Market Overview:

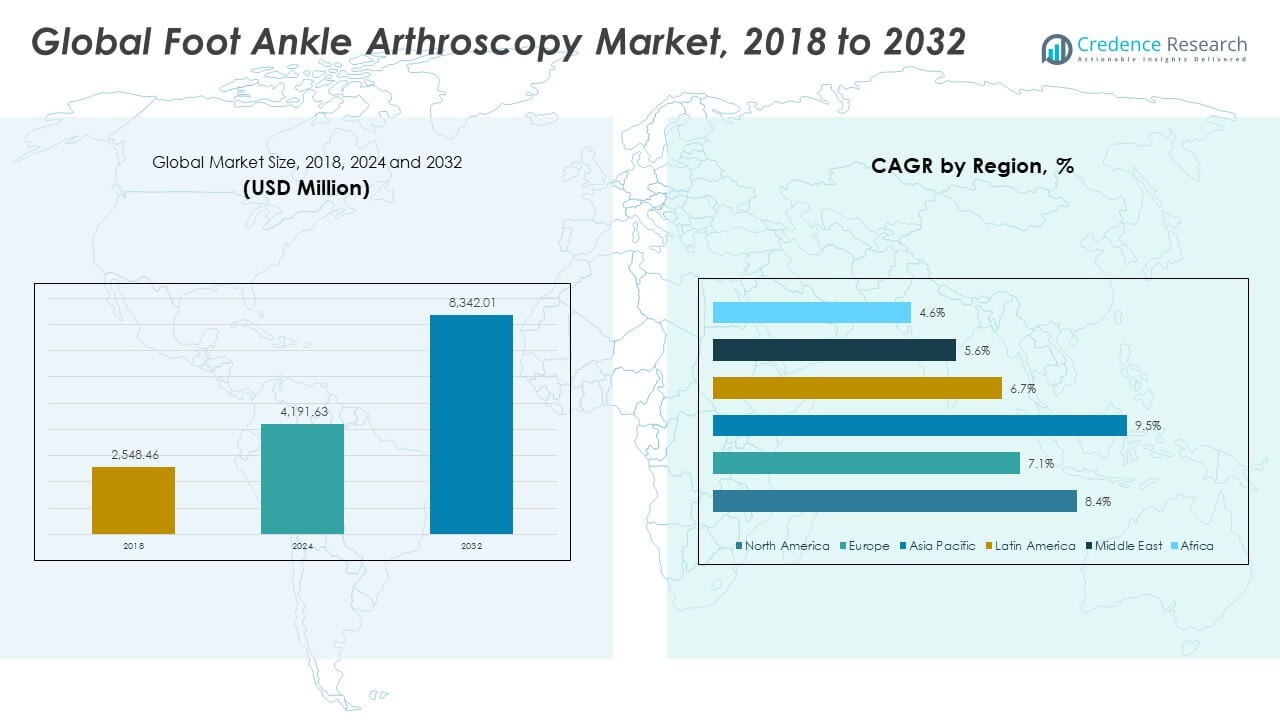

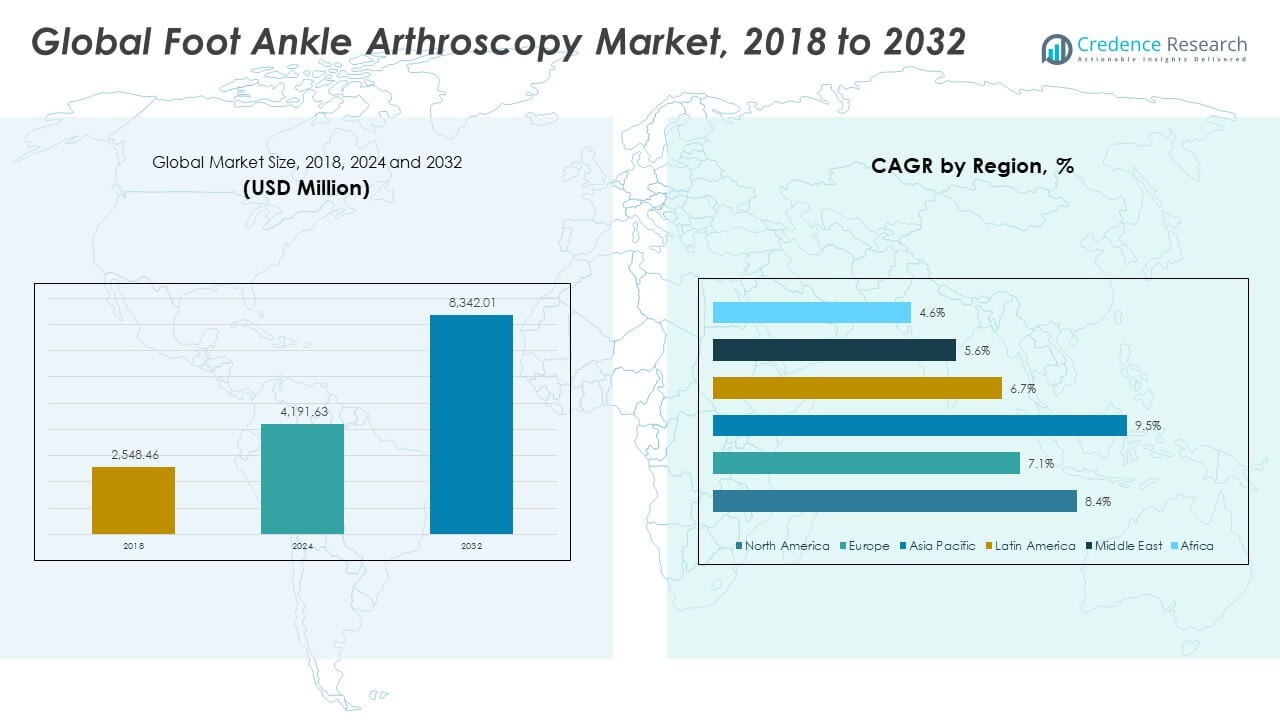

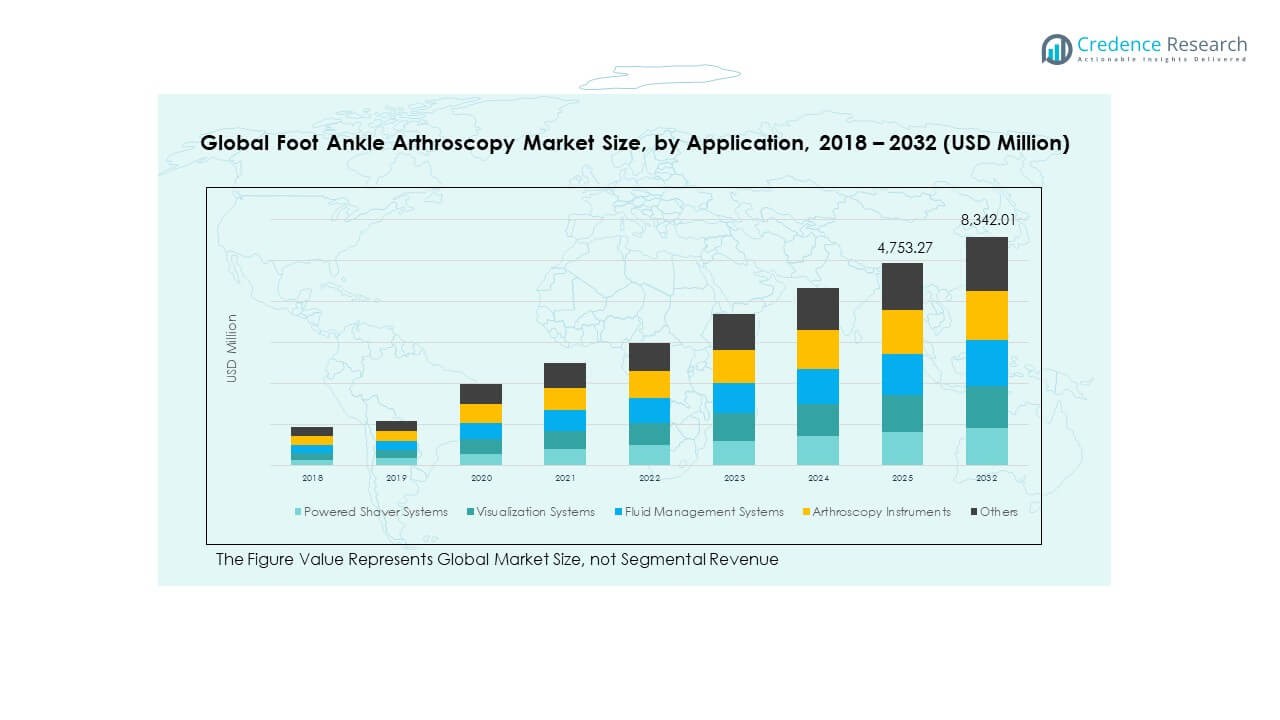

The Global Foot Ankle Arthroscopy Market size was valued at USD 2,548.46 million in 2018, reached USD 4,191.63 million in 2024, and is anticipated to attain USD 8,342.01 million by 2032, growing at a CAGR of 8.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foot Ankle Arthroscopy Market Size 2024 |

USD 4,191.63 Million |

| Foot Ankle Arthroscopy Market, CAGR |

8.37% |

| Foot Ankle Arthroscopy Market Size 2032 |

USD 8,342.01 Million |

Rising sports injuries, an increasing geriatric population, and growing demand for minimally invasive procedures are driving the market. Advancements in arthroscopic instruments, such as high-definition visualization systems and smaller endoscopic tools, enhance precision and recovery outcomes. Surgeons prefer arthroscopy over traditional open surgeries due to reduced hospital stays, faster rehabilitation, and lower infection risk. The market growth is further supported by expanding adoption of advanced orthopedic technologies across hospitals and specialized clinics worldwide.

