Market Overview

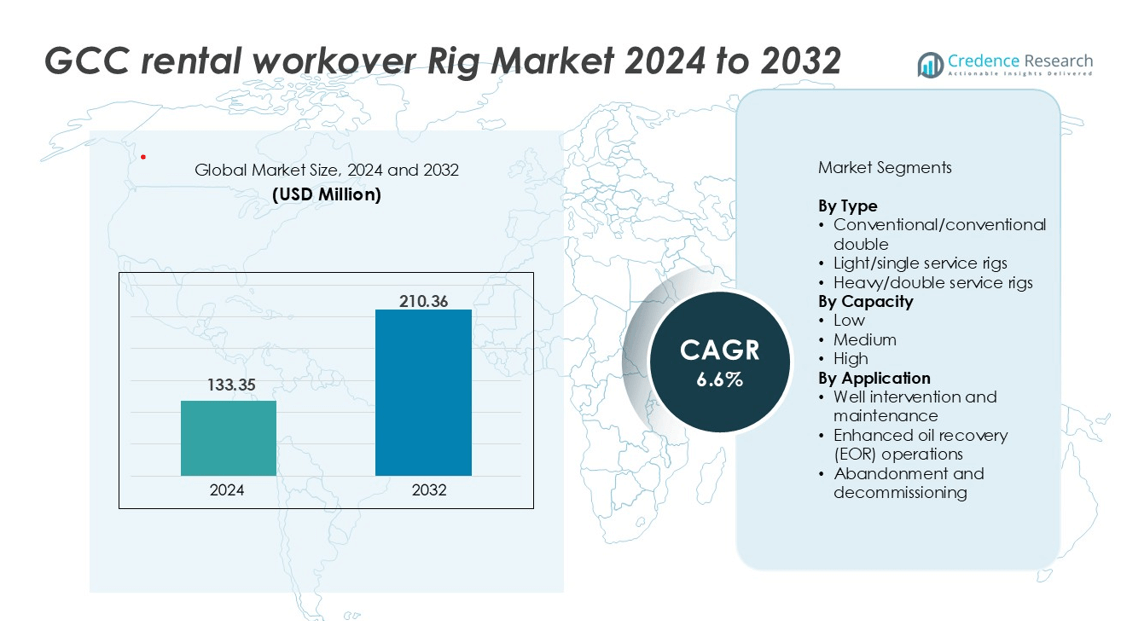

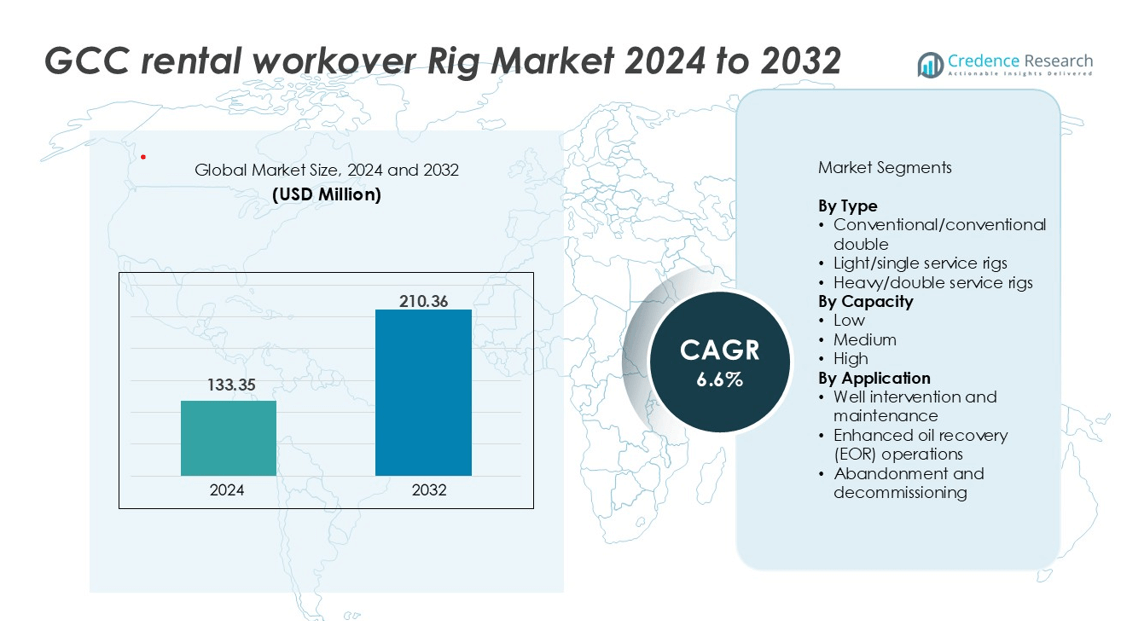

GCC rental workover rig Market size was valued USD 133.35 million in 2024 and is anticipated to reach USD 210.36 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Rental Workover Rig Market Size 2024 |

USD 133.35 million |

| GCC Rental Workover Rig Market CAGR |

6.6% |

| GCC Rental Workover Rig Market Size 2032 |

USD 210.36 million |

Saudi Arabia leads the market, accounting for 32.8% of the regional share in 2024, driven by major crude production and extensive upstream investments by Saudi Aramco. Key players in the market include Halliburton, Schlumberger, and Nabors Industries, which provide a range of services such as well intervention, maintenance, and Enhanced Oil Recovery (EOR) operations. The demand for rental workover rigs is particularly strong in well intervention and maintenance applications, which held 46.1% of the market share in 2024. This growth is supported by aging oilfields and the need for cost-effective maintenance solutions

Market Insights

- The GCC rental workover rig market was valued at USD 133.35 million in 2024 and is projected to reach USD 210.36 million by 2032, growing at a CAGR of 6%.

- Rising demand for well intervention and maintenance services in aging oilfields is driving market growth, with operators seeking cost-effective solutions to optimize production.

- Key trends include the adoption of advanced rig technologies, digital monitoring systems, and flexible rental models to improve operational efficiency and reduce downtime.

- Leading players such as Halliburton, Schlumberger, and Nabors Industries dominate the competitive landscape, focusing on service diversification, strategic partnerships, and regional expansion.

- Saudi Arabia holds the largest regional share at 32.8%, while well intervention and maintenance applications account for 46.1% of the segment share, highlighting the strong focus on sustaining mature oil and gas fields.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The GCC rental workover rig market is dominated by conventional/double service rigs, accounting for approximately 45–50% of the total market share. Their dominance stems from their versatility and ability to handle diverse well intervention and maintenance tasks across both onshore and offshore fields. These rigs are widely preferred for their reliability, cost efficiency, and compatibility with existing well infrastructure in mature oilfields across Saudi Arabia, the UAE, and Oman. Continuous demand for well optimization and reduced downtime in aging reservoirs sustains growth in this segment.

