Market overview

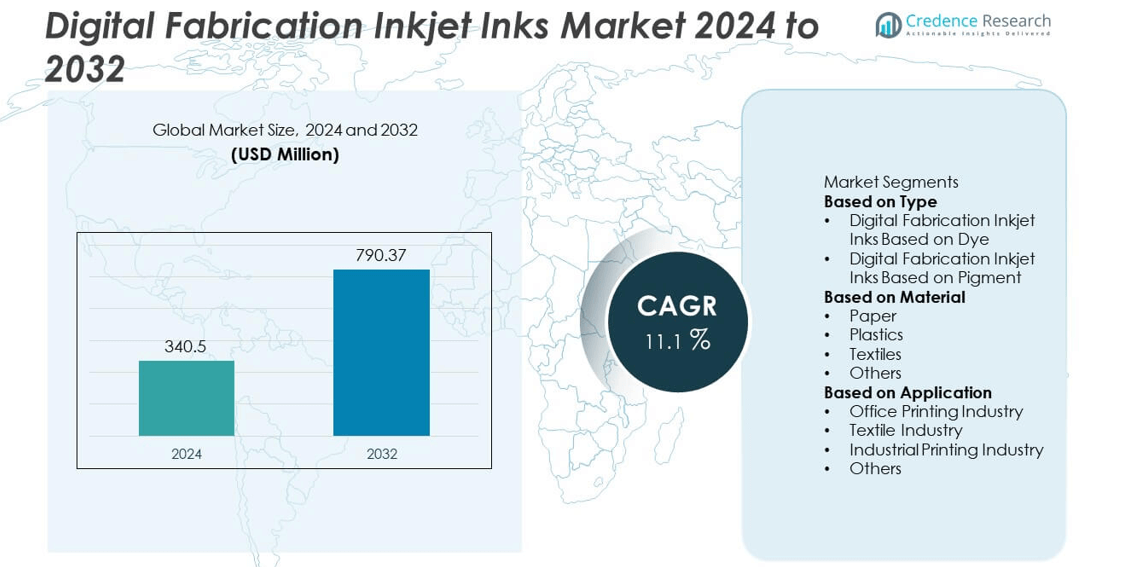

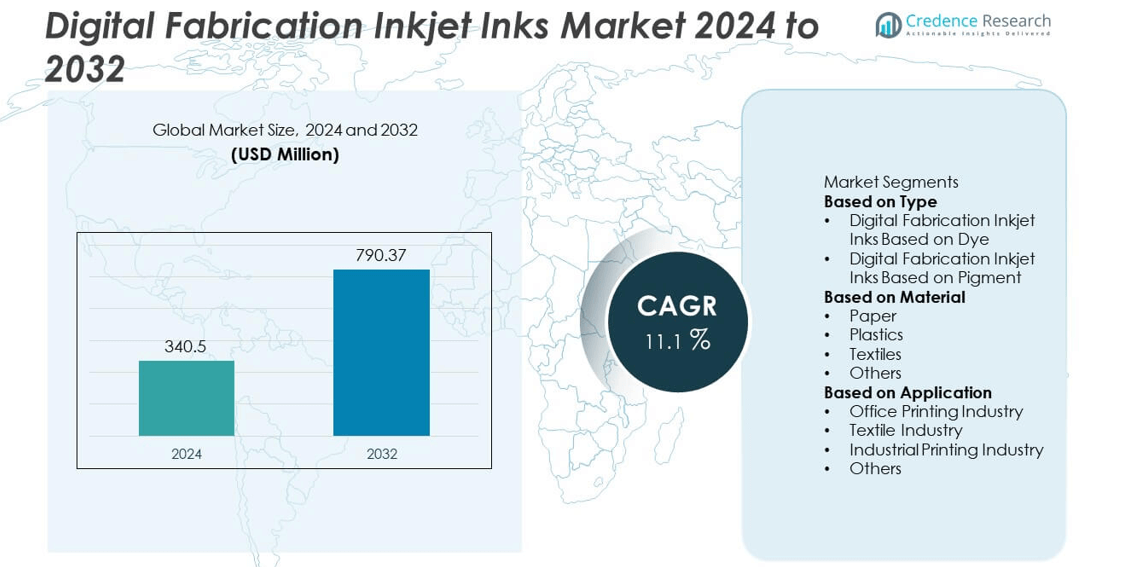

The Digital Fabrication Inkjet Inks market was valued at USD 340.5 million in 2024 and is projected to reach USD 790.37 million by 2032, growing at a CAGR of 11.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Fabrication Inkjet Inks Market Size 2024 |

