Market Overview

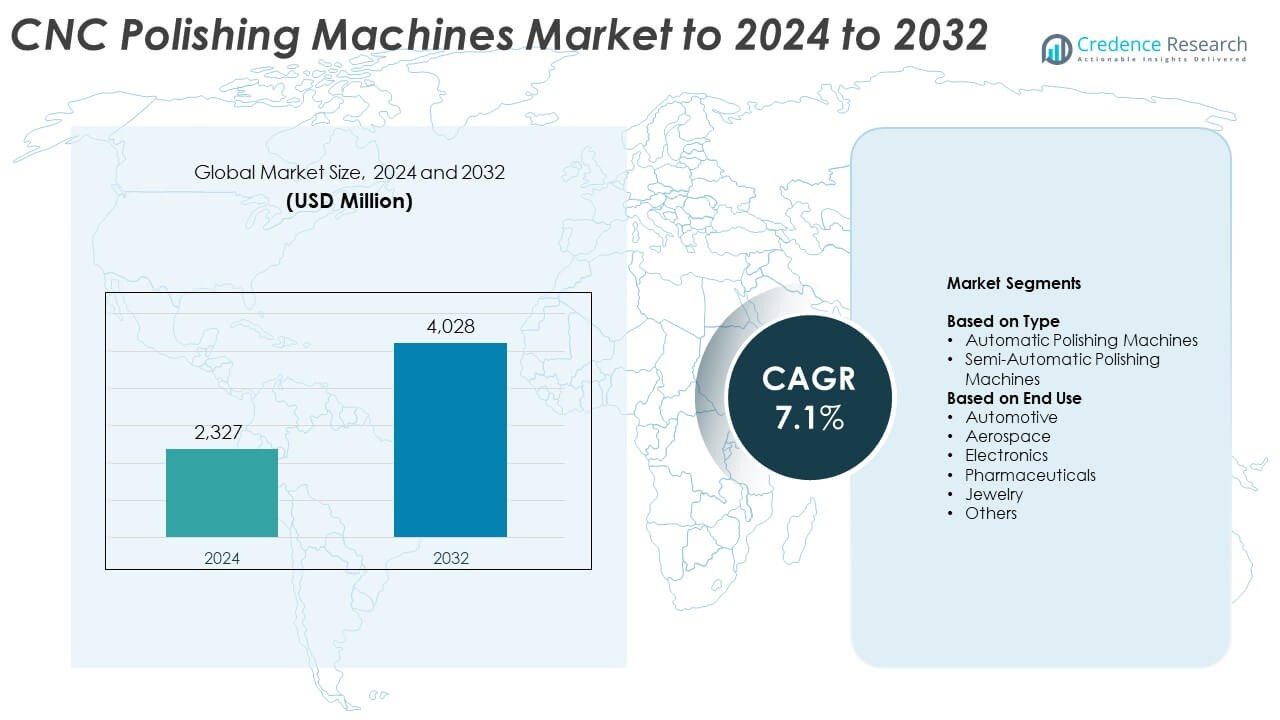

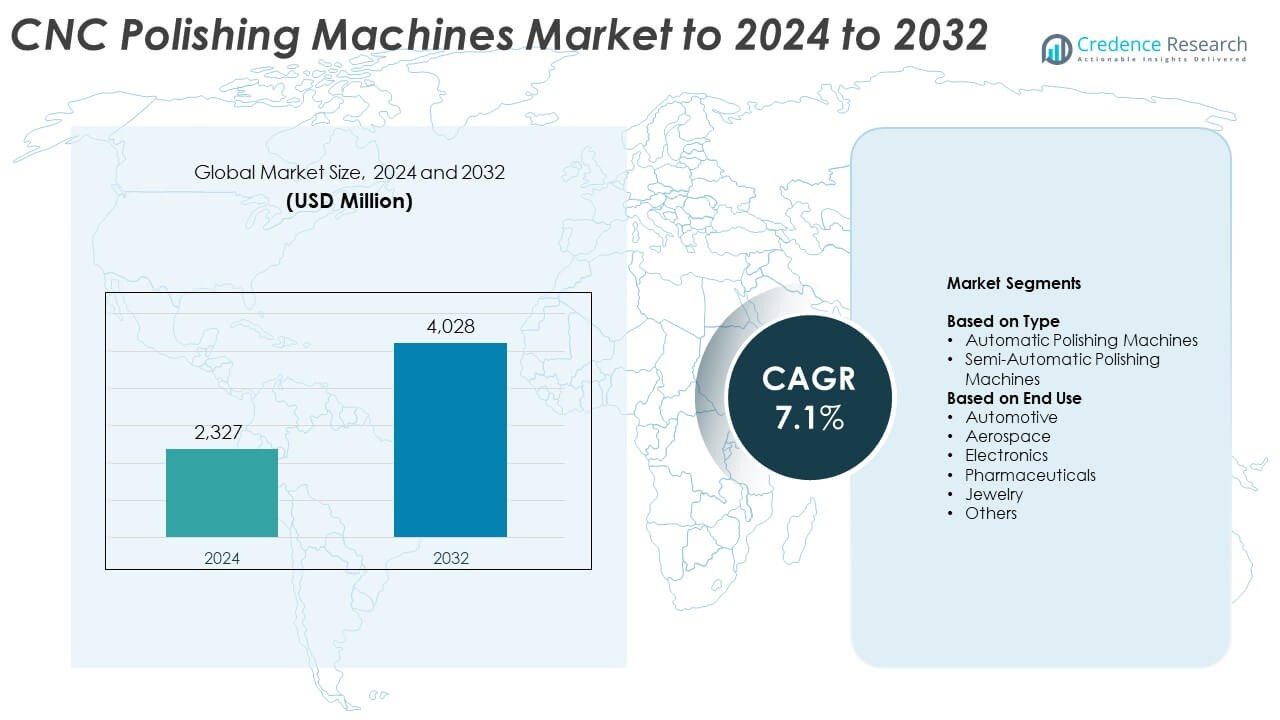

The CNC Polishing Machines market size was valued at USD 2,327 million in 2024 and is anticipated to reach USD 4,028 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CNC Polishing Machines Market Size 2024 |

USD 2,327 Million |

| CNC Polishing Machines Market, CAGR |

7.1% |

| CNC Polishing Machines Market Size 2032 |

USD 4,028 Million |

The CNC polishing machines market is dominated by major players including Yamazaki Mazak Corp., DMG Mori Seiki AG, CHIRON Group, Rollomatic AG, and Matsuura Machinery Corporation. These companies focus on precision automation, multi-axis polishing solutions, and integration of smart control systems to enhance performance and productivity. North America leads the global market with a 34.6% share, driven by advanced manufacturing infrastructure and high adoption of automated polishing systems. Asia Pacific closely follows with a 31.8% share, supported by rapid industrialization and expanding automotive and electronics sectors. Europe accounts for 28.3% of the market, driven by strong demand from aerospace and medical device manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The CNC polishing machines market was valued at USD 2,327 million in 2024 and is projected to reach USD 4,028 million by 2032, growing at a CAGR of 7.1%.

- Rising demand for precision finishing in automotive, aerospace, and electronics sectors drives market expansion, supported by increasing automation and technological advancement.

- Key trends include the integration of IoT-enabled systems, robotic polishing, and energy-efficient technologies that enhance operational accuracy and sustainability.

- The market is highly competitive, with players investing in R&D and expanding production capacities to strengthen their global presence.

- North America holds a 34.6% share, followed by Asia Pacific at 31.8% and Europe at 28.3%, while the automatic polishing machines segment leads with a 68.4% share due to its high efficiency and consistency.

