Market Overview

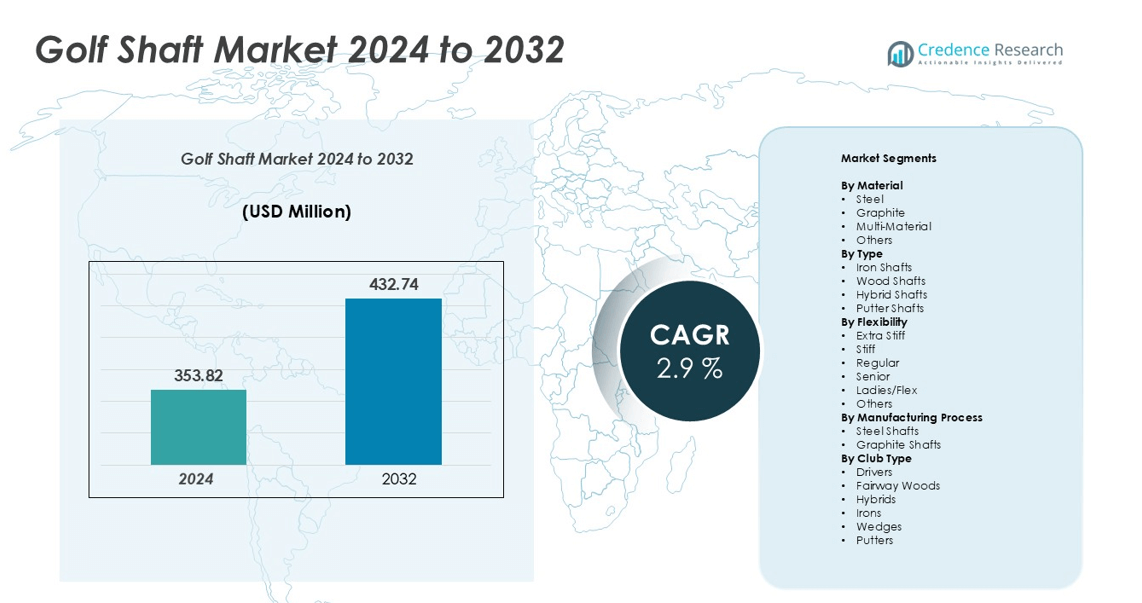

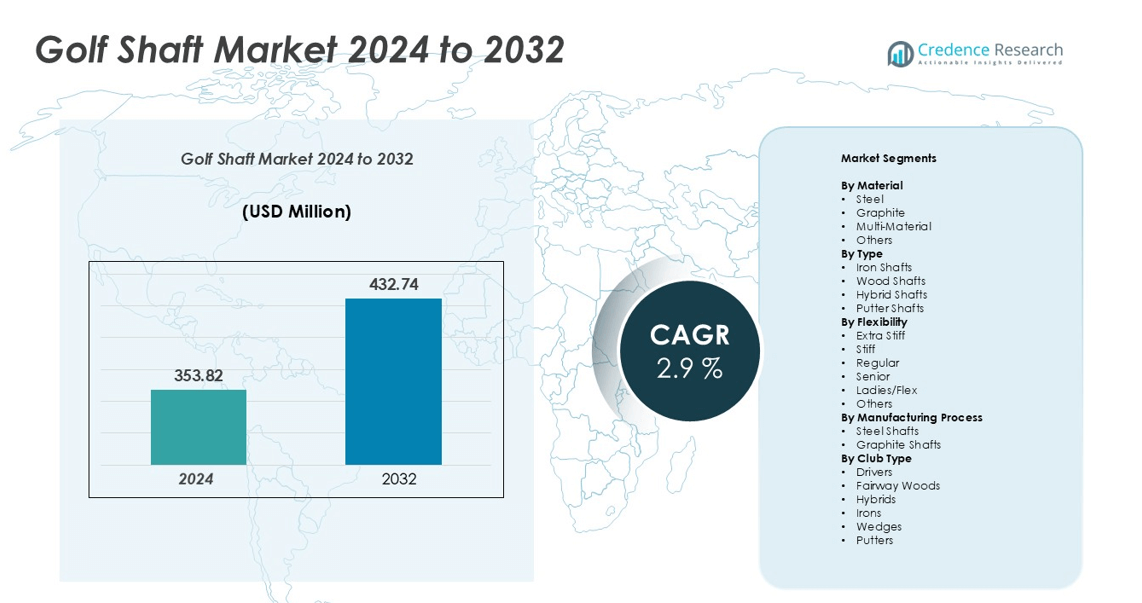

The golf shaft market size was valued at USD 353.82 million in 2024 and is anticipated to reach USD 432.74 million by 2032, at a CAGR of 2.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Shaft Market Size 2024 |

USD 353.82 million |

| Golf Shaft Market, CAGR |

2.9% |

| Golf Shaft Market Size 2032 |

USD 432.74 million |

The golf shaft market is led by prominent players such as True Temper Sports, Mitsubishi Chemical, Fujikura, Aldila, Graphite Design, Project X, KBS Golf Shafts, Accra Golf Shafts, and Grafalloy, who collectively drive innovation and set industry benchmarks. North America dominates the regional landscape, holding approximately 35% of the global market share, driven by strong golf culture, high disposable income, and widespread adoption of premium and customized shafts. Europe follows with around 28% market share, supported by established golfing traditions, technological advancements, and increasing focus on performance-oriented equipment. These top players leverage R&D, strategic partnerships, and endorsements from professional golfers to maintain competitive advantage. Their focus on material innovations, lightweight shafts, and personalized offerings aligns with regional demand patterns, reinforcing their leadership positions and sustaining growth in key global markets.

Market Insights

- The global golf shaft market was valued at USD 353.82 million in 2024 and is projected to reach USD 432.74 million by 2032, growing at a CAGR of 2.9% during the forecast period.

- Growth is driven by rising golf participation, increasing demand for customized and performance-oriented shafts, and technological advancements in steel, graphite, and hybrid materials.

- Key trends include the adoption of lightweight graphite shafts, eco-friendly manufacturing, and integration of smart technology for swing analytics, enhancing player performance and engagement.

