Market Overview

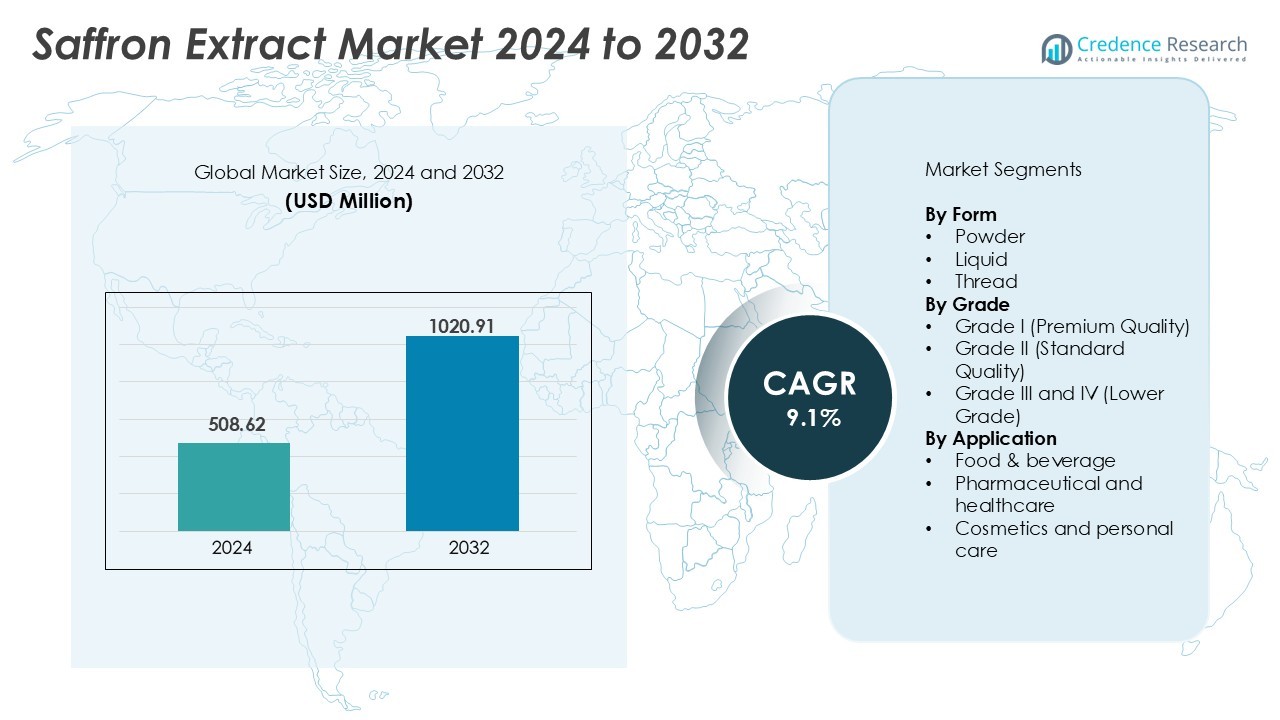

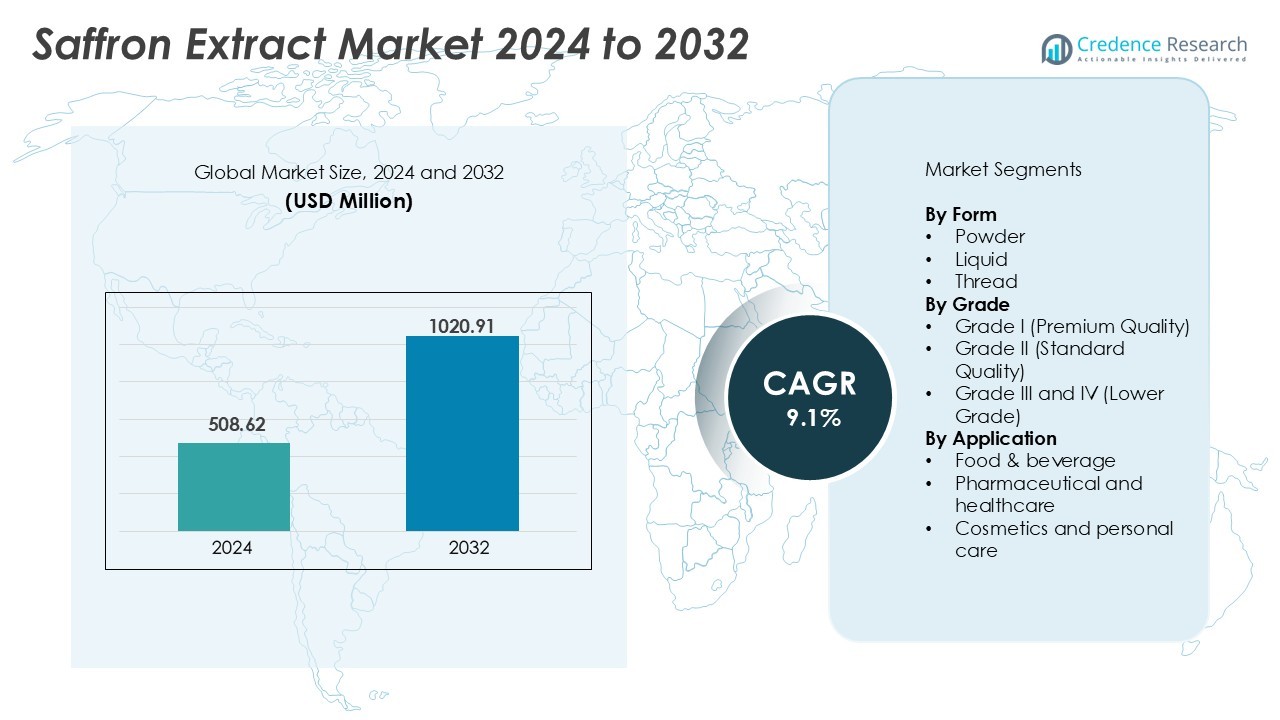

Saffron Extract market was valued at USD 508.62 million in 2024 and is anticipated to reach USD 1020.91 million by 2032, growing at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saffron Extract Market Size 2024 |

USD 508.62 Million |

| Saffron Extract Market , CAGR |

9.1% |

| Saffron Extract Market Size 2032 |

USD 1020.91 Million |

The saffron extract market is led by major players such as Safran Global Company S.L.U., Mehr Saffron, Esfedan Trading Company, Iran Saffron Company, Gohar Saffron, Rowhani Saffron Co., Tarvand Saffron Co., Flora Saffron, Royal Saffron Company, and Saffron Business Company. These companies focus on maintaining high product purity, sustainable sourcing, and advanced extraction techniques to meet growing demand from the food, pharmaceutical, and cosmetic sectors. Asia Pacific dominates the global saffron extract market with a 27% share, driven by large-scale cultivation in Iran, India, and Afghanistan, along with increasing exports and growing demand for natural ingredients across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Saffron Extract Market was valued at USD 508.62 million in 2024 and is projected to reach USD 1020.91 million by 2032, expanding at a CAGR of 9.1% during the forecast period.

- Rising consumer preference for natural, chemical-free ingredients in food, cosmetics, and nutraceuticals is driving demand for saffron extract across premium product categories.

- Increasing adoption of sustainable sourcing and traceable supply chains is a major trend, with manufacturers focusing on organic certification and fair-trade practices to enhance global reach.

- Leading players such as Mehr Saffron, Esfedan Trading Company, and Safran Global Company S.L.U. compete through quality consistency, advanced extraction methods, and strategic export partnerships.

- Asia Pacific holds a 27% regional share, led by high production in Iran and India, while the powder form segment accounts for 46% share, driven by its versatility in food, beverage, and nutraceutical formulations.

