Market overview

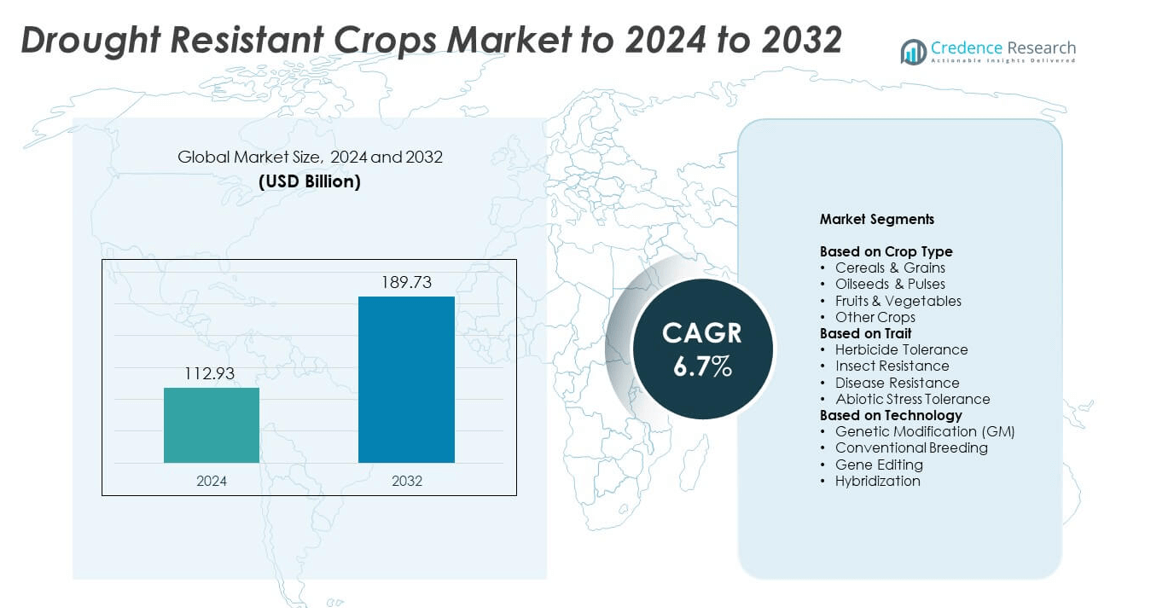

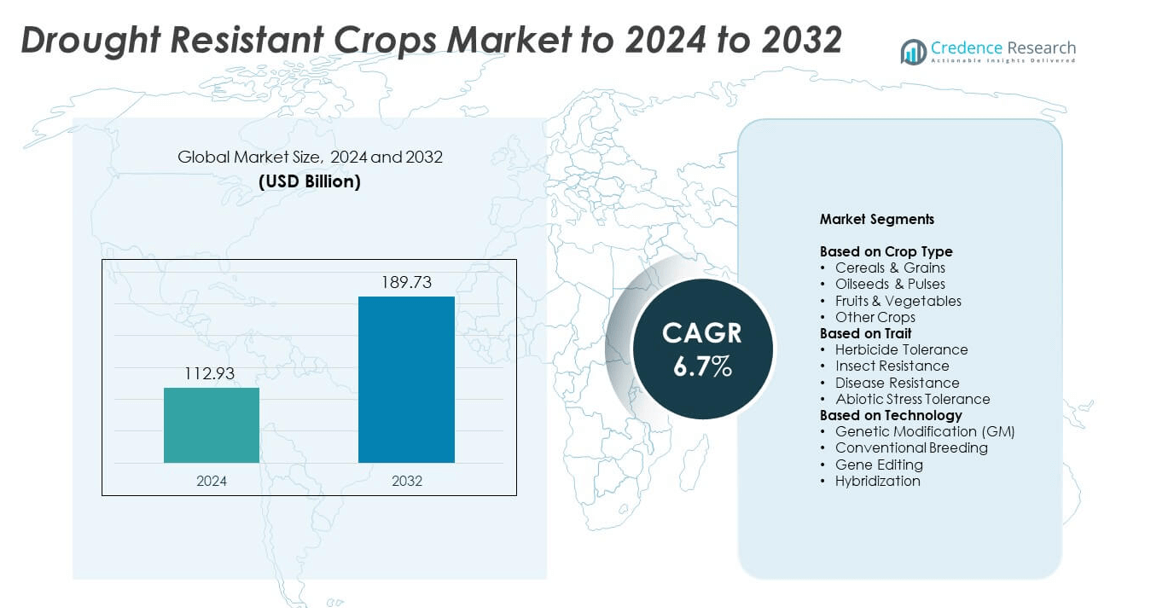

The Drought Resistant Crops Market size was valued at USD 112.93 billion in 2024 and is anticipated to reach USD 189.73 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drought Resistant Crops Market Size 2024 |