- The market is highly competitive with leading players such as True Temper Sports, Mitsubishi Chemical, Fujikura, Aldila, Graphite Design, Project X, KBS Golf Shafts, Accra Golf Shafts, and Grafalloy leveraging R&D, professional endorsements, and product differentiation to maintain market leadership.

- Regionally, North America holds the largest share at approximately 35%, followed by Europe at 28%, Asia-Pacific at 22%, and the Rest of the World at 15%, with steel shafts and irons dominating segment-wise sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Flexibility

The golf shaft market by flexibility is categorized into Extra Stiff, Stiff, Regular, Senior, Ladies/Flex, and Others. Among these, the Regular shaft segment dominates, accounting for the largest market share due to its versatility and suitability for a wide range of golfers, from amateurs to professionals. Drivers for this segment include increasing participation in recreational golf and the growing preference for customized playing experiences that match swing speed and control. Manufacturers are innovating with advanced materials and precision engineering to enhance performance, further driving demand for regular-flex shafts globally.

- For instance, the Dynamic Gold 95 VSS Pro is a lightweight, high-launch shaft designed for players with a moderate swing tempo and is particularly suitable for more accomplished players who seek shot feedback.

By Manufacturing Process

The market segmentation by manufacturing process includes Steel Shafts and Graphite Shafts. Steel shafts hold the dominant position, capturing a significant market share, primarily due to their durability, consistent performance, and cost-effectiveness. They are preferred for irons and wedges where accuracy and control are critical. Drivers of this segment include advancements in steel alloy formulations that improve strength-to-weight ratio and resistance to torque, alongside the continued adoption of premium clubs by professional and amateur golfers seeking reliable performance. Graphite shafts are gaining traction in lightweight and driver applications.