USD 340.5 million |

| Digital Fabrication Inkjet Inks Market, CAGR |

11.1% |

| Digital Fabrication Inkjet Inks Market Size 2032 |

USD 790.37 million |

The digital fabrication inkjet inks market is driven by major players including EPSON, TRIDENT, Nazdar, InkTec, HP, Roland DG, Fujifilm Sericol International, Collins, Sensient Imaging Technologies, Nippon Kayaku, and Wikoff Color. These companies focus on developing advanced, eco-friendly ink formulations for industrial, textile, and packaging applications. North America led the market in 2024 with a 33% share, supported by strong adoption of digital printing in packaging and industrial manufacturing. Asia-Pacific followed with a 30% share, driven by rapid textile production and technological advancements, while Europe accounted for a 29% share, emphasizing sustainable ink solutions and automation across printing processes.

Market Insights

- The digital fabrication inkjet inks market was valued at USD 340.5 million in 2024 and is projected to reach USD 790.37 million by 2032, growing at a CAGR of 11.1% during the forecast period.

- Rising demand for high-precision digital printing in packaging, textiles, and industrial manufacturing is driving market growth globally.

- Advancements in UV-curable, water-based, and pigment-based inks are enhancing print quality, sustainability, and substrate versatility across sectors.

- Leading companies such as EPSON, HP, and Fujifilm Sericol International focus on product innovation, eco-friendly ink formulations, and regional expansion to strengthen competitiveness.

- North America holds 33%, Asia-Pacific 30%, and Europe 29% market share, while the pigment-based ink segment leads with 58%, supported by its superior color stability, durability, and growing use in industrial and textile printing applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The pigment-based ink segment dominated the digital fabrication inkjet inks market in 2024 with a 58% share. Its superiority lies in higher color stability, UV resistance, and long-term durability compared to dye-based inks. Pigment inks are widely used in industrial and textile printing applications where fade resistance and image longevity are essential. Their compatibility with various substrates, including plastics and textiles, supports widespread adoption. Growing demand for high-quality printing in packaging, signage, and 3D design applications continues to drive the use of pigment-based inks in digital fabrication processes.

- For instance, Fujifilm introduced its Uvijet KH ink series, designed for industrial graphic applications and featuring the company’s Micro-V dispersion technology to optimize pigment loading. The inks are compatible with Fujifilm’s Onset M series printers and offer a wide color gamut, lightfast colors, and adhesion across a range of rigid and flexible materials.

By Material

The paper segment held the largest share of 46% in 2024, driven by increasing digital printing in packaging, labeling, and documentation applications. Paper remains the most widely used substrate due to its cost-effectiveness, versatility, and recyclability. The rapid adoption of eco-friendly and high-performance inks for commercial printing enhances this segment’s growth. Additionally, advancements in coated paper and specialty papers improve ink absorption and image clarity. Rising demand for customized and short-run printing solutions in the publishing and advertising sectors further strengthens the dominance of paper-based digital fabrication applications.

- For instance, HP developed its PageWide pigment inks optimized for coated and uncoated paper, achieving droplet placement accuracy within 5 micrometers and a color gamut coverage of over 95% of ISO Coated V2 standards. The formulation delivers sharp image quality at speeds exceeding 200 meters per minute, enabling high-volume digital printing for packaging and publishing on recyclable paper substrates.

By Application

The industrial printing industry segment led the digital fabrication inkjet inks market in 2024 with a 41% share, driven by expanding use in product labeling, electronics, and additive manufacturing. Inkjet printing technology offers precision, flexibility, and scalability, making it ideal for high-speed industrial production. The textile industry also represents a growing segment, adopting pigment inks for digitally printed fabrics that enhance design quality and reduce water use. The industrial sector’s focus on sustainability, automation, and on-demand printing continues to accelerate market adoption across manufacturing, packaging, and product design applications.

Key Growth Drivers

Rising Adoption of Digital Printing in Industrial Applications

The rapid shift toward digital printing in industrial sectors is a major driver of the digital fabrication inkjet inks market. Industries such as packaging, electronics, and automotive increasingly prefer inkjet printing for precision, customization, and faster turnaround times. Inkjet inks enable high-resolution, contactless printing on diverse substrates, improving efficiency and design flexibility. Growing demand for short-run, variable data, and eco-friendly printing solutions continues to boost adoption. As manufacturing integrates digital processes, the need for durable and high-performance inkjet inks is rising significantly.

- For instance, Epson developed its PrecisionCore MicroTFP printhead technology, capable of jetting droplets as small as 3.5 picoliters at resolutions up to 2,400 × 1,200 dpi. This highly scalable technology powers a range of printers, from desktop models to industrial systems that use various UltraChrome pigment or dye-based inks to produce durable output for different applications.