USD 112.93 billion |

| Drought Resistant Crops Market, CAGR |

6.7% |

| Drought Resistant Crops Market Size 2032 |

USD 189.73 billion |

The drought resistant crops market is led by major players such as Bayer CropScience LLC, Syngenta AG, Corteva, BASF SE, Monsanto Company, and Nuseed Pty Ltd. These companies are advancing seed innovation through genetic modification, hybrid breeding, and gene editing technologies to enhance water-use efficiency and yield stability. Strategic collaborations with research institutes and governments strengthen their R&D capabilities and product portfolios. North America remains the leading region, accounting for 36% of the global market share in 2024, supported by large-scale adoption of GM crops, favorable policies, and advanced agricultural infrastructure driving sustained regional growth

Market Insights

- The drought resistant crops market was valued at USD 112.93 billion in 2024 and is projected to reach USD 189.73 billion by 2032, growing at a CAGR of 6.7%.

- Rising climate variability and water scarcity are key drivers, pushing farmers to adopt resilient crop varieties to maintain yield stability.

- Technological trends such as gene editing, molecular breeding, and hybridization are improving drought tolerance and reducing crop loss.

- Leading companies focus on biotechnology advancements and partnerships to strengthen their market position and expand seed portfolios globally.

- North America led with a 36% share in 2024, followed by Europe at 27% and Asia-Pacific at 24%, while the cereals and grains segment held the largest share of 47% due to its widespread cultivation and food security importance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Crop Type

The cereals and grains segment dominated the drought resistant crops market with a 47% share in 2024. This dominance is attributed to the widespread cultivation of crops like maize, wheat, and rice, which are highly vulnerable to water scarcity. Enhanced breeding programs and genetically modified variants with improved drought tolerance have strengthened productivity in arid regions. Governments and research organizations are promoting resilient cereal varieties to ensure food security under climate stress. The segment’s growth is further driven by high global consumption demand and increasing adoption among small and large-scale farmers.

- For instance, In a study evaluating Bayer’s MON 87460 maize under managed drought conditions, a yield increase of 36–62% was observed for specific hybrids in trials in Lutzville, South Africa

By Trait

The abiotic stress tolerance segment held the largest share of 41% in 2024, driven by its ability to withstand water scarcity, heat, and salinity. This trait enhances crop survival and yield stability under extreme weather conditions. Biotech firms are investing heavily in developing seed varieties with multi-stress resistance for crops like maize and soybean. Increasing drought frequency and unpredictable rainfall patterns are encouraging the adoption of these traits. Governments and agricultural institutes also support the development of stress-tolerant cultivars through subsidies and technology-sharing initiatives.

- For instance, Syngenta’s NK9175-DV corn outyielded DEKALB by 8.9 bu/acre in northern trials (N=33).

By Technology

The genetic modification (GM) segment led the market with a 52% share in 2024, owing to its effectiveness in developing high-yield and drought-tolerant seeds. GM technology allows precise gene transfer, enhancing resistance to environmental stress while maintaining crop quality. The growing acceptance of GM crops in developing regions and the strong regulatory framework in North America and Brazil support market expansion. Companies are focusing on CRISPR-enhanced GM seeds that improve drought resilience and nutrient efficiency. The segment’s growth is reinforced by ongoing advancements in molecular biology and gene sequencing tools.

Key Growth Drivers

Rising Climate Variability and Water Scarcity

Increasing drought frequency and unpredictable rainfall are driving the demand for resilient crop varieties. Farmers are adopting drought-tolerant seeds to ensure stable yields under water-limited conditions. Governments and agricultural research bodies are funding breeding programs to mitigate the impact of climate change on crop productivity. The growing awareness of food security challenges further boosts the development of climate-resilient crops, especially in regions prone to prolonged dry spells.

