Market Overview:

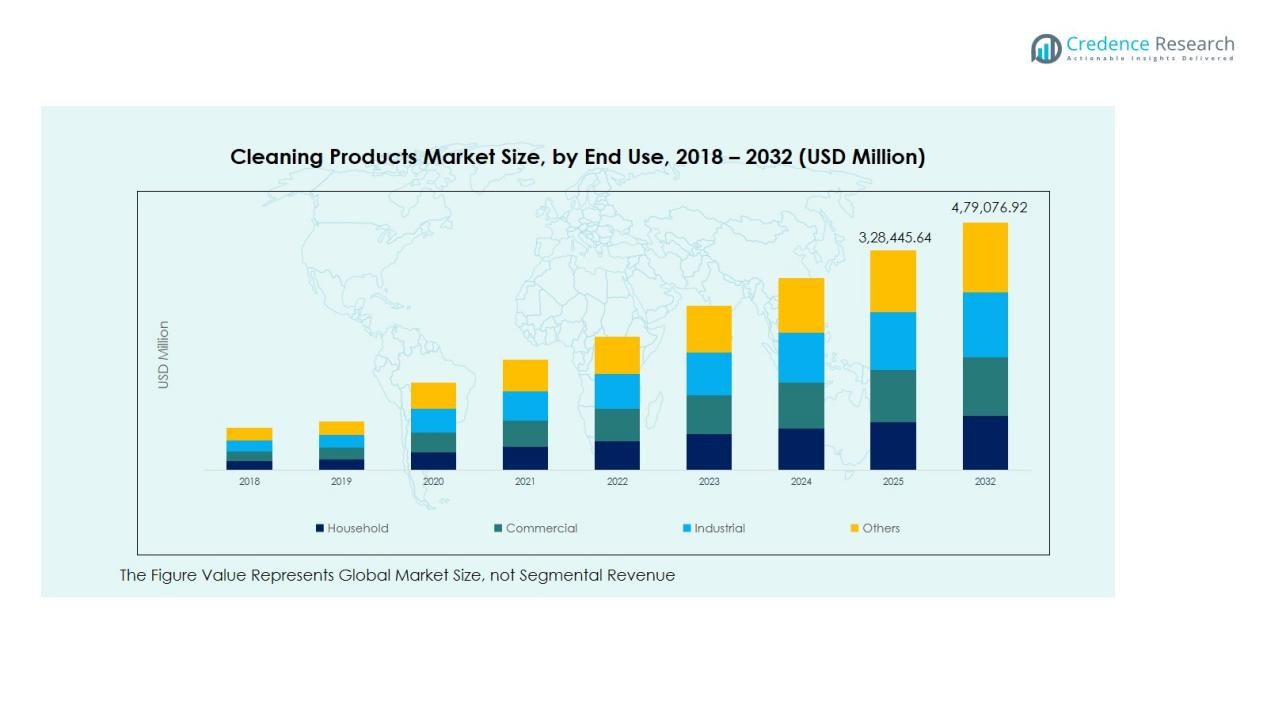

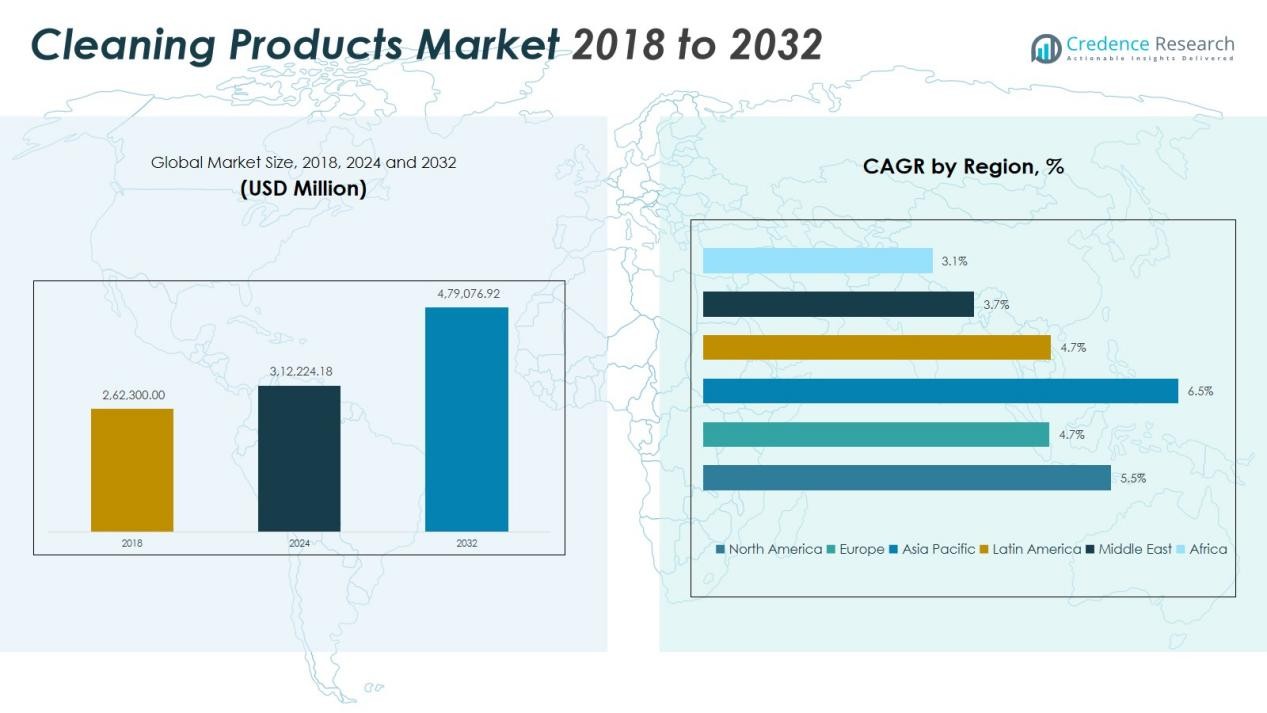

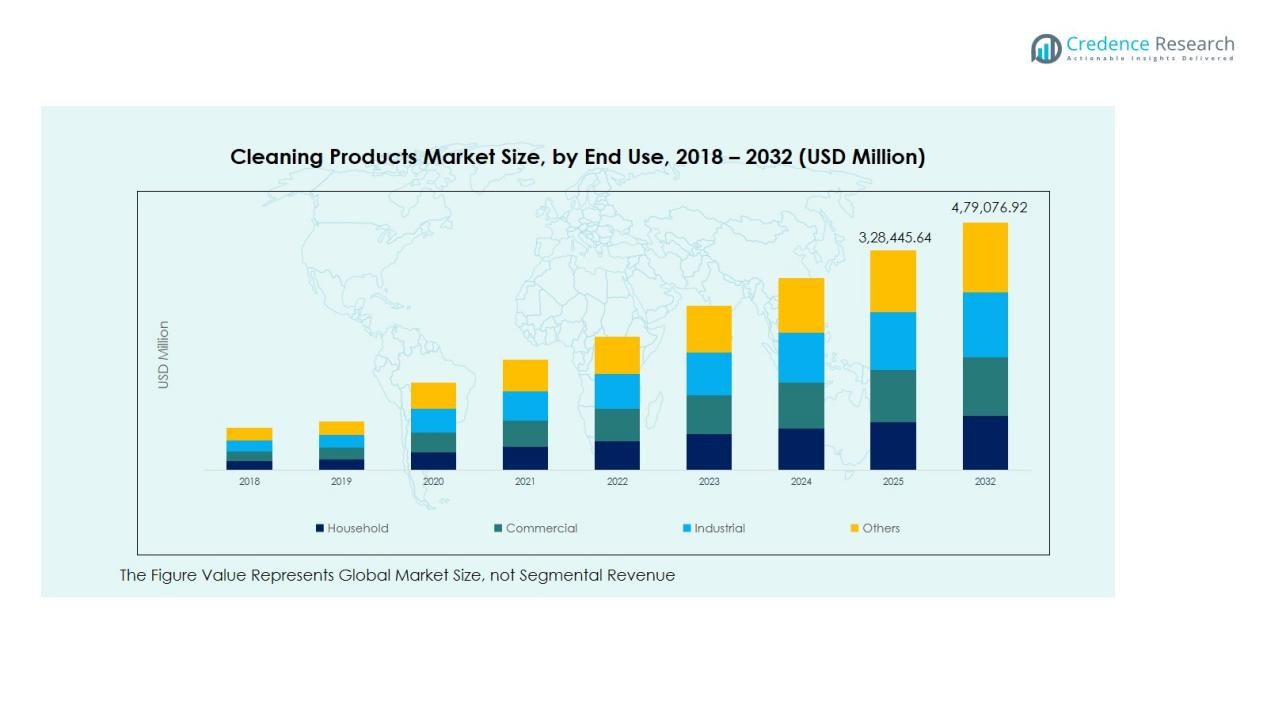

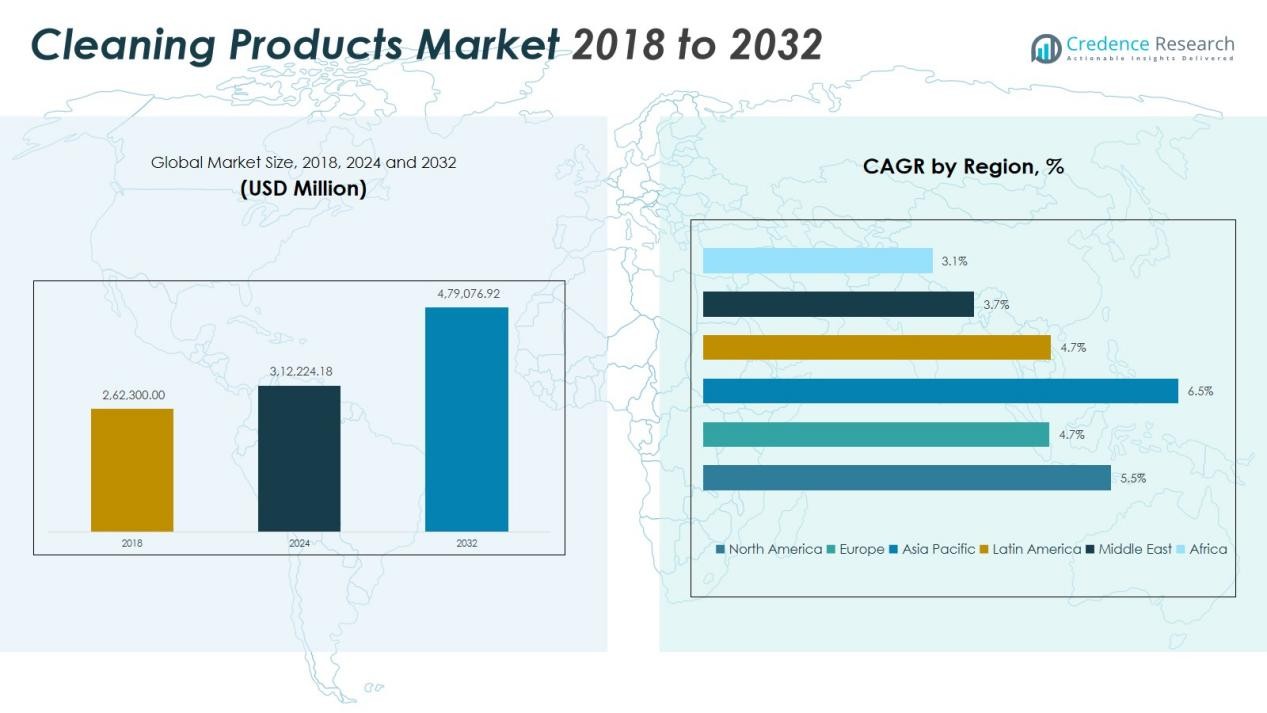

The Global Cleaning Products Market size was valued at USD 2,62,300 million in 2018 to USD 3,12,224.18 million in 2024 and is anticipated to reach USD 4,79,076.92 million by 2032, at a CAGR of 5.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleaning Products Market Size 2024 |

USD 3,12,224.18 Million |

| Cleaning Products Market, CAGR |

5.54% |

| Cleaning Products Market Size 2032 |

USD 4,79,076.92 Million |

The market growth is being propelled by rising awareness of hygiene and sanitation, especially post‑pandemic, which has increased demand for cleaning and disinfectant solutions. At the same time, consumers and institutions are favouring eco‑friendly and sustainable cleaning formulations, pushing manufacturers to innovate. Furthermore, expanding urbanisation and rising disposable incomes in emerging markets are boosting household cleaning product consumption globally.

