Market Overview:

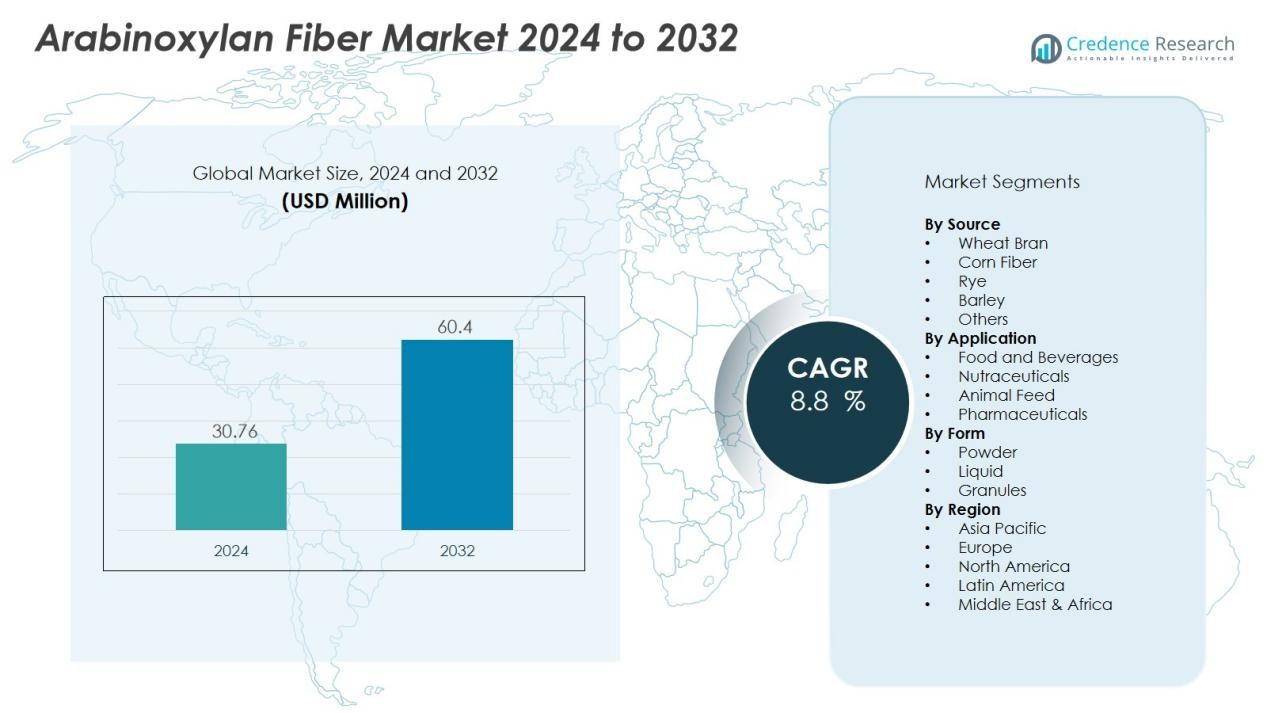

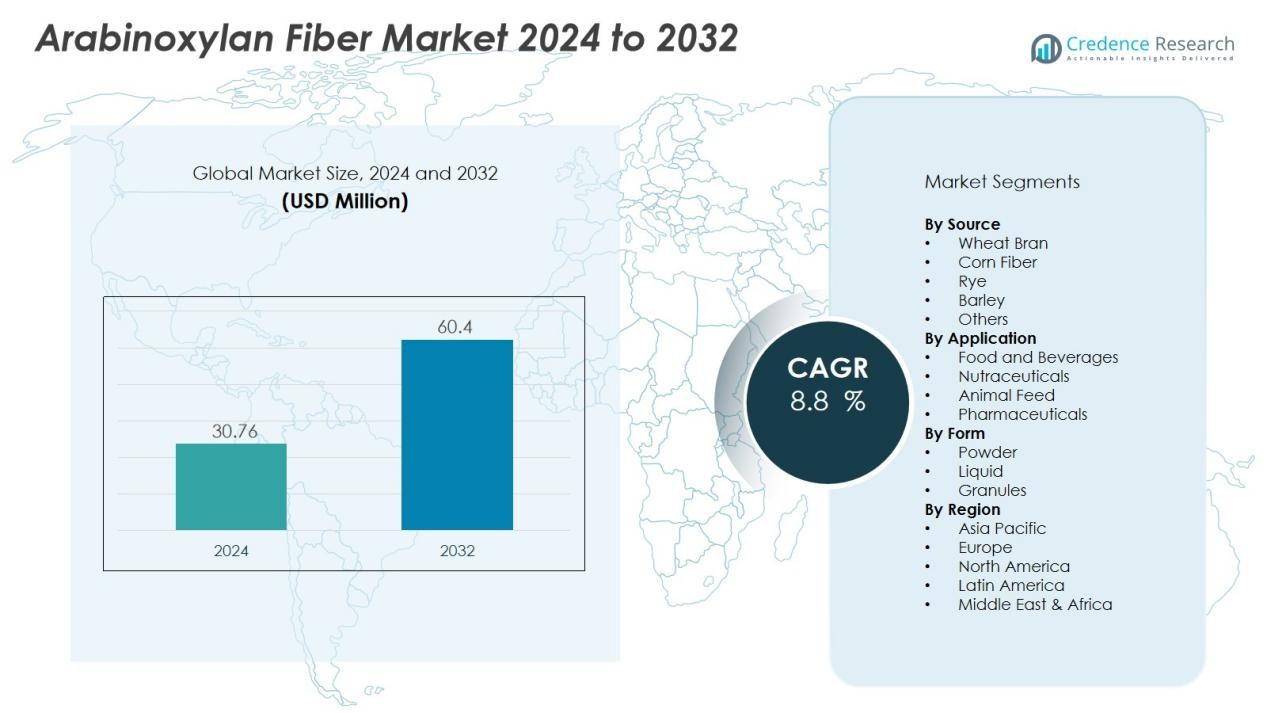

The Arabinoxylan Fiber Market size was valued at USD 30.76 million in 2024 and is anticipated to reach USD 60.4 million by 2032, at a CAGR of 8.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Arabinoxylan Fiber Market Size 2024 |

USD 30.76 Million |

| Arabinoxylan Fiber Market, CAGR |

8.8% |

| Arabinoxylan Fiber Market Size 2032 |

USD 60.4 Million |

The market growth is fueled by the rising incidence of digestive health disorders and the increasing shift toward clean-label products. Arabinoxylan is valued for its proven ability to improve gut microbiota, regulate cholesterol, and support immune health. The growing use of this fiber in functional foods, bakery items, and dietary supplements further amplifies its adoption. Continuous R&D in enzymatic extraction methods and product fortification expands its commercial applications.

Regionally, North America leads the market due to advanced functional food industries and increasing consumer health focus. Europe follows with strong research and regulatory support for fiber-based nutrition. The Asia-Pacific region records the fastest growth, supported by expanding health-conscious populations and growing demand for fiber-enriched products in China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Arabinoxylan Fiber Market was valued at USD 30.76 million in 2024 and is anticipated to reach USD 60.4 million by 2032, growing at a CAGR of 8.8% during the forecast period.

- North America holds the largest market share at 35% in 2024, driven by a health-conscious consumer base and strong functional food industries, with a focus on digestive wellness and clean-label products.

- Europe accounts for 30% of the market share, supported by regulatory support for fiber-based nutrition and a growing demand for preventive healthcare and dietary supplements.

- The Asia-Pacific region, with a market share of 25% in 2024, is the fastest-growing due to urbanization, rising health awareness, and growing demand for fiber-enriched products, particularly in China, Japan, and India.

- The Food and Beverages segment holds the largest share in the Arabinoxylan Fiber Market, while the Nutraceutical segment is expanding rapidly due to increasing consumer awareness of prebiotic and immune health benefits.

Market Drivers:

Rising Demand for Functional and Prebiotic Ingredients in Food and Beverages

The Arabinoxylan Fiber Market grows strongly with the increasing demand for functional and prebiotic ingredients in food and beverage formulations. Consumers seek products that improve gut health and immunity while maintaining clean-label status. Food manufacturers integrate arabinoxylan fiber into cereals, bakery items, and beverages to enhance nutritional profiles and digestive benefits. It supports product differentiation by offering both soluble fiber content and prebiotic functionality.

