Market Overview

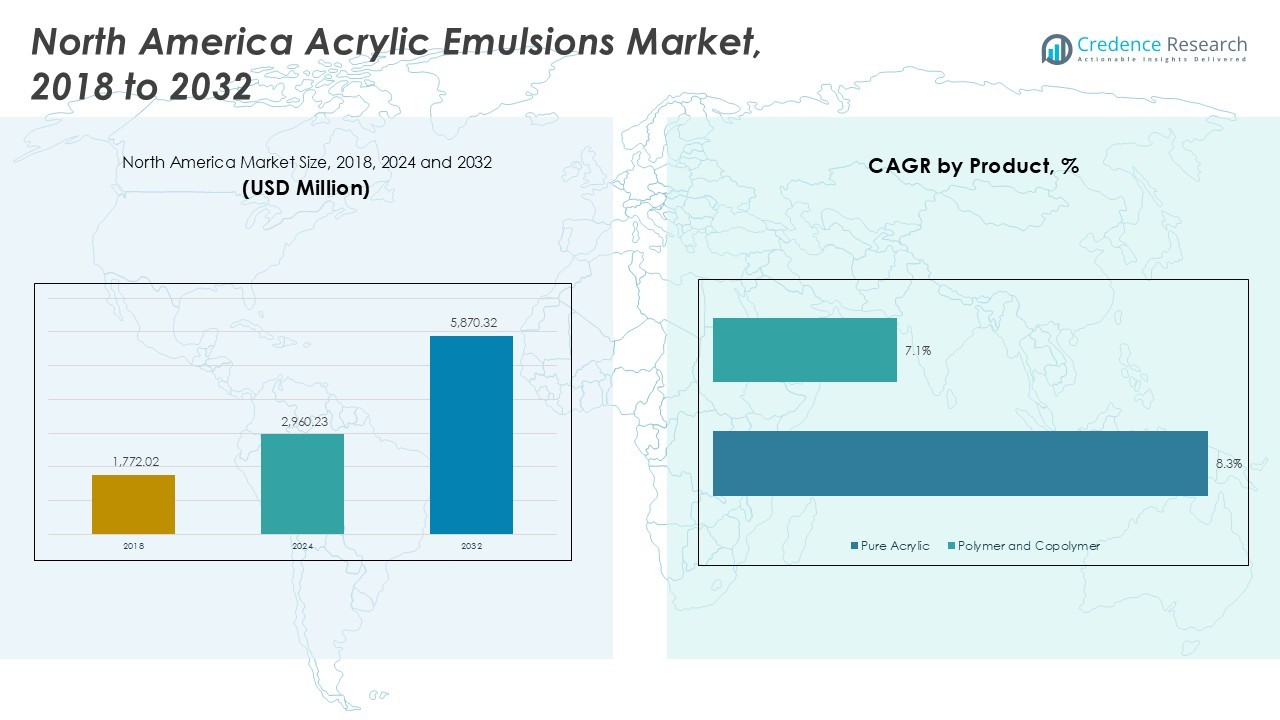

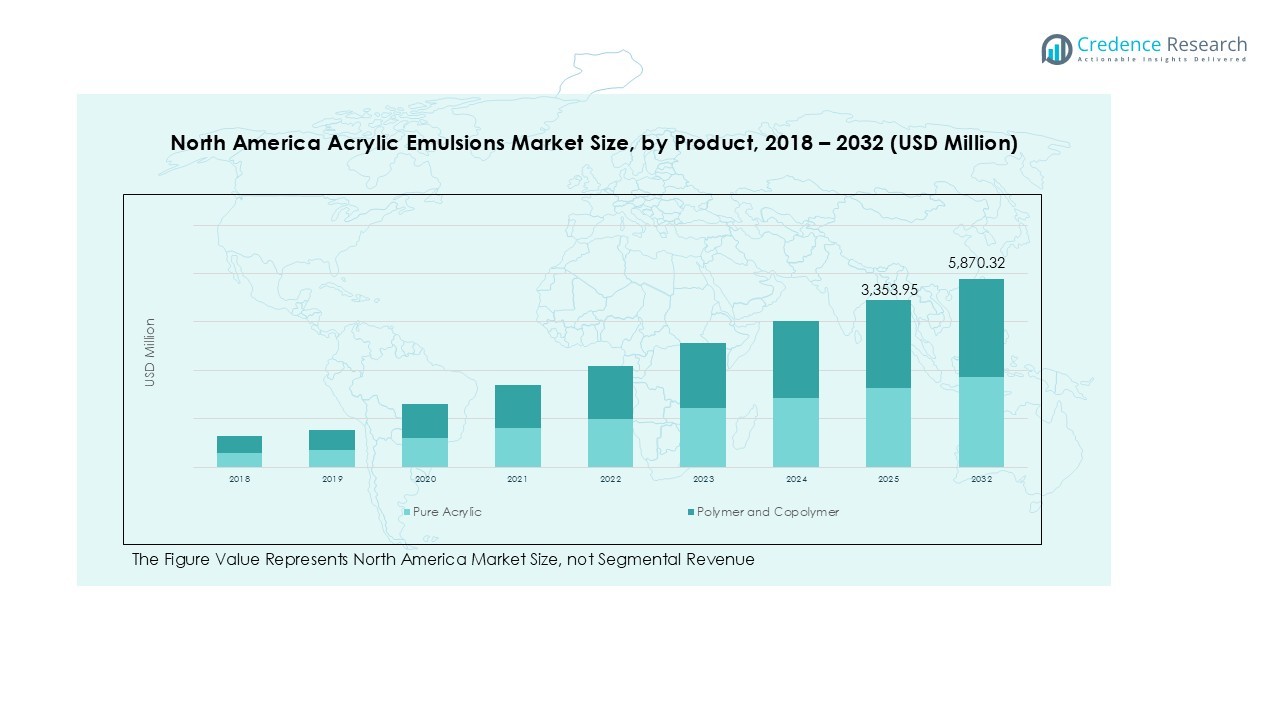

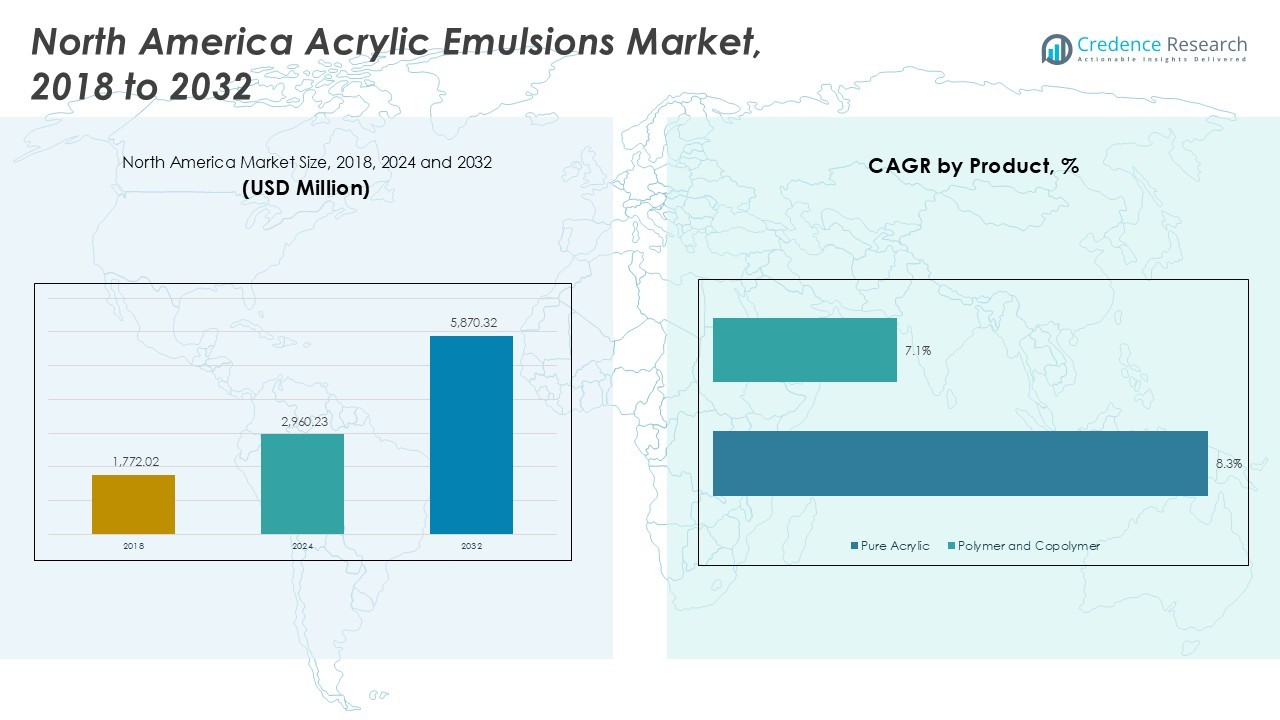

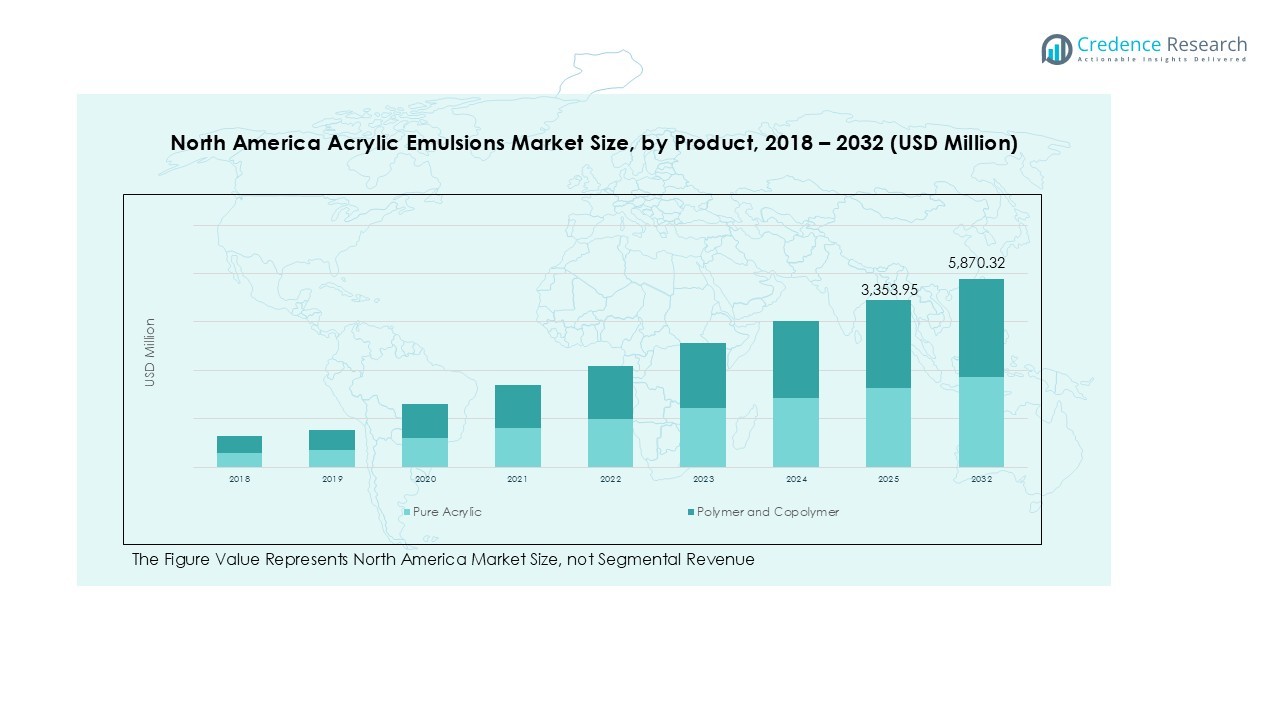

The North America Acrylic Emulsions Market has shown consistent growth, increasing from USD 1,772.02 million in 2018 to USD 2,960.23 million in 2024. The market is anticipated to reach USD 5,870.32 million by 2032, registering a CAGR of 8.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Acrylic Emulsions Market Size 2024 |

USD 2,960.23 Million |

| North America Acrylic Emulsions Market, CAGR |

8.33% |

| North America Acrylic Emulsions Market Size 2032 |

USD 5,870.32 Million |

The North America Acrylic Emulsions Market is dominated by key players including BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, H.B. Fuller, and Synthomer plc, who collectively drive innovation and market expansion through advanced formulations and strategic partnerships. The United States leads the regional market with a 60% share, fueled by strong demand from architectural coatings, adhesives, and industrial