Market Overview

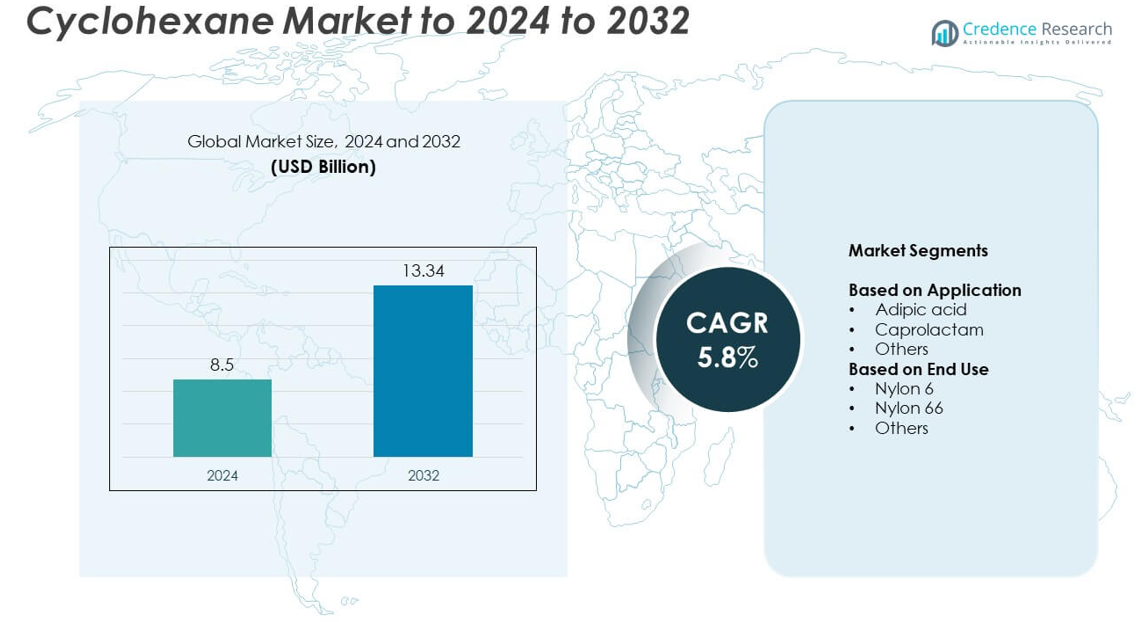

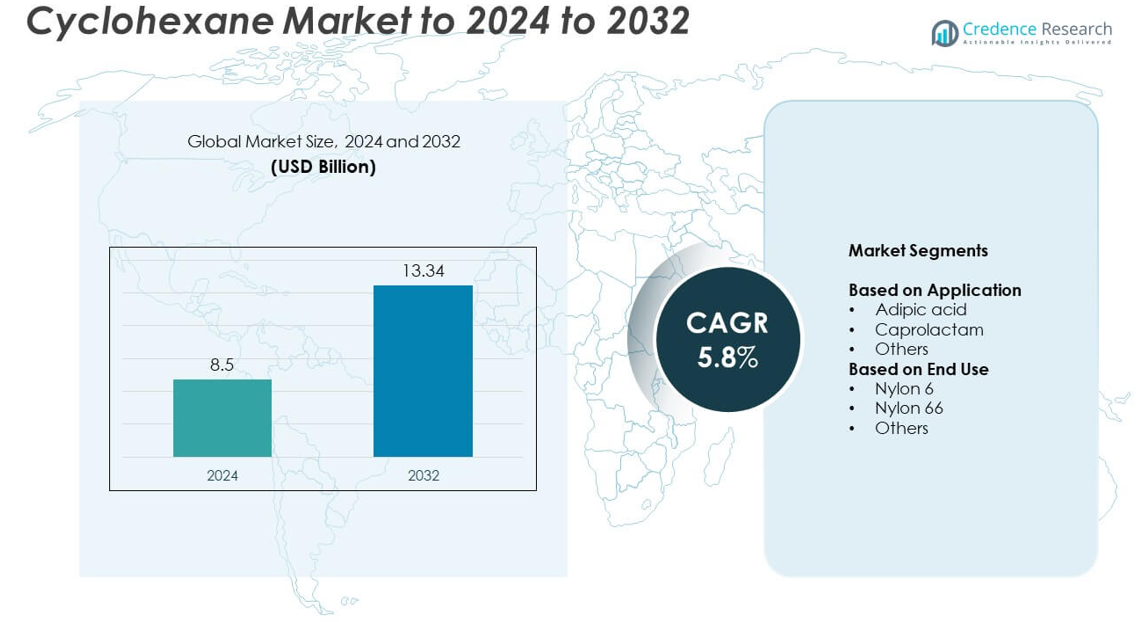

Cyclohexane market size was valued at USD 8.5 billion in 2024 and is anticipated to reach USD 13.34 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclohexane market Size 2024 |

