Market Overview

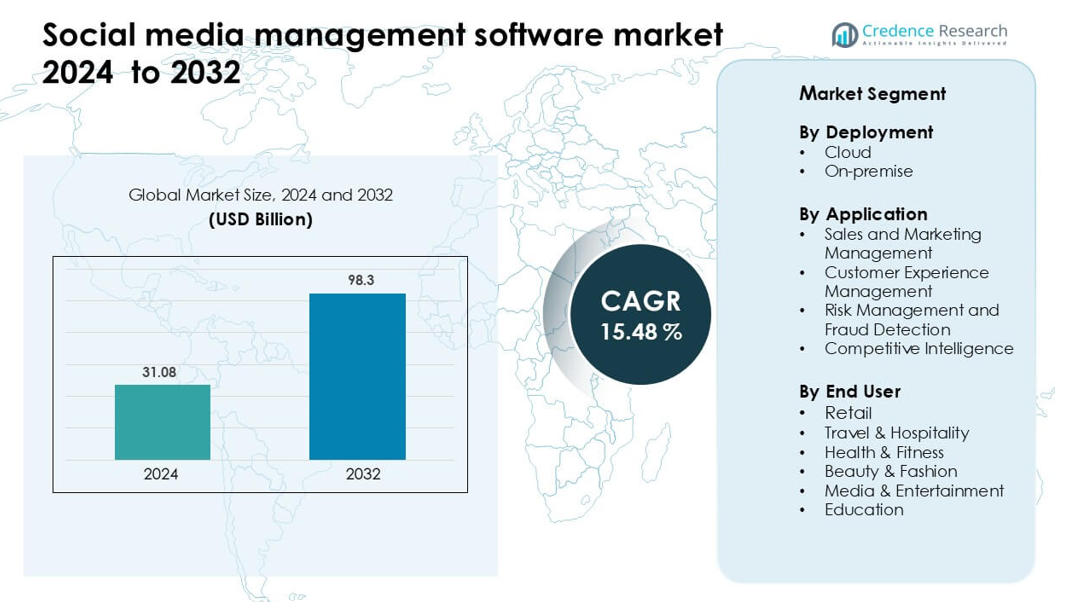

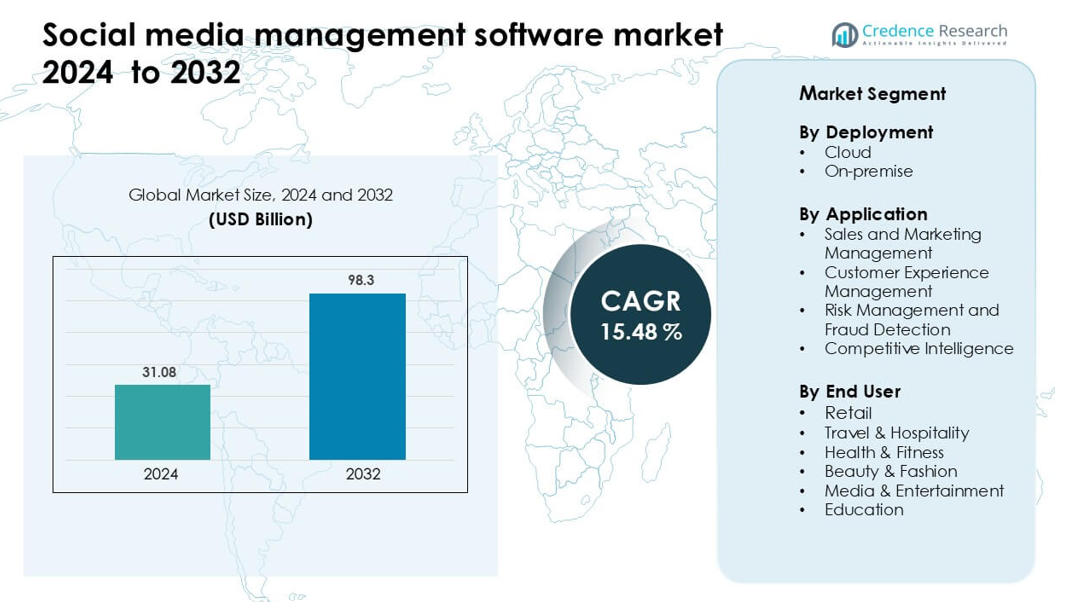

Social media management software market was valued at USD 31.08 billion in 2024 and is anticipated to reach USD 98.3 billion by 2032, growing at a CAGR of 15.48 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Social Media Management Software Market Size 2024 |

USD 31.08 billion |

| Social Media Management Software Market, CAGR |

15.48% |

| Social Media Management Software Market Size 2032 |

USD 98.3 billion |

The social media management software market is driven by major players such as Semrush, Hootsuite, SOCi, SocialDog, Meltwater, Sprinklr, Vista Social, Zoho, HubSpot, and Sprout Social. These companies strengthen their positions through AI-enabled analytics, automated publishing, influencer tracking, and deep integrations with CRM and commerce platforms. Their tools help brands manage multi-channel engagement, improve campaign accuracy, and streamline customer response workflows. North America led the market in 2024 with about 38% share, supported by high digital spending, strong cloud adoption, and advanced marketing ecosystems across the U.S. and Canada.

