Market Overview

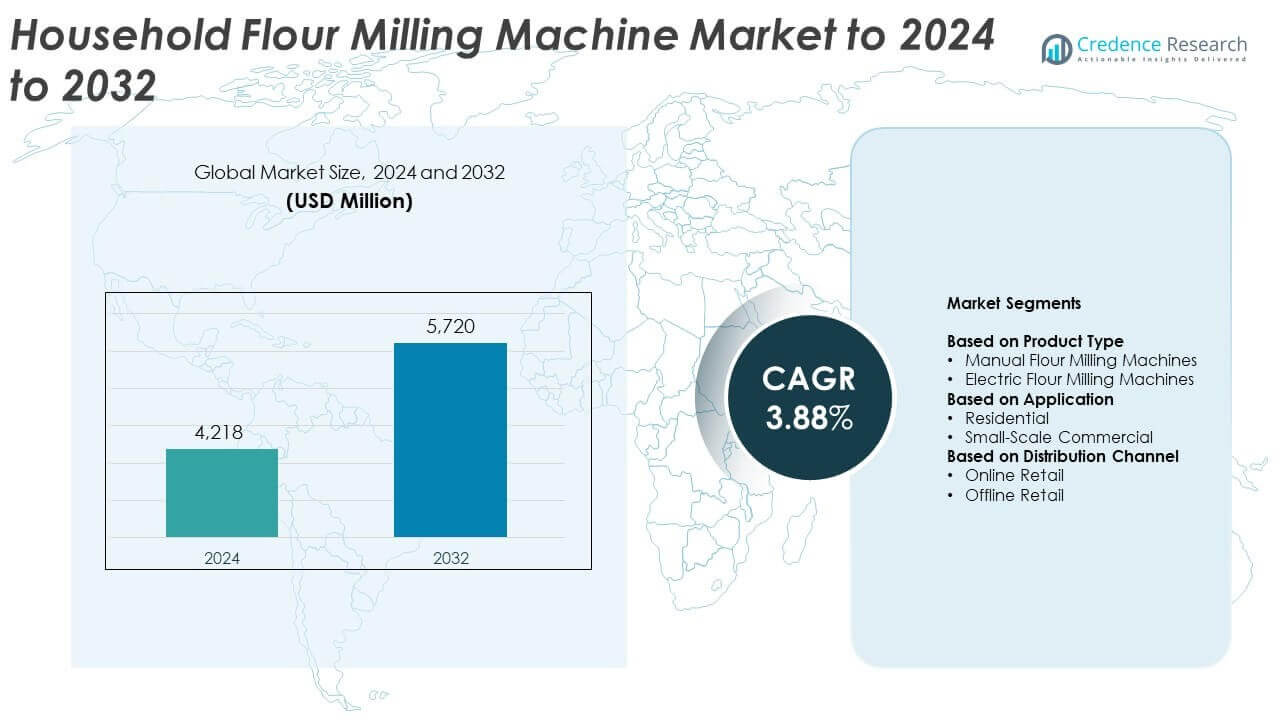

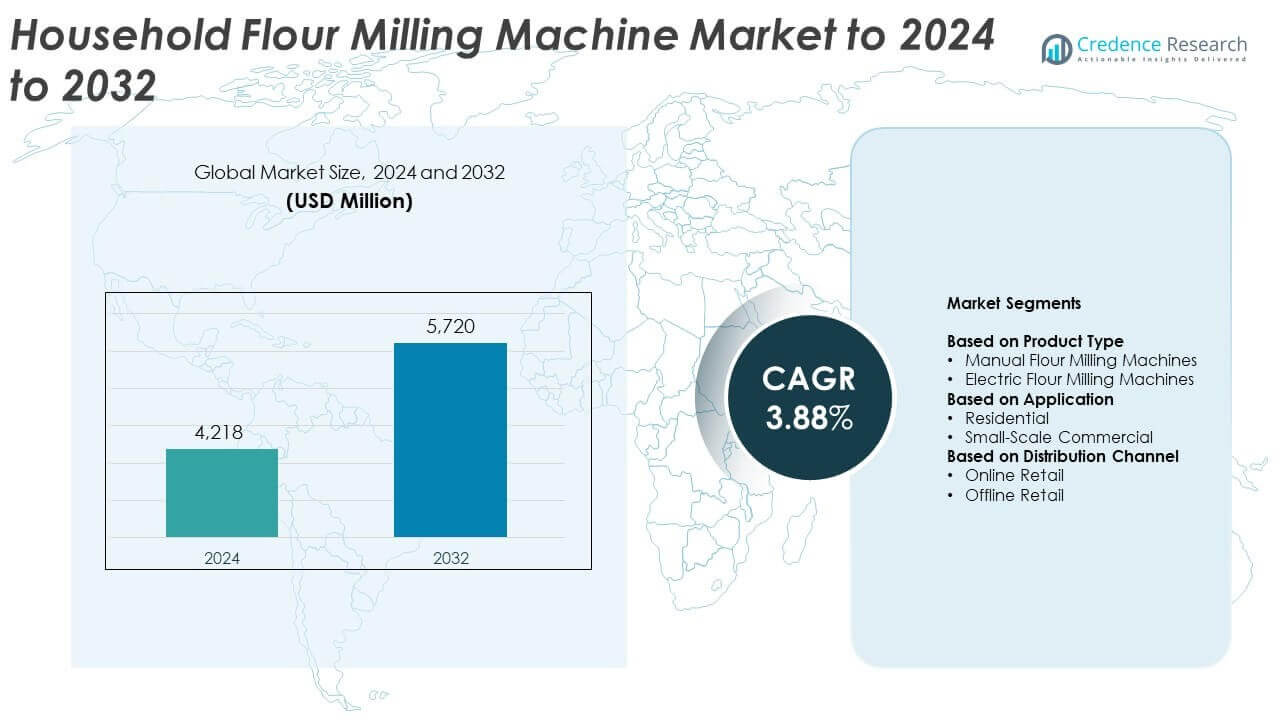

The Household Flour Milling Machine Market size was valued at USD 4,218 million in 2024 and is anticipated to reach USD 5,720 million by 2032, at a CAGR of 3.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Flour Milling Machine Market Size 2024 |

USD 4,218 Million |

| Household Flour Milling Machine Market, CAGR |

3.88% |

| Household Flour Milling Machine Market Size 2032 |

USD 5,720 Million |

The household flour milling machine market features strong competition among top players including KitchenAid, NutriMill, Mockmill, GrainMaker, WonderMill, Marcato, Country Living, Retsel, Blendtec, Hawos, Alpina, Victoria, Milan, Sunshine Nugget, KoMo, and Lehman’s. These manufacturers compete through product innovation, quality enhancement, and advanced milling technologies tailored for household use. Asia Pacific leads the market with a 34.8% share, driven by rising disposable income and growing adoption of electric flour mills. North America follows with a 32.4% share, supported by health-conscious consumers and strong retail infrastructure. Europe maintains a 27.6% share, propelled by sustainability-driven product preferences and artisanal food trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The household flour milling machine market was valued at USD 4,218 million in 2024 and is projected to reach USD 5,720 million by 2032, registering a CAGR of 3.88% during the forecast period.

- Growing consumer preference for fresh, additive-free flour and rising health awareness are key drivers accelerating market adoption across residential households.

- Technological advancements such as smart automation, noise reduction, and compact designs are shaping future trends, enhancing convenience and efficiency for urban consumers.

