Market Overview:

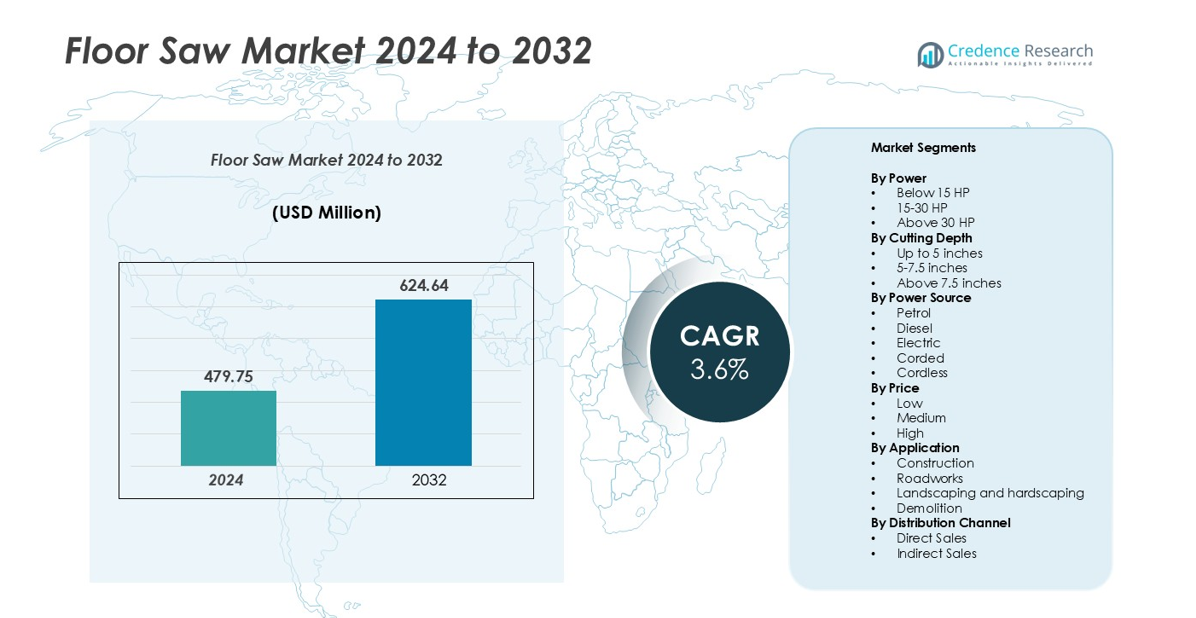

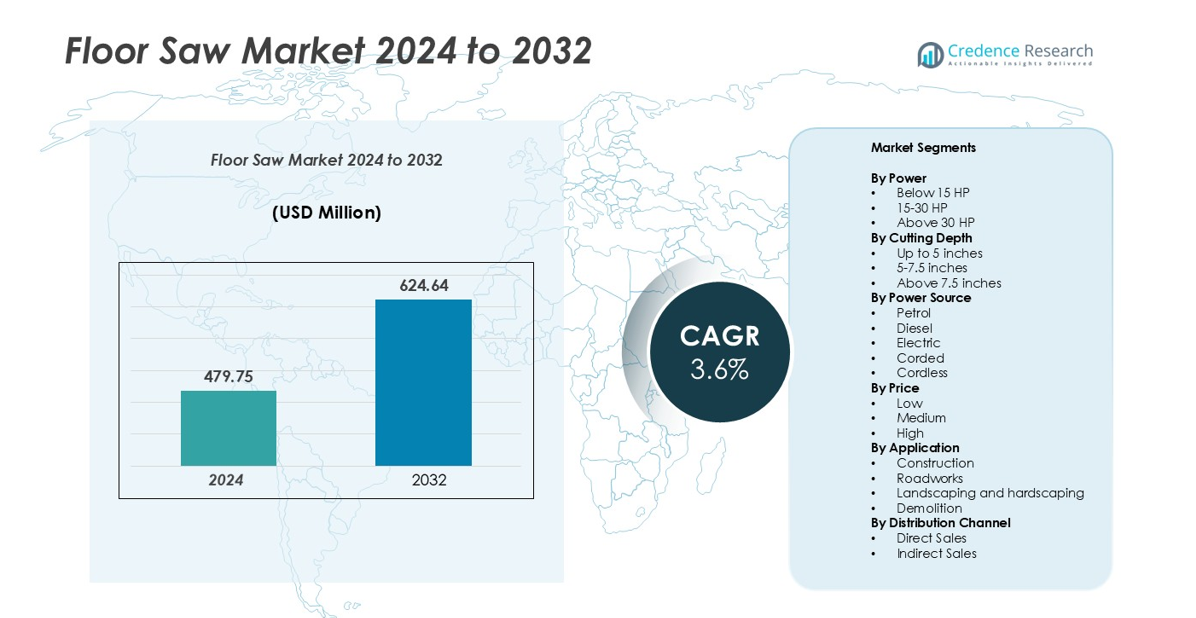

Floor Saw Market Size was valued at USD 479.75 million in 2024 and is anticipated to reach USD 624.64 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Saw Market Size 2024 |

USD 479.75 million |

| Floor Saw Market, CAGR |

3.6% |

| Floor Saw Market Size 2032 |

USD 624.64 million |

The floor saw market is led by prominent players such as Husqvarna Construction, Saint-Gobain, Hilti, Makita, Atlas Copco, LISSMAC Maschinenbau, SIMA, Amada Machinery America, Bycon Industry, IMER, and Chicago Pneumatic. These companies dominate through robust product portfolios, advanced cutting technologies, and extensive global distribution networks. Asia-Pacific emerges as the leading region, accounting for approximately 35% of the global market share, driven by rapid infrastructure development, industrial expansion, and urbanization in countries such as China, India, and Japan. North America follows with around 30%, supported by road maintenance programs and technological innovation, while Europe holds nearly 25%, driven by sustainable construction initiatives and stringent emission regulations.

Market Insights

- The global Floor Saw Market was valued at USD 479.75 million in 2024 and is projected to reach USD 624.64 million by 2032, growing at a CAGR of 3.6% during the forecast period.

- Growing infrastructure development, urban expansion, and road maintenance projects are driving strong demand for high-performance floor saws across construction, roadworks, and demolition applications.

- The market is witnessing trends such as the adoption of electric and cordless saws, integration of digital control systems, and rising preference for eco-efficient and low-noise cutting tools.

- Key players including Husqvarna Construction, Hilti, Saint-Gobain, Makita, and Atlas Copco compete through innovation, partnerships, and advanced product launches, while high equipment costs remain a key restraint for smaller contractors.

