Market Overview

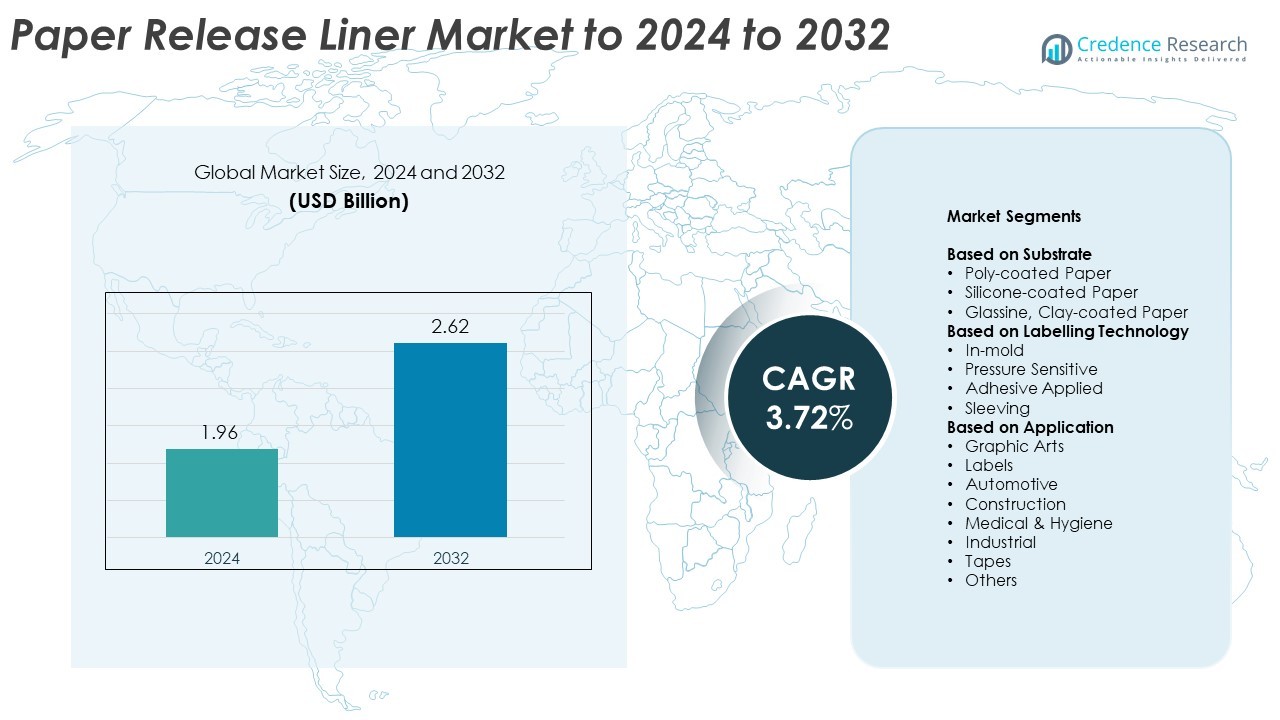

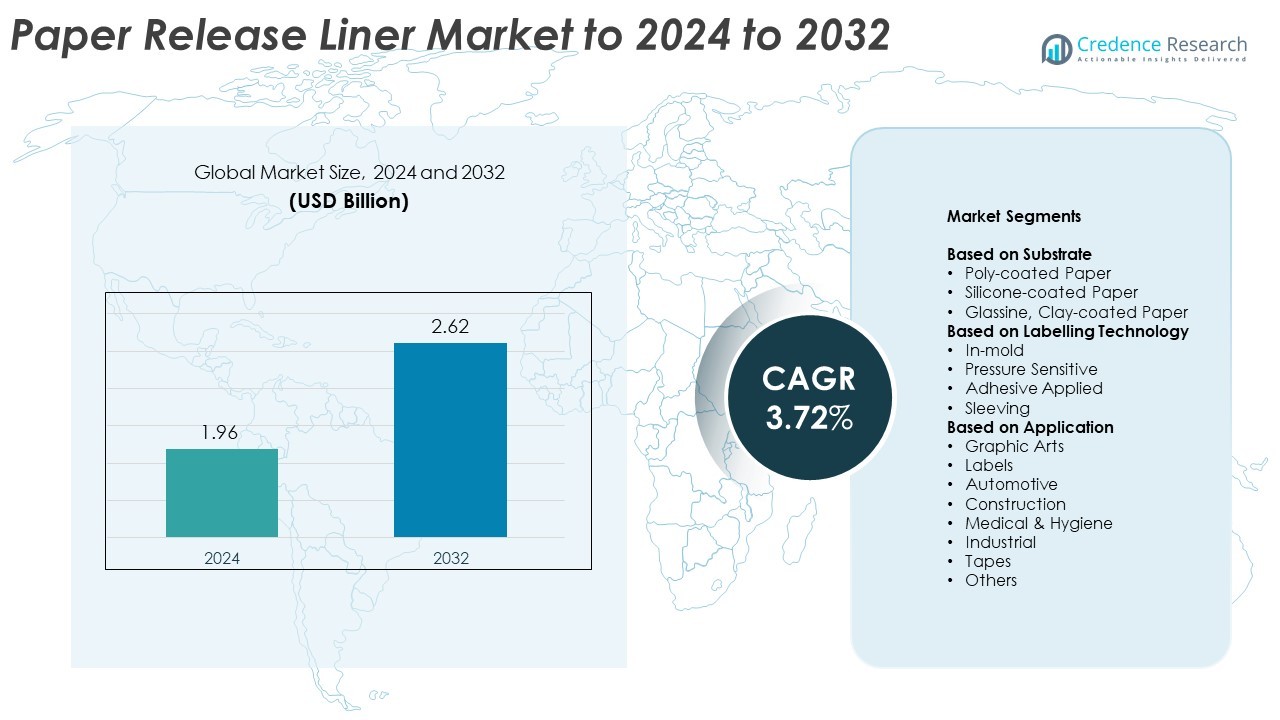

The Paper Release Liner Market size was valued at USD 1.96 Billion in 2024 and is anticipated to reach USD 2.62 Billion by 2032, at a CAGR of 3.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Release Liner Market Size 2024 |

USD 1.96 Billion |

| Paper Release Liner Market, CAGR |

3.72% |

| Paper Release Liner Market Size 2032 |

USD 2.62 Billion |

The Paper Release Liner Market features strong competition among major players including 3M, UPM, Elkem Silicones, Fox River Associates, Loparex Holding B.V., Gascogne Group, Quanjiao Guangtai Adhesive Products Co. Ltd., Rayven Inc., Mondi Group, and Avery Dennison Corporation. These companies focus on expanding product portfolios, enhancing coating technologies, and promoting recyclable liner materials to meet sustainability goals. North America led the market in 2024 with a 33.5% share, driven by technological innovation, advanced packaging demand, and the presence of established manufacturing facilities. Europe and Asia-Pacific followed, supported by eco-friendly production and growing industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Paper Release Liner Market was valued at USD 1.96 Billion in 2024 and is projected to reach USD 2.62 Billion by 2032, growing at a CAGR of 3.72%.

- Rising demand from packaging, medical, and hygiene industries is driving market growth, supported by advancements in coating and liner technologies.

- The market is witnessing trends toward recyclable and biodegradable liners, as sustainability and regulatory compliance become major priorities.

- Competition remains strong, with players focusing on innovation, capacity expansion, and product differentiation to strengthen their global presence.