Market Segmentation Analysis:

By Type

The automatic polishing machines segment dominated the CNC polishing machines market in 2024 with a 68.4% share. Growth is driven by the increasing shift toward automation to enhance precision and reduce manual intervention in surface finishing operations. These machines enable consistent polishing quality, faster cycle times, and improved productivity, particularly in high-volume manufacturing sectors. Rising demand for robotic integration and advanced control software further supports their adoption. Semi-automatic machines continue to find use among small-scale workshops that require flexibility and lower capital investment.

- For instance, Yaskawa Electric introduced its AR1440 robotic arm, which is primarily designed for arc welding applications. It has a reach of 1,440 mm and a repeatability of approximately \(\pm 0.06\) mm (according to Yaskawa India). The robot also features a payload of up to 12 kg.

By End Use

The automotive segment held the largest market share of 32.7% in 2024, supported by high demand for precision finishing of engine components, alloy wheels, and decorative parts. Automakers increasingly use CNC polishing systems to meet stringent quality standards and improve surface aesthetics. The aerospace sector also shows robust growth due to demand for smooth, defect-free metal and composite components. Expanding use of CNC polishing in electronics, pharmaceuticals, and jewelry manufacturing further enhances market growth, driven by precision, reliability, and repeatable surface quality.

- For instance, DMG MORI deployed its LASERTEC 125 Shape system for automotive mold texturing, a process that has demonstrated an ability to significantly improve processing precision and reduce manual finishing time compared to conventional methods like chemical etching.

Key Growth Drivers

Rising Demand for Precision Finishing in Automotive and Aerospace Sectors

The growing need for high-quality surface finishing in automotive and aerospace components is a major growth driver. CNC polishing machines enable superior accuracy and consistency in finishing engine parts, turbine blades, and metallic components. Manufacturers increasingly prefer automated systems to minimize human error and achieve tight tolerances. The demand for lightweight materials and complex geometries also fuels adoption, as CNC systems can polish intricate surfaces efficiently while meeting industry-specific standards for safety and performance.

- For instance, manufacturers in the aerospace industry utilize robotic solutions, which can include models from the FANUC R-2000iC series, for automated polishing of turbine components to improve consistency. The standard FANUC R-2000iC 165F model is a 6-axis robot with a high repeatability of approximately \(\pm 0.05\) mm and a substantial payload capacity of 165 kg.

Technological Advancements in Automation and Control Systems

Continuous innovation in automation and motion control technology has strengthened the capabilities of CNC polishing machines. Integration of AI-driven feedback systems and real-time monitoring enhances polishing accuracy and repeatability. Manufacturers are deploying multi-axis control systems and automated tool changers to improve flexibility across materials and shapes. These developments reduce operational downtime and energy consumption, providing higher productivity and efficiency for large-scale manufacturers. This automation trend continues to drive market expansion across multiple end-use industries.

- For instance, Heidenhain’s TNC 640 controller is widely used in high-precision automated polishing and finishing operations. The controller features rapid block processing times, typically around 0.5 ms per block, in its high-speed machining modes, which helps achieve superior surface quality.

Growing Adoption in Electronics and Medical Manufacturing

The electronics and medical sectors are increasingly adopting CNC polishing machines for precision finishing of delicate components. Demand for miniaturized and defect-free surfaces in semiconductor parts, medical implants, and surgical tools has surged. CNC systems provide micro-level polishing with minimal surface deviation, ensuring product safety and performance. Their ability to handle materials like stainless steel, titanium, and ceramics further broadens their applications. This adoption trend significantly boosts growth prospects in high-precision manufacturing environments.

Key Trends & Opportunities

Integration of Robotic and IoT-Enabled Systems

The integration of robotics and IoT technologies is reshaping the CNC polishing landscape. Smart polishing machines equipped with sensors and connectivity enable predictive maintenance and remote monitoring. Real-time data analytics improve process control, reduce downtime, and enhance operational visibility. Robotic polishing arms allow precise multi-surface finishing and reduce labor dependence, especially in mass production. This digital transformation opens new opportunities for manufacturers aiming to enhance production efficiency and product quality through connected automation.