Regionally, North America leads the market owing to advanced healthcare infrastructure, high awareness, and favorable reimbursement frameworks. Europe follows with steady growth driven by increased adoption of arthroscopic procedures and technological innovation. Meanwhile, Asia-Pacific is emerging rapidly due to rising sports participation, growing healthcare investments, and a surge in foot and ankle injuries in countries like India, China, and Japan. Emerging markets in Latin America and the Middle East are also witnessing gradual adoption as access to modern surgical equipment improves.

Market Insights:

- The Global Foot Ankle Arthroscopy Market was valued at USD 2,548.46 million in 2018, reached USD 4,191.63 million in 2024, and is projected to attain USD 8,342.01 million by 2032, growing at a CAGR of 8.37% during the forecast period.

- North America (43.9%), Asia Pacific (33.2%), and Europe (16.0%) collectively account for over 93% of the market share. North America dominates due to advanced surgical infrastructure and high adoption of minimally invasive technologies, while Europe benefits from established orthopedic expertise and technological integration.

- Asia Pacific, the fastest-growing region, holds a 33.2% share, driven by healthcare modernization, rising sports injury cases, and expanding medical tourism across China, India, and Japan. Increasing access to affordable devices accelerates adoption in emerging economies.

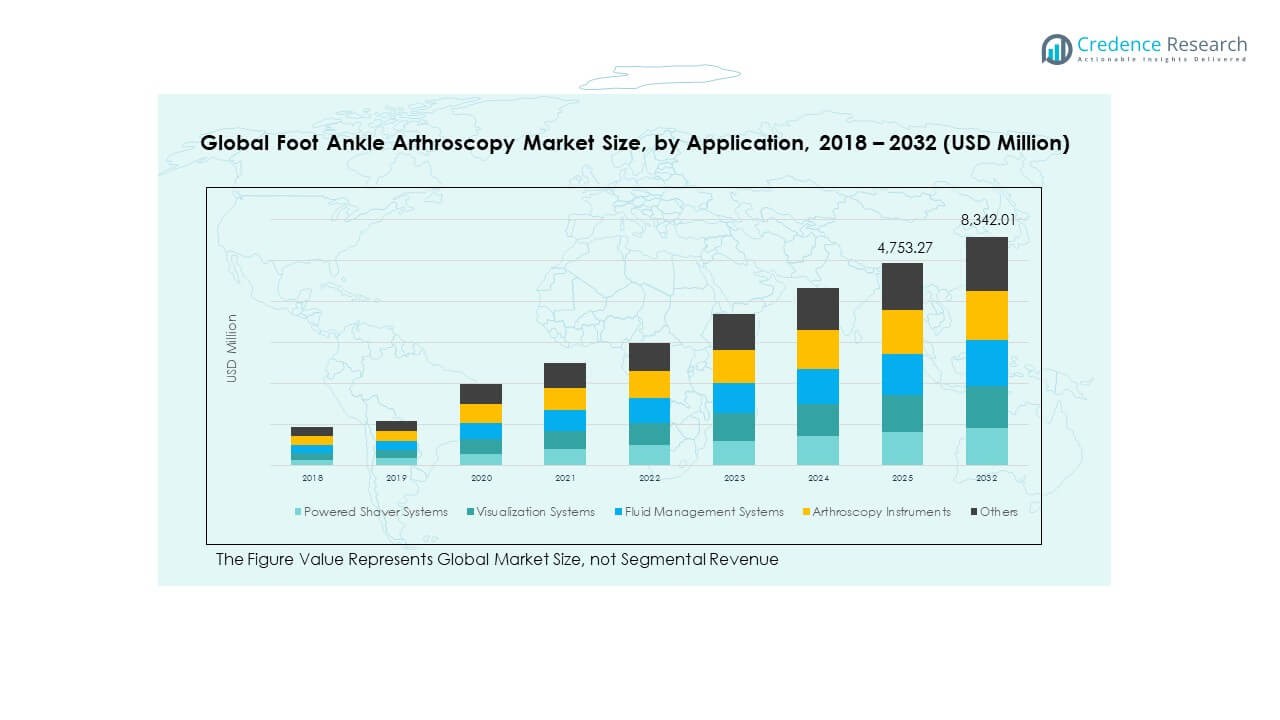

- Based on segmental insights, Powered Shaver Systems lead the market with around 30% share, reflecting their essential role in precision tissue removal and surgical control.

- Visualization Systems hold approximately 25% share, supported by advances in 3D imaging, AI-assisted platforms, and surgeon preference for enhanced visibility during complex arthroscopic procedures.

Market Drivers:

Growing Prevalence of Sports Injuries and Orthopedic Disorders

The Global Foot Ankle Arthroscopy Market is witnessing strong growth due to rising sports-related injuries and orthopedic complications such as ligament tears and cartilage damage. Increasing participation in recreational and professional sports has led to a surge in joint injuries requiring advanced arthroscopic interventions. The growing elderly population prone to osteoarthritis and degenerative joint diseases further drives demand. Technological innovations have improved precision and reduced post-surgical complications. Patients prefer minimally invasive treatments that enable faster recovery and mobility restoration. Hospitals and specialty clinics continue to invest in modern arthroscopic systems to meet rising patient volumes. The trend toward early diagnosis and timely intervention is expanding the patient pool. This factor supports market growth and clinical advancements in arthroscopic care.

