Market Overview

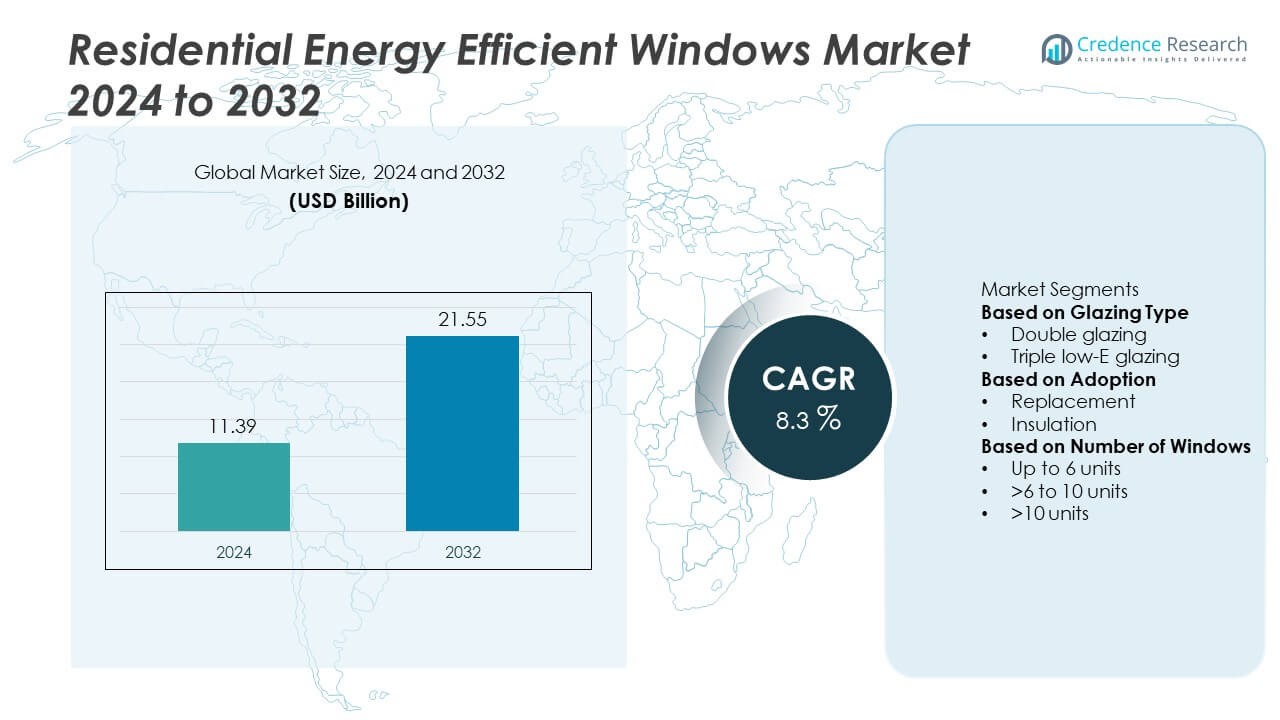

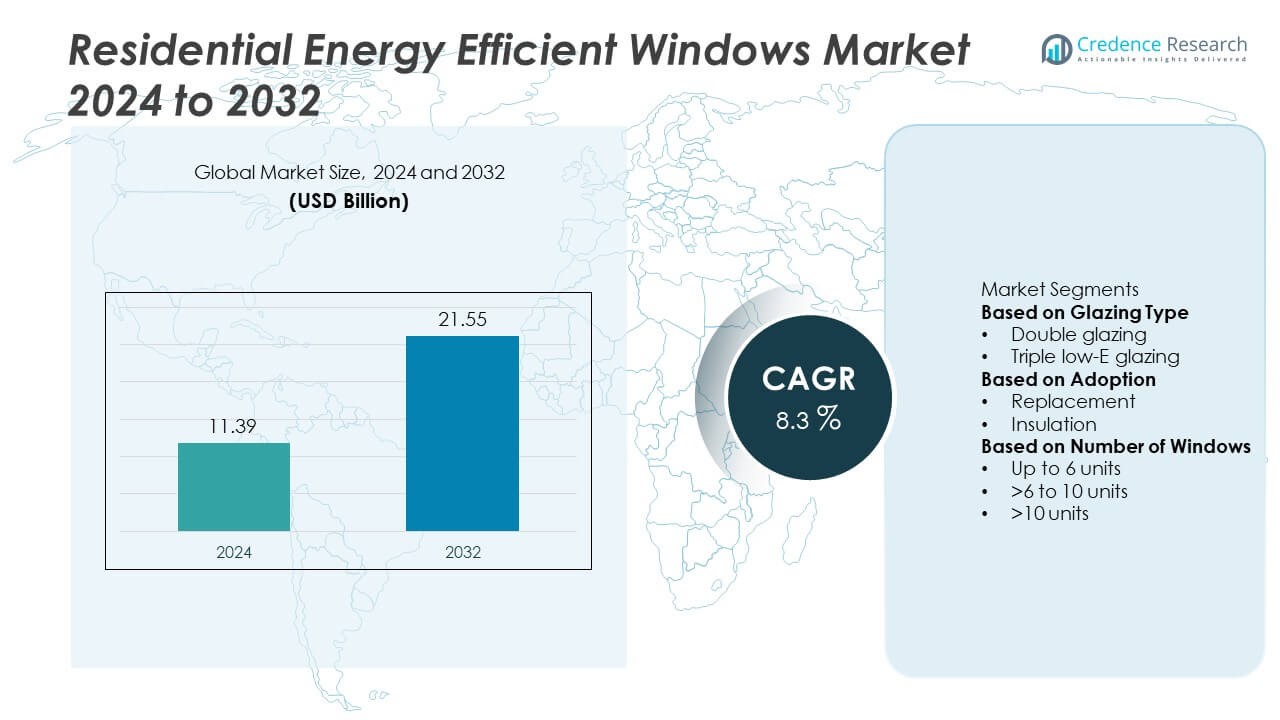

The Residential Energy Efficient Windows Market was valued at USD 11.39 billion in 2024 and is projected to reach USD 21.55 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Energy Efficient Windows Market Size 2024 |

USD 11.39 Billion |

| Residential Energy Efficient Windows Market, CAGR |

8.3% |

| Residential Energy Efficient Windows Market Size 2032 |

USD 21.55 Billion |

The residential energy efficient windows market is led by major players such as Andersen Corporation, Marvin Windows & Doors, Jeld-Wen, Milgard Manufacturing, AeroShield, Atrium Corporation, Builders First Choice, Fenesta, French Steel Company, and Champion Window. These companies drive growth through advancements in Low-E coatings, insulated glazing, and sustainable frame materials that improve thermal performance and aesthetics. North America dominated the market in 2024 with a 35% share, supported by government incentives and high adoption of ENERGY STAR-certified products. Europe followed with a 32% share, driven by stringent building efficiency regulations, while Asia-Pacific accounted for 25%, supported by rising residential construction and green building initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential energy efficient windows market was valued at USD 11.39 billion in 2024 and is projected to reach USD 21.55 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

- Growing emphasis on sustainable construction, energy conservation, and government incentives for green housing drives market adoption globally.

- Advancements in Low-E coatings, double and triple glazing, and smart glass technologies are shaping key trends in residential applications.

- Leading players such as Andersen Corporation, Jeld-Wen, Marvin Windows & Doors, and Milgard Manufacturing focus on R&D, sustainable materials, and regional expansion to strengthen competitiveness.

- North America led with a 35% share in 2024, followed by Europe (32%) and Asia-Pacific (25%), while by glazing type, double glazing dominated with a 57% share, supported by rising energy-efficient renovation projects across developed regions.

Market Segmentation Analysis:

By Glazing Type

