Market Overview

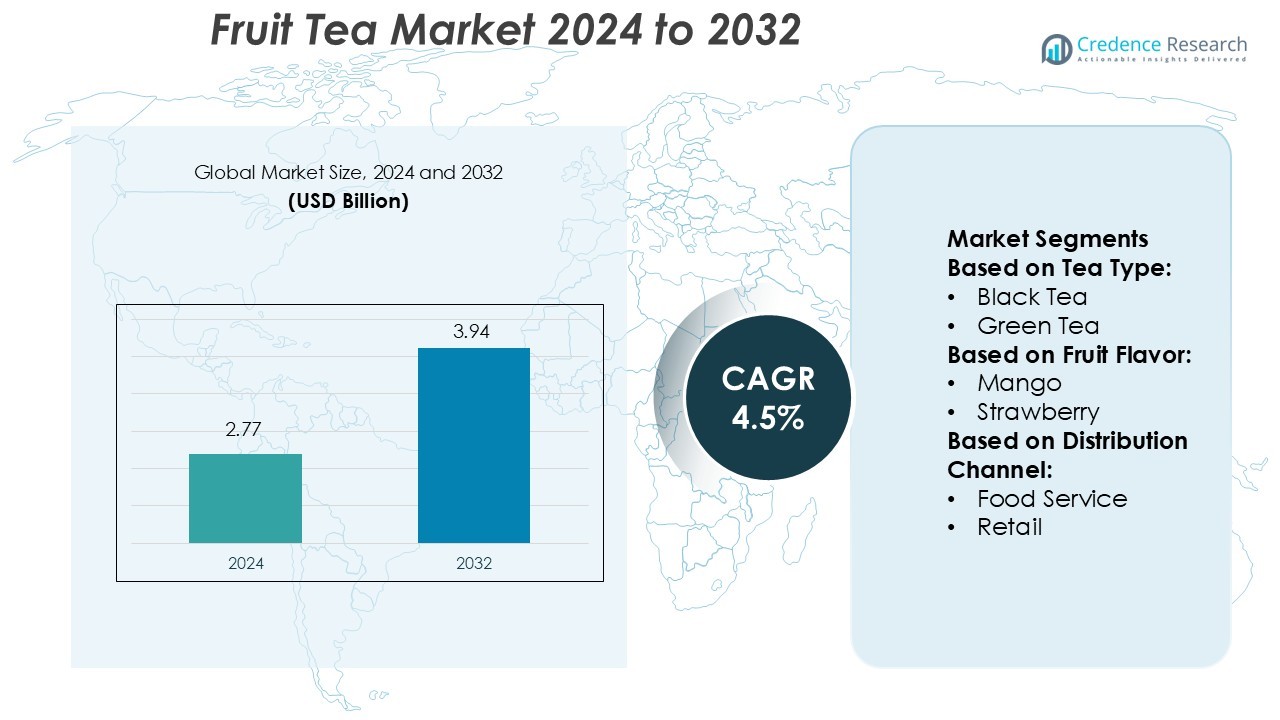

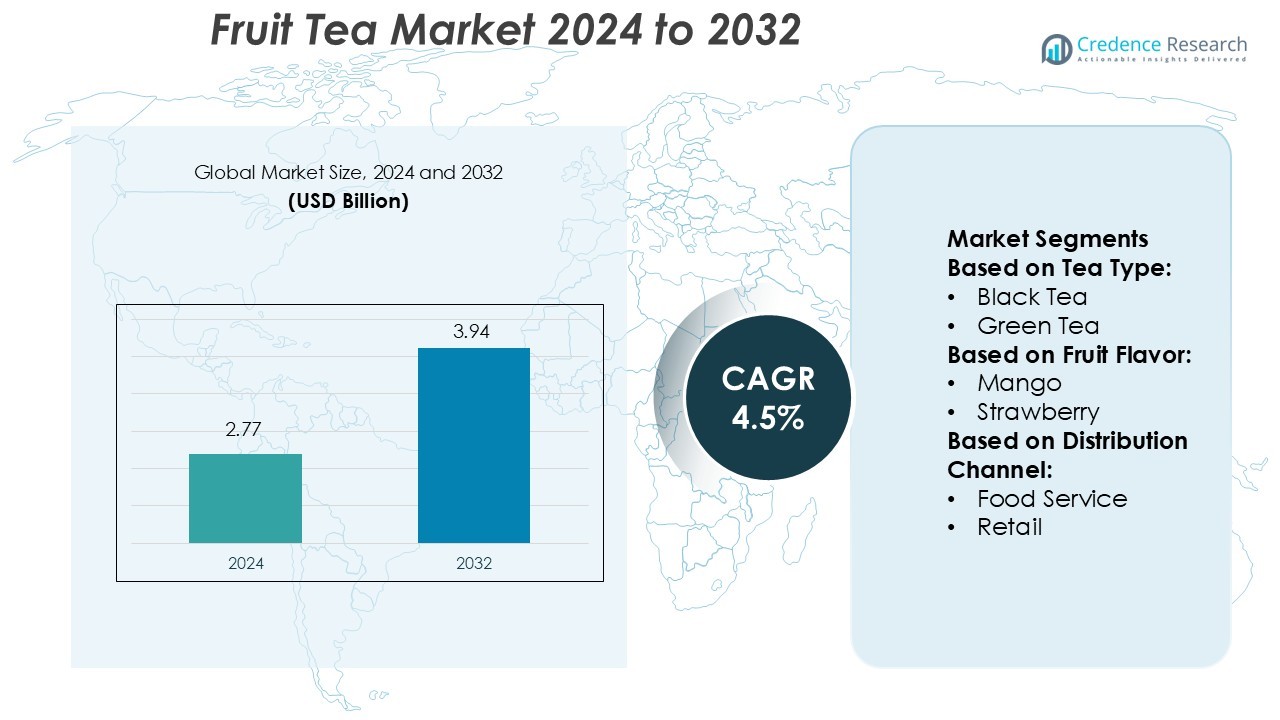

Fruit Tea Market size was valued USD 2.77 billion in 2024 and is anticipated to reach USD 3.94 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Tea Market Size 2024 |

USD 2.77 Billion |

| Fruit Tea Market, CAGR |

4.5% |

| Fruit Tea Market Size 2032 |

USD 3.94 Billion |

The fruit tea market is driven by major players such as Bigelow Tea, The Republic of Tea, YORKSHIRE TEA, Caraway Tea, PepsiCo, Unilever, Dilmah Ceylon Tea Company PLC, Harris Freeman, Starbucks Coffee Company, and R. Twining and Company Limited. These companies focus on innovative flavor development, sustainable sourcing, and product premiumization to strengthen their global presence. Europe leads the global fruit tea market with a 32% share in 2024, supported by strong consumer preference for herbal and flavored teas, established retail networks, and growing demand for organic and caffeine-free blends. Continuous product diversification and eco-friendly packaging remain key strategies driving competitive growth across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fruit Tea Market was valued at USD 2.77 billion in 2024 and is projected to reach USD 3.94 billion by 2032, registering a CAGR of 4.5% during the forecast period.

- Rising health awareness and consumer shift toward natural, low-calorie beverages drive market expansion, supported by strong demand for organic and functional fruit tea blends.

- The market trends highlight increasing innovation in exotic fruit flavors, sustainable packaging solutions, and the rapid growth of ready-to-drink (RTD) formats in retail channels.

- Competitive analysis shows key players focusing on premium product lines, eco-friendly sourcing, and digital marketing strategies to enhance global reach and customer engagement.

- Europe dominates the market with a 32% share, while Asia-Pacific remains the fastest-growing region. The black tea segment leads by type with a 42% share, and the retail channel contributes 61% of total global revenue, supported by strong e-commerce and supermarket distribution networks.