USD 8.5 billion |

| Cyclohexane market, CAGR |

5.8% |

| Cyclohexane market Size 2032 |

USD 13.34 billion |

The cyclohexane market is dominated by major players such as Chevron Phillips Chemical, BASF SE, Dow, BP p.l.c., Reliance Industries Limited, Huntsman International, Clariant, and Exxon Mobil Corporation. These companies maintain leadership through strong production capacities, advanced catalytic technologies, and vertically integrated operations. Strategic expansion and modernization of hydrogenation units enhance efficiency and sustainability across production facilities. Asia-Pacific led the global market with a 34% share in 2024, driven by robust nylon and chemical manufacturing in China, Japan, and India. North America followed with a 31% share, supported by established petrochemical infrastructure and consistent demand from industrial and automotive sectors.

Market Insights

- The cyclohexane market was valued at USD 8.5 billion in 2024 and is projected to reach USD 13.34 billion by 2032, growing at a CAGR of 5.8%.

- Rising demand for nylon 6 and nylon 66 in automotive, textile, and industrial applications is driving market growth globally.

- Advancements in hydrogenation technology and the shift toward bio-based chemical production are shaping emerging market trends.

- The market remains competitive with integrated operations, innovation in catalyst efficiency, and increasing focus on sustainable manufacturing practices.

- Asia-Pacific held a 34% share in 2024, leading global demand, followed by North America at 31% and Europe at 27%, while the adipic acid segment dominated with a 54% share due to strong nylon 66 production demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The adipic acid segment dominated the cyclohexane market in 2024 with a 54% share. This dominance is driven by its extensive use as a precursor in nylon 66 production. Adipic acid derived from cyclohexane is essential in manufacturing fibers, resins, and plastics for automotive, textile, and industrial applications. Increasing demand for lightweight and durable materials in vehicle components further supports market growth. The caprolactam segment also holds a significant share due to rising usage in nylon 6 fiber production for carpets, apparel, and engineering plastics.

- For instance, Shandong Haili lists adipic acid capacity at 225,000 tons/year at its site.

By End Use

The nylon 66 segment held the largest share of 58% in 2024, leading the cyclohexane market. Strong demand from automotive, electrical, and industrial sectors drives this dominance. Nylon 66 offers superior heat resistance and mechanical strength, making it ideal for high-performance engineering plastics. The growing trend toward lightweight components in vehicles and electronics continues to boost its consumption. The nylon 6 segment also shows steady growth, supported by its use in textiles, films, and packaging materials due to its flexibility and durability.

- For instance, Sinopec Hunan runs a caprolactam complex with 600,000 tons/year nameplate output and reported 56,800 tons produced in July 2024.

Key Growth Drivers

Expanding Nylon Production Demand

Rising global demand for nylon 6 and nylon 66 significantly drives cyclohexane consumption. These polymers are essential in automotive, textile, and industrial applications due to their strength and heat resistance. The shift toward lightweight materials in vehicles and high-performance fabrics has accelerated nylon production, directly increasing the need for cyclohexane as a feedstock. Rapid industrialization and growing synthetic fiber demand in Asia-Pacific further strengthen this growth trend across end-use industries.

- For instance, DOMO Chemicals inaugurated a new polyamide production plant in Jiaxing, China, in April 2024, with an initial capacity of 35,000 tons/year and a long-term plan to eventually reach 50,000 tons/year.

Industrial Growth and Infrastructure Development

Infrastructure expansion and industrial development in emerging economies boost the demand for cyclohexane derivatives. Nylon-based products, derived from cyclohexane, are widely used in pipes, construction equipment, and electrical components. Countries like India, China, and Indonesia are experiencing large-scale construction activities that raise the requirement for durable and chemical-resistant materials. This trend, coupled with rising manufacturing output, continues to fuel the demand for cyclohexane in multiple industrial applications.

