Market Overview

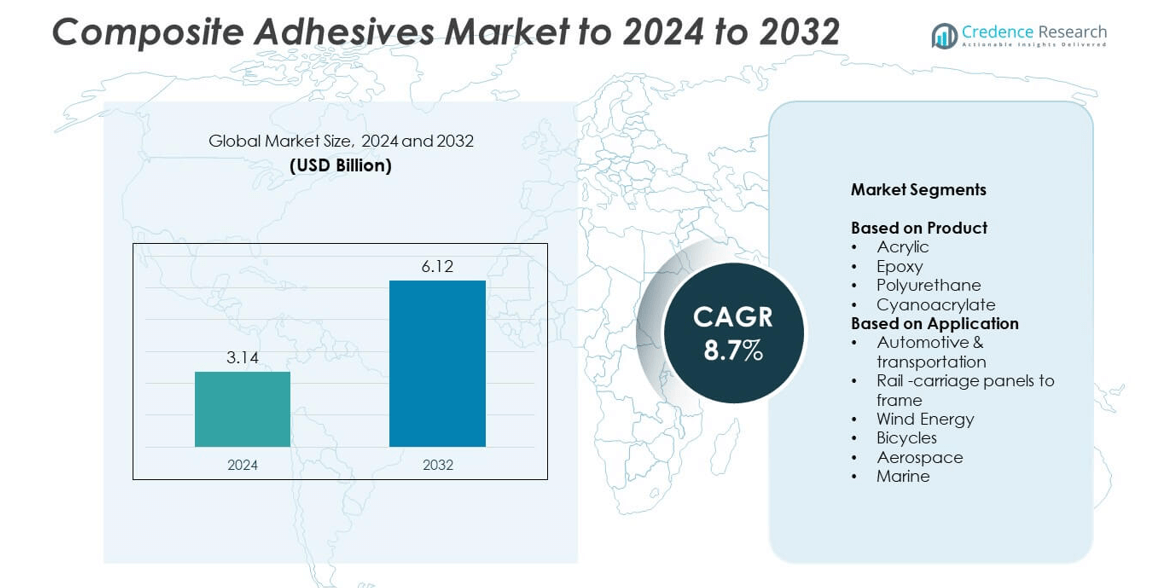

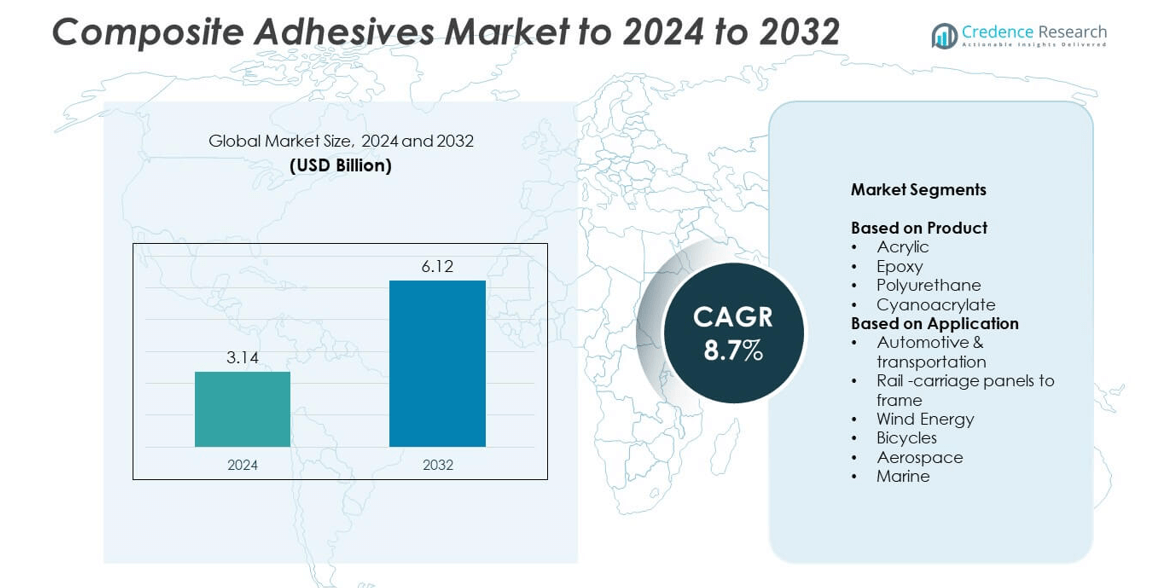

Composite Adhesives Market size was valued at USD 3.14 Billion in 2024 and is anticipated to reach USD 6.12 Billion by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Adhesives Market Size 2024 |

