Market Overview

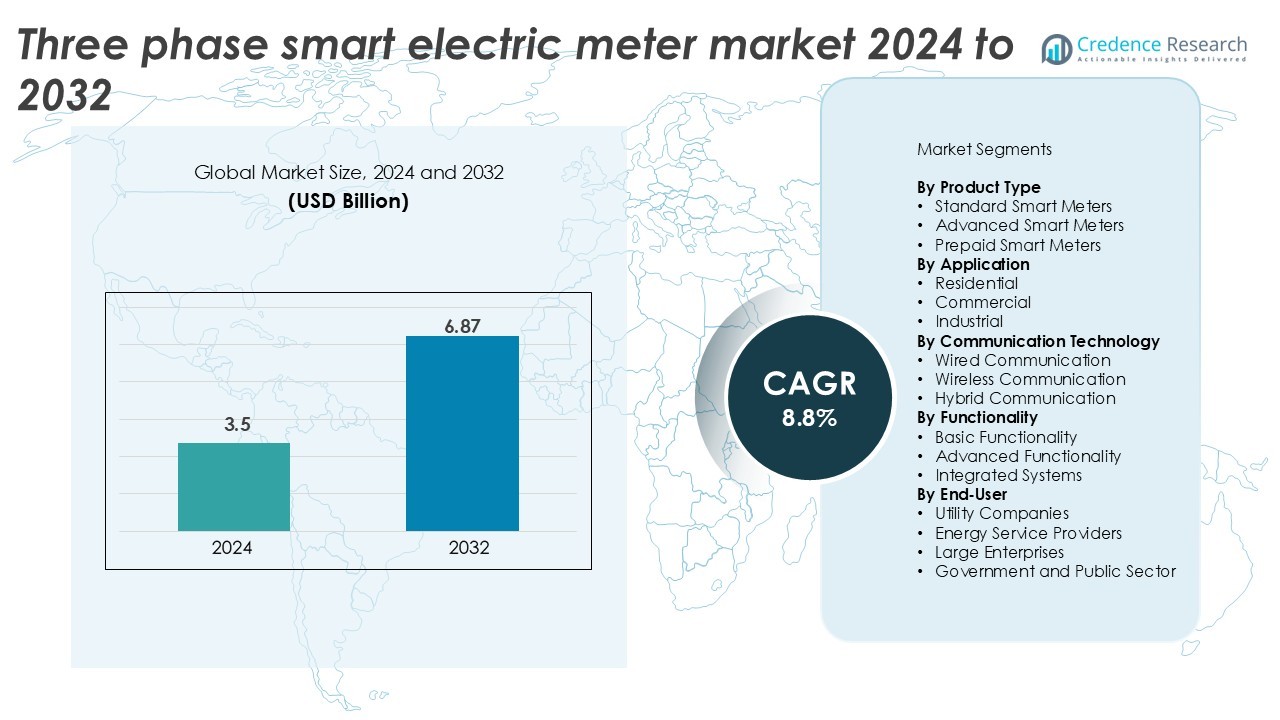

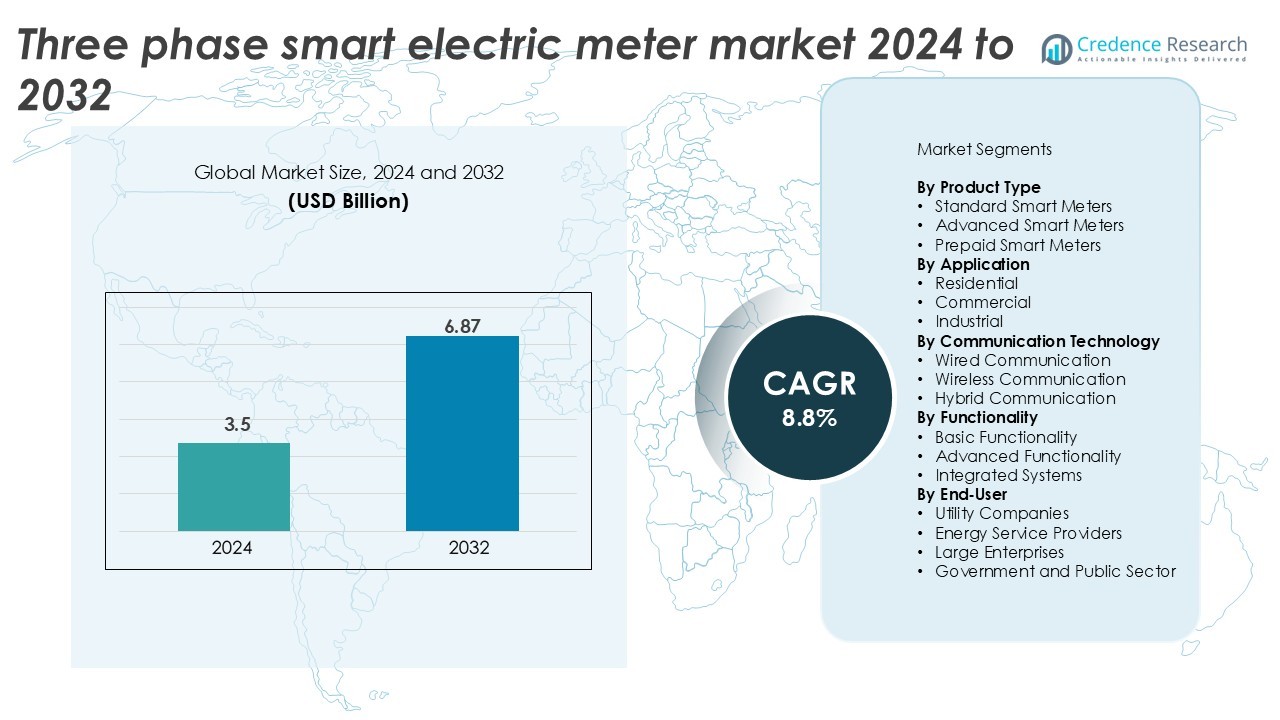

The Three-Phase Smart Electric Meter Market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.87 billion by 2032, registering a CAGR of 8.8% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three-Phase Smart Electric Meter Market Size 2024 |

USD 3.5 Billion |

| Three-Phase Smart Electric Meter Market, CAGR |

8.8% |

| Three-Phase Smart Electric Meter Market Size 2032 |

USD 6.87 Billion |

The Three-Phase Smart Electric Meter Market is led by prominent players including Siemens, Landis+Gyr, Itron Inc., Honeywell International Inc., Kamstrup, General Electric, Apator SA, Holley Performance Products, Iskraemeco Group, CyanConnode, Circutor, and Larsen & Toubro Limited. These companies focus on technological advancements such as IoT-enabled analytics, enhanced accuracy, and cybersecurity integration. Strategic partnerships with utilities and governments strengthen their competitive edge in large-scale smart grid deployments. North America dominates the market with a 36.8% share, supported by strong grid digitalization initiatives, followed by Europe with 28.4%, driven by strict energy efficiency regulations and smart meter mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The three-phase smart electric meter market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.87 billion by 2032, registering a CAGR of 8.8%.

- Rising investments in smart grid infrastructure and government initiatives for digital metering drive strong global demand.

- Integration of IoT, AI, and wireless communication technologies enhances operational efficiency and promotes data-driven energy management.

- The market is highly competitive with players such as Siemens, Landis+Gyr, Itron, Honeywell, Kamstrup, and Schneider Electric focusing on advanced metering infrastructure (AMI) and interoperability.

- North America leads with 36.8% share, followed by Europe at 28.4%, while the industrial segment dominates product deployment, supported by growing smart grid expansion across Asia Pacific.

Market Segmentation Analysis:

By Product Type

Advanced smart meters dominate the three-phase smart electric meter market, holding a 46.7% share in 2024. Their dominance is driven by enhanced features such as real-time monitoring, dynamic pricing, and fault detection, which improve grid reliability and energy management. For instance, Siemens’ SENTRON PAC3200 series supports multi-parameter measurement and digital connectivity, allowing precise power quality tracking in industrial networks. Increasing adoption of IoT-based grid systems and demand for predictive analytics further accelerate the deployment of advanced meters in both developed and emerging economies.

- For instance, SENTRON PAC3200 from Siemens AG measures over 50 electrical parameters (including voltages, currents, power, frequency, THD) and provides direct phase-voltage measurement up to 830 V and current inputs for x/1 A or x/5 A CTs.

