Market Overview

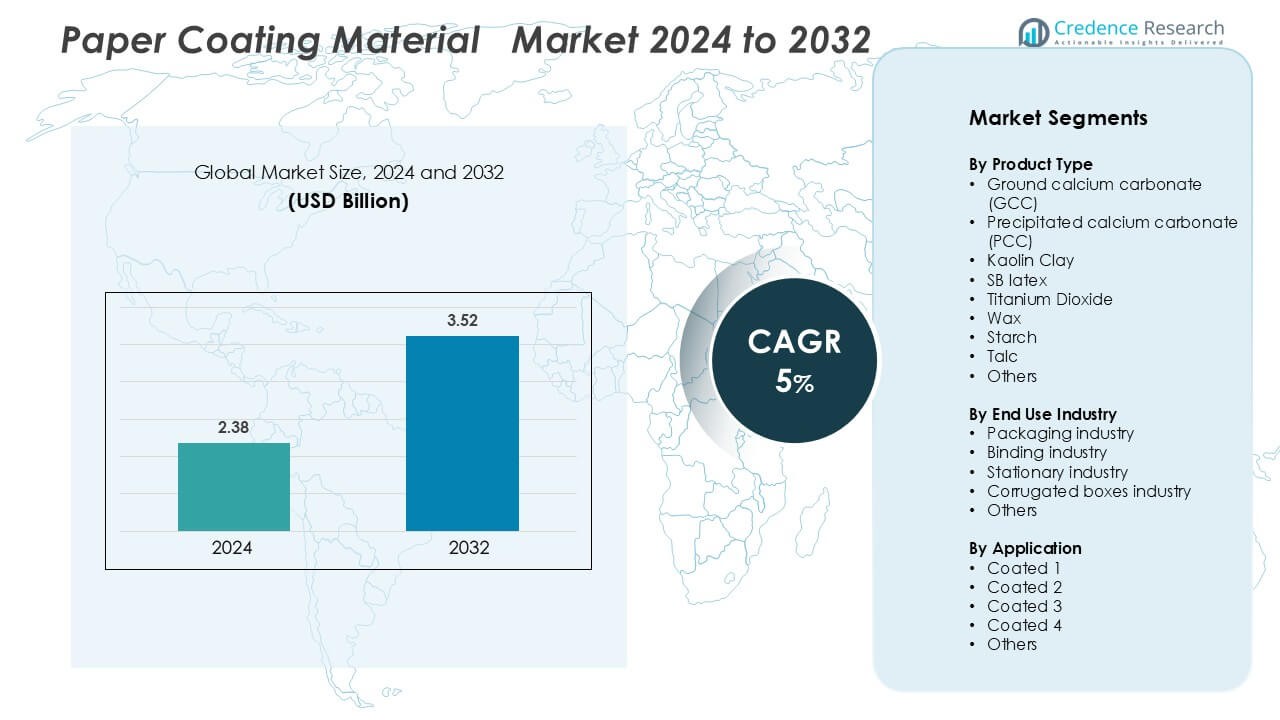

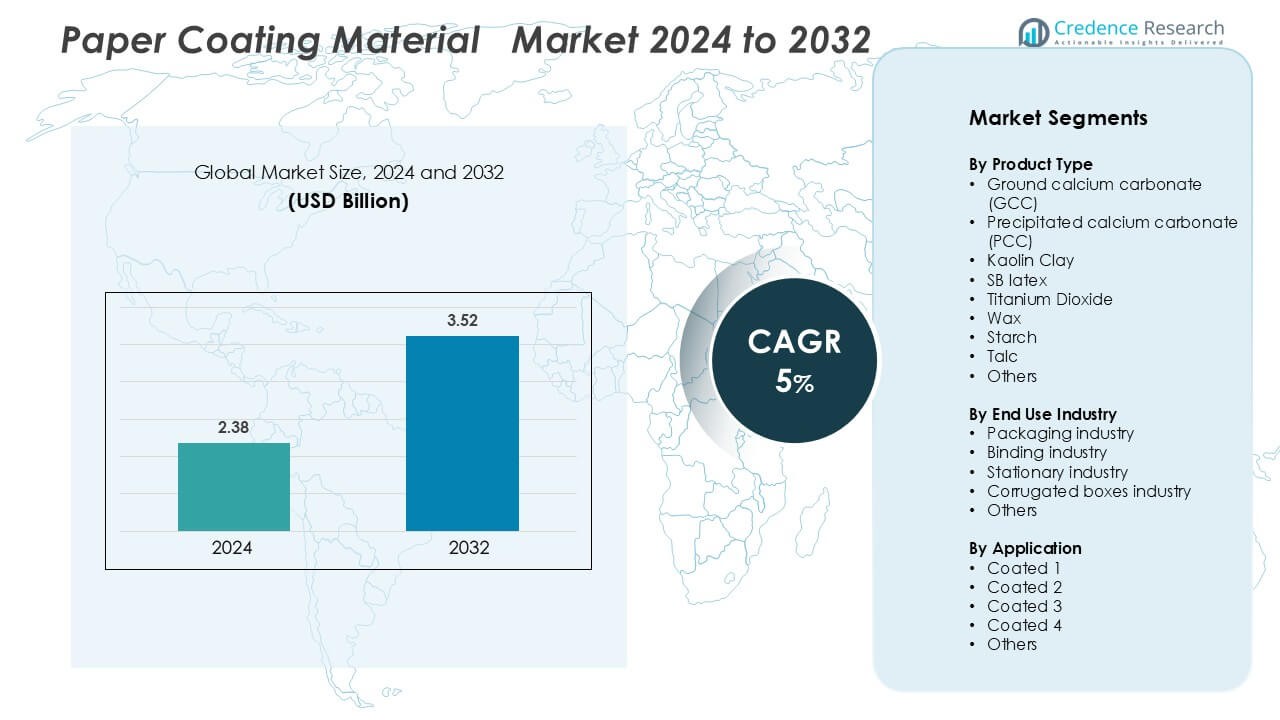

Paper Coating Material Market was valued at USD 2.38 billion in 2024 and is anticipated to reach USD 3.52 billion by 2032, growing at a CAGR of 5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Coating Material Market Size 2024 |

USD 2.38 Billion |

| Paper Coating Material Market, CAGR |

5 % |

| Paper Coating Material Market Size 2032 |

USD 3.52 Billion |

The Asia-Pacific region leads the global paper coating material market, holding a 42% share in 2024. This dominance is attributed to rapid industrialization, a robust packaging sector, and a growing demand for high-quality printed materials. Key players in this region include Asia Pulp & Paper (APP) Sinar Mas, BASF SE, Nippon Paper Industries Co. Ltd, Stora Enso Oyj, Dow, Imerys, Eastman Chemical Company, Minerals Technologies Inc., Ingredion, and Roquette. These companies are investing in sustainable and innovative coating solutions to meet the increasing demand for eco-friendly and high-performance paper products. The region’s strong manufacturing base and expanding consumer markets further bolster its leadership in the paper coating material industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Paper Coating Material Market was valued at USD 2.38 billion in 2024 and is projected to reach USD 3.52 billion by 2032, growing at a CAGR of 5%.

- Growth is driven by increasing demand from the packaging industry, with Asia-Pacific holding 33.8% market share and GCC and kaolin clay coatings dominating the product segment.

- Market trends include a shift toward eco-friendly water-based and bio-based coatings, adoption of digital printing-compatible formulations, and rising use in e-commerce packaging.

