Market Overview

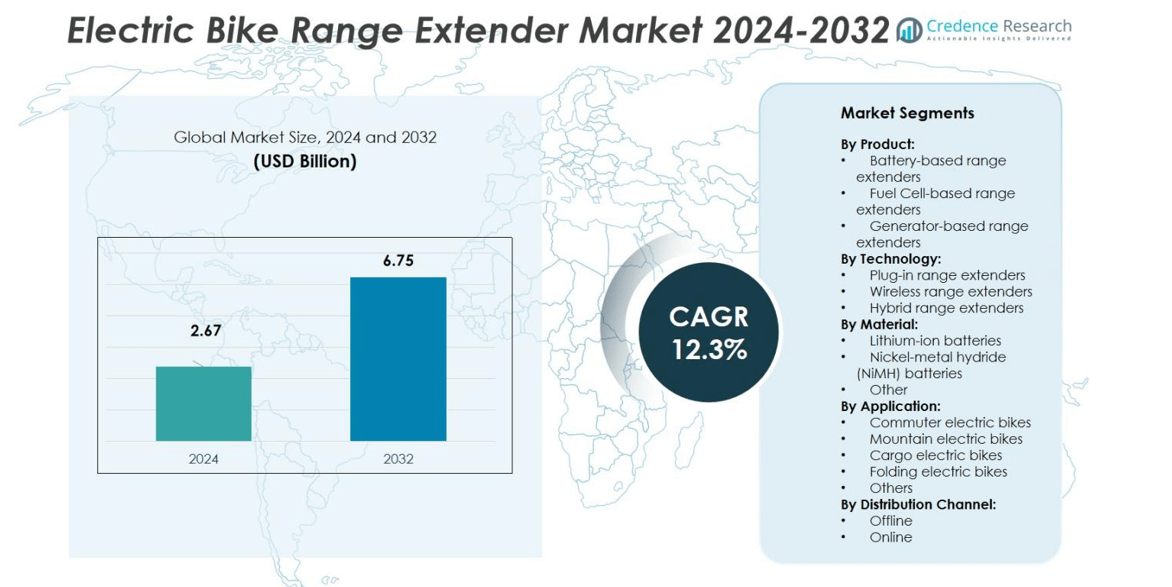

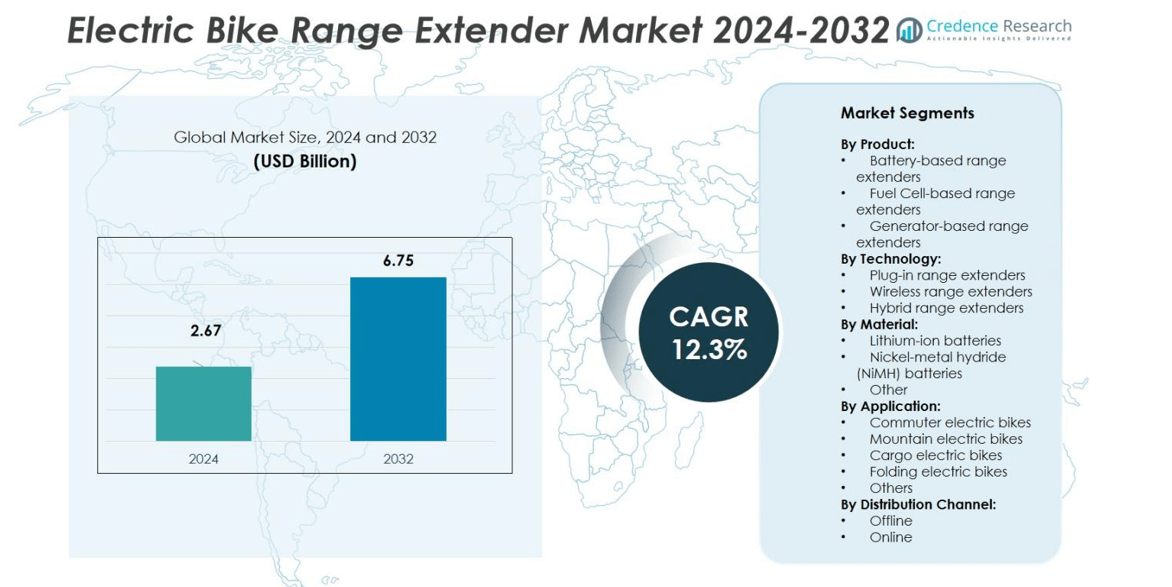

Electric Bike Range Extender Market size was valued at USD 2.67 billion in 2024 and is anticipated to reach USD 6.75 billion by 2032, growing at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ECG Stress Test Market Size 2024 |

