Market Overview:

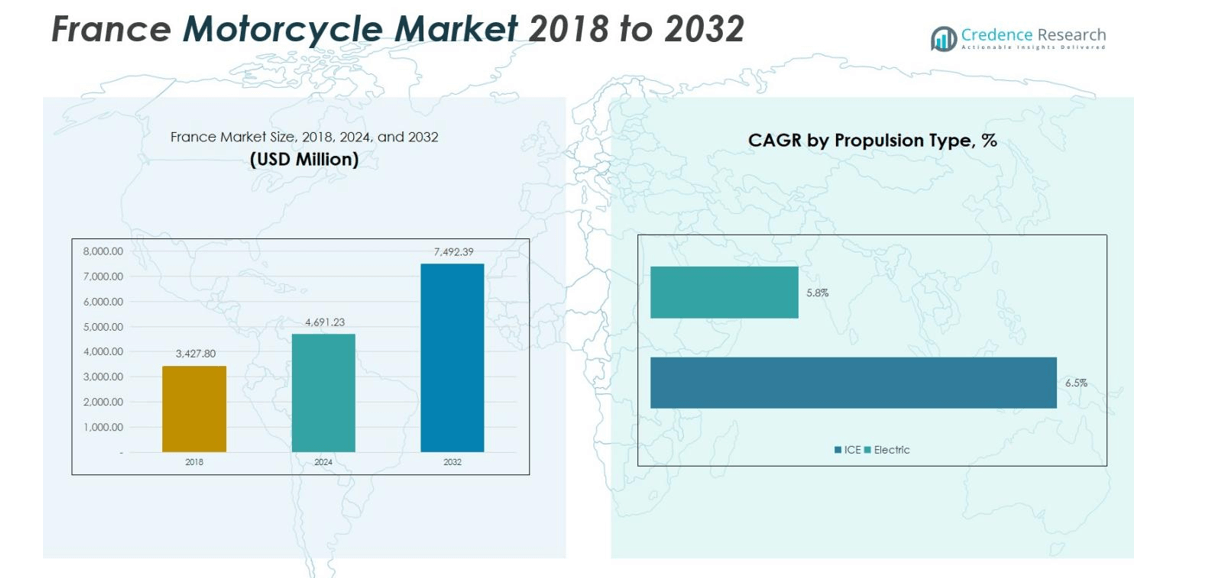

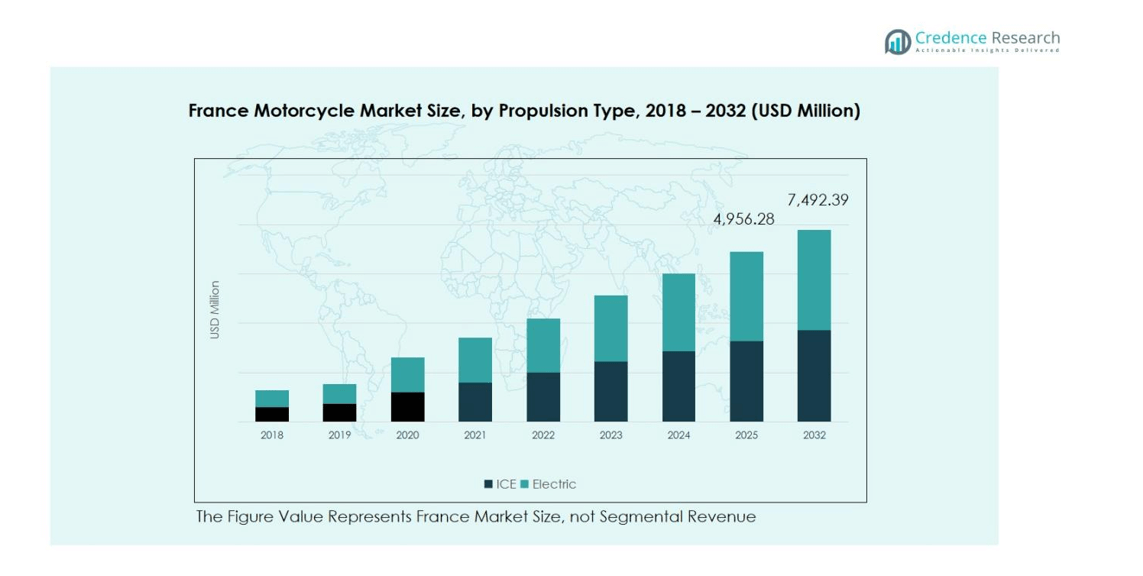

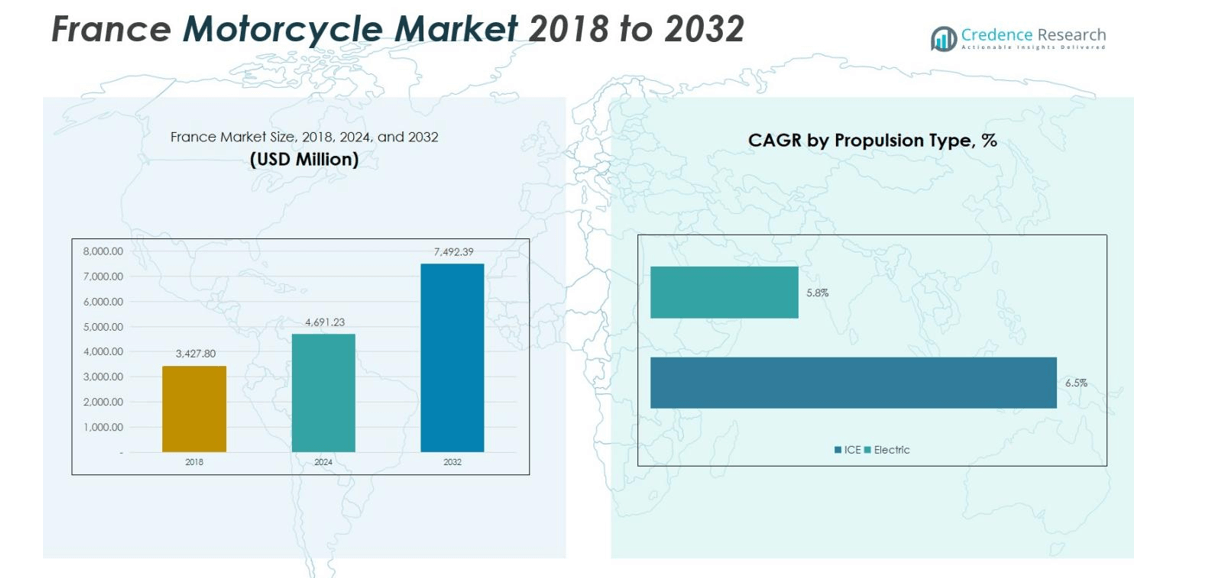

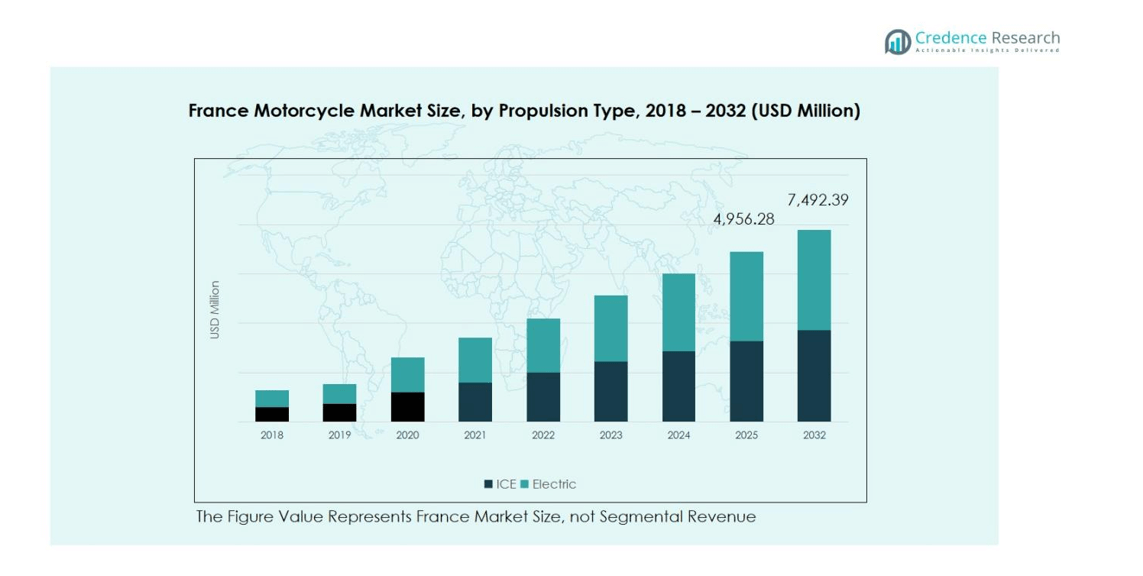

The France Motorcycle Market size was valued at USD 3,427.80 million in 2018, reaching USD 4,691.23 million in 2024, and is anticipated to attain USD 7,492.39 million by 2032, growing at a CAGR of 6.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Motorcycle Market Size 2024 |

