Market Overview

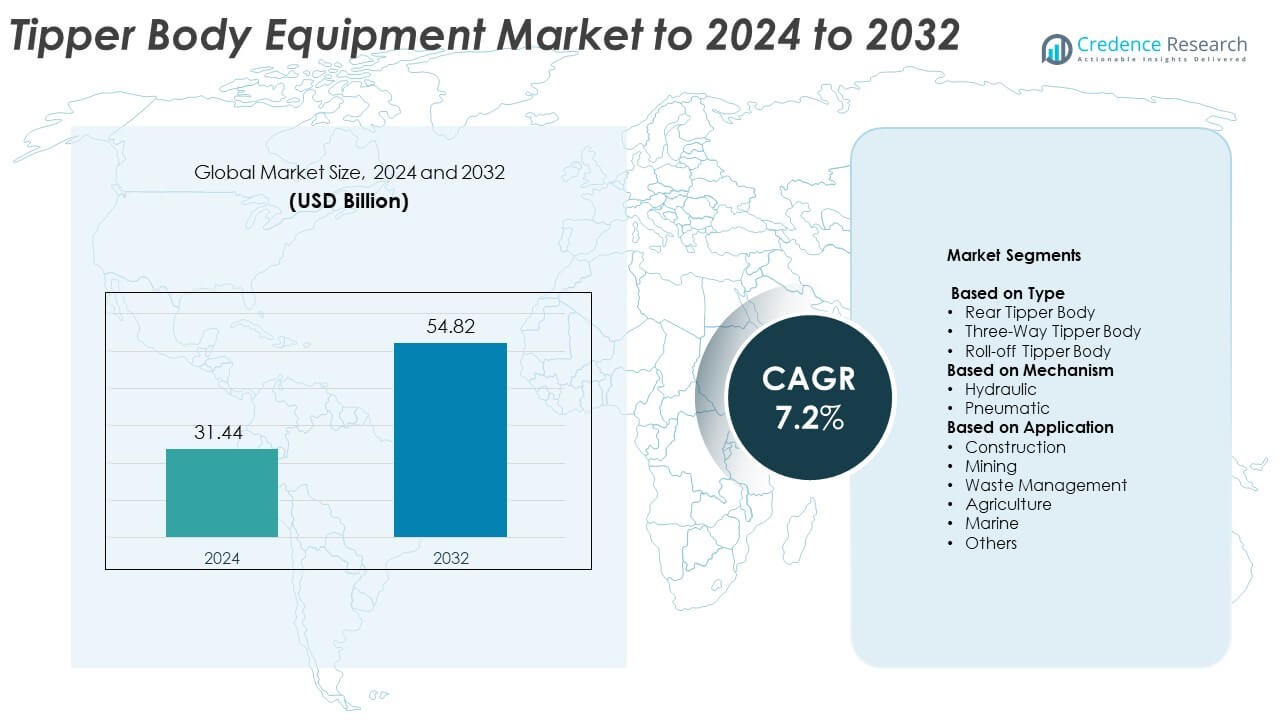

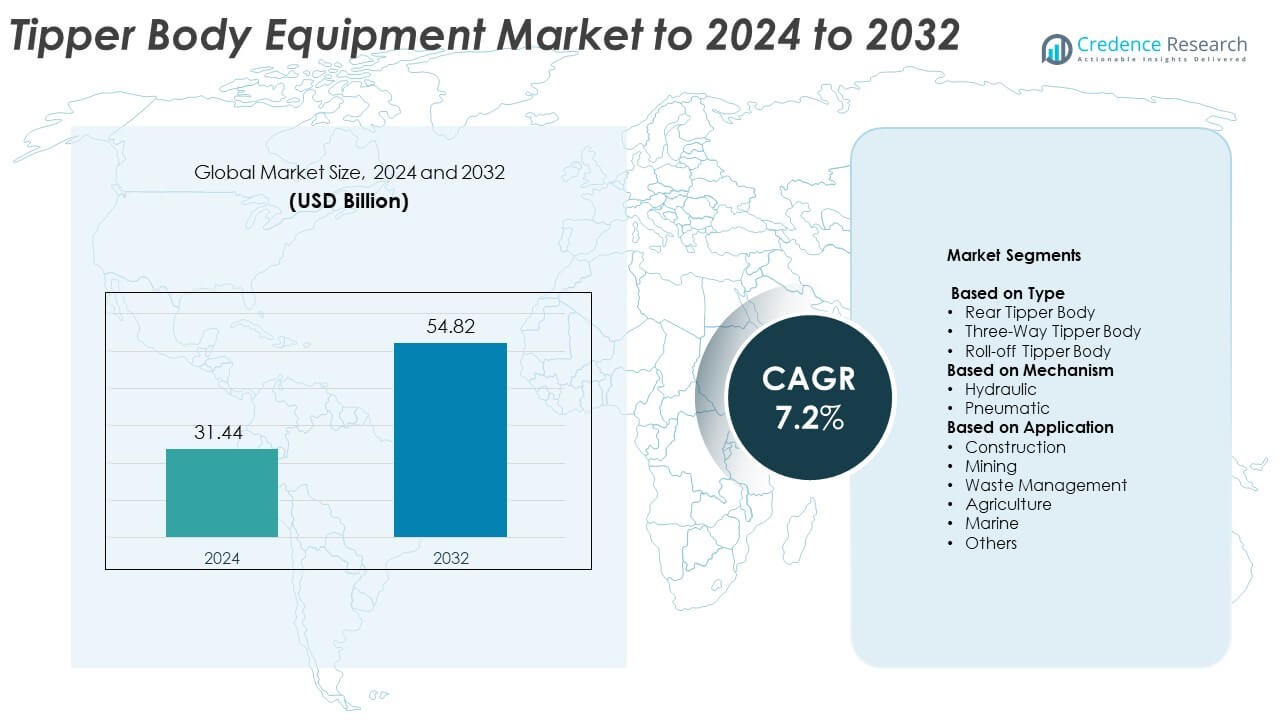

The tipper body equipment market size was valued at USD 31.44 billion in 2024 and is anticipated to reach USD 54.82 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tipper Body Equipment Market Size 2024 |

USD 31.44 Billion |

| Tipper Body Equipment Market, CAGR |

7.2% |

| Tipper Body Equipment Market Size 2032 |

USD 54.82 Billion |

The tipper body equipment market is characterized by strong competition among major players such as Tata Motors, Hyva, Schmitz Cargobull AG, Thompsons Ltd, MEILLER Kipper, Propel Industries, and Crysteel Manufacturing Inc. These companies focus on product innovation, lightweight materials, and hydraulic advancements to enhance vehicle efficiency and load performance. Strategic partnerships and regional expansions strengthen their global presence, particularly in construction and mining applications. North America led the market in 2024 with a 34.7% share, driven by extensive infrastructure investments and modern fleet upgrades, followed by Asia-Pacific and Europe, which are witnessing rapid industrial growth and technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The tipper body equipment market was valued at USD 31.44 billion in 2024 and is projected to reach USD 54.82 billion by 2032, growing at a CAGR of 7.2%.

- Strong demand from construction, mining, and waste management industries is fueling market expansion globally.

- Key trends include the adoption of lightweight materials, electric tippers, and advanced hydraulic systems to enhance performance and reduce emissions.

- The market is moderately consolidated, with manufacturers focusing on automation, digital monitoring, and regional partnerships to gain a competitive edge.

- North America led the market with a 34.7% share, followed by Asia-Pacific at 29.6%, while the rear tipper body segment accounted for 58.6% of global sales.

Market Segmentation Analysis:

By Type