- For instance, Precision Drilling completed the acquisition of CWC Energy Services Corp. on November 8, 2023. The initial agreement was announced in September 2023

By Capacity

The medium-capacity rigs segment holds the leading position, representing about 50–55% of the GCC rental workover rig market. These rigs offer an optimal balance between performance and operating cost, making them ideal for medium-depth wells prevalent in the region. Their adaptability for routine maintenance, re-completion, and light drilling operations enhances their appeal among both national and independent operators. The segment’s market share is reinforced by operators’ increasing preference for cost-effective, flexible rental solutions that support production efficiency without heavy capital investment.

- For instance, the jack-up rig segment holds the largest share within the offshore market, mainly because of its relatively low cost and easy installation in shallow water.

By Application

Well intervention and maintenance dominate the GCC rental workover rig market, commanding nearly 60% of the total market share. This segment benefits from the high concentration of mature wells requiring periodic servicing to sustain output and extend well life. The increasing emphasis on asset integrity management, production optimization, and reduced non-productive time drives the steady utilization of rental rigs. Moreover, advancements in rig automation, remote monitoring, and predictive maintenance technologies are further enhancing efficiency and strengthening the dominance of this application segment across the GCC region

Key Growth Drivers

Expansion of Mature Oilfield Redevelopment Programs

The redevelopment of mature oilfields across the GCC is a major growth driver for the rental workover rig market. Countries such as Saudi Arabia, Kuwait, and Oman are prioritizing enhanced recovery from aging reservoirs to sustain production levels and offset natural declines. This focus has led to rising demand for workover rigs to perform well intervention, recompletion, and re-stimulation operations. Rental service providers are benefiting as operators increasingly opt for flexible leasing models to manage costs while maintaining high operational uptime. Continuous investment in brownfield redevelopment projects, supported by national oil companies’ strategic production targets, ensures steady utilization of medium- and heavy-capacity rigs. Additionally, technology integration, including real-time monitoring and advanced downhole tools, enhances the efficiency and precision of workover operations, further reinforcing demand in this segment.