- For instance, Stryker Corporation’s Formula Shaver handpieces operate at up to 12,000 RPM, offering enhanced precision and efficiency in joint surgeries. Technological innovations have improved precision and reduced post-surgical complications. Patients prefer minimally invasive treatments that enable faster recovery and mobility restoration. Hospitals and specialty clinics continue to invest in modern arthroscopic systems to meet rising patient volumes.

Technological Advancements Enhancing Surgical Precision and Outcomes

Rapid innovation in visualization and imaging tools is strengthening the efficiency of foot and ankle arthroscopy procedures. High-definition cameras, 3D navigation systems, and improved endoscopic devices enhance accuracy during diagnosis and treatment. Integration of robotics and AI-assisted tools supports surgeons in achieving consistent outcomes. The market benefits from the development of smaller and more flexible instruments that minimize tissue trauma. These advancements lower surgical risks and accelerate post-operative recovery. Manufacturers are focusing on designing compact, user-friendly systems suitable for both hospitals and ambulatory centers. The shift toward outpatient arthroscopy procedures supports higher adoption rates. These factors are driving significant technological evolution in the arthroscopy field.

- For instance, Stryker’s CrossBlade cutters incorporate laser-cut inner housings and opposing shear angles to increase cutting efficiency and reduce clogging. Integration of robotics and AI-assisted tools supports surgeons in achieving consistent outcomes. The market benefits from the development of smaller and more flexible instruments that minimize tissue trauma.

Rising Patient Preference for Minimally Invasive and Outpatient Surgeries

Increasing awareness of the benefits of minimally invasive procedures is reshaping patient preferences globally. The Global Foot Ankle Arthroscopy Market benefits from shorter hospital stays, reduced pain, and minimal scarring associated with arthroscopic surgeries. Surgeons favor these methods for their efficiency and precision in addressing complex conditions. Healthcare providers are expanding outpatient facilities to accommodate this growing demand. The approach reduces overall healthcare costs while improving patient satisfaction and mobility recovery. Advancements in anesthesia and post-surgery care make these procedures safer and faster. Patients are more inclined toward early rehabilitation programs that promote long-term joint health. This preference continues to strengthen market adoption across all regions.

Expanding Healthcare Infrastructure and Increasing Reimbursement Support

Governments and private institutions are investing heavily in healthcare infrastructure to improve surgical accessibility. The rising number of orthopedic clinics and specialized centers supports higher procedural volumes. The Global Foot Ankle Arthroscopy Market is benefiting from favorable reimbursement frameworks in developed regions. Improved insurance coverage for arthroscopic treatments is encouraging patients to undergo elective surgeries. Training programs for surgeons are expanding, enabling broader procedural expertise. Emerging economies are prioritizing advanced orthopedic care, supported by medical tourism and technological imports. The availability of modern equipment and skilled professionals improves patient outcomes. These developments collectively contribute to sustainable market growth and procedural adoption.

Market Trends:

Integration of Advanced Visualization and Imaging Technologies in Arthroscopy

Technological evolution in imaging is redefining how surgeons perform arthroscopic procedures. The use of 4K visualization, augmented reality, and 3D imaging allows for superior precision and diagnostic clarity. The Global Foot Ankle Arthroscopy Market is witnessing strong adoption of AI-based analytics to assist intraoperative decision-making. Surgeons benefit from better depth perception and accuracy during complex joint interventions. These tools enhance visualization of hard-to-access areas, reducing procedural errors. Manufacturers are designing compact imaging systems that can integrate with digital healthcare platforms. Portable visualization units are enabling surgery in ambulatory and smaller hospital settings. This ongoing trend strengthens clinical efficiency and procedural safety across the sector.

- For instance, Arthrex’s Synergy Vision system supports fluorescence imaging, enabling surgeons to toggle between multiple visualization modes during surgery. The Global Foot Ankle Arthroscopy Market is witnessing strong adoption of AI-based analytics to assist intraoperative decision-making. Surgeons benefit from better depth perception and accuracy during complex joint interventions.

Shift Toward Ambulatory Surgical Centers and Same-Day Discharge Procedures

The global healthcare industry is experiencing a growing transition toward outpatient arthroscopy procedures. Surgeons prefer ambulatory surgical centers due to lower costs and faster patient turnover. The Global Foot Ankle Arthroscopy Market benefits from rising acceptance of same-day discharge protocols supported by better anesthesia and recovery techniques. Patients experience improved comfort and reduced post-operative complications in these setups. Healthcare providers are optimizing workflows to manage higher case volumes efficiently. Ambulatory centers are investing in compact arthroscopy systems to accommodate patient convenience. The trend enhances procedural accessibility in both developed and emerging markets. This shift is improving treatment affordability and operational efficiency worldwide.

- For instance, manufacturers are supplying compact arthroscopy systems designed specifically for ambulatory surgical centers, enabling faster setup and turnaround. Ambulatory centers are investing in compact arthroscopy systems to accommodate patient convenience.