- Regionally, Asia-Pacific leads with around 35% share, followed by North America (30%) and Europe (25%); among segments, the 15–30 HP power range and petrol-powered models hold dominant market positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power

The Floor Saw market is segmented by power into Below 15 HP, 15-30 HP, and Above 30 HP. The 15-30 HP sub-segment dominates the market, accounting for the largest share due to its balance of performance and versatility for both small- and medium-scale construction projects. Its widespread adoption is driven by increasing urban infrastructure development and the need for efficient cutting solutions that reduce operational time. Additionally, contractors prefer this power range for its reliability, ease of maintenance, and compatibility with various cutting depths, supporting productivity in diverse applications.

- For instance, the Husqvarna FS 400 LV can be equipped with an 11.7 hp Honda GX390 engine and can accommodate a blade up to 20 inches, offering a maximum cutting depth of approximately 7.6 inches.

By Cutting Depth

Segmentation by cutting depth includes Up to 5 inches, 5-7.5 inches, and Above 7.5 inches. The 5-7.5-inch sub-segment holds a leading position in the market, capturing the highest share as it meets the demands of standard construction and roadwork projects. Its dominance is attributed to its versatility in handling medium-thickness concrete and asphalt slabs efficiently, minimizing labor and machine downtime. Rising investments in urban road repair, resurfacing projects, and commercial construction activities further drive demand for floor saws capable of this optimal cutting range.

- For instance, The Husqvarna FS 5000 D, powered by a 47.6 hp Yanmar diesel engine, is a high-production saw designed for cutting concrete and asphalt. Its powerful engine and balanced design make it suitable for mid-sized road work, service jobs, and floor sawing. Depending on the model and blade size, it is capable of cutting up to 15 inches deep.

