Market Overview

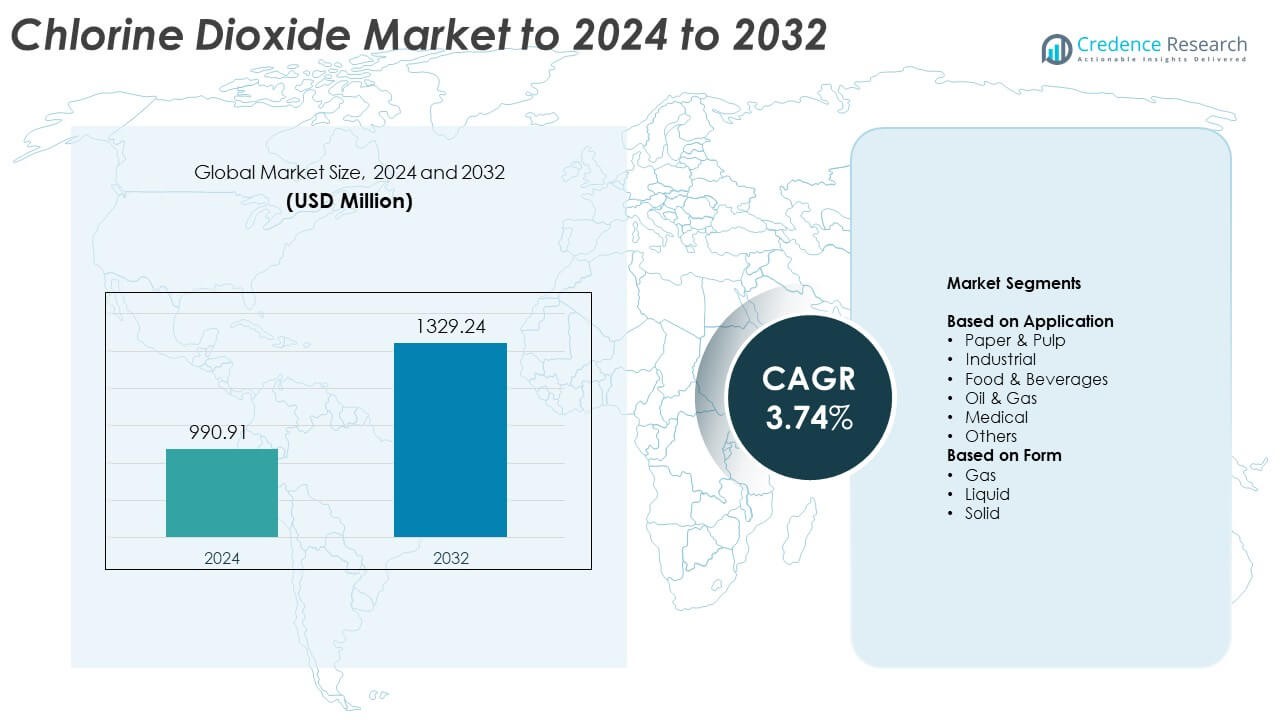

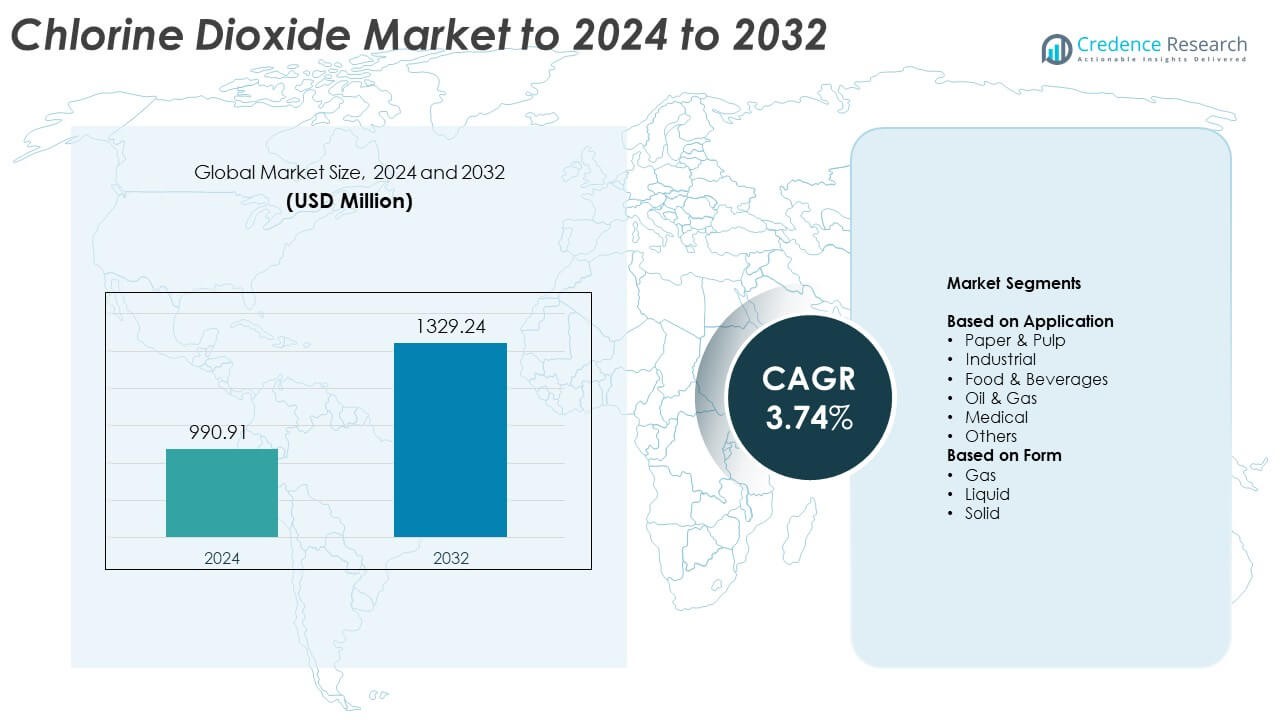

Chlorine Dioxide market size was valued at USD 990.91 Million in 2024 and is anticipated to reach USD 1329.24 Million by 2032, at a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorine Dioxide Market Size 2024 |

USD 990.91 Million |

| Chlorine Dioxide Market, CAGR |

3.74% |

| Chlorine Dioxide Market Size 2032 |

USD 1329.24 Million |

The chlorine dioxide market is shaped by key players including Ecolab, Bio-Cide International, Superior Plus Corp., ProMinent, Evoqua, The Sabre Companies LLC, Dioxide Pacific, Scotmas Group, Accepta, Grundfos, CDG Environmental LLC, Tecme Srl, Vasu Chemicals, HES Water Engineers (India) Pvt Ltd., and Iotronic Elektrogeratebau GmBH. These companies focus on expanding production capacities, enhancing on-site generation technologies, and offering eco-friendly disinfection solutions to meet rising global demand. North America leads the market with a 37% share in 2024, followed by Europe at 28% and Asia Pacific at 24%. Strong regulatory standards, technological advancements, and increasing investments in water treatment infrastructure are driving the dominance of these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chlorine dioxide market was valued at USD 990.91 Million in 2024 and is projected to reach USD 1329.24 Million by 2032, growing at a CAGR of 3.74%.

- Rising demand for clean water and industrial sanitation is driving market growth, supported by strict environmental regulations and the expanding food processing and paper industries.

- Technological advancements in on-site chlorine dioxide generation and the shift toward sustainable disinfection solutions are key market trends.