applications. Canada follows with a 25% share, supported by construction growth and sustainable product adoption, while Mexico holds 15% of the market, driven by urbanization and increasing industrial usage. These companies focus on low-VOC and water-based acrylic emulsions, enhanced durability, and eco-friendly solutions, strengthening their market position and addressing diverse application segments, including paints and coatings, construction material additives, and paper coating.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Acrylic Emulsions Market was valued at USD 2,960.23 million in 2024 and is projected to reach USD 5,870.32 million by 2032, growing at a CAGR of 8.33%.

- Strong demand in paints and coatings, construction material additives, and adhesives is driving market growth, supported by residential, commercial, and industrial construction activities across the region.

- Key trends include increasing adoption of low-VOC and water-based emulsions, growth of DIY and home improvement projects, and technological innovations in copolymers and specialty formulations.

- Competitive landscape is dominated by BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, H.B. Fuller, and Synthomer plc, focusing on product innovation, strategic partnerships, and regional expansion to strengthen market presence.

- Regionally, the United States leads with a 60% share, Canada holds 25%, and Mexico accounts for 15%, while Pure Acrylic dominates the product segment with 45% revenue share, and paints and coatings represent 50% of application demand.

Market Segmentation Analysis:

By Product Segment:

In the North America Acrylic Emulsions Market, Pure Acrylic dominates the product segment, accounting for approximately 45% of the total market share in 2024. Its superior durability, weather resistance, and adhesion properties drive widespread adoption across coatings, adhesives, and construction materials. Polymers and Copolymers hold smaller shares, yet they are increasingly used in specialized applications requiring flexibility and chemical resistance. The strong preference for Pure Acrylic is supported by ongoing infrastructure projects and the expanding demand for high-performance paints and coatings across both residential and commercial sectors.

- For instance, Lubrizol manufactures water-borne pure acrylic emulsions used in high-performance architectural coatings that offer excellent UV stability and environmental compliance.

By Application Segment:

Paints and Coatings represent the leading application in the North America market, capturing around 50% of revenue in 2024. Acrylic emulsions’ excellent gloss, color retention, and low VOC characteristics make them ideal for architectural and industrial coatings. Construction Material Additives and Adhesives are growing steadily due to rising construction activities and DIY trends. Paper coating applications contribute modestly to the market but benefit from the packaging industry’s focus on sustainable and durable materials. The demand is further fueled by strict environmental regulations promoting water-based and low-emission formulations.

- For instance, Dow’s acrylic systems capture significant market share by combining balanced cost and weatherability, powering premium architectural and industrial coatings.

