Market Overview:

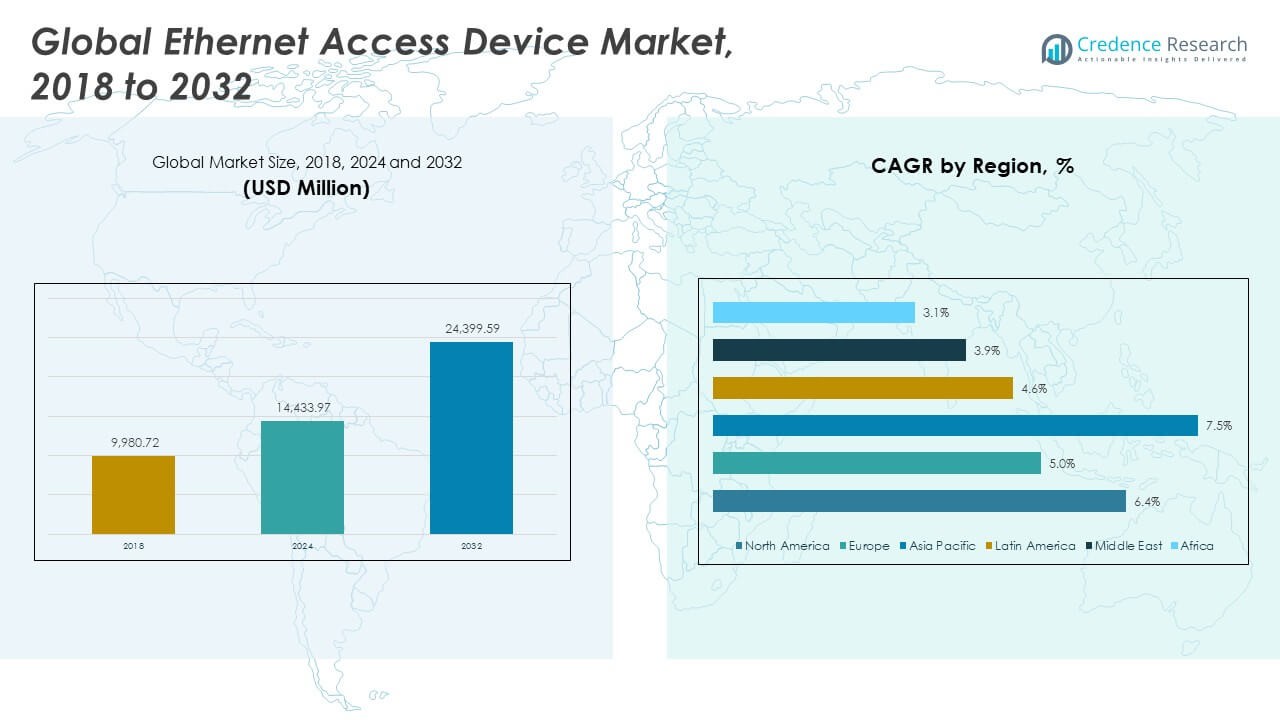

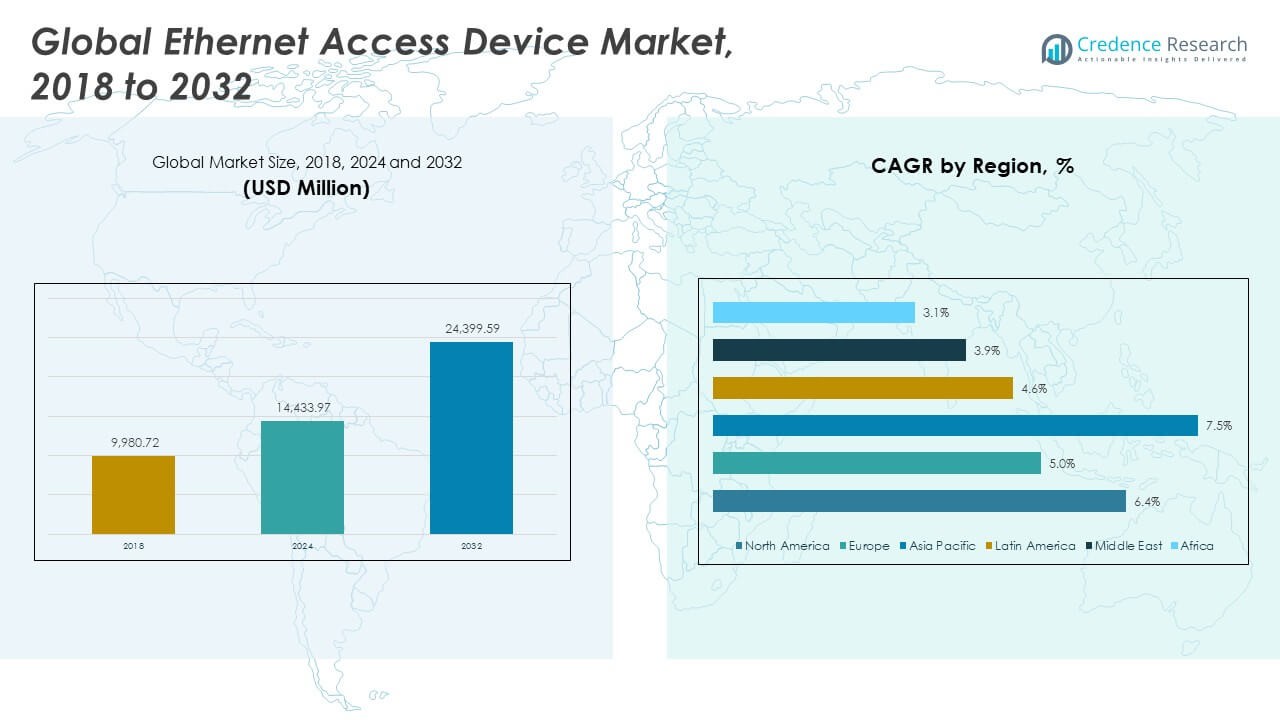

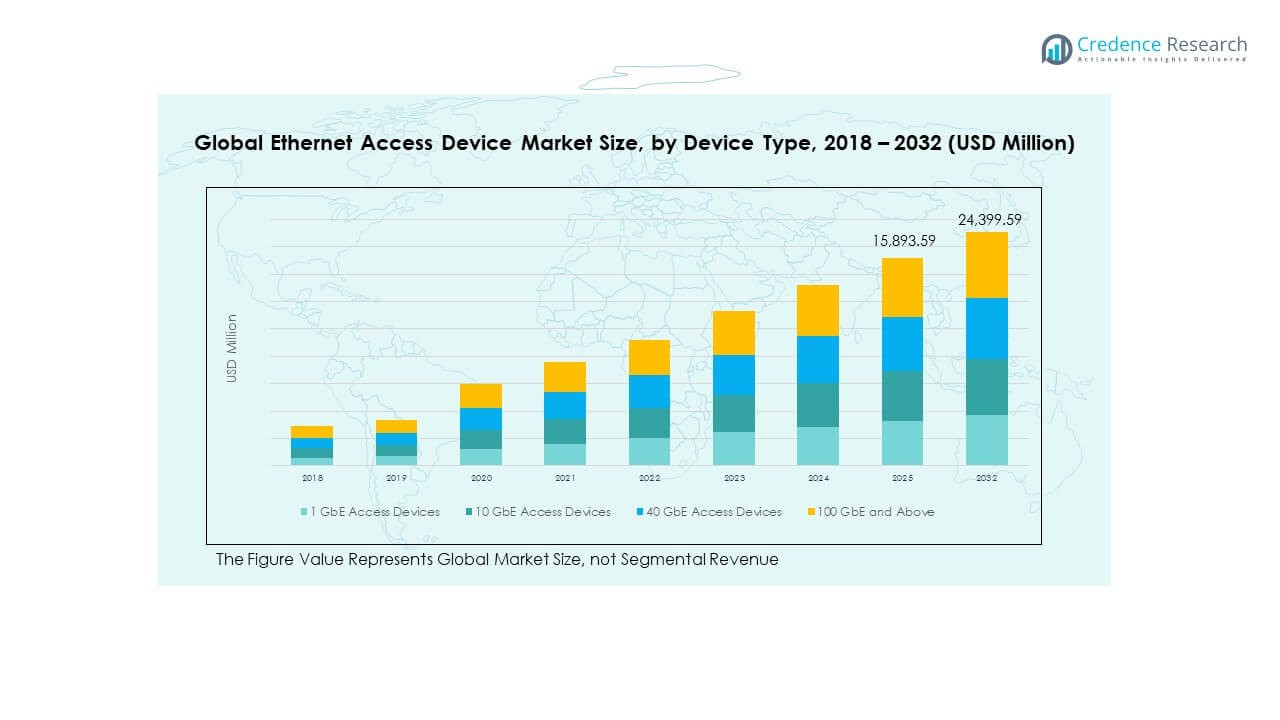

The Global Ethernet Access Device Market size was valued at USD 9,980.72 million in 2018 to USD 14,433.97 million in 2024 and is anticipated to reach USD 24,399.59 million by 2032, at a CAGR of 6.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethernet Access Device Market Size 2024 |

USD 14,433.97 Million |

| Ethernet Access Device Market, CAGR |

6.31% |

| Ethernet Access Device Market Size 2032 |

USD 24,399.59 Million |

The market growth is driven by rising data consumption, expanding enterprise networks, and increasing demand for high-speed broadband connectivity. Businesses are investing in Ethernet access devices to enhance network reliability and reduce latency in digital operations. The growing adoption of cloud services, IoT applications, and 5G infrastructure accelerates deployment, while ongoing upgrades in telecom infrastructure strengthen market expansion.

North America dominates the market due to widespread adoption of advanced networking technologies and strong presence of key telecom providers. Europe follows with growing investment in broadband modernization projects. Meanwhile, the Asia-Pacific region is emerging rapidly, supported by large-scale digital transformation initiatives, rising enterprise connectivity needs, and expanding telecom infrastructure in countries like China, India, and Japan.

Market Insights:

- The Global Ethernet Access Device Market size was valued at USD 9,980.72 million in 2018, reached USD 14,433.97 million in 2024, and is projected to hit USD 24,399.59 million by 2032, expanding at a CAGR of 6.31% during the forecast period.

- North America (36%), Asia Pacific (26%), and Europe (15%) accounted for the top three regional shares in 2024, supported by strong digital infrastructure, early 5G deployment, and large-scale enterprise adoption of Ethernet technologies.

- Asia Pacific remains the fastest-growing region, with nearly 26% share, driven by rapid industrial automation, smart city initiatives, and extensive telecom modernization in China, India, and Japan.