- For instance, KUKA Robotics provides its KRC4 controller with the capability for Industrial Internet of Things (IIoT) connectivity, which enables predictive maintenance through data monitoring. This approach can lead to significant reductions in unplanned downtime, with general studies on IIoT predictive maintenance showing downtime reductions in the range of 35% to 45%.

Shift Toward Sustainable and Energy-Efficient Systems

Sustainability initiatives are driving the development of energy-efficient CNC polishing machines. Manufacturers are adopting eco-friendly polishing fluids, noise-reduction designs, and low-power control systems to align with environmental standards. The move toward recyclable materials and emission-free operations supports the transition to green manufacturing. Demand for sustainable solutions is expected to rise further as industries emphasize energy savings and compliance with global carbon reduction regulations. This shift creates strong market opportunities for eco-conscious technology providers.

- For instance, Haas machines with energy-efficient settings enabled can have daily energy consumption of approximately 65.06 kWh compared to 68.25 kWh without the settings, for a specific 9-hour operational example

Key Challenges

High Initial Investment and Maintenance Costs

The high cost of CNC polishing machines and their maintenance remains a major restraint for small and mid-scale manufacturers. Advanced systems require significant capital for installation, programming, and periodic calibration. Maintenance of precision components such as spindles, sensors, and control units adds to operational expenses. These financial constraints often delay technology adoption, particularly in emerging markets where cost sensitivity is high. Addressing affordability through modular systems and leasing options could help overcome this challenge.

Skilled Workforce Shortage and Programming Complexity

Operating CNC polishing machines requires a skilled workforce capable of managing programming and calibration tasks. The shortage of trained technicians and engineers limits machine efficiency and increases production errors. Complex software interfaces and advanced programming requirements often slow down adoption in traditional manufacturing setups. As a result, companies face productivity losses and extended lead times. Expanding technical training programs and simplifying control software will be crucial to address this workforce gap and sustain growth.

Regional Analysis

North America

North America held a 34.6% share of the CNC polishing machines market in 2024, driven by strong demand from the automotive and aerospace industries. The region’s focus on precision manufacturing and technological innovation supports high adoption rates of automated polishing systems. The United States remains the leading contributor due to the presence of major automotive and electronics manufacturers. Growing investments in advanced production facilities and R&D further enhance market growth. Canada and Mexico also show rising adoption, supported by industrial modernization and increased export-oriented manufacturing activities.

Europe

Europe accounted for 28.3% of the CNC polishing machines market share in 2024, supported by high standards for product quality and surface finishing. Countries like Germany, Italy, and France lead adoption due to their established automotive and machinery sectors. The region’s emphasis on automation, energy efficiency, and precision manufacturing fuels continuous demand for CNC systems. Growth is further strengthened by aerospace and medical device manufacturers seeking enhanced finishing capabilities. Supportive regulations and the adoption of sustainable production technologies contribute to steady expansion across European markets.

Asia Pacific

Asia Pacific dominated the CNC polishing machines market with a 31.8% share in 2024, led by rapid industrialization and the expansion of manufacturing bases in China, Japan, South Korea, and India. The region benefits from strong growth in automotive, electronics, and metalworking industries. Increasing investment in factory automation and smart manufacturing drives widespread adoption. China remains the largest producer and consumer due to large-scale manufacturing operations and favorable government policies. Rising demand for high-precision finishing in semiconductor and medical component production further supports market growth.

Latin America

Latin America captured a 3.2% share of the CNC polishing machines market in 2024, with growth primarily led by Brazil and Mexico. Expanding automotive and electronics production facilities are key drivers of adoption in the region. Manufacturers are increasingly investing in automated polishing solutions to enhance export quality and reduce operational costs. The region’s growing participation in international supply chains supports steady market expansion. However, limited technological infrastructure and high equipment costs restrain faster adoption, though ongoing industrial modernization presents future opportunities.