In terms of geography, the Asia‑Pacific region is emerging as a fast‑growing market, driven by large population bases, increasing nuclear households, and rising hygiene awareness. Meanwhile, North America holds a strong share owing to high product penetration and established retail channels, with Europe also contributing significantly on account of strict regulatory norms and sustainability trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Cleaning Products Market was valued at USD 2,62,300 million in 2018, increased to USD 3,12,224.18 million in 2024, and is expected to reach USD 4,79,076.92 million by 2032, growing at a CAGR of 5.54% during the forecast period.

- North America, Europe, and Asia Pacific are the leading regions in the Global Cleaning Products Market, with North America holding a significant share due to high product penetration and strong demand for eco-friendly solutions. Europe follows closely due to stringent regulations and growing demand for sustainable products. Asia Pacific is the fastest-growing region, driven by urbanization, a large population base, and increasing disposable incomes.

- Asia Pacific is the fastest-growing region, anticipated to capture a significant market share, primarily due to rapid urbanization, a growing middle class, and heightened hygiene awareness post-pandemic.

- The surface cleaners segment holds the largest share of the market, followed by floor cleaners and toilet cleaners, with increasing consumer demand for multi-purpose cleaning products.

- In terms of ingredients, synthetic products continue to dominate, but organic cleaning products are witnessing a rise in popularity, driven by growing environmental and health concerns.

Market Drivers:

Market Drivers:

Increasing Hygiene Awareness and Health Concerns

The growing emphasis on hygiene, particularly after the COVID-19 pandemic, has significantly increased demand for cleaning products globally. Consumers are now more conscious about maintaining cleanliness to prevent the spread of infections and diseases. This awareness has pushed individuals, institutions, and industries to adopt cleaning solutions at an unprecedented rate. The rise in health-consciousness is a critical factor driving the growth of the global cleaning products market, as people seek effective products to safeguard their health and well-being.

- For instance, 3M expanded its global N95 respirator production capacity by over 30 percent between 2020 and 2021, increasing U.S. domestic production to more than 95 million units per month by the end of 2020, compared to 22 million units per month in 2019, demonstrating how manufacturers rapidly scaled hygiene products to meet heightened consumer and institutional demand during the pandemic.

Preference for Eco-Friendly and Sustainable Products

Environmental concerns have led to a growing demand for eco-friendly and sustainable cleaning solutions. Consumers are becoming more aware of the harmful effects of chemical-based cleaning products on the environment. This has spurred manufacturers to innovate and offer products that use biodegradable ingredients and recyclable packaging. The global cleaning products market has seen a noticeable shift toward natural ingredients and environmentally conscious alternatives, particularly in regions where sustainability is a key consumer priority.

- For instance, Seventh Generation launched its Zero Plastic Homecare line, which included laundry powder and powder tablets in reusable steel canisters, as part of a partnership with the zero-waste platform Loop in September 2020.

Urbanization and Changing Lifestyles

Urbanization plays a significant role in expanding the market for cleaning products. As more people move into urban areas and adopt modern lifestyles, the need for household cleaning products increases. Higher disposable incomes, particularly in emerging markets, enable consumers to purchase a wider range of cleaning products. With the increase in the number of working professionals and nuclear families, the demand for convenient and efficient cleaning solutions is on the rise, further driving market growth.

Rising Demand from Commercial Sectors

The global cleaning products market is also experiencing growth due to the increasing demand from commercial sectors such as hospitality, healthcare, and retail. Businesses in these sectors are prioritizing cleanliness to ensure the safety of employees, customers, and visitors. The rising number of establishments requiring frequent and thorough cleaning has led to an increased consumption of cleaning products. This trend, coupled with the growing awareness of sanitation standards, has become a major contributor to market expansion.

Market Trends:

Market Trends:

Expansion of Eco‑Friendly and Green Formulations

Consumers in the Global Cleaning Products Market increasingly favour products that reduce chemical exposure and environmental impact. Manufacturers respond with biodegradable ingredients, refill systems and recyclable packaging. It drives innovation in formulas that deliver performance and sustainability simultaneously. Demand for natural‑based cleaning solutions grew significantly, outpacing many conventional offerings. Brands that commit to transparent sourcing and ingredient safety gain stronger consumer trust and loyalty.

