Market Overview

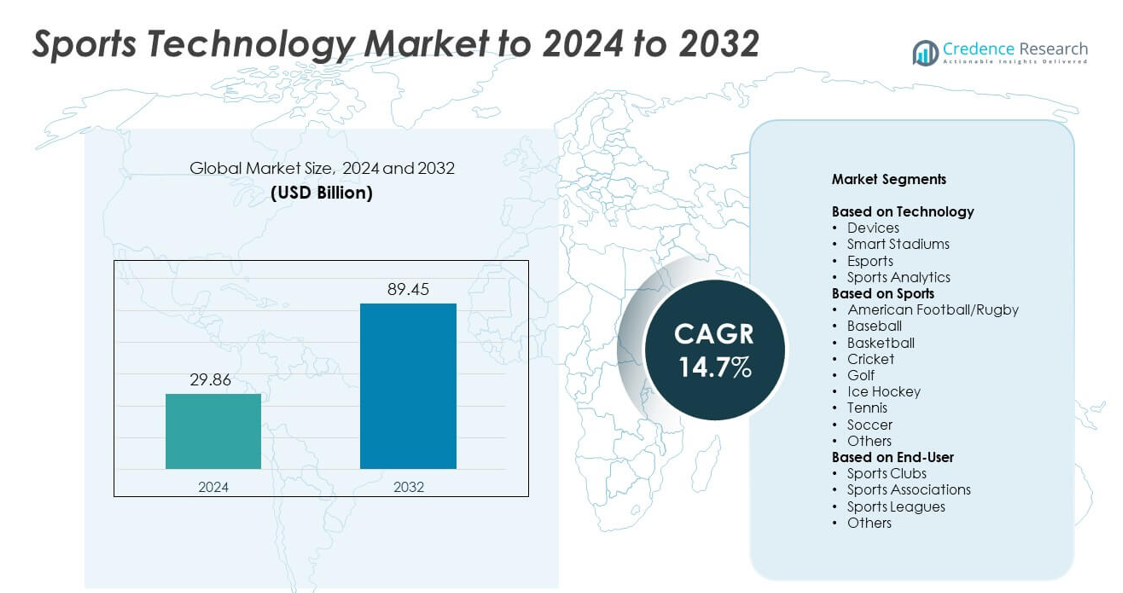

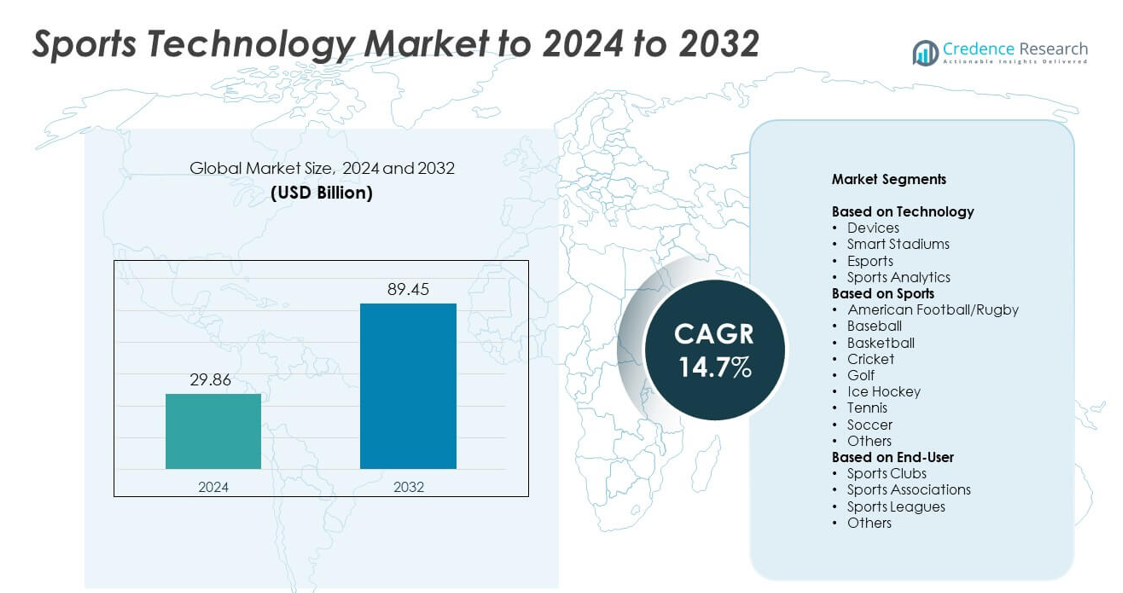

Sports Technology Market size was valued USD 29.86 billion in 2024 and is anticipated to reach USD 89.45 billion by 2032, at a CAGR of 14.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sports Technology Market Size 2024 |

USD 29.86 billion |

| Sports Technology Market, CAGR |

14.7% |

| Sports Technology Market Size 2032 |

USD 89.45 billion |

The Sports Technology Market is driven by major players such as IBM Corporation, Panasonic Corporation, Infosys Limited, Apple Inc., Oracle Corporation, Cisco Systems, Inc., SAP SE, HCL Technologies Limited, Modern Times Group MTG, and ChyronHego Corporation. These companies expand their presence through advanced analytics platforms, connected wearables, smart stadium systems, and AI-enabled performance tools. Their solutions support player monitoring, tactical planning, and fan engagement across global sports ecosystems. North America leads the market with about 37% share due to strong digital adoption in major leagues, followed by Europe with nearly 29% share, supported by heavy investment in football and stadium modernization.

Market Insights

- The Sports Technology Market was valued at USD 29.86 billion in 2024 and is projected to reach USD 89.45 billion by 2032, growing at a CAGR of 14.7%.

- Demand rises due to strong use of analytics, with the sports analytics segment holding about 38% share in 2024 as teams adopt data tools for performance, injury prevention, and tactical planning.

- Key trends include rapid growth of smart stadium upgrades, wider adoption of wearables, and fast expansion of esports technology as digital engagement becomes central to fan experience.

- Competition strengthens as global technology leaders invest in AI systems, cloud platforms, and connected devices to support training, venue operations, and broadcast enhancement across major sports ecosystems.

