Market Overview:

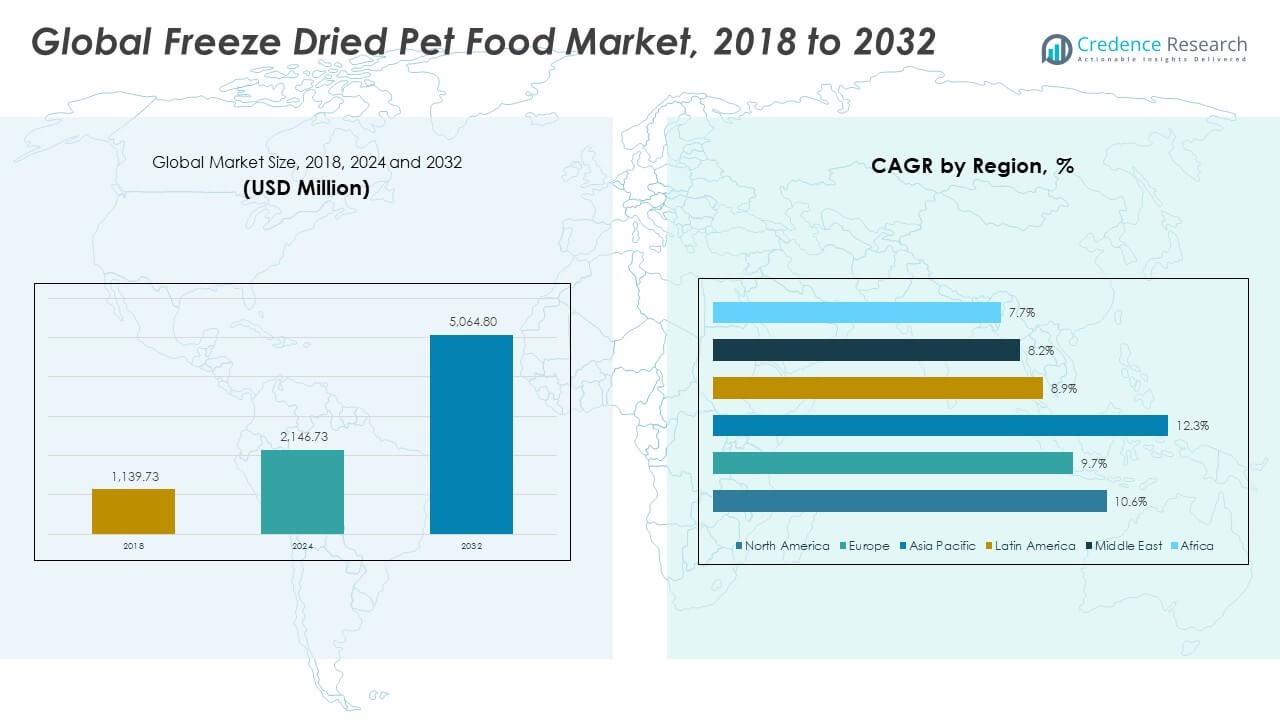

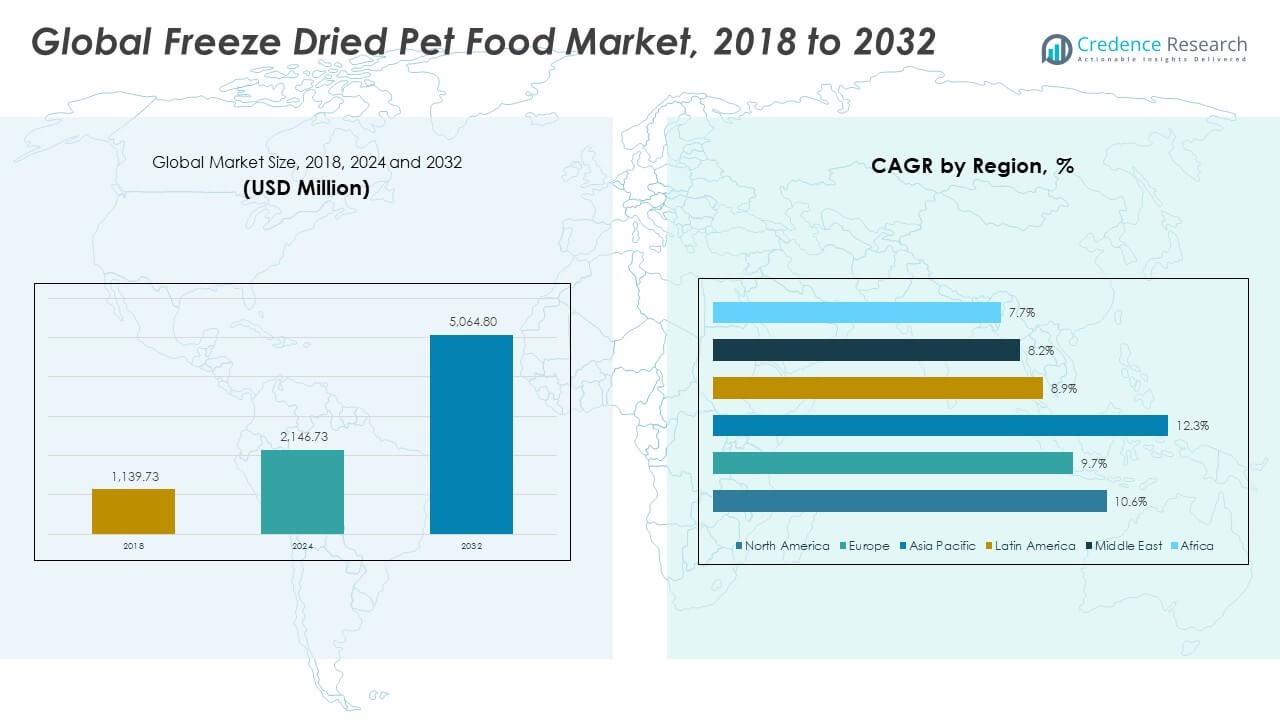

The Global Freeze Dried Pet Food Market size was valued at USD 1,139.73 million in 2018 to USD 2,146.73 million in 2024 and is anticipated to reach USD 5,064.80 million by 2032, at a CAGR of 10.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freeze Dried Pet Food Market Size 2024 |

USD 2,146.73 Million |

| Freeze Dried Pet Food Market, CAGR |

10.55% |

| Freeze Dried Pet Food Market Size 2032 |

USD 5,064.80 Million |

The market is growing due to the rising demand for convenient, nutrient-rich pet food options. Pet owners increasingly prefer freeze-dried products for their longer shelf life, natural flavor retention, and high nutritional value. The trend toward premium and organic pet foods further supports growth. Increasing awareness of pet health, coupled with expanding e-commerce platforms, drives global sales among both dog and cat owners.

North America leads the market due to strong consumer awareness and premium pet food adoption. Europe follows, supported by a growing trend toward natural and minimally processed products. Asia-Pacific shows the fastest growth with increasing pet ownership and rising disposable income in countries like China, Japan, and India. Latin America and the Middle East are emerging markets showing gradual adoption of freeze-dried products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

• The Global Freeze Dried Pet Food Market was valued at USD 1,139.73 million in 2018, reached USD 2,146.73 million in 2024, and is projected to touch USD 5,064.80 million by 2032, expanding at a CAGR of 10.55%.

• North America leads with 43% share, driven by premium pet nutrition demand, strong brand presence, and advanced retail channels. Europe follows with 27%, supported by clean-label preferences and strict quality standards, while Asia Pacific contributes 21%, fueled by rapid urbanization and rising pet ownership.

• Asia Pacific is the fastest-growing region, driven by expanding middle-class income, digital retail penetration, and increasing awareness of high-quality pet diets among urban consumers.

• Dog food dominates the segment, accounting for roughly 70% of global revenue, supported by higher dog ownership and preference for high-protein, convenient products.

• Cat food represents about 30% share, growing steadily due to the rising popularity of indoor pets and demand for tailored nutritional formulations.

Market Drivers:

Rising Pet Humanization and Premium Food Spending

The Global Freeze Dried Pet Food Market grows due to the rising trend of pet humanization. Pet owners now treat animals as family members, driving preference for nutrient-rich, premium, and natural diets. Freeze-dried options retain flavor, texture, and essential nutrients better than traditional dry food. It meets consumer expectations for clean-label and high-quality products. Growing disposable income in urban households increases spending on premium pet food. Brands focus on human-grade ingredients to enhance appeal. Pet owners value transparency and safety, creating sustained demand. This behavioral shift strengthens global sales across developed and emerging regions.

• For instance, Stella & Chewy’s Freeze-Dried Raw Dinner Patties list a crude protein minimum of 48% and crude fat minimum of 28%.

Health Awareness and Preference for High-Nutrition Diets

Growing awareness of pet health encourages consumers to choose freeze-dried food with superior nutritional profiles. It offers higher protein content and minimal processing, maintaining natural vitamins and minerals. Rising cases of pet obesity and allergies push owners toward clean, grain-free formulations. Veterinarians recommend these foods for balanced diets and easy digestion. Demand grows across dogs and cats for natural, preservative-free meals. Consumers seek freeze-dried treats as supplements to daily feeding. Evolving lifestyles and work schedules also support ready-to-serve healthy options. These factors collectively enhance product penetration across markets.

• For instance, the same Stella & Chewy’s product (specifically, the Stella’s Super Beef Freeze-Dried Raw Dinner Patties recipe) shows a guaranteed analysis of 44% minimum crude protein and 35% minimum crude fat on an “as-fed” basis. When converted to a dry matter basis (accounting for a maximum of 5% moisture), this equates to approximately 46% protein and nearly 37% fat.

Expansion of E-Commerce and Direct-to-Consumer Sales Channels

The digital marketplace plays a critical role in the growth of the Global Freeze Dried Pet Food Market. Online channels allow brands to reach new customer segments and provide subscription models for consistent purchases. Pet owners benefit from convenience and detailed product comparisons. It supports small and emerging brands in promoting innovative recipes and regional blends. Social media marketing builds trust through reviews and pet influencer endorsements. Online platforms also allow customization of dietary plans. The convenience of doorstep delivery and flexible payment options accelerates adoption. This online transformation has created new competitive dynamics in the sector.

Product Innovation and Introduction of Organic and Exotic Formulations

Continuous product innovation drives market momentum with the launch of new flavor blends and organic variants. Brands experiment with protein sources such as salmon, duck, and bison to appeal to health-conscious pet owners. It supports consumer diversity by addressing allergies and preferences. Manufacturers invest in freeze-drying technology to retain nutrition and improve texture. Premium packaging and portion-controlled packs enhance value perception. Organic certifications and sustainable sourcing attract eco-aware buyers. The expansion of functional pet foods with probiotics and omega-rich ingredients is gaining traction. These innovations sustain brand differentiation and customer loyalty.

Market Trends:

Increasing Adoption of Sustainable and Eco-Friendly Packaging Solutions

A notable trend in the Global Freeze Dried Pet Food Market is the shift toward sustainable packaging. Brands use recyclable, biodegradable, or compostable materials to reduce environmental footprint. It aligns with global sustainability goals and consumer expectations. Manufacturers adopt lightweight pouches to cut shipping emissions. Eco-labels and certifications strengthen product appeal among responsible buyers. Consumers associate sustainability with quality and care, improving brand reputation. Technology advancements also support resealable and moisture-proof packaging for longer shelf life. This movement is reshaping product presentation across premium pet food categories.

• For instance, The Honest Kitchen offers human-grade food made in a human food facility and highlights its Certified B Corporation status and emphasis on ingredient transparency.

Integration of Functional Ingredients for Health and Wellness

Manufacturers now enrich freeze-dried pet food with functional ingredients like probiotics, omega fatty acids, and antioxidants. This trend caters to pets’ digestive health, coat shine, and immunity improvement. The Global Freeze Dried Pet Food Market benefits from rising demand for preventive pet nutrition. It aligns with growing awareness among owners about long-term wellness. Formulations now include supplements addressing joint and heart health. The focus on functional nutrition elevates product value beyond basic feeding. Companies differentiate products with scientifically backed claims. These health-focused innovations foster premiumization in the category.

• For instance, Vital Essentials states its raw formula includes omega-3 fatty acids to support skin, coat, and joint health.

Technological Advancements in Freeze-Drying and Food Preservation Methods

Technology innovation continues to redefine product quality and efficiency. Modern freeze-drying systems improve moisture control, reducing spoilage and nutrient loss. The Global Freeze Dried Pet Food Market leverages automation for consistent quality and extended shelf stability. Manufacturers employ advanced vacuum drying to retain aroma and color. Improved production lines reduce energy use and processing time. It allows scalability and cost efficiency in mass manufacturing. Technology also supports customization, enabling specific diets for breeds and life stages. These advancements enhance competitiveness and operational sustainability.

Rise of Customization and Personalized Pet Nutrition Plans

Personalized pet diets are transforming purchase behavior in developed regions. Brands offer tailored formulations based on breed, age, weight, and activity level. It enhances engagement and ensures dietary precision. The Global Freeze Dried Pet Food Market sees growing investment in data-driven nutrition services. Companies use online assessments and subscription-based models to deliver customized packs. Consumers appreciate convenience and relevance in feeding patterns. Digital platforms also track consumption trends to refine offerings. Personalization boosts customer retention and brand trust among health-conscious pet owners.

Market Challenges Analysis:

High Production Costs and Limited Consumer Awareness in Developing Economies

The Global Freeze Dried Pet Food Market faces cost challenges due to complex manufacturing processes and high energy needs. Freeze-drying requires advanced equipment and controlled environments, increasing capital investment. Smaller producers find it difficult to match pricing of mass-market pet food. It limits affordability in price-sensitive countries. Many pet owners in emerging markets remain unaware of freeze-dried benefits, restricting adoption. Retail availability also remains low due to storage requirements. Import dependency for premium ingredients adds further cost pressure. These barriers slow market penetration in lower-income regions.

Supply Chain Constraints and Competitive Pressure from Traditional Pet Foods

Supply chain disruptions and limited raw material access create production delays and price volatility. The Global Freeze Dried Pet Food Market also faces strong competition from wet and dry pet food brands offering lower prices. It struggles to maintain consistent ingredient quality amid global sourcing challenges. Retail shelf space competition remains high, favoring established packaged food brands. Distribution networks are still developing in rural and semi-urban regions. It limits exposure and consumer trust. Manufacturers must optimize logistics and inventory to stay competitive. This challenge demands strategic investment and education to shift consumer preference.

Market Opportunities:

Rising Demand for Premium, Human-Grade, and Organic Pet Food Options

The Global Freeze Dried Pet Food Market holds vast potential in the premium and organic food category. Consumers increasingly demand human-grade products with transparent sourcing. It enables brands to capitalize on ethical consumption trends. Manufacturers can focus on clean-label recipes and additive-free formulas. Partnerships with veterinary clinics and pet nutritionists can enhance brand credibility. Expansion in specialty retail and online channels supports market entry. The shift toward chemical-free ingredients creates space for innovation. Growing awareness of sustainable and health-driven choices boosts premium market growth.

Expansion into Emerging Pet Care Markets and Regional Customization

Developing economies present significant untapped potential for freeze-dried products. Rising pet ownership in Asia-Pacific, Latin America, and Eastern Europe supports market expansion. It provides opportunities to introduce locally sourced and culturally adapted flavors. E-commerce and digital marketing help bridge distribution gaps. Brands can target mid-tier consumers through affordable pack sizes. Collaborations with regional distributors enhance accessibility and brand reach. Increased urbanization and lifestyle changes will continue driving awareness. These factors collectively open pathways for long-term growth across emerging markets.

Market Segmentation Analysis:

By Animal Type

The Global Freeze Dried Pet Food Market is segmented into dog food and cat food. Dog food holds a dominant share due to the higher number of dog owners globally and increasing preference for premium, high-protein diets. It meets nutritional needs while offering longer shelf life and better digestibility. Cat food is gaining momentum as feline adoption grows in urban regions. Manufacturers focus on species-specific recipes enriched with taurine, vitamins, and essential minerals. Both categories benefit from rising awareness about balanced nutrition and clean-label formulations that promote pet wellness and longevity.

• For instance, Vital Essentials Freeze-Dried Raw Chicken Mini Nibs for cats list a crude protein minimum of 52% and fat minimum of 20%.

By Product Form

The market is categorized into chips, flakes, and crumbles. Chips account for a notable share due to ease of portioning and palatability among pets. Flakes are favored for their lightweight texture and versatility in mixing with wet or dry food. Crumbles serve the niche segment of smaller pets and those with chewing difficulties. It supports owners seeking convenient, nutrient-dense feeding options. Companies innovate in shapes and textures to enhance flavor retention and feeding appeal. Each form caters to varied consumer preferences and storage requirements, expanding market reach across distribution channels.

• For instance, Nature’s Variety’s freeze-dried format uses vacuum-dehydration to preserve flavor and nutrients in bite-sized nuggets made of 80% chicken.

By Distribution Channel

Key distribution channels include online retail, specialty pet stores, supermarkets/hypermarkets, veterinary clinics, and others. Online retail leads growth due to convenience, product variety, and subscription-based sales models. Specialty stores maintain strong traction with personalized guidance and premium offerings. Supermarkets and veterinary clinics ensure accessibility and professional recommendation-based sales. It reflects the balanced shift toward both physical and digital retail ecosystems driving market expansion.

Segmentation:

By Animal Type

By Product Form

By Distribution Channel

- Online Retail

- Specialty Pet Stores

- Supermarkets/Hypermarkets

- Veterinary Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Freeze Dried Pet Food Market size was valued at USD 496.18 million in 2018 to USD 924.83 million in 2024 and is anticipated to reach USD 2,188.04 million by 2032, at a CAGR of 10.6% during the forecast period. North America holds the largest market share, accounting for about 43% of the global revenue. Strong consumer awareness and widespread pet ownership drive market growth. It benefits from the dominance of leading brands offering premium and organic formulations. The U.S. leads regional demand due to high disposable income and a strong retail network. Canada follows with growing adoption of freeze-dried cat food and sustainable packaging solutions. E-commerce penetration and subscription-based pet food models continue to expand across the region. Innovation in protein sources, including bison and salmon, further strengthens product diversity and consumer loyalty.

Europe

The Europe Global Freeze Dried Pet Food Market size was valued at USD 314.96 million in 2018 to USD 571.28 million in 2024 and is anticipated to reach USD 1,266.80 million by 2032, at a CAGR of 9.7% during the forecast period. Europe contributes around 27% of the global market share. The region’s growth is supported by strict food quality standards and rising adoption of natural pet diets. It is characterized by increasing preference for clean-label, high-protein foods among pet owners in the UK, Germany, and France. Premiumization trends and the shift toward ethical sourcing strengthen brand competitiveness. European pet owners prioritize transparency in ingredient sourcing and environmentally conscious production. Retailers expand their offerings with private labels and locally sourced brands. Growing investments in sustainable packaging and product certification reinforce long-term regional demand.

Asia Pacific

The Asia Pacific Global Freeze Dried Pet Food Market size was valued at USD 222.51 million in 2018 to USD 453.75 million in 2024 and is anticipated to reach USD 1,210.53 million by 2032, at a CAGR of 12.3% during the forecast period. Asia Pacific represents roughly 21% of the total global market share and is the fastest-growing region. Rising pet ownership in China, Japan, and India drives regional expansion. It benefits from rapid urbanization and rising disposable income among middle-class consumers. Local and global players invest heavily in expanding production capacity and online retail channels. Pet humanization trends are increasing demand for high-nutrition freeze-dried foods. Japan and South Korea lead in innovative packaging and pet-specific dietary solutions. The region’s e-commerce growth provides brands with wide market reach and direct consumer engagement.

Latin America

The Latin America Global Freeze Dried Pet Food Market size was valued at USD 53.96 million in 2018 to USD 100.38 million in 2024 and is anticipated to reach USD 209.67 million by 2032, at a CAGR of 8.9% during the forecast period. Latin America holds nearly 4% of the global market share. Brazil and Argentina dominate regional consumption due to expanding pet care industries and urban lifestyle trends. It benefits from a growing shift toward premium and grain-free products. Local manufacturers are introducing affordable options to attract mid-income households. Online sales channels are expanding, supported by increased digital awareness among younger consumers. Rising veterinary recommendations are helping drive trust in freeze-dried formulations. Economic recovery and brand localization strategies strengthen market accessibility across the region.

Middle East

The Middle East Global Freeze Dried Pet Food Market size was valued at USD 32.43 million in 2018 to USD 55.92 million in 2024 and is anticipated to reach USD 111.68 million by 2032, at a CAGR of 8.2% during the forecast period. The region accounts for about 3% of the global market share. Pet ownership is increasing in urban areas across the UAE, Saudi Arabia, and Israel. It benefits from rising expatriate populations and growing demand for imported premium pet food. Retail expansion in supermarkets and specialty stores strengthens product availability. E-commerce and online veterinary channels are gradually gaining traction. Premium imported brands dominate sales due to limited local manufacturing. Rising awareness of pet health and wellness supports long-term growth. Sustainability-driven packaging initiatives are slowly entering the regional landscape.

Africa

The Africa Global Freeze Dried Pet Food Market size was valued at USD 19.69 million in 2018 to USD 40.56 million in 2024 and is anticipated to reach USD 78.08 million by 2032, at a CAGR of 7.7% during the forecast period. Africa contributes roughly 2% of the global market share. The region is in an early stage of adoption, with South Africa leading demand. It benefits from gradual urbanization, improved retail networks, and rising awareness of pet care nutrition. Imports dominate the market due to limited local production capacity. Manufacturers are exploring opportunities in major cities such as Cape Town and Cairo. Pet adoption programs and online education are helping drive awareness of premium pet diets. The region’s long-term potential lies in affordability-driven innovations and regional production partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Stella & Chewy’s LLC

- Regal Pet LLC

- Nature’s Variety, Inc.

- Primal Pet Foods LLC

- The Honest Kitchen, Inc.

- Vital Essentials, LLC

- Northwest Naturals, LLC

- Ziwipeak Limited

- Answers Pet Food, Inc.

- Frozen to Fresh Pet Foods, Inc.

Competitive Analysis:

The Global Freeze Dried Pet Food Market features a concentrated competitive landscape dominated by a handful of major players. These companies leverage strong brand portfolios, premium product offerings, and robust distribution channels to maintain leadership positions. They invest heavily in research, technology, and marketing to differentiate through high-quality ingredients and novel product forms. Smaller firms face high barriers to entry due to capital intensity, stringent quality standards, and supply-chain complexities. Competitive pricing pressures and margin sensitivity drive players to optimize operations and scale quickly. Partnerships and acquisitions enhance geographic reach and portfolio breadth. It remains critical for firms to continuously innovate and respond to evolving pet-owner health and lifestyle preferences to sustain competitive advantage.

Recent Developments:

• In October 2025, Nature’s Variety, Inc. collaborated with Dow and Zermatt to launch an innovative pet food pouch incorporating 10% recycled content. This packaging solution not only reflects an advance in sustainable practices but also supports compliance with the EU’s 2030 Packaging and Packaging Waste targets. The new pouch demonstrates Nature’s Variety’s commitment to eco-friendly solutions in the freeze-dried pet food segment.

• In August 2025, Stella & Chewy’s LLC expanded its distribution footprint by launching a range of freeze-dried meal toppers and dinner products at Target stores nationwide. With this launch, more than 1,900 Target locations began offering Stella & Chewy’s premium products, further increasing the accessibility of high-quality pet nutrition for customers.

• In May 2025, Stella & Chewy’s LLC, a leader in freeze-dried raw pet food, announced a new partnership with PetSmart, the prominent North American pet retailer. Through this alliance, Stella & Chewy’s began offering its comprehensive range of freeze-dried meals, toppers, kibble, and treats in PetSmart stores across the United States, with an online rollout and subsequent expansion into Canada planned for June. This strategic partnership marks a significant milestone in increasing access to premium raw and natural pet nutrition for pet parents nationwide.

Report Coverage:

The research report offers an in-depth analysis based on animal type, product form, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

• Rising focus on human-grade, organic, and minimally processed formulations.

• Expansion of direct-to-consumer and subscription-based online sales models.

• Growing influence of sustainability-driven packaging and ethical sourcing.

• Increasing investments in regional production facilities to reduce import costs.

• Strong growth prospects in Asia Pacific supported by pet adoption trends.

• Product diversification through functional and allergen-free pet diets.

• Continued brand consolidation through mergers and strategic partnerships.

• Rising consumer demand for transparent labeling and traceable supply chains.

• Advancements in freeze-drying technology improving energy efficiency.

• Growing awareness of pet health and longevity boosting premium category demand.