- North America held the largest share at 33.5%, followed by Europe with 29.4% and Asia-Pacific with 26.8%; the silicone-coated paper segment dominated with a 42.6% share in 2024.

Market Segmentation Analysis:

By Substrate

The silicone-coated paper segment dominated the Paper Release Liner Market in 2024 with a 42.6% share. Its smooth surface, moisture resistance, and strong release properties make it ideal for labels, tapes, and industrial applications. Silicone coatings offer consistent release performance under high-speed labeling and harsh environmental conditions. The poly-coated and glassine paper segments also showed steady growth due to their recyclability and cost efficiency, supporting demand in packaging and construction uses. Expanding usage of high-performance silicone formulations continues to drive this segment’s dominance across end-use industries.

- For instance, UPM Specialty Papers’ UPM Brilliant™ Duo lists basis weights of 62.0, 78.0, 87.0, and 120.0 g/m² with thicknesses of 55.0, 68.0, 76.0, and 104.0 µm, respectively.

By Labelling Technology

The pressure-sensitive labelling technology segment held the largest share of 58.3% in 2024. The segment benefits from growing use in consumer goods, logistics, and medical packaging. Pressure-sensitive liners ensure strong adhesion, clean removal, and adaptability to diverse surfaces. Their compatibility with high-speed automated labelling systems enhances production efficiency. In-mold and adhesive-applied labels are expanding due to increasing demand for durable and decorative packaging solutions. The versatility and ease of application of pressure-sensitive technology continue to drive its wide adoption globally.

- For instance, HERMA 500 runs at 200 m/min or 2,000 labels per minute in synchronized, continuous operation.