Market Segmentation Analysis:

By Tea Type

The black tea segment dominates the fruit tea market with a 42% share in 2024. Its wide availability, strong flavor profile, and compatibility with various fruit blends make it a popular base for flavored beverages. Consumers prefer black tea for its rich taste and higher caffeine content compared to green or white tea. The segment also benefits from strong demand in ready-to-drink (RTD) fruit tea products and café-based offerings. Growing innovation in cold-brew black fruit teas further supports its leadership in both retail and foodservice channels.

- For instance, Bigelow Tea installed rooftop solar panels that generate up to 15% of the energy used by its Fairfield facility, demonstrating its commitment to sustainable production aligned with high-volume black tea operations.

By Fruit Flavor

Mango flavor leads the fruit tea market, capturing a 28% share in 2024. The segment’s dominance stems from its tropical appeal, refreshing aroma, and high consumer preference in Asia-Pacific and North America. Mango blends well with both black and green tea bases, creating a balanced sweet-tart flavor. Manufacturers focus on seasonal variants and low-sugar mango tea infusions to attract health-conscious consumers. Expanding premium product launches featuring organic mango extracts also enhance category value and boost adoption across global retail platforms.

- For instance, Yorkshire Tea reports that 75 % of its tea bag material is now natural-based fibres (a mix of wood pulp and plant-based fibres) in its UK packaging.

By Distribution Channel

The retail segment accounts for a 61% share of the global fruit tea market in 2024. Strong sales through supermarkets, convenience stores, and online platforms drive this growth. Consumers favor the convenience and variety of packaged tea bags, loose-leaf blends, and bottled RTD options. E-commerce expansion and subscription-based tea delivery models further enhance reach. The segment benefits from rising brand promotions, attractive packaging, and easy accessibility in urban regions, making retail the preferred channel for fruit tea purchases worldwide.

Key Growth Drivers

Rising Demand for Healthy Beverages

Health-conscious consumers increasingly prefer fruit teas for their antioxidant and low-calorie properties. The shift away from carbonated soft drinks toward natural and functional beverages fuels this growth. Fruit teas rich in vitamins and polyphenols attract consumers seeking detox and wellness drinks. Manufacturers promote blends with added immune and digestive benefits to enhance market appeal. The growing awareness of natural ingredients and organic formulations continues to strengthen global fruit tea consumption.

- For instance, Unilever now generates visuals 2 × faster and at 50% lower cost by using digital twin and AI platforms such as NVIDIA Omniverse; over 500 AI applications are deployed across the business.

Expansion of Ready-to-Drink (RTD) Variants

The RTD fruit tea segment drives significant market expansion through convenience and portability. Leading brands offer bottled and canned fruit teas that target busy, urban consumers. Cold-brew and sparkling fruit teas appeal to younger demographics. Innovative packaging and long shelf life make RTD fruit teas attractive for retail and e-commerce sales. Continuous flavor innovation and low-sugar options further support sustained growth in this segment worldwide.

- For instance, Dilmah introduced its “Craft Iced Tea” in the Netherlands in a 330 mL can format, under a new partnership that enabled scale for chilled RTD tea.

Growth of Premium and Specialty Tea Offerings

Premiumization trends in the beverage industry support fruit tea market expansion. Consumers increasingly favor exotic and artisanal blends featuring natural fruit extracts and sustainably sourced tea leaves. Companies invest in limited-edition collections and organic certifications to enhance brand value. Specialty tea cafés and boutique stores promote premium loose-leaf blends, expanding consumer awareness. The growing appeal of authentic taste experiences drives consistent growth in this high-value segment.

Key Trends & Opportunities

Sustainability and Ethical Sourcing

Sustainability remains a defining trend as companies adopt eco-friendly sourcing and packaging solutions. Leading producers emphasize fair-trade practices and biodegradable tea bags to attract environmentally aware buyers. Brands investing in carbon-neutral operations and recyclable materials strengthen their market reputation. This trend supports long-term loyalty among eco-conscious consumers and aligns with corporate responsibility goals in global beverage markets.

