Market Overview

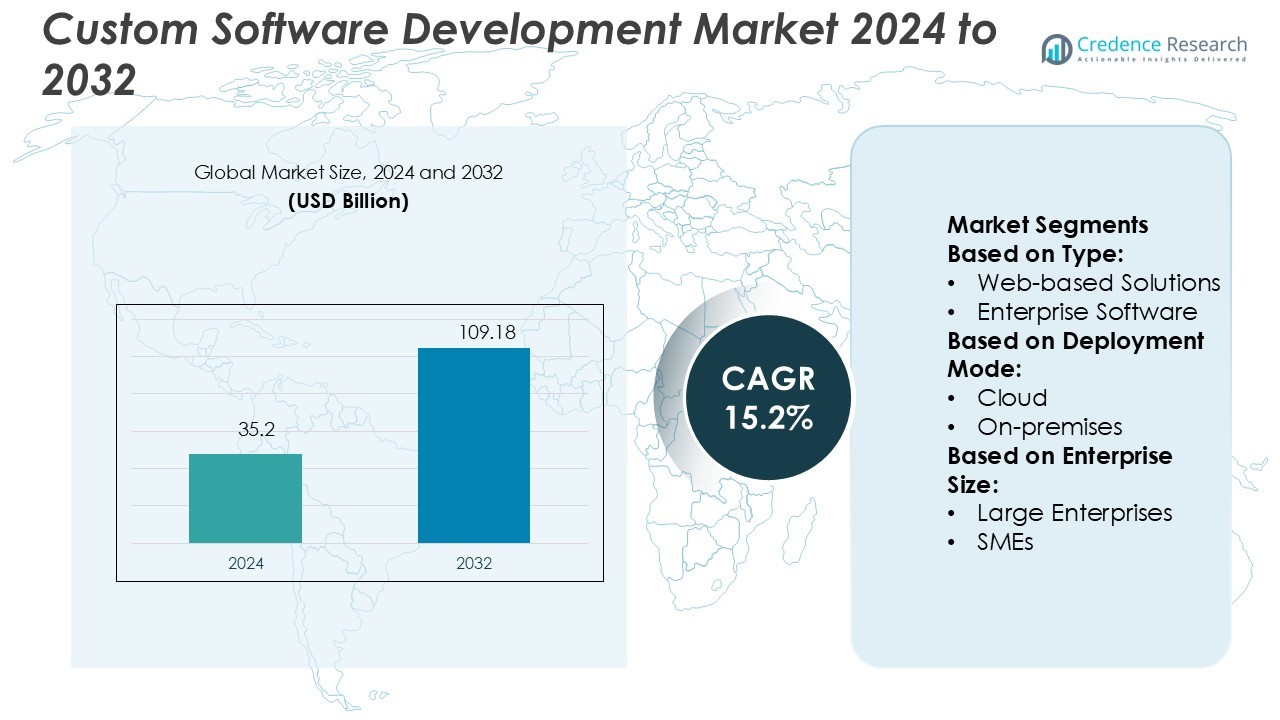

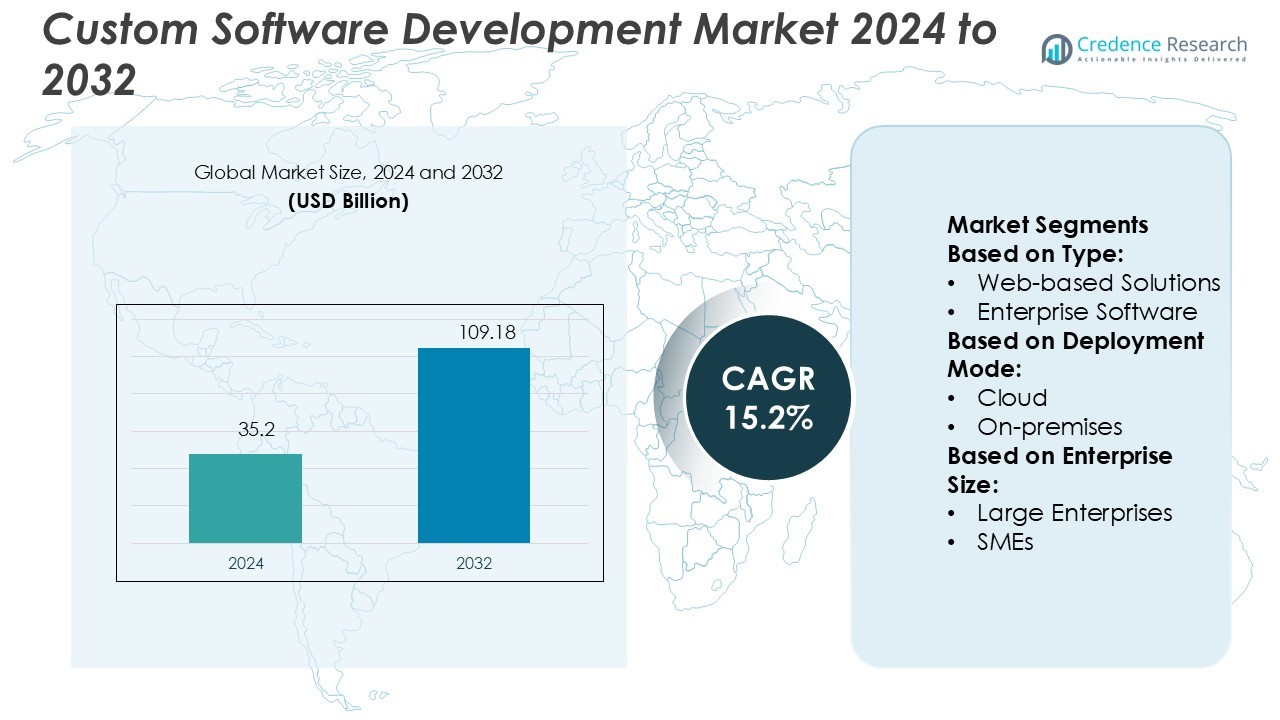

Custom Software Development Market size was valued USD 35.2 billion in 2024 and is anticipated to reach USD 109.18 billion by 2032, at a CAGR of 15.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Custom Software Development Market Size 2024 |

USD 35.2 Billion |

| Custom Software Development Market, CAGR |

15.2% |

| Custom Software Development Market Size 2032 |

USD 109.18 Billion |

The custom software development market is driven by leading companies such as Magora, Cognizant, Microsoft, Brainvire Infotech Inc., Accenture plc, Capgemini, Infopulse, Iflexion, Infosys Ltd., and HCL Technologies Limited. These players focus on delivering scalable, secure, and industry-specific solutions supported by advanced technologies like AI, cloud computing, and low-code platforms. Their strategies include expanding global delivery centers, forming strategic partnerships, and enhancing R&D capabilities to strengthen market positions. North America leads the global market with a 36.2% share, supported by strong enterprise digitalization, robust IT infrastructure, and high investment in advanced software solutions across BFSI, healthcare, retail, and manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The custom software development market was valued at USD 35.2 billion in 2024 and is expected to reach USD 109.18 billion by 2032, growing at a CAGR of 15.2%.

- Growing demand for digital transformation and cloud-native solutions is driving strong adoption across industries such as BFSI, healthcare, retail, and manufacturing.

- Companies focus on AI, low-code platforms, and strategic partnerships to strengthen their competitive position and accelerate delivery.

- High development costs, talent shortages, and integration challenges with legacy systems continue to restrain market growth.

- North America holds a 36.2% regional share, while web-based solutions lead by segment with a 46.8% share, supported by strong enterprise investment and advanced IT infrastructure.