Market Insights

- Social media management software market was valued at USD 31.08 billion in 2024 and is anticipated to reach USD 98.3 billion by 2032, growing at a CAGR of 15.48 % during the forecast period.

- Growth is driven by rising multi-platform engagement needs, AI-based content planning, and demand for real-time analytics across sales, marketing, and service teams.

- Key trends include wider use of predictive analytics, creator-management tools, and deep integrations with CRM, e-commerce, and automation platforms to improve campaign accuracy.

- Competitive intensity remains high as players such as Semrush, Hootsuite, SOCi, Zoho, HubSpot, Sprinklr, Meltwater, and Sprout Social enhance automation, workflow tools, and cross-channel intelligence while facing pricing pressure.

- North America led the market with 38% share, followed by Europe at 28% and Asia Pacific at 25%; cloud deployment remained dominant with 72% share, while sales and marketing management was the leading application segment with 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

Cloud deployment led the social media management software market in 2024 with about 72% share. Brands preferred cloud setups because these platforms scale fast, update in real time, and reduce in-house IT costs. The model supported remote teams and helped companies manage multi-channel campaigns with high uptime. On-premise tools stayed relevant for sectors with strict data rules, but lower flexibility kept adoption limited. Growth in cloud demand came from rising influencer activity, faster API changes, and the need for integrated analytics dashboards across global teams.

- For instance, Sprinklr, a leading cloud-based unified CX-platform, served 1,735 enterprise customers as of January 31, 2024, including over 60% of the Fortune 100, and supports operations in more than 80 countries with its AI-native architecture.

By Application

Sales and marketing management dominated the market in 2024 with nearly 58% share. Companies relied on these tools to run campaigns, track engagement, and manage ads across major platforms. Strong demand came from retail and consumer brands that used real-time insights to boost conversion rates. Customer experience management grew as firms monitored sentiment and service quality. Risk management and fraud detection advanced due to rising fake accounts, while competitive intelligence gained traction through AI-based trend tracking.

- For instance, Sprout Social supports over 30,000 brands on its platform, helping marketers leverage social data for both customer acquisition and retention.

By End User

Retail held the largest share in 2024 with about 34% of the market. Retailers adopted social media management tools to run promotions, handle customer queries, and track product trends. Beauty and fashion brands expanded quickly due to influencer-driven campaigns and high visual content use. Media and entertainment relied on these platforms to manage fan engagement and launch digital releases. Travel and hospitality used them to handle reviews, while health and fitness providers used social channels to build community trust. Education grew steadily with rising digital outreach needs.

Key Growth Drivers

Rising Multi-Channel Engagement Demand

Brands now manage conversations across many platforms, which pushes demand for unified social media management software. Companies use these tools to plan posts, automate workflows, and track engagement patterns across Instagram, Facebook, X, LinkedIn, and short-video platforms. Growing adoption of reels, live streams, and influencer content increases the need for central dashboards. Large retailers, banks, and media firms rely on real-time analytics to guide promotions and service responses. The shift toward audience personalization also drives stronger interest in AI-based monitoring. This rising volume of customer interactions encourages organizations to replace manual methods with scalable, integrated systems.

- For instance, Sprinklr’s Unified-CXM platform ingests over 500 million conversations daily from more than 34 social and messaging channels, including Facebook, Instagram, LinkedIn, and others, enabling enterprises to monitor and respond in real time from a single interface.

Growing Importance of Data-Driven Marketing

More firms now depend on data to guide social campaigns, which expands the market for advanced management software. These tools help companies measure campaign returns, identify high-impact content, and analyze customer behavior. AI and machine learning support predictive insights that improve targeting and scheduling. Brands compare competitor strategies and track sentiment to refine messaging. Sales teams benefit from deeper lead insights, while marketers use automated reports to adjust budgets quickly. As businesses link social data with CRM and ad platforms, demand for high-accuracy attribution and cross-channel analytics keeps increasing and supports long-term market growth.

- For instance, Sprinklr’s Unified-CXM platform ingests unstructured data from more than 30 channels, applies over 1,250 pre-built and custom AI models, and generates more than 10 billion predictions daily, helping brands make cross-channel attribution and sentiment-based marketing decisions.