The double glazing segment dominated the residential energy efficient windows market in 2024, accounting for a 57% share. Its popularity stems from strong insulation performance, cost efficiency, and suitability for various climate zones. Double-glazed windows significantly reduce heat transfer, improving energy savings and indoor comfort. Increasing renovation of existing homes and widespread adoption of double-glazed units in Europe and North America drive segment growth. Manufacturers continue to enhance Low-E coatings and inert gas fillings, further improving energy efficiency and sound insulation in residential buildings.

- For instance, JELD-WEN offers its JWC8500 Series windows with dual-pane and triple-pane options that feature advanced Low-E coatings and argon gas, enhancing energy efficiency and increasing sound resistance.

By Adoption

The replacement segment held the largest share of 64% in 2024, supported by the surge in energy retrofitting projects and aging building stock. Homeowners are increasingly replacing traditional single-pane windows with energy-efficient alternatives to cut utility costs and meet sustainability standards. Government-led renovation programs, tax incentives, and building energy codes encourage replacements across developed markets. The shift toward upgrading existing structures over new construction reinforces demand for advanced insulating window technologies, particularly in urban housing and climate-conscious residential developments.

- For instance, Renewal by Andersen, a division of Andersen Corporation, uses its proprietary Fibrex® composite material, made from up to 40% reclaimed wood fiber by weight.

By Number of Windows

The >6 to 10 units segment accounted for a 46% share in 2024, driven by its prevalence in multi-room homes and small apartment complexes. Energy-efficient window installations in these structures provide measurable savings in heating and cooling loads. Builders and homeowners prefer this configuration due to balanced installation costs and energy returns. Rising adoption of sustainable architecture and expansion of mid-size residential projects globally contribute to growth. Enhanced design flexibility and the availability of modular window solutions further strengthen this segment’s dominance in the market.

