Market Overview

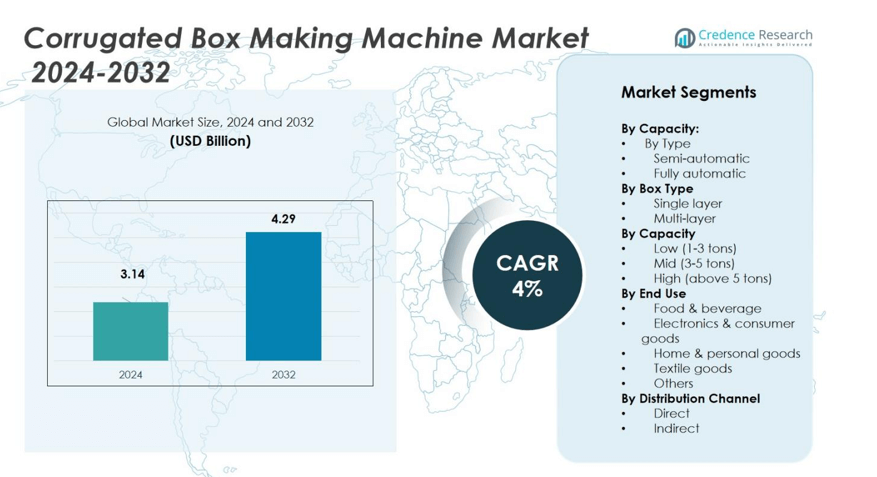

Corrugated Box Making Machine Market size was valued at USD 3.14 Billion in 2024 and is anticipated to reach USD 4.29 Billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Box Making Machine Market Size 2024 |

USD 3.14 Billion |

| Corrugated Box Making Machine Market, CAGR |

4% |

| Corrugated Box Making Machine Market Size 2032 |

USD 4.29 Billion |

The Corrugated Box Making Machine Market is led by key players such as EMBA Machinery, Mitsubishi Heavy Industries, Bobst Group, Fosber, ISOWA, ACME Machinery, Packsize International, Serpa Packaging Solutions, KOLBUS, and Saro Packaging Machine Industries. These companies focus on automation, smart manufacturing, and energy-efficient solutions to enhance operational efficiency and reduce downtime. Asia Pacific dominates the market with a 38% share, driven by large-scale production, expanding e-commerce, and cost-effective manufacturing. North America and Europe follow, holding 26% and 24% shares respectively, supported by advanced industrial infrastructure and growing adoption of sustainable packaging technologies.

Market Insights

- The Corrugated Box Making Machine Market was valued at USD 3.14 Billion in 2024 and is projected to reach USD 4.29 Billion by 2032, growing at a CAGR of 4% during the forecast period.

- Rising e-commerce and logistics activities are the primary growth drivers, increasing the demand for efficient, automated corrugated packaging systems.

- Key trends include digital integration, smart manufacturing, and the adoption of eco-friendly and recyclable packaging materials in production processes.

- The market is moderately consolidated, with top players such as EMBA Machinery, Bobst Group, and Mitsubishi Heavy Industries focusing on innovation, automation, and sustainability to maintain competitiveness.

- Asia Pacific leads with 38% share, followed by North America with 26% and Europe with 24%, while fully automatic machines dominate by 63% share, highlighting the global shift toward advanced and energy-efficient production systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