Middle East & Africa

The Middle East and Africa region accounted for 2.1% of the CNC polishing machines market share in 2024. Growth is driven by expanding industrial sectors in the United Arab Emirates, Saudi Arabia, and South Africa. Increasing investment in metal fabrication, aerospace maintenance, and precision engineering supports rising adoption of CNC polishing systems. The focus on diversifying economies through industrial development is creating opportunities for automation. However, limited technical expertise and slower industrial digitization remain key challenges. Gradual adoption of smart manufacturing solutions is expected to improve growth prospects over time.

Market Segmentations:

By Type

- Automatic Polishing Machines

- Semi-Automatic Polishing Machines

By End Use

- Automotive

- Aerospace

- Electronics

- Pharmaceuticals

- Jewelry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The CNC polishing machines market is characterized by strong competition among leading players such as Yamazaki Mazak Corp., DMG Mori Seiki AG, CHIRON Group, Rollomatic AG, Danobatgroup, Hwacheon Machinery, Mitutoyo Corporation, Jieying Machinery, Supfina, Michael Deckel GmbH & Co. KG, and Matsuura Machinery Corporation. Market participants are focusing on innovation, precision, and automation to strengthen their global footprint. Companies are investing heavily in R&D to develop multi-axis polishing systems, advanced motion controls, and energy-efficient machines. Strategic partnerships with software developers enhance digital integration and real-time monitoring capabilities. Expansion into emerging economies, particularly in Asia Pacific, is a key strategy to capture growing manufacturing demand. Customization options, improved tool life, and reduced operational costs remain core areas of competition. Continuous advancements in automation and smart control technology are expected to define future leadership positions in the market, driving higher efficiency and surface quality across end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yamazaki Mazak Corp. (Japan)

- DMG Mori Seiki AG (Germany)

- CHIRON Group (Taiwan)

- Rollomatic AG (Switzerland)

- Danobatgroup (Spain)

- Hwacheon Machinery (South Korea)

- Mitutoyo Corporation (Japan)

- Jieying Machinery (China)

- Supfina (Germany)

- Michael Deckel GmbH & Co. KG (Germany)

- Matsuura Machinery Corporation (Japan)

Recent Developments

- In 2025, DMG Mori introduced eight world premieres At the EMO exhibition, including new models for 5-axis simultaneous machining and the ULTRASONIC 60 Precision, which offers 5-axis milling with ultrasonic-assisted precision machining, suitable for advanced surface finishing and polishing applications.

- In 2025, Mitutoyo launched the CRYSTA-Apex V PLUS Series, a new generation of CNC coordinate measuring machines optimized for ultra-precise measurement and inspection, complementary to advanced polishing workflows and ensuring surface finish quality in precision manufacturing environments.

- In 2025, CHIRON Group premiered the Micro5 XL at its Open House, targeting ultra-precise micromachining and polishing for medical and electronic components, emphasizing maximum precision and resource efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation and robotics integration will continue to enhance precision and reduce manual intervention.

- Demand from the automotive and aerospace sectors will remain a major growth driver.

- Smart and IoT-enabled CNC polishing systems will gain higher adoption for real-time monitoring.

- Manufacturers will focus on developing energy-efficient and sustainable polishing technologies.

- The Asia Pacific region will strengthen its dominance through rapid industrial expansion.

- Advancements in multi-axis control and adaptive tooling will improve processing flexibility.

- Growth in electronics and medical device manufacturing will increase demand for micro-polishing systems.

- The rise of Industry 4.0 will drive digital integration and remote operation capabilities.

- Training programs for skilled CNC operators will expand to address workforce shortages.

- Partnerships between machine builders and software firms will accelerate innovation and customization.