Market Overview

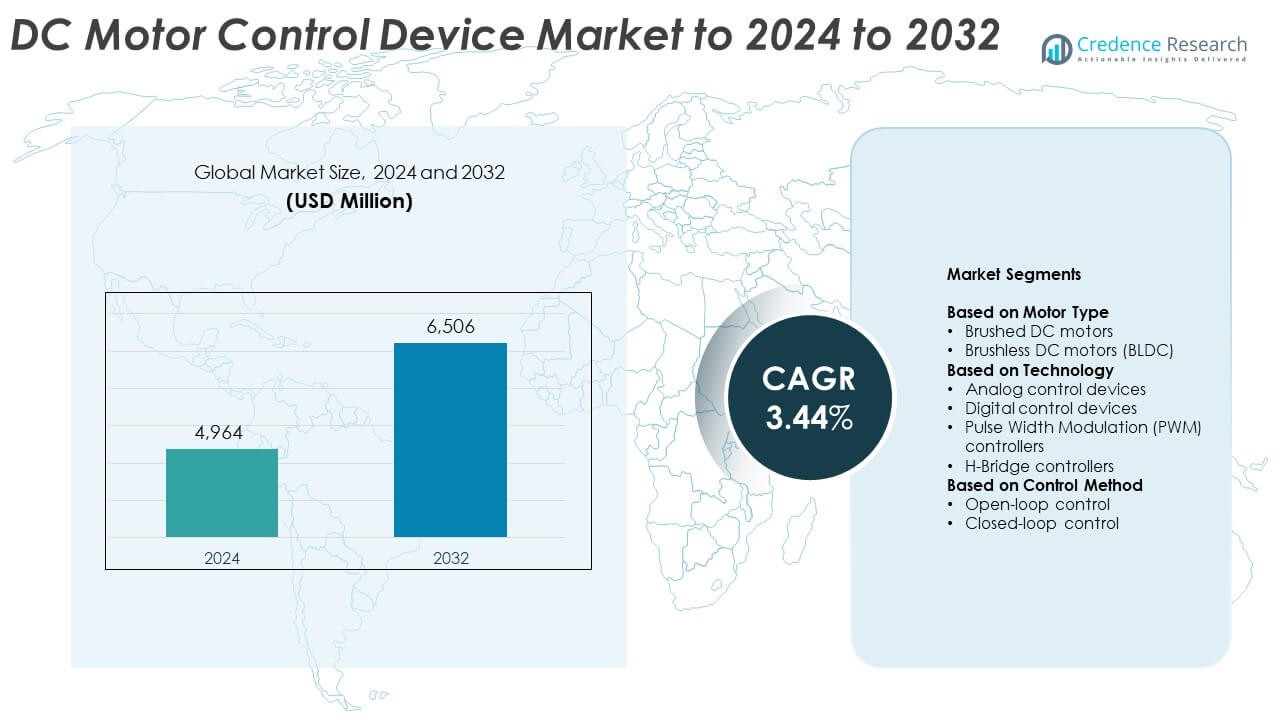

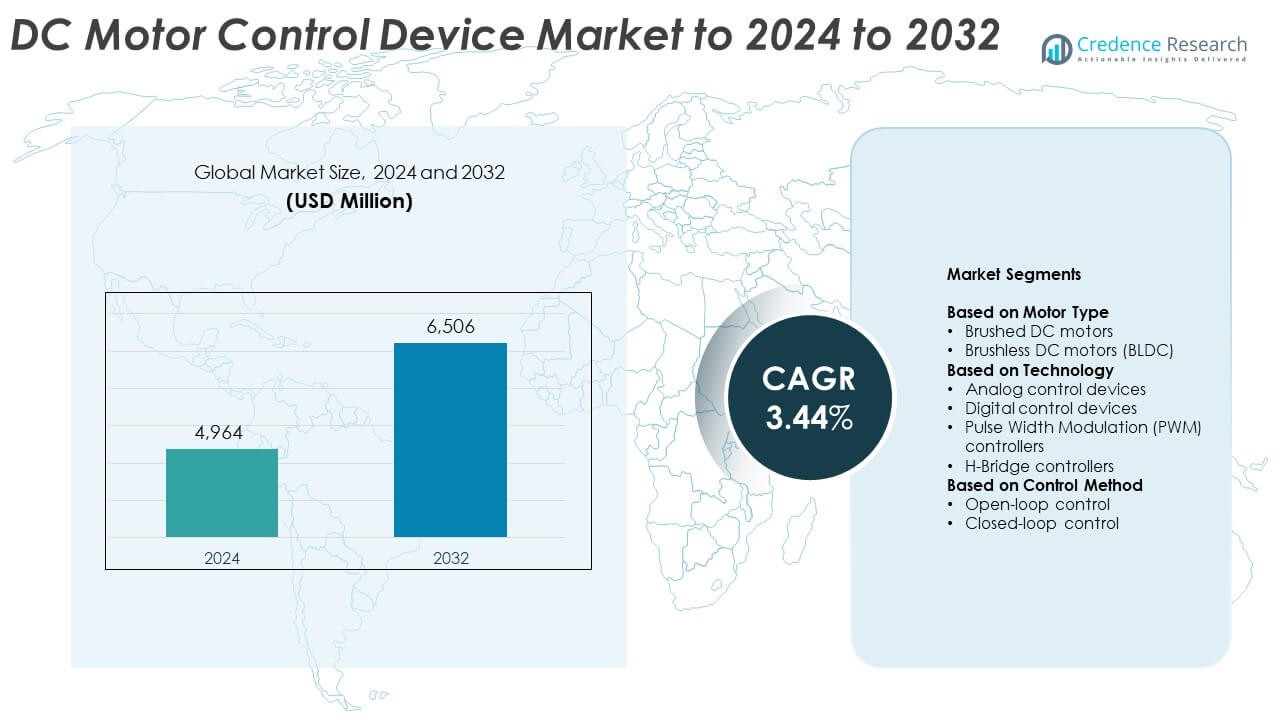

The DC Motor Control Device Market size was valued at USD 4,964 million in 2024 and is anticipated to reach USD 6,506 million by 2032, at a CAGR of 3.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Motor Control Device Market Size 2024 |

USD 4,964 Million |

| DC Motor Control Device Market, CAGR |

3.44% |

| DC Motor Control Device Market Size 2032 |

USD 6,506 Million |

The DC motor control device market is led by key players such as Infineon Technologies, STMicroelectronics, Allegro, ON Semiconductor, Analog Devices, NXP Semiconductors, Microchip Technology, and Texas Instruments (TI). These companies dominate through strong portfolios of high-efficiency controllers, advanced semiconductor technologies, and digital integration capabilities. Their focus on compact, energy-optimized, and IoT-compatible designs drives adoption across automotive, industrial, and consumer applications. North America emerged as the leading region in 2024, accounting for 34.6% of the global market share, followed by Asia Pacific and Europe. Continuous investment in automation, electric mobility, and renewable energy infrastructure supports the region’s technological leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The DC motor control device market was valued at USD 4,964 million in 2024 and is projected to reach USD 6,506 million by 2032, registering a CAGR of 3.44%.

- Market growth is driven by rising adoption of electric vehicles, industrial automation, and energy-efficient motor systems across manufacturing and transportation sectors.

- Emerging trends include integration of IoT-enabled controllers, compact power electronics, and AI-based feedback systems enhancing precision and energy management.

- The market is moderately consolidated, with major players focusing on semiconductor innovation, digital control solutions, and regional production expansion to strengthen competitiveness.

