Market Overview

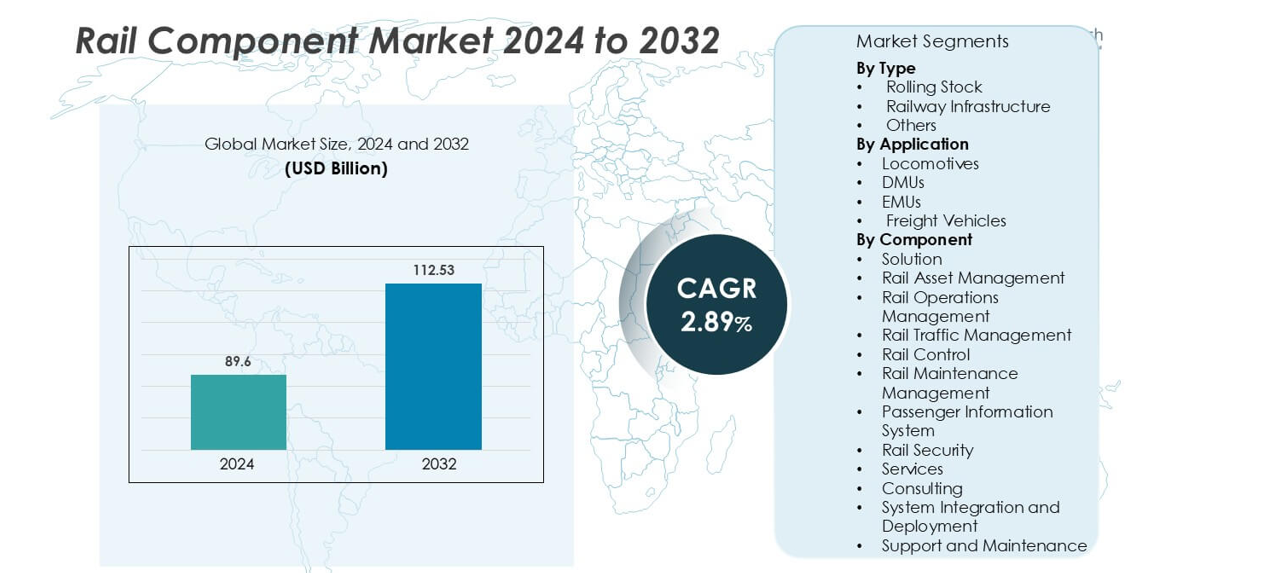

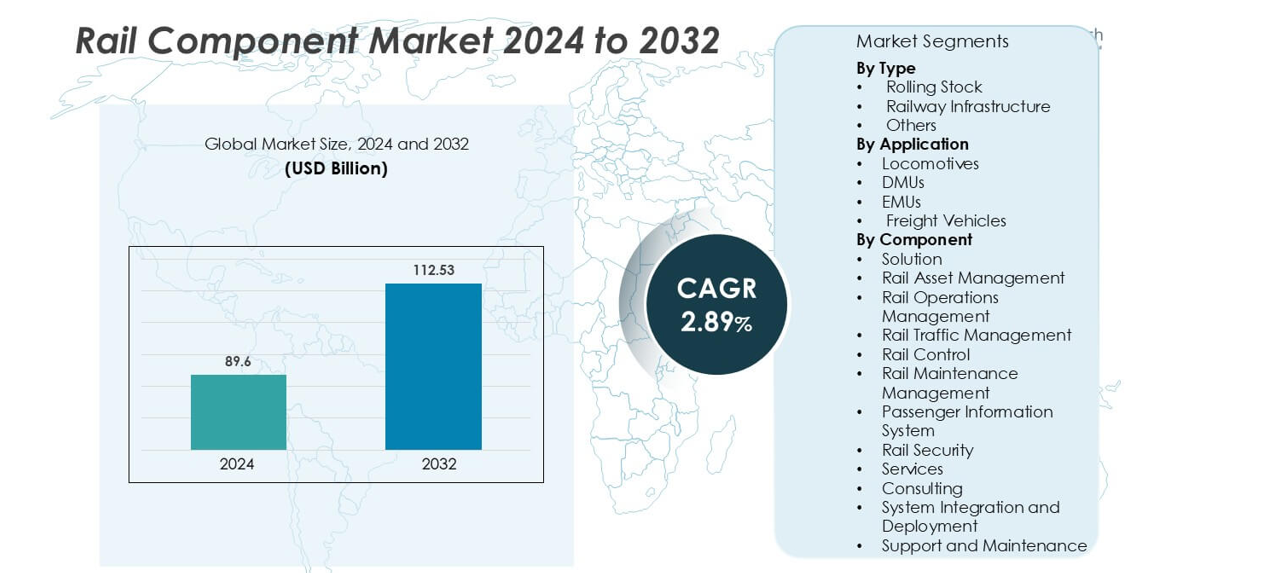

Rail Component market size was valued USD 89.6 billion in 2024 and is anticipated to reach USD 112.53 billion by 2032, at a CAGR of 2.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rail Component Market Size 2024 |

USD 89.6 billion |

| Rail Component Market, CAGR |

2.89% |

| Rail Component Market Size 2032 |

USD 112.53 billion |

The global rail component market is led by key players such as Siemens AG (Germany), Alstom SA (France), Hitachi Ltd. (Japan), ABB Ltd. (Switzerland), Wabtec Corporation (U.S.), CAF S.A. (Spain), and Hyundai Rotem (South Korea), all competing through innovation, strategic alliances, and technological advancements. These companies focus on digital rail systems, energy-efficient rolling stock, and predictive maintenance solutions to strengthen their positions. Asia-Pacific emerges as the leading region, commanding approximately 40–42% of the total market share, driven by rapid urbanization, extensive infrastructure investments, and large-scale adoption of high-speed and electrified rail networks across China, Japan, and India.

Market Insights

- The global rail component market size is expected to grow from USD 89.6 billion in 2025 to USD 112.53 billion by 2032, registering a CAGR of 2.89%.

- Drivers include increasing adoption of solutions (software and platforms) which in 2025 are projected to account for 62% of the digital railway market share.

- A key trend is rising regional segmentation: in 2024, the digital twin urban-rail signal market in Asia Pacific.

- Competitive forces growing: major players including Siemens AG, Alstom, Hitachi Rail, Thales Group and Wabtec Corporation dominate the market for digital-rail solutions and are rapidly investing in IoT, AI and signalling systems.