- For instance, Blueland’s refillable tablet system has diverted over 1 billion single-use plastic bottles from landfills and oceans through its Forever Bottles design, achieving Carbon Neutral Certification (specifically, Climate Neutral Certified) and Cradle to Cradle Certified standards (specifically, Platinum Material Health Certificates for many of their products).

Digital Commerce Growth and Home‑Care Experience Enhancement

The distribution landscape in the Global Cleaning Products Market shifts strongly towards online channels and home‑care personalization. E‑commerce platforms provide convenience, broad product choice and direct‑to‑consumer models. It enables smaller, niche brands to reach global audiences and challenge legacy incumbents. The trend also brings focus on smart packaging, subscription services and tailored cleaning solutions. Home cleaning is now integrated with lifestyle, so brands build experience‑driven messaging, differentiated scent profiles and multi‑purpose applications to engage consumers beyond basic efficacy.

- For instance, Blueland sold over 10 million products to over 1 million customers since its 2019 launch, resulting in more than $100 million in lifetime sales by the end of 2022 (and over $170 million by late 2023).

Market Challenges Analysis:

High Raw Material and Production Cost Pressures

Manufacturers in the Global Cleaning Products Market face rising raw material and energy costs that squeeze profit margins. Many essential ingredients, such as surfactants or bleach compounds, have seen price spikes and inconsistent supply. Supply chain disruptions further force producers to either absorb added costs or pass them to consumers, which can reduce demand. It challenges companies to find cost‑efficient formulations without sacrificing quality. The need for investment in new manufacturing technologies and economies of scale further increases operational burden.

Strict Regulatory Compliance and Product Performance Risks

The Global Cleaning Products Market must navigate tightening regulations around chemical content, labelling and environmental impact. Laws banning or limiting phosphates, VOCs and other ingredients require reformulation of many cleaning solutions. It forces brands to invest heavily in R&D to ensure both compliance and performance. Poor performing products or misleading “green” claims damage consumer trust and can trigger fines or reputational harm. The dual pressure of regulation and maintaining efficacy creates a complex challenge for manufacturers and marketers.

Market Opportunities:

Expansion of Premium and Functional Cleaning Solutions

Growth in consumer expectations opens opportunity for the Global Cleaning Products Market to introduce premium and functional cleaning solutions. Consumers now seek beyond basic cleaning—they look for products with added benefits such as antimicrobial, hypoallergenic, or fragrance‑free features. It invites manufacturers to develop differentiated formulations and position them at higher price tiers. Brands that deliver superior performance and cater to niche segments can secure higher margins. Innovation around single‑step multi‑surface sprays, quick‑drying wipes, or scent‑customised options creates a pathway to capture value. Retailers and online platforms can support premium launches with curated offerings and subscription models.

Growth in Emerging Markets and Digital Channels

Emerging geographies present a strong growth tailwind for the Global Cleaning Products Market. Rising urbanisation, more nuclear households, and increasing disposable income in regions such as Asia‑Pacific and Latin America create demand for cleaning products. It offers manufacturers scope to extend footprint through localised products, smaller packaging sizes, and value‑based pricing models. Growth of e‑commerce and direct‑to‑consumer sales channels provides a cost‑effective way to reach remote consumers and test new formats. Businesses that build supply chains, logistics and digital marketing capabilities can capitalise on these untapped regions.

Market Segmentation Analysis:

By Product Type

The Global Cleaning Products Market is segmented by product type into surface cleaners, toilet cleaners, glass & metal cleaners, floor cleaners, fabric cleaners, dishwashing products, and others (including personal care cleaners and building cleaners). Surface cleaners dominate the market, driven by consumer demand for multi-purpose products. Floor cleaners and toilet cleaners follow closely, especially in household and commercial settings. The increasing preference for specialized cleaning products, such as those for glass and metal, is boosting the adoption of niche cleaners, particularly in residential and industrial sectors.

- For instance, Reckitt Benckiser’s VEO Active-Probiotics Surface Cleaner harnesses breakthrough probiotic technology that provides a deep hygienic clean and keeps biodegrading hidden dirt & grime in cracks, grooves, and crevices for up to 3 days.