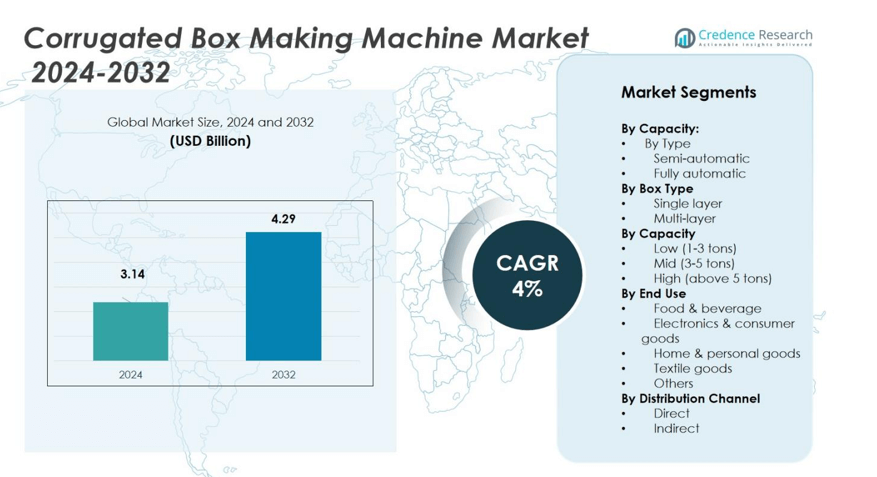

By Type

Fully automatic corrugated box making machines dominate the market with a share of 63% in 2024. Their popularity is driven by higher production efficiency, precision cutting, and reduced manual intervention. These machines cater to large-scale packaging plants focusing on mass production and consistent quality output. Semi-automatic machines, holding 37% share, remain preferred by small and medium manufacturers due to lower investment costs and flexibility for short-run production. The rising demand for automation across logistics and e-commerce packaging industries continues to boost the adoption of fully automatic systems worldwide.

- For instance, Bobst, a Swiss engineering company, offers the FFG 8.20 EXPERTLINE fully automatic corrugated box making machine that achieves speeds up to 350 boxes per minute. This machine integrates advanced folding-gluing technology that supports consistent high-quality output and minimal downtime, emphasizing precise automation suited for mass production settings.

By Box Type

The multi-layer box segment accounts for 58% market share in 2024, leading the corrugated box making machine market due to growing demand for durable packaging solutions. Multi-layer boxes offer superior strength, moisture resistance, and stacking ability, making them ideal for heavy-duty applications in food, electronics, and industrial goods. The single-layer segment, holding 42% share, remains relevant for lightweight packaging such as FMCG and retail products. Increasing e-commerce shipments requiring protective packaging drives continuous upgrades in multi-layer box manufacturing capabilities.

- For instance, Mitsubishi Heavy Industries introduced its EVOL 100/400 series with a capacity of 350 sheets per minute for multi-layer box production.

By Capacity

Machines with mid-capacity (3–5 tons) lead the segment, capturing 46% share in 2024, supported by strong adoption among medium-sized packaging firms. These machines balance speed, energy efficiency, and cost-effectiveness, serving diverse applications from consumer goods to industrial packaging. The high-capacity (above 5 tons) segment follows with 32% share, primarily used in large manufacturing facilities emphasizing bulk production. Low-capacity (1–3 tons) machines, with 22% share, are favored by small enterprises focusing on regional or custom packaging needs. Rising automation in mid-capacity systems continues to fuel their dominance.

Key Growth Drivers

Rising Demand from E-commerce and Logistics

The rapid expansion of e-commerce and logistics sectors drives the need for efficient corrugated packaging solutions. Online retailing requires durable, lightweight, and customizable boxes for product protection during transit. This demand pushes packaging manufacturers to adopt advanced corrugated box making machines for faster output and better precision. Companies are investing in high-speed automatic systems to meet bulk packaging needs and optimize turnaround times, ensuring improved operational efficiency and cost savings across the supply chain.

- For instance, Movopack introduced reusable packaging solutions designed for e-commerce, which can be returned and reused over 20 times, helping brands reduce carbon footprint and enhance sustainability without compromising packaging durability.

Technological Advancements in Automation and Digitalization

Automation and digital integration are transforming corrugated box manufacturing processes. Smart machinery equipped with PLC controls, IoT sensors, and digital printing modules enhances productivity and reduces downtime. Automated setups allow for rapid design changes, improved print accuracy, and real-time monitoring, resulting in higher output consistency. These advancements help manufacturers achieve lower operational costs while meeting sustainability goals through material optimization and waste reduction, strengthening the adoption of next-generation corrugated box making systems.

- For instance, DS Smith leveraged machine learning systems to optimize material usage and reduce waste, supporting its commitment to sustainability by boosting resource efficiency through advanced digital controls and automated process adjustments.