Rising Adoption of Remote and Hybrid Workflows

Remote teams now rely heavily on cloud-based collaboration tools, including social media management software. These platforms help distributed teams coordinate content calendars, assign tasks, and track approvals in real time. Many companies use role-based access controls to manage global teams across different time zones. Automated alerts and shared dashboards keep workflows smooth even when teams work asynchronously. As brands expand digital operations, dependence on centralized management systems grows. The shift toward flexible work models also drives integration of these tools with project management platforms, enabling faster response to trends and improving campaign execution quality.

Key Trend & Opportunity

Rapid Expansion of AI-Driven Content and Sentiment Tools

AI capabilities now shape the future of social media management software. Platforms offer automated content suggestions, hashtag optimization, and predictive posting times. Real-time sentiment tools help brands monitor audience mood and react before issues escalate. Image and video recognition tools support campaign benchmarking. Companies also use AI chatbots for social service tasks, reducing human workload. As creators increase short-form video output, opportunities grow for tools that analyze visual trends. Vendors offering multimodal analytics and generative features can capture significant demand as brands compete for faster and more precise insights.

- For instance, Sprinklr leverages real-time visual analytics to detect brand mentions in images and video, reportedly achieving industry-leading accuracy in sentiment analysis, thanks to deep-learning models that analyze multimodal data (text + image + video).

Integration with E-Commerce and Customer Service Systems

More businesses integrate social media channels with e-commerce, CRM, and service tools. This supports direct sales through shoppable posts, quick issue resolution, and personalized recommendations. Retail and beauty brands lead this shift as buyers rely heavily on social discovery. Software vendors now offer API-based connectors that sync product feeds, tickets, and customer histories. This linkage helps brands track complete customer journeys from discovery to purchase. Opportunities expand for platforms that provide end-to-end commerce analytics, automated replies, and real-time stock or price updates triggered by social demand patterns.

- For instance, Sprinklr provides native integrations with Magento and Microsoft Dynamics under its E-commerce connector suite, enabling brands to sync customer order history and product catalog data directly into the Sprinklr platform.

Growth of Influencer and Community-Driven Marketing

Influencer marketing continues to rise, creating demand for platforms that track creator performance, manage contracts, and analyze collaboration outcomes. Brands now depend on communities for loyalty, making engagement dashboards valuable. Tools that evaluate creator authenticity, audience demographics, and content impact gain strong interest. Micro-influencers generate new opportunities for niche campaigns. As companies invest in creator partnerships, they require unified platforms to monitor reach, ROI, and content compliance. Vendors that offer influencer-management extensions or integrated creator marketplaces stand to benefit from this expanding ecosystem.

Key Challenge

Data Privacy, Compliance, and Platform Dependency

Brands face rising pressure to follow strict privacy rules across regions, including GDPR and evolving platform-specific policies. These rules limit data access and restrict third-party API capabilities. Sudden changes in platform algorithms or data permissions can disrupt analytics and planned campaigns. Vendors struggle to maintain compliance while delivering accurate insights. Businesses also fear over-dependence on major platforms that control data availability. Ensuring secure storage, consent tracking, and responsible data use becomes complex as teams expand digital operations. These limits slow product innovation and increase operational risk for vendors.

High Competition and Limited Differentiation Among Vendors

The market faces intense competition as many vendors offer similar scheduling, analytics, and publishing features. Businesses often struggle to identify unique value across platforms, which drives pricing pressure. New entrants use low-cost plans to attract small businesses, forcing established providers to invest more in innovation. Maintaining feature depth, integration quality, and customer support adds cost for vendors. Enterprises demand custom workflows and API flexibility, increasing development time. This crowded landscape makes it difficult for companies to stand out without strong AI capabilities, industry specialization, or advanced cross-channel intelligence.

Regional Analysis

North America

North America held the largest share in the social media management software market in 2024 with about 38%. Strong digital adoption, high ad spending, and early use of AI-supported analytics drove demand across enterprises. U.S. retailers, media companies, and technology firms relied heavily on integrated dashboards to manage multi-platform campaigns and customer responses. Rapid uptake of influencer programs and short-video formats supported platform expansion. Canada added steady growth as businesses increased spending on digital engagement. Widespread cloud use, strong API access, and mature marketing ecosystems kept North America the leading region.

Europe

Europe accounted for nearly 28% share of the market in 2024. Large consumer brands across Germany, the U.K., France, and Italy used social media tools to improve campaign compliance and track sentiment across multilingual markets. Strict data rules pushed companies toward secure, GDPR-aligned platforms. Retail, automotive, and financial services companies enhanced service response using unified dashboards. Demand rose for analytics that help brands compare cross-country engagement trends. Growing influencer activity, especially in beauty and fashion, supported further adoption. Expanding e-commerce and rising interest in AI automation kept Europe a strong contributor.