By Application

The labels segment led the market with a 36.9% share in 2024. Labels are widely used in food and beverage, pharmaceutical, and logistics industries for identification and branding. Rising e-commerce shipments and consumer goods demand have increased label consumption worldwide. Graphic arts and medical & hygiene applications also recorded notable growth due to improved printability and hygiene-friendly release liners. Automotive and construction sectors adopted high-durability liners for insulation and adhesive bonding processes. The expanding labelling and packaging industries remain key growth drivers for this dominant segment.

Key Growth Drivers

Expanding Packaging and Labelling Industry

The rapid growth of the global packaging and labelling industry is a major driver for the Paper Release Liner Market. Increasing demand for consumer goods, e-commerce packaging, and branded labeling applications boosts liner consumption. Companies are adopting high-quality release liners for faster processing, cleaner label application, and improved durability. Expanding retail sectors in Asia-Pacific and North America further enhance market growth as packaging innovations require more advanced liner materials.

- For instance, Dow’s SYL-OFF™ SL 9106 minimizes mist at coating speeds up to 1,300 m/min, supporting very high-throughput labelstock production.

Rising Demand in Medical and Hygiene Applications

The medical and hygiene sectors are contributing strongly to market expansion. Paper release liners are essential in medical tapes, wound dressings, and hygiene products due to their clean-release characteristics and biocompatibility. Growing healthcare investments and the rise in disposable medical supplies drive liner demand. Manufacturers are introducing advanced silicone coatings and sterilizable liners to meet safety standards. This trend aligns with the growing focus on hygiene and patient comfort across hospitals and personal care products.

- For instance, Lohmann’s DuploMED® 85300 is specified for 28+ days wear on skin and shows MVTR of 250 g/m²/24 h (ISO 13726-2).

Shift Toward Sustainable and Recyclable Materials

Sustainability initiatives are driving innovation in the Paper Release Liner Market. Producers are focusing on recyclable, biodegradable, and low-emission paper liners to meet environmental regulations. The shift away from plastic-based substrates supports the use of eco-friendly paper solutions. Government policies promoting sustainable packaging and consumer awareness are accelerating this trend. Adoption of renewable paper sources and solvent-free silicone coatings is further strengthening the growth potential of eco-conscious liner production.

Key Trends & Opportunities

Technological Advancements in Coating and Manufacturing

Advances in coating and manufacturing technology are creating opportunities for enhanced performance and cost efficiency. Automated coating systems, UV-curable silicones, and digital printing integration are improving liner consistency and speed. These developments help achieve reduced material waste, higher throughput, and better release control. Manufacturers investing in R&D for precision coating and material optimization are gaining a competitive advantage, meeting the growing demand for customized and high-speed labeling operations.

- For instance, WACKER’s SEMICOSIL® 936 UV cures a 2 mil coating in under one minute after a 5-second exposure at 0.7 W/cm².

Growing Adoption in Industrial and Construction Applications

Paper release liners are gaining traction in construction and industrial adhesives. Their use in insulation, sealants, and bonding materials enhances application accuracy and strength. As infrastructure development and industrial production increase globally, demand for reliable release liners rises. The ability to handle high-temperature environments and ensure consistent release performance makes them ideal for modern construction materials, providing manufacturers with new expansion opportunities in non-traditional end-use sectors.

- For instance, Ahlstrom’s liners for tapes and sealants span 60–195 gsm with 2.4–7.0 mil caliper and a differential release range of 1:1 to 1:10.

Key Challenges

Raw Material Price Volatility

Fluctuating prices of pulp, paper, and silicone materials pose significant challenges for manufacturers. Rising input costs directly affect production margins, especially for small and medium producers. Supply chain disruptions and energy cost fluctuations further complicate pricing stability. Maintaining product affordability without compromising quality remains a critical concern. The industry is increasingly exploring local sourcing and material optimization strategies to mitigate these cost pressures.

Limited Recycling Infrastructure and Waste Management Issues

The lack of efficient recycling infrastructure for paper liners hinders sustainability efforts. Silicone coatings often complicate the recycling process, leading to increased waste. Many regions still lack facilities capable of processing composite liners effectively. This challenge creates environmental concerns and compliance risks under evolving regulations. To overcome these issues, producers are investing in recyclable liner designs and closed-loop recovery systems to enhance waste management efficiency.

Regional Analysis

North America

North America held the largest share of 33.5% in the Paper Release Liner Market in 2024. The region’s growth is driven by high demand for advanced labelling and packaging materials across food, beverage, and healthcare industries. Technological innovation and the presence of leading manufacturers contribute to market expansion. The U.S. dominates due to strong industrial and retail sectors that prioritize high-performance liner materials. Growing adoption of pressure-sensitive labelling and eco-friendly substrates continues to support market growth across the region.

