Market Overview

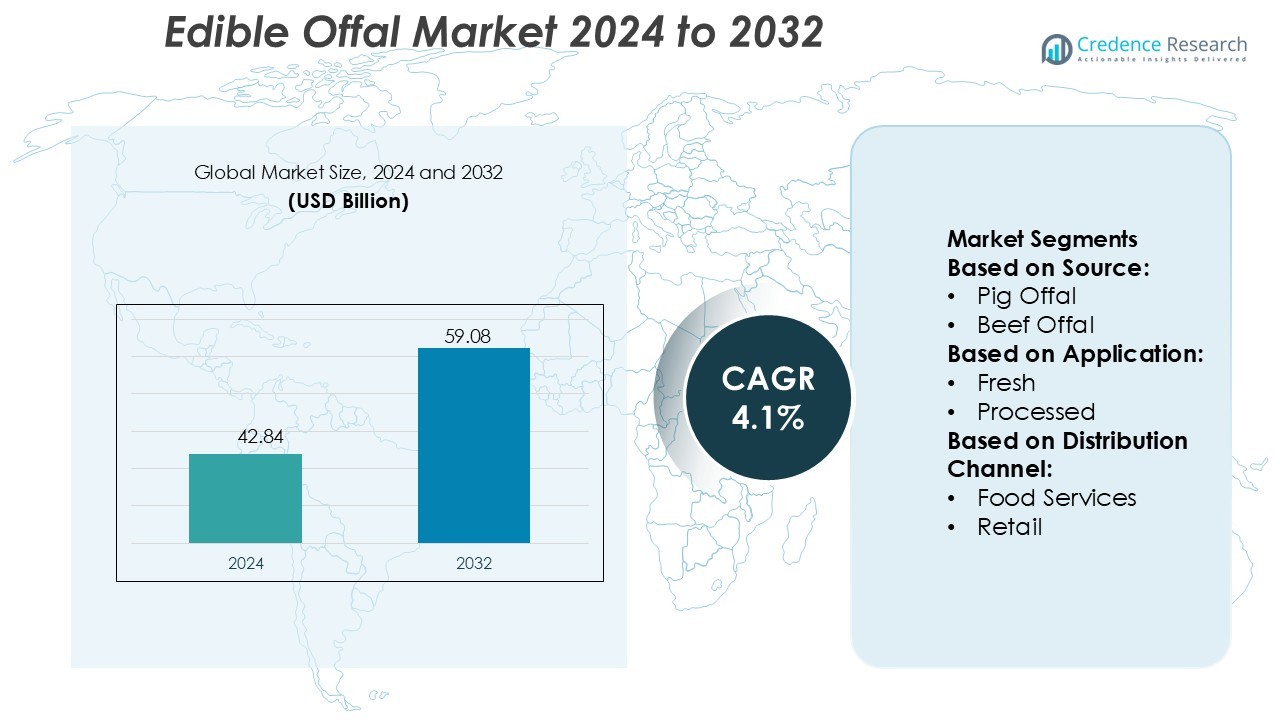

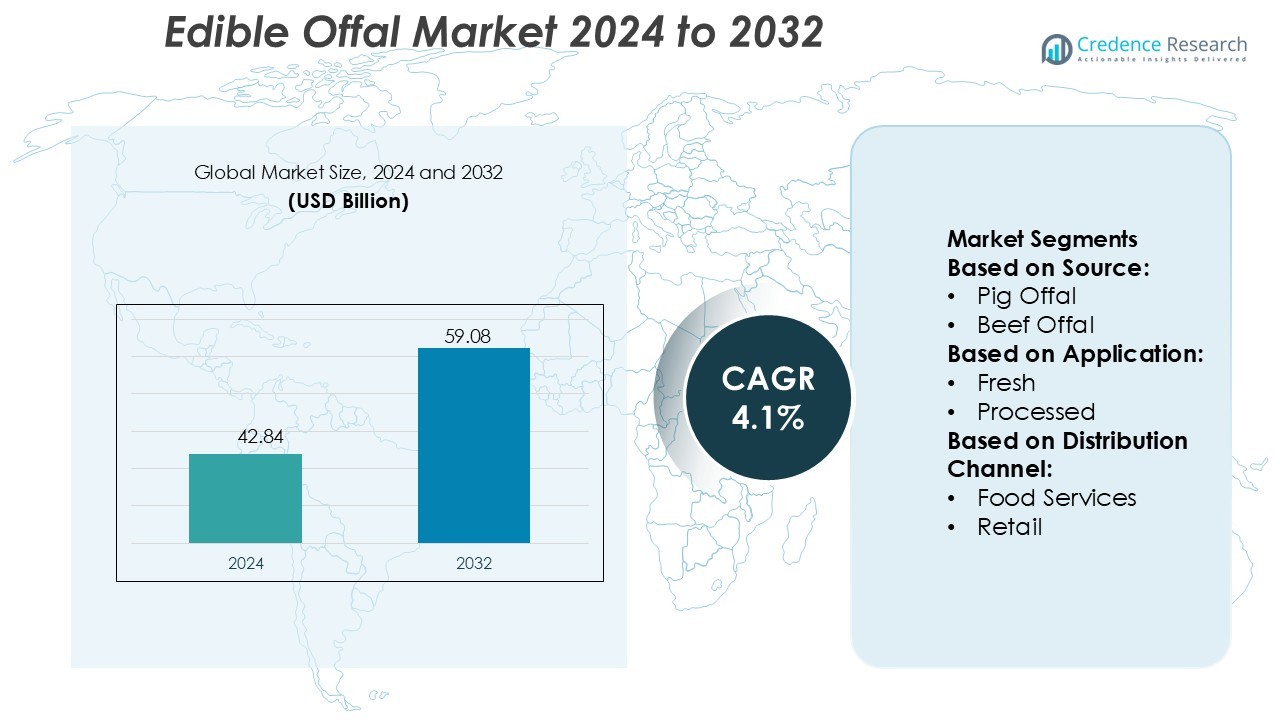

Edible Offal Market size was valued USD 42.84 billion in 2024 and is anticipated to reach USD 59.08 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Edible Offal Market Size 2024 |

USD 42.84 Billion |

| Edible Offal Market, CAGR |

4.1% |

| Edible Offal Market Size 2032 |

USD 59.08 Billion |

The edible offal market includes major producers and processors that supply liver, heart, tripe, and other organ meats to foodservice, retail, and pet food industries. These companies focus on traceability, hygiene, and value-added packaging to meet global food safety standards while supporting bulk exports. Product innovation in frozen, vacuum-packed, and pre-cleaned offal strengthens logistics and shelf life across international channels. Asia Pacific remains the leading region with a 42% market share, supported by high consumption in China, India, and Southeast Asia. Strong slaughtering capacity, price-sensitive demand, and expanding cold-chain networks continue to drive regional dominance.

Market Insights

- Edible Offal Market size was valued at USD 42.84 billion in 2024 and will reach USD 59.08 billion by 2032, growing at a CAGR of 4.1%.

- Rising demand for affordable animal protein and nutrient-rich organ meats drives consumption across foodservice, retail, and pet food industries, supported by growing preference for liver, heart, and tripe in daily diets.

- Frozen, vacuum-packed, and pre-cleaned offal products gain traction as improved processing and packaging extend shelf life and support long-distance exports, strengthening supply chains.

- Competition increases as producers invest in traceability, hygiene standards, and value-added cuts, while some regions face restraints due to limited cold-chain infrastructure and low consumer awareness in premium retail channels.