Increased Collaboration Between Device Manufacturers and Healthcare Providers

Strategic alliances between technology developers and hospitals are transforming surgical practices. The Global Foot Ankle Arthroscopy Market is seeing growing partnerships for innovation, training, and data sharing. Manufacturers work with medical institutions to design customized solutions based on real-world feedback. These collaborations accelerate product development and ensure compliance with safety standards. Joint research programs are focusing on improving visualization, instrumentation, and fluid management systems. Hospitals benefit from early access to next-generation technologies and enhanced staff training. Continuous feedback loops between developers and clinicians drive refinement in device performance. This collaborative model strengthens clinical outcomes and procedural reliability globally.

Emergence of Robotic-Assisted and AI-Guided Arthroscopy Solutions

Automation and artificial intelligence are reshaping orthopedic surgery by improving consistency and control. The Global Foot Ankle Arthroscopy Market is seeing rapid innovation in robotic-assisted surgical systems that reduce manual errors. AI algorithms enhance precision in navigation, alignment, and tissue recognition during procedures. Hospitals are increasingly adopting these systems to improve success rates and reduce surgeon fatigue. The integration of data analytics supports post-surgical monitoring and predictive recovery insights. Robotic systems also minimize intraoperative variability and improve reproducibility. Startups and established players are investing in R&D to enhance affordability and adaptability. These developments mark a transformative shift toward digital and precision-driven arthroscopy.

Market Challenges Analysis:

High Equipment Costs and Limited Access to Skilled Surgeons

The cost of arthroscopic systems and accessories remains a major obstacle to widespread adoption. The Global Foot Ankle Arthroscopy Market faces barriers in price-sensitive regions where hospitals struggle to justify equipment investments. Advanced imaging tools and robotics require high capital expenditure, limiting penetration in smaller facilities. The shortage of trained surgeons skilled in advanced arthroscopy techniques further compounds the issue. Many developing regions lack adequate infrastructure to support precision-based surgeries. Training and certification programs are expanding but still insufficient to meet growing demand. The complexity of device maintenance and software upgrades adds operational burden. These factors collectively restrain adoption across emerging healthcare markets.

Regulatory and Post-Operative Complications Affecting Market Adoption

Complex approval pathways for new medical devices slow down innovation and market entry. The Global Foot Ankle Arthroscopy Market is also challenged by variability in regulatory frameworks across regions. Surgeons and hospitals must adhere to stringent sterilization and procedural guidelines to avoid infections. Post-surgical complications such as joint stiffness or swelling sometimes reduce patient confidence in arthroscopy. Limited awareness in rural healthcare systems further delays early intervention. Hospitals face high costs in maintaining compliance and quality assurance for advanced systems. Data integration challenges also hinder efficient workflow management. These obstacles create a gap between technology availability and clinical adoption rates globally.

Market Opportunities:

Growing Scope for Emerging Markets and Expanding Medical Tourism

Developing countries are becoming lucrative growth centers for arthroscopic procedures. The Global Foot Ankle Arthroscopy Market benefits from improving healthcare infrastructure and affordability in Asia-Pacific and Latin America. Governments are supporting investment in orthopedic care and training. Medical tourism in India, Thailand, and Mexico attracts patients seeking quality treatment at lower costs. Rising disposable incomes and expanding private hospital networks fuel adoption of advanced equipment. Manufacturers are targeting these regions with cost-effective devices tailored for local demand. The rising prevalence of sports injuries and trauma cases strengthens regional opportunities. This growth potential makes emerging economies critical to future market expansion.

Innovation in Arthroscopic Devices and Customizable Surgical Solutions

Technological innovation continues to open new avenues for product development. The Global Foot Ankle Arthroscopy Market is advancing toward customizable instruments that improve patient-specific treatment outcomes. Smart tools integrated with real-time feedback sensors enhance surgeon control during procedures. Companies are focusing on developing eco-friendly disposable components to reduce infection risk. Integration of digital platforms allows surgeons to analyze data for continuous improvement. These innovations appeal to hospitals aiming to modernize surgical operations. Partnerships between medical-device start-ups and established players accelerate R&D efficiency. Such innovations will play a key role in expanding the global reach of arthroscopic solutions.