Europe

Europe accounted for a 29.4% share of the global Paper Release Liner Market in 2024. The region benefits from stringent environmental regulations promoting recyclable and sustainable liner materials. Germany, the U.K., and France lead in innovation and packaging automation, supporting higher production efficiency. Expanding demand from automotive and industrial adhesive applications also contributes to regional growth. Investments in lightweight and compostable liner technologies strengthen the market position, while the shift toward circular economy practices accelerates product innovation.

Asia-Pacific

Asia-Pacific captured a 26.8% share of the Paper Release Liner Market in 2024. Rapid industrialization, strong packaging demand, and the growth of e-commerce are fueling market expansion. China, Japan, and India are major contributors, supported by large-scale manufacturing and increasing adoption of pressure-sensitive labels. The presence of low-cost production facilities and expanding medical and hygiene sectors enhance market competitiveness. Rising sustainability awareness and infrastructure investments further boost demand for high-quality, eco-friendly liner products.

Latin America

Latin America held a 6.3% share of the Paper Release Liner Market in 2024. The region’s growth is supported by the expanding packaging and labeling industry in Brazil and Mexico. Rising urbanization and growing retail sectors drive demand for pressure-sensitive and adhesive-applied labels. Efforts toward modernizing printing and coating technologies enhance local production capabilities. Increasing awareness of recyclable liner materials and adoption of sustainable practices provide new market opportunities, particularly in food and consumer goods packaging.

Middle East & Africa

The Middle East & Africa accounted for a 4.0% share of the Paper Release Liner Market in 2024. The market is gradually expanding due to the rising use of labeling and adhesive materials in construction, healthcare, and industrial sectors. The United Arab Emirates and South Africa lead the demand with ongoing investments in retail and infrastructure. Manufacturers are focusing on cost-effective, durable paper liners to meet regional requirements. Growing adoption of automated labeling systems is further enhancing market penetration across emerging economies.

Market Segmentations:

By Substrate

- Poly-coated Paper

- Silicone-coated Paper

- Glassine, Clay-coated Paper

By Labelling Technology

- In-mold

- Pressure Sensitive

- Adhesive Applied

- Sleeving

By Application

- Graphic Arts

- Labels

- Automotive

- Construction

- Medical & Hygiene

- Industrial

- Tapes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Paper Release Liner Market is moderately consolidated, featuring a mix of global and regional players such as 3M, UPM, Elkem Silicones, Fox River Associates, LLC, Loparex Holding B.V., Gascogne Group, Quanjiao Guangtai Adhesive Products Co. Ltd., Rayven Inc., Mondi Group, and Avery Dennison Corporation. Companies focus on expanding coating capabilities, improving substrate efficiency, and developing recyclable liner solutions to align with sustainability goals. Strategic partnerships, mergers, and capacity expansions are common to strengthen global supply chains. Continuous innovation in silicone technology and automation is helping manufacturers enhance product consistency and reduce production costs, improving overall competitiveness across key end-use sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- UPM

- Elkem Silicones

- Fox River Associates, LLC

- Loparex Holding B.V.

- Gascogne Group

- Quanjiao Guangtai Adhesive Products Co. Ltd.

- Rayven Inc.

- Mondi Group

- Avery Dennison Corporation

Recent Developments

- In 2024, Avery Dennison expand the AD Circular program in North America, specifically in Northern California, this expansion was focused on increasing the recycling rates of PET (filmic) release liners.

- In 2024, Loparex launched its innovative Bubble Liner Technology, which enhances performance and efficiency in construction applications by adding anti-skid properties and improving resistance to temperature and pressure.

- In 2023, UPM Raflatac re-launched and expanded its RafCycle recycling service in the Americas, and also grew its program in Europe through a new partnership (with Soprema) to recycle used liners into construction materials, allowing customers in these regions to send used liners back for recycling.

Report Coverage

The research report offers an in-depth analysis based on Substrate, Labelling Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by expanding packaging and labeling applications.

- Adoption of recyclable and biodegradable liner materials will increase across industries.

- Technological innovations in coating and release formulations will enhance product performance.

- Demand from medical and hygiene sectors will continue rising due to improved product safety.

- Asia-Pacific will emerge as the fastest-growing regional market with rising manufacturing output.

- Pressure-sensitive labeling technology will maintain its dominance in global demand.

- Investments in automation and precision coating will improve production efficiency.

- Sustainability initiatives will push manufacturers toward eco-friendly and low-emission solutions.

- Growth in industrial adhesives and construction applications will open new opportunities.

- Strategic partnerships and capacity expansions will strengthen the competitive landscape.