Market Overview:

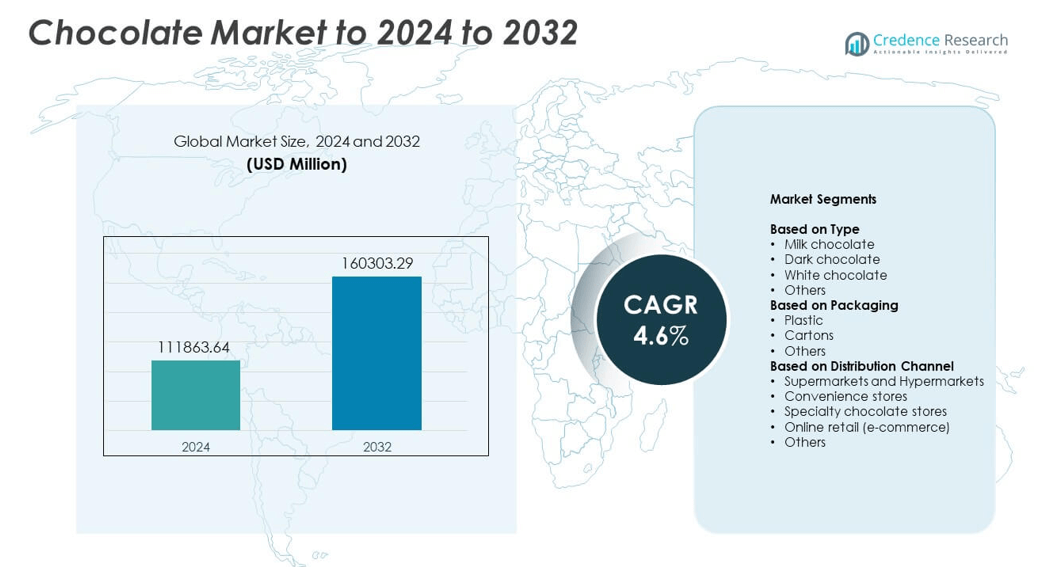

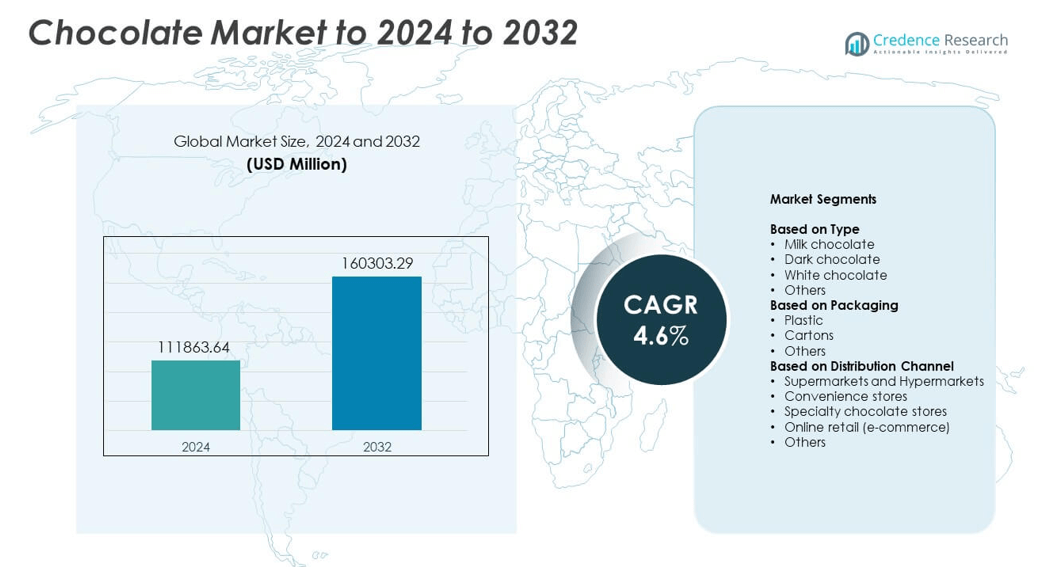

The Chocolate Market size was valued at USD 111863.64 million in 2024 and is anticipated to reach USD 160303.29 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chocolate Market Size 2024 |