- The market is moderately consolidated, with companies focusing on innovation, product efficiency, and strategic expansion across industrial and municipal applications.

- North America leads with 37% share, followed by Europe with 28% and Asia Pacific with 24%, while the paper and pulp segment dominates with 46% share due to its growing adoption of chlorine dioxide as an eco-friendly bleaching agent.

Market Segmentation Analysis:

By Application

The paper and pulp segment dominates the chlorine dioxide market, accounting for nearly 46% share in 2024. This dominance is driven by its widespread use as a bleaching agent that minimizes fiber damage and improves brightness while reducing harmful chlorinated byproducts. The increasing adoption of environmentally friendly bleaching methods in paper manufacturing continues to boost demand. The food and beverage and medical segments are expanding steadily due to rising applications in disinfection and sterilization, supported by growing hygiene awareness and stricter water treatment standards.

- For instance, Stora Enso produced ~4.4 million tonnes of chemical pulp, with 90% bleached using ECF based on chlorine dioxide.

By Form

The liquid segment leads the chlorine dioxide market with around 59% share in 2024. Liquid chlorine dioxide is preferred for its stability, ease of dosing, and high efficacy in water purification and industrial sanitization processes. It enables precise control in disinfection applications across food processing, healthcare, and municipal water treatment. The gas and solid forms are gaining traction in niche uses, including oilfield water treatment and portable sterilization systems, owing to their convenience and lower handling complexity.