Market Segmentation Analysis:

By Form

The powder segment dominates the saffron extract market, accounting for the largest share due to its wide use in food, beverages, and pharmaceutical formulations. Powdered saffron offers high solubility, easy blending, and consistent flavor and color distribution, making it ideal for large-scale processing applications. The liquid form is gaining popularity in beverages, cosmetics, and aromatherapy for its superior absorption and convenience in formulation. The thread segment, although traditional, remains significant in premium culinary uses and luxury cosmetics. Rising demand for natural flavoring and coloring agents continues to strengthen the powder segment’s market leadership.

- For instance, Gohar Saffron Co. is a prominent Iranian saffron exporter, known for high quality, various international certifications (ISO 9001, OHSAS 18001, HACCP, ISO 22000, FDA), and a significant global market presence.

By Grade

Grade I, or premium-quality saffron extract, holds the dominant market share owing to its high concentration of crocin, picrocrocin, and safranal compounds that enhance color, taste, and aroma. This grade is preferred in nutraceuticals, high-end cosmetics, and gourmet foods due to its purity and potency. Grade II finds application in mid-range food and beverage products, while Grades III and IV serve mass-market applications. The increasing consumer preference for authentic and high-quality natural ingredients drives the demand for premium-grade saffron extract globally.

- For instance, high-quality commercial saffron extracts, verified by HPLC testing, commonly have total crocin levels standardized to around 30 mg/g to 60 mg/g (or 3% to 6% w/w), and occasionally up to around 100 mg/g in highly concentrated products.

By Application

The food and beverage segment leads the saffron extract market, supported by rising demand for natural flavoring agents and functional ingredients. Within this segment, functional foods and beverages dominate due to saffron’s antioxidant and mood-enhancing properties. The pharmaceutical and healthcare segment is expanding steadily, driven by its use in traditional and modern medicine formulations for stress relief and cognitive enhancement. The cosmetics and personal care sector also shows strong growth, as saffron extract is widely used in skincare and fragrance products. Increasing awareness of its therapeutic and anti-aging benefits continues to fuel application growth across industries.

Key Growth Drivers

Rising Demand for Natural Ingredients in Food and Cosmetics

The growing consumer preference for clean-label and chemical-free products is driving the demand for saffron extract in food, beverage, and cosmetic industries. Its natural color, aroma, and antioxidant properties make it a popular alternative to synthetic additives. Food manufacturers are increasingly incorporating saffron into premium confectionery, dairy, and functional beverages to enhance product appeal. In cosmetics, saffron extract is valued for its anti-inflammatory and skin-brightening properties. The surge in awareness of natural wellness and sustainable sourcing practices continues to propel saffron’s integration into diverse product formulations globally.

- For instance, Givaudan Active Beauty developed the active ingredient DandErase™, which is derived from saffron petals using green fractionation technology, and this process preserves a high concentration of the active molecules.

Expanding Use in Nutraceuticals and Pharmaceutical Applications

Saffron extract is gaining traction in the nutraceutical and pharmaceutical sectors due to its proven therapeutic benefits. Rich in bioactive compounds like crocin and safranal, it supports mood enhancement, vision improvement, and cognitive function. Manufacturers are developing saffron-based supplements targeting stress management, depression, and age-related disorders. The global shift toward herbal medicine and preventive healthcare further accelerates adoption. Additionally, ongoing clinical studies validating saffron’s medicinal efficacy are expanding its acceptance in regulated pharmaceutical formulations, strengthening its role as a natural bioactive ingredient.

- For instance, Pharmactive Biotech Products developed Affron®, a standardized saffron extract containing 3.5% active compounds (lepticrosalides), verified through HPLC testing.

Growth in Functional Beverages and Dietary Supplements

The increasing demand for functional and health-oriented beverages is a major growth driver for the saffron extract market. Its antioxidant and adaptogenic properties make it a key ingredient in premium wellness drinks and herbal tonics. Beverage producers are introducing saffron-infused teas, energy drinks, and detox formulations targeting urban health-conscious consumers. Likewise, dietary supplement brands are using saffron extracts in capsules and gummies to enhance mood and energy levels. The combination of health benefits and luxury appeal positions saffron extract as a high-value addition in the functional beverage and supplement sectors.

