Market Overview

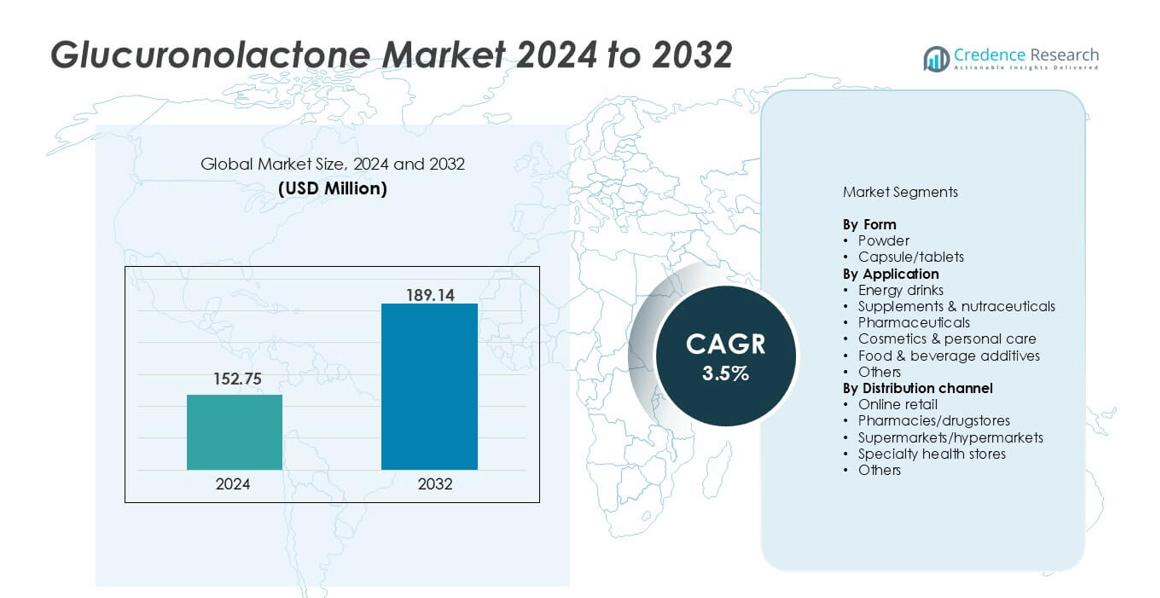

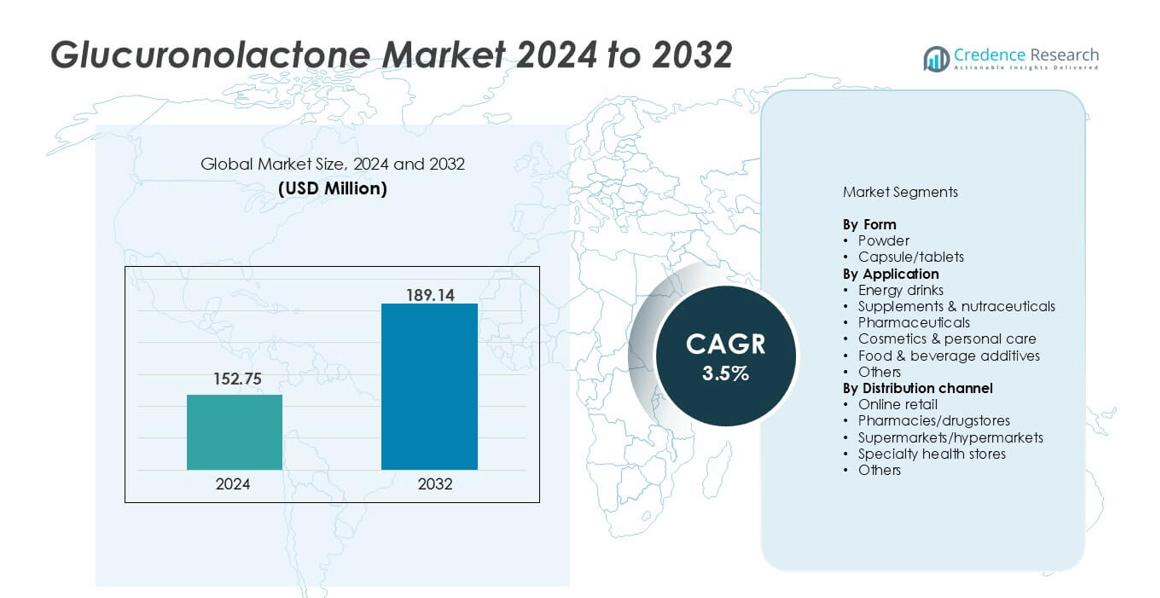

The Glucuronolactone market size was valued at USD 152.75 million in 2024 and is anticipated to reach USD 189.14 million by 2032, growing at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glucuronolactone Market Size 2024 |

USD 152.75 million |

| Glucuronolactone Market CAGR |

3.5% |

| Glucuronolactone Market Size 2032 |

USD 189.14 million |

The global glucuronolactone market is led by major players including Merck, Jungbunzlauer, FUJIFILM Wako Pure Chemical Corporation, Shandong Fuyuan Bio-Tech, and Foodchem International. These companies dominate through high-purity production capabilities, advanced quality control, and strong international distribution networks. Other notable participants such as Hubei Yitai Pharmaceutical, Anhui Fubore Pharmaceutical & Chemical, Muby Chemicals, Anmol Chemicals, and Aadhunik Industries strengthen the market through competitive pricing and regional supply reliability. North America leads the global market with a 34% share in 2024, followed by Asia-Pacific with 29%, driven by expanding energy drink production and rising nutraceutical consumption across major economies.

Market Insights

- The glucuronolactone market was valued at USD 152.75 million in 2024 and is projected to reach USD 189.14 million by 2032, growing at a CAGR of 3.5%.

- Rising demand for energy drinks and dietary supplements drives market growth, supported by increasing health awareness and preference for detoxifying and performance-enhancing ingredients.

- Key trends include a shift toward clean-label, natural formulations and expanding applications in pharmaceuticals and personal care products for liver health and anti-aging benefits.