- For instance, Comet Bio successfully launched its Arrabina® prebiotic arabinoxylan fiber with clinical validation showing that consumers can achieve prebiotic benefits with just 3.6 grams per day—requiring only the equivalent of 5 cups of wheat bran cereal to achieve the same soluble fiber content—while its pH and heat-resistant formulation enables integration into temperature-sensitive applications including gummies and shelf-stable carbonated beverages.

Growing Awareness of Dietary Fiber Benefits and Health-Driven Lifestyles

Expanding public awareness of digestive wellness and fiber intake promotes steady adoption of arabinoxylan-based products. The fiber helps control blood glucose and cholesterol, aligning with global efforts to prevent lifestyle-related diseases. Health-conscious consumers include fiber-enriched products in daily diets to support overall well-being. It encourages producers to position arabinoxylan as a premium ingredient in health supplements and fortified foods.

- For instance, Comet Bio demonstrated through a randomized placebo-controlled clinical trial with 44 participants that its Arrabina arabinoxylan fiber was exceptionally well-tolerated at doses up to 12 grams per day with no gastrointestinal discomfort.

Technological Advancements in Extraction and Processing of Arabinoxylan

Advances in biotechnology and enzymatic processing enhance the purity and yield of arabinoxylan fiber. Producers develop efficient extraction techniques from cereal grains, including wheat bran and corn fiber, improving scalability and cost-effectiveness. Improved processing reduces impurities and retains the fiber’s functional properties, expanding its industrial applications. It enables food and nutraceutical companies to maintain consistency and quality across product lines.

Rising Application in Nutraceuticals and Functional Supplements

The expanding nutraceutical sector drives the integration of arabinoxylan fiber into immune-boosting and digestive health products. It is widely used in capsules, powders, and prebiotic blends targeting metabolic and gastrointestinal health. Strong clinical validation of its prebiotic potential supports market confidence among manufacturers and consumers. Growing investment in preventive healthcare continues to strengthen demand within this sector.

Market Trends:

Increasing Incorporation of Arabinoxylan Fiber in Functional Foods and Beverages

The Arabinoxylan Fiber Market witnesses a strong shift toward incorporation in functional foods and beverages driven by rising consumer focus on digestive and immune health. Food manufacturers include arabinoxylan in ready-to-eat meals, bakery goods, smoothies, and fortified drinks to boost nutritional content and prebiotic value. It helps brands position their offerings within the clean-label and wellness segment. Leading companies invest in product innovation that enhances taste, solubility, and shelf stability without compromising fiber quality. Partnerships between ingredient suppliers and food producers promote awareness of its versatility. The trend supports diversification across categories such as dairy alternatives, energy bars, and dietary snacks. Growing demand for natural ingredients ensures arabinoxylan maintains a central role in product formulation strategies.

- For instance, Comet Bio’s Arrabina® product achieves prebiotic effectiveness at just 3.6 grams per serving—compared to 5 cups of wheat bran cereal required for equivalent fiber content—while demonstrating exceptional tolerability with clinical studies showing no adverse gastrointestinal effects at up to 12 grams daily.

Emergence of Sustainable and Cost-Effective Production Technologies

A key trend involves the development of sustainable and cost-effective production methods for arabinoxylan extraction. Manufacturers focus on valorizing agricultural byproducts like wheat bran and corn husks to improve resource efficiency and lower production waste. It helps create a circular value chain that aligns with global sustainability goals. Enzyme-assisted extraction technologies gain traction for their precision and reduced environmental footprint. Companies also explore fermentation-based processes to improve purity and bioavailability. Strategic investments in pilot-scale facilities enhance production scalability and supply reliability. Growing collaboration between research institutes and ingredient companies accelerates innovation and strengthens the long-term growth outlook for the fiber industry.

- For instance, research teams optimizing double-enzymatic extraction from fresh corn fiber achieved an extraction yield of 40.73% ± 0.09% with arabinoxylan content of 75.88% ± 0.11% using combined Amano HC 90 and Cellulase enzymes under controlled conditions (pH 3.0, 35°C, 6 hours extraction time), demonstrating the precision and reliability of enzyme-assisted extraction in valorizing corn processing byproducts.

Market Challenges Analysis:

High Production Costs and Limited Commercial Scalability

The Arabinoxylan Fiber Market faces challenges from high production costs and limited scalability in extraction processes. Complex separation and purification steps increase operational expenses, restricting availability for mass-market applications. It requires specialized equipment and controlled processing conditions to maintain functional quality, which adds to the cost burden. Small and medium producers struggle to compete with established fiber manufacturers offering lower-cost alternatives. Limited raw material optimization further reduces yield efficiency across supply chains. The lack of standardized production methods also slows technology adoption among new entrants.