Expansion of Textile Digital Printing

The growing adoption of digital printing in the textile industry strongly supports market growth. Textile manufacturers are embracing inkjet printing for on-demand production, detailed designs, and reduced water consumption compared to conventional dyeing. Pigment-based inks offer improved color fastness and compatibility with a variety of fabrics, enabling efficient and sustainable printing. The fashion and home décor sectors increasingly rely on digital textile printing for rapid prototyping and personalization. This transition toward sustainable and flexible production methods continues to accelerate market expansion globally.

- For instance, InkTec introduced its SubliNova Smart textile ink series formulated for polyester fabrics, achieving wash fastness ratings of 4–5 on the ISO 105-C06 scale. The inks allow sublimation at temperatures between 180 and 210 °C for 30 to 60 seconds, enabling high-definition textile printing with minimal environmental footprint across large-format production lines.

Technological Advancements in Ink Formulation

Ongoing innovations in ink chemistry are enhancing print quality, substrate compatibility, and environmental performance. Manufacturers are developing UV-curable, water-based, and solvent-free inks that deliver superior color stability and adhesion. These advancements support high-speed printing and reduce operational costs in digital fabrication. Improved pigment dispersion and nanotechnology integration enhance color precision and material bonding. As industries move toward greener production standards, such technological advancements are fueling broader adoption of advanced inkjet inks across industrial, commercial, and consumer applications.

Key Trends and Opportunities

Shift Toward Sustainable and Eco-Friendly Inks

Sustainability is a defining trend, with manufacturers developing eco-friendly inks that minimize volatile organic compounds (VOCs) and waste. Water-based and bio-derived formulations are gaining traction in packaging, textiles, and industrial printing. These inks reduce environmental impact while maintaining print quality and durability. Governments and regulatory agencies promoting sustainable manufacturing further support this trend. The growing preference for recyclable substrates and low-emission inks is creating new growth opportunities for environmentally conscious producers in the global digital fabrication inkjet inks market.

- For instance, Nazdar offers the 130 Series of solvent-based inkjet inks, a low-odor formulation for industrial packaging and signage applications. These inks offer strong adhesion on various substrates, including vinyl and banner material, along with excellent resistance to UV degradation.

Integration of Inkjet Technology in Additive Manufacturing

Inkjet technology is increasingly integrated into additive manufacturing and 3D printing applications, offering precision and material versatility. Functional inks enable printing of electronic components, sensors, and circuit boards with exceptional accuracy. The technology supports multi-material and full-color 3D printing, expanding its use in electronics, healthcare, and product design. This convergence of inkjet printing and additive manufacturing enhances production flexibility and reduces prototyping time. As industries embrace digital manufacturing, demand for specialized functional inks will continue to grow rapidly.

- For instance, Xerox developed its ElemX 3D metal printing system that employs liquid metal jetting technology to deposit droplets using standard aluminum wire. The system has a minimum layer thickness of 0.24 mm and a maximum build rate of up to 0.5 pounds per hour.

Key Challenges

High Production and Equipment Costs

High production and equipment costs pose a significant challenge for market expansion. Advanced ink formulations require precision manufacturing, specialized pigments, and extensive R&D investment, increasing overall costs. The setup and maintenance of digital fabrication printers also involve substantial capital expenditure. Small and medium enterprises often find it difficult to adopt these technologies due to budget constraints. Despite long-term efficiency benefits, initial costs remain a barrier to large-scale adoption, particularly in emerging economies where price sensitivity is higher.

Substrate Compatibility and Performance Issues

Ensuring consistent ink performance across multiple substrates remains a technical challenge. Different materials—such as plastics, textiles, and metals—require specific ink formulations for optimal adhesion and drying. Variations in surface energy and porosity can affect color uniformity and image durability. Additionally, high-speed printing environments demand precise ink rheology and stability. Manufacturers continue to face difficulties balancing performance, cost, and environmental compliance. Overcoming these limitations through advanced material science and cross-industry collaboration is essential to unlock the full potential of digital fabrication inkjet inks.

Regional Analysis

North America

North America held a 33% share of the digital fabrication inkjet inks market in 2024, driven by strong demand from packaging, industrial design, and textile sectors. The United States leads regional growth, supported by widespread adoption of digital printing for customized and short-run production. Technological innovation and early integration of inkjet systems across industries continue to propel market expansion. The region’s focus on sustainability and high-quality printing fuels the use of eco-friendly and UV-curable inks. Increasing adoption in electronics and decorative applications further strengthens North America’s position in the global market.