- The market is moderately competitive, with global and regional players focusing on energy-efficient models, multi-grain milling capabilities, and expanded online distribution channels.

- Asia Pacific leads the market with a 34.8% share, followed by North America at 32.4% and Europe at 27.6%; among product types, electric flour milling machines dominate with a 67.3% share due to their superior performance and user-friendly features.

Market Segmentation Analysis:

By Product Type

The electric flour milling machines segment dominated the household flour milling machine market in 2024 with a 67.3% share. Growth is driven by the rising adoption of automated and energy-efficient kitchen appliances that simplify home-based grain processing. Consumers prefer electric models for their higher grinding speed, consistent output, and minimal manual effort. Technological advancements such as noise reduction systems and variable-speed control enhance user convenience. Expanding urban households and increased awareness of customized flour quality further support the dominance of electric flour milling machines in the market.

- For instance, Natraj’s Smart AC109 lists 6.5 kg grinding capacity and Wi-Fi control. Power rating is 746 W for household use. These specs support faster, consistent output.

By Application

The residential segment held the largest market share of 72.6% in 2024, driven by growing health consciousness and preference for fresh, chemical-free flour. Households are increasingly investing in compact and easy-to-use flour mills that allow control over grain quality and fineness. Rising disposable income and urban kitchen modernization trends are accelerating adoption. Small-scale commercial users, including local bakeries and eateries, also contribute to market growth by choosing efficient machines for small-batch milling operations to ensure product freshness and quality consistency.