- For instance, Hualu Hengsheng has significantly expanded its adipic acid production capacity in China. While a May 2022 report indicated plans for a new 200,000 tons/year plant, this capacity was intended to replace an older production line.

Rising Use in Engineering Plastics

Cyclohexane-based compounds are key intermediates in producing high-strength engineering plastics. These materials are used in electrical, automotive, and mechanical components due to their durability and thermal stability. Increasing demand for lightweight yet tough materials in electric vehicles and consumer electronics is a major growth factor. The shift toward energy-efficient designs across industries further supports the growing utilization of cyclohexane-derived engineering plastics globally.

Key Trends & Opportunities

Sustainability and Green Chemistry Integration

Manufacturers are focusing on bio-based and sustainable production routes for cyclohexane and its derivatives. Growing environmental concerns are pushing industries to reduce carbon footprints and adopt eco-friendly feedstocks. Research into renewable hydrocarbons and catalytic hydrogenation methods is creating opportunities for cleaner production. This trend aligns with global sustainability targets and provides long-term advantages for companies investing in green cyclohexane technologies.

- For instance, Toray and Honda are piloting chemical recycling of polyamides with a 500-ton/year validation facility in Japan.

Technological Advancements in Production

Process optimization through advanced catalytic systems and energy-efficient reactors is emerging as a key opportunity. Continuous production technologies and improved hydrogenation catalysts have enhanced cyclohexane yield and quality. Adoption of digital monitoring systems for process control also improves operational efficiency and cost-effectiveness. These technological innovations are helping producers meet increasing demand while maintaining competitive production economics.

- For instance, KBR is known for its catalytic distillation technology used in the hydrogenation of benzene to cyclohexane. In industrial applications, this process is designed to achieve high conversion rates, typically exceeding 99%.

Growing Demand from Asia-Pacific

Asia-Pacific presents significant growth potential due to rapid industrialization and expanding manufacturing capacity. China, India, and Japan are leading nylon producers, creating strong regional demand for cyclohexane. The region’s expanding automotive and textile industries further accelerate consumption. Government policies supporting local chemical manufacturing and foreign investments continue to make Asia-Pacific the most lucrative market for cyclohexane expansion.

Key Challenges

Price Volatility of Crude Oil

Cyclohexane production heavily depends on benzene derived from crude oil, making it vulnerable to price fluctuations. Volatile crude oil prices can directly impact production costs and profit margins for manufacturers. Sudden shifts in global supply-demand dynamics or geopolitical events can further destabilize market conditions. Maintaining cost stability becomes difficult, especially for producers relying on imported raw materials in price-sensitive regions.

Stringent Environmental Regulations

Increasingly strict emission and safety standards pose a major challenge for cyclohexane producers. Regulatory frameworks in North America and Europe are enforcing cleaner production methods and restricting volatile organic compound emissions. Compliance often requires significant investment in upgraded technologies and process modifications. These regulations increase production costs and slow down expansion efforts for companies operating in highly regulated markets.

Regional Analysis

North America

North America accounted for 31% of the cyclohexane market share in 2024. The region’s dominance is driven by high nylon 6 and nylon 66 production, primarily used in the automotive and industrial sectors. The United States leads with advanced chemical manufacturing infrastructure and continuous technological upgrades in cyclohexane processing. Strong demand for engineering plastics and synthetic fibers also supports regional growth. Increasing investment in sustainable chemical production further strengthens North America’s position as a key producer and exporter in the global cyclohexane market.

Europe

Europe held a 27% share of the cyclohexane market in 2024, supported by established chemical industries in Germany, France, and the Netherlands. The region benefits from growing adoption of high-performance nylon materials in automotive and packaging applications. Demand for energy-efficient and lightweight materials continues to drive cyclohexane consumption. Additionally, stringent regulations promoting green chemistry are pushing producers to adopt cleaner production routes. Ongoing innovation in catalytic processes and recycling initiatives further enhances Europe’s role in shaping sustainable growth within the cyclohexane industry.

