Market Overview

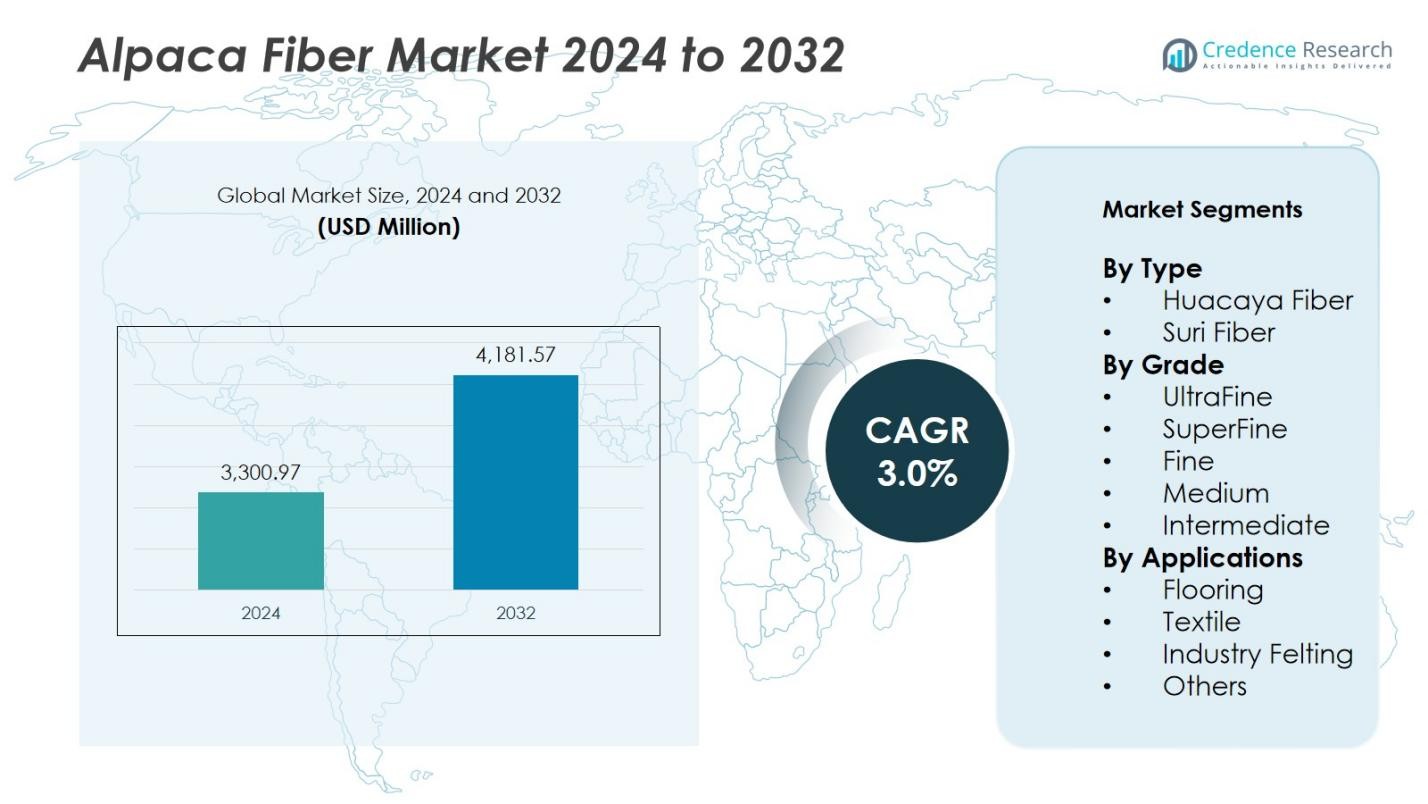

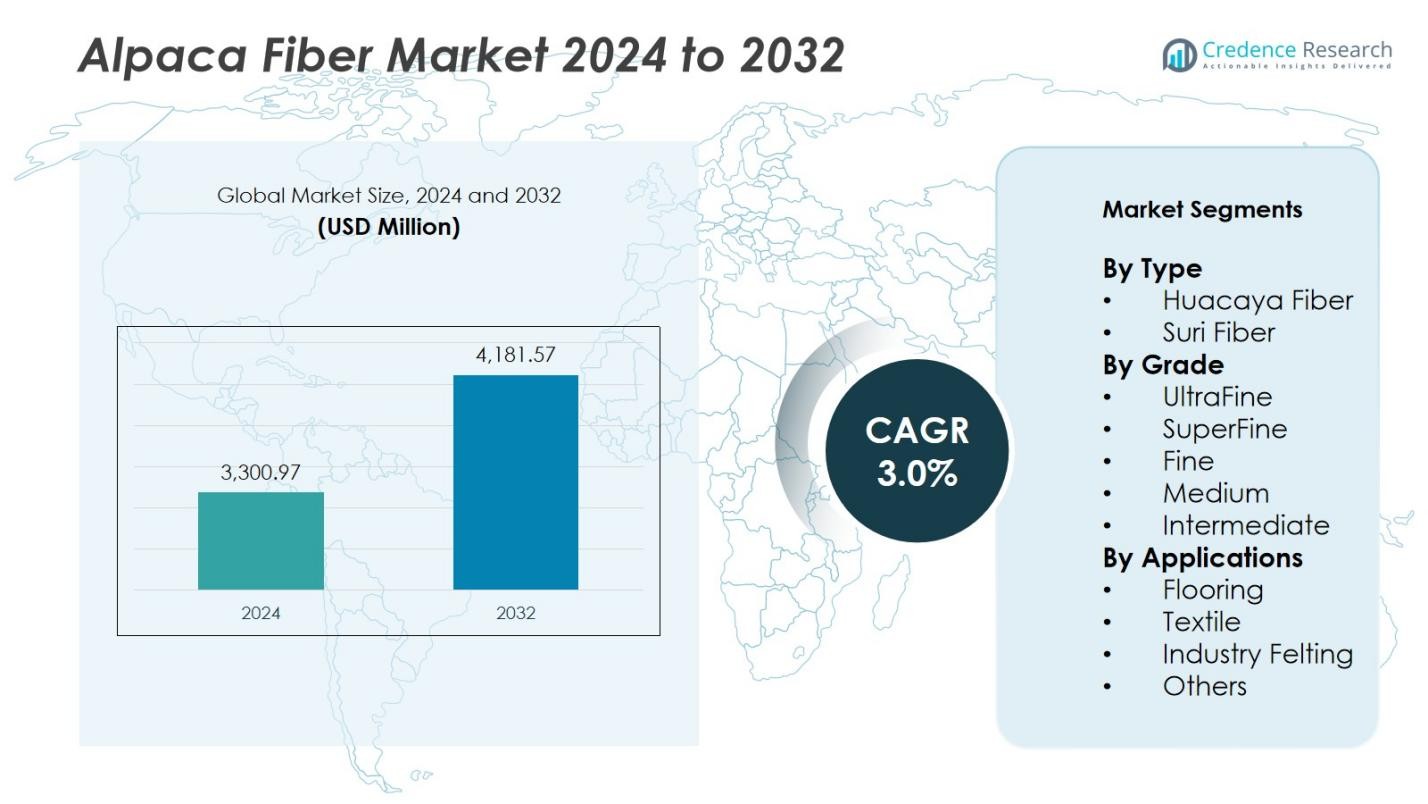

The Global Alpaca Fiber Market size was valued at USD 3,300.97 million in 2024 and is anticipated to reach USD 4,181.57 million by 2032, expanding at a CAGR of 3.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpaca Fiber Market Size 2024 |

USD 3,300.97 Million |

| Alpaca Fiber Market, CAGR |

3.0% |

| Alpaca Fiber Market Size 2032 |

USD 4,181.57 Million |

The Global Alpaca Fiber Market is characterized by moderate competition and growing international participation. Leading companies include Malabrigo Yarn, The Natural Fiber, Plymouth Yarn, Zeilinger Wool, New Era Fiber, Cascade Yarns, The Alpaca Yarn, AndeanSun Yarns, AHA Bolivia, and Coopecan. These firms focus on sourcing premium Huacaya and Suri fibers, maintaining quality through sustainable farming and traceable supply chains. Product innovation, such as blended alpaca yarns and eco-certified fabrics, strengthens their global positioning. Strategic partnerships with local cooperatives in Peru and Bolivia enhance raw material access and brand authenticity. Europe emerged as the leading region with a 28% share in 2024, driven by a strong preference for luxury, eco-friendly textiles and an established fashion industry. Continuous technological advancement and sustainability-led production practices are expected to support competitive differentiation and long-term growth across the Alpaca Fiber Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Alpaca Fiber Market was valued at USD 3,300.97 million in 2024 and is projected to reach USD 4,181.57 million by 2032, expanding at a CAGR of 3.0%.