- For instance, Harris Freeman’s tea-division reports a 34 % reduction in greenhouse-gas emissions since its baseline year of 2009. Harris Tea reports its GHG emissions through the Carbon Disclosure Project (CDP).

Digital Retail and E-commerce Growth

E-commerce platforms create new opportunities for fruit tea sales worldwide. Direct-to-consumer models enable customized subscription boxes and curated tea assortments. Online retailers leverage AI-driven recommendations and influencer marketing to target niche audiences. The surge in online grocery and health product sales post-pandemic continues to expand market visibility for premium fruit teas globally.

- For instance, Starbucks deployed an AI-powered inventory system across 11,000+ company-owned stores in North America by September 2025, enabling inventory to be counted 8× more frequently than before.

Product Diversification through Exotic Flavors

Manufacturers innovate with exotic fruit infusions such as dragon fruit, acai, and kiwi to attract adventurous consumers. These unique blends differentiate brands in crowded retail spaces and enhance global appeal. The inclusion of superfruits adds perceived health value and expands demand across functional beverage segments. Such flavor diversification provides strong growth opportunities in premium and RTD product lines.

Key Challenges

High Production and Raw Material Costs

The cost of high-quality tea leaves, fruit extracts, and natural flavoring agents limits profitability. Supply chain disruptions and seasonal variability in fruit production affect pricing stability. Smaller manufacturers face pressure from fluctuating input costs, leading to reduced margins. Maintaining consistency in flavor and quality while ensuring affordability remains a key challenge for market participants.

Competition from Substitute Beverages

Fruit tea faces intense competition from herbal teas, flavored water, and functional beverages. Consumers seeking quick hydration or specific health benefits often shift toward vitamin-infused drinks or plant-based alternatives. Heavy marketing from global beverage companies in adjacent categories intensifies competition. To remain competitive, fruit tea brands must emphasize unique taste, authenticity, and natural health benefits.

Regional Analysis

North America

North America holds a 28% share of the global fruit tea market in 2024. The region’s growth is driven by increasing consumer preference for natural, low-calorie beverages and the expanding ready-to-drink (RTD) segment. The U.S. leads with a strong café culture and demand for organic and premium blends. Major brands focus on introducing cold-brew and flavored fruit teas tailored to local tastes. Rising health awareness and a growing shift from sugary drinks to antioxidant-rich alternatives continue to fuel market expansion across the U.S. and Canada.

Europe

Europe accounts for a 32% share of the global fruit tea market in 2024, emerging as the leading region. High consumption of herbal and flavored teas in the U.K., Germany, and France supports market dominance. The region benefits from established tea traditions, premium product adoption, and strong retail networks. Manufacturers promote sustainable sourcing and eco-friendly packaging to align with environmental priorities. Increasing popularity of caffeine-free and wellness-focused fruit infusions enhances growth. European consumers favor authenticity, natural ingredients, and region-specific blends, reinforcing the continent’s leadership in global fruit tea consumption.

Asia-Pacific

Asia-Pacific captures a 27% share of the fruit tea market in 2024 and is the fastest-growing region. Strong tea-drinking cultures in China, Japan, and India drive adoption, supported by the rising influence of café chains and youth-focused beverage brands. The region benefits from abundant raw material availability and local fruit diversity, enabling cost-effective production. Growing urbanization and premiumization trends fuel demand for RTD and bubble tea variants. Consumers increasingly seek innovative, refreshing, and health-oriented beverages, positioning Asia-Pacific as a key hub for flavor innovation and export-driven fruit tea manufacturing.