Growing Shift Toward Sustainable Packaging Solutions

The shift toward eco-friendly and recyclable packaging materials drives greater adoption of corrugated boxes. Manufacturers are integrating energy-efficient machines designed to process recycled paperboard while maintaining high-quality standards. Growing environmental regulations and consumer preference for sustainable packaging encourage investments in low-emission, water-based, and waste-minimizing machinery. These initiatives align with corporate sustainability goals, making green production technologies a vital driver for long-term market growth in the corrugated packaging equipment sector.

Key Trends and Opportunities

Integration of Smart Manufacturing Technologies

Smart manufacturing technologies are reshaping the corrugated box making machine market. The use of Industry 4.0 principles, including predictive maintenance and data analytics, enables real-time performance tracking and preventive error correction. Remote monitoring and AI-based process control enhance machine reliability and production speed. This trend opens new opportunities for digitalized production lines, especially among global packaging firms adopting fully automated and connected factories to maximize output and reduce operational costs.

- For instance, Greiner Packaging utilizes PTC’s industrial connectivity solution to link around 500 machines across 11 plants, enabling real-time data analysis and improving overall equipment effectiveness (OEE) consistently across its global factories.

Expansion into Customized and Short-Run Production

The growing demand for custom-sized and branded packaging is encouraging manufacturers to invest in flexible box making machines. Digital die-cutting, automatic slotting, and variable data printing features allow quick design changes and smaller production runs without compromising efficiency. This trend benefits e-commerce and consumer goods sectors that frequently update packaging designs. The ability to deliver short-run, high-quality packaging cost-effectively positions manufacturers to capture emerging opportunities in personalized and premium packaging markets.

- For instance, Darui recently launched the J3 digital laser die-cutter, which simplifies production by eliminating the need for die templates and achieving cutting speeds up to 50 meters per minute.

Key Challenges

High Initial Investment and Maintenance Costs

The high capital cost associated with advanced corrugated box making machines limits adoption among small and mid-sized enterprises. Fully automatic systems with integrated printing and folding features require significant upfront investment, along with ongoing maintenance expenses. These financial constraints discourage smaller firms from upgrading outdated equipment. Additionally, fluctuations in raw material prices, such as kraft paper and adhesives, further strain profitability, challenging market penetration in cost-sensitive regions.

Skilled Workforce Shortage and Operational Complexity

Operating modern corrugated box making machinery requires trained technicians capable of managing automated systems and troubleshooting digital components. However, a shortage of skilled labor in manufacturing sectors creates production inefficiencies and machine downtime. The complexity of integrating digital tools, AI-driven controls, and multi-stage automation increases training demands. Without proper workforce development, companies face challenges in achieving optimal performance and maintaining consistent product quality in automated packaging lines.

Regional Analysis

North America

North America holds a 26% share of the corrugated box making machine market in 2024, supported by strong e-commerce and retail logistics infrastructure. The United States leads the region due to extensive adoption of automated packaging solutions among large manufacturers. Rising focus on sustainable packaging and recyclability standards further boosts machinery upgrades. Canada shows steady demand growth from food, beverage, and pharmaceutical packaging sectors. The presence of established equipment suppliers and advanced production facilities strengthens the region’s competitive position in high-efficiency and precision packaging equipment.

Europe

Europe accounts for 24% of the global market share, driven by sustainability initiatives and stringent recycling regulations. Germany, Italy, and the U.K. dominate regional demand due to robust manufacturing bases and innovation in packaging automation. The region’s strong shift toward energy-efficient and digitalized machines aligns with the EU’s circular economy goals. Growth is further encouraged by increased investments in eco-friendly corrugated packaging, particularly in food, cosmetics, and personal care sectors. Advanced automation and smart factory adoption continue to define Europe’s competitive edge in machine manufacturing.

Asia Pacific

Asia Pacific leads the global market with a 38% share, fueled by rapid industrialization, expanding e-commerce, and rising consumer goods demand. China, India, and Japan represent major growth centers, driven by high production capacity and packaging exports. Local manufacturers are upgrading to fully automatic machines to improve speed and accuracy. Increasing foreign investments and government incentives for sustainable manufacturing also support growth. The strong presence of paper-based packaging industries and cost-effective production make Asia Pacific the most dynamic and fast-evolving regional market.