- Restraints include high upfront implementation costs, integration challenges with legacy systems and cybersecurity risks in the digital rail environment which are cited as significant barriers to adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The rail component market, segmented by type into Rolling Stock, Railway Infrastructure, and Others, is dominated by the Rolling Stock segment, which accounts for the largest market share. This dominance is driven by the rising demand for high-performance and energy-efficient train systems across passenger and freight transport. Increasing investments in modernizing fleets, adopting lightweight materials, and integrating advanced braking and traction systems further enhance growth. Additionally, government initiatives promoting sustainable transportation and the expansion of high-speed rail networks continue to boost the adoption of advanced rolling stock components globally.

- For Instance, the Avelia Liberty trains, also known as Amtrak’s NextGen Acela, have a design speed capability of 186 mph (300 km/h).

By Application

The market is categorized into Locomotives, DMUs, EMUs, Freight Vehicles, and Others, with EMUs (Electric Multiple Units) emerging as the dominant sub-segment. EMUs hold a substantial market share due to the accelerating shift toward electrification and urban mass transit solutions. Their operational efficiency, lower emissions, and suitability for high-frequency suburban and intercity routes drive demand. Increasing government focus on reducing carbon footprints and improving commuter convenience has led to expanded EMU deployment, particularly in Europe and Asia-Pacific, where rail modernization projects are rapidly advancing.

- For instance, Hitachi supplied the Class 800 and 801 Intercity Express Train (IET) series for the UK’s Great Western Railway (GWR).