- North America dominated with a 34.6% share in 2024, followed by Asia Pacific at 29.1% and Europe at 27.3%; among segments, brushless DC motors led with a 61.8% share, supported by strong demand from automotive, robotics, and renewable energy applications.

Market Segmentation Analysis:

By Motor Type

The brushless DC motors segment dominated the DC motor control device market in 2024 with a 61.8% share. Growth is driven by their higher efficiency, longer lifespan, and reduced maintenance needs compared to brushed motors. BLDC motors are increasingly adopted in electric vehicles, HVAC systems, and robotics, where precise speed and torque control are essential. Their integration with smart digital controllers enhances performance and energy optimization. The growing demand for low-noise, compact, and durable motor systems further supports BLDC adoption across industrial automation and consumer electronics applications.

- For instance, Nidec’s Pinghu E-Axle plant lists one million traction motor systems annual capacity as of FY2024, with a 109,600 m² production area.

By Technology

The Pulse Width Modulation (PWM) controllers segment led the market in 2024 with a 44.5% share. PWM technology offers superior speed regulation, minimal power loss, and precise motor torque control, making it ideal for automotive and industrial applications. The rising deployment of energy-efficient motor systems and battery-powered equipment strengthens demand for PWM-based devices. These controllers enable smooth acceleration and deceleration, improving system reliability. Their growing integration into IoT-based smart drives and EV control systems accelerates adoption among manufacturers seeking performance efficiency and compact design flexibility.

- For instance, Texas Instruments’ DRV7308 GaN IPM reaches over 99% inverter efficiency in a three-phase modulated, FOC-driven, 250W motor drive application. The IPM features 650V enhancement mode GaNFETs and is designed for high-voltage, three-phase motor drives.