- North America leads with 37% share, followed by Europe at 29% and Asia Pacific at 24%, while Latin America holds 6% and the Middle East and Africa account for 4%, driven by rising digital transformation in stadiums and leagues.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Sports analytics held the dominant share in 2024 with about 38% of the Sports Technology Market. Strong demand came from real-time performance tracking, video review systems, and AI-based decision tools used by teams and leagues. Analytics platforms support injury prevention and performance planning, which drives rapid adoption across professional and semi-professional sports. Smart stadiums and devices grew as clubs invested in connected infrastructure, wearables, and fan-engagement tools. Esports recorded fast expansion due to rising viewership and digital tournaments worldwide.

- For instance, Catapult Sports reports that its performance analytics and wearable systems are used by more than 4,200 elite teams across over 40 sports in more than 100 countries as of its 2024 annual report.

By Sports

Soccer led the market in 2024 with nearly 34% share due to its large global audience, heavy investment by top leagues, and high use of tracking systems and VAR technologies. Teams adopt data tools, video systems, and smart wearables to improve match preparation and player health. Basketball and cricket also show rapid growth as franchises upgrade training systems and analytics platforms. Other sports adopt technology at a steady pace as digital solutions enhance fairness, safety, and fan engagement.

- For instance, Hawk-Eye goal-line systems in football use seven high-speed cameras per goal, for a total of 14 cameras per match.

By End-User

Sports leagues accounted for the largest share in 2024 with close to 41% of the Sports Technology Market. Leagues invest heavily in analytics, broadcast technologies, VAR systems, and stadium upgrades to improve match quality and commercial reach. Sports clubs follow with rising adoption of wearables, training software, and talent-tracking tools to enhance player performance. Sports associations adopt technology for event management, compliance, and competition monitoring. Wider digital transformation across global tournaments continues to support long-term demand.

