Market Overview

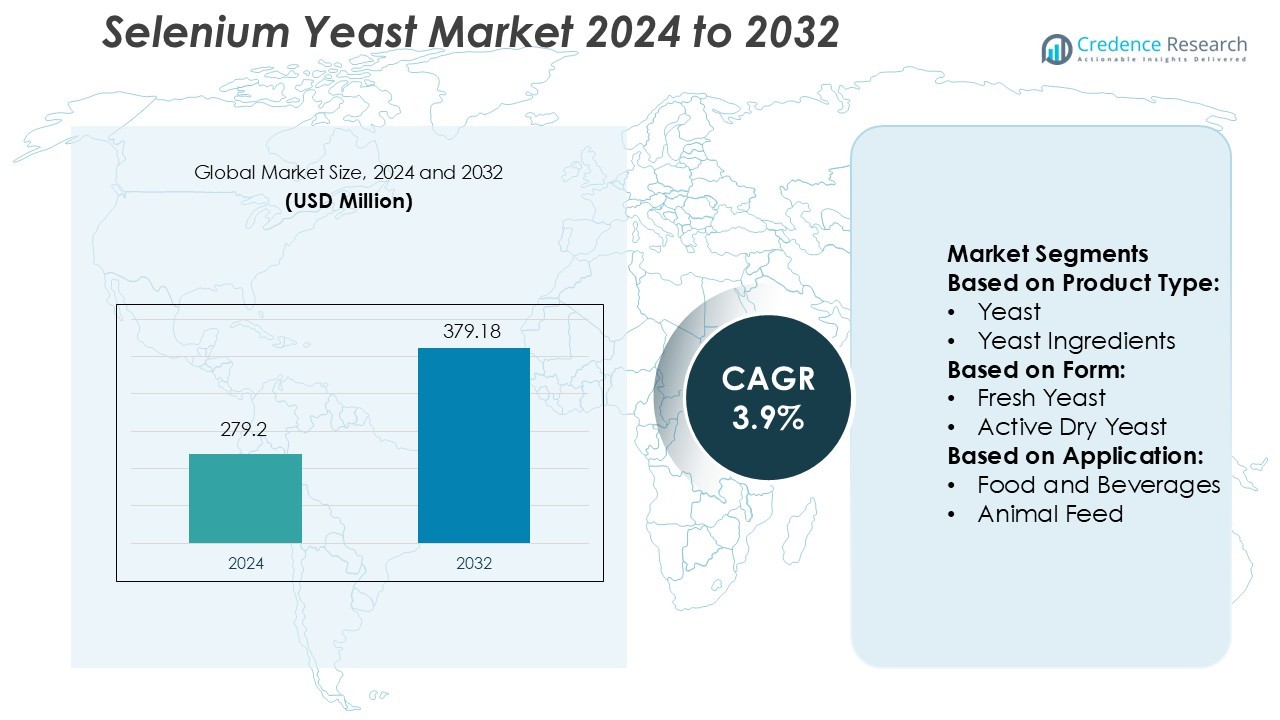

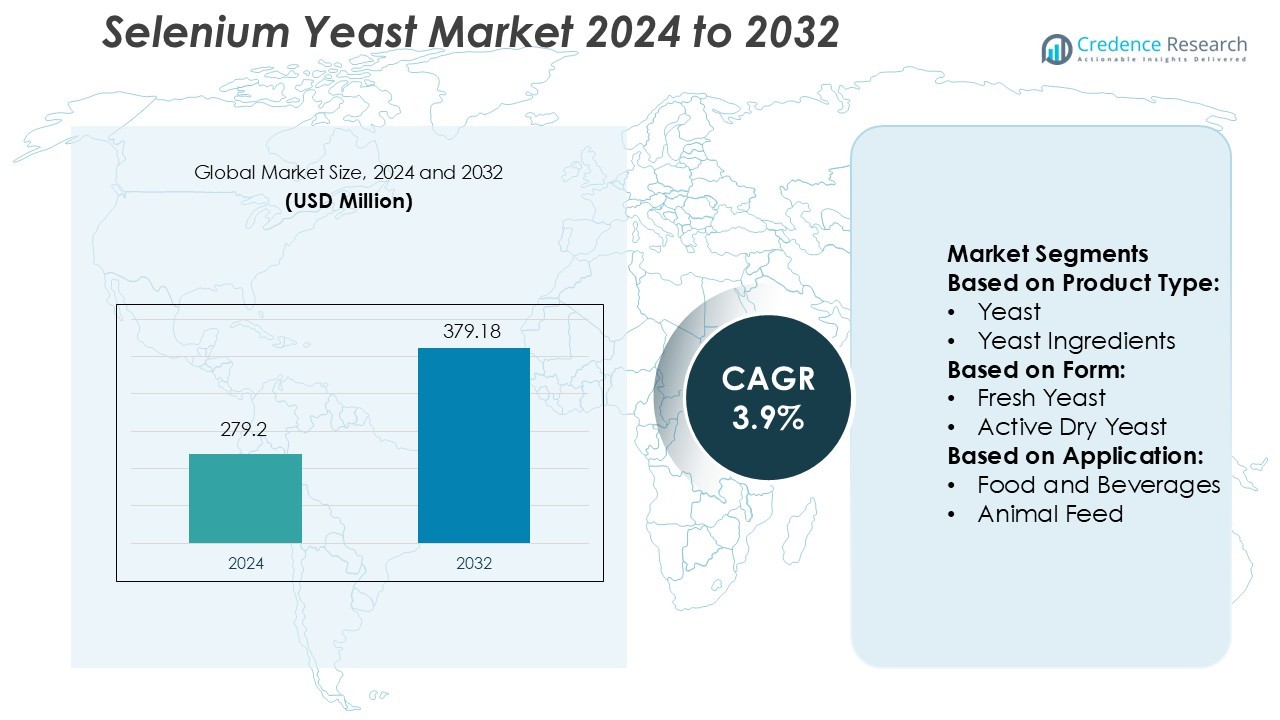

Selenium Yeast Market size was valued USD 279.2 million in 2024 and is anticipated to reach USD 379.18 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Selenium Yeast Market Size 2024 |

USD 279.2 Million |

| Selenium Yeast Market, CAGR |

3.9% |

| Selenium Yeast Market Size 2032 |

USD 379.18 Million |

The Selenium Yeast Market is shaped by major players such as ADM, Biorigin, Novus, Pharma Nord, Garuda, Miro Chembiotech, Johncan Bio, Aleris, Selko, and Cypress Systems Inc. These companies focus on innovation in fermentation technology, product purity, and bioavailability enhancement to cater to diverse applications in food, feed, and nutraceutical industries. Strategic collaborations, capacity expansions, and sustainability-driven production practices remain central to their competitive strategies. North America leads the global market with a 34% share, supported by high consumer awareness, advanced nutritional supplement industries, and strong adoption across animal feed and human health segments.

Market Insights

- The Selenium Yeast Market was valued at USD 279.2 million in 2024 and is projected to reach USD 379.18 million by 2032, growing at a CAGR of 3.9%.

- Rising demand for functional food, nutraceuticals, and feed supplements is a key market driver enhancing global selenium yeast consumption.

- Trends such as clean-label production, non-GMO certification, and sustainable fermentation are reshaping competitive strategies among manufacturers.

- Market restraints include high production costs, limited standardization across regulations, and fluctuating raw material availability.

- North America leads with a 34% market share, followed by Europe at 28% and Asia-Pacific at 25%; the feed segment accounts for the largest share due to strong adoption in livestock and poultry nutrition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The yeast segment dominates the Selenium Yeast Market with a 67% share in 2024. Its wide use in dietary supplements, animal nutrition, and functional foods drives strong demand. Yeast provides a bioavailable selenium source that enhances immune response and antioxidant activity. Manufacturers prefer yeast-based formulations due to their high stability and natural enrichment properties. The growing focus on preventive healthcare and rising use of fortified food products further strengthen the dominance of this segment across both human and animal nutrition sectors.

- For instance, Novus’s ZORIEN® SeY 3000 Prilled Yeast Feed Additive uses a strain of Saccharomyces cerevisiae enriched with organic selenium, delivering a measured selenium content of 3 000 mg/kg in the finished feed additive.

By Form

The active dry yeast segment holds the largest share of 52% in 2024, supported by its long shelf life, high viability, and easy storage. This form offers better nutrient stability and selenium retention during processing, making it suitable for feed and food formulations. Feed manufacturers increasingly use active dry yeast to improve animal gut health and boost nutrient absorption. The segment’s cost-effectiveness and compatibility with diverse production systems have positioned it as the preferred form in commercial feed and food-grade applications.

- For instance, Garuda International’s SelenoExcell® High Selenium Yeast (Product Code SELENOEXCELL) offers a measured selenium content of 1200–1380 ppm (parts per million) in the finished yeast powder.

By Application

The animal feed segment leads the market with a 61% share in 2024, driven by rising awareness of selenium’s role in livestock health and reproduction. Selenium-enriched yeast enhances feed efficiency, immunity, and growth performance in poultry, swine, and dairy cattle. Feed producers prioritize it as a safer alternative to inorganic selenium sources. The increasing demand for high-quality animal protein and fortified feed products, combined with regulations favoring organic additives, continues to propel the segment’s leadership in the global selenium yeast market.

Key Growth Drivers

- Rising Demand for Functional Food and Nutraceuticals

The growing awareness of health benefits associated with selenium yeast is driving its use in functional foods and nutraceuticals. Selenium yeast offers superior bioavailability compared to inorganic forms, enhancing immune function and antioxidant defense. Food manufacturers are integrating selenium yeast into fortified products such as cereals, dairy, and dietary supplements. The increasing consumer shift toward preventive healthcare and immunity-boosting products further supports market expansion across both developed and emerging economies.

- For instance, Pharma Nord’s patented selenium-yeast product each tablet contains 100 µg of selenium in the form of selenomethionine and more than 20 other organically bound selenium compounds.

- Expanding Use in Animal Feed Formulations

The use of selenium yeast in livestock and poultry feed is increasing due to its role in improving fertility, growth performance, and disease resistance. Farmers and feed manufacturers prefer selenium yeast over synthetic alternatives because of its natural composition and higher absorption rates. The rising focus on enhancing meat, milk, and egg quality through nutrient enrichment boosts demand. In addition, growing adoption of organic feed solutions aligns with global sustainability standards, fostering consistent market growth.

- For instance, Biorigin’s “Selemax” organic-selenium yeast product is offered at concentrations of 1,000 ppm and 2,000 ppm selenium content. In at least one documented study concerning weaned piglet nutrition.

- Growing Applications in Pharmaceutical and Clinical Nutrition

Selenium yeast’s role in reducing oxidative stress and supporting metabolic health drives its adoption in pharmaceutical and clinical nutrition segments. It is widely used in formulations aimed at treating cardiovascular, thyroid, and immune-related disorders. Pharmaceutical companies are investing in R&D to develop standardized selenium yeast-based supplements. The rising incidence of lifestyle-related diseases and increasing preference for natural micronutrient sources accelerate demand in hospitals, clinics, and wellness centers worldwide.

Key Trends & Opportunities

- Increasing Preference for Organic and Non-GMO Ingredients

Consumers are showing a growing preference for organic, non-GMO, and clean-label selenium yeast products. Manufacturers are adopting sustainable fermentation processes and sourcing organic yeast strains to meet this demand. The trend aligns with global clean-label food movements and stricter labeling regulations. Companies focusing on traceability, eco-friendly production, and transparent sourcing are expected to gain competitive advantage and attract health-conscious consumers in premium product categories.

- For instance, Selko’s product Optimin SeY is analyzed for both total selenium and selenomethionine (SeMet) content in each batch, and its batches are released only if SeMet accounts for above 63% of total selenium.

- Technological Advancements in Yeast Fermentation and Processing

Innovations in yeast fermentation technology are improving selenium incorporation efficiency and product stability. Enhanced bioprocessing methods enable higher selenium retention and uniform nutrient profiles in final products. Automation and precision fermentation techniques also reduce production costs and environmental impact. These advancements create opportunities for manufacturers to deliver consistent, high-quality selenium yeast suitable for various applications in food, feed, and pharmaceuticals.

- For instance, Cypress Systems’ product SelenoExcell® High Selenium Yeast 1200 is produced via an active, aseptic aerobic fermentation of a non-GMO strain of Saccharomyces cerevisiae.

- Growing Penetration in Emerging Markets

Expanding urbanization, rising disposable incomes, and growing health awareness in regions such as Asia-Pacific and Latin America are opening new growth avenues. Consumers in these markets increasingly demand fortified foods and supplements for preventive health. Governments promoting nutrition programs and fortification initiatives further boost demand. Local manufacturers partnering with international firms to improve production capacity and distribution networks are expected to accelerate regional market penetration.

Key Challenges

- High Production and Raw Material Costs

The production of selenium yeast involves complex bioprocessing and strict quality control measures, leading to higher operational costs. Yeast strain cultivation, selenium enrichment, and drying processes require specialized equipment and skilled labor. Additionally, fluctuations in raw material prices, including selenium compounds, impact profitability. These challenges may limit market entry for small-scale producers and affect product affordability in price-sensitive regions.

- Regulatory Barriers and Standardization Issues

The selenium yeast market faces regulatory challenges related to permissible selenium levels and product labeling across regions. Variations in international standards create barriers for global manufacturers aiming for uniform market access. The lack of harmonized safety and efficacy guidelines also affects product registration and approval timelines. Ensuring compliance with food safety authorities such as EFSA, FDA, and FSSAI adds to operational complexity and delays commercialization.

Regional Analysis

North America

North America holds the largest share of 34% in the Selenium Yeast Market due to its strong demand across dietary supplements and animal nutrition sectors. The region benefits from established nutraceutical and feed industries supported by advanced bioprocessing technologies. Rising consumer awareness of selenium’s role in disease prevention further boosts product adoption. The United States remains a major contributor with high intake of fortified foods and supplements. Government health initiatives promoting micronutrient fortification also encourage selenium yeast inclusion in food and pharmaceutical formulations.

Europe

Europe accounts for 28% of the global market share, driven by the rising demand for organic and non-GMO nutritional ingredients. Countries such as Germany, France, and the U.K. lead the regional market with well-developed functional food industries and strict quality standards. The European Food Safety Authority (EFSA) regulations have encouraged producers to invest in clean-label selenium yeast products. Increased application in animal feed and human health supplements supports steady market growth. Manufacturers are focusing on sustainability and traceability, aligning with Europe’s eco-conscious consumer base.

Asia-Pacific

Asia-Pacific commands a 25% market share, emerging as one of the fastest-growing regions in the Selenium Yeast Market. Growth is fueled by increasing disposable incomes, expanding livestock sectors, and heightened health awareness in countries such as China, India, and Japan. Governments promoting nutrition enhancement programs are further driving consumption. The region also benefits from growing local production capacities and lower manufacturing costs. Global manufacturers are expanding partnerships and distribution networks in the region to meet surging demand for nutritional and feed-grade selenium yeast.

Latin America

Latin America represents a 7% share of the Selenium Yeast Market, with Brazil and Mexico leading the regional growth. The expansion of the livestock industry and increasing adoption of organic feed formulations are key growth drivers. Rising awareness of the nutritional benefits of selenium in animal and human diets is boosting product uptake. Regional producers are enhancing their production capabilities to meet international export standards. The growing nutraceutical industry in South America also contributes to market expansion, supported by rising consumer health consciousness.

Middle East & Africa

The Middle East & Africa region holds a 6% market share and is gradually gaining momentum through expanding livestock and poultry sectors. The region’s focus on improving food security and animal productivity drives selenium yeast demand. South Africa, Saudi Arabia, and the UAE are key contributors due to rising health supplement consumption and growing feed fortification initiatives. Increasing government efforts to reduce micronutrient deficiencies and improve animal health are fostering adoption. However, limited local production facilities continue to constrain wider market penetration.

Market Segmentations:

By Product Type:

By Form:

- Fresh Yeast

- Active Dry Yeast

By Application:

- Food and Beverages

- Animal Feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Selenium Yeast Market features key players including Novus, Garuda, ADM, Pharma Nord, Miro Chembiotech, Johncan Bio, Biorigin, Aleris, Selko, and Cypress Systems Inc. The Selenium Yeast Market is characterized by moderate consolidation, with competition driven by innovation, quality, and product differentiation. Companies are investing heavily in research to enhance selenium bioavailability and stability through advanced fermentation and drying technologies. Strategic collaborations between feed manufacturers, nutraceutical firms, and biotechnology companies are strengthening production capabilities and global distribution networks. The market also reflects a growing shift toward sustainable and clean-label production practices to align with evolving consumer and regulatory demands. Continuous product launches, certifications, and clinical validations are shaping competitive strategies and expanding brand visibility worldwide.

Key Player Analysis

- Novus

- Garuda

- ADM

- Pharma Nord

- Miro Chembiotech

- Johncan Bio

- Biorigin

- Aleris

- Selko

- Cypress Systems Inc.

Recent Developments

- In June 2025, MicroBioGen, an Australian yeast biotechnology company, and Lesaffre, a global fermentation company, established an exclusive worldwide licensing and collaboration agreement to develop yeast solutions for the baking, food, and biochemicals markets. The partnership combines MicroBioGen’s yeast strain platform and 20-year genetic library with Lesaffre’s bioengineering capabilities, Research and Development infrastructure, and global production network to improve efficiency and sustainability across industries.

- In December 2024, Yeastup AG, a Swiss food technology company, secured CHF in Series A funding to establish a large-scale production facility. The company plans to convert a former dairy facility in Switzerland to process more than 20,000 tons of spent brewer’s yeast annually.

- In August 2024, AB Mauri North America acquired Omega Yeast Labs LLC. Operating out of a 14,000-square-foot facility in Chicago, Omega Yeast Labs focuses on research, development, and production, with additional locations throughout the Midwest. AB Mauri views this acquisition as a strategic complement to its AB Biotek division.

- In April 2024, Lesaffre, the world’s largest yeast producer based in France, has opened a new yeast manufacturing facility in Malang Regency, East Java, Indonesia. The facility is operated through PT Lesaffre Sari Nusa, a joint venture with local partner PT Citra Bonang.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for selenium yeast will continue to rise due to its high bioavailability in food and feed applications.

- Nutraceutical companies will increase R&D investment to develop clinically tested selenium yeast supplements.

- Feed manufacturers will expand usage to improve livestock productivity and animal health performance.

- Advancements in fermentation and bioprocessing will enhance selenium conversion efficiency and product consistency.

- Regulatory support for natural and organic additives will strengthen market penetration across developed regions.

- Emerging markets in Asia-Pacific and Latin America will witness strong consumption growth.

- Clean-label and non-GMO product preferences will drive sustainable production innovations.

- Partnerships between global producers and local distributors will boost supply chain efficiency.

- Increased awareness of preventive healthcare will expand selenium yeast adoption in human nutrition.

- Companies focusing on traceability and eco-friendly sourcing will gain a long-term competitive edge.