Market Overview

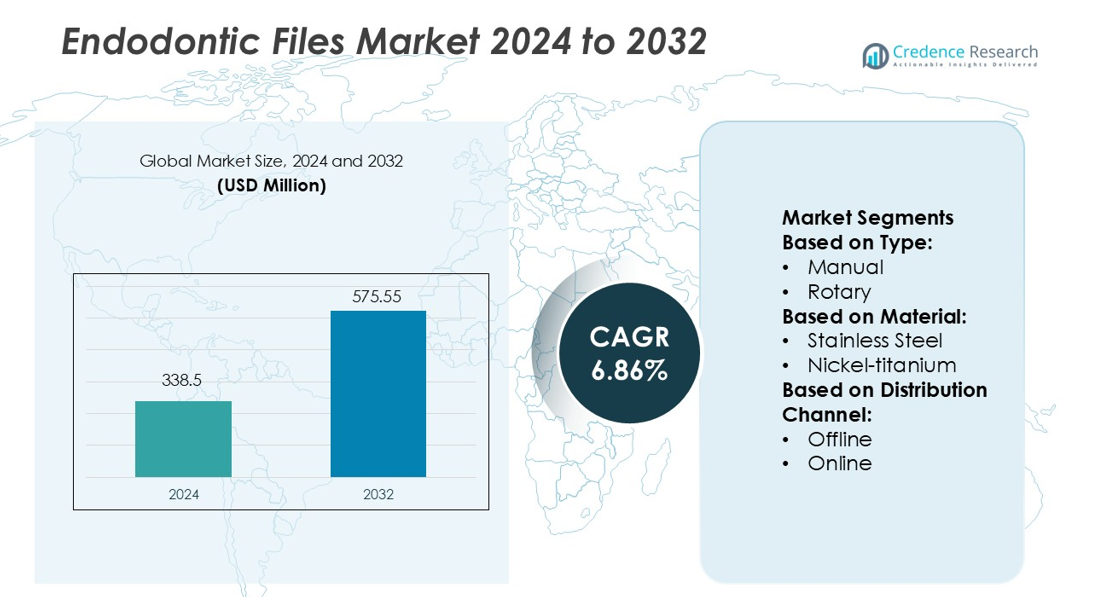

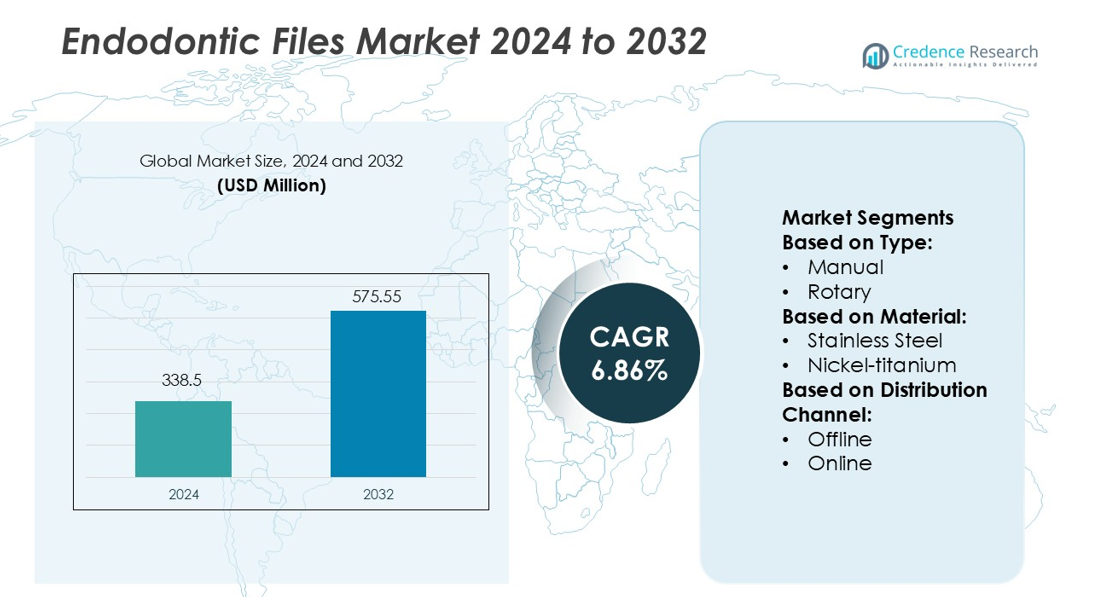

Endodontic Files Market size was valued USD 338.5 million in 2024 and is anticipated to reach USD 575.55 million by 2032, at a CAGR of 6.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endodontic Files Market Size 2024 |