Latin America

Latin America holds an 8% share of the global fruit tea market in 2024. Demand is rising due to shifting consumer preferences toward wellness beverages and tropical fruit-based infusions. Brazil, Mexico, and Chile lead market adoption, supported by local fruit availability and growing café culture. Manufacturers emphasize exotic flavors such as passion fruit, mango, and guava to appeal to regional tastes. Expanding supermarket and online distribution channels strengthen accessibility. As awareness of natural health beverages increases, Latin America presents emerging opportunities for both international and regional fruit tea brands.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share of the global fruit tea market in 2024. The market grows steadily due to rising disposable incomes, urbanization, and growing café chains across GCC nations and South Africa. Consumers prefer fruit teas for their cooling, caffeine-free, and detoxifying qualities suited to warm climates. Brands introduce blends featuring local fruits such as pomegranate and date to cater to regional palates. Expanding retail infrastructure and increasing adoption of premium imported teas enhance market potential across this developing region.

Market Segmentations:

By Tea Type:

By Fruit Flavor:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fruit tea market features prominent players such as Bigelow Tea, The Republic of Tea, YORKSHIRE TEA, Caraway Tea, PepsiCo, Unilever, Dilmah Ceylon Tea Company PLC, Harris Freeman, Starbucks Coffee Company, and R. Twining and Company Limited. The fruit tea market is highly competitive, characterized by innovation, sustainability initiatives, and expanding global distribution networks. Companies focus on developing premium, health-oriented blends that combine natural fruit extracts with high-quality tea bases. Growing consumer demand for organic, low-sugar, and functional beverages drives continuous product reformulation and portfolio diversification. Strategic investments in sustainable sourcing, eco-friendly packaging, and digital marketing enhance brand visibility and consumer engagement. Additionally, collaborations with cafés, online platforms, and retail chains strengthen accessibility across emerging and developed markets. This competitive environment encourages consistent innovation and supports steady long-term market growth.

Key Player Analysis

- Bigelow Tea

- The Republic of Tea

- YORKSHIRE TEA

- Caraway Tea

- PepsiCo

- Unilever

- Dilmah Ceylon Tea Company PLC

- Harris Freeman

- Starbucks Coffee Company

- Twining and Company Limited

Recent Developments

- In September 2024, Tata Tea Gold unveiled a limited edition of Kumartuli-themed packs to celebrate the Durga Puja festival. The packs incorporate five symbolic elements: Dhunuchi dance, Shankho Dhwani, Dhaki, Ashtami Pujarin, and Sindoor Khela. Each bag features a QR code that activates augmented reality experiences, allowing consumers to project ceremonial elements into their surroundings.

- In March 2024, Pansari Group launched its new green tea range, TVOY GREEN TEA, sourced from the esteemed Nilgiris in Tamil Nadu, India. Grown at an elevation of 1900 meters, this eco-friendly product is certified ISO 9001:2008, HACCP, and Fair Trade. TVOY GREEN TEA features biodegradable Pyramid Tea Bag Filter Packaging, emphasizing the company’s commitment to sustainability.

- In March 2024, PepsiCo announced a partnership with Unilever to launch Pure Leaf Zero Sugar Sweet Tea, a new product aimed at meeting the growing demand for zero-sugar beverages. This latest addition to the Pure Leaf brand offers a sweet tea flavor without added sugars, providing a healthier option for consumers conscious of their sugar intake.

- In June 2023, Bigelow Tea launched three new flavors Peak Energy Black Tea, Whispering Wildflowers Herbal Tea, and Ginger Honey Herbal Tea. Each tea features additional ingredients intended to provide specific functional benefits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Tea Type, Fruit Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as consumers continue shifting toward natural and low-calorie beverages.

- Demand for ready-to-drink fruit teas will grow with rising urban lifestyles and convenience trends.

- Premiumization and organic certification will boost sales in developed and emerging economies.

- Sustainable packaging and ethical sourcing will become essential for brand differentiation.

- Innovation in exotic fruit flavors will attract younger and health-focused consumers globally.

- E-commerce and subscription models will strengthen direct-to-consumer engagement.

- Functional fruit teas with added vitamins and probiotics will gain wider acceptance.

- Strategic collaborations with cafés and retail chains will enhance product accessibility.

- Expansion in Asia-Pacific will drive global market growth due to strong local demand.

- Digital marketing and personalized product offerings will shape long-term brand competitiveness.