Latin America

Latin America holds a 7% market share, supported by expanding manufacturing activities and regional trade growth. Brazil and Mexico lead due to investments in food, beverage, and industrial packaging sectors. Companies are gradually adopting semi-automatic and mid-capacity machines to improve output and quality. Growing demand for lightweight and sustainable packaging also encourages machine modernization. Although infrastructure challenges persist, the region shows long-term potential due to rising exports and the emergence of regional packaging hubs serving both domestic and international markets.

Middle East & Africa

The Middle East & Africa region captures a 5% share of the global market, supported by increasing packaging requirements in consumer goods and pharmaceuticals. The UAE and Saudi Arabia lead with strong industrialization and logistics growth. Rising investments in automation and localized packaging production support market expansion. Africa’s demand is growing from small and medium enterprises adopting low-capacity machines for domestic packaging. Infrastructure development and regional trade integration are expected to further stimulate market adoption, especially in nations focusing on import substitution and manufacturing diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Semi-automatic

- Fully automatic

By Box Type

By Capacity

- Low (1-3 tons)

- Mid (3-5 tons)

- High (above 5 tons)

By End Use

- Food & beverage

- Electronics & consumer goods

- Home & personal goods

- Textile goods

- Others

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Corrugated Box Making Machine Market features leading manufacturers such as EMBA Machinery, Mitsubishi Heavy Industries, Bobst Group, Fosber, ISOWA, ACME Machinery, Packsize International, Serpa Packaging Solutions, KOLBUS, and Saro Packaging Machine Industries. These companies compete on technology, automation capabilities, and after-sales support. The market is moderately consolidated, with global players focusing on product innovation and expansion into high-growth regions such as Asia Pacific. Firms are investing in smart manufacturing, IoT-enabled control systems, and energy-efficient designs to enhance performance and reduce operational costs. Strategic partnerships and acquisitions strengthen market presence, while mid-sized firms focus on developing cost-effective semi-automatic machines for small enterprises. Product customization, digital printing integration, and faster setup times remain key competitive factors. Continuous innovation, eco-friendly manufacturing practices, and adherence to global packaging standards help established players maintain a strong position in the global corrugated packaging machinery ecosystem.

Key Player Analysis

Recent Developments

- In September 2025, Fosber Group presented its premium high-performance corrugation machinery at IndiaCorr Expo 2025. The company reinforced its reputation for precision and automation excellence, meeting India’s growing demand for advanced corrugation solutions focused on reliability and efficiency.

- In September 2025, EMBA Machinery showcased its ULTIMA series at IndiaCorr Expo 2025, reaffirming its innovation leadership. Known since 2011 for inline flexo folder gluers, EMBA demonstrated its patented non-crush technology, twin-feed dual box system, and liquid creaser solutions tailored to converter challenges.

- In November 2024, Mitsubishi Heavy Industries Americas (MHIA) Corrugating Machinery Division installed North America’s first MPF-MII Prefeeder. Integrated with EVOL 84 and EVOL 100 lines, the system improved precision, uptime, and throughput in automated corrugated box production.

- In September 2024, Bobst Group expanded in Asia with a new R&D and manufacturing facility in Busan, South Korea. The site produces corrugated board machinery, including NOVAFFG and VISIONFFG models, supporting the company’s re-entry into the large-format equipment market through its JUMBO line.

Report Coverage

The research report offers an in-depth analysis based on Type, Box Type, Capacity, End Use, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising global e-commerce demand.

- Automation and digital integration will dominate new machine installations.

- Energy-efficient and eco-friendly machines will gain wider adoption across industries.

- Asia Pacific will remain the fastest-growing region with strong manufacturing expansion.

- Manufacturers will invest more in IoT-enabled monitoring and predictive maintenance systems.

- Demand for customized, short-run, and on-demand packaging machines will rise.

- Partnerships and acquisitions will strengthen product portfolios and global reach.

- Technological upgrades will focus on precision cutting, waste reduction, and faster setup times.

- Small and medium enterprises will increasingly adopt mid-capacity semi-automatic systems.

- Sustainability regulations will encourage greater use of recyclable and lightweight packaging materials