By Power Source

The Floor Saw market by power source is categorized into Petrol, Diesel, Electric, Corded, and Cordless. Petrol-powered saws are the dominant sub-segment, representing the largest market share due to their high mobility, robust performance, and suitability for outdoor construction environments. The growth of this segment is fueled by increasing infrastructure projects, including highways and urban development, where portability and uninterrupted operation are critical. Diesel and electric variants are gaining traction in specialized applications, but petrol remains the preferred choice for its reliability in heavy-duty cutting and varied construction conditions.

Key Growth Drivers

Expanding Infrastructure Development and Urbanization

Rapid urbanization and large-scale infrastructure development projects are major drivers of the floor saw market. Governments and private sectors worldwide are investing heavily in constructing roads, bridges, airports, and commercial buildings. Floor saws play a critical role in precision cutting for concrete, asphalt, and pavement during these projects. For instance, the surge in smart city initiatives and road rehabilitation programs in emerging economies has significantly increased the demand for efficient concrete cutting tools. Moreover, advancements in power saw technologies enable contractors to complete large-scale projects faster, improving cost efficiency and productivity, which continues to propel the adoption of floor saws across the construction sector.

- For instance, the surge in smart city initiatives and road rehabilitation programs in emerging economies has significantly increased the demand for efficient concrete cutting tools.

Growing Demand for Road Maintenance and Repair Activities

The rising emphasis on road maintenance, refurbishment, and expansion projects significantly fuels the demand for floor saws. Increasing vehicle traffic and aging road infrastructure have intensified the need for efficient cutting equipment that ensures precision and durability in asphalt and concrete cutting. Governments in developed and developing nations are allocating larger budgets for road renovation programs, enhancing opportunities for floor saw manufacturers. For instance, road repair initiatives in Europe and Asia-Pacific are driving higher procurement of mid- to high-powered saws suitable for both surface and deep cuts. This trend aligns with the growing focus on sustainable construction and the extension of road life cycles, where floor saws offer time-saving and cost-effective cutting solutions.

- For instance, the Husqvarna FS 5000 D is a powerful, diesel-powered flat saw designed for cutting concrete and asphalt. It is available in various configurations, which determine the maximum cutting depth.

Technological Advancements in Floor Saw Design and Performance

Continuous innovation in design and functionality has enhanced the performance, safety, and efficiency of modern floor saws. Manufacturers are integrating features such as low-vibration mechanisms, precision depth control, and enhanced dust suppression systems to improve user comfort and operational outcomes. Additionally, the growing shift toward electric and cordless models supports sustainability goals by reducing emissions and noise pollution on job sites. The inclusion of digital controls and sensor-based technologies for monitoring blade wear and depth accuracy further drives adoption among professional contractors. These technological improvements not only enhance productivity but also reduce maintenance costs, making advanced floor saws a preferred choice across multiple industries, including construction, roadworks, and demolition.

Key Trends & Opportunities

Shift Toward Electric and Battery-Powered Floor Saws

A prominent trend in the floor saw market is the transition from fuel-powered to electric and battery-operated models. This shift is driven by rising environmental regulations, noise reduction requirements, and the growing preference for sustainable equipment. Electric floor saws provide lower emissions, minimal maintenance, and quieter operations, making them ideal for urban construction sites and indoor applications. Furthermore, advancements in lithium-ion battery technology are enabling longer runtime and higher power output, enhancing portability and convenience. Manufacturers investing in eco-efficient product lines are poised to capitalize on this transition, aligning with the global movement toward greener construction practices.

- For instance, the Husqvarna FS 500 E is a versatile electric small push floor saw equipped with a 7.5 kW IE3 certified motor, offering zero CO₂ emissions during use.