Market Segmentation Analysis:

By Type

Web-based solutions dominate the custom software development market with a 46.8% share in 2024. Businesses prioritize web applications for their broad accessibility, cost efficiency, and integration capabilities. This segment benefits from strong demand across retail, BFSI, healthcare, and logistics sectors. The rise of progressive web apps (PWAs) and responsive design further accelerates adoption. Mobile app development follows due to rapid smartphone penetration, while enterprise software gains traction in large corporations requiring scalable, secure solutions for complex operations.

- For instance, Microsoft has enhanced its Azure App Service platform to provide native support for Progressive Web Apps (PWAs) and seamless integration with serverless technologies like Azure Functions. The service is deployed across more than 70 Azure regions worldwide, enabling developers to build and deploy highly responsive and scalable web apps.

By Deployment Mode

Cloud deployment leads with a 63.4% share, driven by its scalability, lower upfront costs, and rapid implementation. Organizations prefer cloud solutions for improved collaboration, flexible storage, and automatic updates. This approach also supports remote access and disaster recovery, aligning with hybrid and remote work trends. On-premises deployment retains relevance among industries with strict data control needs, such as government and banking, but growth remains slower due to higher infrastructure costs and maintenance demands.

- For instance, RevolutionEHR’s RevClear module reduces each claim transaction by 8.5 minutes, a feature listed among the benefits of the claims processing service.

By Enterprise Size

Large enterprises hold a 58.2% share, reflecting their strong investment capacity and need for tailored software ecosystems. These organizations adopt custom solutions to enhance operational efficiency, ensure data security, and integrate advanced analytics. Sectors like manufacturing, BFSI, and telecom lead adoption. SMEs increasingly shift toward cost-effective, cloud-based development, aided by low-code and no-code platforms. This growing adoption among smaller firms expands the market’s overall customer base and drives new service models.

Key Growth Drivers

Rising Demand for Business Process Automation

Enterprises increasingly adopt custom software to automate complex workflows and improve efficiency. Automation reduces operational costs, minimizes errors, and accelerates decision-making. Sectors like finance, healthcare, and retail use tailored solutions for billing, reporting, and customer management. Integration with AI and RPA tools enables predictive analytics and real-time monitoring. Organizations prefer custom platforms over off-the-shelf software due to flexibility and scalability. This growing demand for automated systems is driving consistent revenue growth in the custom software development market.

- For instance, Waystar’s Claim Manager maintains a 98.5% first-pass clean claim rate, powered by more than 2.5 million built-in claim edits updated in real time. This level of automation reduces resubmission delays and supports faster reimbursement across 5,000 payer connections.

Expanding Adoption of Cloud-Based Solutions

Cloud computing supports faster development cycles, easy scalability, and reduced IT infrastructure costs. Custom software deployed on cloud platforms enables real-time collaboration, data accessibility, and security compliance. Companies benefit from continuous integration and deployment, making cloud-native applications more efficient and agile. Hybrid and multi-cloud models are increasingly adopted across industries. This shift helps organizations modernize legacy systems while ensuring operational resilience. Strong demand for cloud-native architectures continues to accelerate market expansion globally.

- For instance, NextGen Ambient Assist, introduced nearly two years ago, now handles 1.5 million patient encounters annually. It saves providers up to two hours per day in documentation by transcribing encounters in real time and generating summaries via AI.

Digital Transformation Across Industries

Enterprises are prioritizing digital transformation to enhance customer experiences and optimize business processes. Custom software plays a critical role in modernizing IT infrastructure and integrating advanced technologies such as IoT, blockchain, and AI. Sectors like BFSI, manufacturing, and logistics invest heavily in digital platforms to improve competitiveness. Tailored solutions offer flexibility and better integration with existing systems, enabling faster innovation cycles. This increasing transformation pace positions custom software development as a core enabler of enterprise modernization.

