Market Overview

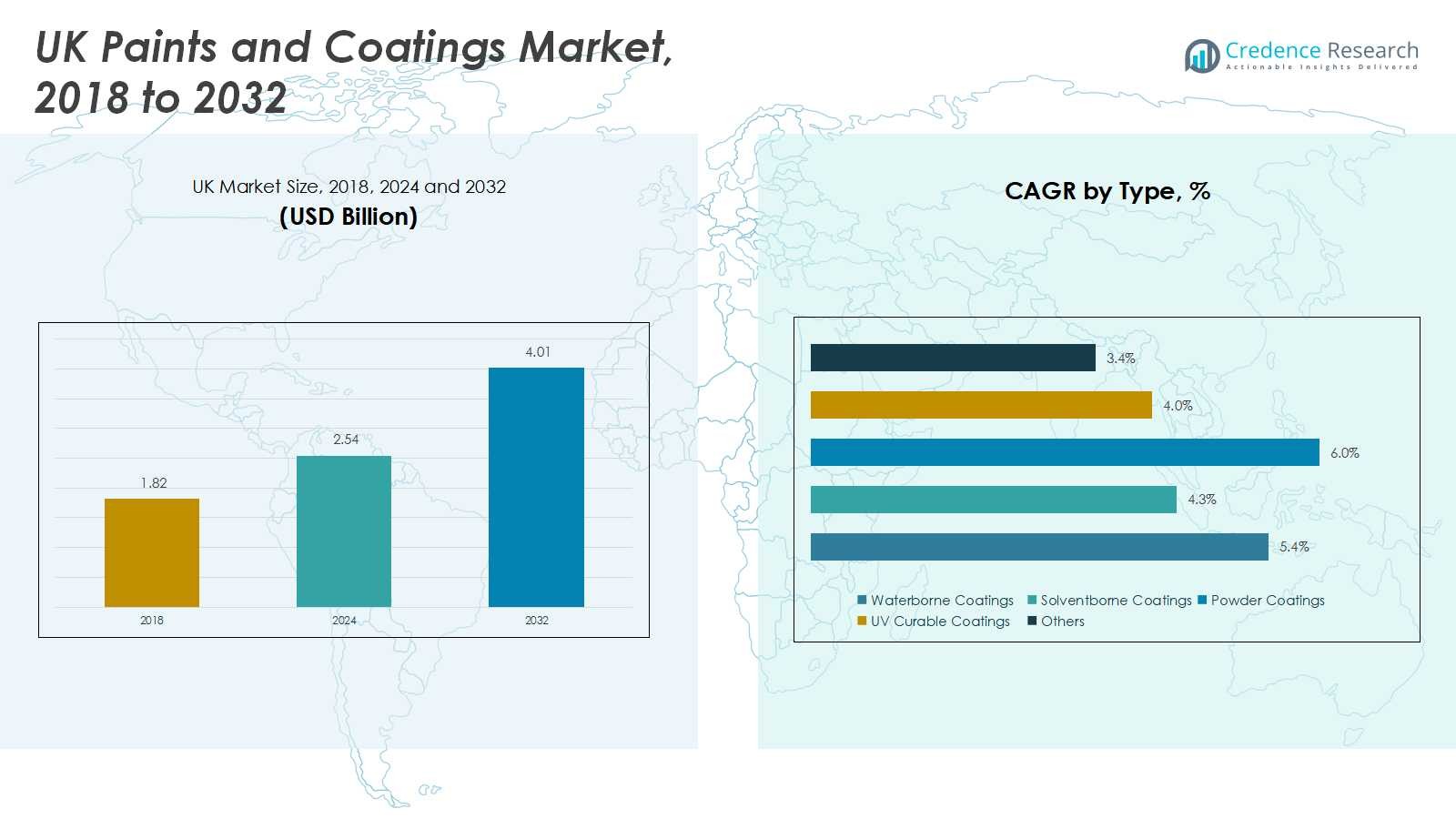

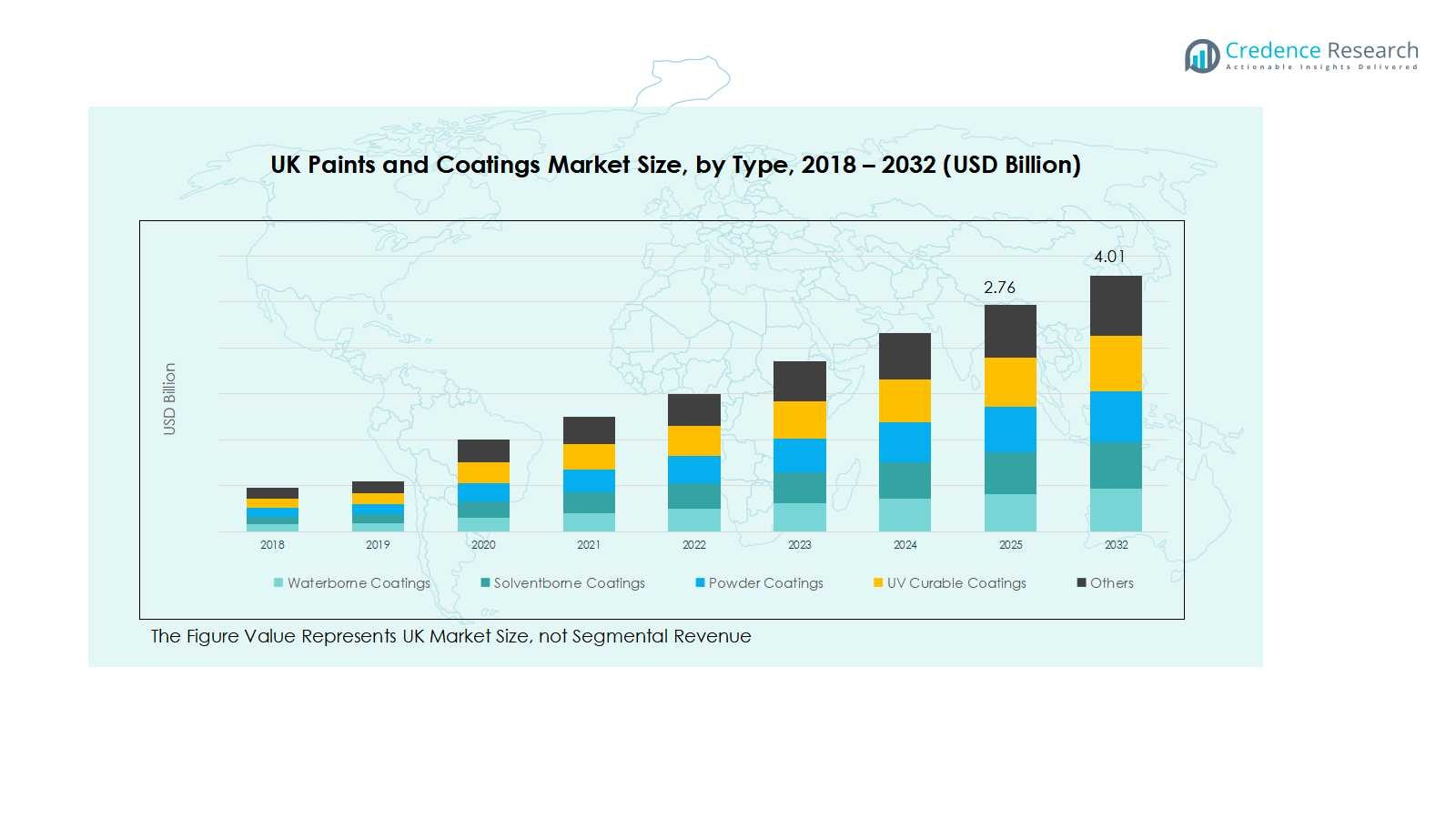

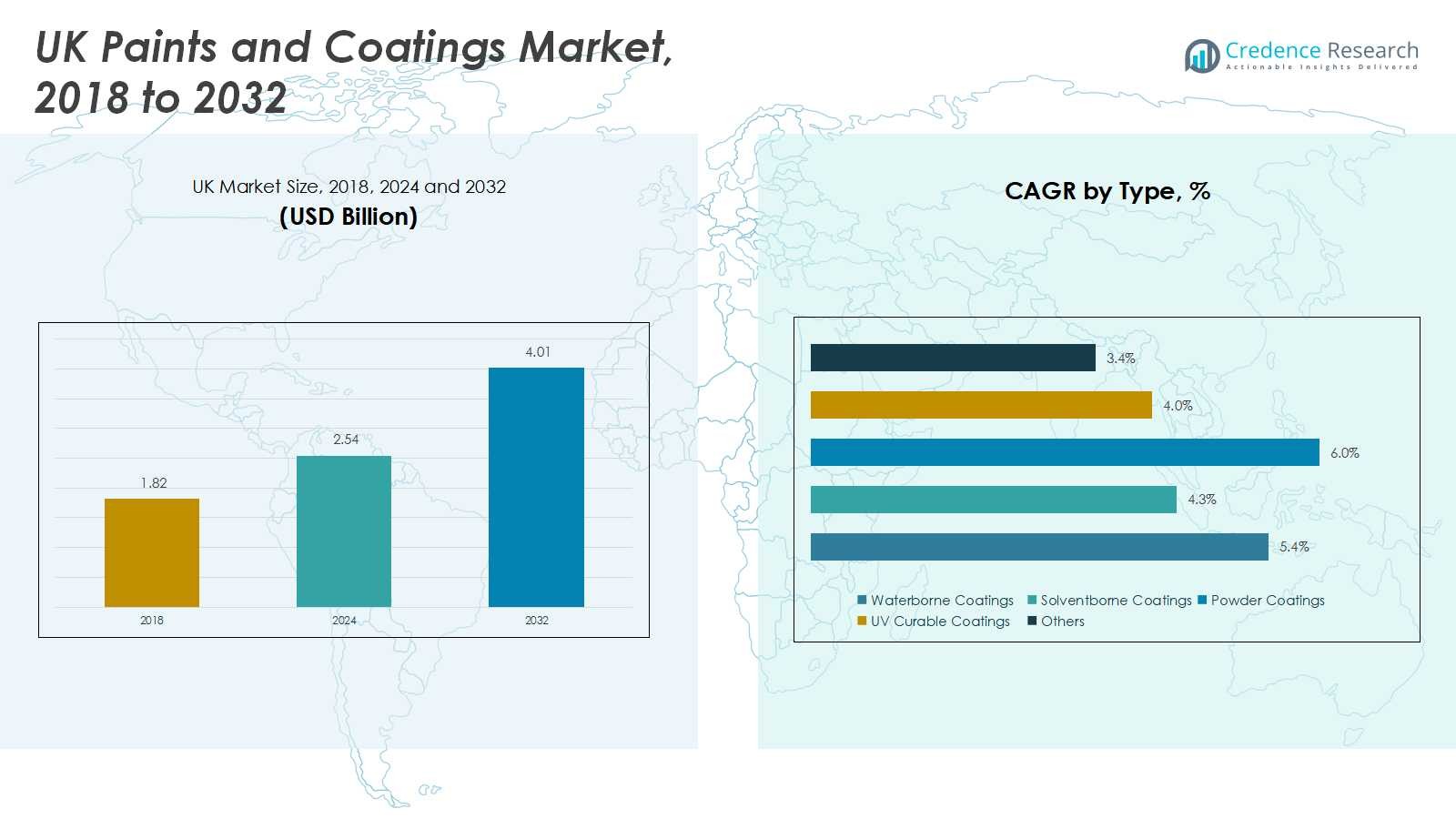

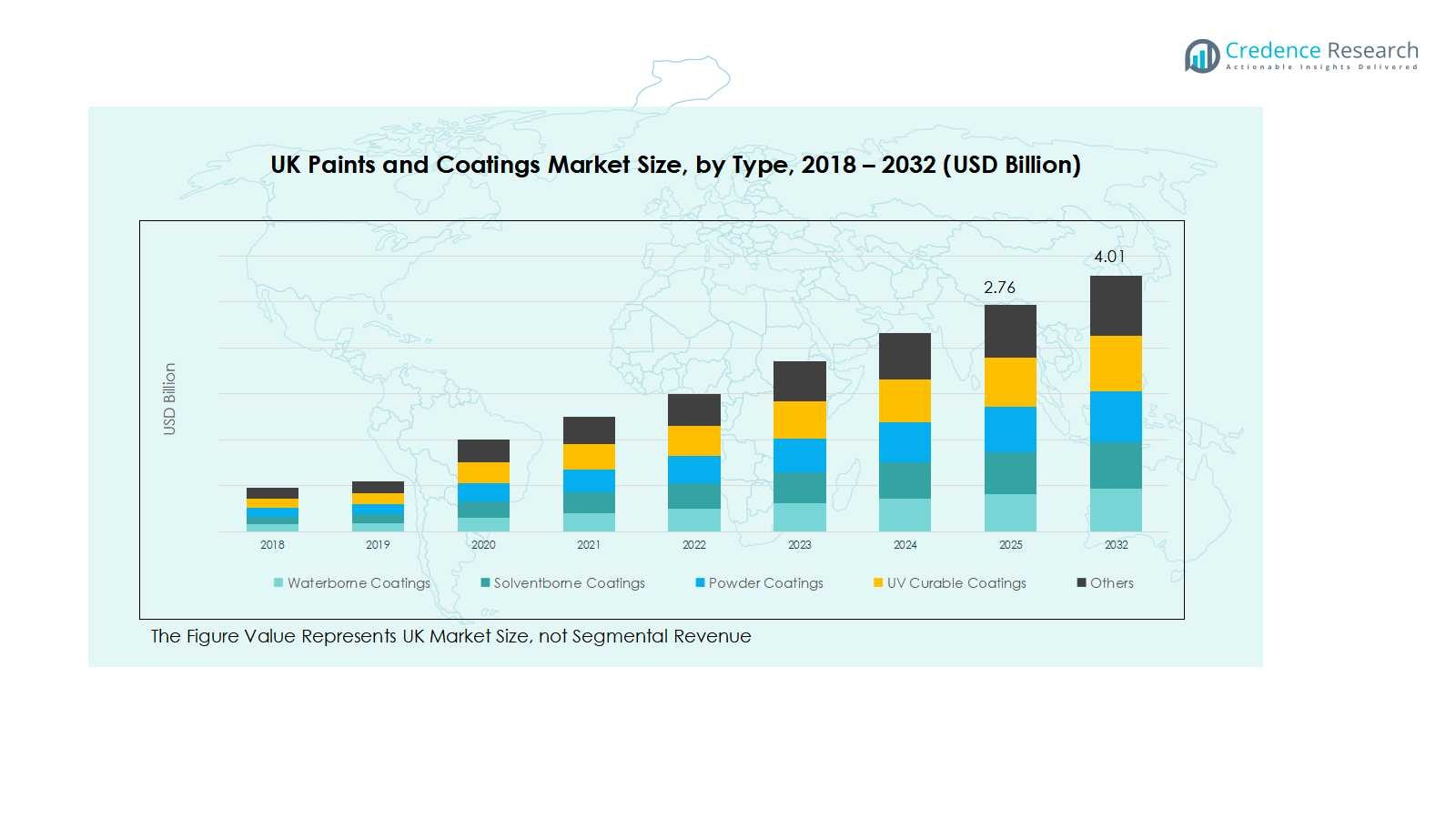

The UK Paints and Coatings market was valued at USD 1.82 billion in 2018 and grew to USD 2.54 billion in 2024. It is projected to reach USD 4.01 billion by 2032, registering a compound annual growth rate (CAGR) of 5.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Paints and Coatings market Size 2024 |

USD 2.54 Billion |

| UK Paints and Coatings market, CAGR |

5.48% |

| UK Paints and Coatings market Size 2032 |

USD 4.01 Billion |

The UK Paints and Coatings market is led by prominent players such as Akzo Nobel, ICI Paints, HMG Paints, Crown Paints, Jotun UK, Sherwin-Williams UK, Axalta UK, PPG Industries UK, and Tikkurila UK. These companies maintain strong market positions through extensive product portfolios, innovation in eco-friendly and high-performance coatings, and strategic regional expansions. England emerges as the leading region, commanding a 72% market share due to its robust residential, commercial, and industrial construction activities. Scotland follows with 12%, supported by growing infrastructure and renovation projects, while Wales and Northern Ireland contribute 9% and 7%, respectively, driven by targeted industrial applications and sustainable coating adoption. Collectively, these players leverage technological advancements, mergers, acquisitions, and partnerships to strengthen distribution networks and capture opportunities across decorative, protective, and specialty coatings, sustaining leadership in the competitive UK paints and coatings landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Paints and Coatings market was valued at USD 2.54 billion in 2024 and is projected to reach USD 4.01 billion by 2032, growing at a CAGR of 5.48% during the forecast period.

- Growth is driven by rising demand for eco-friendly waterborne coatings, expansion in residential and commercial construction, and technological advancements in high-performance coatings such as epoxy, polyurethane, and UV curable formulations.

- Key trends include the increasing adoption of smart and functional coatings with properties like anti-corrosion, self-cleaning, and thermal insulation, alongside growing demand from the automotive and industrial manufacturing sectors.

- The market is highly competitive, led by companies such as Akzo Nobel, ICI Paints, HMG Paints, Crown Paints, Jotun UK, Sherwin-Williams UK, Axalta UK, PPG Industries UK, and Tikkurila UK, focusing on mergers, partnerships, and product innovation to strengthen their positions.

- England holds the largest regional share at 72%, followed by Scotland at 12%, Wales at 9%, and Northern Ireland at 7%, with waterborne coatings dominating the type segment at 42% share.

Market Segmentation Analysis:

By Type:

In the UK Paints and Coatings market, waterborne coatings dominate the type segment, accounting for approximately 42% of the total market share. The growing preference for eco-friendly and low-VOC solutions is driving this sub-segment, as regulatory frameworks and sustainability initiatives push manufacturers toward water-based formulations. Solventborne coatings remain relevant for industrial applications due to their superior durability and chemical resistance, capturing around 28% of the market, while powder coatings and UV curable coatings collectively hold 20%, benefiting from demand in automotive and industrial manufacturing sectors. The remaining 10% includes specialty and niche coatings under “Others.”

- For instance, AkzoNobel emphasizes low-VOC architectural and industrial waterborne coatings that comply with stringent environmental regulations, delivering durability and color consistency.

By Technology:

Among technology segments, epoxy coatings lead with a 35% market share, favored for their strong adhesion, corrosion resistance, and chemical durability, making them ideal for industrial and construction applications. Polyurethane (PU) and acrylic coatings follow, with shares of 25% and 20%, respectively, driven by their flexibility, UV resistance, and aesthetic appeal in automotive and architectural coatings. Alkyd and polyester coatings together account for 15%, largely utilized in traditional construction and wood finishes. The “Others” category, holding 5%, includes emerging hybrid technologies and specialized formulations addressing evolving end-user needs.

- For instance, Master Bond’s EP30FL, a two-component epoxy system, offers exceptional resistance to thermal cycling and chemicals such as water, oil, and organic solvents, with low shrinkage and high flexibility, making it suitable for bonding and sealing in demanding environments.

By End-User Industry:

Residential construction commands the largest share in the UK paints and coatings market, representing nearly 38% of total consumption, fueled by ongoing housing development projects and home renovation trends. Commercial construction contributes 25%, supported by office, retail, and infrastructure expansion. The automotive sector holds 20%, benefiting from increasing vehicle production and aftermarket refurbishment activities. Industrial manufacturing accounts for 12%, where protective and specialty coatings are critical for machinery and equipment. The remaining 5% is represented by other industries, including marine, aerospace, and niche industrial applications, reflecting diversified end-use demand.

Key Growth Drivers

Increasing Demand for Eco-Friendly Coatings

The shift toward sustainable and low-VOC formulations is a major growth driver in the UK paints and coatings market. Regulatory initiatives and environmental awareness among consumers are accelerating the adoption of waterborne and bio-based coatings. Manufacturers are investing in research and development to offer environmentally compliant solutions without compromising performance. This trend is particularly strong in residential and commercial construction, where regulatory pressures and consumer preferences are encouraging the replacement of solventborne products with greener alternatives, driving overall market expansion.

- For instance, Beckers Group has established a Sustainable Innovation Center in the UK, focusing on UV/EB curing technologies to produce coatings with low VOC emissions and high durability, supporting their goal of becoming the most sustainable industrial coatings company.