- For instance, De Nora’s Capital Controls OXICORE™ chlorine dioxide generators are highly scalable and can be configured with a modular design to meet a wide range of needs, producing up to 99% ClO₂ yield.

Key Growth Drivers

Rising Demand for Water Disinfection and Treatment

The growing need for safe drinking water and industrial wastewater treatment is a major driver for chlorine dioxide demand. Municipal and industrial sectors increasingly use chlorine dioxide due to its superior disinfection performance and minimal harmful byproducts. Expanding urbanization, stricter environmental standards, and growing investments in water infrastructure continue to support adoption. This trend positions chlorine dioxide as a sustainable alternative to traditional chlorination in water purification applications worldwide.

- For instance, Ecolab’s PURATE™ program at the Egyptian Fertilizers Company (EFC) site in Suez supports 4 different cooling systems.

Expanding Use in Food and Beverage Processing

Chlorine dioxide is gaining strong traction in food and beverage industries as a disinfectant for equipment, packaging, and raw materials. It offers effective microbial control without leaving toxic residues, making it ideal for regulatory-compliant sanitation. Rising global food safety regulations and increasing focus on hygienic processing environments drive this segment’s growth. Demand from meat, poultry, and beverage manufacturing facilities further strengthens the market outlook for chlorine dioxide.

- For instance, ClorDiSys decontaminated a beverage processing tank with chlorine dioxide gas in under 6 hours before startup

Growing Adoption in the Paper and Pulp Industry

The paper and pulp industry remains a core consumer of chlorine dioxide due to its efficiency as an eco-friendly bleaching agent. It delivers high brightness with reduced lignin degradation and minimal organochlorine formation. The shift toward sustainable and cleaner production processes boosts its use across mills globally. Growing demand for high-quality printing and packaging paper further reinforces chlorine dioxide utilization within this sector.

Key Trends and Opportunities

Shift Toward Eco-Friendly Disinfection Technologies

Industries are adopting chlorine dioxide as a safer and greener substitute for chlorine-based disinfectants. Its ability to minimize harmful byproducts and maintain stable performance across varied pH levels aligns with global sustainability goals. Governments promoting eco-friendly disinfection solutions are further enhancing market growth. Increasing demand for biodegradable and low-impact cleaning chemicals presents a long-term opportunity for manufacturers investing in sustainable formulations.

- For instance, Scotmas’ Bravo Ultra-Pure system delivers chlorine dioxide verified at 99.7% purity to limit DBPs.

Technological Advancements in On-Site Generation Systems

The development of on-site chlorine dioxide generation systems is a major market trend improving operational efficiency. These systems ensure safety, reduce transportation costs, and allow customized concentration levels for specific applications. Industries such as oil and gas, healthcare, and municipal treatment are rapidly adopting these innovations. Continuous research in automation and smart dosing systems is creating opportunities for improved process integration and cost savings.

- For instance, ProMinent’s Bello Zon® CDKd offers 7.5–12,000 g/h ClO₂ output, with configurations metering at 0.2 ppm for up to 60,000 m³/h.

Key Challenges

Health and Safety Concerns During Handling

Chlorine dioxide poses handling risks due to its strong oxidizing nature and potential for instability in high concentrations. Improper storage or mixing can lead to hazardous conditions, prompting the need for strict operational controls. Companies must comply with safety regulations and invest in advanced containment systems. This adds to production and maintenance costs, creating a barrier for smaller manufacturers.

High Production and Operational Costs

The cost of chlorine dioxide generation and storage remains high compared to traditional disinfectants. Complex equipment requirements and specialized material compatibility contribute to elevated capital expenses. Additionally, operational costs rise due to the need for continuous monitoring and technical expertise. These factors can limit adoption in cost-sensitive industries, especially in developing economies.

Regional Analysis

North America

North America leads the chlorine dioxide market with around 37% share in 2024, driven by strong demand from water treatment, food processing, and healthcare industries. The United States dominates regional consumption due to strict regulations on water quality and sanitation standards. Advanced wastewater management infrastructure and growing adoption of chlorine dioxide in industrial disinfection further enhance growth. Continuous investments in eco-friendly treatment technologies and the presence of key manufacturers contribute to the region’s steady market expansion across municipal and industrial sectors.