Key Trends & Opportunities

Rise of Low-Code and No-Code Development Platforms

Low-code and no-code platforms are reshaping software development by reducing reliance on traditional coding. Businesses adopt these tools to accelerate deployment and empower non-technical teams to build applications. This shift lowers development costs and shortens project timelines. Startups and SMEs find these platforms especially attractive for quick market entry. Vendors offering integration-friendly, secure, and scalable solutions are gaining a competitive edge. This trend creates opportunities for service providers to offer customization and support.

- For instance, WebAIM’s 2024 Screen Reader User Survey, which gathered responses from over 1,500 users, revealed that 37.3% of participants commonly use Narrator—Microsoft’s integrated screen reader for Windows desktop.

Integration of Advanced Technologies

Companies are embedding technologies like AI, machine learning, and blockchain into custom software to enhance performance and security. These integrations enable predictive analytics, automated decision-making, and secure transactions. For example, AI improves personalization, while blockchain ensures data integrity and transparency. The demand for intelligent, data-driven software solutions is increasing across finance, healthcare, and e-commerce. This creates significant opportunities for developers focusing on advanced, future-ready applications.

- For instance, ViewPlus Technologies has delivered over 10,000 embossers worldwide, empowering blind and low-vision learners with tactile graphics and braille access across educational and personal use contexts.

Growing Focus on Cybersecurity and Compliance

Data security and regulatory compliance are becoming essential in custom software design. Organizations seek tailored solutions that meet industry-specific security standards such as GDPR, HIPAA, and ISO frameworks. Advanced encryption, multi-factor authentication, and zero-trust architectures are being integrated into modern applications. This rising focus on secure development creates new opportunities for software firms specializing in compliance-driven solutions.

Key Challenges

ising Development Costs and Skilled Talent Shortage

Developing custom software requires specialized skills and advanced tools, increasing overall project costs. Skilled developers, particularly in emerging technologies like AI and blockchain, are in short supply. This talent gap drives wage inflation and delays project timelines. SMEs often face challenges in affording large-scale customization. Maintaining cost competitiveness while ensuring quality remains a major challenge for service providers.

Complexity in Integration with Legacy Systems

Many organizations struggle to integrate custom software with outdated legacy infrastructure. Compatibility issues, data migration risks, and downtime concerns often delay deployment. These challenges increase project complexity and cost. Companies must invest in middleware solutions or phased migration strategies to ensure smooth integration. This remains a significant barrier, especially for industries with deeply entrenched legacy systems.

Regional Analysis

North America

North America holds a 36.2% share of the global custom software development market in 2024. Strong enterprise digitalization, cloud adoption, and early integration of advanced technologies drive regional dominance. The U.S. leads due to its mature IT infrastructure and high R&D spending by major tech companies. Canada contributes through a growing ecosystem of startups focusing on AI, fintech, and cybersecurity. High demand from BFSI, healthcare, and retail sectors further boosts the market. The region benefits from strong developer talent, established service providers, and favorable regulatory frameworks supporting digital transformation initiatives.

Europe

Europe accounts for 28.5% of the global market, driven by rapid modernization of enterprise IT systems. Germany, the UK, and France are key contributors, focusing on cloud migration and cybersecurity-compliant solutions. Strict data privacy regulations such as GDPR drive demand for customized, secure software. BFSI, manufacturing, and automotive industries lead adoption. Increased funding for digital innovation and strong government support for Industry 4.0 initiatives strengthen the regional landscape. The growing presence of nearshore development hubs in Eastern Europe enhances competitiveness and cost efficiency for European businesses.

Asia Pacific

Asia Pacific captures a 24.7% share of the custom software development market. Rapid digitalization in China, India, Japan, and South Korea fuels strong growth. Enterprises invest heavily in mobile and cloud-based applications to support large-scale operations. Expanding e-commerce, fintech, and manufacturing sectors drive demand for scalable solutions. The region benefits from a large pool of IT talent, cost-effective development services, and strong government digitalization initiatives. Major companies in North America and Europe increasingly outsource software development to Asia Pacific, boosting regional revenues and accelerating innovation.