- Competitive analysis highlights Imerys, BASF SE, Nippon Paper Industries, Stora Enso, Dow, Eastman Chemical, Minerals Technologies, Roquette, APP Sinar Mas, and Ingredion as key players, focusing on R&D, sustainable solutions, and regional expansions.

- Restraints include raw material price volatility and stringent environmental regulations, while North America (28.6%) and Europe (25.3%) continue to offer stable growth opportunities.

Market Segmentation Analysis:

By Product Type

Ground calcium carbonate (GCC) dominates the paper coating material market with the largest share due to its cost-effectiveness and excellent brightness. Its fine particle size improves smoothness and print quality, making it ideal for coated paper applications. Precipitated calcium carbonate (PCC) follows closely, offering superior opacity and gloss. The growing demand for high-quality printing paper supports this segment’s growth. Advancements in coating formulations further enhance the use of GCC in premium-grade papers, driving widespread adoption in printing and packaging industries.

- For instance, BASF’s STYRONAL APEX binder platform enables improved binding power and better water retention, optimizing formulations for coated paper and paperboard.

By End Use Industry

The packaging industry holds the dominant market share, driven by increasing use of coated papers in food, beverage, and consumer goods packaging. The segment benefits from the growing shift toward sustainable, recyclable materials. Enhanced barrier properties and printability make coated paper ideal for branding and product protection. The corrugated boxes industry also shows strong growth due to rising e-commerce and retail demand. Manufacturers continue developing biodegradable coating solutions to meet packaging sustainability standards, further strengthening market penetration in this sector.

- For instance, Amcor’s AmFiber™ Performance Paper, introduced in 2023, is a high-barrier laminated paper that is recyclable in most paper recycling streams, earning the How2Recycle® prequalification of “widely recyclable.”

By Application

Coated 1 paper leads the market, accounting for the highest share among all application categories. It is widely used for magazines, brochures, and advertising materials due to its superior gloss, brightness, and print clarity. Coated 2 and Coated 3 grades cater to medium-quality printing needs, offering balanced cost and performance. Increasing demand from publishing and premium packaging drives coated paper production. The segment benefits from ongoing innovations in coating compositions that improve surface finish and ink absorption, enhancing visual appeal and durability.

Key Growth Drivers

Rising Demand for High-Quality Printing and Packaging Materials

The increasing need for high-quality printing and packaging materials is a major growth driver in the paper coating material market. Coated papers enhance surface smoothness, brightness, and ink absorption, improving print definition and visual appeal. Growth in e-commerce, food packaging, and labeling further strengthens demand for coated products that ensure durability and attractive presentation. Manufacturers are adopting advanced coating technologies to improve performance consistency and sustainability. For instance, Omya’s fine-particle calcium carbonate coatings enhance print gloss and opacity while reducing binder consumption. The expansion of the printing and flexible packaging sectors, especially in emerging markets, accelerates the adoption of coating materials like GCC, PCC, and kaolin clay.

- For instance, Omya’s ultrafine products, such as Omyacarb UF-FL, show a median particle size (d50%) of 0.70 microns.

Increasing Focus on Sustainable and Recyclable Coating Solutions

Sustainability is driving innovation in the paper coating material market as industries reduce their reliance on synthetic or non-biodegradable materials. Manufacturers are prioritizing coatings derived from renewable and bio-based sources such as starch, wax, and natural polymers. These materials enhance recyclability and minimize environmental impact while maintaining performance. For example, BASF introduced Acronal ECO, a bio-based binder that replaces fossil-derived components in paper coatings, reducing carbon emissions. Governments and global organizations are enforcing eco-friendly manufacturing regulations, pushing companies to adopt greener alternatives. The packaging industry, in particular, demands recyclable and compostable coated paper to meet consumer and brand sustainability commitments. This shift encourages R&D in biodegradable coatings and water-based dispersions. As circular economy principles gain momentum, sustainable coating materials become central to market differentiation and compliance, supporting long-term industry growth.

- For instance, BASF’s own website explicitly confirms that a specific product, Acronal® ECO 7074, is a bio-based dispersion that “contains up to 30% bio-based content, reducing the reliance on fossil fuel raw materials”.

Expansion of E-Commerce and Food Packaging Applications

The surge in e-commerce and food packaging industries is propelling the paper coating material market. Coated papers provide enhanced printability, grease resistance, and aesthetic appeal, essential for product branding and protection. Online retail packaging requires coated surfaces that maintain strength and visual integrity under shipping stress. In the food sector, coatings like wax and starch improve barrier performance against moisture and oil, ensuring hygiene and shelf-life extension. For instance, Dow’s recyclable barrier coatings support food packaging that complies with global sustainability norms. The global rise in takeaway food consumption and sustainable packaging practices further boost coated paper demand. Companies are investing in multifunctional coatings that combine print quality, durability, and recyclability. As consumer goods manufacturers focus on eco-friendly branding and lightweight packaging, the integration of advanced coating technologies continues to expand the application base across retail, logistics, and food industries.

Key Trends & Opportunities

Technological Advancements in Coating Formulations

Innovation in coating technologies is reshaping the paper coating material market. Manufacturers are adopting nanotechnology, micro-coating, and hybrid formulations to enhance gloss, opacity, and print resolution. Advanced coatings provide improved adhesion, abrasion resistance, and reduced drying time, optimizing production efficiency. For instance, Imerys developed engineered kaolin-based coatings that improve ink retention while lowering formulation costs. The use of digital printing-compatible coatings also opens opportunities in high-quality, short-run printing applications. Automation and process control integration further ensure coating uniformity and sustainability. The rise of multifunctional coatings that combine aesthetic and protective features creates new value in high-end packaging and publishing. As the demand for superior print quality and functional performance grows, technological innovation remains a key competitive differentiator for manufacturers.

Growing Shift Toward Water-Based and Bio-Based Coatings

Environmental regulations and consumer preferences are pushing industries toward water-based and bio-based paper coatings. These coatings emit lower volatile organic compounds (VOCs) and offer improved biodegradability compared to solvent-based alternatives. For instance, Trinseo’s Latex ECO series uses renewable feedstocks, helping manufacturers meet emission and recycling standards. Bio-based coatings derived from starch, lignin, and cellulose provide similar performance while reducing environmental impact. This trend aligns with corporate sustainability goals and growing demand for green packaging solutions. The paper industry’s transition toward circularity further promotes investment in biodegradable and compostable coating technologies. As eco-conscious brands demand recyclable packaging, companies adopting water-based and renewable coating systems gain a significant competitive advantage, creating new growth opportunities in both developed and emerging markets.

- For instance, Trinseo offers specific bio-based latex binders, such as grades within its CO2NET™ or LIGOS™ portfolios, that incorporate a significant percentage of certified renewable or bio-based feedstocks (e.g., via a mass balance approach) to achieve a reduced carbon footprint, while successfully maintaining essential performance properties like film formation and adhesion in coated paper applications.

Rising Demand from Developing Economies

Rapid industrialization and growth in consumer spending across developing economies are fueling coated paper demand. Expanding manufacturing sectors, increasing literacy rates, and the rise of organized retail drive higher use of printed and packaged materials. Asia-Pacific, led by China and India, has become a major hub for coated paper production due to cost advantages and strong demand from printing and packaging industries. For instance, Nippon Paper Industries expanded its production facilities in Southeast Asia to meet growing export and domestic requirements. The shift toward premium-grade coated papers in advertising and product labeling enhances regional market growth. As developing countries invest in digital printing and sustainable packaging infrastructure, the demand for high-performance coating materials continues to accelerate, offering lucrative opportunities for global and local players.

- For instance, in May 2006, Nippon Paper announced plans to build new coated paper facilities at its Ishinomaki Mill, which were expected to increase production capacity by 350,000 metric tons annually.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as kaolin, titanium dioxide, and latex significantly affect profit margins in the paper coating material market. Price instability results from supply chain disruptions, energy cost variations, and geopolitical uncertainties. For instance, the energy crisis in Europe increased production costs for calcium carbonate and kaolin suppliers, impacting coating manufacturers globally. Many producers struggle to maintain price competitiveness while ensuring product quality. Dependence on petroleum-based binders also exposes the industry to crude oil price fluctuations. Companies are responding by diversifying sourcing strategies and exploring renewable substitutes like starch and bio-latex. However, the transition to sustainable raw materials involves high R&D investments and limited scalability, posing ongoing financial challenges for smaller manufacturers.

Environmental and Regulatory Compliance Constraints

Stringent environmental regulations regarding chemical emissions, waste disposal, and VOC content challenge paper coating manufacturers. The shift from solvent-based to eco-friendly coatings requires costly reformulation and equipment upgrades. Regulatory frameworks such as the EU REACH directive and U.S. EPA standards limit the use of hazardous additives like formaldehyde and certain binders. For example, compliance with evolving packaging waste and recycling directives demands significant process adaptation. Manufacturers must balance performance, cost, and sustainability while adhering to these norms. Non-compliance risks product bans and market access limitations. Continuous monitoring, certification, and testing increase operational expenses. Companies investing in cleaner production technologies and closed-loop systems can mitigate risks, but the regulatory burden remains a barrier, especially for small and medium enterprises seeking international market expansion.

Regional Analysis:

North America

North America holds a 28.6% share of the paper coating material market, driven by strong demand from the packaging and printing industries. The United States leads due to its advanced manufacturing base and growing adoption of sustainable, recyclable paper coatings. The region’s focus on eco-friendly packaging in food and consumer goods supports the use of bio-based and waterborne coating materials. Major players such as BASF SE and Omya International AG are investing in R&D to enhance coating performance and reduce environmental impact. Increasing e-commerce packaging demand further strengthens the regional market outlook.

Europe

Europe accounts for a 25.3% share of the global paper coating material market, supported by stringent environmental regulations and high sustainability standards. Countries like Germany, the U.K., and France lead innovation in bio-based and water-based coatings. The growing use of coated paper in premium packaging and publishing sectors drives regional growth. European manufacturers focus on low-VOC, recyclable coatings to comply with EU sustainability goals. Technological advancements in coating formulations enhance print quality and recyclability. The rise in demand for compostable paper packaging across industries reinforces Europe’s leadership in sustainable coating solutions.