Key Growth Drivers

Rising Demand for Data-Driven Performance Optimization

Teams adopt advanced sensors, analytics platforms, and video systems to improve player output and reduce injury risks. Clubs and leagues rely on AI tools to track movement, strength levels, and training loads in real time. This shift helps coaches make fast decisions and upgrade tactical planning. Growing dependence on accurate data strengthens demand for integrated performance technologies across major sports.

- For instance, STATS SportVU optical tracking in the NBA uses six specialised cameras in each arena to track the ball and all players at 25 samples per second, generating roughly one million data records per game for performance analysis.

Expansion of Smart Stadium Infrastructure

Smart stadium projects grow as venues install connected seating, automated ticketing, and real-time fan engagement systems. High-speed networks and IoT sensors support crowd management and enhanced safety. Broad digital upgrades help leagues offer immersive viewing and seamless operations. This expansion drives large-scale adoption of integrated sports technologies across new and existing venues.

- For instance, Cisco states that SoFi Stadium in California runs one of the world’s largest Wi-Fi 6 deployments, with approximately 2,500 Cisco access points supporting high-bandwidth applications such as uncompressed 4K video across the venue

Growth of Esports and Digital Sports Experiences

Esports gains strong traction due to rising global audiences and widespread streaming access. New tournaments create demand for advanced gaming hardware, AI-based event management, and audience analytics. Digital engagement platforms support better viewer interaction and sponsorship value. Rapid commercialization of esports accelerates investment in modern sports technology tools.

Key Trends & Opportunities

Adoption of AI and Machine Learning in Sports

AI systems help teams analyze tactical patterns, forecast injuries, and evaluate player performance with high precision. Machine learning models support scouting and lineup decisions through continuous data processing. Broad use of predictive insights creates strong adoption opportunities. As AI tools become easier to integrate, more leagues invest in automated decision systems.

- For instance, the NBA’s current optical tracking system, provided by Hawk-Eye since the 2023-2024 season, is deployed across all 29 NBA arenas.

Growth in Wearable and Connected Athlete Devices

Wearables track biometric, motion, and fatigue metrics to support personalized training. Demand increases as clubs focus on athlete health and reliable workload management. Advances in miniaturized sensors and cloud dashboards enable real-time monitoring during training and games. This trend expands opportunities for companies offering smart devices and integrated analytics.

- For instance, WHOOP confirms that its performance strap measures key physiological and motion variables more than 100 times per second, 24 hours a day, for athletes including those covered under its data agreement with the NFL Players Association.

Rising Focus on Fan Engagement Technologies

Teams use AR, VR, and digital platforms to improve fan interaction. Enhanced match-day experiences, interactive content, and personalized updates lift user engagement. Strong investment in digital engagement tools supports revenue growth for leagues and clubs. This trend brings new opportunities for tech players delivering immersive fan solutions.

Key Challenges

High Cost of Advanced Sports Technologies

Teams face heavy investment needs for analytics software, AI systems, and smart stadium upgrades. Smaller clubs struggle to adopt premium solutions due to limited budgets. High maintenance costs add pressure on long-term spending. These financial barriers slow technology penetration in developing sports markets.

Data Privacy and Integration Complexities

Sports organizations collect large volumes of player and fan data, raising concerns about privacy and secure storage. Integrating multiple technologies across stadiums, clubs, and leagues also creates compatibility issues. Managing cross-platform data flow requires strong cybersecurity and technical expertise. These challenges slow smooth adoption of modern sports technology systems.

Regional Analysis

North America

North America held the leading share of about 37% of the Sports Technology Market in 2024 due to strong adoption of analytics platforms, wearables, and smart stadium systems across major leagues. High investment by NFL, NBA, and MLS teams drives steady demand for performance tools and fan-engagement technologies. Broad digital infrastructure and early use of AI-based training systems strengthen regional dominance. Expanding esports activity and rising commercialization of data-driven platforms continue to support long-term growth across the United States and Canada.

Europe

Europe accounted for nearly 29% share in 2024, supported by strong adoption across football clubs, racing events, and tennis tournaments. Premier League, Bundesliga, and La Liga teams invest heavily in tracking devices, biometric sensors, and match-analysis systems. Smart stadium upgrades and strict player-health monitoring rules boost market expansion. Esports adoption and training digitization further improve growth prospects. Rising innovation from regional tech companies enhances integration of cloud-based sports tools across competitive and recreational sports environments.