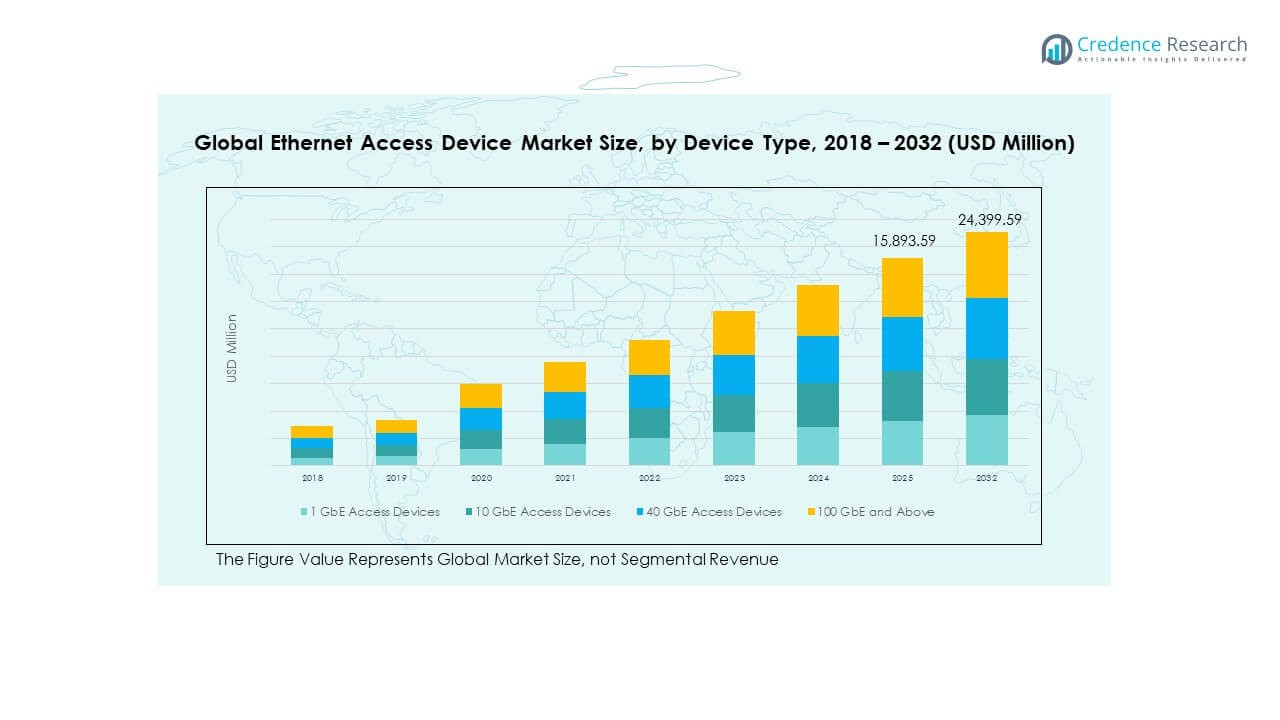

- 1 GbE Access Devices held the largest share of approximately 40% in 2024, driven by widespread use in enterprise broadband and small network deployments.

- 10 GbE and Above Devices represented about 35% of the market, fueled by rising demand from data centers, telecom providers, and cloud service operators for higher bandwidth and network scalability.

Market Drivers:

Rising Demand for High-Speed Broadband and Enterprise Connectivity

The Global Ethernet Access Device Market is expanding due to rising enterprise demand for high-speed and reliable broadband networks. Businesses in banking, healthcare, and retail are adopting Ethernet devices to support real-time data transfer and seamless cloud integration. The rapid digitalization of business operations has created a strong need for low-latency and high-capacity connectivity. Telecom providers are investing heavily in network upgrades to handle surging data traffic volumes. The shift from legacy TDM networks to Ethernet-based solutions drives modernization efforts across sectors. Ethernet access devices deliver scalable bandwidth to meet evolving business requirements. Service providers are leveraging them to offer cost-efficient network access to SMEs and large corporations. Increasing global internet penetration and IoT expansion further accelerate market demand.

- For instance, Arista Networks’ 7500R series supports up to 2,304 10 GbE/25 GbE ports and 576 wire-speed 100 GbE ports in a single platform. The rapid digitalisation of business operations has created a strong need for low-latency and high-capacity connectivity. Telecom providers are investing heavily in network upgrades to handle surging data traffic volumes. The shift from legacy TDM networks to Ethernet-based solutions drives modernization efforts across sectors. Ethernet access devices deliver scalable bandwidth to meet evolving business requirements.

Expanding Cloud Services and Data Center Infrastructure Adoption

The increasing deployment of data centers and cloud platforms is fueling the adoption of Ethernet access devices across industries. Enterprises are shifting to hybrid and multi-cloud environments that require fast, secure, and consistent connectivity. These devices enhance cloud service delivery by reducing latency and improving bandwidth management. Cloud service providers rely on Ethernet access for high-speed interconnections between multiple data centers. Rising adoption of SaaS and IaaS solutions strengthens device integration in enterprise networks. The growth of 5G and edge computing further amplifies the demand for Ethernet-based connections. It supports real-time applications, analytics, and virtualized environments. The scalability and cost efficiency of Ethernet devices make them ideal for data-intensive businesses.

- For instance, Arista’s 7500R provides non-blocking 150 Tbps system capacity and latency under 4 microseconds, supporting data-centre scale Ethernet access. These devices enhance cloud service delivery by reducing latency and improving bandwidth management. Cloud service providers rely on Ethernet access for high-speed interconnections between multiple data centres. Rising adoption of SaaS and IaaS solutions strengthens device integration in enterprise networks.

