Entertainment, AEG Presents, C3 Presents, and Insomniac Events, which collectively hold a significant share through large-scale festivals, tours, and live performances. Supporting firms like Ticketmaster, Eventbrite, and Vivid Seats strengthen the ecosystem with advanced ticketing and audience analytics. Regionally, the South dominates the market with a 32% share in 2024, driven by iconic destinations such as Nashville, Austin, and New Orleans. These cities attract both domestic and international visitors through their deep musical heritage, dynamic event culture, and strong tourism infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. music tourism market was valued at USD 33,079.6 million in 2024 and is projected to reach USD 131,605.8 million by 2032, growing at a CAGR of 18.67%.

- Growth is driven by rising attendance at large-scale music festivals, concerts, and live performances, which held a 41% segment share in 2024.

- Key trends include digital ticketing adoption, hybrid festival formats, and eco-conscious event operations enhancing visitor engagement and sustainability.

- Major players such as Live Nation Entertainment, AEG Presents, and Insomniac Events dominate through strategic partnerships, artist management, and large-scale event organization.

- Regionally, the South led with a 32% share in 2024, followed by the Northeast at 28%, supported by vibrant cultural hubs and strong tourism infrastructure across leading music destinations.

Market Segmentation Analysis:

By Type

The concerts and live performances segment dominated the U.S. music tourism market in 2024 with a 41% share. Growth is driven by rising attendance at large-scale tours, residencies, and arena shows featuring global artists. Expanding digital ticketing platforms and enhanced stage technologies improve accessibility and audience engagement. The segment benefits from strong demand across major cities such as Los Angeles, New York, and Nashville. Increasing sponsorships and partnerships between entertainment firms and hospitality providers further support market expansion across diverse performance categories.

- For instance, Live Nation Entertainment reported that 151 million fans attended its concerts globally in 2024. This represents a 9% rise in attendance compared to the previous year. Arena and amphitheater activity were the primary drivers of this fan count, despite a 30% reduction in stadium shows. North America and Latin America experienced almost all of the growth in fan attendance at Live Nation’s operated venues.

By Age Group

The 18–34 years segment held the largest share of 46% in 2024. These demographic drives market growth through high spending on live experiences, travel, and social events. Younger travelers seek immersive entertainment, social media engagement, and festival tourism packages. Music streaming and digital promotion have amplified event reach among this group, increasing cross-state attendance. The rising trend of combining travel with cultural and leisure experiences also supports segment growth. Organizers are tailoring offerings with tech-driven engagement and affordable packages to attract millennials and Gen Z audiences.

- For instance, Spotify reported that over 68% of its U.S. premium subscribers fall within the 18–34 age group, directly influencing tour discovery and ticket sales.

By End-User

Leisure travelers led the market with a 52% share in 2024, dominating the end-user segment. Their participation is fueled by the growing popularity of destination festivals and music-themed vacations. Increased disposable income and preference for entertainment-based tourism boost spending on concerts and cultural events. Travel agencies and tour operators are offering curated music travel itineraries that include local attractions, enhancing traveler engagement. The expansion of regional air connectivity and event-linked hospitality deals also contributes to the segment’s leadership in the overall market.

Key Growth Drivers

Growing Popularity of Large-Scale Music Festivals

The rising popularity of large-scale music festivals is a major driver of the U.S. music tourism market. Events such as Coachella, Lollapalooza, and Bonnaroo attract millions of attendees annually, boosting domestic and international travel. These festivals generate high visitor spending on accommodation, food, and local transport, benefiting regional economies. Expanding artist lineups and themed experiences enhance audience engagement and retention. Additionally, strong partnerships between event organizers, tourism boards, and hospitality providers increase marketing reach and destination visibility, positioning music festivals as key tourism catalysts nationwide.

- For instance, Goldenvoice, the organizer of Coachella, organized festivals in 2024 that reported a combined total attendance of over 250,000 people across the Coachella and Stagecoach events.

Rising Integration of Travel and Entertainment Experiences

The growing fusion of travel and entertainment is another significant market driver. Tourists increasingly seek immersive experiences that combine live performances with cultural exploration. Travel agencies and event organizers are curating music-themed itineraries, including local heritage tours, culinary experiences, and wellness retreats. The rise of social media and experiential marketing further amplifies the appeal of these multi-sensory journeys. Enhanced air connectivity, flexible travel packages, and digital booking platforms make participation in cross-state and destination-based concerts more convenient, encouraging greater visitor mobility and repeat attendance.

