Market Overview:

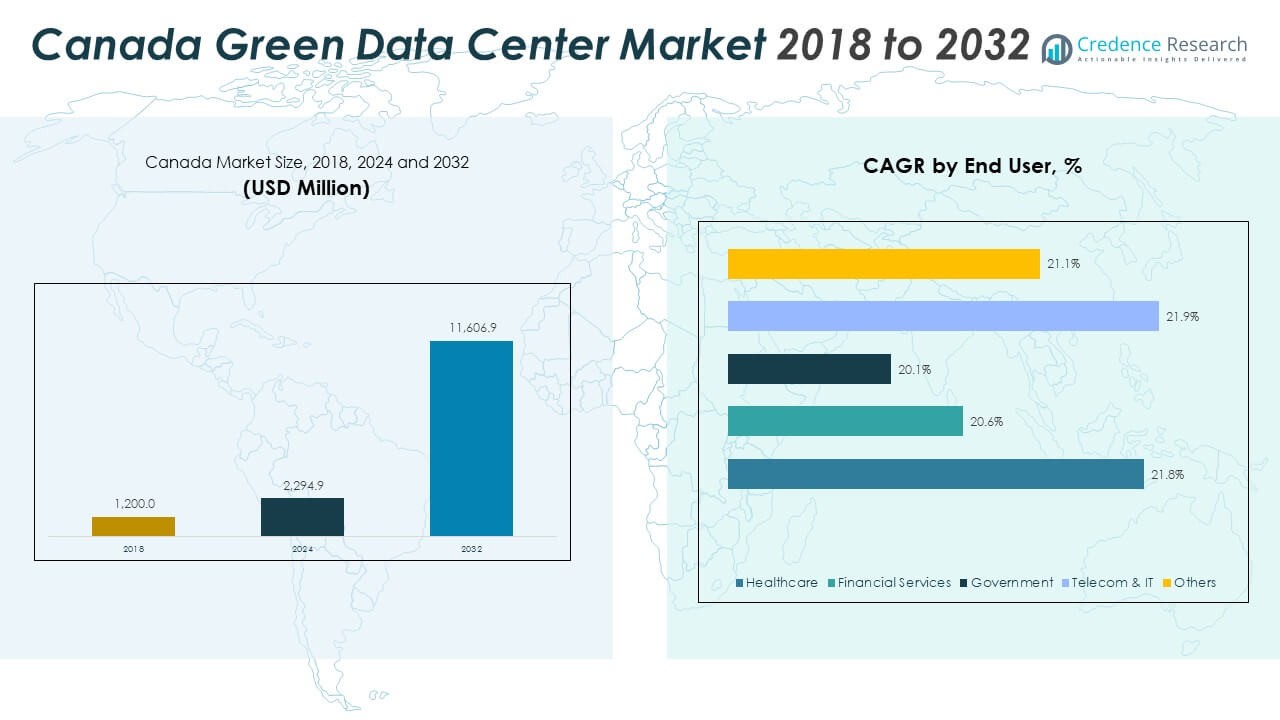

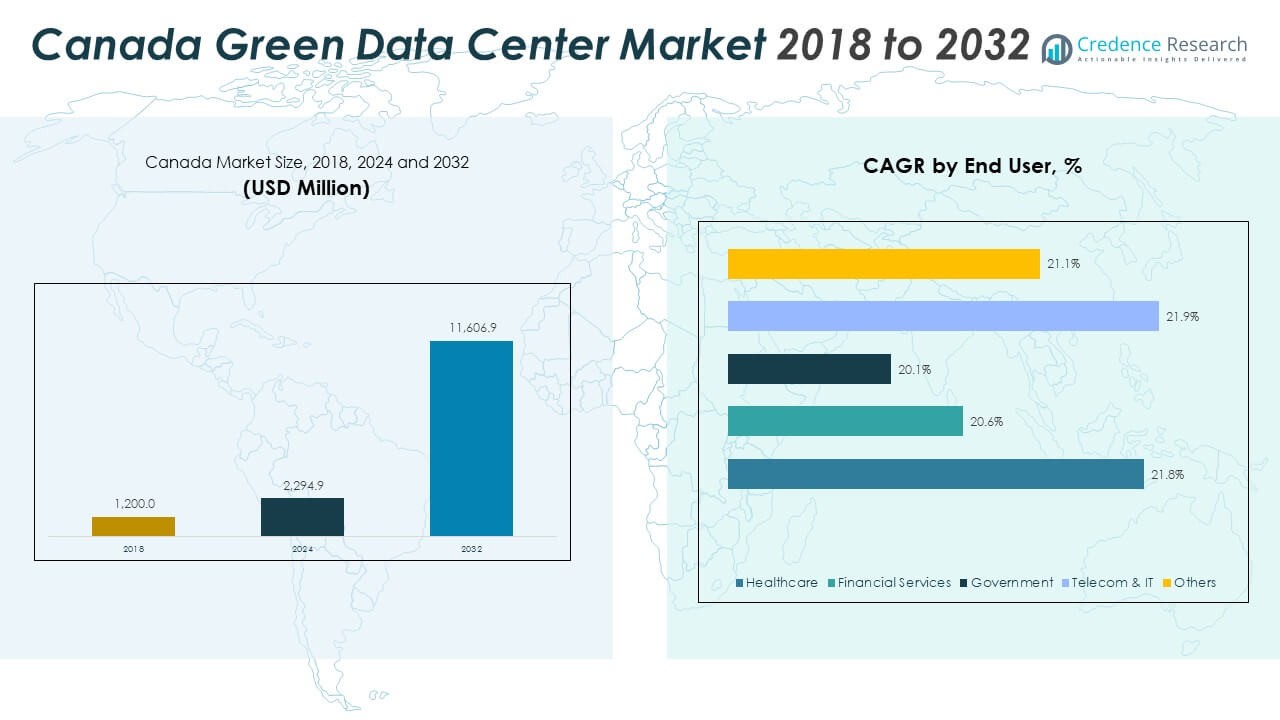

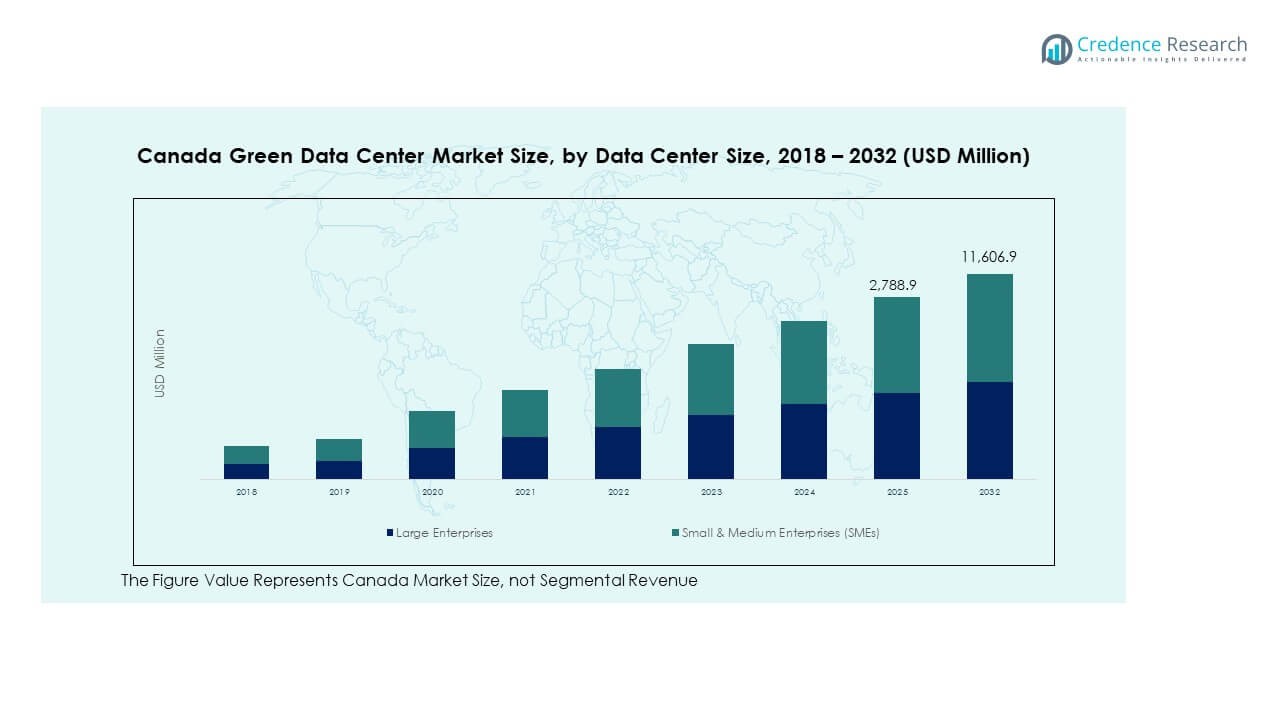

The Canada Green Data Center Market size was valued at USD 1,200.0 million in 2018 to USD 2,294.9 million in 2024 and is anticipated to reach USD 11,606.9 million by 2032, at a CAGR of 22.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Green Data Center Market Size 2024 |

USD 2,294.9 Million |

| Canada Green Data Center Market, CAGR |

22.60% |

| Canada Green Data Center Market Size 2032 |

USD 11,606.9 Million |

Growing focus on energy-efficient digital infrastructure drives strong interest across Canadian operators. Firms adopt advanced cooling, renewable sourcing, and automation to cut operational costs and reduce carbon footprints. Government sustainability rules push operators to upgrade legacy sites and introduce cleaner builds. Cloud expansion, AI workloads, and rising compute density lift demand for low-PUE architectures. Hyperscale firms integrate hydro, solar, and wind-based power to meet net-zero goals. Investors back projects with long-term green credentials. These drivers support steady momentum for green facilities across Canada.

Western and Central Canada lead due to strong renewable availability, stable climate conditions, and major hyperscale presence. Provinces like Quebec and British Columbia gain traction with attractive power rates and mature clean-energy grids. Ontario supports growth with dense enterprise hubs and rising cloud adoption. Emerging activity appears across Alberta and Manitoba as operators expand into regions with scalable land and renewable access. Northern zones also draw interest for natural cooling benefits. This geographic mix strengthens Canada’s position as a preferred green data center corridor.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Green Data Center Market grew from USD 1,200.0 million in 2018 to USD 2,294.9 million in 2024, and is projected to reach USD 11,606.9 million by 2032 at a 22.60% CAGR, driven by sustainability mandates and hyperscale demand.

- Western Canada holds the largest share at 40%, supported by hydro resources and cold climate; Central Canada follows with 35% due to strong enterprise hubs; Eastern & Northern Canada hold 25%, driven by Quebec’s competitive renewable power.

- Eastern & Northern Canada represent the fastest-growing region, holding 25%, supported by hydro-backed grids, low power rates, and rising interest in AI-ready sustainable campuses.