By End User Segment:

The Architectural end-user segment is the most significant, representing roughly 48% of the North America market in 2024. Growth is driven by residential and commercial construction, renovation projects, and increased demand for decorative and protective coatings. Industrial users follow closely, utilizing acrylic emulsions in specialty coatings, adhesives, and paper products. Commercial and residential segments are witnessing steady expansion as sustainability and aesthetic requirements influence material selection. Overall, the end-user demand is supported by evolving construction trends, urbanization, and the need for durable, low-maintenance solutions.

Key Growth Drivers

Rising Demand in Paints and Coatings

The North America Acrylic Emulsions Market is primarily driven by strong demand from the paints and coatings sector, which accounts for a significant portion of revenue. Acrylic emulsions offer superior adhesion, color retention, and weather resistance, making them ideal for architectural and industrial coatings. Increasing residential and commercial construction projects, coupled with renovation activities, are expanding the market. Additionally, the shift toward water-based and low-VOC coatings, driven by environmental regulations, further strengthens demand for acrylic emulsions across North American markets.

- For instance, BASF’s Joncryl® functional packaging coatings utilize water-based acrylic emulsions designed for low-VOC applications, providing mild water and grease resistance, which supports sustainable packaging solutions in compliance with evolving regulatory frameworks.

Expansion in Construction and Infrastructure

Ongoing infrastructure development and construction growth across North America are key drivers for acrylic emulsion consumption. These materials are extensively used as construction material additives and adhesives, enhancing durability, flexibility, and moisture resistance in building applications. Government investments in urban development and smart city initiatives contribute to increased adoption. Rising construction activity in residential, commercial, and industrial projects ensures a steady requirement for high-performance, sustainable materials, supporting long-term market growth and encouraging manufacturers to expand production capacities.

- For instance, EPS CCA offers acrylic emulsions specifically formulated for architectural and industrial roof coatings, providing enhanced protection against corrosion and environmental damage.

Technological Advancements and Product Innovation

Technological innovations in acrylic emulsions, such as enhanced copolymers and specialty formulations, are fueling market growth. Manufacturers are developing products with improved durability, chemical resistance, and eco-friendly properties to meet evolving industry standards. These innovations support diverse applications in paints, adhesives, and paper coatings, enabling better performance and longer lifecycle. Continuous research and development investments allow companies to differentiate their product portfolios, address specific end-user requirements, and capture emerging opportunities in premium and high-performance segments.

Key Trends & Opportunities

Shift Toward Sustainable and Low-VOC Products

Sustainability is a prominent trend in the North America market, with increasing adoption of low-VOC and water-based acrylic emulsions. Regulatory pressures and consumer preference for environmentally friendly solutions are encouraging manufacturers to innovate greener products. This trend opens opportunities for premium, eco-conscious coatings and adhesives in architectural and industrial sectors. Companies that prioritize sustainable formulations are positioned to capture higher market share, as environmentally compliant products gain preference among contractors, developers, and end users seeking long-term performance and reduced environmental impact.

- For instance, Sherwin-Williams has advanced its Scuff Tuff® Interior Waterbased Enamel Paint, recognized as a 2024 Green Builder Sustainable Product of the Year, which delivers high durability and low VOC content for residential and commercial interiors.

Growth in DIY and Home Improvement Projects

The rise of DIY projects and home improvement activities presents a significant opportunity for the acrylic emulsions market. Consumers increasingly prefer easy-to-use, water-based paints, adhesives, and coatings for residential applications. Retail expansion, online distribution, and educational campaigns on product benefits are supporting this trend. This growing consumer awareness and accessibility stimulate demand for high-quality acrylic emulsions in smaller packaging, creating potential for niche products tailored to end users and enabling manufacturers to diversify revenue streams beyond large-scale industrial or commercial contracts.

- For instance, Jenson and Nicholson emphasize their acrylic emulsion paints’ durability and ease of application for homes, highlighting their moisture resistance and long-lasting color retention in high humidity areas like kitchens and bathrooms.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as acrylic monomers and emulsifiers pose a significant challenge for market players. Price volatility impacts manufacturing costs and profit margins, potentially leading to increased product prices that may affect demand. Companies must strategically manage supply chains, adopt cost-effective production processes, or secure long-term contracts to mitigate risk. This challenge can limit growth, particularly for smaller players, while larger companies with integrated supply chains may sustain competitive pricing and stable revenue streams despite market fluctuations.