By Application

The industrial segment leads the market with a 41.2% share in 2024, driven by rising energy consumption in manufacturing and process industries. Smart meters in this segment enable load management, energy optimization, and predictive maintenance. For instance, Schneider Electric’s PowerLogic ION9000 series delivers Class 0.1 accuracy and modular communication options, helping industries reduce operational losses. The need for efficient monitoring in heavy-load facilities, combined with smart grid integration initiatives, strengthens the industrial application segment’s growth globally.

- For instance, Schneider Electric’s PowerLogic ION9000 provides Class 0.1 S accuracy (IEC 62053-22) and supports sampling rates up to 512 samples per cycle, enabling advanced waveform capture for transient events

By Communication Technology

Wired communication dominates the market with a 43.5% share in 2024 due to its reliability and lower latency in transmitting critical data. Utilities favor wired systems such as PLC and Ethernet for secure and stable data flow. For instance, Landis+Gyr’s E450 series uses power line carrier technology to ensure seamless data transmission across long-distance networks. While wireless and hybrid systems are gaining traction, wired communication remains preferred for large-scale grid deployments requiring consistent and interference-free operation.

Key Growth Drivers

Rising Smart Grid Investments and Digitalization of Power Networks

Growing investments in smart grid infrastructure are driving large-scale adoption of three-phase smart meters. Utilities and governments are modernizing grid systems to enable real-time monitoring, dynamic pricing, and efficient energy distribution. The integration of digital technologies such as IoT, AI, and data analytics further enhances demand. For instance, ABB’s smart metering solutions incorporate real-time data analytics that support grid automation and outage management. These developments enable energy providers to reduce technical losses and improve billing accuracy. Expansion of digital power management projects in Asia-Pacific and Europe further strengthens the adoption rate among industrial and commercial users.

- For instance, ABB’s smart-metering and monitoring solutions deliver Class 1 accuracy per IEC 61557-12 and offer native connectivity via multiple protocols, enabling system siting and cloud connection in as little as 10 minutes.

Increasing Industrial Energy Demand and Efficiency Mandates

Industrial sectors are major contributors to electricity consumption, prompting greater adoption of smart metering solutions. Three-phase smart meters help monitor complex load patterns and ensure optimized energy usage across production facilities. Governments are enforcing stricter energy efficiency norms, compelling industries to deploy advanced metering systems. For instance, Siemens’ SENTRON PAC4200 offers over 200 measured parameters, supporting energy audits and ISO 50001 compliance. Industries benefit from predictive maintenance, demand forecasting, and load balancing, leading to reduced operational costs. The combination of efficiency regulations and data-driven energy optimization continues to propel market expansion globally.

- For instance, Siemens’ SENTRON PAC4200 measures over 200 electrical parameters with a sampling rate of 12 kHz, providing total harmonic distortion analysis and event logging accuracy within ±0.2%.

Government Policies Supporting Energy Monitoring and Grid Stability

Supportive regulations promoting smart metering infrastructure are key growth enablers. Governments across the EU, China, and India are implementing mandatory smart meter rollout programs for grid reliability and energy transparency. For instance, India’s Revamped Distribution Sector Scheme (RDSS) aims to install over 250 million smart meters to improve distribution efficiency. These initiatives foster the adoption of three-phase meters in high-load applications like factories and commercial complexes. Policy-driven funding and public-private partnerships further accelerate deployment, while improved interoperability standards ensure seamless integration into national grid systems.

Key Trends & Opportunities

Integration of IoT and Cloud-Based Energy Management Platforms

The market is witnessing a strong shift toward IoT-enabled smart meters connected through cloud-based energy management platforms. These systems allow utilities to analyze real-time data, automate billing, and manage distributed energy resources efficiently. For instance, Landis+Gyr’s Gridstream Connect platform supports secure IoT communication, enabling remote updates and system analytics. This trend enhances energy forecasting and outage prediction capabilities. The growing adoption of cloud-based systems also opens opportunities for subscription-based analytics services and remote firmware upgrades, improving operational flexibility and cost efficiency for utilities and end-users alike.