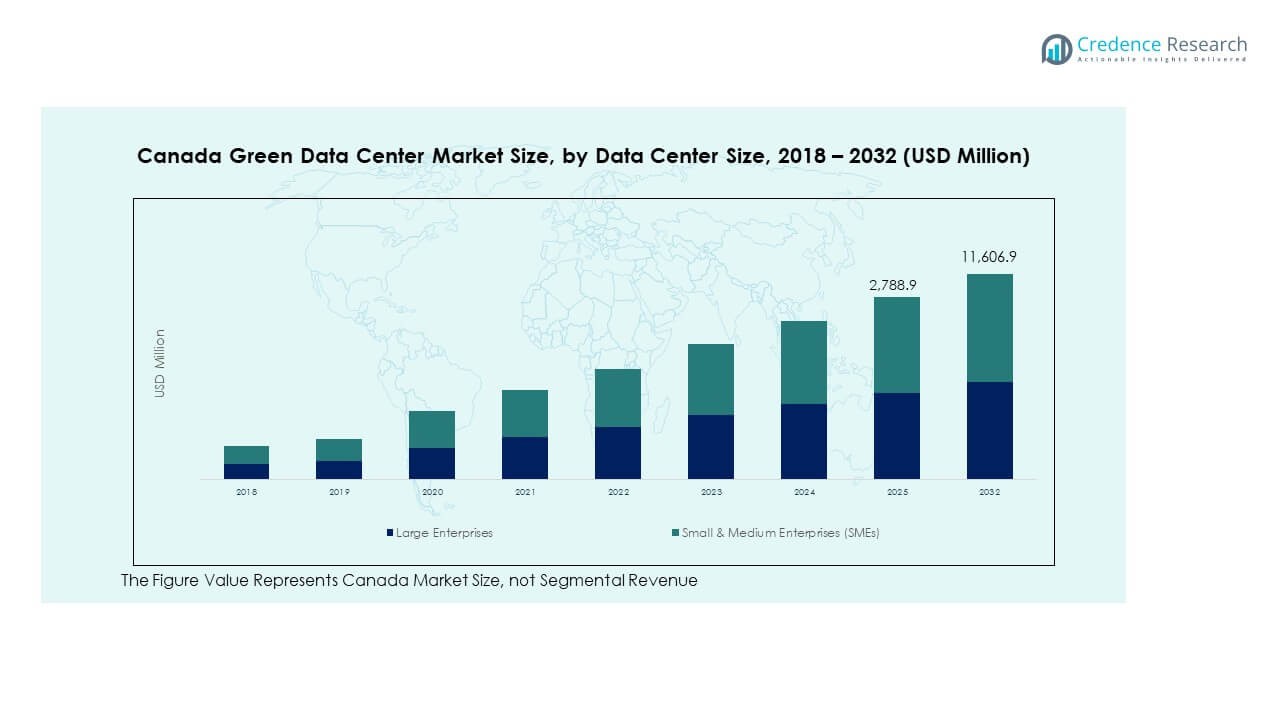

- Small & Medium Enterprises (SMEs) account for roughly 60% of demand in the chart, driven by cloud migration and affordable green infrastructure options.

- Large Enterprises represent about 40% of the segment share, supported by dense workloads, advanced cooling adoption, and strong sustainability commitments across major provinces.

Market Drivers:

Growing Push Toward Low-Carbon Digital Infrastructure

The Canada Green Data Center Market expands due to strong pressure to reduce carbon output across digital operations. Operators use renewable power to support heavy compute loads and meet corporate sustainability mandates. Firms replace older equipment to improve efficiency and meet tightening energy rules. Hyperscale expansions drive higher demand for low-PUE systems across provinces. Government climate frameworks support new projects through clear compliance paths. Enterprise buyers prefer facilities with verified green footprints for long-term cost control. This shift strengthens steady adoption of green standards across major sites.

- For instance, Google’s Canadian operations match 100% of their energy use with renewables and run infrastructure with a reported PUE as low as 1.10 in several North American sites.

Rising Demand for Clean Energy Integration Across Data Center Workloads

Clean energy supply plays a major role in market growth as operators secure hydro and wind access for long-term stability. Companies design new campuses around renewable corridors to reduce dependence on fossil-based grids. AI and cloud workloads increase the need for efficient power use across dense racks. Investors evaluate environmental performance before backing large-scale builds. Energy credits encourage operators to advance greener models. Automation in cooling and power systems helps lower waste across workloads. The shift raises confidence in sustainable digital infrastructure growth.

- For instance, eStruxture MTL-2 facility in Montreal operates on 100% hydroelectric power while delivering up to 30MW of capacity to support energy-efficient workloads.

Rapid Adoption of Advanced Cooling and Sustainable Architecture Designs

Low-temperature climates support stronger interest in advanced cooling frameworks across Canada. Free cooling and liquid systems help operators cut energy footprints in dense sites. Sustainability targets encourage broader use of modular designs and recyclable materials. Local enterprises demand facilities that meet strict environmental standards. Automation tools refine airflow and track performance in real-time to avoid energy loss. Cloud traffic spikes push operators to modernize legacy architecture. This move enhances long-term system reliability across shifting workloads.

Government Support and Enterprise Sustainability Commitments Accelerating Infrastructure Upgrades

Regulatory bodies promote clean energy alignment across digital infrastructure upgrades. Operators face rising pressure to comply with national emission rules. Large enterprises adopt sustainability roadmaps to reach net-zero targets. Modernization of older campuses becomes essential to reduce power waste. Financing for green developments attracts long-term investors. Smart monitoring platforms improve visibility across energy flows. The wave of commitments positions Canada for leadership in sustainable digital ecosystems.

Market Trends:

Expansion of Hyperscale Campuses Supported by Renewable Corridors

The Canada Green Data Center Market follows a rising shift toward hyperscale campuses located near renewable hubs. Operators select sites close to hydro and wind clusters to ensure cleaner power supply. New campuses integrate automation and predictive controls to reduce waste. High-density racks require optimized architecture suited for AI-heavy loads. Firms test low-carbon building materials for sustainability compliance. Renewable-backed contracts strengthen operator credibility across digital ecosystems. This direction increases interest from global cloud players.

Growing Use of Liquid Cooling and Immersion Techniques in Dense Workloads

Operators adopt liquid and immersion cooling to support increasing chip density. AI training loads create higher heat output that demands efficient removal methods. Facilities redesign layouts to support these cooling systems at scale. Enterprises prefer liquid setups for long-term efficiency targets. Developers refine controls to maintain optimal temperature ranges across racks. The shift reduces reliance on traditional air-cooled setups. Adoption supports sustainable operations across demanding workloads.

- For instance, Microsoft publicly confirmed the deployment of two-phase immersion cooling for Azure HPC servers, achieving up to a 30% increase in server performance in production environments.

Rise in Green Certifications and Third-Party Validation for Facility Sustainability

Certification frameworks gain importance as operators seek external validation for green claims. Firms pursue standards tied to renewable sourcing and energy optimization. Certification audits help strengthen investor trust in long-term performance. Enterprises use certified facilities to meet internal sustainability targets. Automated tracking improves transparency across environmental metrics. Operators use reporting to benchmark performance against global peers. This trend improves overall accountability across the market.

Shift Toward Modular, Scalable, and Prefabricated Infrastructure for Faster Deployment

Modular designs help operators expand capacity without long construction timelines. Prefabricated units support flexible deployment across renewable zones. AI and cloud growth pushes companies to prioritize rapid scaling. Operators refine modular cooling and power kits to reduce energy impact. Enterprises select modular setups for predictable performance across sites. These systems support sustainable growth through consistent design templates. Adoption strengthens deployment efficiency across the market.

Market Challenges Analysis:

High Energy Demand, Grid Constraints, and Rising Pressure on Renewable Availability

The Canada Green Data Center Market faces challenges tied to rising energy loads across dense workloads. Grid constraints limit how quickly operators can expand in key provinces. Renewable availability faces seasonal variation that affects long-term supply planning. High-density AI clusters increase power stress across existing networks. Operators navigate complex procurement models to secure green energy contracts. Costs tied to advanced cooling and renewable integration remain high. It creates hurdles for smaller operators seeking scalable growth.

Regulatory Complexity, Land Constraints, and Long Development Cycles

Operators face multi-layered environmental reviews before building large-scale campuses. Land availability is limited in zones near major renewable corridors. Rising construction standards increase capital demands for new sites. Long approval cycles slow market entry for emerging firms. Talent shortages extend timeframes for advanced system integration. Supply chain delays impact delivery of efficient hardware. These factors create challenges for meeting rising digital demand.

Market Opportunities:

Expansion of Renewable-Backed Campuses and Low-PUE Facility Designs

The Canada Green Data Center Market benefits from major opportunities tied to renewable-backed campus growth. Abundant hydro and wind corridors support future hyperscale builds. Low-PUE designs attract global cloud buyers seeking sustainable footprints. Operators can leverage advanced cooling to reduce energy intensity across heavy workloads. Provinces with stable climates support free cooling adoption. Growth in AI and cloud workloads opens demand for efficient power use. These strengths position Canada for long-term capacity growth.

Rise of Edge Deployments, AI Clusters, and Modular Green Facilities

Edge computing gains momentum as enterprises seek low-latency digital access. AI clusters drive interest in sustainable high-density designs. Modular facilities enable fast expansion near renewable zones. Automation enhances energy visibility across distributed sites. Enterprises invest in green platforms to meet corporate sustainability targets. Growth in digital transformation increases demand for eco-efficient deployments. These openings support stronger infrastructure development across Canada.

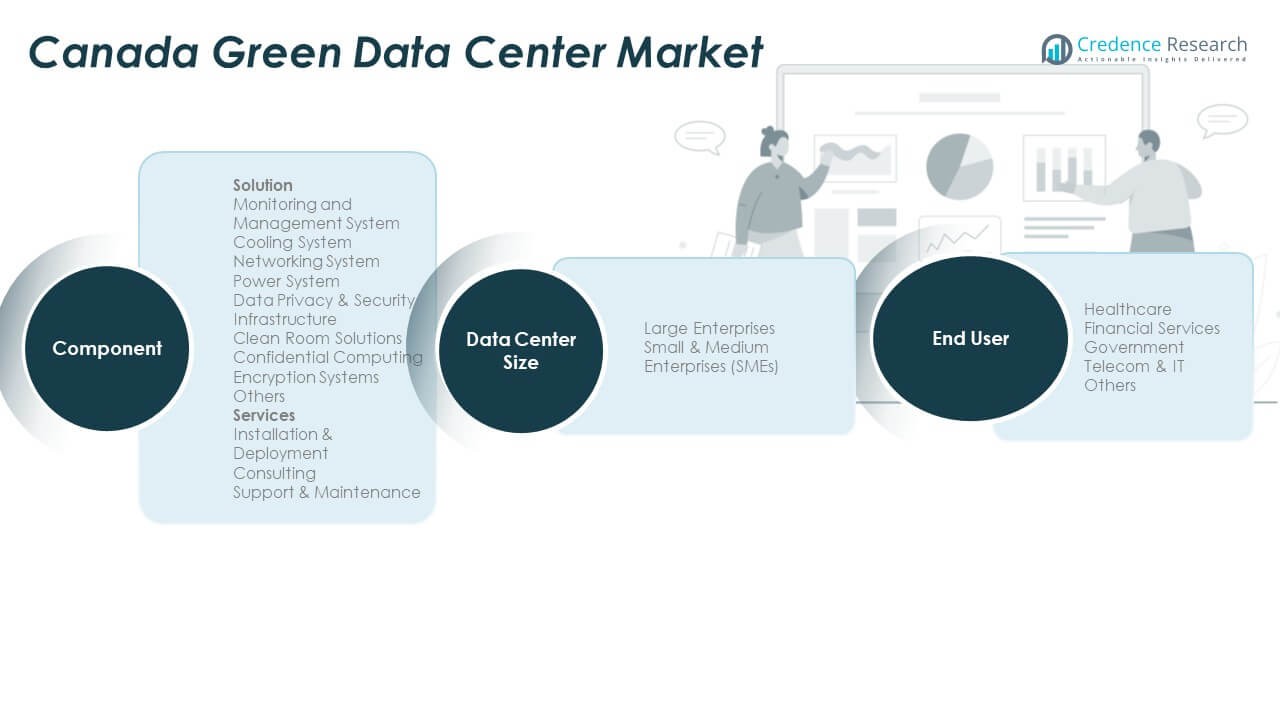

Market Segmentation Analysis:

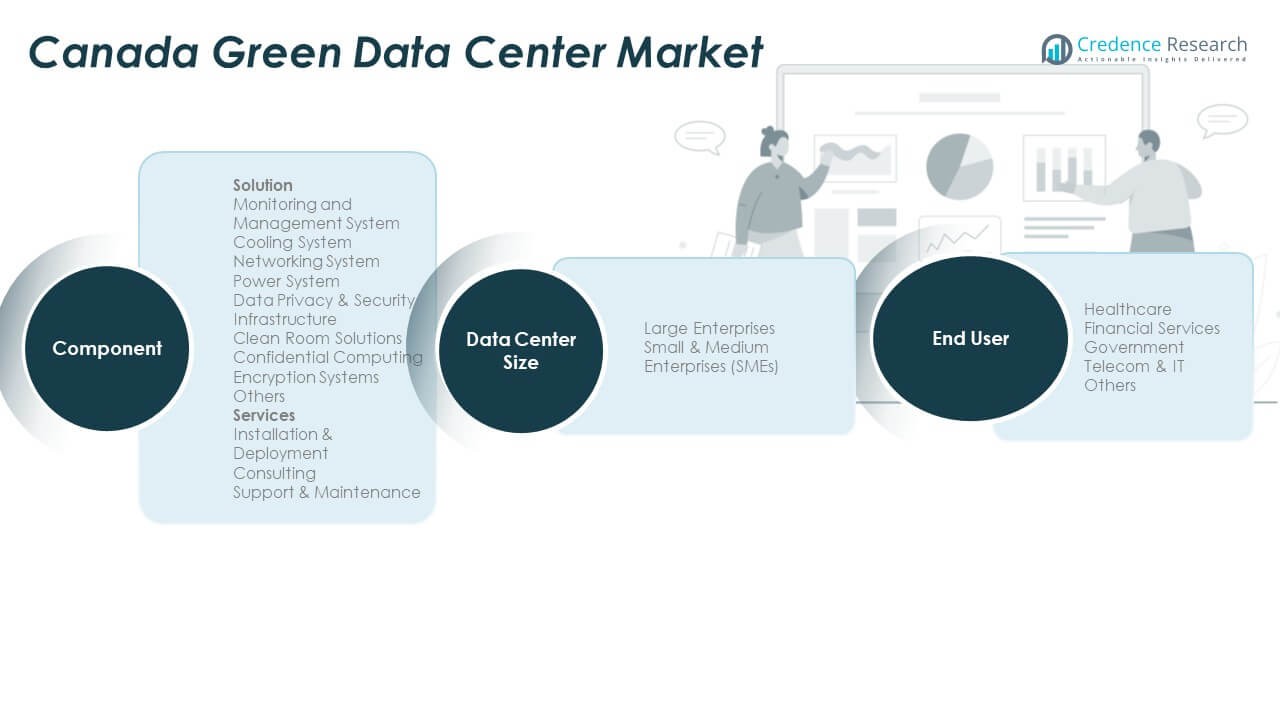

By Component

The Canada Green Data Center Market expands through strong demand across solution and services categories. Solutions hold major traction due to advanced cooling systems, efficient power systems, and modern networking upgrades. Monitoring and management platforms support automation across critical operations. Data privacy and security infrastructure grows through rising adoption of clean room solutions, confidential computing, and encryption systems. The services segment gains steady interest due to installation and deployment needs, expert consulting support, and long-term maintenance contracts.

- For instance, IBM’s confidential computing offering uses hardware-based isolation on IBM Hyper Protect architecture, securing workloads with FIPS 140-2 Level 4 certified modules—the highest commercial security classification.

By Data Center Size

Large enterprises lead demand due to heavy workloads, AI expansion, and higher sustainability targets. These organizations invest in advanced cooling and renewable-backed power to reduce energy impact. SMEs adopt green models at a gradual pace while upgrading legacy infrastructure to meet new efficiency norms. Growth from cloud-native firms supports rising interest in greener facilities across mid-scale deployments. This segmentation shows strong movement toward scalable low-carbon infrastructure.

- For instance, AWS continues expanding its sustainable infrastructure across Canada, with all AWS Regions now operating on 100% renewable energy matching and supporting high-density enterprise workloads.

By End User

Telecom and IT firms dominate adoption due to continuous cloud traffic and digital service expansion. Financial services rely on sustainable facilities to support secure and high-availability operations. Government agencies upgrade digital infrastructure to align with national environmental goals. Healthcare providers depend on efficient data centers to manage compliance-heavy workloads. Other sectors follow similar paths while integrating energy-efficient systems into expanding digital networks.

Segmentation:

By Component

Solution Sub-Segments

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Data Privacy & Security Infrastructure

- Others

Data Privacy & Security Infrastructure Sub-Segments

- Clean Room Solutions

- Confidential Computing

- Encryption Systems

Services Sub-Segments

- Installation & Deployment

- Consulting

- Support & Maintenance

By Data Center Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Regional Analysis:

Western Canada

The Canada Green Data Center Market gains strong momentum in Western Canada due to the region’s abundant renewable energy and low-temperature climate. Western provinces hold an estimated 40% market share, driven by hydroelectric capacity in British Columbia and wind development in Alberta. Operators prefer these provinces for scalable land availability and efficient free-cooling potential. Hyperscale companies select this region to secure long-term clean energy contracts. Government support for carbon-neutral digital infrastructure strengthens investor interest. The region continues to attract AI and cloud deployments that require high-density efficiency. It positions Western Canada as a core cluster for sustainable digital growth.

Central Canada

Central Canada maintains a significant role with an estimated 35% market share, supported by strong enterprise adoption and resilient urban connectivity. Ontario drives most of the regional activity through large data center corridors near Toronto and Ottawa. Enterprises invest in green upgrades to align with corporate sustainability targets and federal clean-energy mandates. The Canada Green Data Center Market benefits from smart-grid expansion and improving renewable integration across Central provinces. Local operators modernize campuses by using high-efficiency cooling and power systems. The region’s dense financial and government sector presence drives demand for secure and energy-efficient workloads. It remains a strategic hub for green transformation across national digital operations.

Eastern & Northern Canada

Eastern and Northern Canada account for an estimated 25% market share, supported by rising activity in Quebec and emerging interest in northern zones. Quebec leads through one of the world’s most competitive hydroelectric footprints, attracting major global operators. Low power prices, strong sustainability policies, and a cold climate support high interest in green facility builds. Northern regions gain attention for natural cooling benefits and growing land availability for future hyperscale campuses. Operators consider these zones suitable for AI-ready infrastructure with low carbon intensity. Rising digitalization across provincial agencies and local enterprises lifts demand for efficient infrastructure. It supports long-term regional expansion opportunities in cleaner, colder zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Canada Green Data Center Market features strong competition among telecom operators, colocation providers, and cloud-focused infrastructure firms. Companies enhance efficiency through advanced cooling, renewable integration, and modern power systems. It gains momentum from hyperscale expansion driven by high-density compute needs. Operators invest in automation to optimize energy performance and strengthen long-term sustainability. Firms seek advantage by securing low-carbon power contracts and expanding capacity near renewable corridors. Partnerships with technology vendors help improve operational resilience. Continuous innovation keeps competitive intensity high across core regions.

Recent Developments:

- In November 2025, TeraGo announced a strategic partnership with Fortinet to deliver advanced managed networking solutions with integrated security. This collaboration follows TeraGo’s earlier divestiture of its physical data center assets (acquired by Hut 8 in 2022) and signals its sharpened focus on providing secure, high-performance connectivity and 5G private wireless networks that link businesses to the broader green cloud and data center ecosystem. The partnership aims to enhance the security and efficiency of data transmission for Canadian enterprises utilizing hybrid and cloud infrastructures.

- In October 2025, the OpenStack community, championed in Canada by key providers like VEXXHOST, celebrated the release of OpenStack 2025.2 (Flamingo). This update is significant for the Canadian green data center market as it enhances the efficiency of cloud infrastructure, allowing operators to better manage power consumption and workloads across “sovereign” clouds. The new release supports the growing demand for open-source, energy-efficient cloud alternatives, which are heavily utilized by Canadian research institutions and sustainable service providers to avoid vendor lock-in and optimize resource usage.

- In August 2025, Rogers Communications entered into a definitive agreement to sell its data center portfolio to InfraRed Capital Partners (part of Sun Life) for an undisclosed amount. While Rogers divested the physical assets to focus on its core telecom business, the partnership allows Rogers to continue selling data center services and connectivity to its clients. This transition transfers the operation of nine Tier 2 and Tier 3 facilities across Canada to InfraRed, an asset manager with a strong focus on sustainable infrastructure investment and value-add strategies.

- In May 2025, Bell Canada launched Bell AI Fabric, a sovereign AI cloud infrastructure designed to support the country’s green data center market. This initiative began with a partnership to deploy a data center supercluster in British Columbia, leveraging the province’s hydroelectric power to provide upwards of 500 MW of environmentally responsible, renewable energy-driven compute capacity. Additionally, in July 2025, Bell deepened its sustainable digital ecosystem by partnering with Cohere to deliver sovereign, energy-efficient AI solutions to Canadian enterprises and government clients.

Report Coverage:

The research report offers an in-depth analysis based on Component, Data Center Size, and End User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Renewable-backed campuses will strengthen adoption of low-carbon digital infrastructure across major provinces.

- AI workloads will drive interest in high-density, energy-efficient designs that support sustainable performance.

- Liquid cooling and immersion technologies will gain traction as operators manage rising power and heat loads.

- Government emission targets will accelerate modernization of legacy facilities into greener, automated sites.

- Growth of cloud-native firms will push demand for scalable and modular green data center designs.

- Provinces with competitive hydro resources will attract global hyperscale investments for large campuses.

- Energy-efficient security and privacy systems will expand within sustainability-focused deployments.

- Smart-grid integration will support stronger performance monitoring across power-intensive workloads.

- Edge facilities will expand to support low-latency applications while maintaining clean energy alignment.

- Long-term investment interest will rise as the sector matures around clear environmental and operational standards.