Regulatory Uncertainty and Low Consumer Awareness Across Emerging Markets

Varying regulatory guidelines for dietary fibers create uncertainty in product labeling and health claim approvals. The Arabinoxylan Fiber Market contends with inconsistent definitions across regions, affecting product positioning in global trade. It also suffers from low awareness among consumers about the specific benefits of arabinoxylan compared with other fibers. Manufacturers invest in educational marketing and clinical studies to address this gap. Regulatory harmonization remains slow, hindering smooth international distribution. Limited promotion and fragmented communication channels continue to restrain consumer uptake in emerging economies.

Market Opportunities:

Expanding Use of Arabinoxylan in Functional and Nutraceutical Formulations

The Arabinoxylan Fiber Market presents strong opportunities through its growing use in functional foods, beverages, and nutraceutical formulations. Rising demand for prebiotic and immune-supporting ingredients encourages manufacturers to include arabinoxylan in everyday nutrition products. It supports applications in dietary supplements, energy bars, and fortified dairy alternatives. Increasing clinical research validating its benefits for gut microbiota and immune modulation strengthens product credibility. Food and nutraceutical companies develop innovative formulations that improve taste and solubility without losing functionality. The expansion of preventive healthcare trends continues to attract investment toward arabinoxylan-based ingredients.

Rising Potential in Sustainable Sourcing and Clean-Label Product Development

Sustainability-focused production methods create new growth avenues for arabinoxylan producers. Companies utilize cereal byproducts such as wheat bran and corn husks to lower waste and improve raw material efficiency. The Arabinoxylan Fiber Market benefits from this transition toward circular manufacturing practices. It aligns with the clean-label and eco-friendly positioning of food and beverage products. Growing consumer preference for transparent and natural ingredients drives demand across global markets. Partnerships between food innovators and bio-based technology developers enhance value creation within sustainable ingredient ecosystems.

Market Segmentation Analysis:

By Source

The Arabinoxylan Fiber Market is segmented by source into wheat bran, corn fiber, rye, barley, and others. Wheat bran remains the leading source due to its high arabinoxylan yield and wide availability across food and feed industries. Corn fiber follows with strong demand from manufacturers emphasizing sustainable raw materials and cost-efficient extraction. Rye and barley contribute to specialty applications in functional foods and nutraceuticals. It benefits from ongoing research aimed at improving extraction efficiency from diverse cereal crops.

- For instance, COMET, a Canadian manufacturer, operates a proprietary upcycling facility in Kalundborg, Denmark, which achieved commercial-scale production of Arrabina® arabinoxylan dietary fiber with the capacity to supply over 4 million kilograms annually of high-purity arabinoxylan using patented thermal-pressure extraction technology that maximizes fiber purity and maintains functional integrity at high temperatures and low pH conditions.

By Application

Food and beverages represent the largest application segment, supported by the inclusion of arabinoxylan in bakery, dairy alternatives, and fortified products. The nutraceutical segment grows rapidly, driven by increasing awareness of prebiotic and immune health benefits. Animal feed applications expand with the focus on digestive efficiency and improved gut health in livestock. It continues to attract research investment targeting clinical-grade supplements and therapeutic nutrition.

- For Instance, COMET’s Arrabina® arabinoxylan prebiotic fiber demonstrates versatility in food applications at a fully soluble, heat-resistant formulation requiring only 3 grams per serving for prebiotic efficacy.

By Form

The market is divided by form into powder, liquid, and granules. Powder form dominates due to ease of handling, storage stability, and compatibility with multiple formulations. Liquid form gains traction in beverages and dietary supplements for improved absorption and dispersion. Granule form serves specialized food manufacturing and pharmaceutical needs. It reflects growing innovation in blending technology and functional ingredient integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Source

- Wheat Bran

- Corn Fiber

- Rye

- Barley

- Others

By Application

- Food and Beverages

- Nutraceuticals

- Animal Feed

- Pharmaceuticals

By Form

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads the Arabinoxylan Fiber Market with Strong Demand in Functional Foods

North America holds the largest share of the Arabinoxylan Fiber Market, accounting for 35% of global demand in 2024. The region benefits from a well-established health-conscious consumer base that prioritizes digestive wellness and functional ingredients. Key market drivers include increasing adoption of fiber-enriched foods and beverages in the United States and Canada. The presence of major manufacturers and ongoing research into fiber’s health benefits further supports growth. Rising consumer awareness around the importance of gut health enhances arabinoxylan’s appeal. It is particularly used in prebiotic supplements and fortified foods. Companies are focusing on product innovation to cater to the increasing demand for clean-label and plant-based nutrition options.