- For instance, Landis+Gyr’s Gridstream® Connect IoT platform has been utilized in the world’s largest utility IoT deployment, a single project at Tokyo Electric Power Company (TEPCO) featuring approximately 30 million connected devices, and supports over 90 million smart grid connected devices globally. The platform operates on multi-technology communication layers including RF Mesh, NB-IoT, and LTE-M, as well as Wi-Fi, PLC, and Wi-SUN.

Expansion of Wireless and Hybrid Communication Technologies

Wireless and hybrid communication technologies are gaining traction due to their scalability and lower installation costs. These systems simplify connectivity in remote or urban environments where wired networks are expensive. For instance, Kamstrup’s OMNIA e-meter series utilizes NB-IoT and LTE-M for stable and secure data transmission. The flexibility to integrate with 4G and 5G networks enhances interoperability and reliability. This trend supports expansion in developing regions and aligns with the growing emphasis on smart city projects, enabling utilities to expand smart grid networks without heavy infrastructure investments.

- For instance, Kamstrup’s OMNIA® e-meter series employs NB-IoT and LTE-M connectivity supporting transmission intervals down to 5 minutes with AES-128 encryption for end-to-end security.

Key Challenges

High Installation Costs and Infrastructure Complexity

Despite strong demand, high upfront installation and maintenance costs pose a significant barrier. Deploying advanced three-phase smart meters requires robust communication infrastructure and integration with legacy grid systems. For instance, utilities often incur additional costs for data concentrators and network upgrades. Small utilities and developing nations face financial limitations in adopting large-scale smart metering solutions. Complexities in synchronization, calibration, and network compatibility further add to project timelines. Addressing these challenges through modular systems and financing programs remains essential for sustained adoption.

Data Privacy and Cybersecurity Concerns

Growing data exchange between meters and grid management platforms increases cybersecurity risks. Vulnerabilities in communication protocols may expose utilities to data breaches or unauthorized access. For instance, ENEL Group has implemented multi-layered encryption and authentication systems in its smart metering network to mitigate such threats. Utilities must invest in secure firmware, regular updates, and compliance with data protection standards like ISO/IEC 27001. The need for strong cybersecurity frameworks, continuous monitoring, and regulatory compliance remains a critical challenge restraining large-scale deployment.

Regional Analysis

North America

North America accounted for 36.8% of the three-phase smart electric meter market in 2024, led by the U.S. and Canada. The region benefits from advanced grid infrastructure, regulatory mandates, and high utility digitalization rates. Major players such as Landis+Gyr, Itron, and General Electric dominate deployments under large-scale AMI programs. The U.S. Department of Energy’s smart grid investments continue to expand meter coverage across states. Canada’s modernization initiatives support accurate load profiling and renewable energy integration. Strong cybersecurity frameworks and robust communication networks further enhance regional adoption.

Europe

Europe captured 28.4% market share in 2024, driven by strict energy efficiency regulations and smart metering mandates. Countries like the U.K., Germany, France, and Italy lead mass rollouts as part of EU energy transition goals. Schneider Electric, Siemens, and Kamstrup play key roles in supplying high-accuracy meters meeting IEC and MID standards. Time-of-use tariffs and interoperability standards such as DLMS/COSEM boost deployment rates. Growing renewable integration and digital utility models support sustained market expansion across the continent.

Asia Pacific

Asia Pacific led the market with a 24.6% share in 2024, supported by rapid electrification and grid modernization. China and India are major growth engines due to large-scale AMI programs. India’s RDSS initiative promotes installation of millions of three-phase smart meters to curb power theft and improve efficiency. Japan, South Korea, and Australia invest heavily in IoT-based metering networks. Companies like Mitsubishi Electric and Holley enhance regional competition through locally manufactured, cost-efficient products tailored for diverse energy infrastructures.

Latin America

Latin America held 5.6% of the market share in 2024, with Brazil, Mexico, and Chile leading adoption. Utilities are focusing on reducing non-technical losses and improving billing transparency through AMI projects. For instance, Landis+Gyr and Itron are expanding pilot installations in urban and semi-urban regions. Government-led modernization programs in Brazil and Mexico foster digital utility infrastructure. The adoption of prepaid and hybrid communication meters is growing as utilities pursue revenue protection and operational efficiency.