- For instance, Halliburton installed an autonomous inflow control device (EquiFlow AICD) in a mature heavy-oil sandstone well in Oman, achieving an initial water cut of 15.9 % and reducing water production by over 65 % compared to offset wells.

Rising Demand for Cost-Efficient Operations and Flexible Contract Models

The ongoing emphasis on cost optimization across the oil and gas value chain has significantly fueled the demand for rental workover rigs in the GCC. Operators facing fluctuating oil prices and high capital expenditure constraints are increasingly adopting rental models to ensure operational flexibility and financial prudence. The rental approach enables companies to access advanced rigs and technologies without incurring large upfront investments. This trend is particularly strong among independent and mid-tier operators managing smaller fields. Moreover, the growing presence of specialized rental service providers offering turnkey solutions—including rig operations, maintenance, and crew management—has made renting rigs more attractive. Competitive rental pricing, coupled with scalable contracts tailored to project duration and complexity, continues to drive market growth.

- For instance, ADNOC Drilling did acquire 16 hybrid-powered rigs, but the acquisitions occurred during 2023. The company then initiated the operation of the first two rigs in early 2024.

Government Initiatives and Strategic Investments in Energy Infrastructure

Government-driven initiatives to enhance oil production capacity and expand energy infrastructure underpin strong growth in the GCC rental workover rig market. National oil companies, supported by favorable regulatory frameworks and sustained investment programs, are executing large-scale field development and well enhancement projects. Countries like the UAE and Saudi Arabia are also focusing on achieving production resilience through upstream diversification and technological modernization. The deployment of advanced workover rigs under long-term field maintenance programs aligns with national strategies for energy security. Additionally, public–private partnerships are creating new opportunities for service contractors to expand rig fleets and introduce digitalized maintenance solutions. These initiatives, combined with favorable oil market conditions and production expansion goals, continue to stimulate consistent rental demand across the region.

Key Trends and Opportunities

Digitalization and Automation in Workover Operations

Digital transformation is reshaping the GCC rental workover rig market through the adoption of automation, data analytics, and remote monitoring technologies. Operators are increasingly deploying smart rigs equipped with sensors and real-time data systems to improve operational safety and performance. Predictive maintenance tools help minimize equipment downtime and extend rig life, enhancing cost efficiency for rental providers. This shift toward automation also supports labor optimization amid tightening workforce availability. The integration of digital twins and IoT-enabled systems further improves decision-making during intervention and maintenance tasks. These advancements present substantial opportunities for rental companies to differentiate their service offerings and deliver value-added solutions aligned with clients’ digital transformation objectives.

- For instance, Precision Drilling Corporation implemented a digital twin system across its Super Single rig fleet, streaming 4 billion data points daily into a machine-learning model that achieved 91 % accuracy in predicting component life.

Growing Focus on Sustainable and Low-Emission Operations

The GCC’s commitment to sustainability and emissions reduction is creating new opportunities in the rental workover rig market. Oil companies are increasingly adopting environmentally efficient technologies and electrified rig systems to align with national decarbonization goals. Rental service providers investing in low-emission engines, hybrid power systems, and automated control mechanisms are gaining a competitive advantage. Additionally, regulatory emphasis on reducing carbon intensity in upstream operations encourages innovation in equipment design and energy management. The transition toward greener workover operations not only enhances operational efficiency but also positions service providers favorably for future contracts under stricter environmental standards.

- For instance, ADNOC Drilling Company ordered 16 new-build hybrid-powered land rigs, and commenced operations of two of those rigs using high-capacity battery and engine automation systems.