- Asia Pacific remains the dominant region with a 42% share, driven by high demand in China, India, and Southeast Asia, while the poultry offal segment holds the largest share due to strong supply, lower cost, and wide use in street food, quick-service restaurants, and pet nutrition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Pig offal leads the market with close to 40% share, driven by strong demand in Asia and Europe. Consumers prefer pig liver, heart, and intestines due to high protein value and affordable pricing. Beef offal follows, supported by wide use in soups, sausages, and traditional dishes. Sheep and poultry offal gain traction in Middle Eastern and African cuisines, where liver and kidneys are popular ingredients. Growing use of organ meats in pet food and nutrient-dense diets supports steady demand across all sources.

- For instance, Smithfield Foods, Inc. processes around 35,000 to 36,000 hogs per day at its largest U.S. facility in Tar Heel, North Carolina, and leverages its offal streams (such as pig stomachs, hearts, and heads) for export markets to maximize yield.

By Application

Processed offal dominates with nearly 55% share. Sausages, canned meats, pâtés, and ready-to-cook products push growth, supported by longer shelf life and convenient preparation. Fresh offal maintains steady sales in supermarkets and wet markets due to its use in home cooking and local cuisine. Rising adoption of organ-based diets and increasing consumption of ethnic dishes strengthen demand for fresh segments, especially in emerging economies.

- For instance, Glanbia states it operates 17 innovation and collaboration centres worldwide, and holds a flavour library of 30,000 options. The firm reports a volume growth of +6.9 % in its Health & Nutrition segment for H1 2025, and revenue growth of 18.0 % (on a constant currency basis).

By Distribution Channel

Food services hold the leading share of over 52%. Restaurants, hotels, and specialty cuisine outlets use edible offal in gourmet and traditional meals, driving bulk purchases. Retail follows through supermarkets, butcher shops, and online platforms offering packaged liver, heart, and gizzards. Growth in e-commerce meat delivery and expanded chilled supply chains allows retailers to serve wider consumer groups seeking nutrient-rich food choices.

Key Growth Drivers

Rising Demand for Affordable Protein Sources

Edible offal consumption grows as households seek low-cost, protein-rich food options. Liver, kidney, and heart offer high nutrient density at lower prices than premium meat cuts. Countries in Asia, Africa, and Latin America drive strong purchase volumes due to traditional diets and limited access to expensive meat. Growing awareness of iron, vitamin A, and B12 content supports demand among health-focused consumers and pet food producers. The combination of affordability and nutrition positions organ meat as a practical choice for both human and animal food sectors.

- For instance, AKVA Group’s environmental sensor network “Akvasmart Multi Sensor” deploys up to six water-quality sensors and logs 12 parameters (including dissolved oxygen, salinity, temperature, depth/pressure) per instrument.

Expansion in Processed Meat Applications

Processed offal-based foods such as pâtés, sausages, canned meats, and snacks gain traction due to improved flavor profiling and longer shelf life. Manufacturers enhance processing methods to reduce odor, boost texture, and increase value-added offerings. Growing demand for ready-to-eat and ready-to-cook foods supports large-scale use of liver, tripe, and intestines. Food brands introduce packaged organ-based meals aimed at young urban consumers seeking convenience. This trend strengthens global trade of frozen offal and supports continuous supply to the foodservice industry.

- For instance, Trimble’s NAV-900 guidance controller supports full multi-constellation GNSS (GPS, GLONASS, Galileo, BDS-III) and delivers positioning accuracy of better than 2.5 cm (≈1 inch) when used with the CenterPoint® RTX correction service.

Growing Utilization in Pet Food and Animal Nutrition

Pet food manufacturers incorporate offal as a natural protein source, supporting nutrient-rich formulations. Organ meats are widely used in dry kibble, canned meals, and raw pet food diets. Rising pet adoption and humanization of pets increase demand for premium and grain-free pet food blends. Offal delivers amino acids, vitamins, and minerals required for animal health, promoting steady bulk consumption. This segment offers strong growth potential due to low raw material cost and consistent supply from meat processors.

Key Trends & Opportunities

Surging Popularity of Ethnic and Traditional Dishes

Global interest in ethnic cuisine expands the culinary use of liver, tripe, tongue, and heart. Restaurants and street food vendors introduce traditional dishes featuring offal to cater to cultural preferences and food tourism. Social media and food influencers promote organ-based recipes, improving consumer acceptance in Western markets. Premium dining formats elevate offal as a gourmet ingredient, creating opportunities for suppliers to provide high-quality, well-trimmed cuts. This trend strengthens foodservice demand and supports market expansion across urban regions.

- For instance, Syngenta’s Cropwise® digital platform now integrates high-resolution satellite imagery at 3-metre spatial resolution with near-daily capture frequency, via its partnership with Planet Labs PBC, enabling farmers to monitor crop health globally.

Growth of Organ-Based Nutritional Diets

Nutrient-rich diets and nose-to-tail eating trends support broader consumption of edible offal. Fitness communities and nutrition-conscious consumers recognize organ meats as clean protein sources with high vitamin content. Liver supplements and dehydrated organ snacks enter mainstream retail, widening applications beyond fresh and processed meat. Food manufacturers explore functional food blends using heart and kidney to improve nutrient value. Rising sustainability awareness encourages full animal utilization, reducing waste and improving processing efficiency.

- For instance, Cisco Systems, Inc. partnered with the ConSenso Project at the Tunasikia Farm in Utengule, Tanzania, deploying 65 solar-powered IoT sensors which collect data on soil conditions, sun exposure, carbon capture, insect activity and plants’ electrical fields.

Key Challenges

Consumer Perception and Preference Barriers

Negative perception of organ meats in some regions limits adoption. Consumers often associate offal with strong flavors, unfamiliar textures, or hygiene concerns. Younger populations in developed markets prefer boneless meat cuts and plant-based proteins, reducing demand for traditional dishes. Marketing efforts and culinary education are required to improve acceptance. Retailers respond by offering flavored, marinated, and pre-cooked organ products, but perception gaps continue to pose challenges.

Quality, Hygiene, and Cold Chain Requirements

Edible offal requires strict processing and temperature control due to faster spoilage. Weak cold chain infrastructure in developing economies causes quality loss during transport and storage. Regulatory approval and certification are essential for export of liver, stomach, and intestines. Suppliers must invest in modern slaughtering, trimming, and packaging systems to meet food safety standards. Higher handling costs and compliance requirements restrict participation of small processors and impact supply consistency.

Regional Analysis

North America

North America holds 28% share of the edible offal market, driven by rising demand for value-added organ meat products and growing consumer interest in nutrient-dense animal proteins. U.S. consumers show higher acceptance for processed liver, heart, and kidney products in pet food ingredients and specialty foodservice channels. Growth in Hispanic and Asian communities supports stronger consumption in retail and wholesale formats. Large slaughtering and meat-processing facilities provide consistent supply, while strict FDA and USDA quality standards strengthen product reliability. Premium exports to Mexico and Canada also boost regional trade volumes.