USD 111863.64 million |

| Chocolate Market, CAGR |

4.6% |

| Chocolate Market Size 2032 |

USD 160303.29 million |

The chocolate market is driven by strong competition among leading players such as Ferrero Group, Meiji Holdings Co., Ltd., Barry Callebaut AG, The Hershey Company, Mondelēz International, Chocoladefabriken Lindt & Sprüngli AG, Nestlé SA, Mars, Incorporated, Arcor SAIC, and The Australian Carob Co. These companies maintain dominance through product innovation, brand loyalty, and strategic distribution expansion. North America leads the global market with a 36.8% share, followed by Europe at 31.5%, supported by mature consumption and established brands. Asia Pacific holds 21.6%, reflecting rapid growth from urbanization and rising disposable income. Latin America and the Middle East & Africa collectively represent emerging regions with increasing retail penetration and growing consumer interest in premium chocolate offerings.

Market Insights

- The chocolate market was valued at USD 111863.64 million in 2024 and is projected to reach USD 160303.29 million by 2032, expanding at a CAGR of 4.6% during the forecast period.

- Increasing consumer preference for premium, organic, and dark chocolates drives consistent demand growth worldwide. Rising awareness of health benefits and clean-label ingredients further fuels product innovation and adoption.

- Trends such as sustainable cocoa sourcing, eco-friendly packaging, and the introduction of plant-based chocolates are reshaping industry practices. Expanding e-commerce and digital retail are enhancing accessibility and consumer engagement.

- The market remains highly competitive, with leading brands investing in product differentiation, ethical sourcing, and automation to maintain dominance. Local artisanal producers are also gaining traction with customized and regionally inspired offerings.

- North America leads the market with a 36.8% share, followed by Europe at 31.5%. Asia Pacific holds 21.6%, reflecting rapid consumption growth, while Latin America and the Middle East & Africa are emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Milk chocolate dominated the chocolate market in 2024, accounting for 48.6% of the total share. Its smooth texture, sweet flavor, and high consumer preference across age groups drive its strong position. Milk chocolate’s versatility in confectionery, bakery, and beverage applications further boosts demand. Rising demand for creamy variants with natural ingredients and reduced sugar also supports growth. Premiumization trends and product innovation, such as filled bars and protein-rich chocolates, strengthen this segment’s dominance globally.

- For instance, Nestlé reported that 4.2 billion fingers of KitKat were sold to consumers in India alone during the 2023-24 financial year, making India the brand’s second-largest market.

By Packaging

Plastic packaging held the largest market share of 54.2% in 2024 due to its durability, cost efficiency, and convenience for mass production. It offers superior protection against moisture and temperature changes, ensuring longer shelf life. The growing adoption of flexible pouches and resealable wraps for single-serve chocolates enhances consumer appeal. Increasing innovations in recyclable and biodegradable plastics also align with sustainability goals, prompting manufacturers to shift toward eco-friendly solutions while maintaining cost efficiency and shelf impact.

- For instance, Ferrero switched Rocher boxes from polystyrene (PS) to polypropylene (PP), with a rollout starting in September 2021. This conversion in North America and China markets resulted in an estimated cumulative saving of approximately 11,000 tonnes of plastic, which was reported in the company’s 2024 Sustainability Report published in July 2025.

By Distribution Channel

Supermarkets and hypermarkets dominated the chocolate distribution channel, capturing 43.5% of the market share in 2024. Their wide product assortment, attractive discounts, and instant availability attract a large consumer base. Organized retail expansion, especially in urban areas, further drives segment growth. In-store visibility and promotional activities by brands like Mondelez and Nestlé enhance customer engagement. Additionally, improved retail infrastructure and product placement strategies strengthen sales of premium and seasonal chocolate variants through this channel.

Key Growth Drivers

Rising Consumer Demand for Premium and Artisanal Chocolate

The growing preference for high-quality, premium, and artisanal chocolates is driving market expansion. Consumers are increasingly choosing chocolates with rich cocoa content, organic ingredients, and unique flavor combinations. The demand for bean-to-bar and single-origin varieties is rising, especially in developed regions. Growing gifting culture and increased awareness of product authenticity further strengthen the premium segment’s growth potential.