Growing Integration of IoT and Smart Network Technologies

Increasing use of IoT and connected devices across industrial and commercial environments drives Ethernet access device utilization. Smart factories, transportation systems, and energy grids depend on stable and high-speed networks for continuous operations. These devices ensure seamless data exchange between machines, sensors, and control systems. The adoption of Industry 4.0 technologies increases the need for efficient connectivity infrastructure. Ethernet access solutions provide reliable communication with minimal downtime in automated facilities. The proliferation of IP-based devices boosts Ethernet traffic volumes globally. It supports the integration of IoT platforms with enterprise networks for optimized monitoring and management. Demand from smart cities and connected utilities enhances long-term growth potential.

Advancements in Carrier Ethernet Standards and Network Automation

Technological progress in carrier Ethernet standards such as MEF 3.0 and SDN-enabled automation is transforming connectivity performance. These advancements allow network operators to deliver flexible, scalable, and secure Ethernet services. Automation reduces manual intervention in configuration and service delivery. It enables faster provisioning and optimized bandwidth allocation for enterprises. Enhanced Quality of Service (QoS) features help prioritize critical business applications. The adoption of software-defined networking (SDN) and network function virtualization (NFV) strengthens Ethernet infrastructure agility. Network operators deploy Ethernet access devices to expand managed service portfolios. Continuous R&D investments in next-generation Ethernet technologies are improving efficiency and interoperability across platforms.

Market Trends:

Shift Toward Software-Defined and Virtualized Network Architectures

The Global Ethernet Access Device Market is witnessing strong adoption of software-defined networking and network function virtualization. Enterprises seek agile, programmable networks that can adapt quickly to changing workloads. Virtualized Ethernet infrastructure enables efficient bandwidth management and service orchestration. Telecom operators are using SDN-based Ethernet access devices to enhance service flexibility. These solutions allow centralized network control, simplifying maintenance and reducing costs. Integration of artificial intelligence in network management improves fault detection and response times. It is supporting a transition from static hardware systems to dynamic, software-driven architectures. This shift enhances scalability and supports new service models such as network slicing.

- For instance, Juniper Networks’ SDN and Orchestration portfolio enables automated network workflows and multicloud control spanning tens of sites. Virtualised Ethernet infrastructure enables efficient bandwidth management and service orchestration. Telecom operators are using SDN-based Ethernet access devices to enhance service flexibility. These solutions allow centralised network control, simplifying maintenance and reducing costs. Integration of AI in network management improves fault detection and response times.

Rising Deployment of 5G Infrastructure and Edge Connectivity Solutions

The rollout of 5G networks across major economies is creating significant demand for Ethernet access devices. Telecom providers are upgrading backhaul infrastructure to handle high-speed data traffic between base stations and core networks. Ethernet-based access ensures low latency, which is vital for 5G performance. The emergence of edge computing expands Ethernet’s role in connecting localized data centers and micro facilities. Enterprises deploying edge networks rely on Ethernet devices for secure and consistent connectivity. The trend supports faster data processing near the source, reducing congestion in central servers. It is enabling applications such as autonomous vehicles, smart manufacturing, and remote healthcare. Integration with fiber networks enhances bandwidth reliability and scalability.

- For instance, Nokia Corporation launched a new high-density 16-port 25G PON line card that supports GPON, XGS-PON and 25G PON in one solution, enabling wider-scale fibre transport to 5G cell sites. Ethernet-based access ensures low latency, which is vital for 5G performance. The emergence of edge computing expands Ethernet’s role in connecting localised data centres and micro-facilities. Enterprises deploying edge networks rely on Ethernet devices for secure and consistent connectivity.

Growing Focus on Energy Efficiency and Sustainable Network Solutions

Sustainability initiatives are influencing product development in the Ethernet device sector. Manufacturers are designing low-power, eco-friendly devices that reduce energy consumption and carbon footprint. Green Ethernet technologies help operators optimize power use during low network activity periods. Enterprises are adopting energy-efficient access devices to align with environmental compliance standards. Governments are encouraging telecom infrastructure upgrades that promote resource-efficient operations. The trend supports cost reduction and sustainability targets for operators. It is driving innovation in component design, cooling systems, and materials. The focus on sustainability enhances corporate reputation and appeals to environmentally conscious enterprises.