Europe Experiences Steady Growth in Arabinoxylan Fiber Adoption Across Nutraceuticals

Europe accounts for 30% of the global Arabinoxylan Fiber Market share in 2024. The demand for functional ingredients is driven by a rising focus on preventive healthcare and dietary supplements across the region. Countries like Germany, the United Kingdom, and France lead the market, with a strong regulatory framework supporting clean-label products. Arabinoxylan is gaining traction in the nutraceutical sector, where it is used to develop functional health supplements. Growing interest in plant-based diets and fiber-rich foods boosts its usage in products targeting digestive health. The market benefits from the region’s commitment to sustainability and natural ingredients, aligning with consumer preferences for environmentally friendly solutions.

Asia-Pacific Shows Rapid Expansion with Increasing Health Consciousness and Urbanization

Asia-Pacific is the fastest-growing region in the Arabinoxylan Fiber Market, with a market share of 25% in 2024. The rapid urbanization in countries such as China, India, and Japan drives increased demand for functional foods and dietary fibers. Rising awareness of the benefits of dietary fiber, including arabinoxylan, fuels its adoption in health-conscious populations. The growth of the middle class and increased disposable income also support market expansion. It is widely used in both food and animal feed sectors, promoting gut health and digestive efficiency. Investment in agricultural innovation helps increase the availability of arabinoxylan from local sources, further supporting regional demand.

Key Player Analysis:

- Acetar Bio-tech Inc.

- Antimex Pharmaceuticals & Chemicals Ltd.

- BioActor BV

- Cargill

- Comet Biorefining

- Daiwa Pharmaceutical

- HL Agro

- JRS

- Kowa India Pvt. Ltd.

- Megazyme

Competitive Analysis:

The Arabinoxylan Fiber Market is highly competitive, with key players such as BioActor BV, Cargill, Comet Biorefining, Daiwa Pharmaceutical, and HL Agro leading the charge. These companies focus on improving production efficiency, enhancing product quality, and expanding their market presence. BioActor BV emphasizes the development of innovative arabinoxylan-based solutions, particularly in the nutraceutical sector. Cargill, with its broad network, plays a pivotal role in the supply chain, enhancing the accessibility of arabinoxylan fibers across diverse industries. Comet Biorefining and Daiwa Pharmaceutical focus on sustainable sourcing and technological advancements to improve fiber extraction. HL Agro strengthens its position through vertical integration, securing a reliable raw material supply. These companies continue to invest in research and development to enhance arabinoxylan’s functional benefits and meet the increasing demand for plant-based, fiber-rich products across food and health sectors.

Report Coverage:

The research report offers an in-depth analysis based on Source, Application, Form and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Arabinoxylan Fiber Market is expected to experience continued growth driven by increasing consumer demand for functional foods.

- Sustainability trends will push for more efficient extraction methods from agricultural byproducts like wheat bran and corn husks.

- Technological advancements in enzymatic processing will enhance arabinoxylan’s functional properties, improving product formulations.

- The market will see a rise in arabinoxylan applications across nutraceuticals, particularly in digestive health and immune-boosting products.

- There will be a growing emphasis on clean-label and plant-based products, strengthening arabinoxylan’s position in the market.

- Increasing awareness of the health benefits of prebiotic fibers will drive demand across regions, particularly in North America and Europe.

- The expansion of the middle class in Asia-Pacific will lead to rising demand for fiber-rich products in emerging markets.

- More partnerships between ingredient suppliers and food manufacturers will foster innovation and new product developments in various sectors.

- Government regulations supporting sustainable and natural ingredients will create favorable conditions for arabinoxylan market expansion.

- Ongoing research into the health benefits of arabinoxylan will boost consumer confidence and accelerate its adoption in mainstream food products.