Market Overview

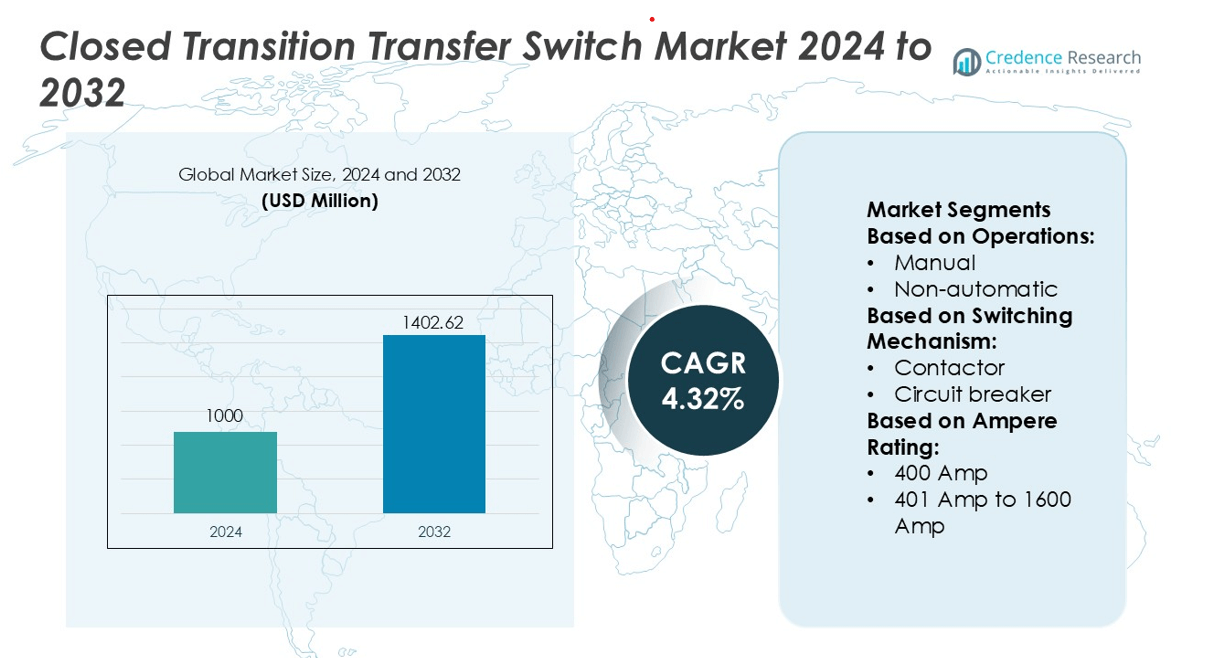

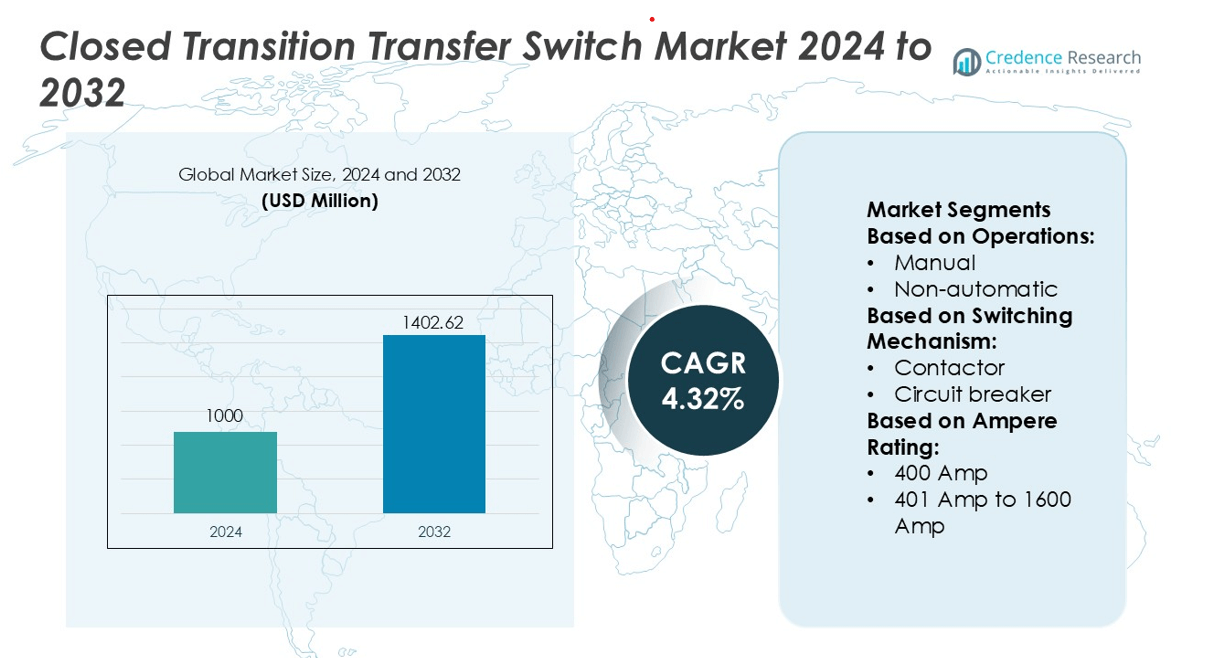

Closed Transition Transfer Switch Market size was valued USD 1000 million in 2024 and is anticipated to reach USD 1402.62 million by 2032, at a CAGR of 4.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Transition Transfer Switch Market Size 2024 |

USD 1000 million |

| Closed Transition Transfer Switch Market, CAGR |

4.32% |

| Closed Transition Transfer Switch Market Size 2032 |

USD 1402.62 million |

The Closed Transition Transfer Switch Market features strong competition among global power equipment and energy management companies offering seamless switching solutions for critical infrastructure. Vendors invest in synchronization controls, digital monitoring, and compact switchgear to serve hospitals, data centers, utility networks, and industrial automation. Product portfolios focus on safe, interruption-free power transfer and compatibility with generators, renewables, and microgrids. North America leads the global market with 38% share, driven by advanced electrical infrastructure, strict reliability standards, and high concentration of commercial and mission-critical facilities. Growing use of backup power units and modernization of aging electrical systems continues to support regional market dominance.

Market Insights

- Closed Transition Transfer Switch Market size was valued USD 1000 million in 2024 and is anticipated to reach USD 1402.62 million by 2032, at a CAGR of 4.32%.

- Demand grows due to rising need for seamless power transfer in hospitals, data centers, industrial plants, and utilities, where interruption-free switching protects sensitive equipment.

- Smart controls, digital monitoring, and compact switchgear designs shape market trends as vendors enhance safety, synchronization speed, and compatibility with renewable power systems.

- Competition remains strong as manufacturers expand product portfolios, offer remote diagnostics, and target commercial and industrial upgrades, while high installation cost and skilled labor needs limit faster adoption.

- North America leads with 38% share due to strict reliability standards and strong backup power usage, while Asia Pacific shows rapid growth from industrial expansion; automatic switches hold the largest segment share thanks to higher adoption in mission-critical operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Operations

Automatic transfer switches hold the dominant share due to higher adoption in commercial, industrial, and mission-critical facilities. They ensure fast response, stable power delivery, and reduced downtime during grid failures. Facilities such as data centers, hospitals, and manufacturing plants choose automatic systems to support uninterrupted operations and safety compliance. Manual and non-automatic models serve low-duty applications but lack the speed needed for continuous load protection. By-pass isolation units gain traction in utility and telecom sites where maintenance access is required without interrupting the load. The shift toward automation keeps automatic switches in the leading position with the highest market share.

- For instance, Caterpillar offers ATS models with a transfer time as low as 40 milliseconds and supports load capacities up to 5,000 amperes. These units integrate digital microprocessor controls and event logging capable of storing 300 operational records. Caterpillar also provides UL 1008 listed systems for high-reliability installations in hospitals and data centers.

By Switching Mechanism

Contactor-based systems represent the dominant sub-segment with the largest market share due to high switching speed, lower maintenance needs, and suitability for frequent load transfers. They support applications where quick transition and reduced electrical stress are critical. Circuit breaker-based mechanisms hold a steady share in heavy-duty and high-fault environments, delivering robust fault protection and arc handling. Growth in industrial automation, commercial buildings, and renewable integration supports wider contactor deployment. Their compact size, lower wiring complexity, and long mechanical life strengthen adoption across low- and medium-voltage installations.

- For instance, Generac’s TX series automatic transfer switches use heavy-duty, contactor-based architectures with transfer times of less than 20 milliseconds and support load capacities up to 800 amperes and beyond in industrial applications.

By Ampere Rating

Switches rated 401 Amp to 1600 Amp lead the market and account for the highest share, driven by widespread use in commercial complexes, industrial plants, data centers, hospitals, and telecom sites. These facilities require strong load-handling capability with reliable transfer during outages. Units ≤ 400 Amp are common in residential and small commercial buildings but hold a smaller share due to limited load capacity. Products above 1600 Amp serve heavy industries, utility substations, and large campuses. Continuous electrification, backup power requirements, and expansion of critical infrastructure strengthen demand for the 401–1600 Amp category.

Key Growth Drivers

Growing Demand for Reliable Backup Power

Demand for continuous electricity in hospitals, data centers, telecom sites, and industrial plants boosts installation of closed transition transfer switches. These switches support seamless switching between power sources without visible interruption. Rising digital workloads, cloud adoption, and smart factory expansion create need for clean and disturbance-free transfers. Growing grid instability and outage frequency also push end users toward safer transfer technology. Manufacturers integrate advanced microprocessor controls and self-diagnostic systems, improving safety and resilience. Increased investment in mission-critical infrastructure further accelerates market adoption across developed and emerging economies.

- For instance, AEG Power Solutions equips its Protect UPS series with DSP-controlled static transfer systems capable of switching in under 5 milliseconds and offering single-module solutions with capacities up to 600 kVA to ensure high reliability in industrial applications.

Expansion of Renewable and Distributed Energy Systems

Rapid deployment of solar, wind, and gas-based distributed power systems drives adoption of closed transition switches. Hybrid facilities require smooth power shifting between utility and on-site generation. Commercial and residential projects seek grid-synchronized transitions to prevent flickers, stoppages, and equipment damage. Government incentives and carbon-reduction mandates push organizations toward cleaner power management setups. Integration with generators and energy storage strengthens demand in factories and commercial buildings. Rising installation of microgrids and CHP plants increases the need for advanced switching solutions that can maintain power quality during load transfer.

- For instance, Midwest Electric Products supplies closed transition transfer solutions integrated with Honeywell Stryker and Allen-Bradley PLC platforms, where individual switchgear units support continuous loads up to 5,000 Amps.

Growth in Industrial Automation and Electrification

Industries accelerate electrification to improve productivity, cut fuel costs, and meet sustainability targets. Automated machinery, control systems, and production lines cannot afford downtime or voltage disturbance. Closed transition transfer switches ensure stable changeover for critical loads such as conveyors, robotics, chemical heaters, and refinery pumps. Rapid growth of smart factories, logistics automation, and cold-chain infrastructure fuels new deployment. Oil and gas, mining, semiconductor fabs, and pharmaceutical units adopt advanced transfer equipment to avoid shutdown losses. Industrial investment in digital monitoring and IoT-based controls further supports long-term market penetration.

Key Trends & Opportunities

Integration of Digital Monitoring and Smart Controls

Transfer switch manufacturers add remote diagnostics, predictive alerts, and real-time monitoring. Facilities gain visibility into switching cycles, load status, and fault events. Cloud-connected interfaces help operators detect failures before they disrupt operations. Smart control logic minimizes switching time and reduces wear on electrical components. The shift toward automation in commercial and utility-scale projects creates strong opportunity for digital-ready switchgear. Software-defined maintenance and energy analytics provide recurring revenue for vendors.

- For instance, Cummins’ PowerCommand® Cloud remote-monitoring system offers 24/7 visibility of multi-site power systems—enabling real-time notifications and remote control of generator sets, transfer switches and auxiliary assets.

Rising Adoption in Data Centers and Healthcare Facilities

Data centers expand due to increased streaming, edge computing, and AI workloads. Surge in hyperscale facilities boosts demand for closed transition switches paired with UPS and standby generators. Healthcare buildings invest in zero-downtime electrical systems for life-support equipment, imaging machines, and surgical units. Government regulations require hospitals to maintain safe emergency backup. Growing private healthcare investments in Asia, Latin America, and the Middle East open new market opportunities.

- For instance, Eaton’s power-frame type automatic transfer switches support continuous current ratings up to 5,000 A and system voltages up to 600 V AC, with withstand closing ratings of 100 kA in 0.05 s and 200 kA for specific fuse classes.

Growth of Modular and Retrofit Installations

A growing segment of customers upgrades legacy power systems with closed transition designs. Modular, compact, and plug-and-play equipment enables quicker deployment in factories and commercial buildings. Vendors develop scalable switchgear to serve schools, airports, shopping malls, and high-rise projects. Replacement of obsolete open-transition units improves energy performance, stability, and safety. Retrofit demand creates long-term business opportunity for service providers and system integrators.

Key Challenges

High Initial Installation Cost

Closed transition transfer switches cost more than open transition types due to synchronization components, monitoring controls, and protective circuits. Small commercial buildings and residential users often choose low-cost options despite power quality risks. Installation requires skilled technicians and proper generator-utility coordination, which increases project expense. Budget constraints in developing nations limit adoption, especially for non-critical facilities. Manufacturers address the issue by offering rental models, financing, and modular low-amp systems, but price remains a significant barrier for cost-sensitive buyers.

Complex Integration and Regulatory Compliance

Closed transition switches must meet grid-synchronization rules and utility safety standards. Incorrect configuration can cause back-feeding or equipment damage. Facilities must coordinate with utilities for testing, inspection, and approval before commissioning. Integration with older generators, electrical panels, or building automation systems can be complex. End users require trained electricians and technicians for safe operation. Delays in approval and compliance procedures slow large project rollouts, especially in hospitals and data centers with strict regulatory frameworks.

Regional Analysis

North America

North America holds the largest share in the Closed Transition Transfer Switch Market with close to 38% share. Strong penetration of data centers, telecom hubs, and industrial automation drives installation of advanced switching systems. Hospitals and government buildings prioritize zero-interruption power supply, supporting high adoption in the U.S. and Canada. Growing renewable integration and backup generator deployments also expand usage in commercial and residential sectors. Strict electrical safety standards and regular upgrade cycles further accelerate product demand. Manufacturers partner with utilities and EPC contractors to deliver synchronized switching solutions across mission-critical infrastructures.

Europe

Europe accounts for 27% share of the global market, supported by smart grid modernization and strict power quality regulations. Industrial automation in Germany, manufacturing expansion in Eastern Europe, and growing digital infrastructure boost deployment of closed transition technology. Hospitals, airports, and railway networks invest in seamless power continuity systems to protect critical equipment. The region also records increasing adoption in cold-chain logistics and real estate projects. EU carbon-reduction targets and renewable energy integration push facilities to adopt synchronized switching and hybrid power setups. Retrofit projects further create steady market demand.

Asia Pacific

Asia Pacific captures 24% share and remains the fastest-growing regional market. Massive data center construction, industrial expansion, and rising commercial infrastructure in China, India, Japan, and South Korea drive installation of closed transition switches. Rapid urbanization and increasing frequency of voltage fluctuations strengthen adoption in manufacturing plants and high-rise buildings. Hospitals, IT parks, and educational institutions upgrade power management systems for stable operations. Government programs promoting reliable electricity and backup generation support market growth. Foreign investments in industrial parks and semiconductor plants create strong future opportunities for advanced transfer switching solutions.

Latin America

Latin America holds 6% share of the market, supported by expansion in commercial construction, mining, and utilities. Power fluctuation issues and grid instability encourage businesses to adopt seamless transfer systems. Brazil and Mexico lead in demand from data centers, industrial plants, and healthcare facilities. Rising adoption of diesel and gas backup generators in commercial buildings also increases switch installations. However, budget constraints limit adoption among smaller facilities. International manufacturers partner with regional distributors to improve market reach and provide maintenance support.

Middle East & Africa

The Middle East & Africa region accounts for 5% share, driven by strong power infrastructure investments and rapid growth in oil and gas, airports, and smart city projects. Gulf nations deploy closed transition units to support hospitals, high-rise buildings, and government facilities. Data centers expand due to cloud adoption and digital transformation programs. Africa shows rising demand in mining and telecom towers, though adoption rates remain slower due to cost barriers. International suppliers gain traction through turnkey EPC contracts and utility-scale backup generation programs.

Market Segmentations:

By Operations:

By Switching Mechanism:

- Contactor

- Circuit breaker

By Ampere Rating:

- 400 Amp

- 401 Amp to 1600 Amp

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Closed Transition Transfer Switch Market players such as Caterpillar, Kohler, Generac Power Systems, AEG Power Solutions, Midwest Electric Products, Cummins, Eaton, ABB, Briggs & Stratton, and General Electric. The Closed Transition Transfer Switch Market focuses on technology upgrades, advanced control logic, and higher safety standards. Manufacturers prioritize seamless power transfer, faster synchronization, and protection against voltage disturbances to support mission-critical applications in data centers, hospitals, and industrial facilities. Companies invest in digital monitoring, remote diagnostics, and automated testing features to reduce downtime and improve reliability. Product portfolios continue shifting toward smart, compact, and scalable designs that fit both retrofit and new installation projects. Strong distribution networks and partnerships with EPC contractors, electrical integrators, and generator suppliers help expand market reach. Vendors also compete through after-sales service, preventive maintenance plans, and compliance with regional electrical regulations, strengthening customer loyalty and contract retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- Kohler

- Generac Power Systems

- AEG Power Solutions

- Midwest Electric Products

- Cummins

- Eaton

- ABB

- Briggs & Stratton

- General Electric

Recent Developments

- In July 2025, ABB products integrate digital control and predictive maintenance features to support smart grids and renewable energy setups. Their focus is on providing high-reliability switches used in hospitals, data centers, and manufacturing plants with energy efficiency and operational continuity.

- In August 2024, AEG Power Solutions introduced new highly reliable analog controlled Switch Mode Power Supplies (SMPS) modules, which likely support improvements in power switching technologies relevant to transfer switches, enhancing performance and reliability in industrial applications.

- In March 2023, Cummins Inc. expanded its North American product line with the release of the PowerCommand B-Series transfer switches, which feature bypass-isolation functionality and are available in capacities ranging from 1200 to 3000 amps

Report Coverage

The research report offers an in-depth analysis based on Operations, Switching Mechanism, Ampere Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as data centers and cloud facilities expand worldwide.

- Hospitals and critical care buildings will continue to adopt zero-downtime switching systems.

- Industrial automation will drive higher installation volumes across factories and processing units.

- Renewable energy and microgrid integration will boost synchronized transfer switch deployment.

- Digital monitoring and remote diagnostics will become standard features in modern switchgear.

- Compact and modular designs will create more opportunities in retrofit and small commercial projects.

- Manufacturers will invest in smart control software to improve switching accuracy and system safety.

- Emerging economies will show faster adoption due to power reliability challenges and growing infrastructure.

- Service-based revenue from maintenance, remote support, and lifecycle management will expand.

- Partnerships with EPC contractors and generator suppliers will strengthen global distribution.