USD 338.5 million |

| Endodontic Files Market, CAGR |

6.86% |

| Endodontic Files Market Size 2032 |

USD 575.55 million |

The Endodontic Files Market is highly competitive, with leading players including Dentsply Sirona, Envista Holdings Corporation, Coltene, META-BIOMED CO., LTD, FKG Dentaire Srl, Planmeca Oy, Brasseler USA, EdgeEndo, DiaDent Group International, and VDW GmbH. These companies focus on innovation in nickel-titanium file systems, enhanced flexibility, and improved cutting efficiency to meet clinical precision standards. North America leads the global market with a 36% share, driven by advanced dental infrastructure, high adoption of rotary file systems, and continuous product development initiatives. Strong professional training programs and a well-established distribution network further reinforce the region’s dominance in endodontic instrumentation.

Market Insights

- The Endodontic Files Market was valued at USD 338.5 million in 2024 and is projected to reach USD 575.55 million by 2032, registering a CAGR of 6.86% during the forecast period.

- Market growth is driven by rising cases of dental disorders, increasing adoption of rotary and nickel-titanium file systems, and expanding dental care infrastructure worldwide.

- Technological advancements, such as heat-treated NiTi files and digital integration in endodontic procedures, continue to define market trends and enhance procedural efficiency.

- North America dominates the market with a 36% share, followed by Europe with 29% and Asia-Pacific with 23%, reflecting regional leadership in dental technology adoption.

- The rotary file segment holds the largest share within product categories, supported by growing demand for automated, high-precision endodontic solutions and strong presence of key manufacturers investing in innovation and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The rotary segment dominated the Endodontic Files Market with a significant market share due to its precision, efficiency, and reduced chair time. Rotary files, powered by electric motors, provide better shaping ability and consistent canal cleaning, which enhances procedural outcomes. The demand for rotary files is driven by the rising adoption of advanced endodontic techniques and the growing number of dental professionals favoring automated solutions. The manual segment, while still relevant in developing regions, is gradually losing share as clinics transition toward mechanized endodontic procedures for higher productivity and patient comfort.

- For instance, Dentsply Sirona’s ProTaper Gold rotary file system uses an 11 mm handle length and a convex triangular cross-section, offers 2.4× greater resistance to cyclic fatigue compared to its predecessor, and features a 24 % increase in flexibility over the previous generation.

By Material

Nickel-titanium (NiTi) files held the dominant share in the market owing to their superior flexibility, shape memory, and resistance to cyclic fatigue. These properties allow NiTi files to navigate complex root canal anatomies with minimal risk of procedural errors. Their growing use among endodontists reflects the shift toward premium, efficiency-driven materials that reduce instrument separation. Stainless steel files, while cost-effective, are more prone to stiffness and deformation, making them less suitable for curved canals. The rising preference for NiTi instruments continues to drive innovation in thermomechanically treated file designs.

- For instance, FKG Dentaire’s “RaCe” system applies an electro-chemical surface polishing treatment that according to the company brochure increases torsional and metal fatigue resistance by “2 to 10 times” compared to untreated instruments.

By Distribution Channel

The offline segment led the Endodontic Files Market, capturing a major market share due to strong sales networks of dental distributors and the trust dental professionals place in in-person product demonstrations. Clinics and hospitals often prefer offline procurement for immediate access and technical support. However, the online segment is expanding rapidly, driven by the convenience of digital ordering platforms and bulk discounts from e-commerce distributors. The shift toward online channels is further accelerated by growing digitalization in dental supply chains and the availability of verified product listings on authorized platforms.

Key Growth Drivers

Rising Prevalence of Dental Disorders

The increasing incidence of dental caries, pulp infections, and root canal complications is driving demand for endodontic procedures globally. As more patients seek effective restorative treatments, the need for advanced endodontic files has grown significantly. Dental care awareness and the availability of specialized clinics are further supporting this growth. Governments and healthcare institutions promoting oral hygiene campaigns have also boosted preventive and therapeutic dental visits, indirectly expanding the market for precision-driven endodontic instruments.

- For instance, Planmeca’s 3D imaging units offer an “endodontic mode” with voxel size of 75 µm, enabling visualization of even the finest anatomical details in root canals.

Technological Advancements in Endodontic Instruments

Continuous innovations in endodontic file design and material composition are propelling market growth. The development of heat-treated nickel-titanium files with enhanced flexibility and fatigue resistance has improved procedural efficiency. Additionally, manufacturers are integrating ergonomic designs and automated rotary systems to enhance safety and reduce procedural errors. These advancements help practitioners complete treatments faster and with greater accuracy. The growing adoption of electric motor-driven rotary systems among dental professionals is further accelerating technological evolution in this field.

