Market Overview

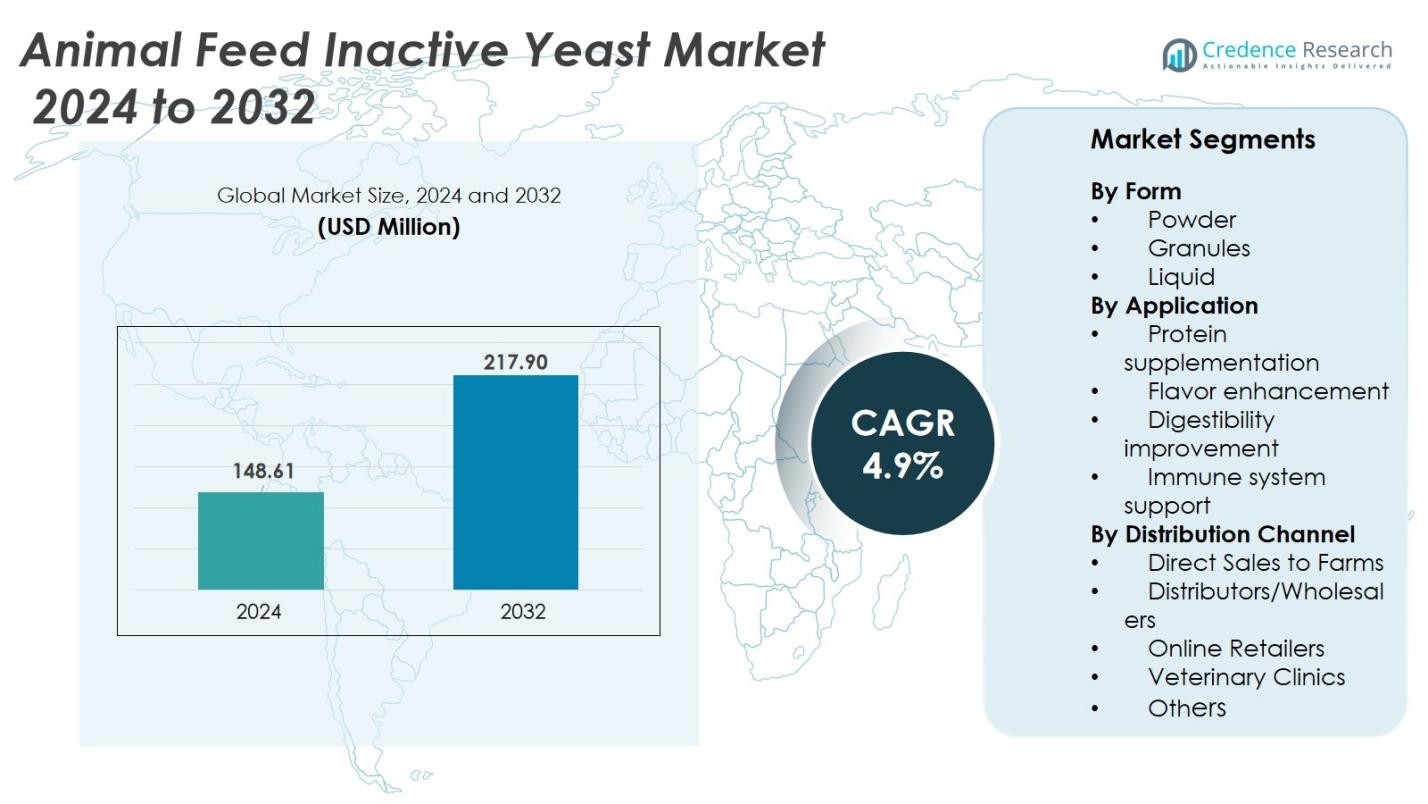

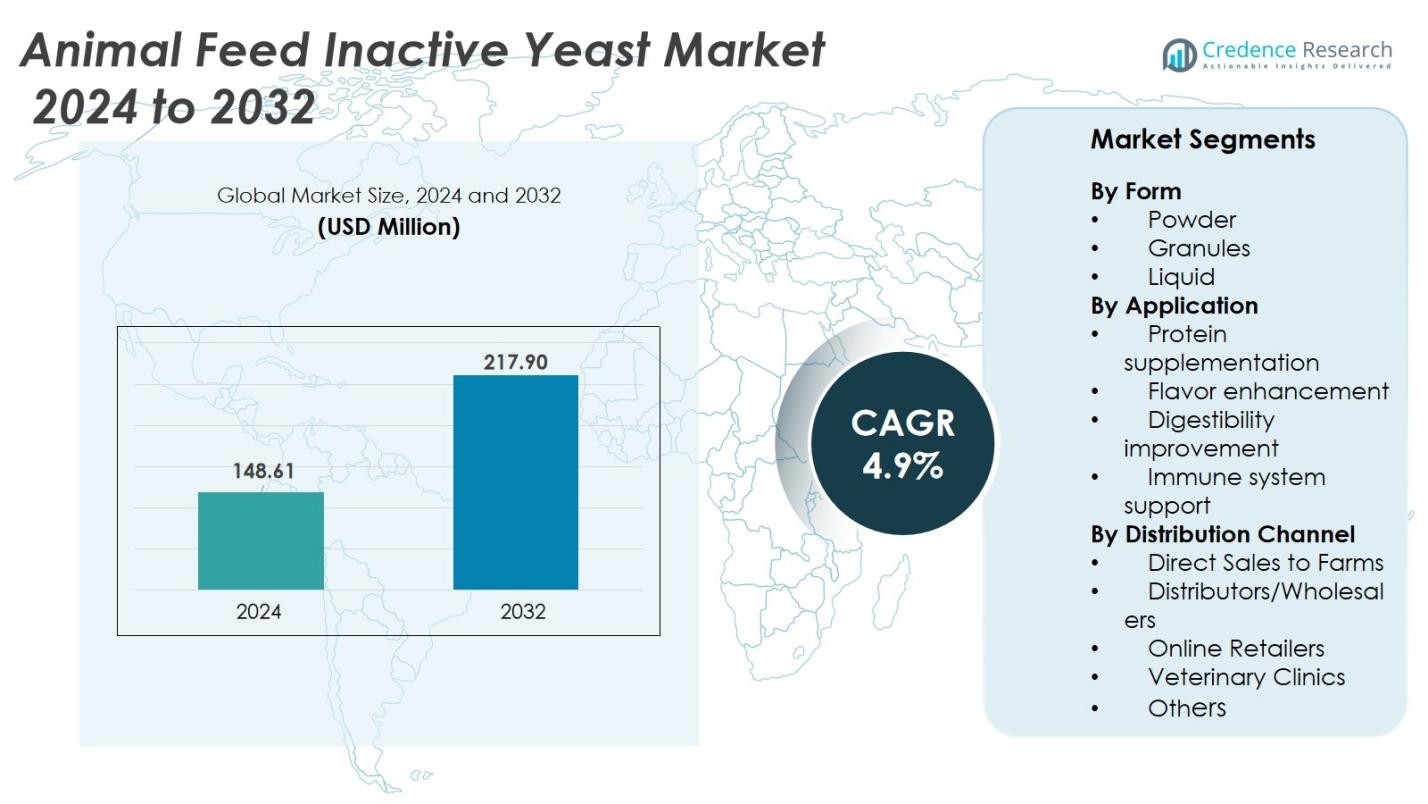

The Animal Feed Inactive Yeast Market size was valued at USD 148.61 million in 2024 and is anticipated to reach USD 217.90 million by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Feed Inactive Yeast Market Size 2024 |

USD 148.61 Million |

| Animal Feed Inactive Yeast Market, CAGR |

4.9% |

| Animal Feed Inactive Yeast Market Size 2032 |

USD 217.90 Million |

The Animal Feed Inactive Yeast Market is driven by key players such as Lallemand Inc., BioSpringer (part of Lesaffre Group), Alltech Biotechnology, Angel Yeast, Titan Biotech Limited, Leiber GmbH, Sensient, Tangshan Top Biotechnology, ABN Spain (Aplicaciones Biológicas a la Nutrición SL), Archer Daniels Midland Company, and Ohly. These companies focus on expanding production capacity, improving yeast strain performance, and developing specialized formulations for livestock nutrition. Strategic partnerships and R&D investments in sustainable fermentation processes enhance their global presence. Asia-Pacific leads the market with a 37% share, supported by its rapidly growing livestock industry, high feed production rates, and increasing preference for natural, nutrient-rich feed additives.

Market Insights

Market Insights

- The Animal Feed Inactive Yeast Market was valued at USD 148.61 million in 2024 and is projected to reach USD 217.90 million by 2032, expanding at a CAGR of 4.9% during the forecast period.