Latin America

Latin America holds a 6.1% market share, supported by expanding IT service exports and rising digital adoption. Brazil and Mexico lead the market, with strong demand from banking, telecom, and retail industries. The region benefits from competitive development costs and increasing collaboration with U.S.-based firms. Governments are investing in digital infrastructure and encouraging tech startup ecosystems. However, uneven digital maturity and skills gaps remain challenges. Nearshoring opportunities and bilingual developer talent position the region as an emerging hub for custom software development services.

Middle East & Africa

The Middle East & Africa region represents a 4.5% share of the global market. The UAE, Saudi Arabia, and South Africa drive growth through digital transformation programs and investments in cloud infrastructure. BFSI, oil and gas, and public sector modernization initiatives create demand for tailored software. Governments are promoting smart city projects and e-governance platforms, accelerating adoption. While talent shortages and regulatory variations limit expansion, increased foreign investments and partnerships with global tech firms strengthen the regional ecosystem and support steady market growth.

Market Segmentations:

By Type:

- Web-based Solutions

- Enterprise Software

By Deployment Mode:

By Enterprise Size:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the custom software development market features key players such as Magora, Cognizant, Microsoft, Brainvire Infotech Inc., Accenture plc, Capgemini, Infopulse, Iflexion, Infosys Ltd., and HCL Technologies Limited. The competitive landscape of the custom software development market is characterized by intense innovation, strategic partnerships, and rapid technological adoption. Companies compete on their ability to deliver scalable, secure, and industry-specific solutions tailored to enterprise needs. Many focus on integrating advanced technologies such as AI, cloud computing, and low-code development platforms to accelerate deployment and enhance flexibility. Firms are also expanding their global delivery centers to improve cost efficiency and access skilled talent. Strategic collaborations and acquisitions help strengthen market positions and broaden service offerings. Continuous R&D investments and domain expertise remain key differentiators in this highly dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magora

- Cognizant

- Microsoft

- Brainvire Infotech Inc.

- Accenture plc

- Capgemini

- Infopulse

- Iflexion

- Infosys Ltd.

- HCL Technologies Limited

Recent Developments

- In March 2025, Rivian Automotive launched Also, Inc., a micromobility startup focused on urban electric transport. Also, Inc. aims to develop lightweight EV solutions and custom mobility software tailored for urban commuters.

- In February 2025, MSys Technologies announced the acquisition of Gophers Lab, a fintech and digital engineering company. This move strengthens MSys’s expertise in AI-powered digital transformation and expands its portfolio in fintech software development.

- In May 2024, Proxet Group Inc. partnered with Palantir Technologies Inc., a leading provider of AI-powered enterprise solutions. Palantir offers a comprehensive suite of tools for data analysis, collaboration, and operational efficiency. Businesses leverage Palantir’s software to enhance vehicle safety, strengthen global supply chains, and advance cancer research.

- In February 2024, HCLTech joined hands with Intel Foundry to develop personalized silicon solutions for system OEMs, semiconductor manufacturers, and cloud service providers to boost foundry services.

Report Coverage

The research report offers an in-depth analysis based on Type, Deployment Mode, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for industry-specific software will increase as enterprises accelerate digital transformation.

- AI and automation will play a central role in custom software development.

- Low-code and no-code platforms will reduce development time and costs.

- Cloud-native solutions will dominate new software deployments.

- Data security and regulatory compliance will drive software design priorities.

- Integration with advanced technologies like IoT and blockchain will expand use cases.

- Outsourcing to cost-efficient development hubs will grow steadily.

- Agile and DevOps practices will enhance delivery speed and flexibility.

- User experience and interface design will become major competitive factors.

- Strategic partnerships and acquisitions will shape the global market structure.