Market Overview

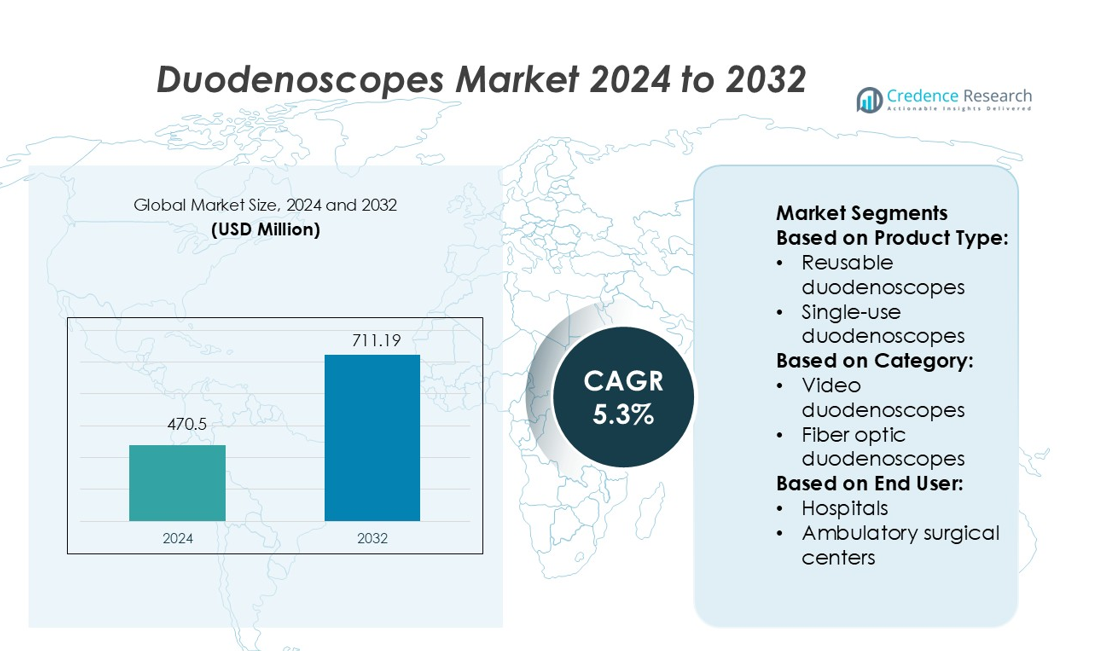

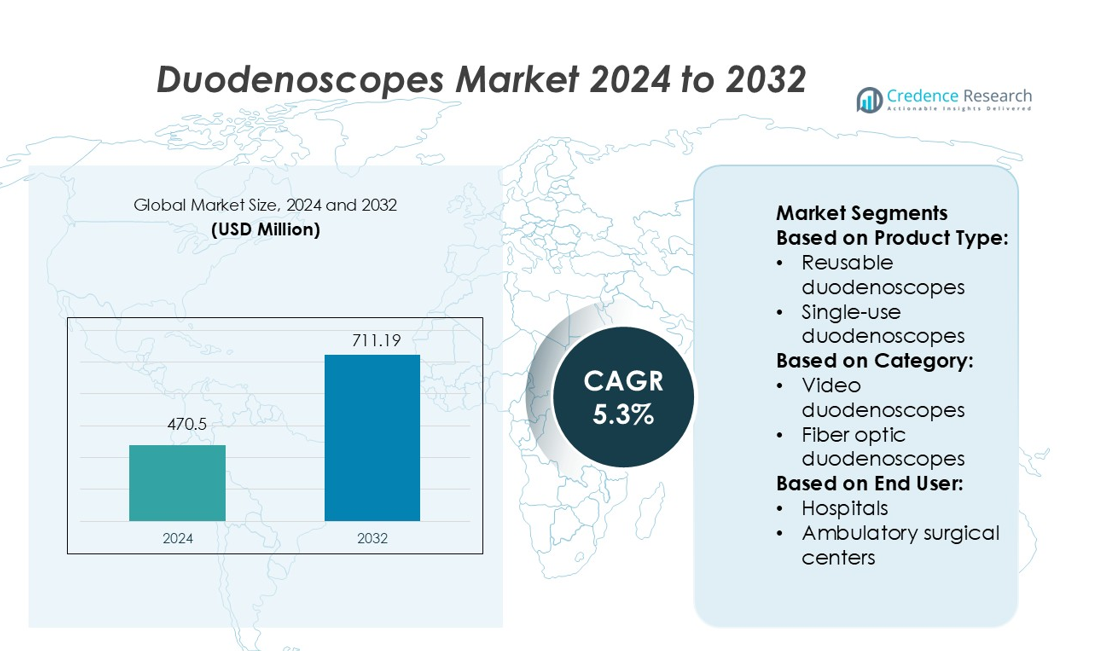

Duodenoscopes Market size was valued USD 470.5 million in 2024 and is anticipated to reach USD 711.19 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Duodenoscopes Market Size 2024 |