- The market is moderately consolidated, with leading players such as Merck, Jungbunzlauer, FUJIFILM Wako Pure Chemical Corporation, and Shandong Fuyuan Bio-Tech, focusing on high-purity production and R&D investments.

- North America led with a 34% share, followed by Asia-Pacific (29%) and Europe (27%); by application, energy drinks dominated with a 41% share, and by form, powder accounted for 58%, reflecting strong demand across beverage and supplement segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

The powder segment dominated the glucuronolactone market with a 58% share in 2024. Its leadership stems from high solubility, stability, and ease of incorporation into beverages and dietary supplements. Powdered glucuronolactone is preferred by manufacturers of energy drinks and functional foods due to its consistent purity and long shelf life. The form also enables flexible formulation for tablets, capsules, and fortified beverages. Growing consumer preference for powdered functional ingredients in sports nutrition and clean-label products continues to support segment growth.

- For instance, Aadhunik Industries offers D-glucuronolactone in white crystalline powder form with a purity range of 98 – 102%, and it lists the material in crystal or micron-mesh sizes tailored for beverage or tablet production.

By Application

The energy drinks segment led the market with a 41% share in 2024, driven by increasing demand for performance-boosting and fatigue-reducing beverages. Glucuronolactone is a common ingredient in popular energy drink formulations for its role in improving alertness and detoxification. Expanding consumption among younger demographics and athletes further supports market expansion. Rising awareness of physical wellness and the global trend toward active lifestyles boost usage across regions. Manufacturers are also reformulating drinks with natural ingredients, enhancing glucuronolactone’s application prospects.

