Market Overviews

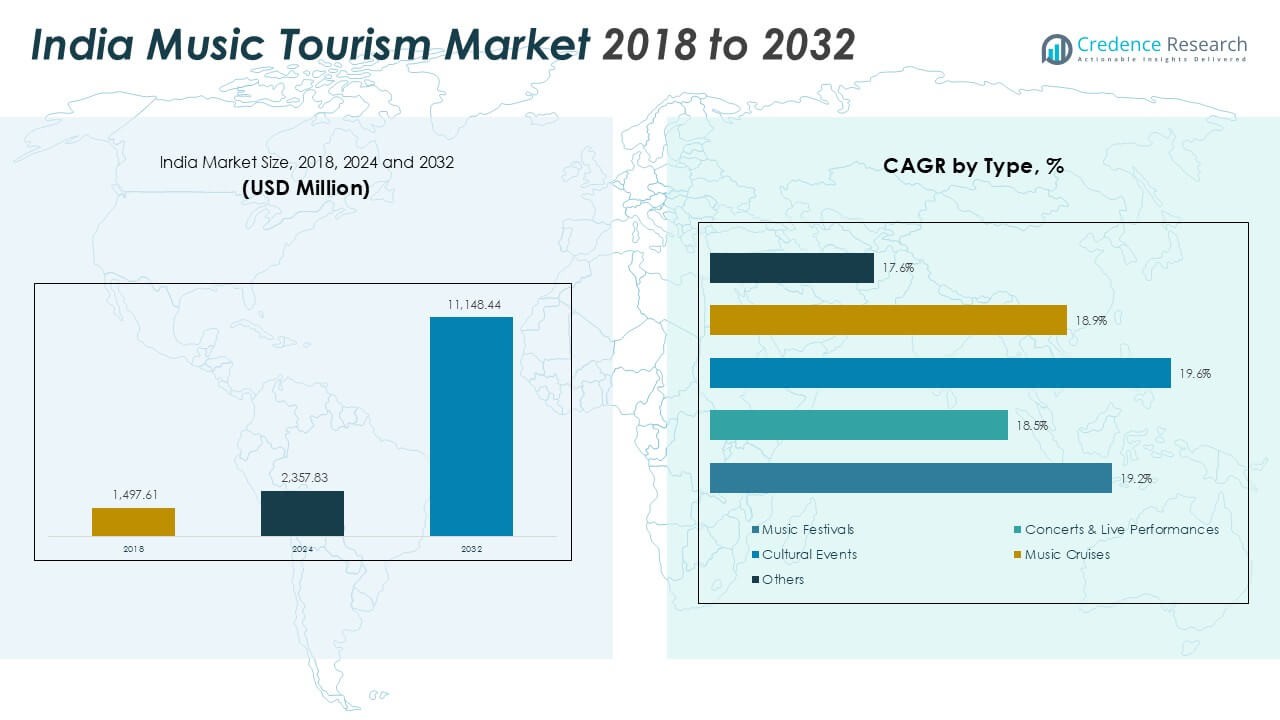

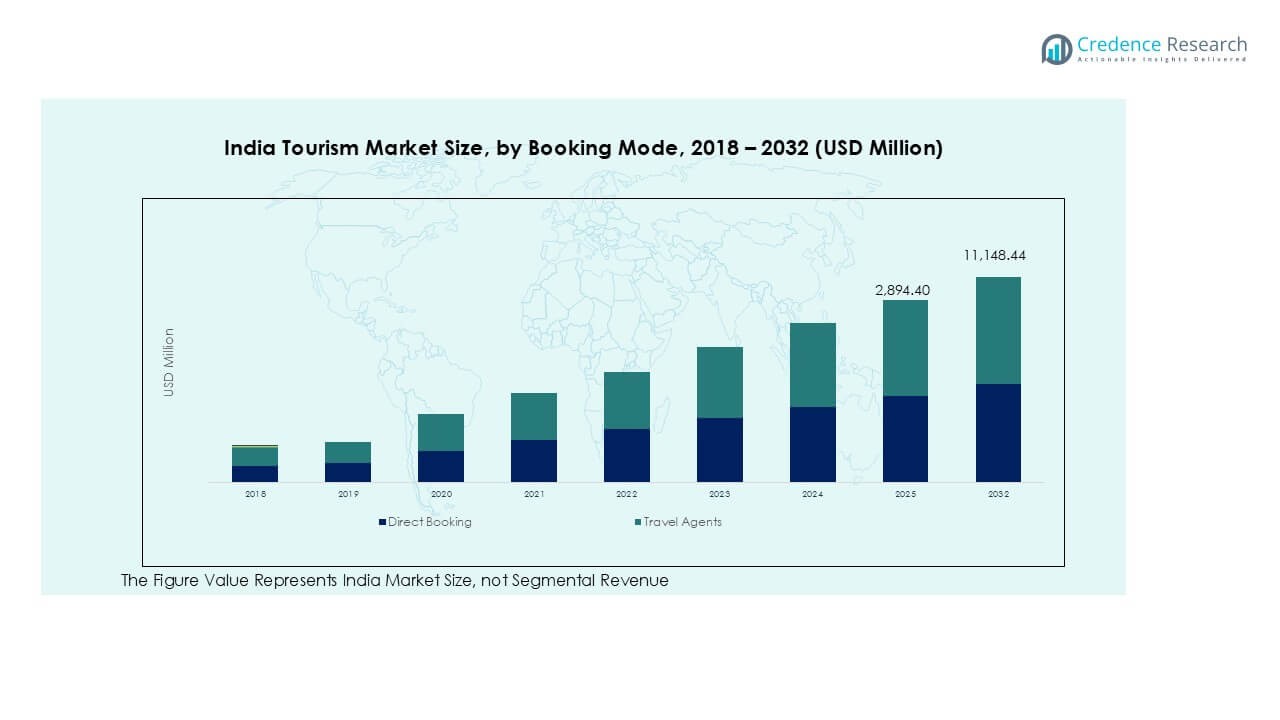

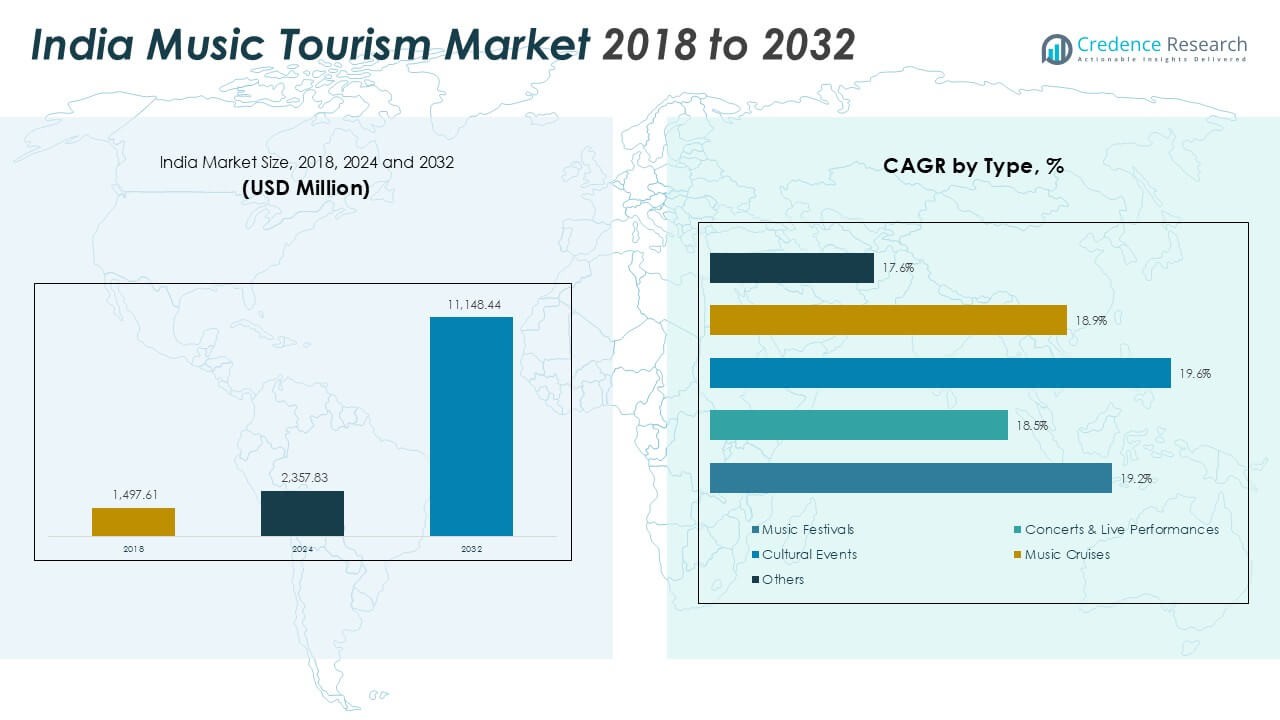

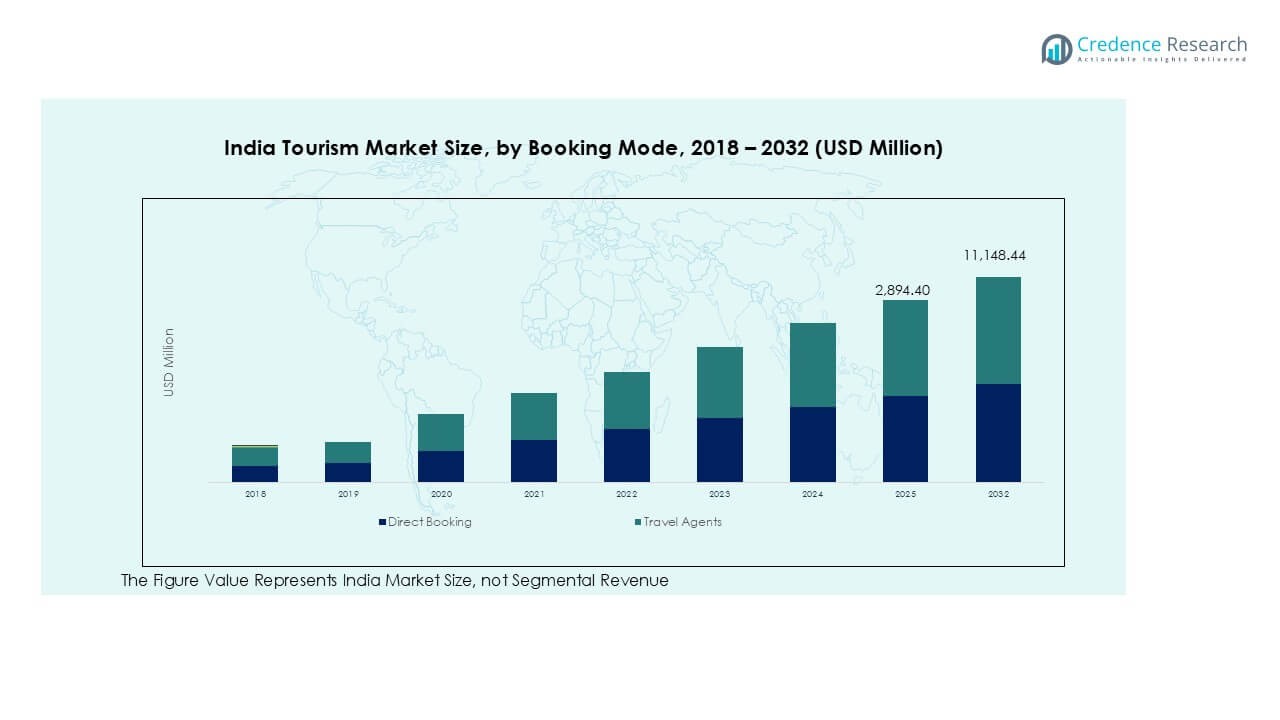

India Music Tourism market size was valued at USD 1,497.61 million in 2018, increasing to USD 2,357.83 million in 2024, and is anticipated to reach USD 11,148.44 million by 2032, growing at a CAGR of 21.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Music Tourism Market Size 2024 |

USD 2,357.83 Million |

| India Music Tourism Market, CAGR |

21.25% |

| India Music Tourism Market Size 2032 |

USD 11,148.44 Million |

The India music tourism market is highly competitive, with key players such as BookMyShow Live, Paytm Insider, Zee Live, Percept Live, and OML Entertainment leading event organization and ticketing services. Companies like Sunburn Festival, NH7 Weekender, Supersonic Festival, and Magnetic Fields Festival further strengthen the ecosystem by hosting large-scale experiential events that attract domestic and international visitors. These firms focus on digital engagement, sponsorship partnerships, and multi-city expansion to enhance reach and profitability. Regionally, North India led the market in 2024 with a 34% share, supported by strong event infrastructure and government-backed cultural initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India music tourism market was valued at USD 2,357.83 million in 2024 and is projected to reach USD 11,148.44 million by 2032, growing at a CAGR of 21.25%.

- Growth is driven by rising youth participation, expanding music festival culture, and improved digital ticketing infrastructure that enhances accessibility across major cities.

- Key trends include the integration of digital streaming partnerships, hybrid event formats, and regional cultural fusion promoting niche tourism circuits.

- Competition remains strong with leading firms such as BookMyShow Live, Paytm Insider, Zee Live, and Percept Live focusing on event expansion and sponsorship collaborations.

- Regionally, North India led with a 34% share in 2024, followed by South India at 27%, West India at 24%, and East India at 15%, while the concerts and live performances segment dominated the market with a 39% share.

Market Segmentation Analysis:

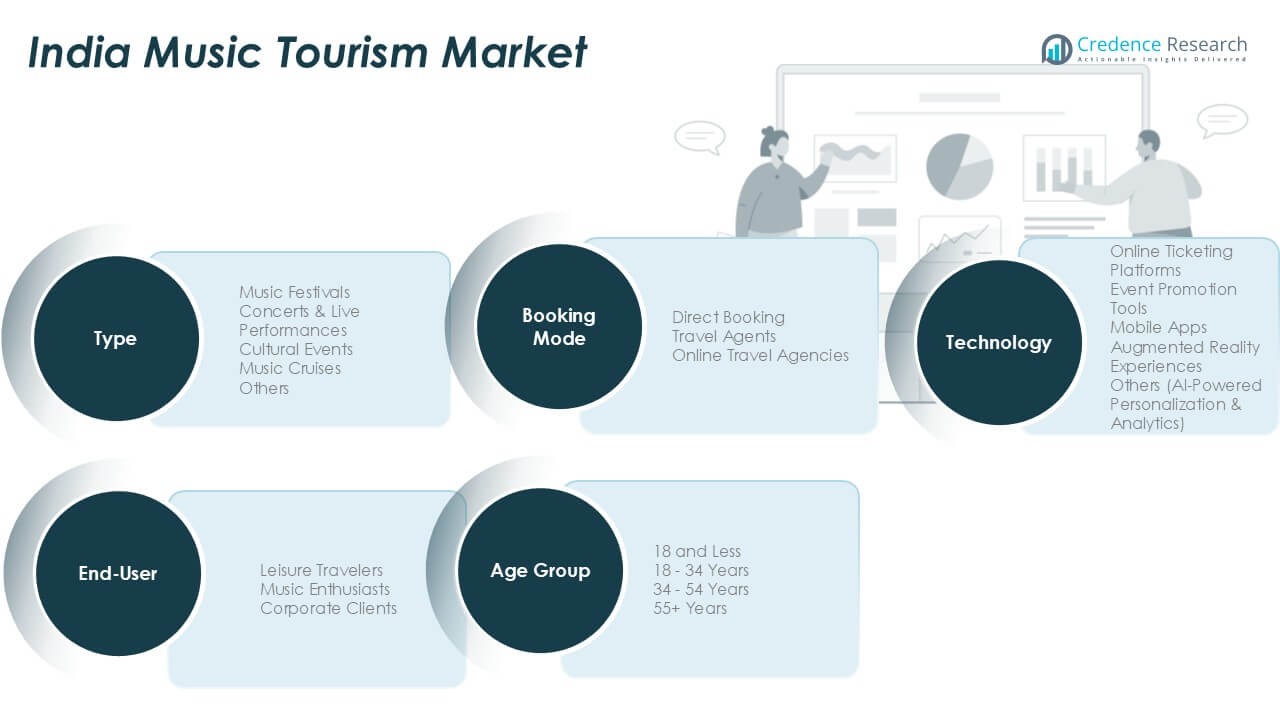

By Type

The concerts and live performances segment dominated the India music tourism market in 2024 with a 39% share. The segment’s leadership is driven by the growing number of large-scale concerts and tours by international and domestic artists. Major cities such as Mumbai, Delhi, and Bengaluru attract high visitor inflows due to improved event infrastructure and digital ticketing platforms. The rise of experiential travel and growing youth participation in music events also contribute to strong segment growth. Festivals like Sunburn and NH7 Weekender continue to strengthen India’s global music tourism appeal.

- For instance, BookMyShow managed over 35 million ticket sales across 4,500 live events in 2024, showcasing India’s expanding live performance network supported by advanced digital booking and cashless entry systems.

By Age Group

The 18–34 years segment held the largest share of 46% in 2024, leading the India music tourism market. This group represents the most active participants in live music events, driven by higher disposable incomes and a strong inclination toward cultural experiences. Increased social media influence and music streaming platforms help connect young audiences to global artists, boosting concert attendance. Millennials and Gen Z travelers also prioritize travel experiences centered around music and entertainment, encouraging domestic and international event participation. Rising affordability of short-haul travel supports continued dominance of this segment.

- For instance, in 2024, Spotify India reported a total of around 70 million monthly active users. This user base, which includes a strong presence of Gen Z and millennials, drives significant engagement with artist tours and influences concert participation trends across major Indian cities.

By End-User

The leisure travelers segment dominated the India music tourism market in 2024 with a 43% share. Growth is fueled by rising preference for combining tourism with cultural and entertainment experiences. Domestic tourists increasingly plan vacations around concerts and music festivals, while inbound travelers explore India’s diverse music heritage. The expansion of destination-based events, including beach and mountain music festivals, attracts both casual and dedicated travelers. The segment benefits from the support of state tourism boards promoting music-led experiences to enhance regional tourism development and year-round visitor engagement.

Key Growth Drivers

Expanding Music Festival Culture

The rise of large-scale music festivals across India has become a central growth driver for music tourism. Events such as Sunburn, NH7 Weekender, and Magnetic Fields attract thousands of domestic and international visitors each year. These festivals blend diverse music genres, art, and lifestyle experiences, encouraging multi-day tourism spending on accommodation, transport, and local attractions. State governments increasingly support such events to enhance destination branding and boost local economies. The growing participation of corporate sponsors and global streaming platforms further fuels event visibility and international attendance, reinforcing India’s position as a vibrant music tourism destination.

- For instance, in 2024, Spotify India had an estimated 70 to 80 million total monthly active users (MAUs), with a significant portion of its audience within the 18–34 age range.