- For instance, Expedia Group recognized music tourism as a significant trend in 2024 and engaged in strategic initiatives to capture this market. This included leveraging its Expedia Group Live platform to promote hotel stays and travel packages around major music events. For example, the company partnered with the New Orleans Jazz & Heritage Festival to create a Travel Hub that showcased deals for festival-goers.

Expanding Investment in Infrastructure and Digital Platforms

Growing investment in event infrastructure and digital ticketing systems also drives market growth. Upgraded venues, improved accessibility, and smart crowd management systems enhance visitor safety and comfort. The adoption of AI-driven ticketing, facial recognition, and mobile apps ensures seamless entry and real-time updates. Streaming integrations enable hybrid attendance models, expanding audience reach beyond physical limits. State governments and private investors are also funding entertainment districts and music hubs, further strengthening the tourism ecosystem. This combination of physical and digital infrastructure investment continues to elevate the overall market experience.

Key Trends & Opportunities

Expansion of Hybrid and Niche Music Experiences

Hybrid and niche music experiences are emerging as key market trends. Organizers are merging live and virtual formats, allowing global fans to join remotely through streaming or virtual reality platforms. Niche events such as jazz retreats, folk heritage festivals, and eco-music gatherings cater to specific audience interests. This diversification attracts high-value travelers seeking cultural depth and sustainability. Moreover, partnerships with local communities and artists promote regional identity, supporting inclusive tourism development and creating new revenue streams within the U.S. music tourism ecosystem.

- For instance, Live Nation partnered with the livestreaming platform Veeps to expand access to hybrid concerts. The collaboration allows fans to attend shows both in person and virtually. This partnership is a real part of Live Nation’s strategy for offering livestreamed and on-demand content.

Growth of Sustainable and Eco-Conscious Tourism Initiatives

The adoption of sustainable tourism practices is reshaping market opportunities. Event organizers are implementing green operations through waste reduction, renewable energy use, and eco-certified venues. Travelers increasingly prefer festivals that align with environmental values. Programs like reusable cup systems, solar-powered stages, and carbon offset partnerships enhance brand credibility. Tourism boards and music promoters jointly promote eco-tourism packages integrating low-impact travel and local sourcing. These sustainability initiatives attract environmentally conscious audiences while reinforcing the long-term resilience of the U.S. music tourism market.

Key Challenges

Rising Competition and Event Saturation

The rapid expansion of music tourism has intensified competition among event organizers and destinations. Many regions now host overlapping festivals and concerts, leading to audience fragmentation and declining ticket margins. High operating costs, including artist fees and logistics, further challenge profitability. Smaller events often struggle to secure sponsorships and brand collaborations. To stay competitive, organizers must innovate with unique themes, exclusive artist partnerships, and immersive experiences. Failure to differentiate offerings risks reduced visitor retention and limits long-term market sustainability.

Logistical and Regulatory Constraints

Logistical and regulatory issues remain significant barriers to market expansion. Large gatherings require complex coordination involving permits, crowd control, safety compliance, and environmental impact assessments. Unpredictable weather conditions and post-pandemic health regulations increase event planning costs and uncertainties. Transportation bottlenecks and limited accommodation in rural festival zones can restrict visitor inflow. Inconsistent state-level policies on event licensing and taxation also affect profitability. Addressing these challenges requires coordinated efforts between public agencies, event organizers, and local tourism authorities to ensure smoother operational frameworks and sustainable growth.

Regional Analysis

Northeast

The Northeast region accounted for 28% of the U.S. music tourism market in 2024, driven by vibrant cultural hubs such as New York, Boston, and Philadelphia. Major events like the Governors Ball and Boston Calling attract diverse audiences and international visitors. The region benefits from a strong concentration of live music venues, historic theaters, and music academies. Growth is supported by expanding tourism infrastructure, efficient transport connectivity, and strong local government backing for cultural festivals. Rising demand for urban music experiences continues to strengthen the region’s leadership in premium live event tourism.

Midwest

The Midwest held a 21% share of the U.S. music tourism market in 2024. The region’s strength lies in large-scale festivals such as Lollapalooza in Chicago and Summerfest in Milwaukee, which attract millions of attendees annually. A thriving local music scene and affordable travel options enhance accessibility for domestic tourists. Urban revitalization projects in Detroit and Minneapolis are transforming them into emerging cultural hotspots. Regional partnerships between event organizers and hospitality firms further boost visitor engagement. The Midwest’s focus on diverse genres and community-centered events continues to broaden its tourism appeal.