- For instance, True Temper’s Dynamic Gold series is a tour-weighted shaft designed for players seeking a penetrating ball flight with optimum control and accuracy.

By Club Type

The club type segment is divided into Drivers, Fairway Woods, Hybrids, Irons, Wedges, and Putters. Irons lead the market in terms of share, owing to their extensive use across all levels of play and critical role in approach shots. Drivers and hybrids are also seeing strong growth driven by technological innovations such as adjustable weights and optimized shaft flex for enhanced distance. Key drivers for this segment include rising golf participation, increasing focus on equipment performance, and customization trends that allow golfers to select shafts specifically designed to improve swing accuracy and overall playability.

Key Growth Drivers

Rising Golf Participation and Amateur Engagement

The growth of the golf shaft market is strongly fueled by the increasing participation of amateur and recreational golfers worldwide. As golf gains popularity across emerging economies and urban areas, demand for high-quality equipment, including performance-optimized shafts, rises. Manufacturers are responding with products that cater to diverse skill levels, swing speeds, and club preferences. Amateur golfers increasingly seek shafts that enhance control, accuracy, and consistency, driving both sales of standard and customized shafts. Additionally, golf academies, clubs, and social programs promoting the sport contribute to sustained demand. This trend is further supported by growing accessibility to golf courses, affordable entry-level equipment, and initiatives encouraging youth engagement, which collectively expand the market base and underpin consistent revenue growth for shaft manufacturers.

- For instance, the Dynamic Gold 95 VSS Pro is designed as the company’s lightest constant weight steel shaft and also its most flexible steel shaft.

Technological Advancements in Shaft Design

Innovations in materials, engineering, and manufacturing processes are key growth drivers in the golf shaft market. Modern shafts leverage advanced steel alloys, high-modulus graphite, and hybrid composites to improve strength, reduce weight, and optimize flexibility. Adjustable weighting, torque control, and precision engineering allow shafts to be customized for swing speed and player preference, enhancing performance across all skill levels. These technological improvements also enable manufacturers to produce lighter, more durable, and vibration-reducing shafts, attracting professional and amateur golfers alike. Continuous R&D and collaborations between OEMs and material science companies are expanding the scope for performance-oriented designs, positioning technologically advanced shafts as a major factor driving market growth globally.

- For instance, True Temper’s Dynamic Gold 95 VSS Pro shafts feature a proprietary technology called Vibration Suppression System (VSS) Pro. This system dampens a significant amount of the harsh vibrations at impact, resulting in a softer and smoother feel for the player. It achieves this without compromising the fundamental stability, consistenc, and durability of the steel shaft’s design.

Increasing Demand for Customization and Personalization

Consumer demand for customized and personalized golf equipment significantly propels the golf shaft market. Golfers increasingly prefer shafts tailored to their swing dynamics, grip style, and aesthetic preferences, prompting manufacturers to offer adjustable flex, weight distribution, and shaft length options. Custom engraving, color choices, and premium finishes further enhance the appeal of personalized shafts. This trend is amplified among professional golfers and avid amateurs seeking competitive advantages, as well as enthusiasts who view golf as a lifestyle sport. The availability of online customization platforms and direct-to-consumer services strengthens accessibility, driving higher adoption rates and encouraging repeat purchases. Overall, personalization and bespoke offerings act as a crucial growth lever in the evolving golf shaft market.

Key Trends & Opportunities

Expansion in Lightweight and Graphite Shafts

A notable trend in the golf shaft market is the growing preference for lightweight graphite and composite shafts. These shafts offer improved swing speed, reduced fatigue, and enhanced shot control, particularly appealing to senior and amateur golfers. Manufacturers are investing in high-modulus graphite materials and hybrid composites that combine strength with flexibility, enabling better energy transfer and optimized performance. The trend also opens opportunities for targeting new demographic segments, including women and youth golfers, who benefit from lighter and easier-to-handle shafts. Partnerships with professional players for product endorsements further promote adoption, presenting a significant opportunity for revenue growth in the lightweight shaft segment.

- For instance, in the 2025 PGA Tour season, the Fujikura Ventus shaft family was in the drivers of the winners of all four men’s Major Championships, an unprecedented accomplishment for a shaft brand. The victories were achieved by multiple players using different Ventus models.

Focus on Sustainability and Eco-Friendly Manufacturing

Environmental sustainability is emerging as a critical opportunity in the golf shaft market. Manufacturers are increasingly adopting eco-friendly production processes, recyclable materials, and energy-efficient manufacturing techniques to appeal to environmentally conscious consumers. Lightweight composite materials with lower carbon footprints, as well as the use of responsibly sourced steel and graphite, are becoming key differentiators. Golf brands are also promoting sustainability as part of their marketing strategy, aligning with global ESG trends. This shift not only supports environmental goals but also enhances brand value, enabling companies to capture a growing niche of eco-conscious golfers and strengthen market positioning in a competitive landscape.

- For instance, Mitsubishi Chemical’s Metal Mesh Technology (MMT), used in golf shafts, integrates braided strands of 304 stainless steel into the prepreg layers to enhance stability and density, which allows for thinner composite walls.

Integration of Smart Technology and Performance Tracking

The adoption of smart technologies in golf equipment presents a compelling trend and opportunity. Manufacturers are exploring shafts embedded with sensors that provide swing analytics, torque measurements, and performance feedback. This technology enables golfers to make data-driven adjustments to optimize their game, creating an intersection of sport and digital innovation. Smart shafts offer potential for subscription-based analytics services and integration with mobile applications, expanding revenue streams. Early adoption by professional players and tech-savvy consumers can drive awareness and create a halo effect across broader market segments, representing a high-growth opportunity for technologically advanced golf shafts.

Key Challenges

High Production Costs of Advanced Shafts

The production of technologically advanced golf shafts, especially graphite and hybrid composites, is associated with high material and manufacturing costs. Specialized alloys, precision engineering, and quality control processes increase unit costs, making premium shafts less accessible to price-sensitive consumers. This cost factor can limit market penetration in emerging economies or among casual golfers. Additionally, investments in R&D and advanced manufacturing equipment impose financial burdens on smaller manufacturers, creating barriers to entry. Managing these costs while maintaining quality and performance standards remains a critical challenge for companies seeking to scale production and meet growing demand across diverse markets.

Market Fragmentation and Intense Competition

The golf shaft market is highly fragmented, with numerous established brands, OEMs, and regional players competing for market share. Intense competition leads to price pressures, limited differentiation, and the need for continuous innovation. Smaller players may struggle to compete against established brands with strong marketing, R&D capabilities, and endorsement deals. Moreover, rapid technological evolution and shifting consumer preferences demand frequent product updates, increasing operational complexity. Navigating this competitive landscape while maintaining profitability, brand loyalty, and market relevance presents a significant challenge for industry participants.

Regional Analysis

North America

North America holds a leading position in the golf shaft market, accounting for approximately 35% of the global share. Strong golf culture, widespread course availability, and high disposable incomes drive demand for premium and customized shafts. The U.S. dominates regional sales due to a robust recreational and professional golf ecosystem, coupled with advanced manufacturing facilities. Growth is further supported by innovations in graphite and hybrid shafts, catering to both amateur and professional golfers. Partnerships between manufacturers and golf clubs, along with rising interest among youth and women golfers, continue to reinforce North America’s dominant market presence.

Europe

Europe represents around 28% of the global golf shaft market, driven by established golfing traditions in the U.K., Germany, and France. The region emphasizes high-quality equipment and precision-engineered shafts, particularly steel and graphite variants for irons and drivers. Technological advancements and product customization are gaining traction, appealing to professional players and affluent amateur golfers. Growth is also supported by tournaments, golfing associations, and increased participation among younger demographics. Sustainability initiatives in manufacturing and marketing strategies further enhance market opportunities, solidifying Europe as a key region for premium and innovative golf shaft offerings.