- Growing demand for sustainable and biodegradable fibers drives market expansion, supported by rising adoption in luxury apparel, knitwear, and home textiles.

- Market trends highlight technological improvements in fiber processing, promoting better softness, durability, and eco-friendly dyeing methods.

- The competitive landscape features key players such as Malabrigo Yarn, The Natural Fiber, Plymouth Yarn, Zeilinger Wool, and Cascade Yarns, focusing on premium-grade and ethically sourced alpaca fiber.

- Europe held a 28% regional share in 2024, leading global consumption, while the Huacaya fiber segment dominated with 72% share, supported by increasing demand for high-quality textile and furnishing applications.

Market Segmentation Analysis:

By Type

Huacaya fiber dominates the Global Alpaca Fiber Market with a share of 72% in 2024, owing to its soft, crimpy texture and superior insulation properties, making it ideal for knitwear and high-end textiles. The fiber’s natural elasticity and volume enable easy spinning and dye absorption, which supports demand in luxury apparel and home furnishings. Suri fiber, with a 28% share, grows steadily due to its silky luster and strength, finding niche use in premium fashion and decorative products across the U.S., Peru, and European markets.

For instance, Peruvian company Inca Alpacas produces Huacaya fiber extensively for luxury knitwear and blankets, valuing its warmth and elasticity for easy spinning and dyeing.

By Grade

The SuperFine grade holds the largest share of 38% in 2024, driven by rising demand for lightweight, soft, and warm apparel such as sweaters, scarves, and shawls. Its fine diameter ensures exceptional comfort and breathability, making it popular among premium textile manufacturers. The UltraFine segment, accounting for 26%, is growing in high-end fashion applications due to its rarity and luxurious feel. Medium and Intermediate grades together contribute 36%, catering to upholstery and industrial textile applications where durability is prioritized.

For instance, Superfine fabrics produced by Austrian manufacturer Superfine are renowned for their fineness, softness, and comfort. Leading brands of premium clothing rely on Superfine® fabrics for their next-to-skin garments, emphasizing their homogeneous, smooth surface preferred in high-end knitwear.

By Application

The Textile segment leads the Alpaca Fiber Market, capturing 64% of total revenue in 2024, supported by growing use in luxury clothing, knitwear, and home furnishing products. Rising consumer preference for sustainable and hypoallergenic fabrics strengthens demand across fashion and interior sectors. The flooring segment, holding nearly 18%, benefits from increased use in rugs and carpets due to alpaca’s resilience and thermal insulation. Industrial felting and other applications collectively account for the remaining 18%, utilized in acoustic insulation and technical nonwoven products.

Key Growth Drivers

Rising Demand for Sustainable and Natural Fibers

The Global Alpaca Fiber Market grows due to the increasing consumer shift toward sustainable and eco-friendly materials. Alpaca fiber’s biodegradable nature, low environmental footprint, and absence of lanolin make it a preferred alternative to synthetic fibers. Fashion brands are integrating alpaca into luxury apparel lines, driven by ethical sourcing trends and sustainable fashion initiatives. Growing awareness about environmental protection further boosts its adoption in textiles, home furnishings, and high-end garments across Europe, North America, and Asia-Pacific.

For instance, Kelly & Windsor launched the Alpaca Royale quilt collection in 2024, featuring 100% pure alpaca fiber processed with environmentally friendly methods, further demonstrating the fiber’s growing position in luxury eco-conscious products.

Expanding Luxury Apparel and Home Textile Segment

The expansion of luxury clothing and home décor markets strongly drives alpaca fiber consumption. Its softness, warmth, and hypoallergenic qualities enhance its appeal among high-income consumers. Premium brands increasingly use alpaca yarns for sweaters, scarves, coats, and blankets, supporting steady revenue growth. Rising disposable incomes, evolving fashion trends, and growing demand for handmade, artisanal products fuel segment expansion. The premium positioning of alpaca fiber products ensures consistent growth across developed and emerging economies.