USD 2.67 billion |

| ECG Stress Test Market, CAGR |

12.3% |

| ECG Stress Test Market Size 2032 |

USD 6.75 billion |

The Electric Bike Range Extender Market is led by major companies such as Panasonic Corporation, Bosch, Yamaha Motor, Mahle, Brose Fahrzeugteile, Valeo, Bafang Electric, FAZUA, Shimano, and TQ-Group. These players dominate through technological advancements, product innovation, and strong partnerships with e-bike manufacturers. Bosch and Mahle focus on efficient plug-in and hybrid range extenders, while Yamaha and Panasonic emphasize intelligent energy management and compact battery solutions. European firms such as Brose and FAZUA drive premium segment growth with lightweight designs. Europe leads the global market with a 36% share in 2024, supported by robust cycling infrastructure, government incentives, and a mature electric mobility ecosystem.

Market Insights

- The Electric Bike Range Extender Market was valued at USD 2.67 billion in 2024 and is projected to reach USD 6.75 billion by 2032, growing at a CAGR of 12.3% during the forecast period.

- Growing demand for long-range and energy-efficient e-bikes drives market expansion, supported by urban mobility initiatives and rising consumer focus on sustainable transport.

- Technological advancements in lithium-ion batteries and integration of IoT-based smart systems are key trends enhancing performance and convenience.

- The market is moderately consolidated, with leading players such as Bosch, Panasonic, Mahle, and Yamaha Motor focusing on innovation, partnerships, and lightweight range extender designs.

- Europe leads with 36% share, followed by North America at 28% and Asia-Pacific at 26%, while battery-based range extenders dominate with 58% share, driven by strong adoption in commuter and performance-oriented electric bikes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

Battery-based range extenders hold the dominant share of 58% in the Electric Bike Range Extender Market in 2024. Their popularity stems from compact design, higher energy density, and compatibility with existing e-bike architectures. Fuel cell-based range extenders account for a growing share due to rising interest in hydrogen-powered mobility solutions. Generator-based systems remain niche but are gaining traction for long-distance applications. The demand for battery-based models is driven by rapid advances in lithium-ion technology, extended riding range, and the increasing adoption of lightweight, cost-effective e-bikes across urban and commuter markets.

- For instance, Bosch’s PowerMore 250 battery adds an additional 250 Wh of capacity to compatible Trek e-bikes, extending their range by up to 40 miles on average, enhancing commuter usability and long rides.

By Technology:

Plug-in range extenders lead the segment with 62% market share in 2024, driven by ease of charging and broad availability of power infrastructure. These systems allow riders to recharge quickly using standard outlets, promoting convenience for daily commuters. Wireless range extenders, holding a smaller share, are expanding through smart charging innovations and efficiency gains. Hybrid range extenders are emerging for users seeking longer range without full reliance on charging stations. The dominance of plug-in technology is supported by infrastructure readiness, user convenience, and integration with energy-efficient battery systems.

By Material:

Lithium-ion batteries dominate the material segment with a 71% share in 2024, owing to superior energy density, lightweight construction, and faster charging capability. Nickel-metal hydride (NiMH) batteries hold a modest portion of the market, primarily in mid-range or cost-sensitive applications. Other materials, including solid-state and advanced polymer batteries, show potential for long-term growth. The dominance of lithium-ion is driven by declining production costs, high cycle life, and ongoing innovations enhancing energy storage capacity, making it the preferred material for both performance-oriented and commuter electric bikes.

- For instance, Contemporary Amperex Technology Co. Limited (CATL) has initiated trial production of 20 Ah solid-state cells with energy densities reaching 500 Wh/kg, aiming for small-scale production by 2027.

Key Growth Drivers

Rising Adoption of Electric Mobility

The growing shift toward eco-friendly transportation fuels demand for electric bikes equipped with range extenders. Consumers seek solutions offering longer travel distances without frequent recharging. Governments worldwide promote electric mobility through subsidies, infrastructure investments, and emission reduction targets. For instance, incentives for e-bike adoption in Europe and North America support market expansion. As urban commuters prioritize efficiency and sustainability, range extender integration provides a cost-effective way to overcome battery limitations and enhance travel convenience, driving significant market growth.

- For instance, The Bosch PowerMore 250 range extender is compatible with its Smart System e-bikes, adding approximately 250 Wh of energy capacity. The actual increase in range depends heavily on the main battery’s capacity and riding conditions. When paired with a smaller main battery (e.g., a 400 Wh battery), it can increase total capacity by up to 60%.