- For instance, Microactive Classic shows 1 HP motor, 2880 rpm, and 8–10 kg/hr output. Hopper size is 5 kg for continuous residential milling. Auto-LED and multi-sieve kit aid control.

By Distribution Channel

The offline retail segment accounted for the largest market share of 61.8% in 2024, supported by consumer preference for physical product inspection before purchase. Specialty appliance stores and hypermarkets provide demonstrations and after-sales support, enhancing customer confidence. However, online retail is gaining momentum due to wider product availability, competitive pricing, and convenient doorstep delivery. The growing digitalization of household appliance brands and the expansion of e-commerce platforms such as Amazon and Flipkart are expected to drive further online sales in the coming years.

Key Growth Drivers

Rising Health Awareness and Demand for Fresh Flour

Growing consumer focus on nutrition and wellness is fueling demand for home-milled flour. People are shifting toward fresh, additive-free flour to ensure higher fiber and nutrient content. This trend is boosting the adoption of compact household flour milling machines that enable control over ingredients and texture. Increasing preference for whole grains such as millet and quinoa further strengthens market expansion among health-conscious urban households.

- For instance, the Prestige PGG-01 grain grinder operates at 180 W, has a grinding capacity of 3–5 kg/hr, and comes with a two-year manufacturer’s warranty.

Technological Advancements in Small Appliance Design

Continuous innovation in design and functionality is driving market growth. Manufacturers are integrating energy-efficient motors, noise reduction systems, and automated cleaning functions in flour milling machines. These upgrades enhance user convenience and durability, attracting a broader customer base. The introduction of multi-grain milling and digital control systems also supports customization, encouraging consumers to invest in advanced home-based solutions.

- For instance, the Milcent Neo/Stylo family of domestic flour mills typically has a grinding capacity of 8-10 kg/hr and uses a 1 HP motor. The weight of specific models can range from approximately 45 kg to 50 kg, depending on the exact variant and material.

Expansion of E-Commerce and Omnichannel Retail

The growing reach of e-commerce platforms and hybrid retail channels is a key driver of sales growth. Consumers increasingly prefer online shopping for product variety, price comparison, and doorstep delivery. Manufacturers are expanding partnerships with major platforms like Amazon and Flipkart to enhance accessibility. Integration of virtual demos and easy return policies further boosts consumer trust and accelerates market adoption.

Key Trends and Opportunities

Growing Popularity of Smart and Compact Milling Systems

Compact and IoT-enabled flour milling machines are becoming popular in urban kitchens. Smart features such as digital timers, grind-level control, and safety sensors are gaining traction. Consumers favor sleek, space-saving designs that align with modern home layouts. This trend offers manufacturers opportunities to introduce multifunctional and connected milling devices tailored for convenience-driven households.

- For instance, Navsukh models provide voice prompts and a 7 kg hopper. Motor speed reaches about 2800 rpm, with 8 sieves included. Compact cabinets fit urban kitchens.

Rising Preference for Sustainable and Energy-Efficient Appliances

Consumers are increasingly choosing machines designed with eco-friendly materials and low power consumption. Manufacturers are focusing on recyclable components and long-lasting designs to meet sustainability goals. Energy-efficient appliances also appeal to cost-conscious users seeking reduced electricity use. This focus on sustainability presents an opportunity for companies to strengthen brand positioning in green home appliance categories.

- For instance, Haystar specifies 0.5–0.75 kWh per hour consumption. Claimed output is 7–10 kg/hr on domestic units. Energy savings reduce household bills.

Key Challenges

High Initial Cost and Maintenance Requirements

The high upfront price of advanced electric flour mills limits adoption among budget-sensitive consumers. Regular maintenance, including blade sharpening and motor servicing, adds to ownership costs. Manufacturers face pressure to balance affordability with technological innovation. This cost barrier restricts penetration in developing regions where traditional milling practices remain prevalent.

Limited Awareness in Rural and Semi-Urban Areas

A lack of consumer awareness about the benefits of home milling machines hinders market expansion in less urbanized regions. Many consumers rely on local mills or packaged flour due to limited exposure to modern appliances. Inadequate retail infrastructure and weak marketing channels further slow product adoption. Expanding awareness campaigns and localized distribution could help overcome this challenge.

Regional Analysis

North America

North America held a 32.4% share of the household flour milling machine market in 2024, driven by strong demand for convenient and health-oriented home appliances. Consumers are increasingly adopting electric milling machines for fresh and organic flour preparation. The United States leads the region with growing awareness of gluten-free and whole-grain diets. Continuous product innovation and the presence of key appliance manufacturers strengthen regional growth. Expanding smart home adoption and high household spending on kitchen automation further support the market’s positive outlook across the region.