Growth in Construction and Infrastructure Activities

Rising residential, commercial, and industrial construction projects are significantly boosting demand for paints and coatings in the UK. Expanding urbanization, renovation activities, and government-supported infrastructure development are increasing the volume of protective and decorative coatings required. This growth supports both waterborne and solventborne segments, as well as epoxy and polyurethane technologies for structural and industrial applications. Consistent investment in construction, coupled with modernization of buildings, ensures a steady rise in market consumption across various end-user industries.

- For instance, Sherwin-Williams offers epoxy and polyurethane flooring and structural coatings specifically engineered for industrial and commercial buildings. These coatings provide durable protection against chemical spills, abrasion, and mechanical wear, widely used in diverse environments demanding long-lasting surfaces.

Technological Advancements in Coatings

Innovations in coating technologies, including UV curable, powder, and hybrid formulations, are propelling the market forward. These advancements enhance durability, chemical resistance, and application efficiency, addressing industry-specific needs such as automotive, industrial manufacturing, and specialty construction. Companies investing in high-performance, customized solutions are gaining a competitive edge, attracting new end-users and fostering market growth. Improved application methods and faster drying technologies also reduce costs and environmental impact, further driving adoption across multiple sectors.

Key Trends & Opportunities

Rising Preference for Smart and Functional Coatings

The adoption of smart coatings with properties such as anti-corrosion, anti-microbial, self-cleaning, and thermal insulation is emerging as a key trend. These functional coatings offer added value across industrial, automotive, and residential applications, creating opportunities for differentiation. Demand for coatings that improve building performance and reduce maintenance costs is increasing. Companies are leveraging this trend by introducing innovative products that meet evolving consumer expectations, enabling higher margins and expanding market reach across both traditional and niche segments.

- For instance, PPG Industries offers advanced anti-corrosion coatings using nanotechnology that provide long-lasting rust protection for automotive and aerospace sectors, reducing maintenance costs.

Expansion of Automotive and Industrial Applications

The automotive and industrial sectors are witnessing significant growth in coatings consumption, presenting lucrative opportunities. Protective and decorative coatings are increasingly used in vehicles, machinery, and heavy equipment to enhance performance and durability. Growth in automotive production, electric vehicle adoption, and industrial manufacturing investments are driving demand for epoxy, polyurethane, and powder coatings. Companies offering specialized, high-performance solutions can capitalize on this expanding segment, particularly in aftermarket applications and OEM collaborations, boosting revenue potential in the UK market.

- For instance, Rustbuster’s Custom 421 Epoxy Primer is extensively used in automotive bodywork for steel and aluminum, providing a non-porous layer that prevents corrosion even in damp storage conditions.

Key Challenges

Volatile Raw Material Prices

Fluctuating costs of raw materials, including resins, solvents, and pigments, pose a significant challenge to the UK paints and coatings market. Price volatility affects production costs, profit margins, and overall pricing strategies. Manufacturers face the dual pressure of maintaining competitive pricing while complying with environmental regulations and quality standards. Sudden increases in raw material costs can disrupt supply chains and delay project timelines, creating uncertainty for both producers and end-users, which may slow market growth if not strategically managed.

Strict Regulatory Compliance

Stringent environmental and safety regulations related to VOC emissions, chemical usage, and waste management are challenging manufacturers. Compliance requires significant investment in R&D, reformulation, and certification processes, which can be resource-intensive for smaller companies. Non-compliance can result in fines, product recalls, or market restrictions. While these regulations promote sustainability, they also increase operational complexity and costs, potentially slowing the adoption of certain traditional coatings and impacting overall market dynamics in the UK.

Regional Analysis

England

England dominates the UK paints and coatings market, accounting for a 72% share due to its robust construction, automotive, and industrial sectors. Rising residential and commercial construction projects, coupled with urban redevelopment initiatives, drive demand for decorative and protective coatings. Strong industrial manufacturing activities, particularly in machinery, automotive, and infrastructure, further boost epoxy, polyurethane, and powder coating consumption. Regulatory support for eco-friendly formulations has accelerated the adoption of waterborne and UV curable coatings. Leading manufacturers maintain a strong presence in England, leveraging technological advancements and strategic partnerships to capture growth opportunities across multiple end-use industries.

