Market Overview

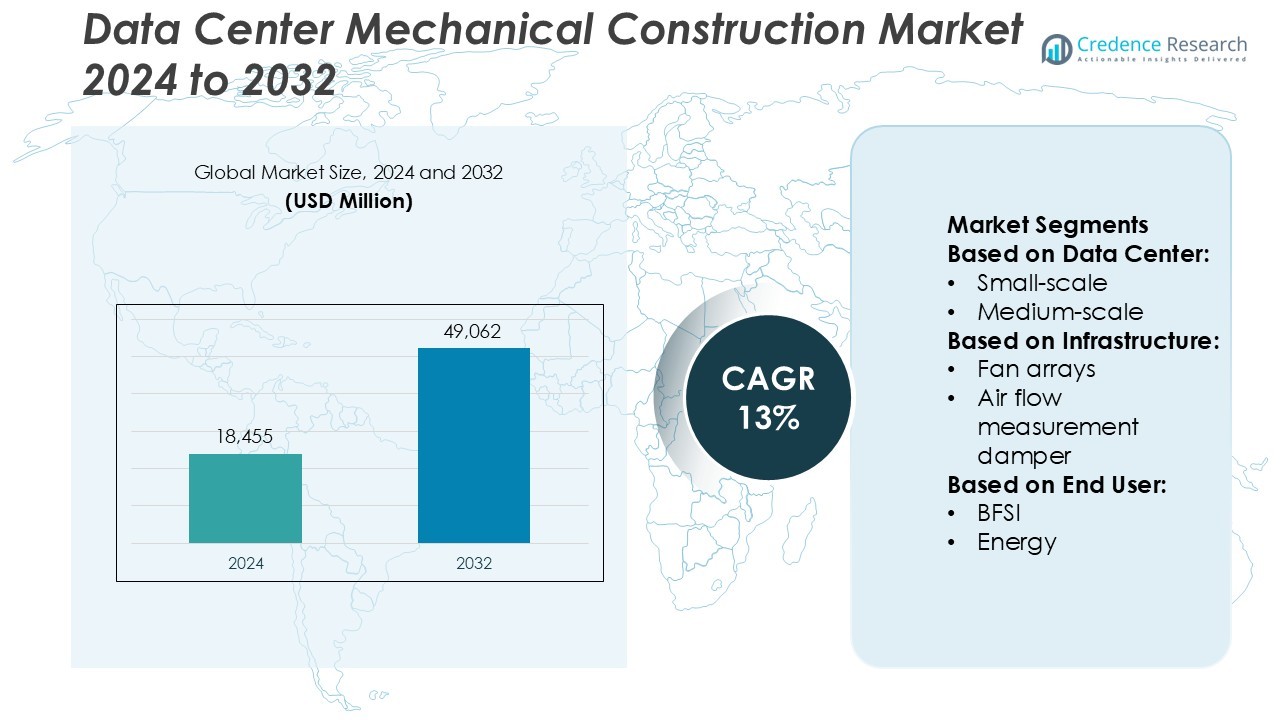

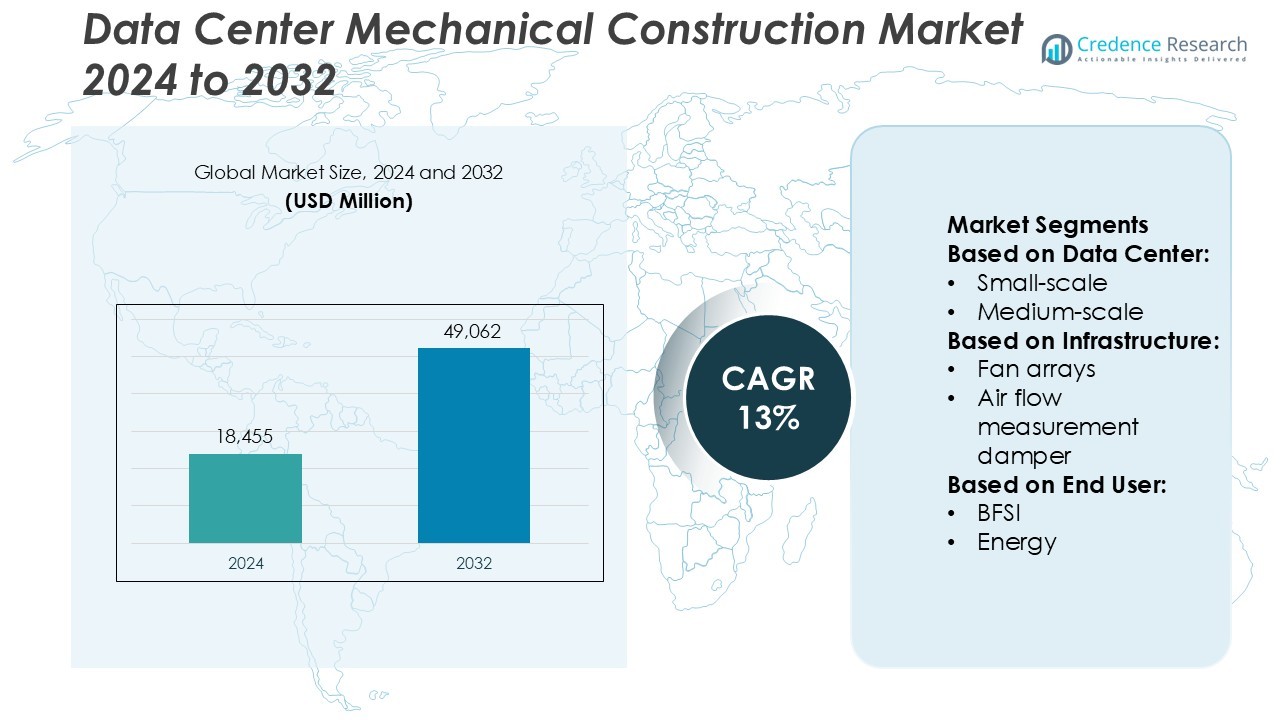

Data Center Mechanical Construction Market size was valued USD 18,455 million in 2024 and is anticipated to reach USD 49,062 million by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Mechanical Construction Market Size 2024 |

USD 18,455 Million |

| Data Center Mechanical Construction Market, CAGR |

13% |

| Data Center Mechanical Construction Market Size 2032 |

USD 49,062 Million |

The Data Center Mechanical Construction Market is highly competitive, characterized by the presence of global engineering, construction, and facility management companies offering advanced mechanical infrastructure solutions. Industry leaders specialize in designing and integrating high-performance cooling, HVAC, and air management systems for hyperscale, colocation, and enterprise data centers. North America leads the market with a 38% share, supported by extensive hyperscale developments and strong sustainability mandates. Companies focus on digital project delivery, modular construction, and smart automation to enhance efficiency and reduce carbon emissions. Strategic collaborations, technology integration, and region-specific customization strengthen their competitive positioning in this rapidly evolving global landscape.

Market Insights

- The Data Center Mechanical Construction Market was valued at USD 18,455 million in 2024 and is projected to reach USD 49,062 million by 2032, growing at a CAGR of 13%.

- Market growth is driven by rising hyperscale data center investments and increasing demand for energy-efficient mechanical systems such as advanced HVAC and cooling solutions.

- Key trends include digital twin adoption, modular mechanical system deployment, and integration of AI-based automation to enhance construction precision and sustainability.

- High capital costs and skilled labor shortages act as major restraints, challenging efficient mechanical system installation and long-term maintenance.

- North America leads with a 38% market share, followed by Europe and Asia-Pacific, while large-scale data centers remain the dominant segment due to high scalability needs and continuous infrastructure expansion by global cloud and colocation providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Data Center

Large-scale data centers dominate the market due to increasing hyperscale deployments by global cloud and colocation providers. These facilities support extensive workloads and require advanced mechanical infrastructure to ensure uninterrupted operations. Demand is driven by large enterprises investing in energy-efficient cooling and high-density server management solutions. For instance, Equinix and Digital Realty continue to expand multi-megawatt data centers integrating modular cooling and airflow optimization systems to reduce energy use and enhance uptime reliability.