For instance, PAKA, a well-known luxury brand, launched the Ultralight COOLPLUS line in May 2025, which combines thermoregulating alpaca fiber with organic cotton and advanced cooling yarns to create breathable, stylish sweaters suited for warm weather.

Government Support and Local Production Incentives

Government initiatives supporting rural economies and livestock management promote alpaca farming, particularly in Peru, Bolivia, and Chile. Programs focusing on quality improvement, genetic enhancement, and export promotion enhance fiber yield and quality. Financial incentives and technical support to small producers strengthen market supply and international competitiveness. The establishment of cooperatives and partnerships between local breeders and textile brands accelerates industry standardization. These initiatives collectively boost the availability of fine-quality alpaca fiber for global markets.

Key Trends & Opportunities

Technological Advancements in Fiber Processing

Innovations in spinning, dyeing, and blending technologies improve alpaca fiber quality and versatility. Automated processing systems help reduce fiber waste and enhance uniformity, supporting broader industrial use. Manufacturers increasingly blend alpaca with wool, silk, or synthetic fibers to enhance texture, elasticity, and performance. Such advancements expand applications across fashion, home textiles, and industrial felting. Continuous R&D investments in fiber treatment and color retention create new growth opportunities in premium textile manufacturing.

For instance, Tintalana, an Italian textile firm, upgraded its dyeing department with Cubotex RVS machines, achieving higher process efficiency and superior color quality while reducing energy consumption.

Rising Adoption in High-End Sustainable Fashion

The growing emphasis on ethical sourcing and transparency drives luxury fashion brands to adopt alpaca fiber. Designers are showcasing alpaca-based collections in major fashion events, highlighting its eco-friendly and luxurious appeal. The fiber’s durability and thermal comfort suit both winter and trans-seasonal clothing. Collaborations between global designers and South American cooperatives strengthen sustainable supply chains. Increasing consumer awareness about cruelty-free fibers further accelerates market opportunities in high-value fashion markets.

For instance, Samantha Holmes, a luxury brand, showcases alpaca knitwear and scarves designed for sustainability and durability, resonating with eco-conscious consumers.

Key Challenges

High Production and Processing Costs

Alpaca fiber production remains labor-intensive and costlier than other natural fibers. Limited automation in shearing, sorting, and grading increases overall production costs. Transporting raw fiber from remote regions to processing centers adds logistical expenses. These high operational costs restrict its adoption in mass-market textile applications. Manufacturers face challenges in maintaining affordability without compromising quality, making cost optimization critical for expanding market accessibility and competitiveness.

Limited Supply Chain Integration and Standardization

The alpaca fiber supply chain is fragmented, with inconsistent quality grading and lack of global certification standards. Variations in fiber quality across regions affect uniformity and pricing transparency. Small-scale producers often lack access to modern equipment and export networks, reducing efficiency and market reach. Absence of standardized quality benchmarks complicates international trade, limiting large-scale industrial adoption. Strengthening cooperative structures and establishing certification systems are essential to enhance global competitiveness.

Regional Analysis

North America

North America holds a market share of 26% in the Global Alpaca Fiber Market, driven by growing consumer preference for sustainable luxury textiles. The U.S. leads regional demand, supported by strong retail presence of eco-conscious brands and expanding artisan yarn markets. Increased import volumes from Peru and Bolivia strengthen supply chains for local manufacturers. Rising popularity of handmade knitwear and premium outdoor apparel further boosts consumption. Canada also shows growing adoption due to favorable climatic conditions for alpaca fiber use in winter garments and interior textiles.

Europe

Europe accounts for 28% of the market, led by countries such as the U.K., Germany, Italy, and France. The region’s well-established fashion industry and emphasis on eco-friendly materials drive continuous demand for alpaca fiber. European consumers value its natural softness and hypoallergenic properties, which suit luxury clothing and home décor. Several high-end fashion brands integrate alpaca textiles into their sustainable product lines. Government-backed green initiatives and rising import partnerships with South American suppliers further contribute to regional market expansion.