Scotland

Scotland contributes a 12% share to the UK paints and coatings market, supported by expanding residential construction and infrastructure development projects. The demand for decorative coatings in commercial buildings and residential renovations is rising steadily. Industrial applications, including machinery and chemical equipment coatings, stimulate the use of epoxy and polyurethane technologies. Additionally, sustainability initiatives promote waterborne coatings adoption. Emerging opportunities in smart coatings, UV curable coatings, and powder coatings are gaining traction. Manufacturers are investing in regional distribution networks and service facilities to meet localized demand, strengthening their foothold in Scotland’s growing paints and coatings sector.

Wales

Wales holds a 9% share of the UK paints and coatings market, driven by infrastructure projects, residential construction, and industrial applications. Urban renewal and commercial building development fuel demand for decorative and protective coatings, while industrial manufacturing supports epoxy, polyurethane, and powder coatings adoption. The government’s focus on energy-efficient buildings and low-VOC formulations encourages waterborne and eco-friendly coatings usage. Regional manufacturers are targeting niche markets with specialized coatings, including corrosion-resistant and UV-curable products. Collaborative initiatives between suppliers and contractors ensure efficient delivery and application, consolidating the market presence and fostering growth opportunities across Wales.

Northern Ireland

Northern Ireland accounts for a 7% share of the UK paints and coatings market, supported by moderate growth in residential and commercial construction projects. Industrial applications, including manufacturing machinery and automotive components, stimulate demand for epoxy and polyurethane coatings. Waterborne and powder coatings are increasingly adopted due to environmental regulations and sustainability initiatives. Market players are focusing on expanding regional distribution, offering tailored solutions, and promoting smart and functional coatings to capture emerging opportunities. Strategic collaborations with contractors and construction firms enhance market reach, ensuring consistent supply and driving growth in Northern Ireland’s paints and coatings industry.

Market Segmentations:

By Type

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End-User Industry

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Competitive landscape in the UK paints and coatings market features key players such as Akzo Nobel, ICI Paints, HMG Paints, Crown Paints, Jotun UK, Sherwin-Williams UK, Axalta UK, PPG Industries UK, and Tikkurila UK. These companies dominate through extensive product portfolios, innovative technologies, and strategic expansions. Market competition is driven by the introduction of eco-friendly waterborne coatings, high-performance epoxy and polyurethane coatings, and UV curable and powder solutions catering to diverse end-user industries. Companies focus on mergers, acquisitions, and partnerships to strengthen regional presence and distribution networks. Continuous investment in R&D enables product differentiation, addressing growing demand for sustainable and smart coatings. Additionally, strong branding, after-sales services, and technological innovations allow these players to maintain market leadership while attracting new customers and expanding into emerging niche segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Akzo Nobel

- ICI Paints

- HMG Paints

- Crown Paints

- Crown Oil

- Jotun UK

- Sherwin-Williams UK

- Axalta UK

- PPG Industries UK

- Tikkurila UK

Recent Developments

- In September 2025, Sherwin-Williams UK launched Acrolon 680, a single-coat topcoat designed to strengthen its industrial coatings portfolio.

- In June 2025, Akzo Nobel completed the sale of its Indian decorative paint unit to JSW Paints, focusing on expanding its performance coatings segment.

- In September 2025, Jotun UK introduced Hardtop XP II, a high-performance coating aimed at industrial applications, broadening its offerings in the UK market.

- In April 2024, the British Coatings Federation (BCF) launched the inaugural Equity, Diversity, and Inclusion (ED&I) Charter to promote a more inclusive and equitable environment across the UK coatings industry.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand in residential and commercial construction.

- Waterborne and low-VOC coatings will see increased adoption driven by sustainability initiatives.

- Technological advancements in UV curable, powder, and hybrid coatings will expand application areas.

- Automotive and industrial manufacturing sectors will drive demand for high-performance coatings.

- Smart and functional coatings with anti-corrosion, self-cleaning, and thermal insulation properties will gain traction.

- Expansion of distribution networks and regional manufacturing facilities will improve market accessibility.

- Mergers, acquisitions, and strategic partnerships will strengthen competitive positioning.

- Regulatory compliance and environmental standards will continue to influence product development.

- Customization and product differentiation will become key strategies for market players.

- Emerging opportunities in niche applications and specialized coatings will support long-term growth.