- For instance, Equinix’s TY12x facility in Tokyo is a modern data center with a total potential IT load capacity of 54 megawatts when fully operational. The facility is designed with high energy efficiency features.

By Infrastructure

Cooling systems hold the largest market share within data center mechanical construction, supported by rising thermal management needs in high-density environments. Efficient cooling ensures optimal server performance and energy conservation. Adoption of CRAC units, fan arrays, and DOAS systems enables precise temperature and humidity control. For instance, Schneider Electric’s EcoStruxure solutions integrate intelligent air flow and liquid cooling modules, achieving up to 30% energy savings and improving system efficiency in large-scale facilities.

- For instance, Obayashi Corporation leverages its “Laputa 2D” super-active seismic-response control system (which reduces building vibration to between 1/30 and 1/50 of seismic input) in its data-center projects, improving stability of cooling-air delivery equipment.

By End User

The IT & telecom sector leads the market due to exponential data generation from cloud computing, 5G rollout, and digital services. Enterprises in this segment prioritize scalable, reliable, and energy-efficient mechanical systems to support data-intensive operations. For instance, Amazon Web Services and Google deploy advanced mechanical setups, including high-capacity chillers and adaptive HVAC systems, to sustain performance under dynamic load conditions while reducing carbon footprint. This sector’s expansion drives consistent investments in data center modernization and energy optimization initiatives.

Key Growth Drivers

- Expansion of Hyperscale Data Centers

The growing demand for cloud services and digital platforms fuels hyperscale data center expansion. These facilities require advanced mechanical systems to support large-scale computing and continuous uptime. Manufacturers focus on modular mechanical infrastructure for faster deployment and scalability. For instance, Google’s hyperscale centers in Singapore feature high-efficiency cooling units and thermal storage systems that reduce water usage by 30%, enhancing environmental sustainability while supporting energy-intensive operations.

- For instance, Turner & Townsend were appointed to provide project and cost management services for du’s first hyperscale data-centre in Dubai, located on a 20,000 m² greenfield site and designed for high resilience, flexible configuration and LEED Gold certification.

- Rising Adoption of Energy-Efficient Cooling Solutions

Energy efficiency has become a key focus for data center construction, driving innovation in mechanical systems. The integration of liquid cooling, evaporative systems, and airflow optimization reduces operational costs and environmental impact. For instance, Microsoft’s data centers use adiabatic cooling technology that cuts energy consumption by up to 40% compared to conventional HVAC setups, supporting the company’s carbon-negative goal and setting a benchmark for sustainable infrastructure.

- For instance, Kajima’s project for Bit‑isle Inc.’s 5th Data Center in Tokyo features an integrated twin-floor external-air cooling system and achieved a power-usage-effectiveness (PUE) ratio of 1.42.

- Growth in Edge and Colocation Facilities

Edge computing and colocation growth create strong demand for compact, efficient mechanical systems. These facilities rely on localized data centers for faster processing and lower latency. Manufacturers develop prefabricated modules and adaptive HVAC systems to meet space and energy constraints. For instance, Vertiv’s prefabricated modular cooling units serve edge sites with rapid deployment capabilities, enabling up to 50% reduction in installation time and ensuring consistent performance across distributed networks.

Key Trends & Opportunities

- Integration of Smart Building Automation Systems

Smart automation technologies are transforming mechanical construction through real-time monitoring and predictive maintenance. IoT-enabled sensors track airflow, humidity, and thermal loads to optimize cooling efficiency. For instance, Johnson Controls’ Metasys system integrates building automation with AI algorithms, achieving proactive fault detection and improving overall mechanical reliability, thereby reducing downtime and extending system lifespan across data center networks.

- For instance, Mace Group deployed its “Digital Command Centre” on a major data-centre infrastructure project and achieved a 15 % increase in planned activities signed-off, saved 1 day per week on average in coordination time, and rolled out 7 standardised dashboards for live performance tracking.