- Rising demand for protein-rich and antibiotic-free animal feed drives market growth across poultry, swine, and dairy sectors.

- Growing adoption of biotechnology and sustainable fermentation practices shapes key market trends, improving product efficiency and nutrient value.

- Leading players such as Lallemand Inc., Lesaffre Group, Alltech Biotechnology, and ADM focus on innovation, capacity expansion, and global partnerships.

- Asia-Pacific dominates the market with a 37% share, followed by North America (34%) and Europe (28%), while the powder form segment leads with a 47% share due to its stability and compatibility in feed formulations.

Market Segmentation Analysis:

By Form

The powder segment dominates the Animal Feed Inactive Yeast Market, holding a 47% share in 2024. Its high stability, easy handling, and compatibility with various feed formulations drive widespread adoption among livestock producers. Powdered inactive yeast enhances protein content and maintains uniform nutrient distribution, improving feed consistency and quality. Granules and liquid forms are gaining traction for their rapid solubility and efficient nutrient release in feed mixes. Continuous innovation in drying and encapsulation technologies is further improving product shelf life and functional performance in feed applications.

- For instance, Lallemand Inc. introduced YELA PROSECURE, a hydrolyzed yeast powder product known for its high digestibility and improved gut health in animals, enhancing nutrient uptake and feed efficiency.

By Application

Protein supplementation leads the market with a 39% share in 2024, driven by the rising need for high-quality, digestible protein sources in livestock diets. Inactive yeast provides essential amino acids, nucleotides, and vitamins that enhance animal growth, feed efficiency, and metabolic health. Other growing applications such as gut health enhancement and immune system support are gaining importance with the global move toward antibiotic-free feed formulations. Feed manufacturers are also focusing on flavor and digestibility improvements to boost palatability and optimize nutrient absorption across animal species.

- For instance, canola meal, containing 35-38% protein, has gained popularity due to improved processing methods that enhance its digestibility and amino acid profile, making it a sustainable protein source for various livestock species.

By Distribution Channel

Direct sales to farms dominate the market, accounting for a 41% share in 2024. Large-scale livestock producers prefer this channel for its reliability, customization, and cost efficiency. Direct sourcing ensures steady supply and consistent product quality, supporting long-term feed strategies. Distributors and wholesalers play a key role in reaching smaller farms and regional feed mills, while online retailers are witnessing steady growth through digital sales channels. Veterinary clinics also contribute to market expansion by recommending specialized yeast-based feed additives for animal immunity and gut health improvement.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Growth Drivers

Rising Demand for Protein-Enriched Animal Feed

The growing need for high-quality protein sources in livestock diets is a major factor driving the Animal Feed Inactive Yeast Market. Inactive yeast provides essential amino acids, nucleotides, and vitamins that improve feed efficiency and animal growth performance. Producers increasingly use yeast-based supplements as a natural and sustainable protein alternative to fishmeal and soybean meal. This demand is particularly strong in poultry and swine production, where feed conversion ratios directly affect profitability. The shift toward nutrient-dense, balanced diets supports yeast adoption, enhancing both productivity and product quality in animal farming.

- For instance, Angel Yeast offers the FUBON line of yeast-based solutions that improve intestinal health and feed efficiency in swine, addressing issues like weaning stress and enhancing meat quality.

Growing Focus on Gut Health and Immunity

The global movement toward antibiotic-free animal feed has accelerated the adoption of inactive yeast as a functional additive. It acts as a natural prebiotic, improving gut microflora balance and immune response. Yeast components such as beta-glucans and mannan oligosaccharides strengthen intestinal barriers and disease resistance, reducing infection risks. Farmers increasingly use yeast-based solutions to minimize dependence on synthetic growth promoters. As consumers demand antibiotic-free meat and dairy products, producers rely on inactive yeast to ensure animal welfare and sustainable growth. This trend enhances livestock performance while aligning with regulatory shifts favoring clean-label feed ingredients.

- For instance, Biorigin, a key player, launched Biorigin X-MOS, an inactive yeast product rich in mannan oligosaccharides, tailored for poultry and swine to support immune response and intestinal barrier integrity.