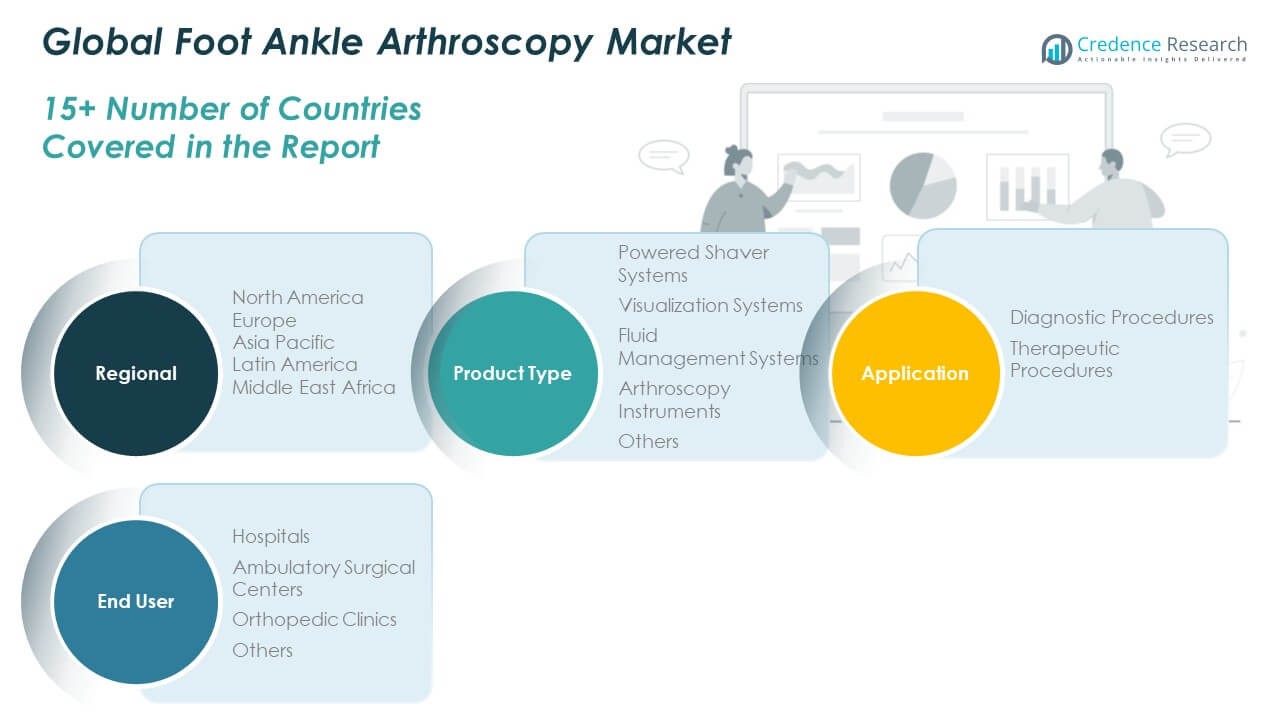

Market Segmentation Analysis:

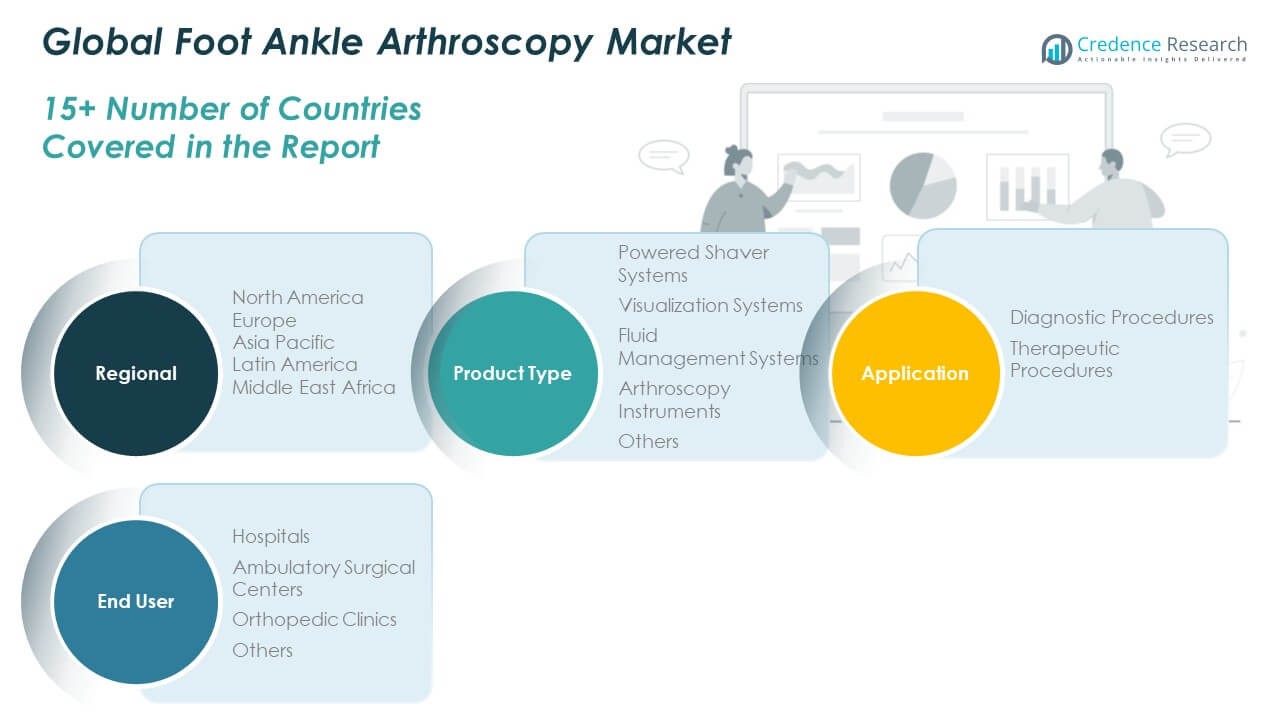

By Product Type

The Global Foot Ankle Arthroscopy Market is categorized into powered shaver systems, visualization systems, fluid management systems, arthroscopy instruments, and others. Powered shaver systems hold a major share due to their precision in removing soft and hard tissues during surgical procedures. Visualization systems continue to gain traction with technological upgrades in high-definition and 3D imaging that improve surgical accuracy. Fluid management systems play a vital role in maintaining clear operative fields, ensuring smooth procedures. Arthroscopy instruments, including forceps and scissors, support diverse diagnostic and therapeutic needs. The others segment includes accessories and ancillary tools that enhance procedural efficiency across hospitals and clinics.