Increasing Adoption of Automation and Smart Cutting Systems

Automation and precision technology are reshaping the floor saw industry. Modern machines are now equipped with GPS-enabled guidance, digital depth indicators, and automatic blade control systems, enabling more accurate and consistent cutting results. These innovations reduce operator fatigue, enhance safety, and minimize material waste. The trend toward smart construction equipment is also supported by rising labor costs and the shortage of skilled workers, encouraging companies to adopt machines that simplify complex cutting tasks. As automation becomes more cost-effective, manufacturers offering integrated digital features are expected to capture a larger share of the market.

- For instance, The Husqvarna FS 5000 D is that it is a powerful diesel floor saw for deep cutting applications in concrete and asphalt. It can achieve a maximum cutting depth of 374 mm (14.75 inches) and includes advanced electronic tracking for precise, straight cuts.

Expansion of Rental Services and Aftermarket Opportunities

The growing popularity of equipment rental services presents new opportunities in the floor saw market. Many small- and medium-sized contractors prefer renting over purchasing to reduce upfront costs and maintenance burdens. This shift has prompted rental companies to expand their fleets with efficient and durable floor saw models. Additionally, aftermarket services such as blade replacement, maintenance, and equipment refurbishment are becoming lucrative revenue streams for manufacturers and distributors. The expansion of rental and service-based business models is expected to sustain long-term market growth and improve customer accessibility to advanced saw technologies.

Key Challenges

High Equipment and Maintenance Costs

One of the major challenges in the floor saw market is the high initial investment and ongoing maintenance expenses associated with advanced models. High-powered floor saws, particularly diesel and electric variants, require significant capital expenditure, which can deter small contractors. Moreover, regular blade replacements, calibration, and servicing add to operational costs. While advanced features enhance performance and safety, they also increase the complexity and cost of repairs. This challenge is especially evident in developing markets, where price sensitivity among end users limits the adoption of technologically advanced saws despite their efficiency benefits.

Safety Concerns and Skilled Labor Shortage

Operating a floor saw demands skilled handling and adherence to strict safety protocols due to risks such as blade kickback, dust exposure, and vibration-related fatigue. The shortage of trained operators often leads to suboptimal performance and increased workplace accidents. Moreover, compliance with evolving occupational safety standards requires continuous training and equipment upgrades, adding pressure on small construction firms. The lack of awareness regarding advanced safety features and the limited availability of skilled labor remain critical barriers to wider market penetration. Addressing these challenges will require enhanced training initiatives and broader adoption of user-friendly, safety-enhanced saw designs.

Regional Analysis

North America

North America holds a significant share of the global floor saw market, accounting for around 30% of the total revenue. The region’s growth is driven by extensive road maintenance programs, commercial construction, and infrastructure modernization projects across the United States and Canada. Strong demand for high-performance and fuel-efficient models, particularly in urban development and highway repair, supports steady market expansion. Moreover, the presence of leading manufacturers and early adoption of advanced electric and cordless floor saws enhance technological competitiveness and ensure consistent product innovation in the region.

Europe

Europe represents approximately 25% of the global floor saw market share, supported by the region’s emphasis on sustainable construction and infrastructure refurbishment. Countries such as Germany, France, and the United Kingdom are focusing on road rehabilitation, smart city projects, and energy-efficient buildings, driving demand for precision cutting tools. Strict emission regulations have accelerated the shift toward electric and low-noise floor saws, particularly in urban applications. Additionally, the expansion of rental equipment services across Europe facilitates greater accessibility to advanced machinery, contributing to consistent growth and steady technological integration in the market.

Asia-Pacific

Asia-Pacific dominates the global floor saw market, capturing around 35% of the total share. Rapid urbanization, industrialization, and government-led infrastructure investments in China, India, and Japan are key growth drivers. The region’s booming construction sector, including highways, airports, and residential complexes, boosts demand for high-powered and durable floor saws. Manufacturers are increasingly localizing production and expanding distribution networks to meet growing domestic needs. Furthermore, the availability of cost-effective labor and raw materials enables competitive pricing, positioning Asia-Pacific as the fastest-growing and most dynamic regional market for floor saws.