Asia-Pacific

Asia-Pacific accounts for approximately 22% of the global golf shaft market, with Japan, China, and South Korea as major contributors. Rapid urbanization, rising middle-class incomes, and increasing awareness of golf as a lifestyle sport are driving demand. Manufacturers focus on lightweight graphite and hybrid shafts, targeting new golfers and youth segments. Expansion of golf courses, golf academies, and government-supported sports initiatives enhances regional growth. Additionally, the popularity of golf simulators and digital training tools boosts interest in high-performance shafts. Rising professional tournaments and endorsements by local athletes further strengthen the region’s growth potential.

Rest of the World (RoW)

The Rest of the World (RoW) contributes around 15% to the global golf shaft market, including Latin America, the Middle East, and Africa. Growing interest in recreational sports, tourism-linked golf resorts, and increasing exposure to international tournaments drive market expansion. Golf infrastructure development and rising disposable income in urban centers support adoption of performance-oriented shafts. However, market penetration is slower due to limited course availability and lower brand awareness compared to mature markets. Investment in marketing campaigns, local partnerships, and affordable yet high-quality shafts presents opportunities to capture this emerging segment and expand global market reach.

Market Segmentations:

By Material

- Steel

- Graphite

- Multi-Material

- Others

By Type

- Iron Shafts

- Wood Shafts

- Hybrid Shafts

- Putter Shafts

By Flexibility

- Extra Stiff

- Stiff

- Regular

- Senior

- Ladies/Flex

- Others

By Manufacturing Process

- Steel Shafts

- Graphite Shafts

By Club Type

- Drivers

- Fairway Woods

- Hybrids

- Irons

- Wedges

- Putters

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The golf shaft market is highly competitive, featuring a mix of established global players and regional manufacturers competing on performance, innovation, and brand reputation. Leading companies such as True Temper Sports, Mitsubishi Chemical, Fujikura, Aldila, Graphite Design, Project X, KBS Golf Shafts, Accra Golf Shafts, and Grafalloy dominate the market through continuous product innovation and strategic partnerships with professional golfers and golf clubs. These players focus on advanced materials, customized shaft designs, and lightweight technologies to enhance swing speed, control, and accuracy. Competitive strategies include product differentiation, R&D investments, and targeted marketing to attract amateur and professional golfers. Additionally, mergers, acquisitions, and collaborations enable companies to expand their geographic reach and technological capabilities. The market’s dynamic nature compels players to adapt quickly to evolving consumer preferences and emerging trends, maintaining a focus on performance-oriented and personalized shaft solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Accra Golf Shafts

- Aldila

- Fujikura

- Graphite Design

- KBS Golf Shafts

- Mitsubishi Chemical

- Project X

- True Temper Sports

- Grafalloy

Recent Developments

- In May 2024, Epic Golf Club, a Scottsdale-based private golf society, offers two US$ 10,000 scholarships to high school seniors who excel in golf and academics. The scholarship is open to students who have demonstrated a commitment to golf as a student-athlete throughout their four years of high school or equivalent documented experience. Applicants must have graduated with a minimum GPA of 3.2 to be considered eligible.

- In March 2023, the first 3D-printed golf club shaft has been released by Snarr3D

Report Coverage

The research report offers an in-depth analysis based on Material, Type, Flexibility, Manufacturing Process, Club Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for customized and performance-oriented shafts is expected to grow steadily.

- Technological innovations in lightweight graphite and hybrid shafts will drive adoption.

- Expansion of golf participation in emerging markets will create new growth opportunities.

- Integration of smart technology and performance tracking will enhance player experience.

- Sustainability initiatives and eco-friendly manufacturing will influence product development.

- Steel shafts will continue to dominate irons, while graphite shafts will gain popularity in drivers and fairway woods.

- Professional endorsements and collaborations with golf academies will boost market visibility.

- Youth and women golfers will increasingly drive demand for specialized shafts.

- E-commerce and direct-to-consumer channels will expand market reach.

- Continuous R&D and material innovations will support long-term competitive advantage and market growth.