Key Growth Drivers

Rising Focus on Energy Conservation and Sustainable Housing

Growing awareness of energy efficiency and carbon reduction is driving demand for energy-efficient windows in residential construction. Homeowners are adopting insulated and Low-E coated glass to reduce heat loss and minimize utility bills. Governments in North America and Europe are enforcing strict building energy codes that encourage the use of high-performance windows. Increasing adoption of green building certifications, such as LEED and BREEAM, further boosts the installation of advanced glazing systems in modern and renovated residential structures.

- For instance, Pella Corporation launched its Architect Series® Reserve windows that meet ENERGY STAR Version 7.0 standards, achieving U-factors as low as 0.18, aligning with U.S. Department of Energy goals.

Supportive Government Policies and Incentive Programs

Government incentives and regulatory frameworks are significantly boosting market expansion. Programs offering tax credits, subsidies, and rebates for energy-efficient home upgrades are encouraging consumers to replace traditional windows. Initiatives like the U.S. ENERGY STAR and the EU’s Energy Performance of Buildings Directive promote low-emission construction materials. These regulations are pushing manufacturers to innovate with high-insulation frames, triple glazing, and improved air sealing to meet stringent thermal performance requirements across residential projects.

- For instance, Guardian Glass expanded its SunGuard® eXtraSelective coating range, introducing products like SunGuard® SNX 70+. This triple-silver coated glass is engineered to balance high visible light transmission with low solar heat gain, aiding green-certified projects globally.

Increasing Renovation and Retrofitting Activities

The global rise in renovation and home improvement projects is a key driver for market growth. Older residential buildings are being upgraded with energy-efficient windows to enhance comfort and reduce energy waste. The trend is particularly strong in Europe and North America, where retrofitting incentives are widely available. Technological advancements in retrofit-friendly window systems and easier installation methods have made replacements more cost-effective. This demand is expected to surge as property owners focus on improving thermal efficiency and overall property value.

Key Trends & Opportunities

Growing Adoption of Smart and Dynamic Glazing Technologies

Smart glass technologies, including electrochromic and photochromic glazing, are gaining traction for their ability to adjust transparency and optimize indoor temperatures. These dynamic windows enhance occupant comfort while reducing HVAC loads, aligning with modern smart home systems. Manufacturers are integrating IoT-enabled controls and sensors to improve real-time performance management. As residential consumers prioritize convenience and sustainability, the adoption of intelligent energy-efficient window solutions is becoming a key opportunity in high-end and eco-conscious housing developments.

- For instance, View Inc. has deployed smart glass in over 90 million square feet of buildings across North America. Its electrochromic glazing technology can reduce glare by up to 99% and significantly lower cooling energy consumption.

Rising Demand for Low-E and Multi-Glazed Systems

The increasing preference for Low-E coated and triple-glazed windows is reshaping the residential market landscape. These products offer superior insulation, UV protection, and reduced noise transmission, making them ideal for both urban and cold-climate environments. Continuous innovation in glass coatings and frame materials enhances performance without compromising aesthetics. Builders and homeowners are recognizing the long-term cost savings and sustainability benefits, driving strong adoption in both new construction and renovation projects globally.

- For instance, Pilkington Optitherm™ S1 Plus features low-emissivity coatings that achieve a high visible light transmittance while supporting energy retention and optimizing natural lighting in modern homes.

Key Challenges

High Installation and Material Costs

Energy-efficient windows involve higher upfront costs compared to standard models due to advanced materials, coatings, and multi-pane construction. The additional expense of professional installation further limits adoption among price-sensitive consumers. Although long-term energy savings offset these costs, the initial investment remains a key barrier in developing markets. Manufacturers are focusing on cost optimization and localized production to make energy-efficient solutions more affordable and accessible for residential consumers.

Limited Awareness and Availability in Emerging Markets

Many developing regions lack awareness about the benefits of energy-efficient window systems. The absence of strict building codes and limited access to advanced glazing technologies hinder widespread adoption. Additionally, inconsistent product availability and a shortage of skilled installers constrain market penetration. Expanding consumer education, establishing energy labeling standards, and building regional manufacturing capabilities are essential steps toward overcoming these challenges and unlocking growth potential in emerging economies.

Regional Analysis

North America

North America held the largest share of 35% in 2024, driven by strong demand for energy-efficient housing and government-backed sustainability programs. The U.S. dominates the regional market with initiatives such as ENERGY STAR certification and tax credits for green home upgrades. Canada’s adoption is also increasing due to colder climates and high heating costs. Technological advancements in low-emissivity coatings and vinyl-framed windows enhance thermal insulation. The ongoing renovation of aging residential structures and consumer preference for sustainable materials continue to fuel regional market expansion.