Key Trends and Opportunities

Emergence of Sustainable and Traceable Sourcing Practices

Sustainability and traceability have become central to saffron production, as consumers demand ethical and transparent supply chains. Producers are adopting fair-trade certifications and digital traceability systems to ensure product authenticity. Technology-driven farming techniques, including precision irrigation and post-harvest processing, are improving yield quality and reducing environmental impact. Major brands are forming partnerships with local growers in regions like Iran, Spain, and India to secure consistent supply while empowering rural communities. This trend enhances consumer trust and opens opportunities for premium branding and long-term business collaborations.

- For instance, Verdure Sciences implemented blockchain-based traceability for its saffron ingredient Saffr’Activ®, enabling end-to-end tracking of harvest batches across 42 certified farms in Khorasan Province, Iran.

Product Innovation and Diversification Across Industries

Manufacturers are introducing innovative saffron-based products across diverse applications, ranging from skincare serums and perfumes to fortified foods and herbal supplements. The fusion of saffron with modern delivery systems, such as nano-encapsulation and controlled-release formulations, improves bioavailability and shelf life. Food companies are leveraging its premium status for luxury positioning, while cosmetic brands emphasize saffron’s anti-aging and brightening benefits. The integration of saffron extract into modern health and beauty products reflects a broader industry shift toward natural, functional, and science-backed ingredients.

Key Challenges

High Production Costs and Supply Constraints

The saffron extract market faces challenges due to high cultivation costs and limited supply availability. Saffron harvesting is labor-intensive, requiring over 150,000 flowers to produce a single kilogram of dried stigmas. Seasonal dependency and climatic sensitivity further restrict large-scale production, particularly in key producing regions such as Iran and Kashmir. This scarcity often leads to volatile prices and inconsistent quality, creating barriers for mass-market adoption. The high cost of raw materials limits the competitiveness of saffron-based products against synthetic alternatives in cost-sensitive industries.

Risk of Adulteration and Quality Inconsistency

Adulteration remains a significant challenge in the saffron market, as fraudulent substitutes and artificial colorants compromise product purity. Low-quality saffron and counterfeit extracts negatively affect brand credibility and consumer confidence. Variations in crocin and safranal content also lead to inconsistencies in product performance, particularly in pharmaceuticals and cosmetics. Regulatory bodies are tightening quality control standards, prompting manufacturers to adopt advanced analytical methods such as HPLC and DNA authentication. Ensuring standardized quality and authenticity is crucial to sustaining saffron’s global reputation as a premium natural ingredient.

Regional Analysis

North America

North America holds a 31% share of the saffron extract market, driven by rising demand for natural and functional ingredients in food, supplements, and cosmetics. The United States leads regional consumption, supported by growing awareness of saffron’s health benefits and its inclusion in premium wellness products. Nutraceutical and dietary supplement manufacturers are increasingly adopting saffron extract for mood enhancement and vision care formulations. Expanding clean-label trends, coupled with the popularity of saffron-infused beverages and skincare products, continue to fuel regional growth. Strategic imports from Iran and Spain ensure consistent supply for U.S. and Canadian industries.

Europe

Europe accounts for a 28% market share, supported by strong demand from the food, beverage, and cosmetic sectors. Countries such as Spain, Italy, and France dominate regional production and export of high-quality saffron. The region’s emphasis on clean-label, organic, and traceable sourcing drives adoption in nutraceuticals and personal care formulations. Saffron’s inclusion in functional foods, premium confectionery, and natural fragrances further strengthens market penetration. The European Union’s regulatory support for botanical extracts and rising consumer awareness of saffron’s antioxidant properties contribute to sustained market growth.

Asia Pacific

Asia Pacific holds a 27% share and represents the fastest-growing regional market for saffron extract. India, Iran, and China lead production and consumption, driven by cultural, medicinal, and culinary traditions. The growing nutraceutical and cosmetic industries in India and Japan are expanding saffron’s commercial applications. Rising disposable incomes and consumer preference for herbal and Ayurvedic formulations are boosting demand. Increasing exports from Iran and Afghanistan to regional markets ensure supply stability. Government support for sustainable cultivation and global trade expansion further strengthens Asia Pacific’s position in the saffron extract industry.