Increased Adoption of Managed Ethernet Services Among SMEs

Small and medium enterprises are rapidly adopting managed Ethernet services to enhance productivity and reduce infrastructure complexity. These services offer scalable connectivity without large capital investment. Ethernet access devices enable service providers to deliver customized, flexible solutions for diverse business needs. Managed Ethernet supports remote operations, video conferencing, and data backup services with high reliability. It allows businesses to integrate cloud applications seamlessly while maintaining security. The growing trend of remote and hybrid work environments further supports adoption. It helps SMEs compete effectively by accessing enterprise-grade connectivity at lower costs. Service providers benefit from recurring revenue streams through managed Ethernet contracts.

Market Challenges Analysis:

High Capital Expenditure and Integration Complexity in Network Infrastructure

The Global Ethernet Access Device Market faces challenges due to high deployment and integration costs associated with large-scale infrastructure upgrades. Network operators must invest heavily in hardware, cabling, and software to meet advanced connectivity demands. Smaller service providers often struggle to manage these expenses, slowing adoption. Integration of Ethernet access devices with legacy systems creates technical complexity and compatibility issues. The need for continuous maintenance and updates increases operational expenditure. Limited interoperability between multi-vendor systems further complicates network management. It requires specialized expertise, increasing dependency on skilled professionals. These factors collectively restrict rapid adoption, particularly among developing economies and smaller enterprises.

Cybersecurity Threats and Data Privacy Concerns Across Expanding Networks

Expanding Ethernet networks expose businesses to higher cybersecurity risks and data breaches. Increasing data traffic and interconnected devices create more entry points for cyberattacks. Network operators must implement strong encryption and access control systems to protect data integrity. Many enterprises face difficulties maintaining consistent security across distributed infrastructures. The shortage of cybersecurity expertise worsens the issue. Unauthorized access, ransomware, and network manipulation incidents reduce trust in connected solutions. It prompts regulatory bodies to impose stricter compliance standards, raising costs for providers. Maintaining security resilience while ensuring seamless connectivity remains one of the biggest challenges in the market.

Market Opportunities:

Emergence of Smart Cities and Expanding IoT Ecosystem

The Global Ethernet Access Device Market offers strong opportunities in smart city and IoT applications. Governments are investing in digital infrastructure to enable connected transportation, energy, and public services. Ethernet devices provide reliable backhaul connectivity for sensors, cameras, and control systems. Smart utilities and industries require continuous, low-latency connections for automation and monitoring. The rise of connected homes and vehicles boosts Ethernet device demand. It supports real-time communication and efficient data exchange within complex urban systems. Manufacturers developing IoT-optimized Ethernet solutions can capture significant growth potential.

Rising Expansion of 5G, Cloud, and Edge Data Centers

Rapid 5G expansion and increasing edge computing investments present growth avenues for Ethernet device vendors. Telecom operators and enterprises are establishing distributed data centers to reduce latency and improve performance. Ethernet access devices enable seamless interconnection between these centers. The rising demand for cloud-based business models accelerates deployments across regions. It creates opportunities for vendors offering high-capacity, programmable Ethernet solutions. Strategic partnerships with telecom providers can help capture emerging opportunities in data-driven ecosystems. Growing digitization across sectors ensures sustained long-term demand for Ethernet connectivity infrastructure.

Market Segmentation Analysis:

By Device Type

The Global Ethernet Access Device Market is segmented into 1 GbE, 10 GbE, 40 GbE, and 100 GbE and above devices. 1 GbE access devices dominate due to their widespread use in small enterprises and broadband connections. 10 GbE devices are gaining traction in data centers and enterprise networks for faster throughput. Demand for 40 GbE and 100 GbE devices is increasing rapidly with the expansion of high-capacity backbone networks and cloud infrastructure. It benefits from continuous upgrades in telecom and enterprise connectivity systems. The shift toward higher bandwidth and scalable Ethernet solutions drives innovation in this segment.

- For instance, Intel Corporation’s Ethernet portfolio supports connectivity from “1-200 GbE” through its E-series controllers, enabling smooth migration from legacy 1 GbE links. 10 GbE devices are gaining traction in data centres and enterprise networks for faster throughput.