Government Support and Infrastructure Development

India’s tourism and cultural ministries are actively promoting music tourism through regional festivals and cultural circuits. Programs like “Dekho Apna Desh” and collaborations with private organizers help showcase India’s diverse music heritage while strengthening local economies. Improved airport connectivity, smart city infrastructure, and upgraded event venues make travel and attendance more convenient for both domestic and foreign tourists. The government’s push toward sustainable tourism and digitized ticketing also enhances the visitor experience. Together, these initiatives create favorable conditions for continuous growth and foreign investment in the country’s music tourism sector.

- For instance, the Ministry of Tourism announced the development of 52 tourism destinations under the revamped Swadesh Darshan 2.0 scheme in 2024. Separately, GMR Airports did handle record passenger traffic in December 2024, with its airports in Delhi and Hyderabad serving a combined total of nearly 10 million passengers that month alone.

Rising Disposable Income and Youth Engagement

A growing middle-class population and increasing disposable income have made live music experiences more accessible to Indian youth. The 18–34 age group, with high digital engagement and interest in global music trends, actively participates in concerts and cultural events. Affordable domestic flights, online booking platforms, and social media-driven marketing further boost event participation. The shift in consumer preference from material purchases to experience-based spending strengthens the market outlook. As international artists increasingly include India in their global tours, youth enthusiasm continues to elevate music tourism demand nationwide.

Key Trends & Opportunities

Integration of Digital Platforms and Streaming Partnerships

Digital transformation in India’s entertainment sector presents major opportunities for music tourism growth. Streaming services and social media platforms play a crucial role in artist promotion and event discovery. Collaborations between event organizers and platforms like Spotify, YouTube, and Instagram enable targeted marketing and real-time engagement. Virtual ticketing and hybrid concert formats also attract remote audiences who may later attend in-person events. The adoption of cashless payments, AI-based recommendations, and mobile-based itinerary planning enhances visitor convenience. This integration of technology strengthens event reach and builds year-round fan engagement, expanding the tourism potential of India’s music scene.

- For instance, Tuborg Zero and other brands collaborated with Sunburn in 2024, as the festival featured over 100 artists across multiple stages. Additionally, BookMyShow’s digital platform, which uses AI-driven personalization tools, recorded a high volume of ticket sales for numerous live events. Its 2024 year-end report showed it offered over 30,000 live events across India, indicating millions of ticket transactions were handled throughout the year.

Cultural Fusion and Regional Event Expansion

India’s rich regional diversity offers significant opportunities to develop niche music tourism circuits. Growing interest in folk, classical, and fusion genres is promoting events in destinations such as Varanasi, Shillong, and Jodhpur. These locations combine traditional music with modern tourism experiences, drawing both cultural enthusiasts and young travelers. Partnerships between tourism boards and private organizers are creating sustainable, community-driven music festivals that celebrate local art forms. The increasing global recognition of Indian musicians also supports inbound tourism from diaspora audiences. This cultural fusion enhances India’s image as a multifaceted and inclusive music destination.

Key Challenges

Logistical Constraints and Infrastructure Gaps

Despite rapid progress, inconsistent event infrastructure remains a key challenge in India’s music tourism sector. Many venues lack adequate crowd management systems, soundproofing, and accessibility for differently abled visitors. Limited inter-city transport options and congestion near popular destinations often disrupt visitor convenience. Smaller cities hosting emerging music festivals also face power, safety, and accommodation challenges. Additionally, high venue rental costs and regulatory clearances delay event planning. Addressing these issues through coordinated public-private investment and standardized event protocols is crucial for improving India’s global competitiveness in music tourism.

Seasonal Dependence and Regulatory Barriers

Music tourism in India is often concentrated around specific seasons and festivals, leading to uneven visitor distribution. Monsoon-related disruptions and extreme temperatures limit event scheduling flexibility. Furthermore, organizers face complex licensing requirements, varying state-level permissions, and high entertainment taxes. These factors increase operational costs and discourage small or independent festival promoters. Inconsistent alcohol and noise regulations also affect event viability. Streamlined policies, harmonized tax structures, and long-term tourism planning are essential to ensure sustainable market growth and to attract continuous private investment in the music tourism ecosystem.