- For instance, a peer-reviewed analysis found that energy drinks often contain approximately 2,400 mg of D-glucuronolactone per litre of beverage.

By Distribution Channel

Pharmacies and drugstores accounted for the largest market share of 36% in 2024, owing to strong consumer trust and professional guidance in supplement purchases. These outlets stock glucuronolactone-based nutraceuticals, tablets, and energy formulations. The segment benefits from rising health awareness and increasing doctor recommendations for liver and metabolic health support. Online retail channels are expanding quickly due to convenience and product availability, but physical stores remain dominant for verified product sourcing and reliable brand access.

Key Growth Drivers

Rising Demand for Energy and Functional Beverages

The expanding energy drink sector is a major driver of the glucuronolactone market. This compound is widely used for its role in improving mental alertness, reducing fatigue, and supporting detoxification. Leading beverage manufacturers include glucuronolactone in formulations aimed at athletes, professionals, and students seeking quick energy boosts. Rapid urbanization, long working hours, and increasing participation in sports have accelerated demand for functional beverages. The global push for natural, performance-enhancing ingredients has further boosted its consumption. As energy drinks continue to penetrate emerging markets, glucuronolactone usage is expected to rise consistently.

- For instance, one review found that energy drinks commonly contain 2 400 mg per litre of D-glucuronolactone in European formulations.

Growing Adoption in Nutraceuticals and Dietary Supplements

The rising popularity of dietary supplements and nutraceuticals is driving glucuronolactone demand across global markets. Consumers are prioritizing preventive healthcare and wellness, increasing the intake of detoxifying and liver-supporting supplements. Glucuronolactone’s proven benefits in promoting liver function and metabolic health have strengthened its position in functional supplement formulations. Nutraceutical brands are expanding their product lines with glucuronolactone capsules, powders, and combination products. The shift toward personalized nutrition and clean-label formulations is reinforcing market growth. Widespread e-commerce availability and increased awareness through fitness influencers also contribute to steady product adoption.

- For instance, one supplier lists a pure D-glucuronolactone powder with a serving size of 1 000 mg per day (as per the label of the BulkSupplements “D-Glucuronolactone Powder”).

Expanding Use in Pharmaceutical and Personal Care Formulations

Pharmaceutical manufacturers increasingly use glucuronolactone in liver health products, detox therapies, and fatigue management drugs. The compound’s proven role in glucuronic acid metabolism enhances its value in formulations targeting toxin elimination and liver enzyme balance. Additionally, cosmetic brands are incorporating glucuronolactone into skincare products for its antioxidant and anti-aging benefits. It supports skin hydration, protection from oxidative stress, and cellular regeneration. Growing consumer demand for multifunctional ingredients and clinically backed formulations is fueling its adoption. With expanding pharmaceutical R&D and cosmeceutical innovation, glucuronolactone applications are broadening beyond conventional supplement categories.

Key Trends & Opportunities

Shift Toward Natural and Clean-Label Ingredients

A major market trend is the increasing preference for clean-label, plant-based, and chemical-free ingredients. Consumers are demanding transparency in ingredient sourcing and formulation. Manufacturers are responding by replacing synthetic additives with natural compounds like glucuronolactone, which offers detoxification and performance benefits without harmful residues. The clean-label movement is particularly strong in the energy drink and supplement sectors, where product authenticity influences purchase decisions. This shift provides an opportunity for glucuronolactone producers to market their products as safe, natural, and compliant with global food safety standards.

- For instance, Howtian Group offers D-glucuronolactone in a white, odorless powder form. This product is described for seamless incorporation into beverages, supplements, joint-health formulations, and liver-support systems. While D-glucuronolactone occurs naturally in the human body, the commercial ingredient is synthesized industrially, typically by oxidizing a natural starting material like starch.

