Market Overview

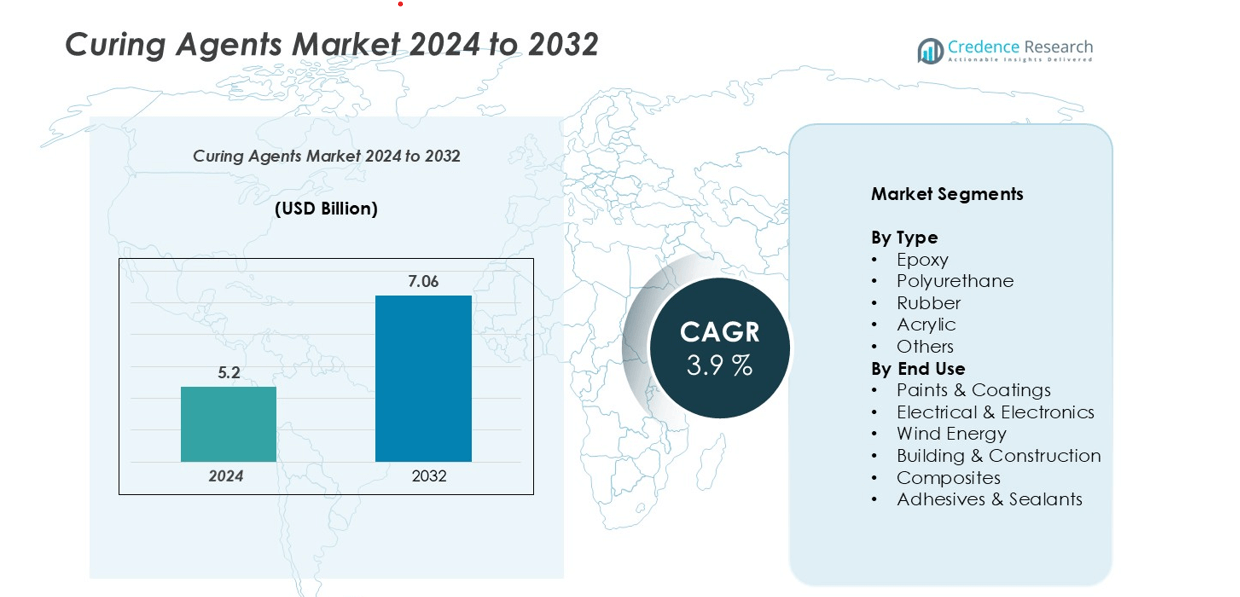

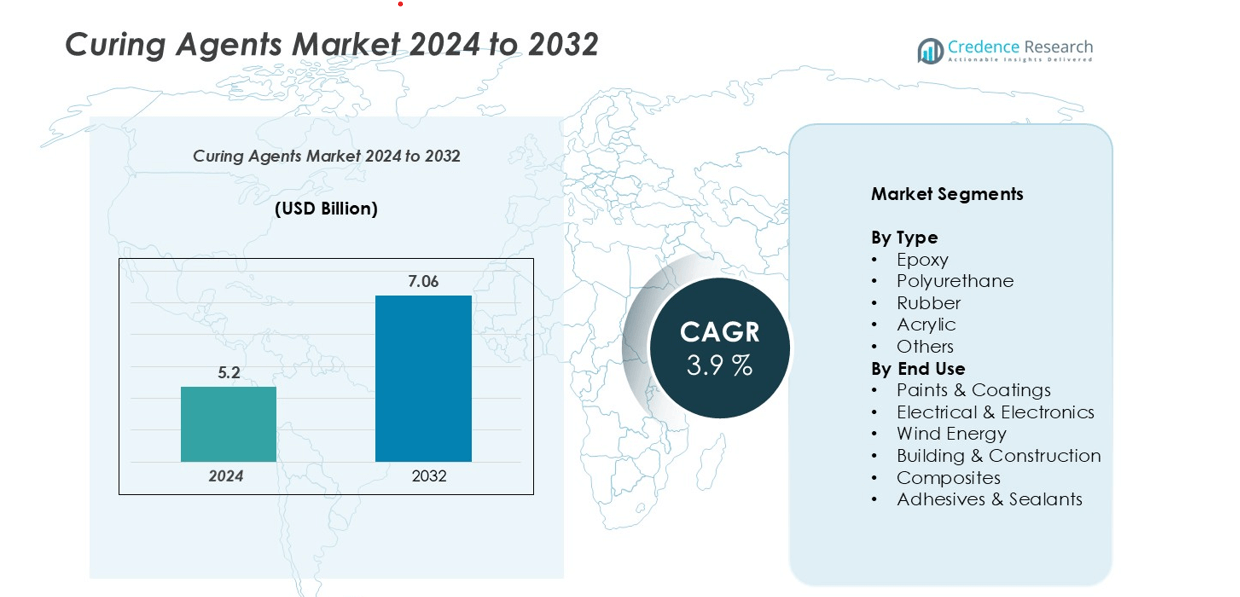

Curing Agents Market size was valued at USD 5.2 billion in 2024 and is anticipated to reach USD 7.06 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Curing Agents Market Size 2024 |