Regional Analysis

North India

North India dominated the India music tourism market in 2024 with a 34% share. The region’s leadership is supported by its vibrant mix of classical, folk, and contemporary music events. Delhi, Jaipur, and Rishikesh host major festivals such as Magnetic Fields and Mahindra Blues, attracting domestic and international audiences. Strong transport connectivity, heritage tourism, and government-backed cultural programs enhance visitor experiences. Rising investments in open-air venues and digital ticketing have further boosted the region’s appeal. The fusion of modern and traditional music genres continues to position North India as a key hub for music tourism growth.

South India

South India held a 27% share in the 2024 India music tourism market, driven by its diverse musical heritage and thriving live performance culture. Chennai, Bengaluru, and Kochi serve as leading centers for Carnatic, fusion, and electronic music festivals. Events such as NH7 Weekender and Indie Earth XChange attract both regional and international audiences. Improved hospitality infrastructure and airline connectivity support rising tourist inflows. The presence of music academies and emerging independent artists also contributes to growing year-round visitor engagement. The blend of traditional art and modern entertainment ensures consistent market growth across the southern states.

West India

West India accounted for a 24% share of the India music tourism market in 2024, driven by major entertainment hubs like Mumbai, Pune, and Goa. The region hosts globally recognized events such as Sunburn and Supersonic, attracting large youth crowds and international performers. Goa’s beach festivals and Pune’s cultural concerts have become key attractions for experiential travelers. The growing nightlife industry and hospitality expansion further strengthen regional demand. Strong corporate sponsorships, along with digital promotions, enhance event accessibility and reach. West India continues to set benchmarks for large-scale live entertainment and high-spending tourist participation.

East India

East India captured a 15% share of the India music tourism market in 2024, showing steady growth supported by emerging cultural destinations. Kolkata, Shillong, and Darjeeling have become regional hotspots for indie and folk music festivals. Events like Ziro Festival and Shillong Autumn Festival attract domestic travelers and international enthusiasts seeking local authenticity. The region’s rich tribal and classical traditions also draw heritage-focused tourists. However, limited infrastructure and lower international connectivity remain challenges. Ongoing state tourism initiatives and collaborations with private event organizers are expected to enhance the region’s visibility and music tourism potential.