Key Challenges

Market Volatility and Oil Price Fluctuations

Frequent fluctuations in global oil prices continue to pose a significant challenge for the GCC rental workover rig market. Price instability affects operators’ capital spending and project timelines, leading to inconsistent demand for rental services. During periods of low oil prices, companies often defer well intervention and redevelopment activities, resulting in underutilization of rig fleets. Rental providers face financial pressure from irregular contract renewals and tighter pricing negotiations. To mitigate this challenge, market participants are focusing on diversifying their service portfolios and establishing long-term contracts with national oil companies. Nonetheless, sustained volatility remains a major risk to market stability and investment confidence.

Skilled Workforce Shortages and Operational Safety Risks

The shortage of highly skilled technical personnel in the GCC’s oilfield services sector remains a critical operational constraint. The complexity of modern workover operations requires trained crews capable of managing advanced digital systems and high-spec rigs. Limited availability of skilled labor can lead to operational inefficiencies, safety incidents, and extended project durations. Additionally, compliance with stringent health, safety, and environmental (HSE) standards demands continuous workforce training and certification, adding to operating costs. Rental service providers are addressing this challenge by investing in local talent development and deploying remote operation technologies. However, the persistent skill gap continues to hinder scalability and operational reliability in the regional market.

Regional Analysis

Saudi Arabia

Saudi Arabia dominates the GCC rental workover rig market, holding approximately 40–45% of the total market share. The Kingdom’s extensive portfolio of mature oilfields and its ongoing focus on maintaining high production capacity drive consistent demand for workover and well intervention services. National oil company Saudi Aramco’s large-scale field redevelopment projects, coupled with its investment in advanced rig technologies, strengthen the rental market. Continuous well maintenance, enhanced oil recovery (EOR) initiatives, and production optimization efforts ensure steady utilization of medium- and heavy-capacity rigs across both onshore and offshore operations.

United Arab Emirates (UAE)

The UAE accounts for roughly 20–22% of the GCC rental workover rig market. Abu Dhabi’s ADNOC-led upstream expansion and redevelopment of mature offshore fields sustain demand for rental rigs. Increasing emphasis on operational efficiency and cost optimization has prompted operators to prefer rental models over full ownership. The market benefits from the UAE’s strong technological adoption, including automation and digital monitoring of rig performance. Furthermore, EOR projects and asset rejuvenation activities in key fields such as Upper Zakum and Bab continue to drive steady rig rental utilization across the country.

Kuwait

Kuwait holds an estimated 15–17% share of the GCC rental workover rig market, supported by ongoing efforts to boost oil output from mature onshore reservoirs. Kuwait Oil Company’s (KOC) strategic focus on well intervention and maintenance, coupled with EOR pilot programs, fuels demand for rental rigs. Medium-capacity rigs are most sought after due to their operational flexibility in shallow to moderate-depth wells. The country’s push to enhance production capacity to meet long-term export commitments, while managing operational costs, underpins the continued growth of the rental segment.

Oman

Oman contributes around 10–12% of the GCC rental workover rig market, driven by active redevelopment of mature oilfields and strong EOR initiatives. Petroleum Development Oman (PDO) continues to prioritize well optimization programs requiring frequent workover and re-completion operations. The country’s challenging geological conditions and diverse well types encourage demand for rental rigs with specialized capabilities. Operators’ preference for short- to medium-term rental contracts enhances market flexibility. Additionally, Oman’s emphasis on digitalized operations and sustainable energy practices supports modern rig deployment and performance monitoring, strengthening the market outlook.

Qatar

Qatar represents approximately 6–8% of the GCC rental workover rig market. The country’s focus on maintaining output from onshore and offshore oilfields to support its broader energy portfolio underpins moderate but steady rig demand. Workover and maintenance operations related to field rejuvenation projects are increasing as QatarEnergy intensifies production efficiency efforts. The rental market benefits from offshore development activities in the Dukhan and Al-Shaheen fields. Growing investment in integrated well service contracts and advanced rig technologies enhances operational reliability and cost control, supporting consistent utilization of rental rigs.

Bahrain

Bahrain accounts for about 3–4% of the GCC rental workover rig market. Despite its smaller oil production base, ongoing redevelopment of mature onshore fields sustains demand for light and medium-capacity rigs. Tatweer Petroleum’s continuous well maintenance and EOR programs are key drivers of rental rig utilization. The market remains supported by Bahrain’s efforts to extend field life and improve production efficiency while minimizing capital expenditure. Increasing adoption of modern workover technologies and flexible rental models also strengthens Bahrain’s position as a niche but stable participant in the regional rig rental market.