By Component

In the component segmentation—Solution and Services—the Solution segment dominates the market, primarily due to advancements in rail control, traffic management, and asset management systems. Within solutions, rail control systems account for the largest share, driven by the need for enhanced safety, automated signaling, and real-time monitoring capabilities. The growing implementation of digital technologies such as IoT, AI, and predictive analytics in railway operations supports this trend. Meanwhile, the Services segment, including consulting and maintenance support, is gaining momentum as operators focus on optimizing lifecycle performance and reducing downtime through proactive management strategies.

Key Growth Drivers

Rising Investments in Rail Infrastructure Modernization

Global investments in rail infrastructure modernization are a major driver of the rail component market’s expansion. Governments and private entities are increasingly funding upgrades to outdated rail systems to improve safety, efficiency, and sustainability. Projects such as high-speed rail networks, metro expansions, and freight corridor developments are fueling demand for advanced rolling stock components, signaling systems, and smart maintenance solutions. Emerging economies, particularly in Asia-Pacific, are leading this transformation with large-scale infrastructure programs aimed at improving connectivity. The integration of automation and digital technologies into modern rail systems further enhances operational efficiency, strengthening market growth.

- For instance, Alstom did supply signaling systems for parts of India’s DFC. In 2015, the company signed two contracts to supply signaling and power supply systems, specifically mentioning the Smartlock 400 system.

Growing Demand for Sustainable and Energy-Efficient Transport

The shift toward eco-friendly transportation is significantly boosting the rail component market. Rail transport is recognized as one of the most energy-efficient and low-emission modes of mass transit, aligning with global sustainability targets. Governments are incentivizing electric and hybrid locomotives, regenerative braking systems, and lightweight materials to minimize carbon footprints. The rising adoption of Electric Multiple Units (EMUs) and electrified freight vehicles underscores this trend. Additionally, the rail sector’s focus on reducing lifecycle costs and improving fuel efficiency encourages innovations in traction systems, energy storage, and smart monitoring technologies that further drive market demand.

- For instance, the iLint’s range of up to 1,000 km on one tank is consistently reported by Alstomand in news coverage. In September 2022, an iLint set a record by traveling 1,175 km without refueling.

Technological Advancements and Digitalization

Rapid digital transformation across the rail industry is a pivotal growth catalyst. The implementation of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and predictive analytics enhances operational control and maintenance efficiency. Digital twins, smart sensors, and automated signaling systems enable real-time monitoring of assets, improving reliability and safety. Moreover, rail operators are increasingly adopting integrated software platforms for traffic management and asset optimization. These advancements not only streamline operations but also minimize downtime and operational costs. The growing emphasis on intelligent transport systems and autonomous rail technologies continues to redefine industry standards and market potential.

- For instance, Hitachi Rail’s acquisition of Thales’ Ground Transportation Systems (GTS) business in May 2024 added approximately 9,000 employees, increasing its total workforce to 24,000 globally.

Key Trends & Opportunities

Expansion of High-Speed and Urban Rail Networks

The rapid expansion of high-speed and urban rail systems presents a significant opportunity for component manufacturers. Countries across Asia, Europe, and the Middle East are investing heavily in high-speed rail corridors and metro systems to alleviate congestion and promote sustainable mobility. This surge in network expansion drives demand for specialized components, including advanced braking systems, traction motors, and signaling technologies. Moreover, urbanization and rising commuter populations are accelerating investments in metro and suburban rail projects, creating new growth avenues for suppliers of modern rolling stock and rail infrastructure components tailored to high-frequency operations.

- For instance, Bombardier Transportation’s joint venture in China delivered 184 new-generation high-speed rail cars for two contracts with China Railway Corporation showing how large rolling-stock orders anchor component-supply demand.