USD 5.2 billion |

| Curing Agents Market , CAGR |

3.9% |

| Curing Agents Market Size 2032 |

USD 7.06 billion |

The curing agents market is led by prominent players such as BASF SE, Evonik Industries, Hexion, Huntsman International LLC, Mitsubishi Chemical Corporation, DIC Corporation, Olin Corporation, Cardolite Corporation, Westlake Epoxy, Supreme Polytech Pvt. Ltd., and Alfa Chemicals. These companies dominate through extensive product portfolios, global distribution networks, and continuous innovation in eco-friendly and high-performance curing technologies. Asia Pacific emerges as the leading regional market, accounting for approximately 38% of global revenue in 2024, driven by rapid industrialization, infrastructure expansion, and strong demand from the automotive and electronics sectors. North America and Europe collectively represent over 50% of the remaining share, supported by advanced manufacturing bases and a growing focus on sustainable materials.

Market Insights

- The global curing agents market was valued at USD 5.2 billion in 2024 and is projected to reach USD 7.06 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

- Growing demand from the construction, automotive, and electronics industries is a major driver, supported by the increasing use of high-performance coatings, adhesives, and composites for enhanced durability and protection.

- Rising trends toward bio-based and low-VOC curing agents are shaping product innovation, as manufacturers focus on sustainable solutions aligned with global environmental regulations.

- The market is moderately consolidated, with leading players such as BASF SE, Evonik Industries, Hexion, Huntsman International LLC, and Mitsubishi Chemical Corporation emphasizing R&D and eco-friendly product development.

- Asia Pacific dominates with 38% of global revenue, followed by North America (28%) and Europe (25%); the epoxy segment leads by type, driven by its superior adhesion and chemical resistance properties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Based on type, the curing agents market is segmented into epoxy, polyurethane, rubber, acrylic, and others. The epoxy segment dominated the market in 2024, accounting for the largest revenue share. This dominance is attributed to its superior mechanical strength, chemical resistance, and excellent adhesion properties, which make it highly suitable for coatings, adhesives, and composite applications. The demand for epoxy curing agents is further driven by their growing adoption in the construction, automotive, and electronics industries, where high-performance and durable materials are essential for long-term structural integrity.

- For instance, The Burj Khalifa’s exterior is a high-performance curtain wall system featuring high-performance reflective glazing, aluminum panels, and textured stainless-steel spandrels and fins. Confirmed suppliers for various aspects of the tower include Jotun Paints for both exterior and interior coatings and Tata Steel for structural components like composite floor decking at the top of the tower.

By End Use:

By end use, the market is categorized into paints & coatings, electrical & electronics, wind energy, building & construction, composites, and adhesives & sealants. The paints & coatings segment held the largest market share in 2024, primarily due to the extensive use of curing agents to enhance coating durability, corrosion resistance, and finish quality. Rapid industrialization, infrastructure expansion, and increasing renovation activities in emerging economies are key factors supporting this growth. Moreover, advancements in eco-friendly and low-VOC curing systems have further stimulated adoption in architectural and industrial coating applications.

- For instance, the claim that Nagase ChemteX developed GREEN DENATITE, a bio-based epoxy formulation with a high bio-content that balances environmental impact reduction with functional performance while lowering environmental impact.

Key Growth Drivers

Expanding Demand from Construction and Infrastructure Sectors

The growing construction and infrastructure industries are major contributors to the curing agents market’s expansion. Curing agents are widely used in epoxy-based coatings, adhesives, and sealants for enhancing the durability, strength, and chemical resistance of concrete and steel structures. Rapid urbanization, smart city initiatives, and investments in infrastructure development across emerging economies such as India, China, and Brazil are accelerating the adoption of advanced coating materials. Additionally, the increasing emphasis on sustainable and high-performance building solutions has boosted the demand for low-VOC and environmentally friendly curing agents. These materials play a critical role in improving the longevity of buildings, bridges, and industrial floors, thereby driving steady market growth.

- For instance, the facade of the Burj Khalifa was constructed using materials from Dow Corning and Guardian Glass, not Araldite 2020.