The rear tipper body segment dominated the tipper body equipment market in 2024, accounting for 58.6% of the total share. Its dominance is due to wide use in construction and infrastructure projects requiring high-load transport and quick unloading. The design allows efficient rear discharge of bulk materials, improving operational speed and safety. Rising urban development and road expansion projects in Asia-Pacific and the Middle East further boost demand. Manufacturers focus on lightweight materials and reinforced chassis to enhance fuel efficiency and durability, strengthening the rear tipper body’s leadership position.

- For instance, Thompsons’ Loadmaster X-Lite steel body cuts unladen weight by 250 kg versus Loadmaster Lite, improving payload headroom for rear discharge work.

By Mechanism

The hydraulic segment held the dominant 72.4% share of the tipper body equipment market in 2024. Hydraulic systems provide superior lifting power, faster tipping cycles, and lower maintenance costs than pneumatic counterparts. They are widely preferred for heavy-duty operations in mining, construction, and waste management. Increasing adoption of advanced multi-stage hydraulic cylinders enhances load stability and energy efficiency. Continuous innovations in hydraulic control valves and power units by leading manufacturers improve reliability and precision, supporting the sustained growth of this segment across global industrial applications.

- For instance, Hyva’s Alpha series of tipping solutions includes FC front-end cylinders, which operate at a maximum working pressure of 250 bar.

By Application

The construction segment led the tipper body equipment market in 2024 with a 46.2% share. Expanding road networks, urban housing projects, and infrastructure investments drive strong demand for tipper trucks in this sector. Construction operations require frequent material transport, including sand, gravel, and asphalt, where tippers offer high efficiency and low downtime. Governments worldwide are increasing infrastructure budgets, further supporting market growth. Manufacturers are integrating telematics and load monitoring systems into construction-oriented tippers to enhance productivity and reduce operational risks, ensuring sustained dominance of the construction application segment.