By Application

The market covers applications such as residential broadband, enterprise & commercial, industrial automation, and others. Residential broadband holds a steady share supported by fiber-to-home deployments. The enterprise & commercial segment leads in revenue contribution due to large-scale adoption of Ethernet in offices, campuses, and data facilities. Industrial automation is emerging as a key application with growing digital transformation in manufacturing. It ensures efficient communication between IoT devices and control systems, improving operational efficiency.

- For instance, Arista’s platform supports breakout modes from 100 GbE down to 10 GbE to handle sensor-to-control network links in smart factories. It ensures efficient communication between IoT devices and control systems, improving operational efficiency.

By End-User Industry

Based on end-user industry, the market includes telecommunications, IT & data centers, manufacturing, healthcare, and others. Telecommunications remains the largest segment driven by network modernization and fiber expansion projects. IT & data centers follow closely, supported by the rise in cloud computing and virtualization. Manufacturing and healthcare sectors show rising adoption of Ethernet solutions to enhance process reliability and data transfer speeds. It continues to evolve with sector-specific requirements for high-performance networking.

Segmentation:

By Device Type

- 1 GbE Access Devices

- 10 GbE Access Devices

- 40 GbE Access Devices

- 100 GbE and Above

By Application

- Residential Broadband

- Enterprise & Commercial

- Industrial Automation

- Others

By End-User Industry

- Telecommunications

- IT & Data Centers

- Manufacturing

- Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

By Country (Regional Breakdown)

- North America:S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Ethernet Access Device Market size was valued at USD 4,365.02 million in 2018 to USD 6,247.16 million in 2024 and is anticipated to reach USD 10,589.66 million by 2032, at a CAGR of 6.4% during the forecast period. North America holds the largest market share of around 36% in 2024, driven by robust technological infrastructure and early adoption of advanced networking solutions. The region benefits from extensive 5G rollout and high enterprise demand for secure, low-latency data transmission. Major cloud and telecom companies are investing in Ethernet solutions to strengthen connectivity performance. The U.S. dominates the regional market, supported by strong digital transformation initiatives across manufacturing, healthcare, and IT sectors. Canada and Mexico are also experiencing steady growth with rising broadband penetration. It continues to benefit from regulatory support for next-generation network deployment and the presence of global technology leaders.

Europe

The Europe Global Ethernet Access Device Market size was valued at USD 1,848.77 million in 2018 to USD 2,526.04 million in 2024 and is anticipated to reach USD 3,879.70 million by 2032, at a CAGR of 5.0% during the forecast period. Europe accounts for nearly 15% of the global market in 2024, led by strong investments in broadband and fiber infrastructure. Germany, the UK, and France remain key contributors to market demand. The European Union’s digital policies are supporting Ethernet-based modernization in both public and private sectors. The rise of smart factories and IoT integration is expanding device utilization across industrial automation. Enterprises in financial services and education are adopting Ethernet to enhance operational efficiency. The regional focus on sustainability and green data centers supports the use of energy-efficient network devices. It continues to evolve with advancements in cloud connectivity and cybersecurity infrastructure.

Asia Pacific

The Asia Pacific Global Ethernet Access Device Market size was valued at USD 2,906.72 million in 2018 to USD 4,436.55 million in 2024 and is anticipated to reach USD 8,174.08 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific commands nearly 26% of the global market in 2024 and remains the fastest-growing region. Strong economic growth, rapid digitalization, and large-scale 5G investments in China, India, Japan, and South Korea are propelling expansion. The region’s manufacturing and IT hubs are increasingly adopting Ethernet for automation and high-speed data exchange. Government-led smart city initiatives further boost demand for reliable network infrastructure. Local players and international vendors are expanding production capacity to meet rising connectivity needs. Cloud adoption and e-commerce growth also enhance the deployment of Ethernet access devices. It continues to strengthen its position as a leading hub for telecom and data network innovation.

Latin America

The Latin America Global Ethernet Access Device Market size was valued at USD 451.47 million in 2018 to USD 644.44 million in 2024 and is anticipated to reach USD 958.59 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America holds about 6% of the global share, supported by expanding telecom infrastructure and growing enterprise connectivity investments. Brazil and Mexico are leading markets, driven by demand for broadband modernization and digital business transformation. The rise in data center construction across major cities encourages the use of Ethernet-based networking. Governments are promoting digital inclusion programs that boost broadband accessibility. Small and medium enterprises are adopting Ethernet solutions to enhance efficiency and competitiveness. It is gradually shifting from legacy systems to high-capacity Ethernet networks. Regional service providers are focusing on cost-effective deployments to attract enterprise customers.