Rising Applications in the Automotive and Aerospace Industries

Curing agents play a vital role in the production of lightweight composites, adhesives, and coatings used in automotive and aerospace applications. The rising preference for fuel-efficient and high-performance vehicles has led manufacturers to adopt composite materials with superior strength-to-weight ratios. Curing agents, particularly epoxy and polyurethane-based formulations, enhance structural integrity, corrosion resistance, and surface finish in both exterior and interior components. Moreover, the demand for durable coatings that withstand extreme temperatures and harsh environments continues to grow in aerospace maintenance and manufacturing. As automakers and aircraft manufacturers increasingly focus on performance optimization and emission reduction, the use of advanced curing systems is expected to expand significantly.

- For instance, The Statue of Liberty’s green color is a natural, protective patina that formed over time on its copper exterior due to oxidation, and a zinc-based rust inhibitor was applied to its interior iron frame during a 1980s restoration.

Technological Advancements and Product Innovation

Continuous advancements in curing technology have introduced high-performance and environmentally sustainable formulations. Innovations such as waterborne, UV-curable, and bio-based curing agents are gaining traction due to stringent environmental regulations and consumer preference for green products. These new formulations offer faster curing times, lower emissions, and improved mechanical properties, making them suitable for a wide range of applications in coatings, composites, and adhesives. Additionally, R&D efforts are focused on developing multifunctional curing agents with enhanced flexibility, impact resistance, and chemical stability. The integration of nanotechnology and hybrid polymers has further expanded application potential across industries, reinforcing the market’s long-term growth outlook.

Key Trends and Opportunities

Shift Toward Sustainable and Bio-based Curing Agents

One of the most prominent trends in the curing agents market is the increasing shift toward bio-based and environmentally friendly formulations. Growing environmental awareness and strict regulatory frameworks, such as REACH and EPA standards, are compelling manufacturers to reduce the use of volatile organic compounds (VOCs) and toxic chemicals. Bio-based curing agents derived from renewable raw materials, such as vegetable oils and lignin, are emerging as sustainable alternatives without compromising performance. This transition presents significant opportunities for innovation and brand differentiation. Companies investing in eco-friendly product lines are likely to gain a competitive edge, especially as end-users in construction, automotive, and coatings industries prioritize sustainability and circular economy practices.

- For instance, Nagase Chemtex developed GREEN DENATITE, a bio-based epoxy formulation with a high bio-content, balancing environmental impact reduction with excellent functional performance.

Growth in Wind Energy and Electronics Applications

The expanding renewable energy and electronics industries are creating new opportunities for curing agent manufacturers. In wind energy, epoxy-based curing systems are critical for producing durable and lightweight turbine blades, ensuring high mechanical strength and long-term stability. Similarly, in electronics, curing agents are used in encapsulants, coatings, and adhesives to protect sensitive components from moisture and thermal stress. The global shift toward clean energy and rapid growth in electric vehicles (EVs) and electronic devices are driving strong demand for advanced curing formulations. Manufacturers focusing on high-performance and thermally stable curing agents are well-positioned to capitalize on these emerging applications.

- For instance, Evonik Industries offers VESTAMIN® diamines as curing components in epoxy systems, playing a major role in the manufacture of fiber-composite materials for wind energy applications.

Key Challenges

Fluctuating Raw Material Prices

The curing agents market faces significant challenges due to volatile raw material prices, particularly those derived from petrochemical feedstocks. The cost of key components such as amines, anhydrides, and polyols is influenced by crude oil price fluctuations and supply chain disruptions. These uncertainties impact production costs, profit margins, and pricing stability across the value chain. Manufacturers often struggle to balance cost competitiveness with quality and performance requirements. To mitigate these effects, industry players are increasingly exploring backward integration, strategic sourcing, and alternative bio-based feedstocks. However, the transition to sustainable raw materials requires substantial investment in R&D and process optimization, posing short-term financial constraints.

Stringent Environmental and Safety Regulations

Environmental and occupational safety regulations present another major challenge for the curing agents industry. Many conventional curing agents contain volatile organic compounds (VOCs), toxic amines, and other hazardous substances that can pose health and environmental risks. Compliance with stringent global standards, such as those set by the EPA and EU REACH, necessitates continuous reformulation and product innovation. This increases production costs and slows product development cycles. Additionally, the requirement for extensive testing and certification adds regulatory burden, particularly for small and mid-sized manufacturers. Companies that fail to adapt to evolving environmental norms risk market share loss, underscoring the need for sustainable manufacturing practices and safer formulations.

Regional Analysis

North America:

North America held a significant share of the global curing agents market in 2024, accounting for approximately 28% of total revenue. The region’s growth is driven by strong demand from construction, automotive, and aerospace sectors. Increasing infrastructure renovation projects and the adoption of advanced coating and adhesive technologies are fueling market expansion. The United States dominates regional consumption due to its mature industrial base and focus on high-performance materials. Moreover, stringent environmental regulations are encouraging manufacturers to develop low-VOC and sustainable curing agents, further shaping the market landscape across North America.