USD 3.14 Billion |

| Composite Adhesives Market, CAGR |

8.7% |

| Composite Adhesives Market Size 2032 |

USD 6.12 Billion |

The composite adhesives market is led by major players such as Sika AG, Henkel Adhesives, Huntsman, 3M, Bostik, and LORD Corporation, which collectively shape global competition through product innovation and technological advancement. These companies focus on high-strength, lightweight bonding solutions for automotive, aerospace, and wind energy applications. Their strategic investments in sustainable, low-VOC, and fast-curing formulations strengthen market penetration across industrial sectors. Regionally, Asia Pacific dominated the market with a 34% share in 2024, driven by expanding automotive production, infrastructure development, and renewable energy projects, followed by North America with a 31% share supported by advanced manufacturing capabilities.

Market Insights

- The composite adhesives market was valued at USD 3.14 billion in 2024 and is projected to reach USD 6.12 billion by 2032, growing at a CAGR of 8.7%.

- Rising demand for lightweight and high-strength materials in automotive, aerospace, and wind energy industries drives market growth.

- Key trends include the shift toward low-VOC, bio-based formulations and increased use of adhesives in electric vehicle and renewable energy applications.

- The market is highly competitive, with leading players focusing on advanced formulations, sustainable production, and global expansion to strengthen presence.

- Asia Pacific led with a 34% share in 2024, followed by North America at 31% and Europe at 28%, while the epoxy product segment dominated with about 42% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Epoxy adhesives held the largest share of about 42% in the composite adhesives market in 2024. Their superior bonding strength, chemical resistance, and ability to join dissimilar materials make them essential in structural applications. Automotive, aerospace, and wind energy sectors rely heavily on epoxy-based adhesives to enhance load-bearing capacity and reduce overall assembly weight. The shift toward lighter, fuel-efficient vehicles and composite-intensive designs continues to drive the adoption of epoxy products. Ongoing innovations in fast-curing and heat-resistant formulations further support their dominant position.

- For instance, 3M Scotch-Weld DP420 lists a 20-minute worklife and room-temperature lap-shear values reported at 4,500 psi in testing.

By Application

The automotive and transportation segment accounted for the highest market share of nearly 45% in 2024. Composite adhesives are increasingly used to bond panels, chassis components, and interior parts, replacing traditional welding and riveting methods. These adhesives improve crash resistance, reduce vibration, and enhance energy absorption, aligning with manufacturers’ goals for lighter and safer vehicles. Expanding electric vehicle production also accelerates demand for composite adhesives in battery modules and structural assemblies. The segment’s growth is supported by stringent emission standards and efficiency-driven design advancements.

- For instance, BMW reported an i8 body “marriage” adhesive that bonds in about 30 minutes, enabling faster structural integration on the line.

Key Growth Drivers

Rising Demand for Lightweight Vehicles

The growing emphasis on vehicle weight reduction to improve fuel efficiency and lower emissions is driving the demand for composite adhesives. These materials enable strong bonding between lightweight substrates like carbon fiber and aluminum, replacing welding or mechanical fasteners. Automotive and aerospace manufacturers increasingly use structural adhesives to enhance performance and safety while meeting global emission regulations. The rapid expansion of electric vehicle manufacturing further strengthens this driver, as adhesives help optimize battery integration and thermal management for improved energy efficiency.

- For instance, Hexcel’s HexPly M77 cures in 1.5 minutes at 160 °C for B-pillar reinforcements.

Expansion of Wind Energy Installations

The global shift toward renewable energy sources has significantly boosted the use of composite adhesives in wind turbine production. Adhesives ensure reliable bonding in turbine blades, nacelles, and rotor housings, providing high strength and fatigue resistance under extreme environmental conditions. The need for larger and more efficient blades in onshore and offshore wind farms further supports demand. As countries increase renewable energy targets, manufacturers continue investing in high-durability adhesive systems to enhance blade longevity and reduce maintenance costs.