Asia Pacific

Asia Pacific captured around 24% share in 2024 and recorded the fastest growth due to rising investments in smart venues, esports tournaments, and advanced athlete-tracking systems. China, Japan, South Korea, and India drive demand through expanding digital sports ecosystems and large fan bases. Wearable devices gain rapid traction as regional leagues use real-time tracking for improved performance analysis. Government-backed sports development programs further accelerate technology adoption across stadiums, clubs, and training centers.

Latin America

Latin America held about 6% share in 2024, driven by growing modernization of football infrastructure and rising adoption of VAR and analytics tools. Brazil, Mexico, and Argentina upgrade training systems to support competitive league performance. Wearables and digital fan-engagement platforms gain popularity as clubs digitize operations. Expansion of esports and strengthening sports investment pipelines contribute to steady growth across the region.

Middle East and Africa

Middle East and Africa accounted for roughly 4% share in 2024, supported by strong government investment in sports development and smart stadium infrastructure. Countries such as the UAE, Qatar, and Saudi Arabia adopt advanced analytics, venue management tools, and athlete-performance systems to support global tournaments and local leagues. Growing interest in esports and rising commercial sports events enhance market penetration. Wider digital transformation efforts continue to expand opportunities across the region.

Market Segmentations:

By Technology

- Devices

- Smart Stadiums

- Esports

- Sports Analytics

By Sports

- American Football/Rugby

- Baseball

- Basketball

- Cricket

- Golf

- Ice Hockey

- Tennis

- Soccer

- Others

By End-User

- Sports Clubs

- Sports Associations

- Sports Leagues

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sports Technology Market is shaped by leading companies such as IBM Corporation, Panasonic Corporation, Infosys Limited, Apple Inc., Oracle Corporation, Cisco Systems, Inc., SAP SE, HCL Technologies Limited, Modern Times Group MTG, and ChyronHego Corporation. The competitive landscape reflects strong investment in AI-based performance systems, real-time analytics platforms, and cloud-integrated solutions that support both team operations and fan engagement. Firms focus on building advanced wearable ecosystems, venue management software, and immersive broadcast technologies to enhance commercial value for leagues and clubs. Many competitors expand through partnerships with sports organizations, enabling faster technology adoption and broader digital transformation. Companies also strengthen portfolios by improving cybersecurity, data accuracy, and predictive modeling capabilities to meet rising expectations across global sports environments. As digital adoption accelerates, competition intensifies around scalable platforms that support training optimization, stadium automation, and interactive viewer experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM Corporation

- Panasonic Corporation

- Infosys Limited

- Apple Inc.

- Oracle Corporation

- Cisco Systems, Inc.

- SAP SE

- HCL Technologies Limited

- Modern Times Group MTG

- ChyronHego Corporation

Recent Developments

- In 2025, Chyron teamed with Asport for a cloud-based live sports production solution featuring AI-driven replay and graphics.

- In 2025, Cisco extended its multi-year partnership with Real Madrid. The agreement focuses on upgrading the Real Madrid Sports City training complex with a new AI-ready data center and the deployment of Wi-Fi 7 connectivity.

- In 2024, Apple launched the Apple Sports app, providing real-time scores, stats, and updates for sports fans on iPhone.

Report Coverage

The research report offers an in-depth analysis based on Technology, Sports, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as teams adopt deeper analytics for performance decisions.

- Smart stadium projects will grow as venues upgrade networks and digital systems.

- Esports technology adoption will rise with increasing global viewership.

- Wearables will advance with better sensors and stronger cloud integration.

- AI tools will become standard in scouting, injury prediction, and tactical planning.

- Fan engagement platforms will evolve with immersive AR and VR features.

- Leagues will invest more in cybersecurity to protect athlete and fan data.

- Training environments will shift toward fully connected and automated systems.

- Broadcasting technology will improve with enhanced real-time data overlays.

- Cross-sport technology collaborations will increase product innovation and global reach.