Europe:

Europe accounted for around 25% of the curing agents market share in 2024, supported by robust demand from the construction, wind energy, and marine industries. Countries such as Germany, France, and the U.K. lead in adopting eco-friendly and bio-based curing technologies driven by strict EU environmental standards. The region’s advanced manufacturing capabilities and focus on sustainable infrastructure development continue to create opportunities for innovation. Moreover, the growing wind energy sector, particularly in Northern Europe, is fueling the need for high-performance epoxy curing agents used in turbine blade production.

Asia Pacific:

Asia Pacific dominated the global curing agents market in 2024, capturing nearly 38% of total revenue. Rapid industrialization, expanding construction activity, and the growth of automotive and electronics manufacturing are key growth drivers. China, India, and Japan are leading markets, benefiting from large-scale infrastructure projects and strong export-oriented production. The rising adoption of advanced composites and protective coatings in industrial applications is further boosting regional demand. Additionally, favorable government initiatives supporting green building and renewable energy projects are encouraging the use of environmentally sustainable curing formulations across Asia Pacific.

Latin America:

Latin America accounted for approximately 5% of the global curing agents market share in 2024. The region’s growth is primarily driven by expanding construction and automotive industries in countries such as Brazil and Mexico. Increased infrastructure investments, urbanization, and the recovery of industrial sectors post-pandemic are supporting market momentum. However, limited local manufacturing capacity and dependence on imports restrain rapid expansion. Nevertheless, growing awareness of durable and eco-friendly coatings and adhesives is gradually encouraging adoption, particularly in industrial and commercial construction projects across the region.

Middle East & Africa (MEA):

The Middle East & Africa region represented about 4% of the global curing agents market share in 2024. Market growth is supported by ongoing infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries. Rising investments in construction, oil & gas, and wind energy sectors are creating new opportunities for high-performance curing agents. The demand for protective coatings in harsh climatic conditions further strengthens regional consumption. However, the market remains moderately consolidated due to limited technological adoption. Increasing government initiatives for industrial diversification are expected to drive gradual growth across MEA.

Market Segmentations:

By Type

- Epoxy

- Polyurethane

- Rubber

- Acrylic

- Others

By End Use

- Electrical & Electronics

- Wind Energy

- Building & Construction

- Composites

- Adhesives & Sealants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global curing agents market is moderately consolidated, with key players focusing on product innovation, strategic partnerships, and capacity expansion to strengthen their market positions. Major companies such as BASF SE, Evonik Industries, Hexion, Huntsman International LLC, and Mitsubishi Chemical Corporation lead the market with extensive product portfolios and strong global distribution networks. These players emphasize the development of sustainable, low-VOC, and bio-based curing agents to meet tightening environmental regulations and rising customer demand for eco-friendly materials. Regional manufacturers, including Supreme Polytech Pvt. Ltd. and Alfa Chemicals, compete by offering cost-effective and customized solutions. Mergers, acquisitions, and collaborations remain central strategies for technology advancement and market expansion. Continuous investments in R&D and the introduction of multifunctional curing systems for coatings, adhesives, and composites are shaping competitive dynamics. As industries prioritize performance, durability, and sustainability, innovation-driven differentiation is expected to define future market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Evonik Industries

- Hexion

- Huntsman International LLC

- DIC Corporation

- Mitsubishi Chemical Corporation

- Olin Corporation

- Cardolite Corporation

- Westlake Epoxy

- Supreme Polytech Pvt. Ltd.

- Alfa Chemicals

Recent Developments

- In March 2024, Evonik Industries introduced a new epoxy curing agent named Ancamine 2880. This innovative product is designed to meet the growing demands of the coatings market by providing a fast-curing and UV-resistant solution that enhances the performance of epoxy coatings.

- In August 2022, Hexion Inc. launched a new epoxy system and curing agent to address the increasing demand for epoxy resins and curing agents in various applications. This initiative reflects Hexion’s commitment to innovation and sustainability in the coatings industry.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance curing agents will continue to grow across construction, automotive, and electronics industries.

- Asia Pacific is expected to remain the largest regional market due to industrialization and infrastructure expansion.

- Adoption of bio-based and environmentally friendly curing agents will increase significantly.

- Epoxy-based curing agents will maintain the dominant share in the market.

- Growth in wind energy and renewable sectors will drive the use of specialized curing agents in turbine blades and composites.

- Manufacturers will focus on developing low-VOC and sustainable formulations to meet regulatory standards.

- Technological advancements such as UV-curable and waterborne curing agents will gain traction.

- Increasing demand for lightweight composites in automotive and aerospace applications will boost market growth.

- Strategic collaborations, mergers, and acquisitions will shape competitive dynamics.

- Expansion in emerging markets will provide new growth opportunities for both regional and global players.