Asia-Pacific

Asia-Pacific dominates the paper coating material market with a 33.8% share, led by China, India, and Japan. Rapid industrialization, expanding printing capacity, and growing packaging production drive the regional demand. The surge in e-commerce, retail, and food packaging fuels coated paper consumption. Manufacturers such as Nippon Paper Industries and Asia Pulp & Paper are expanding capacities to meet rising domestic and export requirements. Affordable raw materials and low production costs further enhance competitiveness. Increasing investment in advanced coating technologies and sustainable alternatives positions Asia-Pacific as the fastest-growing region in the global market.

Latin America

Latin America captures a 6.9% share of the paper coating material market, supported by growth in packaging, labeling, and publishing sectors. Brazil and Mexico lead regional demand, driven by expanding consumer goods and food packaging industries. Manufacturers are adopting cost-effective coating formulations to improve print quality and packaging durability. The shift toward sustainable, recyclable paper products is gaining traction as local producers align with global environmental trends. Rising industrial output and urbanization support continued consumption of coated paper across diverse applications, creating steady growth opportunities for regional suppliers.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 5.4% share of the paper coating material market, primarily fueled by increasing packaging demand from the FMCG and construction sectors. The UAE and South Africa are key markets, emphasizing premium-quality coated papers for branding and marketing materials. Growth in retail and logistics drives the need for coated corrugated packaging. However, limited local production capacity encourages imports from Asia and Europe. Rising awareness of sustainable paper products and investments in recycling infrastructure are gradually strengthening regional market participation and long-term development prospects.

Market Segmentations:

By Product Type

- Ground calcium carbonate (GCC)

- Precipitated calcium carbonate (PCC)

- Kaolin Clay

- SB latex

- Titanium Dioxide

- Wax

- Starch

- Talc

- Others

By End Use Industry

- Packaging industry

- Binding industry

- Stationary industry

- Corrugated boxes industry

- Others

By Application

- Coated 1

- Coated 2

- Coated 3

- Coated 4

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The paper coating material market is moderately consolidated, with major players emphasizing innovation, sustainability, and product performance enhancement. Imerys and Minerals Technologies Inc. dominate the mineral-based coating segment through advanced calcium carbonate and kaolin formulations that improve print quality and opacity. BASF SE and Dow lead in polymer dispersion technologies, focusing on high-gloss, water-resistant coatings that meet eco-label standards. Nippon Paper Industries Co. Ltd. and Stora Enso Oyj integrate coating production with in-house paper manufacturing to ensure consistent quality and reduced carbon footprint. Eastman Chemical Company and Roquette specialize in bio-based additives, offering renewable binders and plasticizers for sustainable coating applications. Ingredion and Asia Pulp & Paper (APP) Sinar Mas invest in starch-based coating innovations that enhance recyclability and print performance. Strategic partnerships, R&D investments, and adoption of green chemistry practices are central to strengthening competitiveness and meeting growing demand for environmentally responsible coated paper solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Imerys

- BASF SE

- Nippon Paper Industries Co. Ltd

- Eastman Chemical Company

- Stora Enso Oyj

- Minerals Technologies Inc.

- Roquette

- Asia Pulp & Paper (APP) Sinar Mas

- Dow

- Ingredion

Recent Developments

- In July 2022, BASF completed the installation and start-up of a state-of-the-art acrylic dispersions production line in Dahej, India, serving the coatings, construction, adhesives, and paper industries for South Asian markets.

- In June 2022, Confoil and BASF collaborated to develop a certified compostable and dual ovenable food tray based on paper. This paper tray is coated on the inside with BASF’s ecovio PS 1606, which is a partly bio-based and certified compostable biopolymer developed especially for coating food packaging made of paper or board.

- In April 2022, BillerudKorsnas completed the acquisition of Verso, a leading manufacturer of coated paper in North America with US$825 million. The main motive of this acquisition was to expand and strengthen the company’s presence in the North American market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use Industry, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for biodegradable coatings will drive strong growth across packaging applications.

- Advancements in barrier coating technologies will improve recyclability and reduce plastic use.

- Expansion in e-commerce packaging will boost consumption of coated paper grades worldwide.

- Growth in food service packaging will increase demand for water-based and bio-based coatings.

- Asia Pacific will remain the fastest-growing region, supported by large-scale manufacturing expansion.

- Companies will invest in nanoclay and bio-latex coatings to enhance moisture and grease resistance.

- Regulatory pressure will accelerate the replacement of polyethylene coatings with compostable solutions.

- Automation and digital quality monitoring will improve coating precision and reduce material waste.

- Key producers will focus on circular economy models and closed-loop fiber recovery systems.

- Strategic collaborations between paper mills and chemical firms will strengthen sustainable coating innovation.