Key Growth Drivers

Rapid Expansion in Construction and Mining Activities

The surge in global construction and mining projects is driving demand for high-capacity tipper bodies. Infrastructure modernization, road development, and mineral extraction operations require heavy-duty vehicles for material handling and transport. Emerging economies such as India, China, and Brazil are witnessing large-scale investments in housing and mining, boosting equipment sales. Manufacturers are developing advanced body designs with improved load efficiency and durability, aligning with the growing need for robust and efficient transport solutions in industrial operations.

- For instance, MEILLER’s redesigned tipping semi-trailer achieved a tare weight reduction of 320 kg, enabling higher usable payload for project haulage.

Adoption of Lightweight and High-Strength Materials

The shift toward lightweight, high-strength materials such as aluminum and advanced steel alloys is enhancing vehicle efficiency. These materials reduce fuel consumption and increase payload capacity while maintaining structural durability. Manufacturers are focusing on optimized chassis and body configurations to meet emission norms and sustainability goals. The rising emphasis on vehicle performance and fuel economy across transportation and construction sectors strengthens the demand for modern, weight-efficient tipper body designs.

- For instance, WIELTON’s Strong Master uses Hardox 450 and S700 steel and attains a maximum tipping angle of 46.5°, aiding clean discharge.

Increasing Automation and Hydraulic Advancements

Integration of advanced hydraulic systems and automation features enhances tipper body performance and safety. Modern hydraulic cylinders allow precise load handling and faster tipping cycles, improving productivity. Automation technologies, including electronic control systems and real-time diagnostics, reduce operational downtime and improve driver control. Growing adoption of smart hydraulic systems and remote monitoring technologies supports the efficiency and reliability of tipper vehicles, making automation a key growth factor in the evolving market landscape.

Key Trends & Opportunities

Growing Demand for Electrified and Hybrid Tipper Vehicles

The shift toward sustainable transportation is opening opportunities for electric and hybrid tipper trucks. OEMs are investing in battery-powered and low-emission models to meet regulatory requirements and corporate sustainability targets. Electrified tippers reduce operating costs and improve energy efficiency in urban applications. Governments offering incentives for green commercial vehicles further accelerate this transition, positioning electrification as a key opportunity for future market expansion and technological innovation.

- For instance, Volvo FE Electric offers 280–375 kWh battery options, up to 275 km range, and 28 tonnes GCW for urban tipper applications.

Integration of Telematics and Fleet Management Solutions

Advancements in digital connectivity are transforming fleet operations through telematics and IoT-enabled monitoring. Telematic systems provide real-time insights on vehicle performance, fuel usage, and maintenance schedules. Fleet managers leverage this data to optimize route planning and reduce operational costs. The growing adoption of smart monitoring in logistics and construction fleets enhances transparency, safety, and efficiency, creating strong growth potential for manufacturers integrating digital technologies into tipper body systems.

- For instance, ZF’s OptiTire monitors up to 20 rolling wheels plus two spares, delivering real-time pressure and temperature data to fleets.

Key Challenges

High Initial Investment and Maintenance Costs

The significant upfront cost of advanced hydraulic systems, reinforced materials, and automation technologies limits adoption among small fleet operators. Maintenance and replacement of components such as hydraulic cylinders, sensors, and control systems further add to operational expenses. Price-sensitive markets, particularly in developing regions, face challenges in upgrading to premium tipper body models. This cost barrier restricts widespread adoption and impacts overall market penetration, especially among medium-scale construction and mining enterprises.

Stringent Emission and Load Regulations

Evolving environmental and safety regulations are creating compliance challenges for manufacturers. Stricter emission norms and vehicle weight restrictions increase production complexity and cost. Companies must invest in R&D to develop lighter, fuel-efficient models that meet diverse regional standards. The need to balance performance, payload, and environmental compliance puts pressure on OEMs to innovate continuously while maintaining cost competitiveness, posing a significant constraint to market growth.

Regional Analysis

North America

North America held a 34.7% share of the tipper body equipment market in 2024. Strong construction and infrastructure activities in the United States and Canada drive steady equipment demand. The region benefits from large-scale highway expansion and mining operations, supported by federal funding and private investments. Advanced manufacturing capabilities and strict safety standards encourage adoption of hydraulic and smart control systems. Key players emphasize lightweight materials and automation technologies to enhance fleet productivity and comply with emission norms, further strengthening the regional market presence.