Expansion of Livestock Production and Feed Industry

Rising meat, dairy, and egg consumption globally drives livestock production growth, directly increasing feed additive demand. Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing rapid expansion of commercial farming systems. Feed manufacturers integrate inactive yeast into formulations to improve productivity, nutrient utilization, and environmental sustainability. The ingredient’s role in enhancing feed digestibility and reducing waste aligns with eco-friendly production goals. Increasing investments in feed mill modernization and automation further support consistent yeast usage. This expanding livestock base, coupled with global trade growth in animal products, strengthens market opportunities for inactive yeast suppliers.

Key Trends & Opportunities

Integration of Biotechnology in Yeast Production

Advancements in biotechnology are reshaping the inactive yeast industry by improving strain development, nutrient bioavailability, and product stability. Companies are adopting fermentation optimization and enzymatic treatment technologies to enhance yeast yield and protein content. Genetically refined yeast strains provide specific functional benefits, such as improved amino acid profiles or enhanced immune-boosting properties. The use of biotechnology also supports the development of species-specific formulations targeting poultry, swine, ruminants, and aquaculture. This innovation-driven trend creates opportunities for premium, performance-oriented yeast products that address diverse nutritional needs across animal categories.

- For instance, Angel Yeast Co., Ltd. invested in a green manufacturing project for enzyme preparations with an annual output capacity of 5,000 tons, thus significantly expanding their capabilities in yeast biotechnology.

Sustainability and Circular Bioeconomy Initiatives

The growing emphasis on sustainable feed ingredients has positioned inactive yeast as a key eco-friendly alternative. Derived from fermentation by-products, yeast contributes to the circular bioeconomy by reducing waste and promoting resource efficiency. Feed producers and biotech companies are partnering to convert brewery and ethanol residues into high-value yeast-based additives. This reduces environmental impact while supporting cost-effective production. The shift toward sustainable protein sources also aligns with global goals to lower carbon footprints in livestock operations. As environmental compliance tightens, yeast producers focusing on sustainable sourcing and green manufacturing gain a competitive advantage.

- For instance, AB InBev’s LIFE YEAST project innovates by converting brewer’s spent yeast (BSY), which constitutes about 15% of brewing by-products, into valuable raw materials for sustainable brewing processes.

Key Challenges

High Production and Processing Costs

Despite strong demand, the high cost of yeast cultivation and drying processes remains a key challenge. Producing inactive yeast requires precise temperature control and nutrient media, increasing operational expenses. Energy-intensive drying and sterilization methods further raise production costs compared to synthetic additives. Smaller feed producers in developing regions face limited affordability, hindering large-scale adoption. To overcome this, companies are investing in energy-efficient fermentation and low-cost substrate technologies. However, achieving cost optimization without compromising quality and nutrient stability remains a major hurdle for industry scalability.

Limited Awareness Among Small-Scale Farmers

Lack of awareness regarding the benefits of inactive yeast in animal feed limits its adoption, particularly among small and medium livestock farmers. Many producers still rely on conventional feed ingredients such as soybean meal or fishmeal due to familiarity and perceived cost-effectiveness. The technical understanding of yeast’s role in improving gut health, immunity, and feed conversion is relatively low in emerging markets. Inadequate extension services and distribution networks further slow market penetration. Strengthening farmer education, demonstrations, and regional marketing efforts is essential to expand awareness and encourage broader acceptance of yeast-based feed additives.

Regional Analysis

North America

North America holds a 34% share in the Animal Feed Inactive Yeast Market in 2024. The region benefits from a highly developed livestock industry and strong focus on antibiotic-free nutrition. The U.S. and Canada lead in yeast adoption due to advanced feed technologies and strict quality standards. Increasing demand for functional and high-protein feed additives supports steady market expansion. Major feed producers in the region are investing in sustainable yeast-based formulations to enhance feed efficiency and animal health, driven by consumer awareness of safe and traceable animal products.

Europe

Europe accounts for a 28% market share in 2024, driven by stringent regulations on antibiotic use and emphasis on sustainable livestock production. Countries such as Germany, France, and the Netherlands dominate due to extensive R&D investments in feed biotechnology. The European Union’s support for environmentally friendly feed ingredients accelerates yeast utilization. Feed producers increasingly favor inactive yeast for its prebiotic and immune-boosting properties. Regional players focus on developing premium yeast-based formulations to align with animal welfare and organic farming standards, strengthening Europe’s position in the global market.