Europe

Europe accounts for 24% market share, supported by strong cultural consumption of organ meats in Germany, France, Spain, Poland, and the U.K. Traditional dishes using liver, tripe, and tongue help retain steady household demand. The region benefits from advanced cold-chain infrastructure and EU quality approvals that improve product handling and traceability. Rapid expansion of halal and kosher certified processing plants increases adoption among ethnic communities. Animal-based protein usage in processed foods, canned meats, and ready-to-eat meals boosts offal utilization, while sustainability goals encourage full carcass usage to minimize waste across meat value chains.

Asia Pacific

Asia Pacific leads the global market with a 42% share, driven by high consumption in China, India, Vietnam, Indonesia, and the Philippines. Offal is an affordable protein source in household cooking, street food, and quick-service restaurants. Growing meat processing capacity and fast-moving retail chains support bulk distribution of tongue, liver, intestine, and tripe in frozen and chilled forms. Demand also rises in health-focused consumers due to iron-rich organ meats. Strong export activities from China and India expand supply to the Middle East and Africa, while domestic e-commerce platforms enable convenient home delivery options.

Latin America

Latin America holds 4% market share, with Brazil, Mexico, and Argentina as primary producers and consumers. Offal consumption is rooted in traditional cuisine, especially in beef-rich nations, where liver, heart, and tripe are used in grilled and stewed dishes. Large cattle slaughtering operations enable strong supply for domestic use and export. Economic affordability promotes frequent household purchases, while pet food manufacturers drive industrial-grade demand. Export channels to Asia and Africa support revenue growth, though limited cold-chain infrastructure and inconsistent quality standards restrict broader product penetration across premium retail channels.

Middle East & Africa

Middle East & Africa account for 2% market share, driven mainly by halal-certified offal imports from Asia and Europe. Organ meats are widely used in local cuisine across the Gulf nations and North Africa, with steady demand from foodservice and butcher shops. Limited domestic livestock processing capacity increases dependency on imports. Urban supermarkets sell packaged frozen offal at low prices, supporting budget-conscious consumers. Growth in the pet food and feed industries also encourages higher bulk consumption. Lack of cold-chain logistics and product handling challenges continue to slow market expansion in remote areas.

Market Segmentations:

By Source:

By Application:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The edible offal market features a competitive landscape shaped by leading suppliers and processing companies, including FlexSea, EdiblePro, Ecolotec, Glanbia, Incredible Eats, Evoware, Contibelt, Edible Cutlery, Devro, and Amtrex. The edible offal market is shaped by strong demand from foodservice operators, retailers, and pet food manufacturers. Producers focus on hygiene, standardized cuts, and traceable processing to meet food safety regulations across global markets. Many firms introduce value-added products such as pre-cleaned, frozen, and vacuum-packed organ meats that extend shelf life and simplify handling. Halal and kosher certifications support expansion across Middle Eastern, African, and Asian regions. Companies also diversify into collagen, bone broth, and organ-based nutritional supplements to tap into health-focused consumer segments. Investments in automation, cold-chain logistics, and export-grade packaging improve supply consistency and strengthen distribution networks. Sustainability strategies promoting whole-carcass utilization further enhance profitability and minimize waste across meat production chains.

Key Player Analysis

- FlexSea

- EdiblePro

- Ecolotec

- Glanbia

- Incredible Eats

- Evoware

- Contibelt

- Edible Cutlery

- Devro

- Amtrex

Recent Developments

- In January 2025, French pioneers Ynsect and Agronutris disclosed liquidity challenges; Ynsect began exploring third-party takeovers, and Agronutris filed a safeguard plan with commercial courts.

- In September 2023, Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- In April 2023, SARIA SE & Co. KG successfully completed the acquisition of Devro plc, a leading supplier of collagen-based edible films and coatings. The acquisition is aimed at enhancing SARIA’s product portfolio and expanding its market presence in the food industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as consumers seek affordable animal protein and nutrient-rich food.

- Foodservice chains will add more organ-based dishes in urban markets.

- Exports of frozen liver, heart, and tripe will expand into Africa and the Middle East.

- Value-added processing such as pre-cleaned and vacuum-packed cuts will gain traction.

- Halal and kosher certified production will boost international trade.

- Pet food manufacturers will increase bulk purchases of organ meats.

- E-commerce platforms will improve retail accessibility of frozen and chilled offal.

- Nutritional products like bone broth and collagen will support new revenue streams.

- Slaughterhouses will invest in automation and cold-chain upgrades.

- Sustainability programs will promote full carcass utilization and reduce waste.