South

The South captured 32% of the U.S. music tourism market in 2024, the largest regional share. Renowned for its deep musical heritage in jazz, blues, country, and rock, cities such as Nashville, Austin, and New Orleans anchor growth. Iconic events like SXSW and CMA Fest attract global audiences, supported by robust entertainment infrastructure and year-round performances. Expanding air connectivity and music-driven travel packages amplify tourist inflow. The region’s blend of traditional and modern genres, along with strong state tourism promotion, solidifies its dominance in the national music tourism landscape.

West

The West region accounted for 19% of the U.S. music tourism market in 2024. California remains the primary hub, hosting world-famous events such as Coachella and Outside Lands that draw both domestic and international tourists. Expanding investments in festival infrastructure and digital ticketing platforms enhance visitor experience. The region’s scenic destinations and integration of music with art and wellness festivals attract high-spending travelers. Strong participation from hospitality and travel partners supports continued growth. The West’s fusion of innovation, entertainment diversity, and global recognition positions it as a key growth contributor to the overall market.

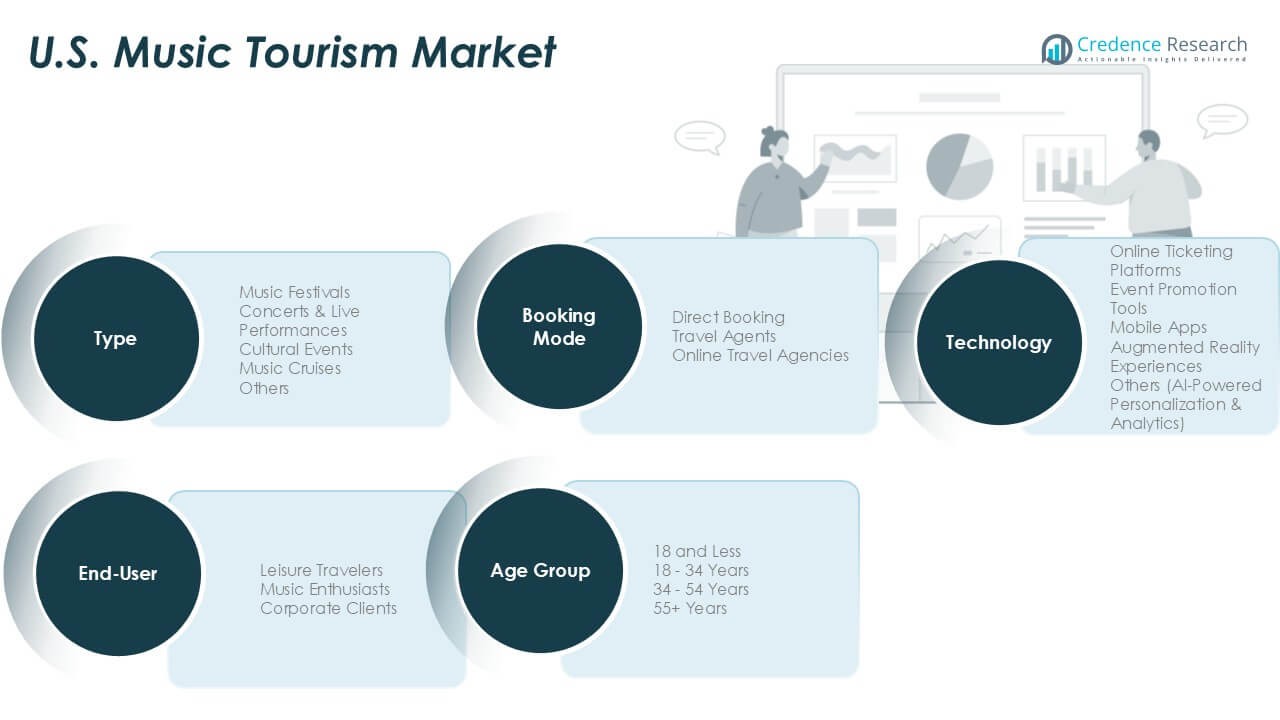

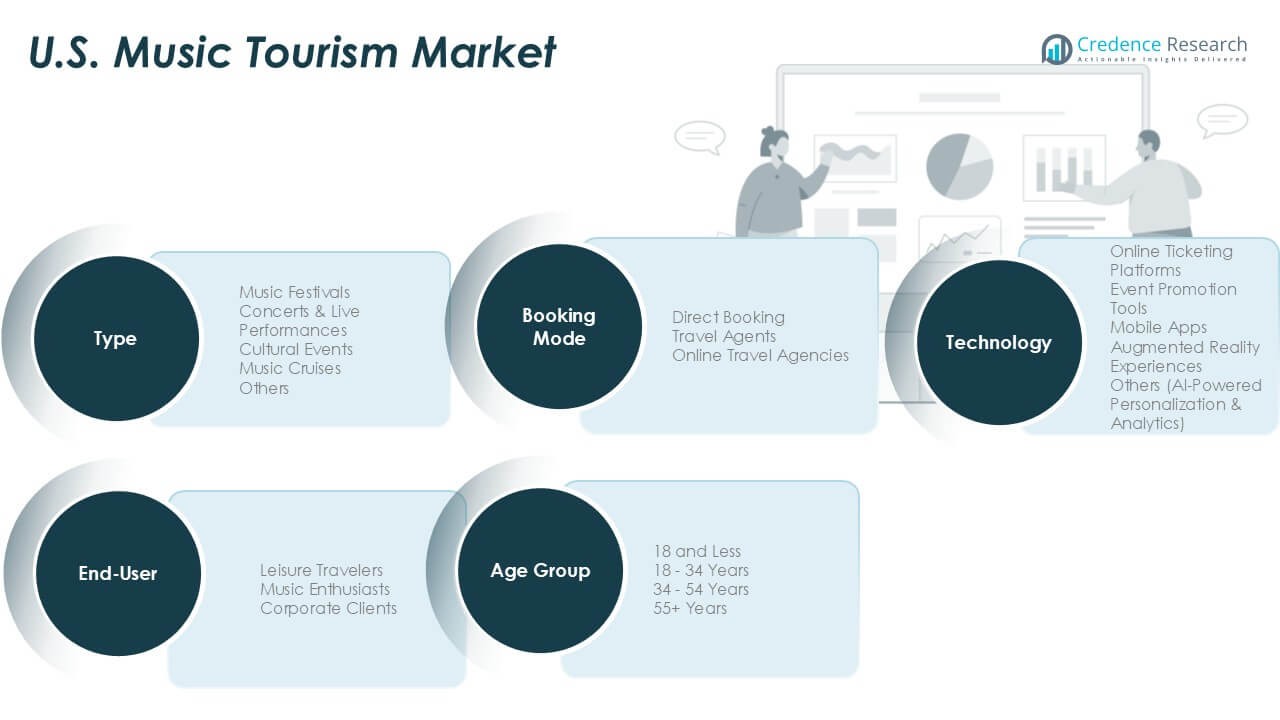

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. music tourism market features a highly competitive landscape driven by leading event organizers, ticketing platforms, and entertainment service providers. Key players such as Live Nation Entertainment, AEG Presents, and C3 Presents dominate through large-scale festival management, artist partnerships, and nationwide venue operations. Companies like Insomniac Events and Another Planet Entertainment specialize in genre-specific festivals that attract younger audiences and niche markets. Ticketing