Europe

Europe holds about 28% share of the chlorine dioxide market in 2024, supported by stringent environmental regulations and rising adoption of sustainable disinfection practices. Countries such as Germany, the United Kingdom, and France are leading consumers, primarily driven by industrial water purification and paper bleaching applications. The European Union’s emphasis on reducing harmful chlorine byproducts encourages the use of chlorine dioxide. Continuous innovation in green chemistry and water reuse systems further supports market expansion across the region’s manufacturing and utility sectors.

Asia Pacific

Asia Pacific accounts for approximately 24% share of the chlorine dioxide market in 2024 and is projected to grow rapidly. The expansion of industrial manufacturing, paper production, and food processing sectors in China, India, and Japan drives strong regional demand. Rapid urbanization and increasing awareness of safe water management practices further support adoption. Government initiatives promoting clean water infrastructure and industrial sanitation compliance strengthen market growth, while local production facilities enhance cost efficiency and supply reliability across developing economies.

Latin America

Latin America represents around 7% share of the chlorine dioxide market in 2024, primarily driven by growing use in water treatment and food processing industries. Brazil and Mexico are major contributors due to expanding industrial sectors and increasing focus on clean water accessibility. Government-led sanitation programs and infrastructure development projects encourage chlorine dioxide adoption in municipal applications. Rising awareness of eco-friendly disinfectants and growing demand for high-quality industrial water solutions are expected to enhance regional market performance over the coming years.

Middle East and Africa

The Middle East and Africa hold close to 4% share of the chlorine dioxide market in 2024, supported by increasing demand for potable water treatment and oilfield applications. GCC countries are investing in advanced disinfection technologies to address water scarcity and improve hygiene standards. Industrial growth in petrochemical and food sectors also contributes to rising consumption. Ongoing efforts toward water recycling and infrastructure modernization, combined with rising environmental awareness, are expected to create new opportunities for chlorine dioxide manufacturers in the region.

Market Segmentations:

By Application

- Paper & Pulp

- Industrial

- Food & Beverages

- Oil & Gas

- Medical

- Others

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chlorine dioxide market features strong competition among major players such as Ecolab, Bio-Cide International, Superior Plus Corp., ProMinent, Evoqua, The Sabre Companies LLC, Dioxide Pacific, Scotmas Group, Accepta, Grundfos, CDG Environmental LLC, Tecme Srl, Vasu Chemicals, HES Water Engineers (India) Pvt Ltd., and Iotronic Elektrogeratebau GmBH. The competitive environment is characterized by continuous innovation, strategic partnerships, and product diversification to strengthen global presence. Companies are focusing on enhancing on-site generation systems, improving chemical stability, and developing eco-friendly solutions to meet strict environmental regulations. Expansion into emerging markets, along with investment in automation and digital monitoring technologies, supports operational efficiency and customer satisfaction. Leading manufacturers are also prioritizing sustainability through energy-efficient production methods and recyclable packaging. The market remains moderately consolidated, with a mix of multinational corporations and regional players competing through technological advancement, pricing strategies, and after-sales service offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecolab

- Bio-Cide International

- Superior Plus Corp.

- ProMinent

- Evoqua

- The Sabre Companies LLC

- Dioxide Pacific

- Scotmas Group

- Accepta

- Grundfos

- CDG Environmental LLC

- Tecme Srl

- Vasu Chemicals

- HES Water Engineers (India) Pvt Ltd.

- Iotronic Elektrogeratebau GmBH

Recent Developments

- In 2024, Accepta continued supplying chlorine dioxide dosing systems and generators suitable for small and large water treatment applications.

- In 2024, Evoqua introduced the DIOX-3000 series, a range of chlorine dioxide generators optimized for large-scale wastewater treatment.

- In 2023, Tecme Srl enhanced its chlorine dioxide generator technology by introducing the DXT series, which uses state-of-the-art technology to ensure high levels of performance, production, and safety.

Report Coverage

The research report offers an in-depth analysis based on Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chlorine dioxide will rise with expanding global water treatment projects.

- Adoption in food and beverage sanitation will grow due to stricter hygiene regulations.

- On-site chlorine dioxide generation systems will become more common in industrial facilities.

- Paper and pulp producers will continue using chlorine dioxide for eco-friendly bleaching.

- Increasing focus on sustainable disinfection will drive innovation in low-impact formulations.

- Technological advances will improve chlorine dioxide stability and application safety.

- Growing urbanization will boost demand for municipal water purification solutions.

- Emerging economies will see higher usage due to infrastructure development programs.

- Rising investment in healthcare sanitation will expand medical applications.

- Partnerships between technology providers and chemical companies will enhance market competitiveness.