Middle East

The Middle East accounted for 2.7% market share in 2024, with Saudi Arabia and the UAE leading smart grid integration. Government-backed projects such as Saudi Vision 2030 and UAE’s smart city initiatives drive deployment. Siemens and SAMI Advanced Electronics are key suppliers in the region, supporting grid automation and renewable energy integration. Utilities prioritize three-phase meters for commercial and industrial sectors to enhance power distribution reliability and real-time monitoring. Expanding solar projects further strengthen metering demand.

Africa

Africa represented 1.9% of the global market in 2024, driven by ongoing electrification and revenue assurance programs. South Africa, Kenya, and Nigeria are expanding prepaid smart meter installations to address power theft and improve revenue collection. Local suppliers like Trinity Energy Systems and international firms such as Iskraemeco and ZIV play active roles in deployment. Support from multilateral development agencies funds large-scale grid digitization projects. Increasing focus on hybrid communication and low-maintenance designs enhances feasibility in remote areas.

Market Segmentations:

By Product Type

- Standard Smart Meters

- Advanced Smart Meters

- Prepaid Smart Meters

By Application

- Residential

- Commercial

- Industrial

By Communication Technology

- Wired Communication

- Wireless Communication

- Hybrid Communication

By Functionality

- Basic Functionality

- Advanced Functionality

- Integrated Systems

By End-User

- Utility Companies

- Energy Service Providers

- Large Enterprises

- Government and Public Sector

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The market features global leaders and strong regional specialists. Key players include Landis+Gyr, Itron, Schneider Electric, Siemens, ABB, Kamstrup, Iskraemeco, Hexing, Wasion, and Genus Power. Vendors compete on accuracy, cybersecurity, interoperability, and lifecycle cost. Product roadmaps emphasize modular designs, edge analytics, and remote firmware updates. Communication stacks span PLC, RF mesh, NB-IoT, LTE-M, and emerging 5G. Many suppliers bundle AMI head-end, MDMS, and outage management integrations. Utilities favor proven DLMS/COSEM compliance and IEC 62052/62053 accuracy classes. Prepayment capability and tamper detection remain vital in revenue-risk markets. Partnerships with telecom operators accelerate cellular deployments and coverage. Local manufacturing and meter data services support competitive bids and faster rollouts. M&A targets include analytics firms and cybersecurity specialists to strengthen platforms. Vendors also prioritize green designs and recyclability to meet procurement mandates.

Key Player Analysis

- Kamstrup

- Itron Inc.

- Honeywell International Inc.

- Landis+Gyr

- Apator SA

- Holley Performance Products, Inc.

- General Electric

- Iskraemeco Group

- CyanConnode

- Circutor

- LARSEN & TOUBRO LIMITED

Recent Developments

- In July 2023, Landis+Gyr secured a contract with the Israel Electric Corporation (IEC) to deploy smart electricity meters, software, and related services to meet forthcoming regulations. Initially, 565,600 smart meters will be provided, with potential for IEC to expand to 4.2 million units, some of which may be sourced from a third-party supplier. Landis+Gyr will also furnish the head-end system and services, essential for Israel’s smart grid establishment.

- In June 2023, Holley and their representative finalized a contract for the procurement of Prepayment Type Smart Meters designated for the PEC Yemen Market. This agreement marks a significant milestone as Holley’s agent assumes exclusive representation for the company’s metering operations in Yemen. Through this collaboration, Holley commits to delivering top-quality products and services to PEC. The acquired Prepayment Type Smart Meters feature remote communication options, including RF, Cellular, and PLC, supporting PEC’s future smart grid development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product type, Application, Communication technology, Functionality, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities accelerate AMI rollouts for industrial and commercial customers.

- Advanced analytics enable predictive maintenance and loss reduction at scale.

- IoT and edge computing deepen real-time visibility and control.

- Hybrid communication (PLC, RF, cellular) becomes deployment default.

- Cybersecurity-by-design and zero-trust architectures gain priority in procurements.

- Prepaid and revenue-protection features expand across emerging markets.

- Interoperability with DERs and microgrids streamlines bidirectional energy flows.

- Time-of-use and dynamic tariffs broaden adoption in regulated markets.

- Local manufacturing and modular designs reduce lifecycle costs.

- Regulatory mandates tighten accuracy, data privacy, and sustainability requirements.