Advancements in Battery and Power Technologies

Continuous improvements in lithium-ion and hybrid battery systems enhance range extender performance and efficiency. Modern range extenders now deliver higher energy density, reduced weight, and improved charging capabilities. Manufacturers like Bosch and Mahle focus on optimizing battery management systems for better power output. These innovations allow riders to cover longer distances on a single charge while minimizing overall energy consumption. As technology becomes more compact and cost-efficient, range extenders increasingly appeal to performance-oriented users and long-distance commuters.

- For instance, Mahle has developed an innovative immersion cooling system for electric vehicle batteries, which significantly reduces charging time by keeping battery temperatures uniformly low.

Expanding Urbanization and Commuter Demand

Rapid urbanization drives the need for practical and sustainable mobility solutions. Electric bikes equipped with range extenders offer flexibility, particularly for city dwellers facing limited charging access. Growing traffic congestion and rising fuel prices encourage consumers to shift toward low-emission transport alternatives. Governments’ urban mobility initiatives and expanding cycling infrastructure further support adoption. As working professionals seek reliable transportation with extended range, demand for advanced range extender-equipped e-bikes continues to surge across metropolitan areas.

Key Trends & Opportunities

Integration of Smart and Connected Features

Manufacturers increasingly integrate digital connectivity and smart diagnostics into electric bike range extenders. Features like remote monitoring, predictive maintenance, and energy optimization enhance rider convenience. Companies such as Yamaha and Shimano are developing IoT-enabled systems that provide real-time range tracking and performance insights. This digitalization trend improves reliability and user experience while aligning with broader smart mobility initiatives. The integration of connectivity technologies represents a strong opportunity for differentiation and user engagement in competitive markets.

- For instance, Yamaha’s XLC Range Extender offers an additional 360Wh battery capacity and connects via the MRS system, allowing for seamless power integration and real-time battery status monitoring.

Growing Focus on Sustainable Energy Sources

The market is witnessing a shift toward renewable and eco-friendly energy systems for powering range extenders. Hydrogen-based fuel cells and recyclable battery materials are gaining interest among manufacturers. Such developments aim to minimize carbon footprints and enhance lifecycle sustainability. Governments supporting clean energy adoption further accelerate this transition. Companies investing in green innovation, such as fuel cell integration and solar-assisted charging systems, are expected to gain a competitive edge in addressing environmental concerns and consumer expectations.

- For instance, Ballard Power Systems’ FCmove-HD fuel cell module delivers a net system power of 70 kW. It weighs 250 kg and operates across 250 to 500 volts, designed for medium-duty applications like buses, where multiple modules totaling over a megawatt of clean hydrogen power have been deployed for zero-emission urban transport fleets.

Key Challenges

High Initial Cost and Limited Infrastructure

Despite rising interest, electric bike range extenders remain expensive for many consumers. The added hardware increases the base cost of e-bikes, limiting adoption in price-sensitive regions. Additionally, limited charging and hydrogen refueling infrastructure restricts range extender usability in certain markets. Manufacturers face pressure to reduce production costs and improve component efficiency to broaden accessibility. Overcoming these financial and logistical barriers is essential to sustain large-scale market penetration and ensure consistent consumer adoption globally.

Regulatory and Technical Complexity

Diverse global regulations and technical standards challenge market growth. Manufacturers must comply with varying safety, emission, and performance guidelines across regions, increasing product development costs. Integration complexity between range extenders and existing bike systems can affect reliability and maintenance. Furthermore, limited standardization in charging interfaces and communication protocols complicates user experience. Addressing these challenges through harmonized regulations and modular design approaches will be key to ensuring interoperability, safety, and scalability within the electric bike range extender ecosystem.

Regional Analysis

North America

North America holds a 28% share of the Electric Bike Range Extender Market in 2024, driven by strong consumer interest in high-performance e-bikes and robust charging infrastructure. The U.S. dominates the region due to increasing adoption of sustainable mobility solutions and government incentives promoting electric vehicle use. Technological advancements by major players such as Bosch and Yamaha Motor support product innovation. Canada follows with growing investments in cycling infrastructure and environmental initiatives. The region’s expanding commuter base and preference for long-range electric bikes continue to enhance overall market demand.