Integration of Predictive Maintenance and Smart Monitoring Solutions

The growing adoption of predictive maintenance solutions represents a key trend transforming the rail component market. Operators are leveraging data analytics, IoT sensors, and AI-driven monitoring tools to predict component wear and prevent failures before they occur. This approach enhances safety, reduces downtime, and lowers lifecycle costs. The increasing focus on condition-based maintenance also drives the need for sensor-equipped components and connected platforms capable of real-time data collection. As digital maturity increases, the integration of cloud-based analytics and remote monitoring systems offers new revenue opportunities for component suppliers and service providers alike.

Public-Private Partnerships (PPPs) in Rail Development

Public-private partnerships are emerging as a vital model for financing and executing large-scale rail projects. Governments are collaborating with private investors to modernize infrastructure, develop advanced rolling stock, and introduce innovative rail technologies. These collaborations improve funding efficiency and enable faster implementation of modernization programs. For component manufacturers, PPPs open long-term contracts for supply and maintenance services. Additionally, such partnerships encourage innovation by fostering competitive ecosystems that prioritize safety, digitalization, and sustainability, positioning the rail component market for sustained growth in both developed and emerging regions.

Key Challenges

High Capital and Maintenance Costs

The rail component market faces significant challenges due to high initial capital investments and ongoing maintenance costs. Developing and deploying advanced rail systems, including high-speed trains and smart infrastructure, require substantial financial commitments. Smaller operators often struggle with funding constraints, limiting the adoption of cutting-edge technologies. Moreover, maintenance of sophisticated components such as digital control systems, signaling devices, and traction equipment demands skilled labor and consistent upgrades, increasing operational expenses. These cost pressures can hinder modernization initiatives, especially in emerging markets where budget limitations restrict large-scale infrastructure investmen

Supply Chain Disruptions and Raw Material Volatility

Volatility in raw material prices and global supply chain disruptions pose major hurdles for the rail component industry. Key materials such as steel, aluminum, and composites are subject to price fluctuations influenced by global economic conditions and trade policies. Additionally, geopolitical tensions and logistics bottlenecks have led to delays in component availability and manufacturing schedules. These disruptions impact production timelines and profitability for manufacturers. To mitigate risks, companies are increasingly focusing on supply chain diversification, local sourcing, and strategic partnerships; however, sustained instability remains a threat to consistent market growth and cost efficiency.

Regional Analysis

North America:

North America holds a significant share of the global rail component market, accounting for approximately 22–25% of the total market value. The region’s growth is driven by the modernization of freight rail networks and the adoption of advanced signaling and control systems. The United States leads with substantial investments in freight rail upgrades, while Canada focuses on expanding passenger and commuter rail infrastructure. Ongoing initiatives to enhance energy efficiency and integrate digital technologies in rail operations further support market expansion, with increasing emphasis on predictive maintenance and sustainable transport solutions.

Europe:

Europe represents around 28–30% of the global rail component market, driven by strong rail infrastructure, technological innovation, and sustainability goals. Countries such as Germany, France, and the United Kingdom lead in adopting electric and high-speed trains, supported by EU-funded modernization programs. The region’s emphasis on decarbonization and smart mobility fosters demand for advanced rolling stock, signaling systems, and maintenance solutions. Additionally, the deployment of cross-border rail projects and intelligent traffic management systems continues to strengthen Europe’s position as a leader in rail technology and efficient transportation networks.

Asia-Pacific:

Asia-Pacific dominates the global rail component market with an estimated 40–42% market share, fueled by rapid urbanization, infrastructure investment, and expanding high-speed rail networks. China, Japan, and India are at the forefront, implementing large-scale projects to improve connectivity and reduce congestion. Government initiatives promoting electrified rail systems and sustainable transportation further accelerate market growth. The region’s strong manufacturing base, coupled with rising demand for freight and passenger mobility, continues to drive technological advancements in rolling stock and signaling components, reinforcing Asia-Pacific’s leadership in the global rail component industry.