Asia-Pacific

Asia-Pacific dominated the global cyclohexane market with a 34% share in 2024. China, Japan, and India are major contributors, driven by robust nylon fiber and resin production. Rapid industrialization and expanding automotive and textile sectors boost cyclohexane demand across the region. The presence of large-scale chemical facilities and cost-effective raw material availability further support market expansion. Continuous investments in capacity expansion and growing domestic consumption are establishing Asia-Pacific as the fastest-growing region for cyclohexane production and utilization.

Latin America

Latin America captured 5% of the global cyclohexane market share in 2024. Brazil and Mexico are leading markets due to growing industrialization and rising demand for nylon-based materials in automotive and construction applications. Expanding polymer production facilities and increased foreign investment are enhancing regional manufacturing capabilities. However, limited technological advancement and dependency on imported raw materials slightly restrict growth. Efforts toward developing local chemical infrastructure and government incentives for industrial growth are expected to improve the region’s market position over the forecast period.

Middle East & Africa

The Middle East & Africa region accounted for 3% of the cyclohexane market share in 2024. Growth is supported by expanding petrochemical industries, particularly in Saudi Arabia and the United Arab Emirates. Availability of low-cost feedstock and increasing downstream investment strengthen production potential. Rising demand for nylon resins in packaging and construction applications adds to market momentum. However, the region faces challenges in scaling production capacity due to limited technological expertise. Ongoing diversification of the chemical sector and infrastructure development continue to create emerging opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Application

- Adipic acid

- Caprolactam

- Others

By End Use

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The cyclohexane market is led by key players such as Chevron Phillips Chemical, BASF SE, Clariant, Cepsa, BP p.l.c., REE ATHARVA LIFESCIENCE, Dow, Reliance Industries, Huntsman International, DuPont, China Petrochemical Corporation, Merck KGaA, Idemitsu Kosan, PTT Global Chemical, Liaoning Yufeng Chemical, and Exxon Mobil Corporation. The competitive landscape is characterized by strong integration across the value chain, from benzene sourcing to downstream nylon production. Companies are emphasizing technological efficiency, process optimization, and sustainability initiatives to enhance yield and reduce emissions. Continuous investment in hydrogenation technologies, capacity expansion, and development of bio-based alternatives is a key strategic focus. Firms are also strengthening regional presence through mergers, partnerships, and long-term supply contracts to ensure raw material stability. Additionally, digital monitoring and automation in production processes are being widely adopted to improve operational control, product consistency, and cost-effectiveness across major chemical manufacturing hubs globally.

Key Player Analysis

- Chevron Phillips Chemical (U.S.)

- BASF SE (Germany)

- Clariant (Switzerland)

- Cepsa (Spain)

- BP p.l.c. (U.K.)

- REE ATHARVA LIFESCIENCE PVT. LTD. (India)

- Dow (U.S.)

- Reliance Industries Limited. (India)

- Huntsman International LLC. (U.S.)

- DuPont (U.S.)

- China Petrochemical Corporation (China)

- Merck KGaA (Germany)

- Idemitsu Kosan Co., Ltd. (Japan)

- PTT Global Chemical Public Company Limited (Thailand)

- Liaoning Yufeng Chemical Co., Ltd. (China)

- Exxon Mobil Corporation. (U.S.)

Recent Developments

- In 2024, INVISTA announced the completion of its nylon 6,6 polymer site expansion at the Shanghai Chemical Industry Park, doubling its annual production capacity to 400,000 metric tons.

- In 2024, NILIT, a leading Israeli nylon manufacturer, announced a joint venture with Shenma Industry Co., Ltd., a subsidiary of China Pingmei Shenma Group.

- In 2023, BASF announced the reduction of its adipic acid production capacity at the Ludwigshafen site and the shutdown of its caprolactam production line

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising nylon 6 and nylon 66 production will continue to drive cyclohexane demand.

- Expanding automotive and textile industries will boost consumption across major regions.

- Asia-Pacific will remain the fastest-growing market with strong manufacturing investments.

- Technological advances in hydrogenation processes will improve production efficiency.

- Increasing focus on bio-based cyclohexane will support sustainable market growth.

- Integration of green chemistry practices will reduce environmental impact in production.

- Growing demand for engineering plastics will enhance usage in industrial applications.

- Strategic partnerships and capacity expansions will strengthen global supply chains.

- Regulatory support for cleaner production will shape future manufacturing trends.

- Rising research in catalyst innovation will enhance yield and product quality.