USD 470.5 million |

| Duodenoscopes Market, CAGR |

5.3% |

| Duodenoscopes Market Size 2032 |

USD 711.19 million |

The duodenoscopes market is shaped by strong competition among major players such as Olympus Corporation, Arthrex, Inc., FUJIFILM Holdings Corporation, SonoScape Medical Corp., Ambu A/S, Boston Scientific Corporation, Aesculap, Inc., PENTAX Medical (Hoya Corporation), Ottomed Endoscopy, and Covidien Plc. These companies focus on advancing imaging technologies, improving device safety, and expanding their global reach through partnerships and product innovation. North America leads the global duodenoscopes market with a 36% share, driven by high procedure volumes, advanced healthcare infrastructure, and rapid adoption of single-use models. Strong investment in R&D and regulatory compliance further strengthens the region’s leadership position.

Market Insights

- The duodenoscopes market was valued at USD 470.5 million in 2024 and is projected to reach USD 711.19 million by 2032, growing at a CAGR of 5.3%.

- Rising prevalence of gastrointestinal diseases and growing demand for minimally invasive procedures are driving market expansion.

- Increasing adoption of single-use duodenoscopes and integration of advanced imaging technologies are key trends shaping the market.

- The market is highly competitive with major players focusing on innovation, strategic collaborations, and expanding product portfolios.

- North America holds a 36% market share, leading globally, while reusable duodenoscopes dominate the product segment, supported by established clinical use and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Reusable duodenoscopes hold the dominant market share due to their widespread use in ERCP procedures and established integration in clinical workflows. Hospitals prefer reusable models for cost efficiency and consistent imaging performance across high patient volumes. Their advanced reprocessing systems help maintain infection control while extending product life. Manufacturers are enhancing durability and ease of reprocessing to meet stricter regulatory standards. In contrast, single-use duodenoscopes are growing rapidly, driven by infection prevention initiatives and regulatory push for safer endoscopy practices.

- For instance, Olympus’s TJF-Q190V duodenoscope features a 20% expanded vertical field of view compared with the prior model, enabling improved cannulation efficiency.

By Category

Video duodenoscopes lead the category segment with a significant share, supported by their superior imaging quality and advanced diagnostic capabilities. These devices offer high-resolution visualization, which improves procedure accuracy and patient outcomes. Growing adoption of digital platforms for real-time image sharing in hospitals and clinics strengthens their market leadership. Fiber optic duodenoscopes continue to serve lower-cost and resource-limited settings but are declining in share due to the increasing preference for digital alternatives in modern endoscopy centers.

- For instance, Arthrex’s Synergy Vision imaging system delivers ultra-high-definition 4K resolution (3840 × 2160 pixels) with a 10-bit color depth and HDR support. The system also supports secure live video streaming to authorized remote viewers and image export to USB or network locations.

By End User

Hospitals dominate the end-user segment, supported by their high patient inflow, advanced endoscopy units, and strong reimbursement infrastructure. Hospitals prioritize reusable and video duodenoscopes to perform complex procedures with precision and efficiency. Strategic procurement programs and investments in sterilization facilities further reinforce their market leadership. Ambulatory surgical centers are expanding rapidly due to faster procedure turnaround and lower costs, while other end users, including specialty clinics, cater to niche patient groups with rising adoption of single-use devices.

Key Growth Drivers

Rising Prevalence of Gastrointestinal Disorders

The increasing incidence of gastrointestinal diseases, including pancreatic and biliary conditions, is a major driver of the duodenoscopes market. Hospitals and clinics are performing more endoscopic retrograde cholangiopancreatography (ERCP) procedures, which depend heavily on duodenoscopes for accurate diagnosis and treatment. The growing elderly population is further increasing demand for minimally invasive procedures. Early disease detection and improved treatment outcomes are encouraging healthcare facilities to expand endoscopy services, fueling market growth worldwide.

- For instance, Fujifilm’s new video duodenoscope model ED-840T features a 4.5 mm instrument channel and a tip outer diameter of 13.1 mm, designed to improve insertion and treat biliary and pancreatic diseases.