- For instance, Brasseler USA’s power system offers a speed range of 200-1,000 rpm with torque control and auto-reverse functions designed to reduce procedural errors.

Expansion of Dental Care Infrastructure

The rapid establishment of dental clinics and hospitals, especially in developing economies, is boosting the adoption of endodontic files. Governments and private organizations are investing in modernizing oral healthcare facilities to meet increasing patient demand. The expansion of dental service networks and inclusion of advanced endodontic treatments in insurance plans have encouraged higher procedural volumes. Educational programs and dental workshops are also enhancing practitioner proficiency, further driving market penetration. This expansion is strengthening product accessibility across both urban and semi-urban regions.

Key Trends & Opportunities

Growing Adoption of Minimally Invasive Endodontics

Minimally invasive endodontic techniques are gaining traction due to patient preference for pain-free and tissue-conserving procedures. Manufacturers are developing ultra-flexible files designed for smaller canal access and enhanced cleaning efficiency. This approach reduces postoperative discomfort and improves recovery time. The trend aligns with the broader shift toward conservative dental treatments, creating opportunities for file makers to introduce specialized product lines. Dental professionals increasingly favor these instruments for their precision and safety in complex procedures.

- For instance, EdgeEndo’s EdgeFile® X7 system uses its Heat-Treated FireWire™ NiTi alloy and is offered in tapers .04 and .06 across sizes 17-45 and lengths 21 mm, 25 mm and 29 mm.

Integration of Digital and AI-Based Technologies

Digital imaging, computer-aided design, and AI-assisted diagnostic systems are reshaping endodontic workflows. Advanced software allows dentists to plan and execute root canal procedures with higher precision using real-time data. AI-based systems assist in canal morphology analysis and file selection, improving treatment outcomes. Manufacturers that integrate digital compatibility with their instruments are gaining a competitive edge. This trend offers opportunities for collaboration between dental device companies and digital technology providers to create smarter, data-driven endodontic solutions.

- For instance, Coltène’s HyFlex EDM system uses an electrical discharge machining process that produces a hardened surface and yields up to 700 % higher fracture resistance compared with conventional NiTi files.

Rising Demand in Emerging Economies

Developing regions such as Asia-Pacific and Latin America present significant opportunities due to growing dental tourism and improved healthcare infrastructure. Increasing disposable income and awareness of oral health are driving patient visits for restorative treatments. Governments in these regions are investing in public dental programs, expanding access to endodontic care. Local manufacturing and distribution networks are also strengthening, reducing costs and improving availability. These factors collectively enhance market growth potential across emerging economies.

Key Challenges

High Cost of Advanced Endodontic Systems

The high cost of rotary and NiTi-based file systems remains a barrier for small dental clinics and practitioners in low-income regions. Premium materials and precision manufacturing increase production expenses, making these instruments less accessible. Additionally, the need for compatible electric motors and frequent replacement of worn files adds to operational costs. Limited reimbursement coverage for endodontic procedures further discourages widespread adoption in cost-sensitive markets. Addressing affordability through localized production and competitive pricing remains a key industry challenge.

Risk of Instrument Fracture and Procedural Errors

Despite technological improvements, file separation and instrument fracture continue to pose challenges during root canal treatments. These issues often arise due to improper usage, cyclic fatigue, or inadequate training among dental practitioners. Such complications can compromise treatment success and lead to patient dissatisfaction. Manufacturers are investing in research to improve fatigue resistance and develop more durable materials. However, the need for continuous practitioner training and procedural precision remains critical to minimizing these operational risks.Top of Form

Regional Analysis

North America

North America held the largest share of the Endodontic Files Market at 36%, driven by a high prevalence of dental disorders, advanced healthcare infrastructure, and strong adoption of rotary endodontic systems. The U.S. dominates regional demand due to the presence of key manufacturers, frequent product innovations, and extensive insurance coverage for dental procedures. Increasing dental awareness and widespread access to technologically advanced treatments also support growth. The market benefits from high expenditure on oral healthcare and an established network of dental professionals skilled in modern endodontic practices.

Europe

Europe accounted for 29% of the global Endodontic Files Market, supported by strong healthcare systems, an expanding elderly population, and increased focus on preventive dental care. Countries such as Germany, France, and the U.K. lead in market adoption due to advanced clinical infrastructure and government-backed oral health programs. The region’s demand is further fueled by the growing use of nickel-titanium rotary files and strict regulatory standards promoting product quality. Rising investments in dental education and professional training continue to strengthen procedural outcomes and drive consistent market expansion.