Rising Penetration in Asia-Pacific Markets

Asia-Pacific is emerging as a key growth opportunity due to rising disposable incomes and increasing health consciousness. Expanding urban populations in China, Japan, and South Korea are driving the consumption of functional beverages and wellness products. Governments are supporting domestic supplement manufacturing through favorable regulations and investments in nutraceutical innovation. Additionally, regional consumers are adopting Western-style energy drinks and fitness-focused lifestyles. Local manufacturers are incorporating glucuronolactone into regional brands, strengthening its presence in both food and healthcare segments. This regional expansion creates long-term growth potential for suppliers and formulators.

- For instance, in April 2019, the China National Center for Food Safety Risk Assessment (CFSA) held a public consultation regarding a proposal to authorize D-glucuronolactone as a new food additive for energy drinks, with a suggested maximum usage limit of 2.4 g per litre.

Key Challenges

Regulatory Restrictions and Safety Concerns

Regulatory scrutiny regarding glucuronolactone levels in energy drinks poses a key challenge. Several health authorities have imposed concentration limits due to concerns about potential overconsumption and interactions with caffeine. Variations in regional safety standards complicate product formulation and distribution. Manufacturers must navigate compliance frameworks across different countries, increasing production costs. Negative publicity from debates over stimulant safety may also affect consumer perception. Ensuring transparency, clinical validation, and adherence to safety thresholds will be essential to maintaining market credibility.

Price Volatility and Supply Chain Constraints

Fluctuating raw material costs and complex supply chains affect production stability. Glucuronolactone synthesis requires controlled fermentation or chemical oxidation processes, both sensitive to input prices and quality variations. Global disruptions, such as logistics bottlenecks and energy cost increases, have added to price instability. These challenges impact small and medium manufacturers that depend on imported raw materials or intermediates. To sustain profitability, producers are adopting local sourcing, process optimization, and backward integration. However, persistent cost volatility continues to pressure margins and restrict expansion in emerging markets.

Regional Analysis

North America

North America dominated the glucuronolactone market with a 34% share in 2024, supported by strong consumption of energy drinks and dietary supplements. The United States leads the region due to high adoption of functional beverages among young adults and athletes. Growing awareness of liver health and detox supplements also fuels demand. Key beverage companies continue to include glucuronolactone in formulations targeting mental alertness and physical endurance. Expanding retail networks, including online supplement platforms and specialty stores, further enhance market accessibility across the U.S. and Canada.

Europe

Europe accounted for a 27% share in 2024, driven by a mature nutraceutical industry and strict quality standards. The region’s consumers show strong preference for natural, clinically validated ingredients in functional foods and supplements. Germany, the U.K., and France are major contributors, supported by health-focused lifestyles and regulatory support for safe functional formulations. European beverage brands are increasingly using glucuronolactone in energy and detox drinks targeting working professionals. The trend toward clean-label and sustainable sourcing continues to shape product innovation and regional demand growth.

Asia-Pacific

Asia-Pacific held a 29% market share in 2024, emerging as the fastest-growing regional market. Rising disposable incomes, urbanization, and interest in health-oriented beverages drive regional consumption. China, Japan, and South Korea lead the market with expanding functional drink portfolios and growing fitness awareness. Government initiatives promoting domestic nutraceutical production further strengthen the sector. Increasing preference for energy and detox beverages among younger populations fuels steady expansion. Local manufacturers are also leveraging e-commerce platforms to boost product reach and strengthen glucuronolactone’s market presence.

Latin America

Latin America captured a 6% share in 2024, supported by increasing adoption of energy drinks and dietary supplements. Brazil and Mexico lead the market due to expanding sports nutrition awareness and lifestyle shifts toward functional beverages. The growing urban population and wider retail penetration of international brands are boosting demand. Local supplement producers are introducing glucuronolactone-based formulations to meet rising consumer interest in wellness products. Despite moderate growth rates, regional opportunities exist in affordable supplement lines targeting middle-income groups and young professionals.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share in 2024, driven by increasing consumer interest in fitness and preventive health. The United Arab Emirates and Saudi Arabia are leading markets with rising demand for imported energy and detox beverages. Growth in organized retail, coupled with increasing influence of Western dietary trends, supports market expansion. The region’s young population is showing growing awareness of nutritional supplements for energy and endurance. However, limited domestic manufacturing and price sensitivity continue to restrict broader market penetration.