Latin America

Latin America commands a 7% market share, driven by growing applications of saffron extract in the food, beverage, and nutraceutical sectors. Brazil and Mexico lead consumption, with expanding middle-class populations supporting premium product adoption. Saffron-infused teas, desserts, and health supplements are gaining popularity among health-conscious consumers. Manufacturers are introducing saffron-based natural cosmetics targeting the organic skincare segment. Although saffron cultivation remains limited, imports from Spain and Iran sustain regional demand. Rising awareness of saffron’s mood-boosting and antioxidant properties continues to promote growth in Latin American markets.

Middle East & Africa

The Middle East & Africa region holds a 7% share, with Iran dominating global saffron production and export. Iran’s favorable climate and traditional expertise make it the world’s largest supplier of high-grade saffron extract. Regional demand is supported by the use of saffron in traditional medicine, culinary applications, and perfumery. The UAE and Saudi Arabia are emerging as key import and processing hubs for value-added saffron products. Africa’s growing pharmaceutical and cosmetic industries, particularly in South Africa and Egypt, present new opportunities for market expansion across this region.

Market Segmentations:

By Form

By Grade

- Grade I (Premium Quality)

- Grade II (Standard Quality)

- Grade III and IV (Lower Grade)

By Application

- Food & beverage

- Pharmaceutical and healthcare

- Cosmetics and personal care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the saffron extract market is moderately fragmented, with several regional and international players competing through quality differentiation, sourcing networks, and product innovation. Key companies such as Safran Global Company S.L.U., Mehr Saffron, Esfedan Trading Company, Iran Saffron Company, and Tarvand Saffron Co. dominate production and export, focusing on premium-grade extracts with high crocin and safranal concentrations. These firms prioritize traceability, organic certification, and sustainable farming to strengthen global presence. European and Middle Eastern producers emphasize fair-trade and eco-friendly practices to meet rising consumer expectations for purity and transparency. Emerging players like Flora Saffron and Saffron Business Company are expanding into nutraceuticals, cosmetics, and functional food sectors through advanced extraction technologies and partnerships. Product innovation, brand credibility, and consistent quality remain the primary competitive factors shaping growth in the global saffron extract industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2023, Mane Kancor inaugurated its saffron extract manufacturing plant in Byadgi, Karnataka, which further expands its operations. The facility is equipped with advanced technologies and implements a continuous extraction process, which enables Mane Kancor to quadruple its production capacity.

- In March 2023, after acquiring similar patents in Europe, Malaysia, and South Africa, ingredient supplier Activ’Inside announced that it has now been granted a patent for its saffron ingredient, Safr’Inside. The ingredient has been included in dietary supplements that target digestion, premenstrual syndrome, menopause, stress management, and sleep.

- In June 2022, Natac, a Spanish biotechnology company acquired INOREAL significantly with an objective to grant the nutraceutical, pharmaceutical, food, animal nutrition, and cosmetic industries access to premium, value-added bioactive ingredients, and ultimately, to improve the health and well-being of consumers through the products.

Report Coverage

The research report offers an in-depth analysis based on Form, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label ingredients will continue to strengthen market growth.

- Expansion in nutraceutical and functional food applications will boost product utilization.

- Rising investments in sustainable and traceable saffron farming will enhance supply reliability.

- Advanced extraction technologies will improve product purity and bioactive retention.

- Increasing use of saffron in skincare and cosmetics will create new growth avenues.

- Strategic collaborations between producers and global distributors will expand market reach.

- Growing awareness of saffron’s therapeutic properties will drive pharmaceutical adoption.

- Premium and organic saffron products will gain more traction among health-conscious consumers.

- Development of saffron-infused beverages and supplements will diversify product portfolios.

- Asia Pacific will remain the leading production and export hub supporting long-term market expansion.