- For instance, Arthrex’s NanoNeedle Scope provides minimally invasive visualization with diameters as small as 1.1 mm for tight joint access. Fluid management systems play a vital role in maintaining clear operative fields, ensuring smooth procedures. Arthroscopy instruments, including forceps and scissors, support diverse diagnostic and therapeutic needs.

By Application

The market is divided into diagnostic and therapeutic procedures. Diagnostic procedures are gaining prominence due to growing emphasis on early detection of joint disorders. Therapeutic procedures dominate in revenue share, driven by increasing incidences of ankle fractures, cartilage injuries, and ligament tears. Advancements in arthroscopic technology have reduced recovery times and post-operative complications. It supports both sports injury management and geriatric orthopedic care effectively.

- For instance, studies on 2-mm diameter arthroscopy of the ankle show safe and effective visualization and surgical reach in anterior ankle joint repairs. It supports both sports injury management and geriatric orthopedic care effectively.

By End User

Based on end user, the market includes hospitals, ambulatory surgical centers, orthopedic clinics, and others. Hospitals lead the segment due to well-equipped facilities and the availability of specialized surgeons. Ambulatory surgical centers are expanding rapidly with the rising preference for outpatient procedures. Orthopedic clinics contribute significantly through personalized treatment and rehabilitation programs. The others category covers specialty centers focusing on trauma and sports medicine. This segmentation structure highlights the diverse adoption landscape of arthroscopic solutions worldwide.

Segmentation:

By Product Type

- Powered Shaver Systems

- Visualization Systems

- Fluid Management Systems

- Arthroscopy Instruments

- Others

By Application

- Diagnostic Procedures

- Therapeutic Procedures

By End User

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Clinics

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Foot Ankle Arthroscopy Market size was valued at USD 1,127.30 million in 2018, reached USD 1,835.14 million in 2024, and is anticipated to attain USD 3,662.23 million by 2032, growing at a CAGR of 8.4% during the forecast period. North America accounts for nearly 43.9% of the total Global Foot Ankle Arthroscopy Market share. It leads due to advanced healthcare infrastructure, strong adoption of minimally invasive technologies, and high patient awareness. The presence of major companies such as Arthrex, Stryker, and Zimmer Biomet supports product innovation and procedural growth. Increasing sports-related injuries and the aging population continue to drive demand across the United States and Canada. Reimbursement policies and specialized orthopedic centers enhance patient accessibility to advanced arthroscopic procedures. Growing preference for outpatient surgeries strengthens the role of ambulatory centers. The region’s well-established training programs ensure skilled professionals to perform complex procedures efficiently.

Europe

The Europe Foot Ankle Arthroscopy Market size was valued at USD 474.89 million in 2018, reached USD 738.22 million in 2024, and is anticipated to attain USD 1,335.70 million by 2032, growing at a CAGR of 7.1% during the forecast period. Europe contributes around 16.0% of the global market share. It benefits from established orthopedic practices and growing investments in healthcare modernization. The UK, Germany, and France dominate the region, supported by technological innovation and skilled surgeons. Demand is driven by an aging population and the increasing prevalence of osteoarthritis. Hospitals across Western Europe are adopting digital visualization systems and robotic-assisted surgery platforms. The region also shows rising adoption of outpatient treatment models to reduce healthcare costs. Eastern Europe is emerging with improved access to surgical equipment and medical training. Continued focus on patient-centric care and early diagnosis is supporting market growth.

Asia Pacific

The Asia Pacific Foot Ankle Arthroscopy Market size was valued at USD 734.84 million in 2018, reached USD 1,276.27 million in 2024, and is anticipated to attain USD 2,770.55 million by 2032, growing at a CAGR of 9.5% during the forecast period. Asia Pacific holds approximately 33.2% of the global market share, reflecting its rapid expansion. Rising healthcare expenditure, large patient base, and strong government initiatives promote orthopedic advancement. China, Japan, and India are the major contributors, driven by increasing sports participation and trauma cases. Hospitals are adopting minimally invasive procedures supported by local manufacturing of affordable arthroscopic instruments. The growth of medical tourism in Thailand and India supports market accessibility. Private healthcare investments are expanding advanced surgical facilities across the region. It benefits from favorable demographic trends and the growing presence of international medical device manufacturers. Continuous improvements in clinical training are strengthening regional adoption rates.

