Market Overview

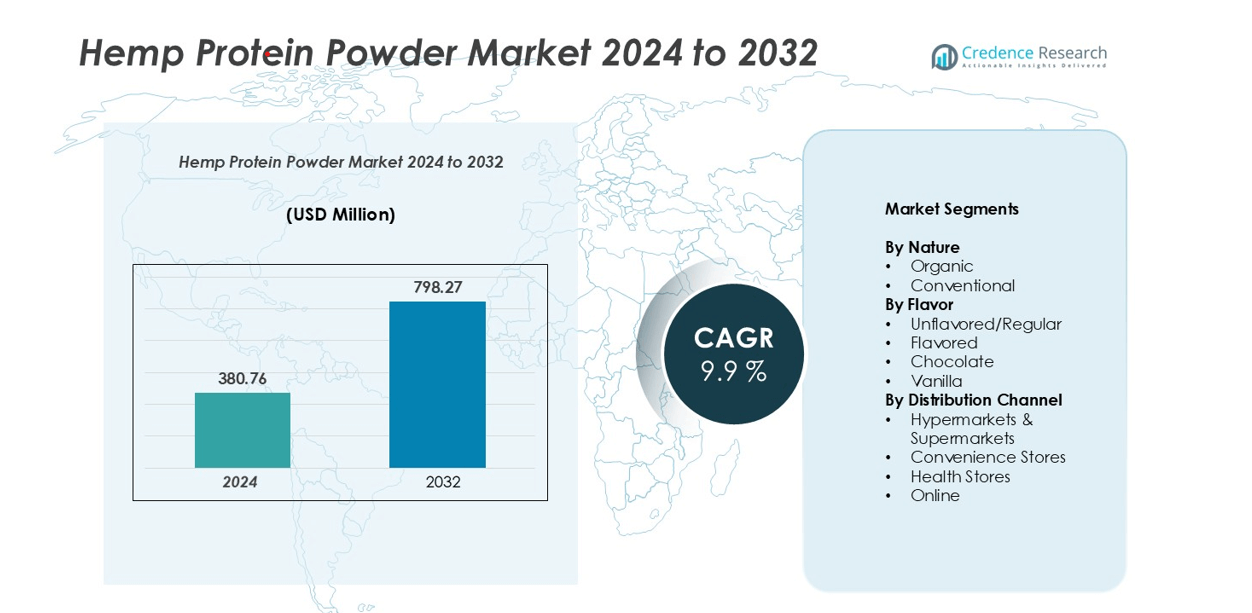

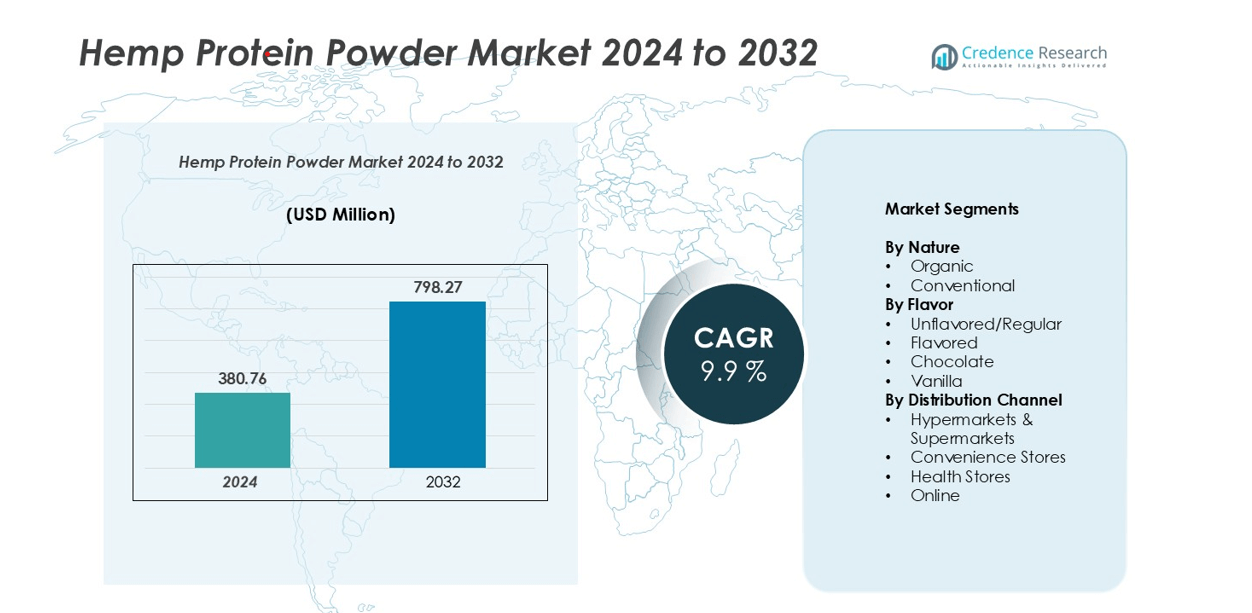

Hemp protein powder market size was valued at USD 380.76 million in 2024 and is anticipated to reach USD 798.27 million by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemp Protein Powder Market Size 2024 |

USD 380.76 million |

| Hemp Protein Powder Market, CAGR |

9.9% |

| Hemp Protein Powder Market Size 2032 |

USD 798.27 million |

The hemp protein powder market is dominated by key players such as Manitoba Harvest, Navitas Organics, Nutiva, Evo Hemp, Sunwarrior, India Hemp and Co., Terrasoul Superfoods, India Hemp Organics, Anthonys Goods, and Health Horizons. These companies leverage strong brand recognition, diversified product portfolios, and strategic distribution across retail and e-commerce channels to maintain competitive advantage. North America leads the global market with a 38% share, driven by high health awareness, established retail infrastructure, and a growing fitness culture. Europe follows with 27%, supported by rising veganism and demand for organic, sustainable products. Asia-Pacific accounts for 20% of the market, reflecting increasing adoption of plant-based nutrition and urbanization. Latin America and the Middle East & Africa hold 9% and 6% shares, respectively, with growth fueled by expanding consumer awareness and e-commerce penetration.

Market Insights

- The global hemp protein powder market was valued at USD 380.76 million in 2024 and is projected to reach USD 798.27 million by 2032, growing at a CAGR of 9.9%.

- Rising consumer awareness of health, fitness, and plant-based nutrition is driving demand for organic and unflavored hemp protein, with the organic segment holding a dominant share of 62% in 2024.

- Key market trends include flavor diversification with chocolate and vanilla options, product innovation with fortified protein blends, and increasing adoption of sustainable and eco-friendly products.

- The market is highly competitive, with leading players including Manitoba Harvest, Navitas Organics, Nutiva, Evo Hemp, and Sunwarrior, focusing on e-commerce, retail expansion, and product innovation.