Asia-Pacific

Asia-Pacific leads the global market with a 37% share in 2024, supported by expanding livestock populations in China, India, and Southeast Asia. Rising meat and dairy consumption, coupled with growing awareness of feed quality, boosts yeast-based additive demand. Governments across the region encourage sustainable protein sources to reduce antibiotic dependency in animal farming. Local manufacturers are investing in large-scale yeast fermentation facilities to meet domestic needs. The shift toward intensive animal husbandry and export-oriented production further drives demand for inactive yeast, positioning Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America holds a 9% market share in 2024, fueled by expanding poultry and swine sectors in Brazil, Mexico, and Argentina. The region is witnessing increased adoption of functional feed additives to improve livestock productivity and export quality. Yeast-based ingredients are gaining preference due to their contribution to better digestion and immunity. Local feed producers collaborate with global biotechnology firms to improve yeast strain performance and cost efficiency. Supportive government initiatives promoting sustainable feed production strengthen the region’s potential for future growth in inactive yeast utilization.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share in 2024, reflecting steady growth in animal feed modernization. Rising livestock farming in Saudi Arabia, South Africa, and Egypt drives the adoption of nutrient-rich feed additives. Increasing urbanization and demand for poultry and dairy products stimulate market development. Limited local production capacity encourages imports from global yeast suppliers. Ongoing investments in animal health programs and expanding distribution networks are helping bridge the supply gap, gradually positioning the region as an emerging growth hub for inactive yeast feed applications.

Market Segmentations:

By Form

By Application

- Protein supplementation

- Flavor enhancement

- Digestibility improvement

- Immune system support

By Distribution Channel

- Direct Sales to Farms

- Distributors/Wholesalers

- Online Retailers

- Veterinary Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Animal Feed Inactive Yeast Market is moderately consolidated, with key players focusing on innovation, strategic partnerships, and capacity expansion to strengthen their global footprint. Leading companies such as Lallemand Inc., BioSpringer (part of Lesaffre Group), Alltech Biotechnology, Angel Yeast, Titan Biotech Limited, Leiber GmbH, Sensient, Tangshan Top Biotechnology, ABN Spain (Aplicaciones Biológicas a la Nutrición SL), Archer Daniels Midland Company, and Ohly dominate the market through diverse product portfolios and technological expertise. These players invest heavily in research to enhance nutrient bioavailability, fermentation efficiency, and strain optimization. Collaborative ventures between feed manufacturers and biotech firms aim to develop specialized formulations tailored for poultry, swine, and ruminants. Sustainability remains a core focus, with companies utilizing fermentation by-products and renewable substrates to reduce environmental impact. Continuous product innovation and expansion in emerging markets further reinforce competitive differentiation and long-term growth potential across the industry.

Key Player Analysis

- Lallemand, Inc

- BioSpringer (Part of Lesaffre Group)

- Alltech Biotechnology

- Angel Yeast

- Titan Biotech Limited Company

- Leiber GmbH

- Sensient

- Tangshan Top Biotechnology

- ABN Spain (APLICACIONES BIOLOGICAS A LA NUTRICION SL)

- Archer Daniels Midland Company

Recent Developments

- In October 2024, Lesaffre acquired the yeast extract business of DSM-Firmenich, strengthening its position in the animal feed inactive yeast segment.

- In February 2023, Angel Yeast announced its plans to speed up supply and innovation features. For this, the company will upscale its R&D capabilities and invest in production facilities to achieve a competitive edge.

- In June 2022, Archer Daniels Midland Company, an animal feed manufacturer, announced the acquisition of a feed mill in the Philippines. With this, the company intended to expand its range of leading-edge products and offer high-quality ingredients for the animal nutrition market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for inactive yeast will grow as livestock producers shift toward antibiotic-free feed solutions.

- Advancements in yeast fermentation technology will improve nutrient bioavailability and product consistency.

- Asia-Pacific will continue to lead market expansion due to rising meat and dairy

- Sustainable sourcing from fermentation by-products will enhance environmental and cost

- Increased focus on gut health will drive demand for yeast-based prebiotic feed additives.

- Feed manufacturers will integrate yeast with enzymes and probiotics for multifunctional formulations.

- Digitalization in feed supply chains will strengthen direct farm sales and online distribution.

- Rising investments in R&D will lead to the development of species-specific yeast formulations.

- Strategic collaborations between global and regional feed producers will boost market penetration.

- Regulatory support for natural and traceable feed ingredients will sustain long-term market growth.

Market Insights

Market Insights