Latin America:

Latin America accounts for approximately 5–6% of the global rail component market, with moderate growth supported by ongoing infrastructure development and public transport initiatives. Brazil, Mexico, and Argentina are key markets focusing on modernizing freight corridors and urban rail systems. Government efforts to enhance regional connectivity and attract private investments have increased the adoption of advanced rail technologies. Although economic constraints and uneven project implementation pose challenges, rising interest in sustainable transport and efficiency improvements is expected to create new opportunities for rail component manufacturers in the coming years.

Middle East & Africa:

The Middle East and Africa region holds around 4–5% of the global rail component market, driven by government-led infrastructure diversification and mobility initiatives. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in rail modernization and urban transit development. The expansion of metro systems, freight corridors, and intercity rail networks is stimulating demand for advanced signaling, control, and rolling stock components. Although high project costs and funding limitations remain challenges in parts of Africa, increased partnerships and regional connectivity goals continue to support steady market growth.

Market Segmentations:

By Type

- Rolling Stock

- Railway Infrastructure

- Others

By Application

- Locomotives

- DMUs

- EMUs

- Freight Vehicles

- Others

By Component

- Solution

- Rail Asset Management

- Rail Operations Management

- Rail Traffic Management

- Rail Control

- Rail Maintenance Management

- Passenger Information System

- Rail Security

- Services

- Consulting

- System Integration and Deployment

- Support and Maintenance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rail component market is characterized by the presence of several global and regional players competing through technological innovation, strategic partnerships, and product diversification. Leading companies such as Siemens AG, Alstom SA, Hitachi Ltd., Wabtec Corporation, and ABB Ltd. dominate the market by offering comprehensive solutions across rolling stock, signaling, control, and maintenance systems. These firms are investing heavily in digitalization, automation, and sustainability-focused technologies to strengthen their market position. Emerging players and specialized component manufacturers are focusing on niche segments, including smart monitoring and predictive maintenance systems, to capture growth opportunities. Strategic collaborations, mergers, and acquisitions remain key competitive strategies to expand geographical reach and enhance product portfolios. The increasing focus on energy efficiency, reliability, and real-time data integration continues to reshape competition, driving companies to develop next-generation rail components aligned with evolving regulatory standards and customer expectations worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG (Germany)

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain)

- Honeywell International Inc. (U.S.)

- ABB Ltd. (Switzerland)

- Hitachi, Ltd. (Japan)

- Indra Sistemas, S.A. (Spain)

- Wabtec Corporation (U.S.)

- Hyundai Rotem (South Korea)

- IBM Corporation (U.S.)

- Alstom SA (France)

- Huawei Technologies Co., Ltd. (China)

- Cisco Systems, Inc. (U.S.)

Recent Developments

- In April 2025, Jupiter Tatravagonka Railwheel Factory Pvt. Ltd. began constructing India’s first private forged-wheel and axle plant in Odisha with a Rs 2,500 crore outlay (USD 301 million), targeting 100,000 wheelsets per year.

- In March 2025, Aanjaney Rail Pvt. Ltd. secured a CONCOR contract for 1,350 LW LH25 25 t axle-load bogies and associated components, with completion slated by August 2026.

- In January 2024, Wabtec won a USD 157 million brake-system contract from Siemens Mobility India for 1,200 9,000-HP electric locomotives destined for Indian Railways

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rail component market will experience steady growth driven by ongoing rail infrastructure modernization worldwide.

- Increasing adoption of digital and automated technologies will enhance operational efficiency across rail systems.

- Electrification of rail networks will continue to accelerate, reducing dependency on fossil fuels.

- Demand for lightweight and energy-efficient rolling stock components will rise with sustainability goals.

- Predictive maintenance and IoT-enabled monitoring solutions will become standard across major rail operators.

- Emerging economies will witness rapid expansion in urban rail and high-speed network projects.

- Integration of artificial intelligence and data analytics will improve safety and asset management.

- Public-private partnerships will play a crucial role in financing and executing large-scale rail projects.

- Component manufacturers will focus on modular designs and interoperability to meet diverse regional needs.

- The growing emphasis on sustainable mobility will position rail transport as a key pillar of global green infrastructure.