Market Segmentations:

By Form

By Application

- Energy drinks

- Supplements & nutraceuticals

- Pharmaceuticals

- Cosmetics & personal care

- Food & beverage additives

- Others

By Distribution channel

- Online retail

- Pharmacies/drugstores

- Supermarkets/hypermarkets

- Specialty health stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The glucuronolactone market features a moderately consolidated competitive landscape, with key players focusing on product quality, capacity expansion, and strategic partnerships to strengthen their global presence. Leading companies such as Merck, Jungbunzlauer, FUJIFILM Wako Pure Chemical Corporation, and Shandong Fuyuan Bio-Tech emphasize advanced manufacturing technologies to ensure high-purity output for food, beverage, and pharmaceutical applications. Firms like Foodchem International and Hubei Yitai Pharmaceutical are expanding production capacities to meet growing demand from nutraceutical and energy drink manufacturers. Continuous investment in R&D, adherence to global safety standards, and collaboration with beverage and supplement brands remain key strategies to gain market share. The competitive environment is defined by innovation in purification processes, product diversification, and long-term supply agreements with global functional ingredient producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck

- Jungbunzlauer

- FUJIFILM Wako Pure Chemical Corporation

- Shandong Fuyuan Bio-Tech

- Foodchem International

- Hubei Yitai Pharmaceutical

- Anhui Fubore Pharmaceutical & Chemical

- Muby Chemicals

- Anmol Chemicals

- Aadhunik Industries

Recent Developments

- In August 2025, the European Food Safety Authority (EFSA) issued a positive opinion on the safety and efficacy of Glucuronolactone as a functional ingredient. This approval marked a significant milestone for the industry, as it allowed for the increased use of Glucuronolactone in food and beverage applications across Europe (EFSA, 2025).

- In May 2025, a significant strategic partnership was formed between BASF SE and Bio-Techne Corporation. The collaboration focused on the production and commercialization of Glucuronolactone and other related products. This partnership aimed to expand the reach and capacity of Glucuronolactone production, addressing the growing demand in various industries such as food, beverages, and pharmaceuticals (BASF SE, 2025).

- In March 2024, Nutraceutical Corporation, a leading manufacturer and marketer of nutritional and dietary supplements, launched a new product line, “GlucoFlex,” containing Glucuronolactone. This innovative supplement was designed to support joint health and overall wellness. The product was launched in response to increasing consumer demand for natural health solutions (Nutraceutical Corporation, 2024).

- In January 2023, DSM, a leading global science-based company in Nutrition, Health, and Sustainable Living, announced the expansion of its portfolio with the acquisition of the specialty ingredients business of DuPont Nutrition & Biosciences. This acquisition included Glucanolactone, a key ingredient in the production of Glucuronolactone. The deal aimed to strengthen DSM’s position in the nutritional ingredients market (DSM, 2023).

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily due to expanding energy drink and nutraceutical applications.

- Increasing health awareness and preventive wellness trends will continue driving global demand.

- Manufacturers will focus on clean-label and high-purity formulations to meet regulatory and consumer expectations.

- Strategic collaborations between beverage, supplement, and pharmaceutical brands will enhance market penetration.

- Asia-Pacific is expected to witness the fastest growth, supported by rising urbanization and fitness awareness.

- North America will maintain its leadership with strong consumption of functional beverages and supplements.

- Product innovation in pharmaceutical and skincare applications will diversify future revenue streams.

- Advancements in production efficiency and fermentation technologies will improve cost competitiveness.

- Compliance with regional safety standards and global food regulations will shape market strategies.

- Expanding online retail and e-commerce distribution will further boost accessibility and market expansion worldwide.