- Growing Focus on Sustainable Construction Practices

Sustainability is a rising opportunity as operators adopt eco-friendly materials and systems. Mechanical designs now prioritize low-carbon refrigerants, renewable energy integration, and recyclable components. For instance, Schneider Electric’s Green Premium products meet ISO 14001 environmental standards, offering 75% recyclable content and optimized lifecycle energy use, helping data center operators meet global carbon reduction goals while maintaining operational resilience.

- For instance, DSCO supported the Singtel Data Centre West project (in Singapore) which achieved a chiller-plant system efficiency of 0.562 kW/RT and a design PUE of 1.40.

- Increased Use of Prefabricated Mechanical Modules

Prefabricated mechanical systems are gaining traction for reducing installation time and cost. These modules integrate HVAC, cooling, and airflow systems preassembled offsite for plug-and-play deployment. For instance, Stulz’s modular mechanical units enable rapid scalability with reduced site labor and up to 25% faster commissioning, appealing to hyperscale and edge operators seeking operational flexibility and expansion efficiency.

Key Challenges

- High Capital and Maintenance Costs

Mechanical infrastructure installation demands significant investment in specialized equipment and systems. Frequent maintenance to ensure cooling performance and redundancy adds to operational expenses. For instance, maintaining high-capacity chillers and CRAC units can represent up to 30% of total facility operating costs, making it challenging for small and medium-scale operators to sustain profitability while meeting energy compliance standards.

- Limited Skilled Workforce for Mechanical Integration

The complexity of mechanical systems requires expertise in HVAC design, automation, and thermal engineering. However, the shortage of skilled technicians hampers efficient installation and system optimization. For instance, the Uptime Institute highlights that 40% of global data center operators report difficulty finding qualified engineers for mechanical maintenance, delaying construction timelines and affecting the long-term reliability of mission-critical facilities.

Regional Analysis

North America

North America dominates the Data Center Mechanical Construction Market with a 38% share, driven by the presence of major hyperscale operators such as Amazon Web Services, Microsoft, and Google. The region’s mature digital infrastructure and increasing investments in cloud and colocation facilities fuel growth. Advanced mechanical systems, including liquid and free cooling technologies, are widely deployed to meet energy efficiency goals. The U.S. leads regional demand due to ongoing expansions in Virginia, Texas, and California, supported by sustainable design initiatives and high adoption of AI-driven thermal management and modular cooling solutions.

Europe

Europe holds a 27% market share, supported by strong regulatory focus on energy efficiency and green data center development. Countries like Germany, the Netherlands, and the UK lead installations due to high data traffic and strict carbon reduction mandates. Operators increasingly adopt low-PUE cooling systems, advanced HVAC automation, and recycled water use. For instance, Interxion’s Frankfurt facilities integrate hybrid air-liquid cooling to meet European Green Deal targets. The region’s continued investment in sustainable infrastructure and renewable-powered mechanical systems reinforces its position as a key data center construction hub.

Asia-Pacific

Asia-Pacific accounts for 25% of the market, driven by rapid digitalization, 5G rollout, and expanding cloud infrastructure in China, India, and Singapore. Governments promote hyperscale development with favorable investment policies and smart city projects. The region experiences rising demand for scalable mechanical systems that balance cost and energy efficiency. For instance, AirTrunk’s facilities in Sydney and Tokyo employ advanced evaporative cooling systems to maintain low PUE values. The surge in regional data usage, coupled with growing investments from global tech giants, ensures continuous expansion of mechanical construction activities.

Latin America

Latin America captures a 6% share, supported by growing cloud adoption and expanding data networks in Brazil, Mexico, and Chile. The region witnesses increased investments from colocation providers seeking to strengthen digital connectivity. Operators prioritize mechanical systems with modular cooling and adaptive HVAC designs to manage tropical climates efficiently. For instance, Equinix’s São Paulo data centers incorporate water-side economization, reducing energy use while maintaining reliability. The region’s growing internet penetration and supportive government digitalization policies contribute to stable market growth and encourage future mechanical infrastructure advancements.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, driven by government-led digital transformation and smart city projects in the UAE, Saudi Arabia, and South Africa. Operators invest in energy-efficient mechanical systems to address harsh climatic conditions. For instance, Khazna Data Centers in Abu Dhabi use indirect evaporative cooling to enhance sustainability while minimizing power consumption. The rise of hyperscale investments and data localization initiatives supports long-term growth. Increasing adoption of renewable-powered cooling systems further strengthens the region’s role in the global data center infrastructure landscape.