By Control Method

The closed-loop control segment accounted for the largest share of 57.2% in 2024, driven by its ability to maintain consistent motor performance under variable loads. This method uses real-time feedback systems to adjust voltage and current dynamically, ensuring higher precision and operational stability. Industries such as manufacturing, aerospace, and healthcare increasingly adopt closed-loop systems for automation and motion control applications. Rising use of sensors and microcontrollers enhances system responsiveness and fault detection, making closed-loop control devices preferred for critical performance-driven environments over open-loop alternatives.

Key Growth Drivers

Rising Adoption of Electric Vehicles

The expanding electric vehicle industry is a major driver for the DC motor control device market. DC motors are widely used for traction systems and auxiliary components due to their efficiency and controllability. Manufacturers are developing compact, high-performance control devices to optimize motor torque and battery usage. Increasing global investment in e-mobility infrastructure and emission reduction policies further support adoption. The shift toward energy-efficient transportation systems continues to drive significant demand for advanced motor control technologies across automotive production lines.

- For instance, According to a March 2025 announcement by NXP, the company’s S32K5 automotive MCU family debuted on the 16 nm FinFET process node with embedded MRAM (Magnetic RAM), making it the industry’s first automotive MCU with this combination.

Growth in Industrial Automation

Rapid industrial automation across manufacturing, logistics, and processing sectors is boosting the demand for precise motor control systems. DC motor control devices play a vital role in managing motion, torque, and speed in automated machinery. The integration of sensors and real-time digital feedback enhances production efficiency and system reliability. Expanding adoption of robotics and conveyor systems in automotive and electronics manufacturing further accelerates market growth. Rising emphasis on productivity improvement and energy efficiency continues to strengthen industrial deployment of advanced control devices.

- For instance, Siemens’ SINAMICS S200 specifies a 125 µs current-control cycle, 8 kHz PWM, and up to 21-bit encoder support for precise motion.

Expansion of Renewable Energy Applications

The increasing integration of DC motor systems in solar tracking, wind turbines, and energy storage applications is driving market expansion. DC motor control devices ensure smooth operation and precise positioning in renewable installations. Growing global investment in clean energy projects creates consistent demand for efficient control solutions. Manufacturers are focusing on durable and intelligent controllers to enhance operational reliability in variable environmental conditions. The emphasis on sustainable and decentralized power systems continues to widen opportunities for DC motor control adoption.

Key Trends & Opportunities

Integration of IoT and Smart Control Systems

The growing adoption of IoT-enabled motor control devices is transforming operational efficiency and predictive maintenance. Smart controllers collect real-time data on performance, temperature, and load variations, improving decision-making and fault detection. The integration of AI algorithms enables dynamic adjustment of motor operations for enhanced energy efficiency. This trend supports automation in sectors such as manufacturing, HVAC, and automotive. The demand for connected and self-optimizing systems provides a strong opportunity for manufacturers to deliver next-generation motor control solutions.

- For instance, an ABB Cylon deployment at MMU connects 25,000 control points across more than 1,500 building controllers for real-time analytics.

Miniaturization and Compact Design Innovations

Manufacturers are focusing on developing compact and lightweight motor control devices that offer higher performance within smaller footprints. Miniaturization supports growing applications in robotics, drones, and medical equipment, where space and energy efficiency are critical. Advancements in semiconductor design, power electronics, and thermal management enable higher control precision. The ongoing push for space optimization in industrial and consumer devices drives steady innovation. This trend aligns with global efforts toward energy conservation and enhanced product portability across emerging applications.

- For instance, TI’s DRV8311 integrates a three-phase BLDC driver in a 3.00 mm × 3.00 mm WQFN package with 5 A peak drive capability.

Key Challenges

High Cost of Advanced Control Technologies

The development of high-performance digital and smart motor controllers involves substantial R&D and component costs. Advanced designs using high-grade semiconductors and integrated sensors increase manufacturing expenses. These costs limit adoption among small and medium-sized enterprises, particularly in price-sensitive regions. The lack of standardized architectures across industries also adds to customization expenses. Overcoming cost barriers through scalable production and modular system designs remains a critical challenge for market expansion in developing economies.

Complex Integration and Compatibility Issues

Integrating DC motor control devices with diverse industrial systems poses significant challenges. Variations in communication protocols, software interfaces, and power configurations complicate system deployment. Inconsistent design standards between controllers and motor types often lead to compatibility concerns. This increases installation time and maintenance complexity, especially in large-scale automation projects. Manufacturers are focusing on universal interface designs and plug-and-play compatibility to overcome these issues and improve user accessibility across multiple application areas.

Regional Analysis

North America

North America held the largest share of 34.6% in the DC motor control device market in 2024. Growth is supported by strong demand from automotive manufacturing, robotics, and industrial automation sectors. The United States dominates regional demand with widespread adoption of electric vehicles and factory automation systems. Increasing investment in energy-efficient motion control technologies and the presence of leading manufacturers enhance regional competitiveness. Integration of advanced digital and PWM controllers in HVAC and industrial machinery applications further supports growth, while ongoing R&D in AI-based motor control systems drives long-term market expansion.