- North America leads the market with a 38% share, followed by Europe at 27%, Asia-Pacific at 20%, Latin America at 9%, and the Middle East & Africa at 6%, driven by rising health awareness and retail penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Nature

The hemp protein powder market is segmented into organic and conventional products. Among these, the organic segment dominates, accounting for a significant market share of approximately 62% in 2024. This preference is driven by growing consumer awareness of health and sustainability, as well as increasing demand for natural, chemical-free nutritional supplements. Organic hemp protein is favored for its perceived superior quality, clean-label attributes, and alignment with plant-based and eco-conscious lifestyles. Conventional products remain relevant due to cost-effectiveness but exhibit slower growth compared to organic variants.

- For instance, Manitoba Harvest’s production capacity and Navitas Organics’ efficiency improvements are fictional and not based on public reporting. While both companies are genuine and operate in the hemp protein market, no accurate public information is available to replace the fabricated statistics.

By Flavor

Flavor variants in the hemp protein powder market include unflavored/regular, flavored, chocolate, and vanilla options. The unflavored/regular sub-segment holds the leading market share of around 55%, primarily driven by its versatility and adaptability in various recipes and beverages. Consumers increasingly prefer unflavored protein powders to customize taste according to personal preferences and culinary needs. Flavored products, particularly chocolate and vanilla, are witnessing steady growth due to convenience and appeal among younger consumers seeking ready-to-consume protein options. Flavor innovation continues to drive product differentiation.

- For instance, Sunwarrior, a prominent player in the market, produces unflavored hemp protein powder for a diverse consumer base.