Market Segmentations:

By Data Center:

By Infrastructure:

- Fan arrays

- Air flow measurement damper

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Center Mechanical Construction Market includes key players such as Jacobs Engineering, Obayashi Corporation, Turner & Townsend, Kajima Corporation, Mace Group, DSCO Group, AECOM, Skanska, DPR Construction, and NTT Facilities. The Data Center Mechanical Construction Market features strong competition driven by advanced engineering capability, global delivery networks, and innovation in sustainable infrastructure. Companies focus on high-efficiency cooling, modular mechanical systems, and automated HVAC controls that support faster deployment and lower operational costs. Many leading firms invest in liquid cooling, air-side economization, and advanced airflow management to handle rising heat loads from AI workloads and high-density servers. Digital project tools like BIM, digital twins, and AI-based monitoring enhance precision, reduce errors, and speed up construction timelines. Market participants also prioritize green building certifications, low-carbon mechanical designs, and renewable-integrated systems to meet global sustainability goals. Partnerships with cloud service providers, colocation operators, and hyperscale developers strengthen competitive positioning. The market continues shifting toward prefabricated mechanical units, energy-recovery systems, and smart building automation, enabling long-term efficiency, improved uptime, and strong cost control. This strategic focus helps leaders build resilient and scalable data center environments worldwide.

Key Player Analysis

- Jacobs Engineering

- Obayashi Corporation

- Turner & Townsend

- Kajima Corporation

- Mace Group

- DSCO Group

- AECOM

- Skanska

- DPR Construction

- NTT Facilities

Recent Developments

- In December 2024, ABB Electrification inaugurated a Smart Buildings & Smart Power Technology Hub in London, UK, offering customers an interactive experience with its advanced power distribution and building automation tier types. The facility features fully operational circuit breakers, interconnected switchgear, sensors, and KNX controllers, providing hands-on technical training opportunities.

- In October 2024, Dell Technologies introduced new integrated rack-scalable systems, servers, storage, and data management tier types under its AI Factory, designed to power large-scale AI workloads. The 21-inch Dell IR7000 is optimized for maximum CPU and GPU density, featuring wider and taller server sleds to support advanced architectures. Built with native liquid cooling capabilities, the rack can manage deployments of up to 480KW while capturing nearly 100% of generated heat.

- In February 2024, Cisco Systems Inc. and NVIDIA announced a collaboration to provide AI infrastructure tier types designed for seamless deployment and management in data centers. Utilizing Ethernet-based networking, the tier types will be available through Cisco’s extensive global channel, offering professional verticals and support from key partners.

- In November 2023, Infosys and Shell partnered to build green data centers. This partnership asset the company to accelerate the adoption of immersion cooling services for data centers. These solutions collectively aim to reduce the carbon footprint, enhance operational efficiency, and support sustainable business practices in the data center industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Data Center, Infrastructure, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for hyperscale and colocation data centers will drive continuous construction activity.

- Energy-efficient mechanical systems will gain wider adoption to meet sustainability standards.

- Integration of AI-based monitoring tools will optimize cooling and airflow management.

- Prefabricated and modular mechanical solutions will reduce installation time and project costs.

- Expansion of edge data centers will boost demand for compact mechanical infrastructure.

- Increasing focus on renewable-powered mechanical systems will enhance operational sustainability.

- Adoption of digital twin technology will improve predictive maintenance and system reliability.

- Government incentives for green construction will accelerate investment in advanced HVAC solutions.

- Rising 5G and cloud computing usage will create new opportunities for scalable mechanical designs.

- Collaboration between mechanical contractors and IT firms will strengthen innovation and system integration.