platforms including Ticketmaster, Eventbrite, and StubHub enhance accessibility through digital integration and personalized booking systems. Firms are increasingly investing in technology, sustainability, and hybrid event formats to strengthen customer engagement. Strategic collaborations with hospitality groups and tourism boards further expand market reach and event visibility. Continuous innovation, brand differentiation, and data-driven marketing remain central to maintaining competitiveness in a rapidly evolving live entertainment ecosystem that caters to both domestic and international travelers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Livestyle, Inc.

- Live Nation Entertainment

- AEG Presents

- C3 Presents

- Insomniac Events

- Another Planet Entertainment

- The Bowery Presents

- Frank Productions

- Ticketmaster

- Eventbrite

- StubHub

- Vivid Seats

- Festicket

- Music Travel Consultants

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Expanding hybrid and virtual music experiences will broaden audience reach across states.

- Sustainable event operations will become a central focus for major festival organizers.

- Growth in destination-based festivals will boost partnerships with hospitality and travel firms.

- Integration of AI and data analytics will enhance ticketing, marketing, and crowd management.

- Younger demographics will continue to drive demand for immersive and tech-enabled music experiences.

- Increased investment in venue infrastructure will improve capacity and visitor comfort.

- Rising government support for cultural tourism will strengthen regional event ecosystems.

- Collaborations between artists and tourism boards will create new experiential travel offerings.

- Themed music tours and niche festivals will attract international travelers seeking cultural diversity.

- Digital engagement and streaming tie-ins will sustain post-event monetization and brand loyalty.