Asia-Pacific

Asia-Pacific captured 23% of the Endodontic Files Market and is the fastest-growing regional segment. The region’s growth is driven by increasing dental tourism, improving healthcare infrastructure, and growing awareness of oral hygiene. China, India, and Japan lead demand with expanding networks of private dental clinics and rising disposable incomes. Manufacturers are increasingly focusing on local production to offer cost-effective endodontic solutions. The region also benefits from a growing number of dental colleges and training programs, which enhance professional expertise and accelerate adoption of advanced endodontic technologies across emerging economies.

Latin America

Latin America represented 7% of the Endodontic Files Market, supported by improving access to dental care and a gradual rise in dental procedure volumes. Brazil and Mexico lead regional growth, driven by expanding private dental practices and government-led oral health initiatives. The increasing availability of affordable endodontic instruments and local distribution networks supports market penetration. However, limited insurance coverage and uneven healthcare access restrain overall growth. Still, growing awareness about root canal treatments and ongoing modernization of dental facilities continue to offer promising opportunities for market participants.

Middle East & Africa

The Middle East & Africa region accounted for 5% of the Endodontic Files Market, reflecting a steady yet developing demand for endodontic instruments. Growth is supported by expanding dental tourism in the UAE and Saudi Arabia, along with increasing investment in healthcare modernization. The rising number of specialized dental clinics and training institutions is improving treatment standards across major cities. However, limited access to advanced technologies in low-income African nations hampers adoption. Ongoing healthcare reforms and import partnerships are gradually improving market reach and encouraging product availability across the region.

Market Segmentations:

By Type:

By Material:

- Stainless Steel

- Nickel-titanium

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Endodontic Files Market features leading companies such as META-BIOMED CO., LTD, Dentsply Sirona, FKG Dentaire Srl, Planmeca Oy, Brasseler USA, EdgeEndo, DiaDent Group International, Coltene, VDW GmbH, and Envista Holdings Corporation. The Endodontic Files Market is characterized by strong innovation, product differentiation, and expanding global reach. Manufacturers are focusing on developing advanced nickel-titanium files with enhanced flexibility, fatigue resistance, and cutting efficiency to meet evolving clinical needs. The market is also witnessing increased integration of digital tools and endodontic motors to improve treatment accuracy and workflow efficiency. Strategic collaborations with dental institutions and continuous professional training programs are strengthening brand visibility and customer loyalty. Companies are further investing in automation, biocompatible materials, and sustainable manufacturing processes to align with global quality standards and maintain competitiveness in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Kerr Dental introduced ZenFlex CM, an advanced rotary file designed to enhance endodontic procedures. Featuring innovative technology and a proprietary heat-treatment process, ZenFlex CM delivers exceptional performance and reliability, setting a new benchmark in root canal treatments.

- In September 2024, SCHOTT Pharma, one of the leaders in pharmaceutical drug containment and delivery solutions, joined forces with Gerresheimer AG (and Stevanato Group S.p.A. to form a strategic alliance called the “Alliance for RTU.” This collaboration aims to promote the market adoption of Ready-to-Use (RTU) vials and cartridges.

- In September 2024, Opentrons Labworks, Inc. introduced the Opentrons Flex Prep robot, featuring innovative no-code software. This new system enables users to easily configure a pipetting task and execute the workflow directly via Flex Prep’s touchscreen interface, streamlining lab automation processes.

- In August 2024, Dentsply Sirona launched the U.S. X-Smart Pro+ and Reciproc Blue, offering a streamlined one-file endodontic solution. The X-Smart Pro+ motor includes an integrated apex locator and features genuine reciprocating motion, while the flexible Reciproc Blue file is designed for efficient one-file endodontic procedures.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for advanced nickel-titanium files will continue to rise due to superior flexibility and durability.

- Digital integration and AI-assisted endodontic planning tools will enhance treatment precision.

- Rotary and reciprocating file systems will dominate clinical adoption for faster and safer procedures.

- Manufacturers will focus on eco-friendly and reusable materials to meet sustainability goals.

- Dental tourism in emerging economies will drive higher procedural volumes and equipment sales.

- Expanding dental education and training programs will accelerate the adoption of modern endodontic tools.

- Product innovations with enhanced fatigue resistance and adaptive motion technology will shape competition.

- E-commerce channels will gain traction as dental professionals prefer convenient online procurement.

- Government-supported oral health programs will boost awareness and procedural demand globally.

- Strategic mergers and partnerships will strengthen market presence and broaden global product portfolios.