Europe

Europe leads the global market with a 36% share in 2024, supported by progressive clean mobility policies and strong cycling culture. Countries like Germany, the Netherlands, and France are major contributors due to high e-bike penetration and infrastructure readiness. Leading manufacturers including Brose Fahrzeugteile, FAZUA, and Mahle drive product innovation and partnerships across the region. Government subsidies and carbon reduction targets further encourage adoption. Rising urban congestion and growing demand for energy-efficient commuting options reinforce Europe’s dominant position in the electric bike range extender landscape.

Asia-Pacific

Asia-Pacific accounts for a 26% share of the global market, driven by growing electric mobility adoption in China, Japan, and India. Rapid urbanization and population growth fuel strong demand for affordable long-range e-bikes. China remains the regional leader with extensive manufacturing capabilities and supportive government initiatives. Japan and South Korea show increasing innovation in compact range extender technologies. Expanding urban infrastructure and local production incentives make Asia-Pacific a vital hub for mass adoption and large-scale manufacturing within the market.

Latin America

Latin America captures a 6% share in 2024, primarily driven by emerging adoption in Brazil, Mexico, and Argentina. Urban air quality concerns and rising fuel costs are pushing consumers toward sustainable commuting options. Governments are gradually implementing policies promoting electric mobility. Although infrastructure remains limited, investments in charging networks and renewable energy are expanding. The region’s growing middle class and interest in cost-efficient, long-range e-bikes create opportunities for global manufacturers to strengthen their presence and partnerships across Latin American markets.

Middle East & Africa

The Middle East & Africa represent a 4% share of the global Electric Bike Range Extender Market in 2024. Demand is supported by increasing focus on eco-friendly transport and smart city initiatives in countries like the UAE, Saudi Arabia, and South Africa. Limited charging infrastructure and high equipment costs currently restrain rapid expansion. However, rising tourism-related mobility projects and government sustainability programs encourage gradual growth. As urban electrification advances, the region shows potential for future adoption of range extender-equipped electric bikes in both personal and commercial mobility sectors.

Market Segmentations:

By Product:

- Battery-based range extenders

- Fuel Cell-based range extenders

- Generator-based range extenders

By Technology:

- Plug-in range extenders

- Wireless range extenders

- Hybrid range extenders

By Material:

- Lithium-ion batteries

- Nickel-metal hydride (NiMH) batteries

- Other

By Application:

- Commuter electric bikes

- Mountain electric bikes

- Cargo electric bikes

- Folding electric bikes

- Others

By Distribution Channel:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Bike Range Extender Market features major players such as Panasonic Corporation, Bosch, Yamaha Motor, Mahle, Brose Fahrzeugteile, Valeo, Bafang Electric, FAZUA, Shimano, and TQ-Group. These companies focus on technological innovation, product diversification, and strategic partnerships to strengthen their market positions. Bosch and Mahle lead with advanced plug-in and hybrid range extender systems offering enhanced efficiency and compact design. Yamaha Motor and Panasonic invest heavily in battery optimization and intelligent control systems. European firms such as FAZUA and Brose emphasize lightweight and integrated designs for premium e-bike models, while Asian manufacturers expand cost-effective mass-market solutions. Strategic collaborations with e-bike manufacturers and advancements in lithium-ion technology continue to define competition. The market is moderately consolidated, with firms prioritizing energy efficiency, extended range performance, and smart connectivity to cater to diverse consumer preferences across commuting, leisure, and long-distance applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Rad Power Bikes introduced its new Range Extender accessory, designed for the RadRunner Plus and RadRunner Max models to enhance riding distance and convenience.

- In July 15, 2024, MOD Bikes introduced the MOD Berlin e-bike featuring dual-battery capability (up to ~90 miles of range) and accessory-friendly modular design.

- In March 2025, FAZUA announced two new battery options (“Energy 480” fixed and removable) and a new “Mode Control” operating unit for its Ride 60 system, available from June 2025

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Material, Application, Distribtuion Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for long-range electric bikes.

- Battery-based range extenders will continue to dominate due to efficiency and lower maintenance needs.

- Advancements in lithium-ion and solid-state batteries will improve energy density and lifespan.

- Plug-in technology will remain preferred as charging infrastructure expands globally.

- Fuel cell-based systems will gain attention with growing interest in hydrogen-powered mobility.

- Integration of smart connectivity and IoT features will enhance user experience and performance tracking.

- Europe and Asia-Pacific will remain the key regions driving innovation and adoption.

- Manufacturers will focus on lightweight, compact, and eco-friendly range extender designs.

- Strategic collaborations between e-bike makers and energy companies will accelerate product development.

- Supportive government policies and urban mobility programs will sustain long-term market expansion.