USD 4,691.23 million |

| France Motorcycle Market, CAGR |

6.02% |

| France Motorcycle Market Size 2032 |

USD 7,492.39 million |

The France Motorcycle Market is dominated by leading manufacturers such as Polaris Inc., Peugeot Motorcycles, Triumph Motorcycles Ltd., KTM AG, BMW AG, Piaggio Group, Benda Motorcycles, Ariel Motor Company, Midual, and BSA Motorcycles. These companies maintain strong brand presence through diverse product portfolios, advanced technology integration, and extensive distribution networks. Competitive dynamics are driven by innovation in electric motorcycles, premium performance models, and sustainable mobility solutions. Regionally, Île-de-France remains the leading market, accounting for 35% of total market share in 2024, supported by dense urbanization, strong commuter demand, and high adoption of premium motorcycles.

Market Insights

- The France Motorcycle Market was valued at USD 4,691.23 million in 2024 and is projected to reach USD 7,492.39 million by 2032, growing at a CAGR of 6.02% during the forecast period.

- Market growth is driven by increasing urban mobility needs, rising disposable incomes, and the growing demand for electric motorcycles as consumers shift toward sustainable transportation.

- Trends such as integration of smart connectivity features, expansion of mid-capacity motorcycles, and premium touring models are shaping the market landscape.

- The competitive landscape is dominated by key players like Peugeot Motorcycles, KTM AG, BMW AG, Polaris Inc., and Piaggio Group, who focus on product innovation and strategic partnerships to expand their market presence.

- Regionally, Île-de-France holds the largest share at 35%, while the Standard motorcycle segment leads with 50% market share, supported by strong consumer preference for practical and affordable commuting options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motorcycle Type

The Standard segment dominates the France Motorcycle Market, accounting for nearly 50% of total sales in 2024. Its leadership stems from versatility, affordability, and suitability for daily commuting, making it a preferred choice among urban riders. The Sports segment follows with about 20% share, driven by young riders seeking performance and style, while Cruisers hold around 15%, supported by lifestyle appeal and comfort. Touring motorcycles represent roughly 10% share, favored by long-distance riders, and Others, including adventure and off-road bikes, comprise the remaining 5%, reflecting niche but rising interest.

- For instance, the Honda CB500 series continues to be popular for its versatility and affordability, making it a preferred choice for urban riders.

By Propulsion Type

The Internal Combustion Engine (ICE) segment retains a commanding 80% market share in France due to mature infrastructure, established servicing networks, and consumer familiarity with traditional engines. However, the Electric motorcycle segment, with a growing 20% share, is expanding rapidly. Government subsidies, urban emission regulations, and an increasing focus on sustainability are accelerating electric adoption. French cities such as Paris are pushing for cleaner mobility solutions, which is expected to significantly enhance the electric segment’s penetration by 2032.

- For instance, Yamaha Motor’s recent investment in the French electric motorcycle firm Electric Motion highlights industry confidence in market growth.

By Engine Capacity

Motorcycles with up to 200cc engines dominate the French market with a 50% share, owing to affordability, low maintenance, and ease of maneuverability in urban areas. The 200cc–400cc segment follows with 25%, appealing to riders seeking better performance at moderate costs. The 400cc–800cc range accounts for 15%, driven by mid-tier premium demand, while above 800cc motorcycles hold 10% share, attracting affluent riders preferring high-end touring and performance models. Overall, engine capacity preferences align closely with France’s urban commuting trends and economic diversity.

Key Growth Drivers

Rising Urban Mobility and Commuter Demand

France’s growing urban population and worsening traffic congestion are driving the demand for motorcycles as efficient personal transport solutions. Cities like Paris, Lyon, and Marseille have seen increasing adoption of two-wheelers for daily commuting due to their fuel efficiency and ability to navigate narrow streets. Affordable entry-level models and the rising number of younger riders choosing motorcycles over cars further strengthen market expansion. Additionally, the availability of flexible financing options and lower operational costs continue to enhance motorcycle adoption across urban France.

Technological Advancements and Electrification

The rapid integration of advanced technologies, including smart connectivity, ABS, traction control, and digital dashboards, is enhancing rider safety and comfort. Moreover, France’s strong regulatory support for clean mobility is accelerating the shift toward electric motorcycles. Manufacturers are investing heavily in battery efficiency and charging infrastructure to meet environmental goals. These innovations not only improve performance and sustainability but also attract tech-savvy consumers seeking modern, eco-friendly mobility options, thereby fostering sustained growth in both electric and premium motorcycle segments.

- For instance, Ducati’s V21L prototype, launched in 2021, demonstrates high-performance capabilities with electric power, benefiting from Ducati’s racing expertise.

Expanding Recreational and Tourism Activities

Rising interest in recreational motorcycling and long-distance touring is boosting premium bike sales across France. Improved road infrastructure, scenic routes, and motorcycle tourism events are drawing both local and international enthusiasts. Manufacturers are capitalizing on this lifestyle trend by launching touring and adventure models equipped with enhanced comfort and safety features. Furthermore, the growing influence of motorcycle clubs and riding communities promotes brand engagement and aftermarket spending, driving sustained revenue growth within the high-capacity and leisure motorcycle segments.

- For instance, BMW reported that its flagship adventure bikes (the R 1300 GS and R 1250 GS Adventure) accounted for more than 68,000 units globally in 2024, highlighting strong demand for high-capability leisure machines.

Key Trends & Opportunities

Growth of Electric and Hybrid Motorcycles

France’s transition toward sustainable mobility is creating significant opportunities for electric and hybrid motorcycles. Supportive government policies, including subsidies, reduced registration fees, and emission-free zones, are encouraging consumers to adopt cleaner alternatives. Advancements in battery range, charging speed, and vehicle performance are overcoming early adoption barriers. As cities tighten emission norms, electric motorcycles are expected to become a central part of urban transport networks, opening new revenue streams for manufacturers and investors in the coming decade.

- For instance, Zero Motorcycles employs custom lithium-ion batteries that retain 80% capacity after 1,500 cycles, enabling longer range and durability.

Integration of Smart and Connected Features

The adoption of IoT-enabled and AI-assisted technologies is transforming the riding experience in France. Features like GPS navigation, real-time diagnostics, anti-theft alerts, and smartphone connectivity are becoming standard in premium and mid-range models. Manufacturers are focusing on digital integration to enhance rider safety and convenience while appealing to a younger, tech-oriented consumer base. This digital shift is also fostering data-driven after-sales services and subscription-based models, creating new business opportunities across the value chain.

- For instance, BMW Motorrad’s ConnectedRide system integrates navigation, tire pressure monitoring, and emergency call features through a TFT display.

Key Challenges

High Cost of Electric Motorcycles and Infrastructure Limitations

Despite strong government initiatives, the high initial cost of electric motorcycles and limited charging infrastructure continue to constrain adoption. Battery replacement expenses and range limitations deter price-sensitive consumers. Rural regions in France still lack adequate charging stations, which restricts long-distance usability. To sustain momentum, manufacturers and policymakers must collaborate to improve affordability, expand charging networks, and promote cost-efficient battery technologies that align with consumer expectations for convenience and reliability.

Stringent Regulations and Safety Concerns

France’s evolving environmental and safety regulations present compliance challenges for manufacturers. Stricter emission standards, licensing requirements, and safety certifications increase production costs and delay new model launches. Additionally, road safety concerns linked to high-speed motorcycles deter new riders and impact insurance premiums. To address these challenges, the industry must invest in advanced safety features, rider training programs, and regulatory harmonization to balance compliance costs with consumer accessibility and market competitiveness.

Regional Analysis

Île-de-France

Île-de-France dominates the France Motorcycle Market with a market share of 35%, driven by dense urbanization, high commuter demand, and favorable infrastructure for two-wheelers. The region’s growing preference for motorcycles as a solution to heavy traffic congestion in Paris and nearby metropolitan areas continues to strengthen sales. Rising adoption of electric motorcycles, supported by city-level emission control policies and dedicated parking zones, further fuels growth. Moreover, a strong presence of dealerships, rental services, and maintenance networks makes Île-de-France the central hub for motorcycle sales and innovation.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur holds a 20% market share, supported by the region’s tourism-driven demand and favorable climate for year-round riding. The scenic routes along the French Riviera and the Alps attract both domestic and international motorcycle enthusiasts. High-income consumers in cities like Nice and Marseille contribute significantly to premium and touring motorcycle sales. Local events and motorcycle rallies strengthen the region’s recreational riding culture, while the growing adoption of electric and hybrid models aligns with regional sustainability initiatives, further expanding market opportunities.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounts for 18% of the France Motorcycle Market, driven by its blend of urban commuters and adventure riders. The region’s diverse terrain, including mountainous routes, promotes the popularity of touring and adventure motorcycles. Strong economic activity in cities like Lyon and Grenoble supports steady sales of mid-capacity and premium models. Additionally, the region’s growing investment in electric vehicle infrastructure and government incentives for low-emission mobility are encouraging a gradual transition toward electric motorcycles, enhancing its long-term market potential.

