Market Overview

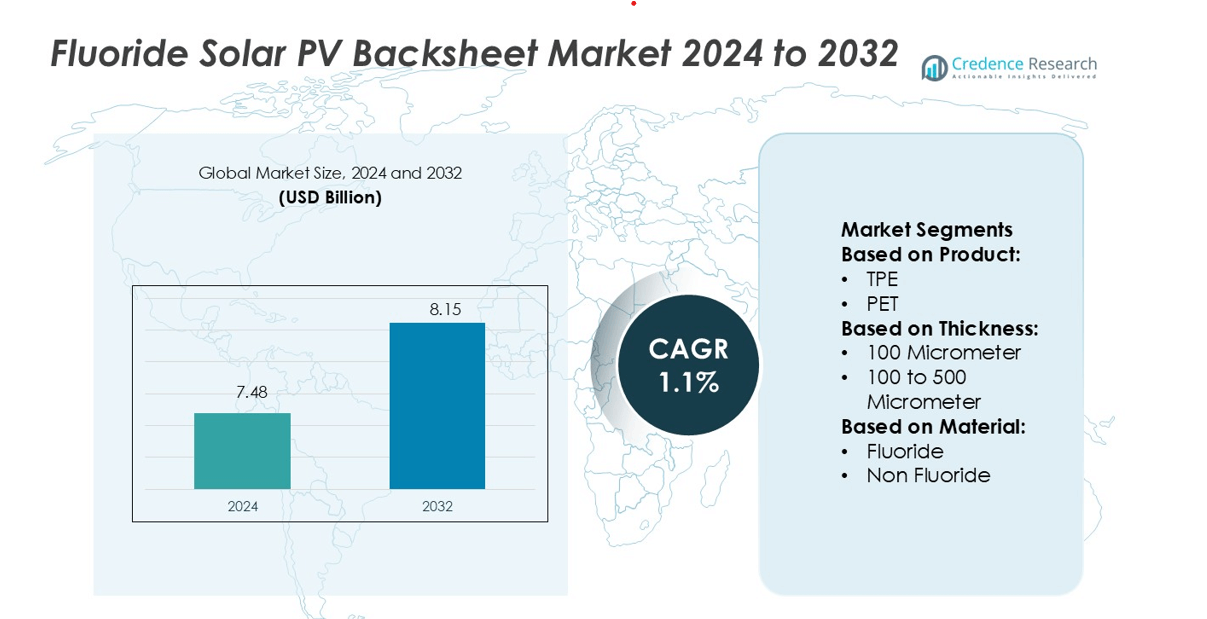

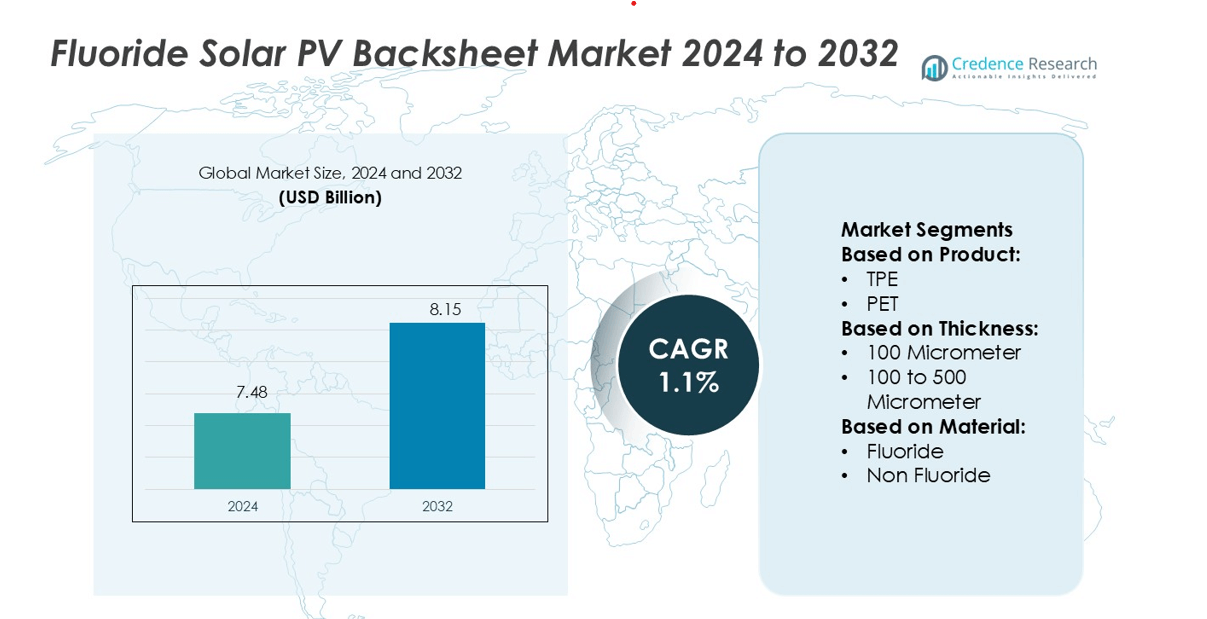

Fluoride Solar PV Backsheet Market size was valued USD 7.48 billion in 2024 and is anticipated to reach USD 8.15 billion by 2032, at a CAGR of 1.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoride Solar PV Backsheet Market Size 2024 |

USD 7.48 billion |

| Fluoride Solar PV Backsheet Market, CAGR |

1.1% |

| Fluoride Solar PV Backsheet Market Size 2032 |

USD 8.15 billion |

The Fluoride Solar PV Backsheet Market features strong competition among leading players including MJK Power, Arkema, DuPont, Astenik Solar, Krempel, Coveme, DUNMORE, Alishan Green Energy, RenewSys India, and 3M. These companies are focusing on advanced fluoropolymer technology, improved UV resistance, and enhanced product durability to support long-term solar performance. Strategic partnerships and regional expansions strengthen their global market position. Asia Pacific leads the market with a 34% share, driven by large-scale solar installations, cost-competitive manufacturing, and favorable government policies. This regional dominance is supported by rapid technological advancements and high production capacity, positioning Asia Pacific as a central hub for global backsheet supply.

Market Insights

- The Fluoride Solar PV Backsheet Market was valued at USD 7.48 billion in 2024 and is projected to reach USD 8.15 billion by 2032, with a CAGR of 1.1% during the forecast period.

- Strong competition and technological advancement drive the market, with companies focusing on durable fluoropolymer solutions and improved UV resistance to enhance solar module performance.

- Trends show rising investments in recyclable materials, multilayer coatings, and efficient production processes to meet long-term sustainability goals.

- Market restraints include high production costs, supply chain complexities, and the need for continuous innovation to match evolving solar technologies.

- Asia Pacific leads with a 34% regional share, driven by large-scale solar projects and cost-effective manufacturing, while North America and Europe follow with 29% and 27% shares respectively, reflecting steady adoption and strong regulatory support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The TPT-Primed segment holds the largest market share in the Fluoride Solar PV Backsheet Market. Its dominance is driven by high durability, strong UV resistance, and stable thermal performance, which make it ideal for large-scale solar installations. Manufacturers prefer TPT-Primed backsheets due to their proven field performance and compatibility with advanced PV module technologies. PVDF and PEN segments are also gaining traction with growing demand for lightweight and high-efficiency modules. However, TPT-Primed remains the preferred choice for utility projects requiring long-term reliability and reduced maintenance costs.

- For instance, RenewSys provides solar backsheets, such as those in its PRESERV series, which are integrated into modules installed worldwide. These backsheets are engineered to withstand up to 1,500 V system voltage and endure conditions like 85 °C temperatures to ensure extended field performance.