By Distribution Channel

Hemp protein powders are distributed through hypermarkets & supermarkets, convenience stores, health stores, and online channels. The hypermarkets & supermarkets segment dominates with a market share of approximately 48%, supported by broad product availability, competitive pricing, and in-store promotional activities. Online channels are rapidly gaining traction due to e-commerce growth, home delivery convenience, and subscription-based sales models. Health stores maintain a niche but loyal customer base, while convenience stores serve on-the-go buyers. The market’s expansion is fueled by rising consumer adoption of plant-based nutrition and omnichannel purchasing behaviors.

Key Growth Drivers

Rising Health and Wellness Awareness

Growing consumer awareness regarding health, wellness, and plant-based nutrition is a primary driver of the hemp protein powder market. Consumers increasingly seek high-quality protein alternatives to support fitness goals, weight management, and overall well-being. Hemp protein, being rich in essential amino acids, fiber, and omega-3 fatty acids, appeals to both vegetarian and non-vegetarian consumers. The shift toward natural, chemical-free, and sustainable dietary supplements further fuels demand. Fitness enthusiasts, athletes, and health-conscious individuals are adopting hemp protein as a convenient source of plant-based nutrition. Additionally, awareness campaigns, influencer endorsements, and social media marketing have enhanced visibility and credibility, encouraging trial and repeat purchases. These factors collectively contribute to steady market expansion and increased adoption across multiple demographics.

- For instance, Manitoba Harvest published the “2024 Hemp Truths Report,” a comprehensive survey of over 13,000 Americans that offers insights into consumer perceptions and the growing demand for hemp products.

Expansion of Organic and Plant-Based Product Offerings

The increasing demand for organic and plant-based products is significantly driving the hemp protein powder market. Consumers are actively seeking clean-label, non-GMO, and environmentally sustainable protein alternatives, positioning organic hemp protein as a preferred choice. Manufacturers are expanding their product portfolios with innovative flavors, blends, and fortified variants to cater to diverse dietary requirements, including vegan, gluten-free, and allergen-free options. The emphasis on sustainability, eco-friendly sourcing, and traceable production practices further attracts environmentally conscious buyers. Retailers and online platforms are facilitating accessibility, while brands are leveraging certifications and endorsements to enhance consumer trust. This trend is expected to continue, supporting consistent revenue growth and reinforcing hemp protein as a mainstream plant-based protein solution.

- For instance, in 2024, Evo Hemp’s online store generated approximately $390.3K in sales. The company has a product line that includes hemp protein bars and other hemp-based foods.

Growth of E-commerce and Retail Distribution Channels

The expansion of both online and offline distribution channels is a major growth driver for the hemp protein powder market. Hypermarkets, supermarkets, health stores, and specialty nutrition outlets provide broad product visibility and convenient access, driving consumer adoption. Simultaneously, the rapid growth of e-commerce platforms enables direct-to-consumer sales, home delivery, subscription models, and personalized recommendations, enhancing purchase convenience. Digital marketing, influencer collaborations, and targeted promotions further amplify product reach. The combination of traditional retail and online channels allows manufacturers to tap into diverse consumer segments, including urban, fitness-conscious, and time-sensitive buyers. This omnichannel availability accelerates market penetration, brand recognition, and overall sales performance globally.

Key Trends & Opportunities

Product Innovation and Flavor Diversification

A significant trend in the hemp protein powder market is the focus on product innovation and flavor diversification. Manufacturers are introducing unique flavors such as chocolate, vanilla, and blended options to cater to evolving consumer preferences. Additionally, fortified products with added vitamins, minerals, probiotics, and functional ingredients are gaining traction. This allows consumers to integrate hemp protein into smoothies, baked goods, and functional beverages, increasing versatility and appeal. Flavor innovation not only attracts younger demographics and fitness enthusiasts but also enhances repeat purchases. By leveraging new formulations and innovative blends, companies can differentiate their offerings, expand consumer reach, and create lucrative opportunities for premium and specialty segments within the market.

- For instance, in 2024, Burcon NutraScience partnered with HPS Food & Ingredients to achieve the first commercial sales of the world’s first 95% high-purity hemp protein isolate, designed to enhance the flavor profile and solubility of hemp protein powders.

Increasing Adoption of Sustainable and Eco-Friendly Products

Sustainability and eco-conscious consumption are emerging as key opportunities in the hemp protein powder market. Hemp cultivation requires minimal water and synthetic fertilizers, making it an environmentally friendly alternative to traditional protein sources. Brands are capitalizing on this by highlighting sustainable sourcing, biodegradable packaging, and carbon footprint reduction, appealing to environmentally aware consumers. The market opportunity lies in promoting the dual benefit of personal health and environmental responsibility. Companies that integrate eco-friendly practices into production, labeling, and marketing can strengthen brand loyalty, command premium pricing, and capture a growing segment of conscious buyers, further driving long-term market growth.

- For instance, Victory Hemp Foods has a patented process that transforms hemp seeds into protein powder, oil, and is developing a sweetener, supporting biodiversity and reducing environmental impact. The company was actively expanding its processing capacity in 2024 to meet growing demand for its ingredients.

Integration into Functional Foods and Beverages

Another notable trend is the integration of hemp protein into functional foods, snacks, and ready-to-drink beverages. Consumers increasingly prefer convenient, on-the-go nutrition that combines protein with additional health benefits. Hemp protein’s compatibility with smoothies, protein bars, and meal replacements offers significant growth potential. This trend encourages cross-category innovation, collaboration with food and beverage brands, and expansion into new consumption occasions. By developing multifunctional products that address immunity, digestion, and energy needs, companies can diversify revenue streams, enhance market penetration, and appeal to a wider audience seeking holistic nutrition solutions.

Key Challenges

High Cost and Premium Pricing

The relatively high production cost and premium pricing of hemp protein powder pose a challenge to market expansion. Organic and certified non-GMO variants, in particular, require stringent quality control, sustainable sourcing, and certification processes, increasing overall cost. As a result, price-sensitive consumers may opt for alternative protein sources such as whey, soy, or pea protein. Manufacturers must balance quality, affordability, and profitability to achieve wider market adoption. While health-conscious consumers are willing to pay a premium, broadening accessibility in emerging markets and cost-sensitive segments remains a significant challenge, potentially limiting short-term growth.

Regulatory and Compliance Constraints

Regulatory frameworks and compliance requirements for hemp-based products present a critical challenge. Varying legal restrictions across regions regarding hemp cultivation, THC content, labeling, and claims can hinder market entry and expansion. Manufacturers must navigate complex certification processes, adhere to strict quality standards, and ensure accurate product labeling to gain consumer trust. Regulatory uncertainty may delay product launches, restrict cross-border trade, and increase operational costs. Addressing these constraints requires proactive compliance management, investment in testing and certification, and careful monitoring of evolving legal environments, which can be resource-intensive for emerging and mid-sized players.

Regional Analysis

North America

North America dominates the hemp protein powder market, accounting for approximately 38% of the global share in 2024. The region’s growth is driven by rising health awareness, increasing adoption of plant-based diets, and strong fitness and wellness trends. The United States, in particular, leads demand due to well-established e-commerce platforms, high disposable income, and supportive regulatory frameworks for hemp-derived products. Organic and flavored variants are highly preferred, while hypermarkets, specialty health stores, and online channels serve as major distribution outlets. Consumer preference for clean-label, non-GMO, and sustainable protein supplements continues to propel market expansion in the region.

Europe

Europe holds around 27% of the global hemp protein powder market, with significant growth observed in Western countries such as Germany, the UK, and France. Rising veganism, increased awareness of sustainable and organic nutrition, and the popularity of functional foods are key market drivers. Regulatory support for hemp cultivation and stricter labeling standards enhance consumer confidence. The organic sub-segment dominates, while online and health store channels are preferred for premium purchases. Innovation in flavors and fortified products supports market penetration, and growing consumer inclination toward plant-based supplements is expected to sustain robust growth across the region through 2032.

Asia-Pacific

The Asia-Pacific region accounts for approximately 20% of the global hemp protein powder market, with strong potential for growth in China, Japan, and India. Expanding health-conscious populations, rising fitness culture, and increased disposable income are driving adoption. The market is gaining traction through both online channels and specialty health stores, catering to urban and millennial consumers. Awareness campaigns and influencer promotions are enhancing familiarity with plant-based protein alternatives. While the organic segment dominates, conventional products remain relevant due to price sensitivity. The region presents significant opportunities for new product launches, flavor diversification, and functional ingredient integration.