By Ingredient

The market is divided into organic and synthetic cleaning products. Organic cleaning products, which use natural ingredients, are gaining traction due to growing health and environmental concerns. Synthetic products, while still dominant, are seeing slower growth due to increasing consumer demand for sustainable alternatives. The trend toward organic formulations is expected to continue, with both manufacturers and consumers prioritizing eco-friendly solutions. It offers companies opportunities to develop innovative products that meet the rising demand for safer, greener cleaning options.

- For instance, SC Johnson, a major synthetic cleaning products manufacturer, has reduced its virgin plastic footprint by 33 percent since 2018, surpassing its original 30% reduction goal by 2025, while simultaneously increasing post-consumer recycled (PCR) content to 25% across its plastic packaging—utilizing more than 16,000 metric tons of recycled material in 2024.

By Price Range

The price range segment of the Global Cleaning Products Market includes economy, medium, and high-end products. Economy products dominate the market, catering to mass-market consumers seeking cost-effective cleaning solutions. Medium-priced products are popular in both residential and commercial sectors, offering a balance between cost and quality. High-end products, often sold in specialized or niche categories, cater to consumers willing to pay a premium for performance or eco-friendly features. The rise in disposable income in emerging markets has further bolstered demand for mid-range and premium products.

Segmentations:

By Product Type:

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaner, etc.)

By Ingredient:

By End-use:

- Household

- Commercial

- Industrial

- Others

By Price Range:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Cleaning Products Market

The North America Cleaning Products Market was valued at USD 75,148.95 million in 2018 and is anticipated to reach USD 134,908.92 million by 2032, growing at a CAGR of 5.5% during the forecast period. North America holds a significant share in the Global Cleaning Products Market, driven by strong consumer demand for both household and industrial cleaning solutions. The U.S. dominates the market within the region, accounting for a substantial portion of total revenue. Increasing awareness about hygiene, coupled with innovation in eco-friendly and premium cleaning products, fuels the market’s growth. Retail and e-commerce platforms contribute heavily to sales, offering consumers a wide range of options. High disposable income and strong purchasing power further support demand for premium and specialized products. The growing trend of sustainability and green cleaning formulations is expected to continue shaping the market in North America.

Europe Cleaning Products Market

The Europe Cleaning Products Market was valued at USD 61,745.42 million in 2018 and is projected to reach USD 101,158.37 million by 2032, at a CAGR of 4.7% during the forecast period. Europe holds a substantial share in the Global Cleaning Products Market, with countries such as Germany, the UK, and France driving the demand. The region is witnessing a growing preference for eco-friendly cleaning solutions, propelled by stringent environmental regulations. Innovations in product formulations, such as biodegradable ingredients and reduced packaging waste, are contributing to market growth. The shift towards sustainability and increasing health consciousness among consumers are pivotal drivers. Both residential and commercial sectors are expected to continue showing strong demand for cleaning products across Europe, with a particular emphasis on green products.

Asia Pacific Cleaning Products Market

The Asia Pacific Cleaning Products Market was valued at USD 92,854.20 million in 2018 and is expected to reach USD 187,463.18 million by 2032, growing at a robust CAGR of 6.5% during the forecast period. The region is the largest and fastest-growing market for cleaning products globally, accounting for a significant share. Rapid urbanization, growing middle-class populations, and increasing disposable incomes in countries like China, India, and Japan contribute to strong market demand. Rising awareness about sanitation and hygiene, especially after the pandemic, further propels growth. The expansion of the retail sector and online platforms is broadening access to cleaning products. The market is also benefiting from a shift toward sustainable cleaning solutions in countries with growing environmental awareness. The Asia Pacific market is expected to maintain its dominance due to favorable socio-economic conditions and increasing consumer spending on cleaning products.

Latin America Cleaning Products Market

The Latin America Cleaning Products Market was valued at USD 19,541.35 million in 2018 and is projected to reach USD 33,233.56 million by 2032, growing at a CAGR of 4.7% during the forecast period. Latin America shows steady growth in the Global Cleaning Products Market, with countries such as Brazil and Mexico leading the demand. Urbanization, rising living standards, and increased health consciousness among consumers in the region are key drivers. The market is also seeing increased demand for household and personal care cleaning products, reflecting global trends toward hygiene and sanitation. Price-sensitive consumers in Latin America fuel demand for economical yet effective products. The growth of e-commerce platforms has made cleaning products more accessible, leading to further market expansion.