- For instance, Monsanto’s CRISPR-edited ARGOS8 maize added 5 bu/acre under flowering drought.

Advancements in Agricultural Biotechnology

Rapid innovations in genetic modification, gene editing, and molecular breeding are accelerating the development of drought-resistant seeds. Companies are investing in precision genetic tools that enhance water-use efficiency and yield potential. These biotechnological advancements have expanded the range of stress-tolerant crop varieties across cereals, pulses, and vegetables. The adoption of advanced genomics and molecular marker-assisted breeding has improved the efficiency and accuracy of drought-resistance trait selection.

- For instance, Corteva’s CRISPR waxy corn averaged +5.5 bu/acre across 25 field locations. It was developed >1 year faster than conventional methods.

Government Support and Policy Initiatives

Supportive policies promoting sustainable agriculture and seed innovation are strengthening market growth. Governments in drought-prone regions are offering subsidies, R&D funding, and extension programs to encourage adoption of drought-resistant crops. International initiatives from organizations like FAO and CGIAR also promote resilient agriculture. These policy efforts are crucial in boosting farmer awareness, enabling technology transfer, and expanding access to high-performance seeds in developing economies.

Key Trends and Opportunities

Integration of Gene Editing Technologies

The adoption of CRISPR-Cas9 and other gene-editing tools is transforming drought-resilient crop breeding. These technologies allow precise modification of genes responsible for water stress tolerance and yield stability. Seed developers are integrating these methods to reduce breeding time and cost. The trend is creating opportunities for faster commercialization of high-performance crop varieties, especially in markets with supportive biosafety regulations and strong biotech infrastructure.

- For instance, according to an AgTechNavigator.com report from January 8, 2025, Inari is aiming for a 10% to 20% increase in yield for crops such as soybeans, corn, and wheat, using AI and gene editing technology.

Expansion of Climate-Smart Agriculture Practices

The growing focus on climate-smart agriculture is creating significant opportunities for drought-resistant crop adoption. Farmers are combining resilient seed varieties with precision irrigation and digital monitoring tools to optimize water use. Governments and agribusinesses are promoting integrated solutions to enhance sustainability and productivity. This shift toward holistic farm management aligns with global goals to improve resource efficiency and reduce climate risk in agriculture.

- For instance, Netafim drip-irrigated rice used 70% less water and cut methane to near zero.

Key Challenges

Regulatory and Public Acceptance Issues

Strict regulatory frameworks and public skepticism toward genetically modified crops continue to restrict market expansion. Many countries maintain lengthy approval processes for GM and gene-edited varieties, delaying commercialization. Limited public understanding of biotechnology benefits also hinders adoption in certain regions. Addressing biosafety concerns and improving transparency in research communication remain essential for broader acceptance of drought-resistant technologies.

High Development Costs and Limited Farmer Accessibility

Developing drought-resistant varieties through genetic modification and advanced breeding involves significant R&D investment. Small and medium farmers often face affordability barriers due to high seed costs and limited distribution networks. Insufficient access to financing and technical support further constrains adoption in emerging markets. Reducing production costs and improving outreach programs are key to expanding the availability of resilient seeds across all agricultural scales.

Regional Analysis

North America

North America held the largest share of 36% in the drought resistant crops market in 2024. The region’s dominance is driven by strong adoption of genetically modified seeds in the United States and Canada. Major seed producers and biotech companies invest heavily in R&D to develop water-efficient crop varieties. Government initiatives supporting sustainable farming and climate-resilient agriculture further boost regional growth. Widespread use of advanced irrigation technologies and precision farming practices strengthens the market presence of drought-resistant crops across major agricultural zones.

Europe

Europe accounted for a 27% share of the drought resistant crops market in 2024. The region’s growth is supported by the EU’s focus on sustainable agriculture and climate adaptation policies. Countries such as Spain, Italy, and France are adopting drought-tolerant varieties due to frequent dry seasons and declining water availability. Investments in gene-editing research and partnerships between seed developers and research institutions promote technological innovation. Increasing awareness of climate-smart agriculture and the need to secure regional food production drive adoption across diverse crop types.

Asia-Pacific

Asia-Pacific captured a 24% share of the drought resistant crops market in 2024, driven by expanding agricultural biotechnology initiatives. Rapid population growth and rising food demand have accelerated the adoption of resilient crop varieties across India, China, and Australia. Government-led programs promoting water-efficient crops and partnerships with private seed developers support market expansion. The region benefits from large-scale field trials and public research investments focusing on climate-resilient agriculture. Growing farmer awareness and the availability of genetically improved seeds are enhancing yield stability in water-scarce regions.

Latin America

Latin America represented an 8% share of the drought resistant crops market in 2024. The region’s growth is led by Brazil and Argentina, where genetically modified maize and soybean are widely cultivated. Supportive regulatory environments and strong export demand for grains encourage the adoption of drought-tolerant technologies. Local seed companies and international agribusinesses collaborate to develop hybrid and gene-edited varieties suited for semi-arid zones. Increasing climate volatility and the need for sustainable farming practices are reinforcing the shift toward resilient crop solutions in the region.

Middle East & Africa

The Middle East and Africa accounted for a 5% share of the drought resistant crops market in 2024. The region faces severe water scarcity and frequent droughts, driving the need for high-performance seed varieties. Governments and global organizations are investing in agricultural modernization and capacity-building programs. Countries such as South Africa, Kenya, and Saudi Arabia are adopting improved maize, sorghum, and millet seeds to enhance food security. Expanding irrigation infrastructure and collaborations with international research centers are supporting the gradual adoption of drought-tolerant crops.

Market Segmentations:

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crops

By Trait

- Herbicide Tolerance

- Insect Resistance

- Disease Resistance

- Abiotic Stress Tolerance

By Technology

- Genetic Modification (GM)

- Conventional Breeding

- Gene Editing

- Hybridization

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The key players in the drought resistant crops market include Bayer CropScience LLC, Syngenta AG, Corteva, BASF SE, Nuseed Pty Ltd., Maharashtra Hybrid Seed Company (MAHYCO), Stine Seed Farm Inc., Cyanamid Agro Ltd., Calyxt Inc., INRA, and Monsanto Company. These companies focus on advanced seed development using genetic modification, gene editing, and hybridization technologies to enhance crop resilience against water stress. Strategic collaborations with agricultural research institutions and government agencies are accelerating innovation and product commercialization. Continuous investments in biotechnology research, molecular breeding, and multi-trait seed development are improving crop yield stability in arid regions. Market players are expanding distribution networks and farmer training programs to boost adoption across developing economies. Partnerships with agri-tech firms and data-driven farming platforms are strengthening their presence in precision agriculture. Competitive differentiation is increasingly defined by R&D strength, regulatory compliance, and the ability to deliver sustainable, climate-resilient seed solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer CropScience LLC

- Syngenta AG

- Corteva

- BASF SE

- Nuseed Pty Ltd.

- Maharashtra Hybrid Seed Company (MAHYCO)

- Stine Seed Farm Inc.

- Cyanamid Agro Ltd.

- Calyxt Inc.

- INRA

- Monsanto Company

Recent Developments

- In 2024, Corteva announced a new non-GMO hybrid wheat technology that showed promising results in research trials, indicating potential for higher yields in water-stressed environments and contributing to global food security.

- In 2023, Bayer and the gene-editing company Pairwise announced an extended partnership focused on applying gene-editing technologies to create advanced short-stature corn. This work is intended to optimize and enhance the genetics for future use within Bayer’s broader Preceon™ Smart Corn System, which combines multiple technologies to produce shorter, more resilient corn.

- In 2023, INRA launched a Jawahir new drought-tolerant durum wheat variety in Morocco

Report Coverage

The research report offers an in-depth analysis based on Crop Type, Trait, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of drought-tolerant crop varieties will expand as climate change intensifies.

- Gene editing and molecular breeding will enhance drought resistance and crop yield.

- Governments will increase funding for climate-resilient agricultural programs.

- Biotechnology firms will focus on developing multi-trait drought-resistant seeds.

- Farmers will shift toward precision irrigation and digital monitoring for better efficiency.

- Partnerships between research institutes and agribusinesses will accelerate innovation.

- Developing regions will see faster adoption through subsidy and awareness programs.

- Hybridization technologies will gain traction for improving seed adaptability.

- Regulatory harmonization will support commercialization of gene-edited crops.

- Rising global food demand will strengthen long-term investment in resilient farming systems.