Asia-Pacific

Asia-Pacific captures a 22% share, emerging as one of the fastest-growing regions in the alpaca fiber market. China, Japan, and Australia lead demand, driven by rising disposable incomes and growing appreciation for premium fabrics. Expanding fashion and home furnishing sectors in these markets create lucrative opportunities for imports and local production. Increasing consumer interest in sustainable materials fuels collaborations between South American suppliers and Asian textile firms. Investments in blending technologies and fiber finishing also enhance the competitiveness of alpaca fiber in the region.

Latin America

Latin America dominates the global landscape with a 20% share, primarily driven by Peru, Bolivia, and Chile. Peru remains the world’s leading producer and exporter, supported by favorable climatic conditions for alpaca breeding and government-backed agricultural programs. The region benefits from abundant raw material availability and a well-developed network of cooperatives. Local value addition through yarn spinning and textile exports continues to strengthen regional economies. Growing global recognition of Peruvian alpaca fiber as a luxury textile material supports both export growth and domestic consumption.

Middle East & Africa

The Middle East & Africa region holds a 4% share, characterized by niche adoption in premium textile and fashion markets. Demand is gradually increasing in the UAE and South Africa due to expanding luxury retail sectors. Importers focus on alpaca’s natural insulation and moisture-wicking properties, catering to high-end consumers seeking sustainable fashion. Limited local production and high import costs currently restrict large-scale adoption. However, rising awareness of eco-conscious fabrics and potential partnerships with Latin American exporters are expected to create future growth avenues.

Market Segmentations:

By Type

By Grade

- UltraFine

- SuperFine

- Fine

- Medium

- Intermediate

By Applications

- Flooring

- Textile

- Industry Felting

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Alpaca Fiber Market features prominent players such as Malabrigo Yarn, The Natural Fiber, Plymouth Yarn, Zeilinger Wool, New Era Fiber, Cascade Yarns, The Alpaca Yarn, AndeanSun Yarns, AHA Bolivia, and Coopecan. The market is moderately fragmented, with competition centered around product quality, fiber grade, and sustainability standards. Companies focus on sourcing premium Huacaya and Suri fibers directly from Latin American farms to maintain consistent quality. Leading manufacturers emphasize eco-friendly processing and organic certifications to attract environmentally conscious consumers. Strategic collaborations with local cooperatives and expansion of online retail channels enhance brand visibility in international markets. Product innovation, including blended yarns and dyed alpaca fabrics, continues to shape competition. Many players are also investing in traceability and ethical sourcing programs to strengthen brand credibility and appeal to global fashion brands seeking sustainable luxury materials.

Key Player Analysis

- Malabrigo Yarn

- The Natural Fiber

- Plymouth Yarn

- Zeilinger Wool

- New Era Fiber

- Cascade Yarns

- The Alpaca Yarn

- AndeanSun Yarns

- AHA Bolivia

- Coopecan

Recent Developments

- In Nov 2024, the company PAKA expanded its Traceable Alpaca program to its full product line, enabling consumers to scan a QR code and trace the exact coordinates of the alpaca herds used in each garment.

- In Sep 2025, SOL ALPACA announced its expansion into strategic airports across Europe and Asia from Q1 2026, focusing on high-traffic locations and partnering with duty-free operators to enhance its international presence.

- In August 2024, MGI Tech, along with the National Agrarian University La Molina (UNALM) and Inca Tops S.A., announced a genomics partnership that will sequence 1,500 alpacas to improve fiber fineness and strengthen Peru’s textile industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Grade, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Alpaca Fiber Market is expected to grow steadily due to rising demand for sustainable textiles.

- Luxury fashion brands will continue integrating alpaca fiber into eco-friendly collections.

- Advancements in fiber processing technology will improve softness, color retention, and durability.

- Increasing consumer awareness about biodegradable and hypoallergenic fabrics will boost adoption.

- Online and specialty retail channels will expand global access to alpaca-based products.

- Latin America will remain the primary production hub, supported by government programs.

- Europe and North America will drive demand through sustainable apparel and home décor markets.

- Collaboration between cooperatives and global textile firms will enhance supply chain efficiency.

- Blending alpaca with other fibers will expand its use in industrial and functional textiles.

- Growing interest in cruelty-free and ethically sourced materials will sustain long-term market growth.