Stringent Environmental and Regulatory Norms

The North America Acrylic Emulsions Market faces challenges from strict environmental regulations, including limits on VOC emissions and chemical usage. Compliance requires continuous innovation in product formulations and may increase production costs. Non-compliance risks penalties, recalls, or market access restrictions. While regulations promote safer and sustainable products, they can act as a barrier for smaller manufacturers. Companies must invest in research, adapt production processes, and educate end users to maintain compliance while continuing to meet performance expectations across diverse applications.

Regional Analysis

United States

The United States dominates the North America Acrylic Emulsions Market, accounting for 60% of regional revenue in 2024. Strong demand from the paints and coatings industry, driven by residential and commercial construction, fuels growth. The architectural segment is the largest end-user, supported by renovation projects and urban infrastructure development. Industrial applications in adhesives and specialty coatings further contribute to the market. Innovation in low-VOC and water-based formulations aligns with regulatory requirements and sustainability trends. Growing DIY and home improvement activities also enhance demand, positioning the U.S. as the leading contributor to the North American acrylic emulsions market.

Canada

Canada holds a 25% share of the North America Acrylic Emulsions Market in 2024, driven by rising construction and infrastructure projects. Demand is particularly strong in architectural coatings and adhesives, supported by government investments in residential and commercial developments. Industrial applications, including paper coating and specialty coatings, also contribute to growth. The market benefits from increased adoption of eco-friendly, low-VOC acrylic emulsions to meet environmental regulations. Urbanization and modernization of industrial facilities encourage manufacturers to introduce innovative products with enhanced durability and chemical resistance, solidifying Canada’s position as a key regional player in the North American acrylic emulsions market.

Mexico

Mexico accounts for 15% of the North America Acrylic Emulsions Market in 2024, supported by expanding construction and industrial sectors. Rapid urbanization and rising residential development drive demand for paints, coatings, and construction material additives. The architectural and industrial segments dominate usage, with adhesives and paper coatings gaining traction in commercial applications. Increasing awareness of sustainable and low-VOC products encourages manufacturers to offer water-based emulsions, enhancing market growth. Mexico’s favorable manufacturing environment and cost-effective production capabilities attract regional suppliers and global companies, reinforcing its contribution to the North American acrylic emulsions market while providing opportunities for continued expansion.

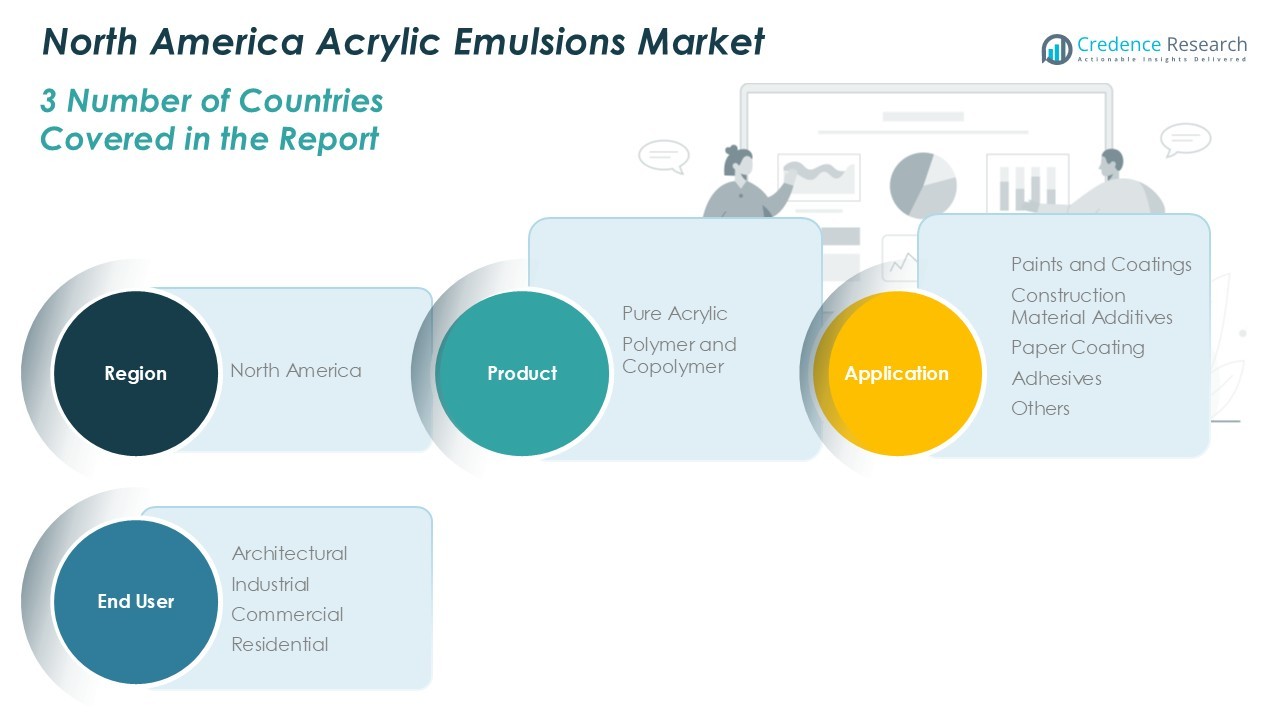

Market Segmentations:

By Product

- Pure Acrylic

- Polymer

- Copolymer

By Application

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End User

- Architectural

- Industrial

- Commercial

- Residential

By Region

Competitive Landscape

The competitive landscape of the North America Acrylic Emulsions Market includes key players such as BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, H.B. Fuller, and Synthomer plc. Market competition is intense, with companies focusing on product innovation, sustainable formulations, and strategic partnerships to enhance market share. Players are investing in advanced acrylic emulsions with low-VOC and water-based properties to meet stringent environmental regulations and evolving customer preferences. Expansion of production capacities, acquisitions, and regional collaborations are common strategies to strengthen distribution networks and address growing demand in architectural, industrial, and commercial segments. Additionally, companies emphasize research and development to introduce high-performance emulsions catering to paints, coatings, adhesives, and paper coating applications, ensuring differentiation and long-term growth in the North American market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, The Lubrizol Corporation announced a $20 million investment to enhance acrylic emulsion production at its Gastonia, North Carolina facility. This strategic move aims to bolster the company’s capabilities in manufacturing innovative acrylic emulsions, supporting the growing demand in the coatings industry.

- In September 2025, Arkema partnered with Catalyxx to develop low-carbon, bio-based acrylic resins, leveraging proprietary technology to strengthen sustainability across the acrylics value chain.

- In September 2025, Dow Chemical launched a next-generation acrylic polymer emulsion designed for coatings and adhesives. This product offers enhanced durability and weather resistance while reducing volatile organic compound (VOC) emissions.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for water-based and low-VOC acrylic emulsions is expected to increase.

- Growth in residential and commercial construction will drive market expansion.

- Architectural coatings will remain the largest end-user segment.

- Industrial applications, including adhesives and paper coating, will see steady growth.

- Technological innovations in copolymers and specialty emulsions will enhance product performance.

- Manufacturers will focus on eco-friendly and sustainable formulations to meet regulations.

- DIY and home improvement trends will create additional consumer-driven demand.

- Strategic partnerships and regional expansions will strengthen key players’ market positions.

- Adoption of acrylic emulsions in emerging industrial applications will create new opportunities.

- Competitive pressures will encourage continuous R&D and product portfolio diversification.