Asia Pacific

Asia Pacific captured about 25% share in 2024, driven by fast digital expansion and high social media usage across China, India, Japan, and Southeast Asia. Local brands adopted management platforms to handle large follower volumes, real-time promotions, and festival-driven spikes. E-commerce giants and travel platforms used advanced analytics to track trends and run targeted campaigns. Influencer ecosystems grew rapidly, boosting demand for creator-tracking tools. Cloud adoption accelerated as small and mid-size firms digitized operations. Rising video consumption and mobile-first behavior strengthened market prospects across the region.

Latin America

Latin America held close to 6% of the market in 2024. Brands in Brazil, Mexico, and Argentina increased use of social media management tools to support promotions, customer service, and influencer partnerships. High mobile usage and strong entertainment-driven engagement supported market adoption. Retail and food-service companies used scheduling and sentiment tools to manage rapid customer feedback cycles. Growth slowed slightly due to economic volatility, but cloud-based platforms remained attractive for cost efficiency. Expanding digital payment ecosystems and rising creator activity continued to push adoption across emerging markets.

Middle East & Africa

Middle East & Africa accounted for about 3% share in 2024, supported by rising digital marketing investments in the UAE, Saudi Arabia, South Africa, and Nigeria. Companies in retail, finance, and hospitality used social media management tools to enhance customer engagement and brand visibility. Government-led digital transformation programs encouraged broader adoption. The region saw growing interest in sentiment tracking due to rising online service queries. Infrastructure gaps slowed uptake in some markets, yet cloud platforms gained traction due to low setup costs. Increasing influencer participation and youth-driven social activity supported steady growth.

Market Segmentations:

By Deployment

By Application

- Sales and Marketing Management

- Customer Experience Management

- Risk Management and Fraud Detection

- Competitive Intelligence

By End User

- Retail

- Travel & Hospitality

- Health & Fitness

- Beauty & Fashion

- Media & Entertainment

- Education

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the social media management software market shows strong activity from global and regional providers. Companies such as Semrush, Hootsuite, SOCi, SocialDog, Meltwater, Sprinklr, Vista Social, Zoho, HubSpot, and Sprout Social compete through analytics depth, multi-platform support, and automation tools. Firms focus on AI features that improve content planning, sentiment tracking, and campaign reporting. Vendors also expand integrations with CRM, e-commerce, and help-desk systems. Many players target specific industries with custom workflows and approval tools. Subscription models remain flexible to attract small and large teams. Strong competition encourages rapid updates and feature expansion. Vendors also invest in influencer tools, compliance features, and real-time monitoring. Market growth pushes companies to enhance mobile apps and cloud performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Semrush (U.S.)

- Hootsuite Inc. (Canada)

- SOCi, Inc. (U.S.)

- SocialDog, Inc. (Japan)

- Meltwater (U.S.)

- Sprinklr, Inc. (U.S.)

- Vista Social LLC (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- HubSpot, Inc. (U.S.)

- Sprout Social, Inc. (U.S.)

Recent Developments

- In November 2025, SOCi, Inc. (U.S.) SOCi announced it had deployed 150,000 AI “Genius” agents, which together completed over 10 million local marketing tasks for multi-location brands. This milestone underlines SOCi’s shift toward an AI-driven social and local marketing platform that automates scheduling, engagement, and reputation workflows at scale.

- In October 2025, Semrush launched “Semrush One”, an integrated suite that unifies SEO, social, and AI search visibility management for marketers across engines and AI assistants. The platform centralizes workflows so teams can plan, publish, and analyze social and search campaigns from a single environment.

- In October 2025, Hootsuite Inc. (Canada) Hootsuite introduced a new Whiteboard workspace in its dashboard, letting teams brainstorm, organize, and move social content ideas directly into publishing. The update connects with its OwlyGPT assistant so users can turn AI-generated suggestions into planned posts without leaving the platform

Report Coverage

The research report offers an in-depth analysis based on Deployment, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger use of AI-driven content creation and automated scheduling.

- Predictive analytics will help brands refine engagement strategies with higher accuracy.

- Cloud-based platforms will expand as companies prefer flexible and scalable deployment.

- Integration with CRM, e-commerce, and service tools will deepen to support unified workflows.

- Influencer management features will grow as brands increase creator-driven campaigns.

- Real-time sentiment tracking will become essential for reputation and risk management.

- Video-focused tools will rise due to rapid growth of short-form and live content.

- Enterprises will demand advanced compliance and data-governance capabilities.

- Small businesses will adopt more affordable, automation-first platforms.

- Regional growth will accelerate in Asia Pacific as mobile-first engagement increases.