Market Overview

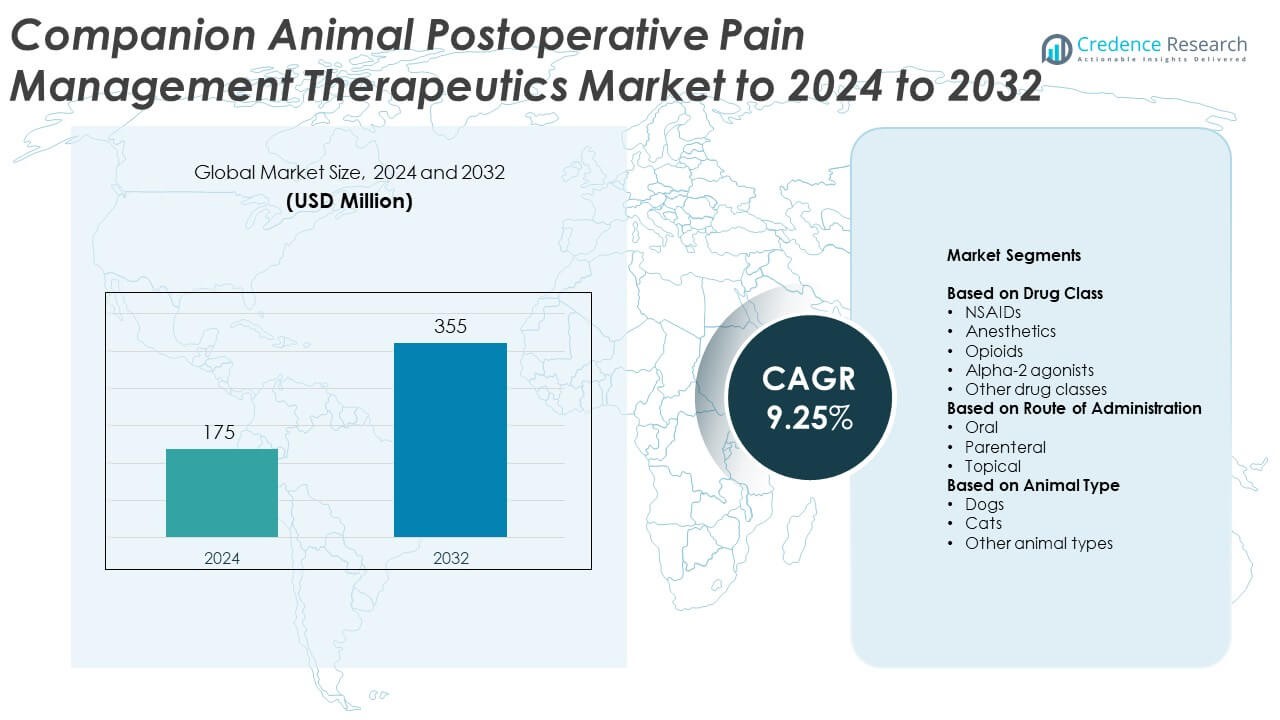

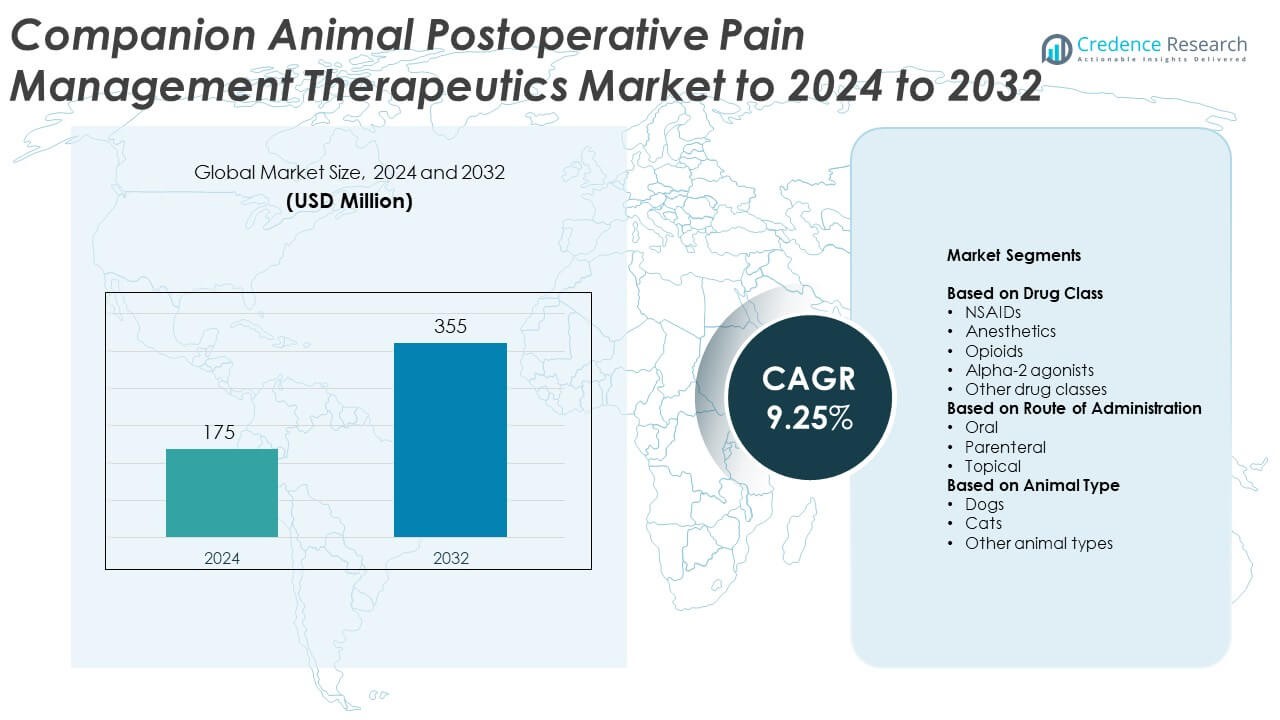

Companion Animal Postoperative Pain Management Therapeutics Market size was valued at USD 175 million in 2024 and is anticipated to reach USD 355 million by 2032, at a CAGR of 9.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Postoperative Pain Management Therapeutics Market Size 2024 |

USD 175 Million |

| Companion Animal Postoperative Pain Management Therapeutics Market, CAGR |

9.25% |

| Companion Animal Postoperative Pain Management Therapeutics Market Size 2032 |

USD 355 Million |

The Companion Animal Postoperative Pain Management Therapeutics Market is led by major companies including Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Zoetis Inc., Dechra Pharmaceuticals, and Merck Animal Health. These players dominate through strong product portfolios and continued innovation in multimodal analgesics, non-opioid therapies, and extended-release formulations. North America accounted for the largest regional share of 39.8% in 2024, supported by high pet ownership, advanced veterinary care, and early adoption of novel pain therapeutics. Europe followed with a 28.3% share, driven by strict animal welfare standards and rising adoption of biologics and targeted analgesic solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Companion Animal Postoperative Pain Management Therapeutics Market was valued at USD 175 million in 2024 and is projected to reach USD 355 million by 2032, growing at a CAGR of 9.25%.

- Rising surgical procedures in pets and increasing awareness of pain prevention drive market demand across veterinary clinics and hospitals.

- The market is witnessing strong trends toward non-opioid, biologic, and long-acting injectable formulations for safer and sustained pain control.

- Competition remains moderate, with leading companies focusing on innovation, species-specific drugs, and regulatory approvals to strengthen market presence.

- North America led with a 39.8% share in 2024, followed by Europe with 28.3%, while the dog segment dominated the market with 59.2% share due to higher surgical frequency and growing adoption of advanced postoperative care therapies.

Market Segmentation Analysis:

By Drug Class

NSAIDs dominated the Companion Animal Postoperative Pain Management Therapeutics Market in 2024, accounting for 41.6% of the total share. Their leadership is driven by their proven efficacy in reducing inflammation and pain following surgical procedures. Widespread adoption of NSAIDs in both dogs and cats is supported by their safety profile and easy dosing schedules. The development of selective COX-2 inhibitors further enhances clinical outcomes by minimizing gastrointestinal side effects. Increasing veterinary preference for long-acting formulations also supports the segment’s dominance across clinics and hospitals.

- For instance, Boehringer Ingelheim’s Metacam (meloxicam) 5 mg/mL solution for injection is labeled for the control of postoperative pain and inflammation in cats associated with orthopedic surgery, ovariohysterectomy, and castration.

By Route of Administration

Parenteral administration held the largest market share of 46.8% in 2024, reflecting its effectiveness in delivering rapid pain relief during and after surgery. Injectable formulations ensure quick onset and precise dosage control, making them ideal for perioperative pain management. Veterinary professionals prefer this route for complex surgical procedures where immediate analgesia is essential. Growing demand for preoperative and postoperative injections enhances market growth. Rising innovation in sustained-release injectable products is further strengthening adoption across veterinary hospitals and specialty clinics.

- For instance, Elanco’s NOCITA liposomal bupivacaine (5.3 mg/kg per forelimb for a total dose of 10.6 mg/kg per cat) delivered via a four-point nerve block provided postoperative analgesia for up to 72 hours in a pivotal field study of 120 cats (with a matching 121 cats in the placebo group for a total safety population of 241 cats).

By Animal Type

Dogs accounted for the largest market share of 59.2% in 2024, supported by higher surgical volumes and growing awareness of postoperative care. Canine procedures such as spaying, orthopedic surgeries, and dental extractions drive consistent demand for pain management therapeutics. Increasing availability of dog-specific analgesic formulations promotes compliance and clinical safety. Rising pet ownership and expanding expenditure on advanced veterinary care also support the segment’s dominance. Furthermore, increasing use of multimodal analgesic regimens in dogs continues to enhance recovery outcomes and comfort levels.

Key Growth Drivers

Rising Surgical Procedures in Companion Animals

The growing number of elective and emergency surgeries among pets significantly boosts demand for postoperative pain management therapeutics. Common procedures like spaying, orthopedic surgeries, and tumor removal create a steady need for effective analgesics. Increasing awareness among pet owners regarding pain prevention and faster recovery supports market expansion. Veterinary clinics are focusing on advanced multimodal pain protocols to improve postoperative care, further driving the use of NSAIDs, anesthetics, and local analgesics in companion animal treatment.

- For instance, following the suspension of elective surgeries during the early stages of the COVID-19 pandemic in 2020, the Banfield Foundation partnered with the Humane Society of the United States and over 25 other organizations in a coalition called #SpayTogether.

Advancements in Veterinary Analgesics and Drug Delivery

Continuous innovation in veterinary pain therapeutics, such as extended-release formulations and targeted COX-2 inhibitors, enhances treatment precision. These advancements provide sustained pain control with fewer side effects, improving animal comfort and recovery. The adoption of novel delivery methods, including transdermal patches and long-acting injectables, strengthens therapeutic compliance. Research focusing on species-specific analgesics supports wider product acceptance across both companion and specialty veterinary care segments.

- For instance, Ceva’s Meloxidyl Injection is dosed at 0.2 mg/kg IV or SC pre-op, with oral continuation at 0.1 mg/kg once daily to extend control.

Growing Pet Humanization and Healthcare Expenditure

The rising trend of pet humanization has led to increased spending on advanced veterinary treatments. Owners are prioritizing animal well-being, resulting in higher adoption of postoperative pain relief drugs. Expanding pet insurance coverage further supports access to premium pain management options. This shift is encouraging pharmaceutical companies to invest in developing innovative veterinary analgesics, strengthening the market outlook for postoperative pain therapeutics.

Key Trends & Opportunities

Increased Adoption of Multimodal Pain Management

Veterinarians are increasingly using multimodal approaches that combine NSAIDs, local anesthetics, and alpha-2 agonists to achieve comprehensive pain control. This trend improves recovery time and reduces reliance on opioids. The integration of such strategies enhances safety and long-term outcomes. Growing research on combination therapies and cross-class synergies presents significant opportunities for pharmaceutical companies in the companion animal therapeutics sector.

- For instance, Orion’s Dexdomitor dosing guidance specifies 500 µg/m² IM for canine sedation/analgesia, or 300 µg/m² IM when combined with butorphanol 0.1 mg/kg for deeper analgesia.

Rising Use of Non-Opioid and Biologic Therapies

Growing concerns over opioid safety are driving interest in non-opioid pain management solutions. Biologics and monoclonal antibodies are emerging as effective alternatives for managing postoperative inflammation. These therapies offer targeted relief with fewer side effects, aligning with regulatory trends favoring safer drug classes. Increased research funding and clinical validation are creating opportunities for market growth and long-term innovation.

- For instance, Zoetis’ Solensia (frunevetmab) is administered SC once monthly at a minimum 1 mg/kg dose to control osteoarthritis pain in cats.

Key Challenges

High Cost of Advanced Analgesics and Procedures

The cost of innovative pain management drugs and surgical interventions remains a major barrier for many pet owners. Advanced therapies, such as biologics and long-acting injectables, are often expensive, limiting adoption in low-income regions. Despite growing insurance support, affordability continues to affect treatment accessibility. Price sensitivity among pet owners may restrain market penetration of premium therapeutics.

Regulatory and Safety Approval Barriers

Obtaining regulatory clearance for new veterinary analgesics involves extensive clinical testing and documentation. Strict safety and efficacy requirements increase time-to-market and development costs. Limited harmonization between regional veterinary drug approval standards adds complexity for manufacturers. These regulatory constraints can delay product launches and slow innovation in postoperative pain management for companion animals.

Regional Analysis

North America

North America held the largest share of 39.8% in the Companion Animal Postoperative Pain Management Therapeutics Market in 2024. The region’s dominance is supported by a high rate of pet ownership and well-established veterinary infrastructure. Increased adoption of advanced analgesics and multimodal pain management approaches enhances postoperative care standards. Growing awareness among pet owners and expanding pet insurance coverage further drive regional growth. The presence of major pharmaceutical companies and frequent new product launches continue to strengthen North America’s leading position in the global market.

Europe

Europe accounted for a 28.3% share in 2024, driven by increasing focus on animal welfare and stringent regulatory frameworks promoting ethical veterinary practices. The region’s demand is supported by rising adoption of companion animals and the presence of advanced veterinary hospitals. Widespread use of NSAIDs and anesthetics for surgical pain management continues to expand. Countries such as Germany, the United Kingdom, and France are key contributors due to their growing pet healthcare expenditure. The market also benefits from strong R&D initiatives and rapid acceptance of non-opioid analgesics across veterinary clinics.

Asia Pacific

Asia Pacific captured a 21.7% share in 2024, emerging as the fastest-growing regional market. Rising pet ownership in countries like China, Japan, and India, coupled with improving veterinary infrastructure, is fueling demand for postoperative pain therapeutics. Increased awareness about animal health and preventive care drives product adoption. The market is also benefiting from regional investments in local drug manufacturing and the growing availability of advanced analgesics. Expanding urbanization and higher disposable income levels further contribute to the region’s growth potential in postoperative pain management for companion animals.

Latin America

Latin America accounted for 6.1% of the market in 2024, driven by growing awareness of veterinary healthcare and the increasing number of companion animals. Brazil and Mexico represent the major markets, supported by expanding veterinary service networks. The availability of affordable pain management solutions and the gradual introduction of advanced NSAIDs are strengthening market presence. However, limited insurance penetration and uneven access to specialized veterinary care restrict wider adoption. Continued investment in veterinary education and government initiatives to improve animal welfare are expected to support future regional growth.

Middle East & Africa

The Middle East & Africa region held a 4.1% market share in 2024, characterized by steady growth in urban pet ownership and increasing veterinary facility development. Rising adoption of companion animals in Gulf countries and South Africa contributes to market expansion. The availability of basic analgesics and growing awareness about postoperative care are improving treatment adoption. However, economic disparities and limited access to advanced pain therapeutics constrain broader market reach. Ongoing efforts to strengthen veterinary healthcare infrastructure are expected to enhance future demand for postoperative pain management products.

Market Segmentations:

By Drug Class

- NSAIDs

- Anesthetics

- Opioids

- Alpha-2 agonists

- Other drug classes

By Route of Administration

By Animal Type

- Dogs

- Cats

- Other animal types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Companion Animal Postoperative Pain Management Therapeutics Market is moderately consolidated, with key players such as Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Zoetis Inc., Dechra Pharmaceuticals, Virbac Group, Merck Animal Health, Ceva Sante Animale, Vetoquinol S.A., Bayer AG, Norbrook, SAVA Vet, Chanelle Pharma Group, Assisi Animal Health, and Bimeda Animal Health competing through innovation and product differentiation. The market is witnessing strategic emphasis on research in multimodal and non-opioid pain management solutions to enhance animal safety and recovery outcomes. Companies are investing heavily in developing targeted drug formulations, such as COX-2 inhibitors and long-acting injectables, to minimize side effects and improve compliance. Increasing focus on species-specific therapies, digital pain assessment tools, and collaborative research with veterinary institutes is expanding treatment options. Strategic alliances, product line expansions, and regulatory approvals are further shaping competition, positioning global players to strengthen their presence in emerging veterinary healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Zoetis Inc.

- Dechra Pharmaceuticals

- Virbac Group

- Merck Animal Health

- Ceva Sante Animale

- Vetoquinol S.A.

- Bayer AG

- Norbrook

- SAVA Vet

- Chanelle Pharma Group

- Assisi Animal Health

- Bimeda Animal Health

Recent Developments

- In 2025, Merck Animal HealthReceived U.S. FDA approval for Mometamax Single, an innovative one-dose, in-clinic treatment for canine otitis externa, which helps manage inflammation and discomfort following ear procedures.

- In 2025, Assisi Animal Health continues to promote its targeted Pulsed Electromagnetic Field (PEMF) therapy for postoperative pain management in companion animals, highlighting its non-invasive, drug-free therapeutic approach for pain relief and healing, as evidenced by their ongoing science and research efforts.

- In 2024, Boehringer Ingelheim: Acquired Saiba Animal Health, adding a technology platform for developing new therapeutic antibodies aimed at chronic diseases, including future pain management applications.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Route of Administration, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to expand steadily driven by increasing surgical procedures in pets.

- Rising awareness of pain prevention and welfare standards will boost adoption of advanced analgesics.

- Innovation in non-opioid and biologic therapies will reduce dependency on traditional painkillers.

- Demand for sustained-release formulations and multimodal treatment strategies will continue to grow.

- Veterinary clinics will increasingly adopt digital tools for postoperative monitoring and pain assessment.

- Expansion of pet insurance coverage will improve access to premium pain management products.

- Regional manufacturers will strengthen supply chains to meet growing local veterinary demand.

- Research investment in species-specific drug development will enhance treatment effectiveness.

- Collaboration between pharmaceutical firms and veterinary associations will accelerate therapeutic advancements.

- Emerging markets in Asia and Latin America will present strong growth opportunities through rising pet care awareness.