Shift Toward Minimally Invasive Procedures

Healthcare systems are increasingly adopting minimally invasive approaches to reduce recovery time, hospital stays, and post-surgical complications. Duodenoscopes play a critical role in enabling ERCP procedures with high precision and minimal patient discomfort. This shift is supported by advancements in imaging technology and endoscopic accessories, which improve procedural accuracy. Growing patient preference for less invasive treatments and healthcare cost reduction strategies are driving higher procedure volumes and supporting broader market adoption.

- For instance, SonoScape’s X-2600 series image processor supports 1080p full high-definition output, integrates a 2-LED multi-spectrum light source with an average lifespan of 50,000 hours.

Advancements in Endoscopic Technologies

Continuous technological innovation in duodenoscopes is enhancing clinical performance and patient safety. Advanced video duodenoscopes now offer high-resolution imaging, real-time data sharing, and improved maneuverability during procedures. Integration of infection control features and better sterilization compatibility further increase their reliability. Manufacturers are also focusing on single-use models to eliminate contamination risks. These developments strengthen physician confidence, expand clinical applications, and contribute to market growth across both developed and emerging economies.

Key Trends & Opportunities

Growing Adoption of Single-Use Duodenoscopes

The increasing emphasis on infection prevention is driving demand for single-use duodenoscopes. Hospitals are shifting toward disposable models to reduce cross-contamination risks and comply with stricter regulatory guidelines. Leading manufacturers are introducing cost-effective designs and integrating advanced imaging features to match reusable models. This trend is opening opportunities in both high-income and emerging markets, especially where infection control infrastructure is limited, creating a new growth path for device suppliers and healthcare providers.

- For instance, Ambu’s aScope™ Duodeno 2 has a working channel diameter of 4.2 mm, a distal end outer diameter of 13.7 mm and an insertion tube outer diameter of 11.5 mm.

Integration of Digital Imaging and AI Technologies

The integration of advanced imaging and artificial intelligence tools in duodenoscopes is improving clinical accuracy and decision-making. AI-powered image analysis assists in early detection of lesions and enhances procedural efficiency. Digital platforms also enable real-time data transmission, improving collaboration among healthcare teams. These technologies not only increase diagnostic precision but also reduce procedure times and complications. This creates strong growth opportunities for vendors investing in smart, connected endoscopy solutions.

- For instance, BSX benchmarks of force reductions include a 35% reduction in left/right bending force, 25% in up/down, and 25% in elevator force, compared with Generation 2 models.

Expanding Access to Endoscopy in Emerging Markets

Rising healthcare investments and infrastructure development in emerging economies are creating strong market opportunities. Governments and private providers are expanding endoscopy units to improve access to advanced diagnostics. Affordable duodenoscope models and local training programs are encouraging adoption in secondary care facilities. Growing medical tourism in regions such as Asia-Pacific and Latin America is further boosting demand, supporting market expansion beyond traditional high-income markets.

Key Challenges

High Cost of Advanced Duodenoscopes

The high purchase and maintenance costs of advanced duodenoscopes remain a major challenge, particularly for small hospitals and clinics. Video duodenoscopes and single-use models involve significant upfront investments or recurring expenses. These costs limit adoption in resource-constrained settings and create barriers for rapid market penetration. Reimbursement limitations and budget constraints further restrict access to new technologies, slowing down growth in cost-sensitive markets.

Risk of Infection and Complex Reprocessing Procedures

Despite advancements, reusable duodenoscopes carry a persistent risk of infection transmission if not properly reprocessed. Reprocessing involves multiple steps and requires specialized equipment and trained personnel. Any breach in the sterilization process can lead to contamination and patient safety concerns. These risks increase operational complexity for healthcare providers and drive stricter regulatory scrutiny. As a result, hospitals face operational burdens that may slow adoption or require costly procedural changes.

Regional Analysis

North America

North America holds the largest market share of 36% in the global duodenoscopes market, driven by advanced healthcare infrastructure and a high volume of ERCP procedures. The United States leads the region, supported by favorable reimbursement policies and rapid adoption of innovative endoscopic technologies. Growing awareness of infection control has accelerated the shift toward single-use duodenoscopes, particularly in hospitals and outpatient centers. Major players are investing in product innovation and training programs to strengthen clinical adoption. High disease prevalence and increasing healthcare spending further solidify North America’s strong position in the global market.

Europe

Europe accounts for 29% of the global duodenoscopes market, supported by well-established healthcare systems and strict infection control regulations. Countries such as Germany, France, and the UK are leading adopters of advanced video duodenoscopes and single-use models. Regulatory bodies strongly emphasize patient safety, encouraging healthcare providers to adopt disposable solutions to minimize contamination risks. Strategic collaborations between hospitals and manufacturers are enhancing procedural efficiency and access to modern endoscopy. High awareness levels among physicians and steady technological adoption contribute to the region’s strong and stable market position.