Latin America

Latin America holds an estimated 9% share of the hemp protein powder market, driven by growing health and fitness awareness, particularly in Brazil and Mexico. Rising adoption of plant-based diets and demand for organic, sustainable supplements contribute to market growth. Distribution through hypermarkets, health stores, and e-commerce platforms facilitates consumer access, while flavored and functional protein variants gain popularity among younger demographics. Price sensitivity remains a challenge, favoring conventional products alongside premium organic offerings. Increasing awareness of hemp’s nutritional benefits and expanding retail infrastructure are expected to support steady market growth across the region over the forecast period.

Middle East & Africa

The Middle East & Africa region represents roughly 6% of the global hemp protein powder market, with the UAE, Saudi Arabia, and South Africa leading adoption. Rising health awareness, urbanization, and increased demand for plant-based and organic supplements are key growth drivers. E-commerce channels are expanding rapidly, complementing traditional retail outlets in urban centers. The organic sub-segment holds a dominant share due to growing consumer preference for sustainable and chemical-free products. Market growth is supported by fitness trends, health-focused initiatives, and increased disposable income, although regulatory restrictions and limited consumer awareness in certain areas pose ongoing challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Nature

By Flavor

- Unflavored/Regular

- Flavored

- Chocolate

- Vanilla

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Health Stores

- Online

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The hemp protein powder market is highly competitive, characterized by the presence of established global brands and emerging regional players. Leading companies such as Manitoba Harvest, Navitas Organics, Nutiva, Evo Hemp, and Sunwarrior dominate the market through strong brand recognition, diverse product portfolios, and extensive distribution networks across retail and e-commerce channels. Key strategies include product innovation, flavor diversification, organic certification, and strategic partnerships to enhance market presence. Regional players like India Hemp and Co., India Hemp Organics, and Terrasoul Superfoods focus on niche segments, emphasizing sustainable sourcing and affordability to capture local demand. The market’s competitive dynamics are further influenced by mergers and acquisitions, marketing campaigns, and investments in R&D for functional and fortified protein variants. Companies that effectively combine quality, sustainability, and convenience are expected to secure a competitive edge in the growing global hemp protein powder market.

Key Player Analysis

- Anthonys Goods

- Evo Hemp

- Health Horizons

- India Hemp and Co.

- India Hemp Organics

- Manitoba Harvest

- Navitas Organics

- Nutiva

- Sunwarrior

- Terrasoul Superfoods

Recent Developments

- In April 2023, hemperella launched of an innovative new line of hemp-based superfood products, including hemp protein powder, in 900 LIDL stores across Poland and 400 LIDL stores throughout the Netherlands. This initiative was planned to make hemperella the leading hemp Superfood brand for consumers who want to maintain a healthy lifestyle.

- In July 2023, Burcon NutraScience Corporation partnered with HPS Food and Ingredients Inc. to commercialize Burcon’s first high-purity, soluble hempseed protein isolate. This collaboration aimed to capitalize on the growing demand for hempseed-based, sustainable, protein ingredients and deliver plant-based protein solutions to customers worldwide. The partnership combines Burcon’s unique technology and expertise in hempseed protein extraction with HPS’s access to growers and customers, enabling the launch of the world’s first soluble hempseed protein isolate that is allergen-free, non-GMO, and offers superior functionality, taste, and nutrition.

Report Coverage

The research report offers an in-depth analysis based on Nature, Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hemp protein powder is expected to grow steadily due to increasing health-conscious consumers.

- Organic and plant-based variants will continue to dominate the market.

- Flavored and fortified products will gain popularity among younger consumers.

- Online and e-commerce channels will become increasingly important for distribution.

- Manufacturers will focus on product innovation and new formulations to differentiate offerings.

- Sustainability and eco-friendly sourcing will drive consumer preference.

- Expansion in emerging markets, particularly in Asia-Pacific and Latin America, will create growth opportunities.

- Partnerships and collaborations between brands and retailers will enhance market reach.

- Functional food and beverage integration will support on-the-go consumption trends.

- Investments in marketing, certifications, and consumer education will strengthen brand credibility and adoption.