- For instance, Siemens Gamesa is fitting a total of 150 recyclable blades across 50 of the 100 turbines at the 1.4 GW Sofia offshore wind project.

Advancement in High-Performance Adhesive Formulations

Ongoing innovation in adhesive chemistry is expanding performance capabilities in harsh operating conditions. New formulations of epoxy, polyurethane, and acrylic adhesives offer improved thermal stability, faster curing, and compatibility with diverse composite materials. These developments address stringent quality standards in aerospace, automotive, and marine sectors. The focus on sustainability also promotes bio-based and low-VOC adhesive technologies, aligning with environmental regulations. This continuous material innovation strengthens product reliability and widens application possibilities across high-performance industrial segments.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Adhesives

Manufacturers are prioritizing low-VOC and solvent-free composite adhesives to comply with environmental regulations. The adoption of water-based and bio-based adhesive systems is growing in response to green building certifications and sustainability goals. This trend opens opportunities for producers to develop eco-friendly alternatives that maintain strength and durability. Major companies are also investing in circular manufacturing and energy-efficient production methods, reinforcing their commitment to carbon reduction and sustainable growth across the industrial value chain.

- For instance, Swancor’s EzCiclo recyclable epoxy resin is being used in the blades deployed at the Sofia offshore wind farm in the UK. A total of 150 recyclable blades, manufactured by Siemens Gamesa using Swancor’s technology, are being installed across 50 of the project’s 100 turbines. The use of this technology aims to increase the recyclability rate of the wind farm to more than 90%.

Increasing Use in Electric Vehicles and Aerospace Applications

The rapid growth of electric vehicle and aerospace production presents strong opportunities for advanced composite adhesives. These adhesives enable lightweight construction, improved design flexibility, and enhanced crash performance. In EVs, adhesives contribute to battery safety, heat management, and vibration control. In aerospace, structural adhesives support weight reduction and fuel savings in next-generation aircraft. The integration of digital manufacturing and automation further promotes adhesive usage in precision assembly processes, enhancing production efficiency and consistency.

- For instance, Syensqo’s FM 309-1 film adhesive cures at 177 °C in 90 minutes at 0.28 MPa and has a glass transition near 182 °C.

Key Challenges

High Production and Processing Costs

Composite adhesives often involve complex formulations and specialized curing processes that raise manufacturing costs. The need for advanced equipment, controlled temperature conditions, and precise surface preparation increases operational expenses. These cost factors can limit adoption among small-scale manufacturers. Price sensitivity in end-use industries like automotive and wind energy also challenges market penetration. To address this, suppliers are focusing on developing cost-effective curing systems and optimized application methods to maintain performance while reducing overall production expenses.

Stringent Testing and Certification Requirements

Composite adhesives must meet rigorous mechanical, thermal, and environmental performance standards before approval for industrial use. The lengthy testing and certification processes, especially in aerospace and automotive sectors, can delay product commercialization. Variations in global safety and compliance regulations further add complexity. These challenges slow down market expansion and increase development costs. Manufacturers are therefore investing in advanced testing infrastructure and collaboration with regulatory agencies to streamline approval timelines and ensure consistent product quality.

Regional Analysis

North America

North America held a 31% share of the composite adhesives market in 2024, driven by strong adoption in automotive, aerospace, and wind energy applications. The United States leads regional demand due to advanced manufacturing capabilities and the presence of key adhesive producers. Rising investments in electric vehicle production and renewable energy installations continue to fuel market expansion. Canada contributes through growing aerospace component manufacturing and sustainable construction projects. Increasing regulatory emphasis on low-emission adhesives further supports technological innovation, positioning North America as a key hub for high-performance composite adhesive applications.

Europe

Europe accounted for 28% of the composite adhesives market share in 2024, supported by stringent environmental regulations and technological advancements. Germany, France, and the United Kingdom dominate regional demand due to established automotive and aerospace industries. The EU’s focus on reducing carbon emissions and promoting recyclable materials drives the development of sustainable adhesive systems. Manufacturers are adopting solvent-free and bio-based formulations to comply with REACH and VOC standards. The growing use of composite materials in rail, marine, and wind energy sectors continues to strengthen Europe’s market position.

Asia Pacific

Asia Pacific led the global composite adhesives market with a 34% share in 2024, supported by rapid industrialization and infrastructure expansion. China, Japan, South Korea, and India are major contributors, driven by increasing automotive production and renewable energy investments. Strong demand for lightweight materials in electric vehicles and aerospace structures accelerates market growth. The expansion of regional manufacturing hubs and rising foreign investments in composite technologies enhance competitiveness. Cost-efficient production and high export potential further reinforce Asia Pacific’s leadership in the global composite adhesives industry.

Latin America

Latin America captured a 4% share of the composite adhesives market in 2024, with Brazil and Mexico being key contributors. Growth is supported by expanding automotive assembly, wind energy projects, and marine applications. Increasing government initiatives toward renewable energy and infrastructure modernization stimulate adhesive demand. Local manufacturers are gradually adopting high-performance adhesive systems to improve durability and energy efficiency. Economic recovery and foreign investments in industrial sectors are expected to enhance regional production capacity, creating new opportunities for composite adhesive suppliers across Latin America.

Middle East & Africa

The Middle East and Africa accounted for 3% of the composite adhesives market in 2024, reflecting steady growth in construction, transportation, and energy sectors. The United Arab Emirates and Saudi Arabia lead market demand due to major infrastructure and renewable energy projects. Expanding aerospace and marine manufacturing facilities contribute to adhesive adoption. Africa shows emerging potential with developing automotive assembly and wind energy capacity. Increasing investments in industrial diversification and localized production of composite materials are expected to strengthen the region’s role in the global market.

Market Segmentations:

By Product

- Acrylic

- Epoxy

- Polyurethane

- Cyanoacrylate

By Application

- Automotive & transportation

- Rail -carriage panels to frame

- Wind Energy

- Bicycles

- Aerospace

- Marine

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The composite adhesives market is highly competitive and features prominent players such as Sika AG, Henkel Adhesives, Huntsman, 3M, Bostik, LORD Corporation, Hexcel, L&L Products, Permabond, Scott Bader, Masterbond, Parson Adhesives, Loxeal, and SciGRIP. The market is characterized by strong product innovation, extensive R&D investments, and a focus on sustainable and high-performance adhesive solutions. Companies are emphasizing lightweight bonding technologies to serve automotive, aerospace, and renewable energy sectors. Strategic collaborations and capacity expansions are central to strengthening global distribution networks. Firms are also integrating advanced formulation technologies that enhance mechanical strength, temperature stability, and curing efficiency. Sustainability remains a major competitive factor, driving the adoption of solvent-free, low-VOC, and bio-based adhesive systems. Continuous advancements in production automation and digital application systems further enhance quality consistency and reduce operational costs. Overall, the market demonstrates consolidation trends with growing emphasis on material performance, environmental compliance, and customer-specific product customization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sika AG

- Henkel Adhesives

- Huntsman

- 3M

- Bostik

- LORD Corporation

- Hexcel

- L&L Products

- Permabond

- Scott Bader

- Masterbond

- Parson Adhesives

- Loxeal

- SciGRIP

Recent Developments

- In 2025, Henkel launched Loctite AA 3952 and Loctite SI 5057, new light-cure adhesives designed for use in flexible medical devices.

- In 2025, Huntsman unveiled new bio-based I-BOND resins for manufacturing particleboard and oriented strand board at the LIGNA trade fair.

- In 2024, Bostik, adhesive solutions by Arkema, has invested in UV acrylic hot melt pressure sensitive adhesive (UV acrylic HMPSA) capabilities

- In 2023, Huntsman launched innovative polyurethane and epoxy materials for electric vehicle (EV) battery packs.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for lightweight materials continues to rise.

- Electric vehicle production will boost the use of structural composite adhesives.

- Aerospace manufacturers will adopt advanced adhesives for high-strength composite bonding.

- Renewable energy growth will increase adhesive use in wind turbine blade manufacturing.

- Innovations in bio-based and low-VOC formulations will support sustainability goals.

- Automation and precision dispensing systems will enhance production efficiency.

- Adhesive suppliers will focus on faster-curing and temperature-resistant technologies.

- Asia Pacific will remain the leading production hub for composite adhesives.

- Strategic partnerships will strengthen global supply chains and R&D capabilities.

- Expanding marine and construction applications will create new long-term opportunities.