Asia-Pacific

Asia-Pacific represents 22% of the global duodenoscopes market and is the fastest-growing region. The market growth is driven by rising healthcare investments, growing patient awareness, and an increasing burden of gastrointestinal disorders. China, Japan, and India are major contributors, supported by expanding hospital networks and improved endoscopy infrastructure. Affordable device offerings and government-led healthcare programs are improving access to advanced diagnostics. Additionally, growing medical tourism in countries like India and Thailand is boosting demand. The region’s expanding healthcare capacity and rapid technology adoption position Asia-Pacific as a key future growth hub.

Latin America

Latin America holds a 7% share in the global duodenoscopes market, supported by growing investments in healthcare infrastructure and rising adoption of endoscopic procedures. Brazil and Mexico are the primary contributors, driven by increasing prevalence of gastrointestinal diseases and improving access to specialized care. Public and private healthcare providers are investing in modern endoscopy units to expand service capabilities. While reusable duodenoscopes dominate due to cost advantages, interest in single-use models is rising in larger hospitals. Economic development and healthcare modernization efforts continue to support gradual market expansion in the region.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global duodenoscopes market, driven by improving healthcare infrastructure and increasing demand for advanced diagnostic procedures. The UAE, Saudi Arabia, and South Africa are key markets, supported by growing investments in specialized care centers. High-end hospitals are adopting video and single-use duodenoscopes to enhance infection control and procedural safety. However, limited access to advanced equipment in rural areas remains a restraint. Government healthcare initiatives and private sector participation are expected to gradually expand the adoption of duodenoscopes across the region.

Market Segmentations:

By Product Type:

- Reusable duodenoscopes

- Single-use duodenoscopes

By Category:

- Video duodenoscopes

- Fiber optic duodenoscopes

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The duodenoscopes market is characterized by strong competition among key players including Olympus Corporation, Arthrex, Inc., FUJIFILM Holdings Corporation, SonoScape Medical Corp., Ambu A/S, Boston Scientific Corporation, Aesculap, Inc., PENTAX Medical (Hoya Corporation), Ottomed Endoscopy, and Covidien Plc. The duodenoscopes market is highly competitive, driven by rapid technological advancements and rising clinical demand. Manufacturers are focusing on improving visualization, maneuverability, and infection control features to enhance procedural safety and efficiency. Single-use duodenoscopes are gaining strong momentum as healthcare providers aim to reduce contamination risks and comply with stricter regulatory guidelines. Companies are actively investing in product development, strategic collaborations, and global distribution expansion to strengthen their market presence. Growing emphasis on training programs, after-sales support, and cost-effective product offerings is further intensifying competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- Arthrex, Inc.

- FUJIFILM Holdings Corporation

- SonoScape Medical Corp.

- Ambu A/S

- Boston Scientific Corporation

- Aesculap, Inc.

- PENTAX Medical (Hoya Corporation)

- Ottomed Endoscopy

- Covidien Plc

Recent Developments

- In August 2024, KARL STORZ United States partnered with FUJIFILM Healthcare Americas Corporation (Fujifilm) to provide comprehensive solutions for endoscopists and surgeons.

- In August 2024, PENTAX Medical, a division of HOYA group, announced that it has received FDA clearance for their DEC Duodenoscope compatible with the STERRAD 100NX Sterilizer, a product of Advanced Sterilization Products (ASP). This partnership between Pentax and ASP may enable to improve the ongoing challenges of duodenoscope reprocessing.

- In July 2024, FUJIFILM India opened a new endoscopy center in Mumbai. This center is FUJIFILM’s second-largest unit, equipped with repair tools and technology that aim to reduce service turnaround times.

- In April 2024, Ambu announced that it has received FDA clearance for its new generation duodenoscopy solution, Ambu aScope Duodeno 2 and Ambu aBox 2, to be used in ERCP procedures. This development may allow company to expand its product basket and enhance its industry presence

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive procedures will continue to increase worldwide.

- Single-use duodenoscopes will gain wider adoption due to infection control measures.

- Technological advancements will enhance imaging quality and procedural precision.

- Integration of AI and digital tools will support real-time diagnostics.

- Hospitals will expand endoscopy units to meet rising patient volumes.

- Emerging markets will experience faster growth due to infrastructure development.

- Regulatory bodies will enforce stricter safety and sterilization standards.

- Strategic partnerships will strengthen global product distribution.

- Training programs will increase physician adoption of advanced scopes.

- Competition will drive innovation and faster product launches.