Europe

Europe accounted for a 29% share of the global digital fabrication inkjet inks market in 2024, supported by high adoption in the packaging, textile, and industrial sectors. Germany, the United Kingdom, and Italy are key contributors, emphasizing precision printing, sustainable ink solutions, and automation. The region’s strong focus on environmental compliance has accelerated the shift toward water-based and low-VOC inks. Growth in digital textile printing for fashion and interior design applications further boosts demand. Continuous advancements in printhead technology and substrate compatibility ensure Europe’s leadership in innovative inkjet printing solutions.

Asia-Pacific

Asia-Pacific captured a 30% share of the digital fabrication inkjet inks market in 2024, emerging as the fastest-growing region. Rapid industrialization, expanding packaging demand, and booming textile production in China, India, and Japan are key growth drivers. Regional manufacturers are increasingly investing in high-speed inkjet printing for mass customization and efficiency. The growing e-commerce and electronics industries further increase the use of digital printing in product labeling and surface decoration. With rising environmental awareness and adoption of sustainable inks, Asia-Pacific continues to lead global market expansion in both production and consumption.

Latin America

Latin America accounted for a 5% share in 2024, driven by rising demand for digital printing in packaging, advertising, and textile industries. Brazil and Mexico lead regional adoption, supported by the expansion of flexible packaging and printed design sectors. Increasing preference for on-demand printing and sustainable ink formulations supports market growth. However, limited access to advanced equipment and high costs pose challenges for smaller manufacturers. Growing investment in industrial printing infrastructure and the adoption of eco-friendly inks are expected to improve regional competitiveness in the coming years.

Middle East & Africa

The Middle East & Africa region held a 3% share of the digital fabrication inkjet inks market in 2024, driven by expanding industrial and commercial printing sectors. Countries such as the UAE, Saudi Arabia, and South Africa are adopting digital printing for packaging, signage, and textile decoration. Rising infrastructure projects and rapid urbanization are boosting the use of digitally printed materials for advertising and interior design. Increasing awareness of sustainable inks and improved printing technology accessibility are creating new opportunities, although limited local production still constrains large-scale market penetration.

Market Segmentations:

By Type

- Digital Fabrication Inkjet Inks Based on Dye

- Digital Fabrication Inkjet Inks Based on Pigment

By Material

- Paper

- Plastics

- Textiles

- Others

By Application

- Office Printing Industry

- Textile Industry

- Industrial Printing Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the digital fabrication inkjet inks market includes major players such as EPSON, TRIDENT, Nazdar, InkTec, HP, Roland DG, Fujifilm Sericol International, Collins, Sensient Imaging Technologies, Nippon Kayaku, and Wikoff Color. These companies focus on developing high-performance inks for industrial, textile, and packaging applications, emphasizing superior adhesion, color accuracy, and durability. Leading manufacturers are investing in eco-friendly formulations, including water-based and UV-curable inks, to meet sustainability standards. Strategic partnerships, product innovations, and regional expansions are key strategies to enhance market presence. Companies are also improving pigment dispersion, printhead compatibility, and curing efficiency to meet evolving industrial needs. Growing demand for precision printing, customization, and short-run production continues to intensify competition, encouraging technological advancements and diversification of ink formulations across various digital fabrication applications worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EPSON

- TRIDENT

- Nazdar, InkTec

- HP

- Roland DG

- Fujifilm Sericol International

- Collins

- Sensient Imaging Technologies

- Nippon Kayaku

- Wikoff Color

Recent Developments

- In June 2025, Epson introduced its Direct-to-Shape Printing System utilizing S800 PrecisionCore printheads capable of printing directly on curved and three-dimensional surfaces at 600 × 600 dpi, enhancing application versatility in packaging and product decoration.

- In January 2025, Nazdar had its UV digital inkjet ink portfolio receive GREENGUARD Gold certification, indicating very low chemical emissions suitable for indoor environments.

- In 2025, Nazdar announced that it would showcase a broad range of inkjet, screen, and narrow-web inks, including new high-viscosity formulations, at FESPA Global Print Expo 2025

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for digital fabrication inkjet inks will increase with the rise of industrial digital printing.

- Adoption of sustainable and water-based inks will expand due to stricter environmental regulations.

- Advancements in pigment dispersion technology will enhance color quality and durability.

- Growth in textile and packaging industries will drive large-scale adoption of inkjet printing.

- Integration of inkjet systems in 3D printing and additive manufacturing will create new opportunities.

- Manufacturers will focus on developing high-speed, UV-curable, and energy-efficient ink formulations.

- Expansion of e-commerce packaging will boost demand for customizable and short-run printing.

- Asia-Pacific will emerge as the fastest-growing region due to strong textile production and industrialization.

- Collaborations between ink manufacturers and printer OEMs will strengthen innovation and market reach.

- Increasing automation and digitalization in printing processes will shape the future of industrial inkjet applications.