Europe

Europe accounted for a 32% share in 2024, supported by stringent energy efficiency regulations and the widespread implementation of the European Green Deal. Countries such as Germany, France, and the United Kingdom are leading adopters due to well-established retrofitting programs and building performance standards. High awareness of carbon footprint reduction and rising energy prices drive consumer preference for advanced glazing systems. The growing adoption of triple-glazed and smart windows across residential buildings supports Europe’s transition toward low-energy housing solutions.

Asia-Pacific

Asia-Pacific captured 25% share in 2024, fueled by rapid urbanization, rising income levels, and expanding construction of energy-efficient residential buildings. China leads the region with policies promoting low-carbon architecture and green housing standards. Japan and South Korea are early adopters of insulated glazing and smart window technologies in modern homes. India’s market is growing as developers adopt sustainable construction practices in urban housing projects. Increasing investment in infrastructure and government focus on energy-efficient construction continue to drive steady market growth across the region.

Latin America

Latin America accounted for a 5% share in 2024, driven by growing awareness of sustainable building materials and rising middle-class income. Brazil and Mexico are leading markets supported by energy conservation initiatives and building code improvements. Adoption remains higher in urban centers where new housing projects emphasize thermal efficiency. However, limited awareness in rural areas and higher upfront costs slow large-scale adoption. Expanding urban infrastructure projects and regional manufacturing capabilities are expected to enhance future growth opportunities for energy-efficient windows.

Middle East & Africa

The Middle East & Africa represented a 3% share in 2024, supported by ongoing urban development and increasing focus on sustainable housing. Gulf nations such as the UAE and Saudi Arabia promote energy-efficient construction under national sustainability programs like Vision 2030. Hot climates in these countries drive strong demand for solar control and insulated glazing. In Africa, South Africa and Egypt are emerging markets with rising green construction trends. Growing investments in smart cities and building retrofits are expected to improve adoption across the region.

Market Segmentations:

By Glazing Type

- Double glazing

- Triple low-E glazing

By Adoption

By Number of Windows

- Up to 6 units

- >6 to 10 units

- >10 units

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential energy efficient windows market features key players such as Marvin Windows & Doors, Andersen Corporation, Jeld-Wen, Milgard Manufacturing, AeroShield, Atrium Corporation, Builders First Choice, Fenesta, French Steel Company, and Champion Window. These companies are focusing on developing advanced glazing technologies, including Low-E coatings, triple-pane insulation, and smart glass systems to enhance thermal efficiency and aesthetics. Strategic initiatives include expanding regional manufacturing capacities, forming partnerships with green building developers, and launching eco-certified product lines. Innovation in sustainable materials and digital design tools allows customization for energy-efficient retrofits and new residential constructions. Continuous investment in R&D for lightweight, high-durability frames and solar control coatings helps improve performance and regulatory compliance. The market remains moderately competitive, with companies differentiating through product innovation, sustainability credentials, and strong distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marvin Windows & Doors

- Fenesta

- Andersen Corporation

- AeroShield

- Builders First Choice

- French Steel Company

- Jeld-Wen

- Milgard Manufacturing

- Atrium Corporation

- Champion Window

Recent Developments

- In August 2025, JELD‑WEN Holding, Inc. of Canada received the 2025 ENERGY STAR® Canada Special Recognition Award for expanding its portfolio of ENERGY STAR certified windows and glazing technologies.

- In March 2025, Andersen Corporation celebrated production of its 10 millionth 100 Series window, which uses proprietary Fibrex® composite material containing 40 percent reclaimed wood fiber by weight.

- In 2024, BigHorn Roofing introduced window installation services to enhance home energy efficiency. Through the installation of new windows, the company aims to help homeowners improve insulation and reduce heating costs during the winter months.

- In January 2023, YES WORLD Climate Tech Pte Ltd announced the launch of energy-efficient Windows Solution for home and commercial buildings.

Report Coverage

The research report offers an in-depth analysis based on Glazing Type, Adoption, Number of Windows and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient windows will rise as governments tighten building energy codes.

- Homeowners will increasingly replace traditional windows with insulated and Low-E coated models.

- Smart glass and dynamic glazing technologies will gain wider adoption in modern homes.

- Manufacturers will focus on recyclable materials and eco-friendly production processes.

- Integration of IoT-enabled window systems will enhance home energy management.

- Expansion of retrofitting programs will drive demand in developed markets.

- Asia-Pacific will emerge as the fastest-growing region due to rapid urbanization.

- Cost optimization and localized production will improve product accessibility for consumers.

- Partnerships between window manufacturers and green building developers will increase.

- Continuous innovation in glazing and frame materials will enhance efficiency and design flexibility.