Latin America

Latin America accounts for nearly 6% of the global floor saw market, with growth primarily concentrated in Brazil, Mexico, and Chile. The region’s expanding construction and road improvement projects, coupled with increasing investments in commercial infrastructure, are fueling market demand. Governments are emphasizing modernization of transportation and industrial zones, creating opportunities for manufacturers offering durable and efficient cutting equipment. However, economic volatility and limited adoption of advanced technologies in certain countries slightly restrain growth, though the rental segment and small-scale contractors continue to support consistent market activity.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 4% of the global floor saw market share. Infrastructure development, particularly in Gulf Cooperation Council (GCC) nations, and urban construction in South Africa are key contributors to growth. Large-scale projects such as smart cities, commercial complexes, and road expansions are driving the demand for robust, high-capacity floor saws. The preference for diesel-powered models remains strong due to their suitability for high-temperature environments. Although market penetration is moderate, increasing foreign investments and government-backed construction initiatives are expected to create long-term opportunities for floor saw manufacturers in MEA

Market Segmentations:

By Power

- Below 15 HP

- 15-30 HP

- Above 30 HP

By Cutting Depth

- Up to 5 inches

- 5-7.5 inches

- Above 7.5 inches

By Power Source

- Petrol

- Diesel

- Electric

- Corded

- Cordless

By Price

By Application

- Construction

- Roadworks

- Landscaping and hardscaping

- Demolition

By Distribution Channel

- Direct Sales

- Indirect Sales

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The floor saw market features a competitive landscape characterized by both global leaders and regional manufacturers striving to enhance performance, efficiency, and user safety. Key players such as Husqvarna Construction, Saint-Gobain, Hilti, Makita, Atlas Copco, LISSMAC Maschinenbau, SIMA, Amada Machinery America, Bycon Industry, IMER, and Chicago Pneumatic dominate through innovation, strong distribution networks, and diversified product portfolios. These companies focus on developing technologically advanced models featuring reduced vibration, improved dust management, and enhanced power efficiency. Strategic initiatives such as mergers, acquisitions, and collaborations with construction and rental equipment firms strengthen their market reach. Continuous investment in R&D, sustainability, and digital control integration supports competitive differentiation. Meanwhile, regional players are gaining traction by offering cost-effective and locally customized solutions. The industry’s competition is expected to intensify as manufacturers increasingly emphasize eco-friendly materials, ergonomic designs, and smart technologies to meet evolving construction and infrastructure requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Atlas Copco attended CleanPower 2025 in Phoenix, showcasing their industrial and construction solutions, including bolting and cutting tools, to a broad audience. Although floor saws weren’t product-central, it was a company-wide feature presence.

- In May 2025, Hilti had its DSH 600-22 ATC & DSH 700-22 ATC battery-powered cut-off saws recognized as Concrete Contractor Top Product Award 2025, recognized for gas-like power, torque control (ATC), speed of charge, low vibration, and overall jobsite safety & efficiency.

- In March 2025, Wacker Neuson SE unveiled new reversible center plates featuring ergonomic design, digital controls, Bluetooth telematics, and optional diagnostics features, signifying an increased effort toward efficiency and digitalization from a technology integration standpoint across construction equipment product lines, including floor saws.

- In January 2024, STIHL launched its battery-powered TSA 300 Cutquik, a professional-grade concrete saw capable of cutting a 4-inch slab with minimal vibration, signaling a push into eco-friendly electric cutting tools.

Report Coverage

The research report offers an in-depth analysis based on Power, Cutting Depth, Power Source, Price, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The floor saw market will experience steady growth driven by global infrastructure expansion and increasing urban construction projects.

- Advancements in electric and battery-powered models will enhance efficiency and reduce environmental impact.

- Integration of smart technologies such as digital depth control and automation will improve precision and productivity.

- Demand for compact and ergonomic floor saws will rise due to the growing focus on operator safety and convenience.

- Rental and leasing services will gain traction among small and medium construction firms seeking cost-effective solutions.

- Manufacturers will invest more in sustainable materials and low-emission engines to meet green construction standards.

- Asia-Pacific will continue to dominate the market, supported by rapid industrialization and infrastructure modernization.

- The commercial construction and road maintenance sectors will remain key revenue contributors.

- Ongoing product innovation and R&D will strengthen competitive differentiation among leading players.

- Strategic partnerships and acquisitions will expand global distribution networks and enhance market presence.