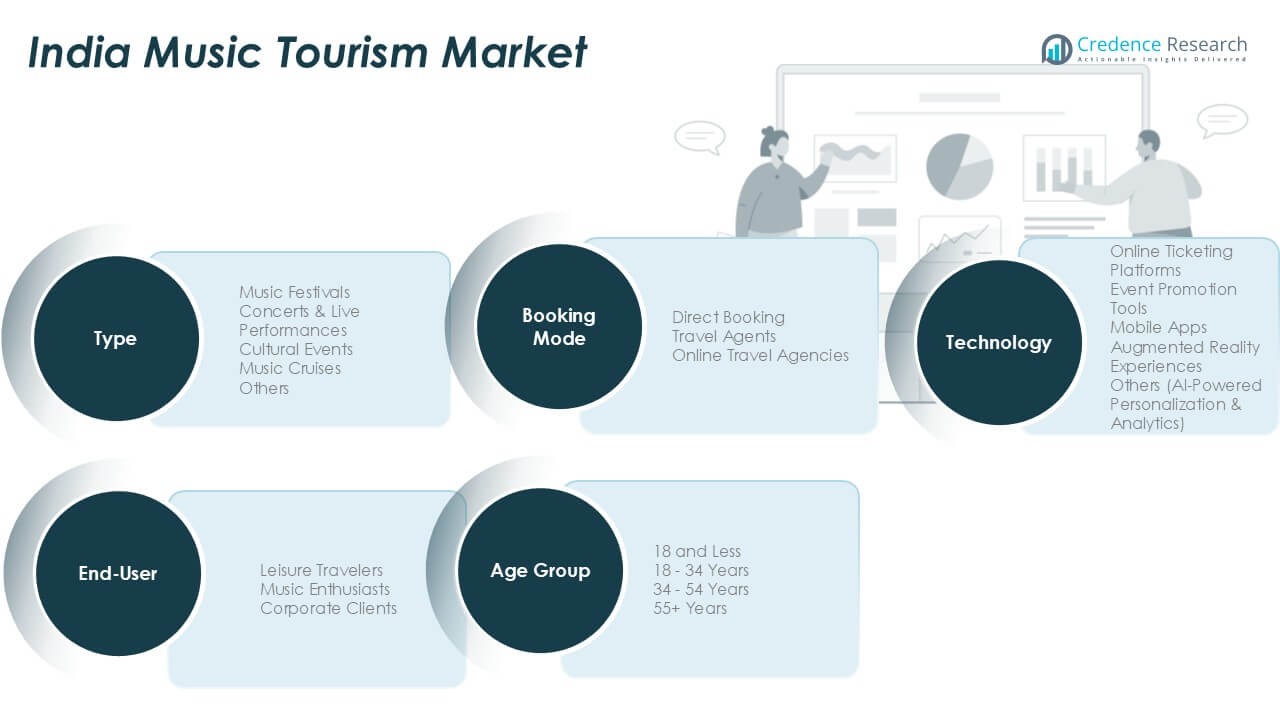

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- North India

- South India

- West India

- East India

Competitive Landscape

The competitive landscape of the India music tourism market is characterized by strong collaboration between event organizers, digital ticketing platforms, and entertainment companies. Leading players such as BookMyShow Live, Paytm Insider, Zee Live, and Percept Live dominate through large-scale event management, artist partnerships, and nationwide festival organization. Companies like OML Entertainment, Submerge Entertainment, and Live Viacom18 further enhance the ecosystem with branded experiences and youth-oriented events. Music festivals such as Sunburn, NH7 Weekender, Supersonic, and Magnetic Fields have become cultural landmarks, driving both domestic and international tourism. Firms increasingly adopt digital engagement tools, data analytics, and sponsorship tie-ups to boost attendance and profitability. The market remains competitive as regional organizers and independent promoters gain visibility through niche, genre-based events. Continuous innovation, hybrid event formats, and sustainability initiatives are emerging as key differentiators, positioning India as one of the fastest-growing music tourism markets in the Asia-Pacific region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BookMyShow Live

- Paytm Insider

- Zee Live

- Percept Live

- OML Entertainment (Only Much Louder)

- Submerge Entertainment

- Wizcraft International Entertainment

- Hyperlink Brand Solutions

- Encompass Events

- Ferriswheel Entertainment

- Live Viacom18

- Fountainhead MKTG

- Event Capital

- Sunburn Festival

- NH7 Weekender

- Supersonic Festival

- Magnetic Fields Festival

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Music festivals will expand across new destinations, promoting regional tourism growth and cultural exchange.

- Digital ticketing and mobile-based booking platforms will further enhance visitor convenience and engagement.

- Government initiatives will continue to promote music-led tourism through state-backed events and cultural circuits.

- Global artists and international tours will increasingly include India in their concert schedules.

- Hybrid and virtual concert formats will attract wider audiences and generate new revenue opportunities.

- Corporate sponsorships and brand collaborations will strengthen event financing and marketing reach.Youth participation will rise as experience-based travel becomes a lifestyle preference.

- Infrastructure upgrades in transport and hospitality will support larger and more frequent events.

- Sustainable event practices will gain traction with eco-friendly venues and reduced waste initiatives.

- North and South India will remain key hubs, while emerging markets in the East will see faster growth.