By Thickness

The 100 to 500 Micrometer segment dominates the market, supported by its superior balance between protection, flexibility, and cost-efficiency. This thickness range ensures strong mechanical strength, enhanced moisture barrier properties, and prolonged module lifespan. It is widely adopted in both rooftop and utility-scale installations, meeting industry durability standards. The <100 micrometer segment is used in cost-sensitive projects, while >500 micrometer is selected for extreme environments. However, the 100–500 micrometer range remains the most popular choice for high-efficiency modules in global PV deployments.

- For instance, Arkema’s Kynar® PVDF films are manufactured in thicknesses from 10 µm up to 175 µm per layer, enabling multilayer backsheet stacks that fall into the 100-500 µm effective thickness range when laminated.

By Material

The Fluoride segment leads the market with the largest share due to its excellent resistance to UV degradation, moisture, and harsh weather. Fluoride-based backsheets extend module life and maintain power output efficiency over time. Their superior chemical stability and performance in high-temperature conditions make them suitable for utility-scale and commercial installations. Non-fluoride materials are growing in adoption for low-cost applications, but they lack the same level of durability. Fluoride materials remain the standard for high-performance solar PV modules, especially in high-irradiation regions.

Key Growth Drivers

Rising Demand for High-Efficiency PV Modules

The demand for high-efficiency solar PV modules is accelerating the adoption of fluoride backsheets. These backsheets offer strong UV resistance, high thermal stability, and moisture protection, ensuring long operational life. Their superior performance supports higher energy yields, which aligns with growing utility and commercial solar deployments. Energy developers prefer fluoride backsheets for large-scale projects where durability and minimal maintenance are key. This demand is further reinforced by rising investments in renewable energy and the global shift toward net-zero emission goals.

- For instance, in DuPont’s 2020 Global PV Reliability Report, DuPont’s Tedlar® PVF-based backsheets showed a defect rate below 0.05 % even after 35 years in the field, based on inspections of over 4.2 million panels across 275 solar sites.

Expansion of Utility-Scale Solar Projects

The rapid growth of utility-scale solar farms is a major driver for fluoride solar PV backsheet demand. These installations require backsheets with excellent weather resistance and long-term reliability to maintain power output. Fluoride backsheets provide strong protection against UV radiation and harsh environmental conditions, making them ideal for large solar arrays. Governments and private investors are increasing funding for renewable energy infrastructure. This growth in capacity additions directly boosts the demand for durable, high-performance backsheet materials.

- For instance, Krempel certifies that its AKASOL® fluoropolymer-based backsheet laminates comply with system voltages up to 1,500 V per IEC 61730 and undergo accelerated ageing tests exceeding 2,000 hours of UV exposure.

Technological Advancements in Backsheet Manufacturing

Continuous innovation in backsheet production technologies enhances the performance of fluoride materials. Manufacturers are introducing advanced multilayer designs with improved moisture barriers and thermal endurance. These innovations extend module life and reduce power degradation rates. Automation and precision coating techniques are improving production efficiency and lowering costs, increasing adoption in price-sensitive markets. This shift toward advanced manufacturing supports the expansion of reliable solar modules for utility, commercial, and residential applications.

Key Trends & Opportunities

Growing Shift Toward Bifacial and High-Power Modules

The growing use of bifacial and high-power modules is creating strong opportunities for advanced backsheet solutions. Fluoride backsheets provide better reflectivity and weather resistance, improving module efficiency. Their compatibility with next-generation cell architectures makes them a preferred option for large solar developers. This shift toward higher wattage modules encourages manufacturers to design backsheets with enhanced mechanical and UV stability, supporting longer performance warranties and improved power output.

- For instance, Coveme’s dyMat® KF PVDF-based laminate for 1,500 V systems has a total thickness of 330 µm, which is primarily comprised of a PET core. The backsheet is UL, TÜV Rheinland, and TÜV SÜD certified and features a much thinner outer PVDF layer for weather resistance.