Middle East Cleaning Products Market

The Middle East Cleaning Products Market was valued at USD 7,475.55 million in 2018 and is anticipated to reach USD 10,829.77 million by 2032, growing at a CAGR of 3.7% during the forecast period. The market in the Middle East is experiencing steady growth, driven by increasing urbanization, rising disposable income, and a growing focus on hygiene and cleanliness. Countries such as Saudi Arabia and the UAE are major contributors to the market due to their rapid urban development and a high standard of living. The demand for both household and commercial cleaning products is rising as the region experiences population growth and more affluent consumer bases. Additionally, the construction and hospitality industries, which require specialized cleaning solutions, are key market drivers in the Middle East.

Africa Cleaning Products Market

The Africa Cleaning Products Market was valued at USD 5,534.53 million in 2018 and is expected to reach USD 11,483.11 million by 2032, growing at a CAGR of 3.1% during the forecast period. The market in Africa is expanding gradually, with increased demand for cleaning products in both the residential and commercial sectors. The rising middle class, urbanization, and improvements in living standards in key countries such as South Africa and Nigeria are fueling market growth. As sanitation awareness increases, consumers are adopting cleaning products to maintain hygiene in households and businesses. Price sensitivity remains an important factor, with demand for economical cleaning solutions prevalent in many African countries. Market growth is also supported by the increasing penetration of retail and e-commerce platforms, which are making cleaning products more accessible to a broader population.

Key Player Analysis:

- Azelis

- Blue Wonder

- Bona

- Borer Chemi

- Ecolab

- Henkel

- Nerta

- Nouryon

- Pollet

- Procter & Gamble

- Reckitt Benckiser

- Solenis

- Unilever

Competitive Analysis:

The competitive landscape of the Global Cleaning Products Market is marked by the presence of key players such as Azelis, Blue Wonder, Bona, Borer Chemi, Ecolab, Henkel, and Nerta. These companies dominate the market by offering a diverse range of cleaning solutions for both commercial and residential sectors. Azelis and Henkel lead with strong distribution networks and a wide variety of product offerings that cater to different consumer needs. Ecolab is a major player in industrial and commercial cleaning, leveraging its expertise in sanitation and hygiene. Bona and Nerta focus on niche product categories, providing specialized cleaning solutions for floor care and industrial applications. With growing demand for eco-friendly products, companies like Henkel and Bona are also investing in sustainable and organic product lines. The competitive pressure in the market forces constant innovation, leading to improvements in product formulations and technology.

Recent Developments:

- In July 2025, Reckitt Benckiser Group agreed with Advent International to divest its Essential Home business, securing an enterprise value of up to $4.8 billion and retaining a 30% equity stake in Essential Home.

- In May 2025, Azelis announced the acquisition of S. Amit Group, a Mumbai-based distributor specializing in performance chemicals for pharmaceutical, agricultural, and CASE markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use, Price Range and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The future of the Global Cleaning Products Market is expected to be shaped by several key trends and developments.

- Sustainability will continue to be a significant focus, with increasing consumer demand for eco-friendly and biodegradable cleaning products.

- The market will likely see further innovation in product formulations, driven by the rising preference for natural and non-toxic ingredients.

- Smart cleaning products, such as those incorporating IoT technology for more efficient cleaning, will gain popularity across both household and commercial sectors.

- E-commerce and online sales platforms will play an even larger role in distribution, expanding market reach and improving consumer accessibility.

- The demand for specialized cleaning solutions will rise, particularly for industrial, healthcare, and commercial sectors, where hygiene standards are more stringent.

- Consumer preferences will shift towards multi-purpose and convenient cleaning products, offering cost-effective and time-saving solutions.

- The growing middle-class population in emerging markets will fuel increased consumption of cleaning products, particularly in Asia-Pacific and Latin America.

- Companies will likely focus on expanding their presence in untapped regions, increasing investments in local manufacturing and distribution networks.

- Technological advancements, such as AI-powered cleaning devices, will transform cleaning processes and increase market efficiency.

- Regulations around chemical content and packaging will continue to evolve, pushing manufacturers to align with stricter environmental standards.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: