Market Overview

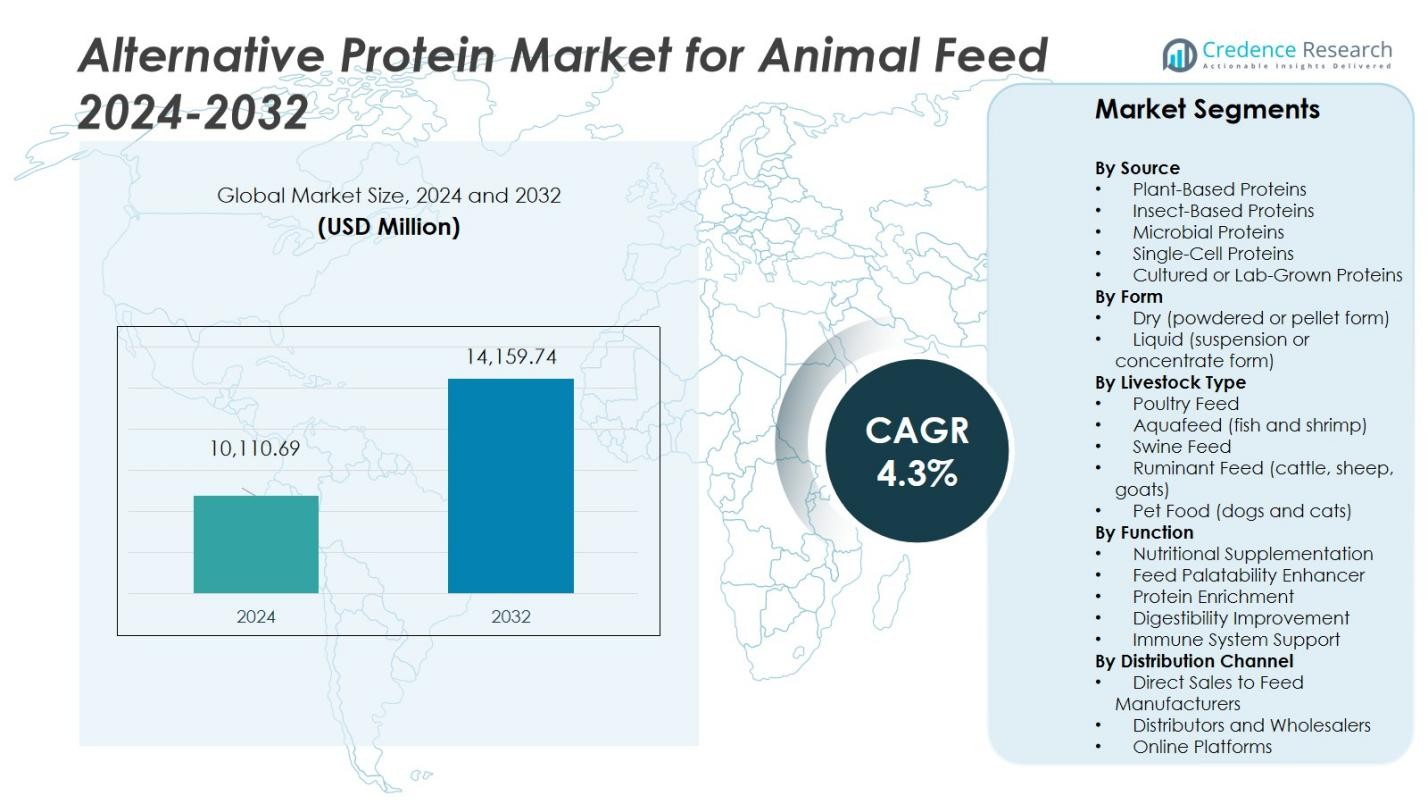

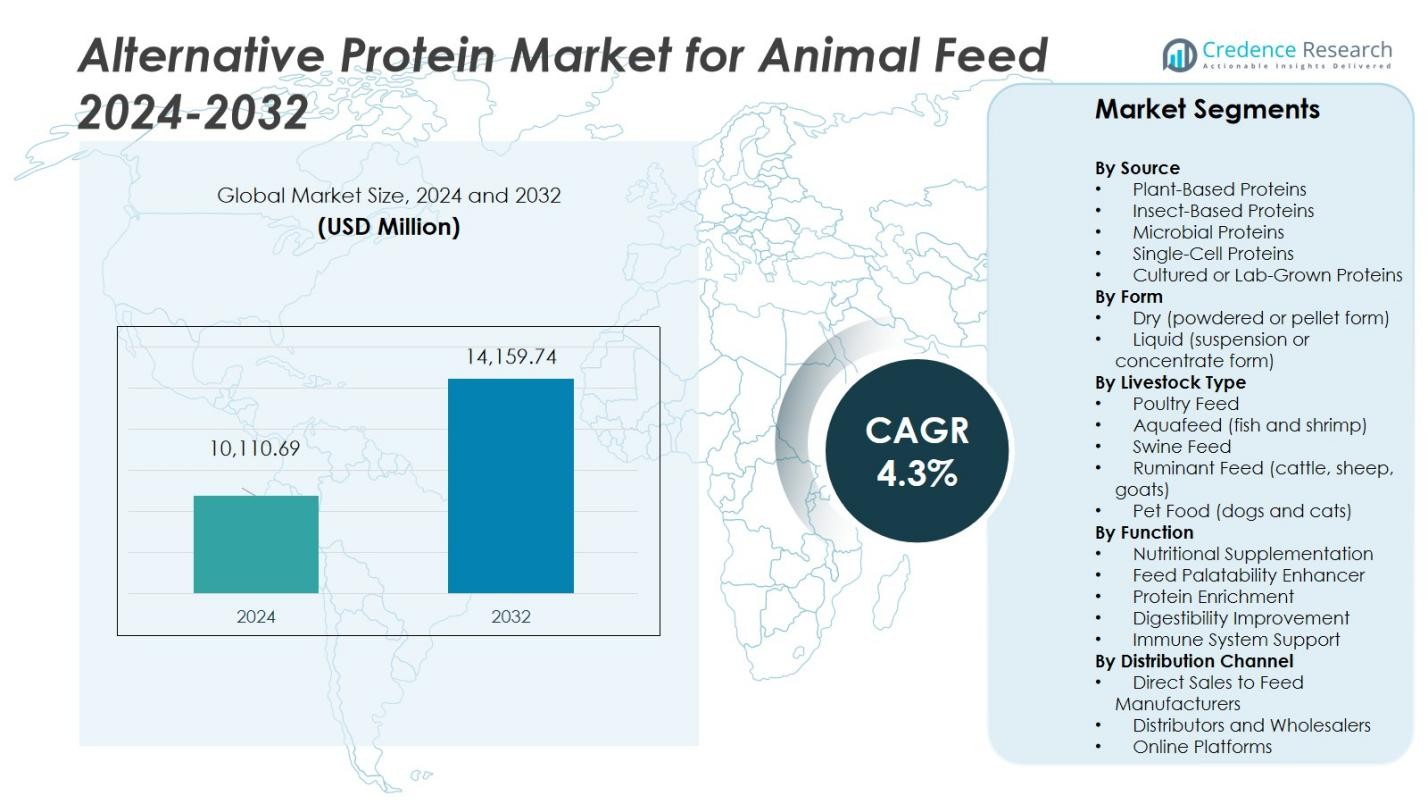

The Alternative Protein Market for Animal Feed was valued at USD 10,110.69 million in 2024 and is anticipated to reach USD 14,159.74 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alternative Protein Market for Animal Feed Size 2024 |

USD 10,110.69 Million |

| Alternative Protein Market for Animal Feed , CAGR |

4.3% |

| Alternative Protein Market for Animal Feed Size 2032 |

USD 14,159.74 Million |

The Alternative Protein Market for Animal Feed is shaped by prominent players such as Innovafeed, Angel Yeast, Darling Ingredients, Nordic Soy, CHS Inc., Deep Branch Biotechnology, Hamlet Protein, Ynsect, DuPont, and AgriProtein GmbH. These companies focus on sustainable protein innovation through insect, microbial, and plant-based sources to meet global feed demand. Strategic collaborations, R&D investments, and capacity expansion drive their competitive positioning across poultry, aquaculture, and pet food sectors. North America leads the market with a 33% share in 2024, supported by advanced feed technologies and sustainability-focused policies. Europe follows with 29%, driven by strong regulatory frameworks and extensive insect protein production facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alternative Protein Market for Animal Feed was valued at USD 10,110.69 million in 2024 and is expected to reach USD 14,159.74 million by 2032, growing at a CAGR of 4.3%.

- Rising demand for sustainable and eco-friendly protein sources drives market growth, with feed manufacturers shifting toward plant-based, insect, and microbial proteins to reduce environmental impact and ensure nutritional efficiency.

- Key trends include increasing adoption of insect and single-cell proteins, technological advancements in fermentation and extraction processes, and growing partnerships between biotechnology firms and feed producers.

- The market is moderately consolidated, with major players such as Innovafeed, Angel Yeast, Darling Ingredients, and DuPont leading through innovation, R&D investments, and strategic collaborations for large-scale production.

- Regionally, North America dominates with a 33% share, followed by Europe at 29%, while plant-based proteins lead the source segment with 45% share in 2024, supported by strong adoption in poultry and aquafeed applications.

Market Segmentation Analysis:

By Source

Plant-based proteins dominate the Alternative Protein Market for animal feed, accounting for 45% of total market share in 2024. Soy and pea proteins are widely used due to their rich amino acid profiles, digestibility, and stable supply chain. Their acceptance among feed manufacturers stems from cost-effectiveness and scalability compared to emerging options. Insect-based and microbial proteins are rapidly gaining attention for sustainability and high nutrient density. However, plant-based sources continue to lead, driven by established processing technologies and consistent global demand from poultry and aquafeed producers.

- For instance, Ingredion launched a new pea protein designed to maintain softness in pet treats, highlighting the growing application of pea proteins in animal nutrition.

By Form

The dry form segment holds the leading position with 70% of the market share in 2024. Dry proteins are preferred for their longer shelf life, easy transportation, and compatibility with pelleted feed formulations. Feed producers value their stable quality and blending flexibility during feed manufacturing. The liquid form, though smaller, is expanding steadily, mainly for specialized applications in aquafeed and pet nutrition. The dominance of the dry segment is supported by efficient bulk handling and lower storage costs across industrial-scale feed operations.

- For instance, SARVAL produces high-quality dried poultry proteins for pet food and aquafeed across the UK and Europe, utilizing a high-temperature sterilization process to ensure product safety and quality.

By Livestock Type

The poultry feed segment leads the market, representing about 38% of the total share in 2024. Rising global poultry consumption and demand for high-protein feed blends have accelerated adoption. Feed producers are integrating plant-based and insect proteins to improve growth rates and gut health in broilers and layers. Aquafeed follows closely, driven by sustainable protein sourcing needs in fish and shrimp farming. Poultry’s dominance is further reinforced by large-scale commercial production and ongoing research into cost-efficient protein alternatives that maintain feed conversion efficiency.

Key Growth Drivers

Rising Demand for Sustainable and Eco-Friendly Feed Sources

Growing environmental concerns and pressure to reduce livestock-related emissions drive the shift toward sustainable protein alternatives. Feed manufacturers are prioritizing plant-based, insect, and microbial proteins to lower carbon footprints and dependence on traditional soy and fishmeal. These sources offer efficient land and water use, aligning with global sustainability goals. Regulatory support promoting circular economy practices further strengthens adoption. Producers across poultry, aquaculture, and pet food sectors are increasingly investing in eco-friendly feed formulations to meet consumer and environmental expectations.

- For instance, Nestlé Purina launched its “Beyond Nature’s Protein” pet food line in Switzerland, incorporating insect protein from black soldier fly larvae alongside plant proteins like fava beans and millet, emphasizing sustainable resource use.

Advancements in Protein Extraction and Processing Technologies

Technological innovations in fermentation, enzymatic hydrolysis, and drying processes are improving the nutritional quality and digestibility of alternative proteins. Enhanced extraction efficiency allows manufacturers to scale production while reducing waste and energy consumption. Companies are adopting precision fermentation and bioconversion techniques to develop high-value proteins from agricultural by-products and organic waste. Such advancements increase cost-effectiveness and ensure consistency in amino acid profiles, encouraging large feed producers to integrate these proteins into mainstream feed formulations.

- For instance, Quorn uses air-lift fermentation technology to cultivate the filamentous fungus Fusarium venenatum, producing mycoprotein with a fibrous texture and high protein content suitable for meat alternatives.

Expanding Livestock and Aquaculture Production

The rapid expansion of global poultry and aquaculture industries boosts the demand for alternative protein ingredients. Rising protein consumption, especially in Asia-Pacific and Latin America, accelerates the need for affordable and sustainable feed options. Feed producers are blending insect meal, yeast, and algae-based proteins to enhance animal growth and immunity while reducing feed conversion ratios. Governments and private investors are supporting sustainable feed innovation through funding and research collaborations, further driving the market’s long-term growth potential.

Key Trends and Opportunities

Emergence of Insect-Based and Single-Cell Proteins

Insect and microbial protein production is emerging as a major trend, offering high nutrient density and circular economy benefits. Black soldier fly larvae, algae, and yeast-based proteins are being adopted for poultry, aquafeed, and pet nutrition applications. Companies are investing in vertical farming and bioreactor-based production to achieve scalability and regulatory compliance. These innovations not only diversify feed ingredients but also reduce pressure on traditional protein sources, presenting significant growth opportunities for sustainable feed manufacturers.

- For instance, Innovafeed, a French biotech company, is leading large-scale production of black soldier fly larvae protein for aquaculture and animal feed, emphasizing sustainability and circular economy solutions.

Increased Strategic Collaborations and Regulatory Support

Collaborations between feed manufacturers, biotech firms, and research institutes are shaping the market landscape. Partnerships aim to enhance R&D in protein innovation, sustainable sourcing, and cost reduction. Governments in Europe and North America are establishing clear regulatory frameworks for insect and microbial proteins, promoting their safe integration into animal feed. Funding programs and sustainability certifications are further encouraging adoption, creating a favorable environment for long-term market expansion and investment inflows.

- For instance, European biotech companies BRAIN Biotech and Formo launched a strategic partnership to advance the production of animal-free milk proteins, demonstrating strong collaboration between biotech firms toward innovative protein sources.

Key Challenges

High Production and Processing Costs

Despite strong market potential, the production of insect and microbial proteins remains cost-intensive due to advanced technology and infrastructure needs. Scaling up bioconversion and fermentation facilities requires significant capital investment. Feed producers often face higher input costs compared to conventional sources like soy or fishmeal, limiting mass adoption in price-sensitive markets. Reducing energy consumption and improving automation in processing remain essential to enhance economic viability and competitiveness against traditional protein ingredients.

Limited Consumer Awareness and Regulatory Complexity

Regulatory uncertainty and low awareness among end-users continue to hinder market growth. While plant-based proteins enjoy broad acceptance, insect and microbial options face perception barriers in certain regions. Inconsistent labeling standards and slow regulatory approvals across countries create obstacles for commercialization. Addressing these issues through transparent communication, education campaigns, and harmonized global regulations is crucial to build trust and accelerate the adoption of alternative proteins in mainstream animal feed production.

Regional Analysis

North America

North America dominates the Alternative Protein Market for Animal Feed with a 33% market share in 2024. The region’s leadership stems from established livestock production systems, strong adoption of sustainable feed technologies, and robust R&D investments. Major players such as Darling Ingredients and Innovafeed have expanded partnerships to scale insect and microbial protein facilities across the U.S. and Canada. Supportive regulatory frameworks, along with consumer preference for ethically sourced feed ingredients, drive regional growth. The U.S. remains the core contributor, driven by innovation in aquafeed and poultry feed applications.

Europe

Europe accounts for 29% of the market share in 2024, driven by stringent sustainability regulations and strong adoption of insect and yeast-based proteins. The region’s feed industry benefits from policy support promoting circular bioeconomy practices. Countries like France, Germany, and the Netherlands lead production due to established facilities for insect protein and fermentation-based processes. Companies such as Ynsect and Deep Branch Biotechnology are key contributors. Growing focus on reducing soy imports and promoting traceable protein alternatives further reinforces Europe’s market position and long-term sustainability focus.

Asia-Pacific

Asia-Pacific holds a 25% market share in 2024 and is projected to witness the fastest growth during the forecast period. Expanding livestock and aquaculture industries in China, India, and Southeast Asia fuel the demand for cost-effective and sustainable protein sources. Regional feed manufacturers are increasingly integrating plant-based and microbial proteins to address supply challenges. Government initiatives encouraging innovation in sustainable feed production also support market expansion. With rising meat and seafood consumption, Asia-Pacific continues to attract major global investments in alternative protein manufacturing facilities.

Latin America

Latin America captures a 7% market share in 2024, supported by abundant agricultural resources and increasing awareness of sustainable feed solutions. Brazil and Argentina lead regional growth through large-scale soy protein production and pilot projects in insect-based feeds. Growing aquaculture activities along coastal regions and government-led agricultural sustainability programs are enhancing the region’s competitiveness. However, limited access to advanced processing technologies slightly restrains broader adoption. International collaborations and R&D partnerships are expected to strengthen Latin America’s position in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share in 2024, driven by gradual adoption of innovative feed ingredients to support food security and livestock health. Countries like South Africa, Saudi Arabia, and the UAE are investing in microbial and algae-based protein projects to reduce dependency on imports. Rising poultry and aquaculture demand, coupled with government-backed agricultural diversification strategies, supports growth. However, infrastructure limitations and high production costs remain challenges. The region’s long-term potential lies in sustainable feed development tailored to arid environmental conditions.

Market Segmentations:

By Source

- Plant-Based Proteins

- Insect-Based Proteins

- Microbial Proteins

- Single-Cell Proteins

- Cultured or Lab-Grown Proteins

By Form

- Dry (powdered or pellet form)

- Liquid (suspension or concentrate form)

By Livestock Type

- Poultry Feed

- Aquafeed (fish and shrimp)

- Swine Feed

- Ruminant Feed (cattle, sheep, goats)

- Pet Food (dogs and cats)

By Function

- Nutritional Supplementation

- Feed Palatability Enhancer

- Protein Enrichment

- Digestibility Improvement

- Immune System Support

By Distribution Channel

- Direct Sales to Feed Manufacturers

- Distributors and Wholesalers

- Online Platforms

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alternative Protein Market for Animal Feed includes major players such as Innovafeed, Angel Yeast, Darling Ingredients, Nordic Soy, CHS Inc., Deep Branch Biotechnology, Hamlet Protein, Ynsect, DuPont, and AgriProtein GmbH. These companies focus on sustainable feed innovation, advanced protein extraction, and large-scale commercialization of insect, plant-based, and microbial proteins. Strategic collaborations and acquisitions are common, aimed at strengthening production capacity and global presence. For instance, Innovafeed and Cargill partnered to expand insect protein production for aquaculture, while DuPont continues to advance fermentation-based solutions. European players like Ynsect and Nordic Soy lead in insect and soy protein technology, supported by strong R&D investments and regulatory backing. North American firms such as Darling Ingredients leverage integrated supply chains for high-value feed ingredients. The market remains moderately consolidated, with technological innovation, cost optimization, and sustainable sourcing emerging as primary competitive differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2024, Entocycle announced the expansion of its insect protein production facilities in the U.K. to support greener feed options for poultry and swine industries.

- In April 2024, Innovafeed partnered with ADM to open a large-scale insect protein innovation center in Decatur, U.S., expanding its production capacity for sustainable animal feed solutions.

- In February 2025, Meatly became the first company in the world to commercially supply cultivated meat for pet food, launching Chick Bites at Pets at Home’s Brentford store in London.

- In February 2025, Calysta and German pet food manufacturer Marsapet launched MicroBell, the first complete dog food featuring FeedKind Pet protein, a cultured protein fermented without using any arable land or animal ingredients.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Livestock Type, Function, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by sustainable livestock production practices.

- Insect and microbial proteins will gain wider acceptance across poultry and aquaculture sectors.

- Technological advancements in fermentation and bioconversion will lower production costs.

- Feed manufacturers will increasingly adopt circular economy models for protein sourcing.

- Strategic partnerships between biotechnology firms and feed producers will expand innovation pipelines.

- Regulatory frameworks will become more defined, supporting commercialization of novel protein sources.

- Asia-Pacific will emerge as the fastest-growing region due to expanding livestock and aquaculture industries.

- Consumer preference for environmentally responsible animal products will influence feed composition trends.

- Investments in R&D will enhance nutritional profiles and amino acid balance of alternative proteins.

- The market will move toward large-scale integration of blended protein formulations for better feed efficiency.