- For instance, Lindt & Sprüngli grow its Global Retail network to approximately 590 own stores and 21 e-shops as of mid-2025 (specifically, the H1 2025 results reported in July 2025).

Health and Wellness Trends Boosting Dark Chocolate Consumption

Health-conscious consumers are fueling demand for dark chocolate due to its antioxidant properties and lower sugar content. The perception of dark chocolate as a functional indulgence supports steady consumption. Growing research on cardiovascular and cognitive benefits of cocoa compounds enhances its appeal. Manufacturers are also introducing sugar-free and low-calorie variants to align with evolving dietary preferences.

- For instance, Ghirardelli’s Intense Dark range offers 86% cacao bars and squares, aligning with high-cacao, lower-sugar choices favored by health-focused buyers.

Expanding Global Retail and E-commerce Presence

Widespread retail availability and rapid expansion of e-commerce platforms have boosted chocolate accessibility. Online retail offers convenience, variety, and doorstep delivery, driving higher purchase frequency. Global brands are leveraging omnichannel strategies to reach consumers directly through digital promotions and subscription models. The rise of online gifting and festive sales further contributes to market growth across regions.

Key Trends & Opportunities

Innovation in Sustainable and Ethical Sourcing

Sustainability has become a major focus, with companies investing in ethically sourced cocoa and fair-trade practices. Initiatives to reduce deforestation and improve farmer livelihoods are shaping procurement strategies. Brands promoting traceable supply chains and recyclable packaging are gaining consumer trust, supporting long-term brand loyalty and differentiation.

- For instance, Barry Callebaut mapped 669,174 cocoa farm plots in 2023/24, enabling farm-level traceability that strengthens ethical and deforestation-free sourcing.

Growing Demand for Functional and Plant-Based Chocolates

Consumers are increasingly drawn to chocolates with added health benefits such as probiotics, vitamins, or plant-based proteins. The rise of veganism and lactose intolerance awareness has encouraged companies to launch dairy-free alternatives. These innovations cater to niche segments while supporting clean-label and cruelty-free positioning in competitive markets.

- For instance, Nestlé launched its “Les Recettes de L’Atelier Incoa” bar with 70 % cocoa content under its premium segment.

Key Challenges

Volatility in Cocoa Prices and Supply Constraints

Fluctuating cocoa prices due to weather conditions, labor shortages, and political instability in key producing regions pose challenges for manufacturers. These factors impact profit margins and production costs. Supply chain disruptions and uneven cocoa quality further strain operations, forcing brands to explore cost-efficient sourcing strategies.

Health Concerns Related to Sugar and Calorie Content

Rising concerns over obesity and diabetes are affecting conventional chocolate consumption. Consumers are becoming cautious of high-sugar products, leading to a shift toward healthier substitutes. Manufacturers face the challenge of balancing taste with nutritional value while reformulating products to meet regulatory and consumer expectations.

Regional Analysis

North America

North America held the largest share of 36.8% in the chocolate market in 2024, driven by high consumption in the United States and Canada. The region benefits from strong demand for premium and functional chocolates made with organic or ethically sourced ingredients. Seasonal gifting occasions such as Valentine’s Day and Christmas significantly boost sales. Major manufacturers continue to introduce low-sugar and protein-enriched variants to meet evolving preferences. The expansion of retail networks and e-commerce channels also enhances product accessibility and brand penetration across urban and suburban markets.

Europe

Europe accounted for 31.5% of the global chocolate market in 2024, supported by its long-standing confectionery culture and innovation in artisanal chocolate. Countries such as Germany, Switzerland, and the United Kingdom are key contributors, driven by high per capita consumption. Premium and sustainable chocolate products are gaining strong traction, with several brands investing in fair-trade sourcing. Increasing tourism and gifting culture also support regional demand. Manufacturers are emphasizing packaging innovation and seasonal assortments to maintain market leadership across traditional and emerging European economies.