Middle East

The Middle East Global Ethernet Access Device Market size was valued at USD 262.94 million in 2018 to USD 345.53 million in 2024 and is anticipated to reach USD 486.49 million by 2032, at a CAGR of 3.9% during the forecast period. The region contributes nearly 4% of the global share, supported by telecom sector reforms and growing investments in data connectivity. GCC countries are leading adoption with extensive fiber rollouts and smart city projects. The UAE and Saudi Arabia are accelerating network modernization to meet the rising digital service demand. Enterprises in oil and gas, financial services, and government sectors are deploying Ethernet access devices for enhanced communication reliability. Regional expansion of hyperscale data centers is improving infrastructure resilience. It continues to benefit from national initiatives aimed at digital transformation and infrastructure diversification.

Africa

The Africa Global Ethernet Access Device Market size was valued at USD 145.79 million in 2018 to USD 234.24 million in 2024 and is anticipated to reach USD 311.06 million by 2032, at a CAGR of 3.1% during the forecast period. Africa represents about 3% of the global market share in 2024, with growth driven by rising internet connectivity and mobile broadband expansion. Countries such as South Africa, Egypt, and Kenya are investing in telecom modernization to improve data access. Increasing cloud service availability is fostering Ethernet adoption among enterprises. The need for reliable communication infrastructure across banking, education, and logistics sectors enhances market penetration. It faces challenges from limited network funding and infrastructure gaps but continues to progress steadily. Ongoing international partnerships and investments in undersea cables support future growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Fujitsu Ltd.

- ADVA Optical Networking

- RAD Data Communications

- Ciena Corporation

- ZTE Corporation

- Ekinops S.A.

Competitive Analysis:

The Global Ethernet Access Device Market is highly competitive, characterized by innovation-driven strategies and expanding product portfolios. Leading companies such as Cisco Systems, Huawei Technologies, Juniper Networks, and Nokia Corporation dominate through continuous investment in high-speed connectivity and network automation solutions. It focuses on developing scalable and software-defined Ethernet devices to meet enterprise and telecom needs. Strategic collaborations and regional expansions strengthen market presence and customer reach. The competition also involves mid-tier firms like ADVA Optical Networking, Ciena Corporation, and RAD Data Communications focusing on customized enterprise and industrial applications.

Recent Developments:

- In October 2025 Cisco announced the introduction of the Cisco 8223 routing system, built around the Silicon One P200 chip, delivering industry-leading scale for AI-connected data centers and enabling secure, scalable inter-data-center AI workloads.

- In 2025 Hewlett Packard Enterprise completed its acquisition of Juniper Networks to offer a broad, cloud-native AI-driven portfolio, a move announced in February 2025 and finalized mid-year, marking Juniper’s transition into HPE’s networking strategy. In parallel, Juniper formalized its channel and partner programs, such as the Juniper Partner Advantage 2025 initiative launched in January 2025 to accelerate partner growth and profitability amid the integration.

- In 2025 Huawei announced strategic collaborations focused on 5G/6G network infrastructure and global optical transport solutions, including partnerships with regional operators to deploy high-capacity Ethernet access devices and secure AI-enabled networking fabrics.

Report Coverage:

The research report offers an in-depth analysis based on Device Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration of AI-driven Ethernet devices will enhance network intelligence and performance.

- Rising demand for 10 GbE and above access devices will reshape enterprise connectivity.

- Expansion of 5G infrastructure will increase Ethernet backhaul deployment across regions.

- Adoption of SDN and NFV technologies will drive automation in network management.

- Data center expansion and cloud adoption will boost large-scale Ethernet deployments.

- Small and medium enterprises will increasingly adopt managed Ethernet services.

- Green networking initiatives will push development of energy-efficient access devices.

- Regional players in Asia-Pacific will gain traction with localized and cost-effective solutions.

- Strategic collaborations between telecom and IT firms will accelerate digital transformation.

- Continuous R&D investment will foster innovation in next-generation Ethernet technologies.