Europe

Europe accounted for 27.3% of the market share in 2024, driven by advancements in electric mobility and renewable energy applications. Germany, France, and the United Kingdom lead the regional market due to strong automotive and industrial automation industries. The region’s focus on energy efficiency and emission reduction promotes adoption of brushless DC motors and digital controllers. Manufacturers invest heavily in modernizing production facilities with smart motor control systems. The growing implementation of Industry 4.0 practices across manufacturing and transportation sectors further accelerates market growth, enhancing operational flexibility and energy optimization.

Asia Pacific

Asia Pacific captured a 29.1% share of the DC motor control device market in 2024, led by rapid industrialization and rising electric vehicle production in China, Japan, and South Korea. Expanding manufacturing bases and increasing investment in automation technologies drive regional demand. Governments promote energy-efficient motor systems under sustainability initiatives, further supporting adoption. Rising use of robotics, smart home devices, and automated machinery also fuels growth. The availability of cost-effective electronic components and local manufacturing capabilities strengthens the region’s leadership in mass-scale production and technological innovation within the global market.

Latin America

Latin America held a 5.4% share of the DC motor control device market in 2024, with growing adoption in industrial equipment, renewable energy, and electric transportation systems. Brazil and Mexico are key contributors due to ongoing industrial automation and infrastructure development. Expanding automotive assembly operations and renewable energy projects enhance demand for efficient motor control systems. Local manufacturers increasingly integrate digital and PWM controllers to improve energy performance and reliability. Supportive government policies promoting electrification and modernization of industrial machinery are expected to sustain moderate growth across the region during the forecast period.

Middle East and Africa

The Middle East and Africa accounted for 3.6% of the market share in 2024, driven by ongoing industrial diversification and energy infrastructure development. Gulf countries, including Saudi Arabia and the UAE, are investing in smart manufacturing and automation projects, fueling adoption of advanced motor control devices. The growth of the construction, mining, and renewable energy sectors further supports demand. Rising adoption of energy-efficient technologies and modernization of manufacturing facilities contribute to steady expansion. Increasing partnerships with international suppliers are helping local industries transition toward automated and sustainable motor control solutions.

Market Segmentations:

By Motor Type

- Brushed DC motors

- Brushless DC motors (BLDC)

By Technology

- Analog control devices

- Digital control devices

- Pulse Width Modulation (PWM) controllers

- H-Bridge controllers

By Control Method

- Open-loop control

- Closed-loop control

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the DC motor control device market include Infineon Technologies, STMicroelectronics, Allegro, ON Semiconductor, Analog Devices, NXP Semiconductors, Microchip Technology, and Texas Instruments (TI). The market is highly competitive, with companies focusing on technological innovation, miniaturization, and power efficiency to strengthen their market position. Manufacturers are investing in the development of smart and energy-efficient motor controllers that integrate IoT connectivity, digital feedback, and precision torque control. Strategic collaborations with automotive and industrial automation firms are enabling expansion into emerging applications such as robotics, renewable systems, and electric mobility. The growing emphasis on compact design and semiconductor integration is driving continuous improvement in controller performance. Leading companies are also focusing on production scalability and regional partnerships to enhance supply chain resilience. Continuous R&D in AI-enabled control algorithms and energy-optimization circuits is expected to define the competitive edge across the global DC motor control device market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Microchip Technology introduced new dsPIC® Digital Signal Controller (DSC)-based integrated motor drivers that combined the controller, gate driver, and transceiver in a single package to simplify brushless DC (BLDC) and permanent magnet synchronous motor (PMSM) control applications.

- In 2023, Infineon Technologies Introduced new sensor-based motor control ICs aimed at improving energy efficiency and precision in automotive DC motor applications.

- In 2022, Allegro MicroSystems did announce the release of the A19360, and it uses high-resolution giant magnetoresistance (GMR) technology.

Report Coverage

The research report offers an in-depth analysis based on Motor Type, Technology, Control Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of electric and hybrid vehicles will boost demand for advanced motor controllers.

- Increasing automation in industrial operations will drive integration of digital and smart control systems.

- Growth in renewable energy projects will expand applications in solar tracking and wind systems.

- Miniaturization of motor control devices will enhance usage in compact robotics and medical equipment.

- Advancements in semiconductor technology will improve energy efficiency and power management.

- IoT-enabled monitoring will enable predictive maintenance and real-time performance optimization.

- Expanding production of consumer electronics will support adoption of brushless motor controllers.

- Growing focus on sustainability will encourage development of energy-efficient motor control solutions.

- Regional manufacturing expansion in Asia Pacific will strengthen global supply chain resilience.

- Increased collaboration between automation and software companies will foster intelligent motor control ecosystems.