Europe

Europe accounted for a 27.6% share of the global household flour milling machine market in 2024. The market benefits from rising interest in artisanal baking, clean-label food consumption, and home-based food preparation. Germany, France, and the United Kingdom dominate the region due to high consumer preference for quality and locally sourced grain products. Electric and energy-efficient models are gaining traction, supported by the region’s sustainability goals. Manufacturers are emphasizing compact design and low-noise operation to cater to urban households, strengthening Europe’s competitive position.

Asia Pacific

Asia Pacific led the global household flour milling machine market with a 34.8% share in 2024. Rapid urbanization, population growth, and changing dietary preferences are key growth drivers. China, India, and Japan are major contributors due to rising awareness of home-milled flour benefits and increasing disposable income. Expanding e-commerce channels and growing health consciousness boost the adoption of compact and affordable electric flour mills. Domestic manufacturers are enhancing production efficiency and expanding distribution networks, further reinforcing the region’s leadership position in the market.

Latin America

Latin America captured a 3.1% share of the household flour milling machine market in 2024. The market is supported by a growing shift toward homemade and unprocessed food products. Brazil and Mexico are leading adopters, driven by urban middle-class consumers embracing healthier food preparation habits. However, price sensitivity and limited product availability in rural areas restrict broader adoption. Manufacturers are focusing on affordable product ranges and partnerships with local retailers to expand market reach and improve accessibility across emerging economies.

Middle East and Africa

The Middle East and Africa region held a 2.1% share of the global household flour milling machine market in 2024. Growth is driven by rising interest in nutrition-focused food preparation and increasing appliance penetration in urban areas. Countries such as South Africa, the United Arab Emirates, and Saudi Arabia are emerging as key markets. However, limited awareness and high import costs remain challenges. The rising presence of global appliance brands and investment in regional distribution channels are expected to support steady market development over the forecast period.

Market Segmentations:

By Product Type

- Manual Flour Milling Machines

- Electric Flour Milling Machines

By Application

- Residential

- Small-Scale Commercial

By Distribution Channel

- Online Retail

- Offline Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The household flour milling machine market is characterized by the presence of prominent players such as KitchenAid, NutriMill, Mockmill, GrainMaker, WonderMill, Marcato, Country Living, Retsel, Blendtec, Hawos, Alpina, Victoria, Milan, Sunshine Nugget, KoMo, and Lehman’s. These manufacturers compete through continuous product innovation, design enhancements, and energy-efficient solutions aimed at meeting the evolving needs of modern households. The market emphasizes performance, durability, and ease of use, with growing integration of digital controls and low-noise technologies. Companies are also expanding online sales channels and regional distribution partnerships to strengthen customer reach. Strategic focus on compact, multifunctional models and sustainable materials is reshaping product portfolios. Intense competition drives frequent upgrades and differentiation in milling speed, capacity, and automation. Rising consumer awareness of healthy eating habits and home-based food preparation continues to create favorable opportunities for established and emerging brands across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KitchenAid

- NutriMill

- Mockmill

- GrainMaker

- WonderMill

- Marcato

- Country Living

- Retsel

- Blendtec

- Hawos

- Alpina

- Victoria

- Milan

- Sunshine Nugget

- KoMo

- Lehman’s

Recent Developments

- In October 2025, the WonderMill Electric Grain Mill continues to be promoted as the quietest and fastest mill, offering both superfine and coarse flour at temperatures that preserve nutrients.

- In 2024, Milan (a brand under the Classic Group) revealed a new completely automatic residential flour mill (Ghar Ghanti) with user-friendly interfaces and upgraded safety features.

- In 2024, NutriMill launched a new electric grain mill called the Impact. It was consistently marketed as an affordable and accessible option, particularly for home bakers and those new to milling their own flour.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for home-based flour milling machines will continue to rise with growing health awareness.

- Electric and smart-connected milling systems will dominate future household adoption trends.

- Compact and energy-efficient designs will attract urban consumers with limited kitchen space.

- Manufacturers will focus on integrating noise reduction and automatic cleaning technologies.

- E-commerce platforms will play a larger role in product distribution and customer engagement.

- Asia Pacific will remain the fastest-growing region due to rising disposable income and urbanization.

- Sustainability initiatives will drive innovation in recyclable and low-power components.

- Customizable grain milling features will appeal to consumers seeking nutritional flexibility.

- Strategic collaborations with appliance retailers will expand market visibility and accessibility.

- Increased investment in rural awareness programs will help broaden market penetration globally.