Market Segmentations:

By Type

- Conventional/conventional double

- Light/single service rigs

- Heavy/double service rigs

By Capacity

By Application

- Well intervention and maintenance

- Enhanced oil recovery (EOR) operations

- Abandonment and decommissioning

By Geography

- Saudi Arabia

- United Arab Emirates (UAE)

- Kuwait

- Oman

- Qatar

- Bahrain

Competitive Landscape

The GCC rental workover rig market is characterized by a moderately consolidated competitive landscape, led by a mix of international service providers and national oilfield contractors. Key players include Schlumberger Limited, Halliburton Company, Arabian Drilling Company, Nabors Industries Ltd., National Energy Services Reunited Corp. (NESR), and ADES International Holding. These companies dominate the market through extensive regional fleets, advanced rig technologies, and long-term service contracts with national oil companies. Saudi Arabia leads the market, accounting for approximately 40–45% of total share, followed by the UAE and Kuwait, driven by continuous field redevelopment and EOR programs. The competitive environment is marked by increasing investment in digitalized rig operations, enhanced safety standards, and flexible rental agreements aimed at improving operational efficiency and cost control across the GCC’s mature oilfields.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Halliburton

- SLB

- Dalma Energy

- Gulf Energy

- Alshawamikh Oil Services

- PNG Drilling & Service

- Rukun Al Yaqeen (RAY) International

- ERIELL

- Baker Hughes

- Ingeo Drilling Company

- Tarabut

- CNPC Bohai Drilling Engineering Company

- Advanced Energy Systems

- NPS Bahrain for Oil and Gas Wells Services

- NDSC

- Challenger

- Saudi Arabian Oil

- Gulf Drilling

- Nortech

- Abu Dhabi National Oil Company (ADNOC) Drilling Company

Recent Developments

- In October 2024, ADNOC Drilling signed a significant onshore contract valued at approximately USD 1.1 billion with Abu Dhabi National Oil Company (ADNOC) to provide drilling, workover and other well services for the 2022-2025 period. The agreement covers Onshore drilling activities, with an objective to support ADNOC’s oil production capacity. This deal is intended to help meet ADNOC’s strategic plan of increasing capacity and maximizing the efficiency of its operations. This partnership demonstrates the dedication of ADNOC Drilling to deliver quality services with the support for the UAE oil industry.

- In May 2024, Baker Hughes achieved a significant milestone with the expansion of its facility in Dammam, Saudi Arabia, which will enhance the company’s manufacturing capabilities and increase local job opportunities. This state-of-the-art facility will focus on producing advanced technologies for the oil and gas industry, aligning with Saudi Arabia’s Vision 2030 objectives. The expansion is expected to bolster Baker Hughes’ presence in the region and facilitate innovation in energy solutions. This development is part of Baker Hughes’ broader strategy to strengthen its operational footprint in the Middle East.

- In January 2024, Halliburton launched Reservoir Xaminer software that tests wirelessly to enhance property evaluations. This system employs advanced technologies to capture data and give it in real time which helps enhance operative decision making while exploring oil and gas. Some features of Reservoir Xaminer include the ability to test extreme environments and capture quality formation samples which reduces cost and time. This signaled Halliburton’s launch of new offerings tailored towards increasing productivity and efficiency focused solutions for energy sector customers.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising energy demand and increasing well maintenance needs.

- Operators will adopt smart workover rigs with digital tools to improve efficiency and recovery rates.

- Demand for medium-capacity rigs will increase, balancing cost-effectiveness and performance.

- Well intervention and maintenance applications will drive higher utilization of rental rigs.

- Low-capacity rigs will see growth for shallow well maintenance as a cost-effective solution.

- Investments by national oil companies in upstream operations will boost rental rig demand.

- Hybrid-powered rigs will gain popularity to align with sustainability and reduce emissions.

- Collaborations between regional and international service providers will expand market reach.

- Market consolidation is likely, with leading companies acquiring smaller firms to strengthen positions.

- Technological innovation, strategic partnerships, and sustainable practices will shape continued market growth and competitiveness.