Occitanie

Occitanie captures 15% of the market share, propelled by its expanding leisure and commuter segments. The region benefits from a favorable climate and well-connected road networks that encourage motorcycle use for both transportation and recreation. Rising adoption of mid-capacity motorcycles among working professionals and students, particularly in Toulouse and Montpellier, fuels consistent growth. Moreover, increasing eco-awareness and public investment in sustainable mobility initiatives support gradual expansion of the electric motorcycle segment, positioning Occitanie as a promising growth region within southern France.

Hauts-de-France and Other Regions

Hauts-de-France, along with other northern and western regions, collectively holds a 12% market share. The region’s demand is supported by commuter-oriented sales and increasing interest in low-capacity motorcycles suited for urban and suburban mobility. Industrial zones and cross-border connectivity with Belgium also contribute to trade and distribution activities. However, colder weather and shorter riding seasons moderately restrain growth compared to southern regions. Despite this, expanding dealership networks and improving road infrastructure continue to create opportunities for steady, long-term market development across northern France.

Market Segmentations:

By Motorcycle Type:

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity:

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- Île-de-France

- Provence-Alpes-Côte d’Azur

- Auvergne-Rhône-Alpes

- Occitanie

- Hauts-de-France

- Other Regions

Competitive Landscape

The competitive landscape of the France Motorcycle Market is characterized by the strong presence of leading manufacturers such as Polaris Inc., Peugeot Motorcycles, Triumph Motorcycles Ltd., KTM AG, BMW AG, Piaggio Group, Benda Motorcycles, Ariel Motor Company, Midual, and BSA Motorcycles. The market is moderately consolidated, with global and domestic brands competing across varied price segments and motorcycle categories. European and Japanese manufacturers dominate through innovation, extensive dealer networks, and brand loyalty. Companies are increasingly focusing on product diversification, electric mobility, and advanced safety technologies to gain a competitive edge. Strategic initiatives such as partnerships, technological collaborations, and localized production have enhanced supply efficiency and market penetration. Premium brands like BMW and Triumph lead in the high-capacity and touring segments, while Peugeot and Piaggio remain strong in urban and commuter motorcycles. Continuous innovation in electric models and smart connectivity features is expected to intensify competition across all segments in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Hero MotoCorp entered the France motorcycle market through a partnership with GD France and launched its Euro 5+-compliant model, the Hunk 440, marking its strategic expansion into Europe.

- In November 2024, Yamaha Motor Co., Ltd. made a strategic investment in the French electric motorcycle manufacturer Electric Motion SAS, aiming to expand its electric vehicle portfolio and align with France’s growing shift toward sustainable mobility.

- In June 2025, Ultraviolette Automotive launched its F77 MACH 2 and F77 SuperStreet electric motorcycles in France and nine other European countries.

- In November 2024, Peugeot Motocycles completed its acquisition of a controlling stake by Mutares and entered into a partnership with DAB Motors to produce electric motorcycles in France from 2024 onward.

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Motorcycle Market is expected to witness steady growth driven by rising urban mobility needs and lifestyle-oriented demand.

- Increasing adoption of electric motorcycles will accelerate as government incentives and emission regulations strengthen.

- Technological integration such as smart connectivity and advanced safety systems will enhance consumer experience and brand differentiation.

- Growing interest in recreational and touring motorcycles will support premium segment expansion.

- Urban regions like Île-de-France will continue to lead market demand due to dense population and commuter preference.

- Expanding charging infrastructure will encourage broader acceptance of electric two-wheelers.

- Manufacturers will focus on mid-capacity motorcycles offering balance between performance and affordability.

- Strategic collaborations and localized production will improve cost efficiency and market reach.

- Rising female participation and youth ridership will open new demographic opportunities for brands.

- The overall market outlook remains positive, supported by technological innovation and sustainable mobility trends.