Europe

Europe accounted for 27.3% of the global tipper body equipment market in 2024. The region’s focus on sustainable transport solutions and emission reduction policies promotes innovation in lightweight aluminum and hybrid tipper designs. Countries such as Germany, the UK, and France lead in integrating telematics and automation in fleet operations. Infrastructure rehabilitation projects and strict waste management regulations boost demand for advanced tippers. European OEMs are investing in electric and hybrid tipper bodies to align with the EU’s decarbonization goals, ensuring consistent market growth.

Asia-Pacific

Asia-Pacific dominated the tipper body equipment market with a 29.6% share in 2024. Rapid urbanization, industrial expansion, and infrastructure megaprojects in China, India, and Southeast Asia drive regional demand. Government-backed road construction and mining initiatives further strengthen equipment utilization. Local manufacturers focus on cost-efficient, durable models suited for challenging terrains. Rising investments in smart cities and construction automation support technological upgrades, while expanding mining operations across Australia and Indonesia create additional growth opportunities, positioning Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America captured a 5.2% share of the tipper body equipment market in 2024. Expanding mining and construction projects in Brazil, Chile, and Mexico support moderate market growth. Public infrastructure development and regional transportation improvements are key demand drivers. However, fluctuating raw material costs and limited technological adoption constrain market expansion. Manufacturers are partnering with local distributors to enhance service networks and introduce durable, low-maintenance tipper models designed for diverse climatic conditions and rough operational environments across the region.

Middle East & Africa

The Middle East and Africa region accounted for 3.2% of the tipper body equipment market in 2024. Infrastructure development under national modernization plans such as Saudi Vision 2030 and African road-building initiatives fuel demand. The mining sector in South Africa and construction growth in the UAE and Qatar further contribute to equipment sales. However, dependency on imports and cost constraints affect local adoption. Regional governments’ focus on logistics and industrial diversification creates opportunities for global players to expand operations and offer specialized tipper solutions.

Market Segmentations:

By Type

- Rear Tipper Body

- Three-Way Tipper Body

- Roll-off Tipper Body

By Mechanism

By Application

- Construction

- Mining

- Waste Management

- Agriculture

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the tipper body equipment market include Tata Motors, Hyva, Schmitz Cargobull AG, Thompsons Ltd, Propel Industries, MEILLER Kipper, Crysteel Manufacturing Inc., Ashok Leyland, VFS Ltd, Cantoni & C S.p.A., and Ingimex Ltd. The market remains moderately consolidated, with global and regional manufacturers competing through innovation, product customization, and geographic expansion. Companies are emphasizing advanced hydraulic technologies, lightweight materials, and automated tipping mechanisms to enhance load efficiency and fuel economy. Strategic partnerships with fleet operators and construction firms strengthen aftermarket services and product reliability. Manufacturers are investing in smart control systems, telematics integration, and eco-friendly production to meet evolving emission standards. Competitive differentiation is increasingly based on operational durability, payload optimization, and compliance with safety regulations, positioning leading players to capitalize on growing infrastructure and mining activities worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tata Motors

- Hyva (Netherlands)

- Schmitz Cargobull AG (Germany)

- Thompsons (UK) Ltd (UK)

- Propel Industries (India)

- MEILLER Kipper (Germany)

- Crysteel Manufacturing Inc. (US)

- Ashok Leyland (India)

- VFS (Southampton) Ltd (UK)

- Cantoni & C S.p.A. (Italy)

- Ingimex Ltd. (UK)

Recent Developments

- In 2024, Schmitz Cargobull AG introduced an updated S.KI tipper semi-trailer with a focus on improved payload capacity.

- In 2024, Propel Industries Received Homologation certification for its 470 HEV electric heavy-duty tipper, confirming its roadworthiness.

- In 2023, Tata Motors delivered its high-end Prima VX tipper truck, featuring a new engine and driver safety and comfort enhancements, including an infotainment system.

Report Coverage

The research report offers an in-depth analysis based on Type, Mechanism, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising infrastructure and mining investments will continue driving strong demand for tipper body equipment.

- Manufacturers will focus on lightweight and durable materials to improve fuel efficiency and load capacity.

- Integration of telematics and automation will enhance operational safety and fleet management efficiency.

- Electric and hybrid tipper models will gain traction as emission norms tighten globally.

- Hydraulic system innovations will remain central to improving load handling and tipping speed.

- Emerging economies in Asia-Pacific will lead market growth due to rapid industrial expansion.

- Custom-built tippers for waste management and agriculture will create new revenue opportunities.

- Adoption of digital monitoring systems will reduce downtime and improve maintenance accuracy.

- Strategic collaborations between OEMs and fleet operators will strengthen aftermarket services.

- Growing focus on sustainability will accelerate the shift toward recyclable materials and eco-friendly production.