Latin America

The Latin America Foot Ankle Arthroscopy Market size was valued at USD 117.83 million in 2018, reached USD 191.34 million in 2024, and is anticipated to attain USD 336.08 million by 2032, growing at a CAGR of 6.7% during the forecast period. Latin America accounts for nearly 4.0% of the global market share. Growth is supported by expanding healthcare infrastructure and rising awareness of minimally invasive surgical options. Brazil and Mexico dominate the market with increasing adoption of arthroscopic techniques. Public-private collaborations are improving access to advanced orthopedic equipment. Training programs are expanding, supporting the availability of skilled professionals. Local distributors are partnering with global device manufacturers to improve product reach. Government reforms promoting healthcare investments create favorable market conditions. Rising sports activity and injury rates across the region continue to drive market expansion.

Middle East

The Middle East Foot Ankle Arthroscopy Market size was valued at USD 61.48 million in 2018, reached USD 91.03 million in 2024, and is anticipated to attain USD 147.79 million by 2032, growing at a CAGR of 5.6% during the forecast period. The region holds around 1.8% of the global market share. Growth is driven by increasing healthcare modernization and rising demand for advanced orthopedic treatments. GCC countries lead the market, supported by higher healthcare spending and adoption of western medical practices. Hospitals in the UAE and Saudi Arabia are upgrading their orthopedic departments with state-of-the-art arthroscopy equipment. Medical tourism in Dubai and Qatar adds momentum to procedural volumes. The presence of skilled surgeons and expanding private healthcare investments strengthen regional adoption. It benefits from strategic partnerships between global manufacturers and regional healthcare providers. Gradual improvement in public healthcare infrastructure continues to enhance procedural accessibility.

Africa

The Africa Foot Ankle Arthroscopy Market size was valued at USD 32.13 million in 2018, reached USD 59.63 million in 2024, and is anticipated to attain USD 89.65 million by 2032, growing at a CAGR of 4.6% during the forecast period. Africa contributes about 1.1% of the global market share. Growth is primarily driven by improving healthcare access and rising medical awareness in urban centers. South Africa leads the market with increasing investments in orthopedic care and trauma management. Limited infrastructure and high equipment costs restrict widespread adoption across other regions. However, training initiatives and public health programs are helping bridge the skill gap. Import of advanced arthroscopic systems is gradually increasing across Egypt and Nigeria. It is witnessing growing support from international health organizations for capacity building. The expansion of private hospitals and clinics offers a positive outlook for long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arthrex, Inc.

- Stryker Corporation

- Smith+Nephew

- DePuy Synthes (Johnson & Johnson)

- Karl Storz GmbH & Co. KG

- Zimmer Biomet

- CONMED Corporation

- Olympus Corporation

- Medtronic plc

- Richard Wolf GmbH

Competitive Analysis:

The Global Foot Ankle Arthroscopy Market is characterized by intense competition among established medical device manufacturers and emerging technology innovators. Key players such as Arthrex, Stryker Corporation, Smith+Nephew, DePuy Synthes, and Zimmer Biomet dominate through strong product portfolios and global distribution networks. It demonstrates high product differentiation supported by continuous R&D investment and clinical collaborations. Companies focus on improving visualization, precision, and recovery outcomes through technological advancements. Strategic mergers and partnerships enhance their market reach, while smaller firms emphasize cost-effective and portable solutions. Continuous innovation in minimally invasive systems remains a core competitive strategy for sustaining market leadership.

Recent Developments:

- In October 2025, Zimmer Biomet and Paragon 28 jointly launched the Gorilla® Pilon Fusion Plating System and Phantom® TTC Trauma Nail, both designed to address complex trauma in foot and ankle surgery. These innovations support advanced fusion and fixation for challenging cases with enhanced precision.

- In July 2025, Smith+Nephew launched the Q-FIX KNOTLESS All-Suture Anchor, an advanced device for soft tissue-to-bone fixation, covering shoulder, hip, and especially foot and ankle procedures. The anchor offers superior fixation strength and minimally invasive deployment, supporting better healing and lower failure rates in joint repair.

- In March–April 2025, Zimmer Biomet completed its acquisition of Paragon 28, a dedicated foot and ankle solutions provider. This step expands Zimmer Biomet’s offering and supports the growing shift toward ambulatory surgery centers for orthopedic procedures.

- In February 2025, the company introduced adjustable tensioning technology for insertional Achilles reconstruction and lateral ankle instability repair in Australia and New Zealand, enabling surgeons to personalize range-of-motion and optimize outcomes for foot and ankle repairs.

- In January 2025, Karl Storz also acquired the medical business of T1V, a US-based visual collaboration software company, to complement integrated hardware and software solutions in the digital surgery ecosystem.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for minimally invasive surgeries will drive continuous innovation in arthroscopic devices.

- Growing sports injury cases among younger populations will expand procedural adoption.

- Hospitals will increasingly integrate AI-assisted and robotic-guided arthroscopy systems.

- Emerging economies will witness higher investments in orthopedic care infrastructure.

- Surgeons will benefit from enhanced visualization and real-time data integration technologies.

- The market will experience a shift toward outpatient and ambulatory surgical center procedures.

- Training and skill development initiatives will improve global access to advanced arthroscopy.

- Sustainability and eco-friendly medical disposables will influence future product designs.

- Strategic collaborations between hospitals and manufacturers will drive product refinement.

- Advancements in fluid management and imaging precision will strengthen procedural outcomes.