Sustainability and Eco-Friendly Material Development

Sustainability initiatives in solar manufacturing are driving the development of eco-friendly fluoride backsheet alternatives. Companies are investing in recyclable materials and low-carbon production techniques to align with environmental regulations. This trend opens opportunities for innovative products that combine durability with reduced environmental impact. Governments and investors are favoring sustainable technologies, giving manufacturers a competitive edge. These efforts support both cost optimization and compliance with evolving international standards.

- For instance, DUN-SOLAR PV backsheets support system voltages up to 1,500 V DC and are engineered for durability under UV, moisture, and weather stress.

Strategic Partnerships and Capacity Expansion

Manufacturers are pursuing strategic partnerships and expanding production capacities to meet rising global demand. Collaborations between module producers and backsheet suppliers ensure stable supply chains and technology integration. New facilities in key solar markets like Asia-Pacific and Europe are enabling cost-competitive production. This expansion strengthens market positioning and supports large-scale solar deployment plans, creating new revenue opportunities for backsheet manufacturers.

Key Challenges

High Cost of Fluoride Materials

The higher production cost of fluoride materials compared to non-fluoride alternatives is a major challenge. These costs increase the overall module price, affecting competitiveness in cost-sensitive markets. While fluoride backsheets offer superior durability, developers with tight budgets may opt for lower-cost options. This pricing pressure can limit market penetration, especially in regions focused on low-cost solar deployment. Manufacturers must balance performance with affordability to maintain market share.

Regulatory Pressure and Environmental Concerns

Increasing regulatory scrutiny on fluorinated compounds poses a challenge for market growth. Concerns regarding the environmental impact and end-of-life management of fluorinated materials are rising. Governments are tightening rules around production, disposal, and recycling. These measures may increase compliance costs for manufacturers. Companies need to innovate and invest in sustainable alternatives to meet environmental standards while maintaining backsheet performance and reliability.

Regional Analysis

North America

North America holds a 29% share of the global Fluoride Solar PV Backsheet Market in 2024. The market is driven by rapid solar power adoption, strong incentive programs, and advanced manufacturing capabilities. The U.S. leads with large-scale utility projects and innovative solar farms. Companies are integrating durable backsheet materials to meet high efficiency and long operational life demands. Strategic collaborations between module manufacturers and material suppliers are expanding regional capacity. Supportive policies like the Inflation Reduction Act are encouraging long-term investments, reinforcing North America’s position as a key market for fluoride-based PV backsheet solutions.

Europe

Europe accounts for 27% of the global market share in 2024, supported by strong solar infrastructure in Germany, Spain, and France. EU energy transition goals and strict environmental regulations are pushing demand for long-life, recyclable fluoride backsheet materials. Manufacturers are focusing on developing PV modules with enhanced UV resistance and weather protection. The region benefits from well-developed R&D hubs and advanced testing facilities. Utility-scale and rooftop solar projects are rising steadily. Government incentives, coupled with net-zero targets, continue to accelerate solar deployment, making Europe a major hub for fluoride PV backsheet production and application.

Asia Pacific

Asia Pacific dominates the Fluoride Solar PV Backsheet Market with a 34% share in 2024. China, India, Japan, and South Korea drive regional growth through massive solar capacity expansion. Government-led renewable energy targets and cost-competitive manufacturing strengthen the region’s leadership. Local suppliers are scaling up high-performance backsheet production to meet rising domestic and export demand. Technological innovations such as double-glass modules and improved thermal resistance enhance product reliability. Large investments in utility and distributed solar projects are increasing backsheet installations, positioning Asia Pacific as the fastest-growing and most competitive regional market globally.