Asia Pacific

Asia Pacific captured 21.6% of the chocolate market in 2024, fueled by rising disposable income and westernization of dietary habits. Markets such as China, India, and Japan are witnessing strong growth due to expanding urban retail networks. The demand for milk and dark chocolates is increasing, especially among younger consumers. Product localization, smaller packaging formats, and online availability are strengthening brand reach. Growing preference for premium and novelty flavors also attracts international manufacturers to invest in regional production and distribution facilities.

Latin America

Latin America represented 6.9% of the global chocolate market in 2024, supported by abundant cocoa production and increasing domestic consumption. Countries such as Brazil and Mexico are key markets due to expanding retail presence and confectionery exports. The region is witnessing growing demand for affordable, locally produced chocolates alongside rising interest in artisanal variants. Strengthening trade networks and modernization of processing facilities enhance competitiveness. Economic recovery and promotional activities by global brands are further stimulating consumer interest and driving steady growth across this segment.

Middle East & Africa

The Middle East and Africa accounted for 3.2% of the chocolate market in 2024, reflecting steady demand growth driven by urbanization and rising incomes. The United Arab Emirates, Saudi Arabia, and South Africa are major contributors due to high demand for imported and premium chocolates. Seasonal festivals and gifting traditions significantly influence purchasing patterns. Expanding retail chains and increasing product availability in supermarkets and duty-free outlets are boosting visibility. Investments by international manufacturers to establish local distribution networks support the market’s long-term development.

Market Segmentations:

By Type

- Milk chocolate

- Dark chocolate

- White chocolate

- Others

By Packaging

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience stores

- Specialty chocolate stores

- Online retail (e-commerce)

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chocolate market is led by key players such as Ferrero Group, Meiji Holdings Co., Ltd., Barry Callebaut AG, The Hershey Company, Mondelēz International, Inc., Chocoladefabriken Lindt & Sprüngli AG, Nestlé SA, Mars, Incorporated, Arcor SAIC, and The Australian Carob Co. The competitive landscape is characterized by strong brand recognition, global distribution networks, and consistent investment in innovation. Companies focus on expanding premium and health-oriented product lines to attract evolving consumer preferences. Strategic collaborations with cocoa suppliers ensure sustainable sourcing and quality control. Leading manufacturers are also leveraging automation and digital marketing to optimize production efficiency and brand visibility. The growing emphasis on ethical practices, recyclable packaging, and transparent supply chains enhances long-term competitiveness. Moreover, regional product customization, limited-edition launches, and direct-to-consumer retail strategies are helping brands maintain relevance and strengthen market presence across diverse demographic segments worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ferrero Group

- Meiji Holdings Co., Ltd.

- Barry Callebaut AG

- The Hershey Company

- Mondelēz International, Inc.

- Chocoladefabriken Lindt & Sprüngli AG

- Nestlé SA

- Mars, Incorporated

- Arcor SAIC

- The Australian Carob Co.

Recent Developments

- In 2025, Ferrero completed the acquisition of Power Crunch, a protein snack company known for its high-protein wafers

- In 2023, Barry Callebaut announced the launch of “BC Next Level”, a CHF 500 million strategic investment program through 2025 to drive efficiency and operational excellence

- In 2023, The Hershey Company introduced limited-edition chocolate bars to celebrate International Women’s Day, featuring packaging that highlights influential women.

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for premium and dark chocolate will continue to shape product development.

- Growing health awareness will drive manufacturers to introduce low-sugar and functional variants.

- Expansion of e-commerce and direct-to-consumer platforms will increase product accessibility.

- Sustainable and traceable cocoa sourcing will remain a key priority for major producers.

- Innovation in packaging with eco-friendly materials will support brand differentiation.

- Increasing adoption of plant-based and vegan chocolates will attract health-conscious consumers.

- Asia Pacific will emerge as the fastest-growing region with expanding retail networks.

- Collaborations between global and local brands will enhance regional competitiveness.

- Advanced production technologies will improve flavor precision and reduce energy consumption.

- Seasonal gifting trends and personalized offerings will strengthen long-term consumer engagement.