Latin America

Latin America captures a 6% share of the global market in 2024, led by Brazil, Chile, and Mexico. The region’s growing solar sector benefits from abundant sunlight and expanding energy diversification policies. Utility-scale projects are driving fluoride PV backsheet demand for long-term durability in harsh climates. Several international players are entering through joint ventures and partnerships. Supportive government incentives and tariff reforms are accelerating renewable investments. Although manufacturing capacity remains limited, import volumes are increasing steadily. With growing private sector participation, Latin America is emerging as a promising market for fluoride PV backsheet solutions.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the global market in 2024. Countries like the UAE, Saudi Arabia, and South Africa are investing heavily in solar energy projects. Harsh climatic conditions drive the need for durable fluoride-based backsheets with high UV and temperature resistance. Government-backed renewable programs and infrastructure investments are creating new opportunities for suppliers. Most products are imported from Asia, reflecting strong international supplier participation. Utility-scale installations dominate, with growing interest in hybrid energy systems. Rising renewable targets and strategic diversification plans position the region for steady market growth.

Market Segmentations:

By Product:

By Thickness:

- 100 Micrometer

- 100 to 500 Micrometer

By Material:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fluoride Solar PV Backsheet Market is shaped by key players such as MJK Power, Arkema, DuPont, Astenik Solar, Krempel, Coveme, DUNMORE, Alishan Green Energy, RenewSys India, and 3M. The Fluoride Solar PV Backsheet Market is defined by strong innovation, expanding production capacity, and strategic collaborations. Manufacturers are focusing on advanced material engineering to enhance backsheet durability, weather resistance, and energy yield. Companies are prioritizing high-performance fluoropolymer coatings and multilayer designs to support long operational lifespans of solar modules. Many firms are expanding their regional footprint through joint ventures and supply agreements with leading solar panel producers. Sustainability is also a key focus, with investments in recyclable materials and low-emission manufacturing processes. Competitive pressure is driving continuous product improvements, cost optimization, and increased integration with evolving solar technologies. This environment fosters rapid technological advancements and stronger positioning in high-growth renewable energy markets worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MJK Power

- Arkema

- DuPont

- Astenik Solar

- Krempel

- Coveme

- DUNMORE

- Alishan Green Energy

- RenewSys India

- 3M

Recent Developments

- In February 2025, Arkema decided to increase its PVDF capacity by 15% in North America. The global PVDF footprint with capabilities that match market development. It will further support the increasing demand for locally manufactured high-performance resins for lithium-ion batteries as well as the growing semiconductor and cable markets.

- In July 2024, Jinko Solar announced that its subsidiary JinkoSolar Middle East DMCC entered into a joint venture agreement with Renewable Energy Localization Company (RELC) and Vision Industries Company (VI) in Saudi Arabia. The JV has been signed to build & operate a solar module and solar cell manufacturing plant in the economy.

- In April 2024, RENESOLA announced its partnership with BayWa r.e. to develop and build its sales and marketing activities in Mexico. The two companies are expected work together to increase the presence of RENESOLA’s solutions in the Mexican solar distribution market, capitalizing on their combined strengths in solar energy and aiming to reach the target of distributing 100 MW of solar modules in 2024.

- In February 2023, Endurans Solar received an equity investment from Riverbend Energy Group. The company expanded its U.S. production unit owing to influx of finance, in order to fulfill the growing demand for its innovative solar backsheet

Report Coverage

The research report offers an in-depth analysis based on Product, Thickness, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance backsheets will rise with expanding solar capacity worldwide.

- Manufacturers will focus on recyclable and eco-friendly materials to meet sustainability goals.

- Advanced fluoropolymer coatings will gain traction for longer module lifespans.

- Cost optimization will remain a priority to support large-scale solar deployments.

- Partnerships between material suppliers and module makers will strengthen supply chains.

- Asia Pacific will continue to lead market growth through rapid capacity expansion.

- R&D investment will increase to enhance UV resistance and thermal performance.

- Regulatory support for renewable energy will drive backsheet adoption globally.

- Localized production facilities will expand to reduce logistics costs and lead times.

- Technological innovation will shape competitive strategies and market positioning.